UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 11, 2015

Commission

file number: 0-22773

NETSOL

TECHNOLOGIES, INC.

(Exact

name of small business issuer as specified in its charter)

| NEVADA |

|

95-4627685 |

(State or other Jurisdiction of

Incorporation or Organization) |

|

(I.R.S.

Employer NO.) |

24025

Park Sorrento, Suite 410, Calabasas, CA 91302

(Address

of principal executive offices) (Zip Code)

(818)

222-9195 / (818) 222-9197

(Issuer’s

telephone/facsimile numbers, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item

2.02 Results of Operations and Financial Condition.

On

February 11, 2015, NetSol Technologies, Inc. issued a press release announcing results of operations and financial conditions

for the six months and quarter ended December 31, 2014. The press release is furnished as Exhibit 99.1 to this Form 8-K.

The

information in this report shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not

be incorporated by reference into any registration statement or other document field under the Securities Act of 1933, as amended,

or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Exhibits

Item

9.01

99.1

News Release dated February 11, 2015

SIGNATURES

In

accordance with the requirements of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

NETSOL TECHNOLOGIES, INC. |

| |

|

| Date: February 12, 2015 |

/s/ Najeeb

Ghauri |

| |

NAJEEB GHAURI |

| |

Chief Executive Officer |

| |

|

| Date: February 12, 2015 |

/s/ Roger Almond |

| |

Roger Almond |

| |

Chief Financial Officer |

EXHIBIT

99.1

NEWS

RELEASE DATED February 11, 2015

|

Investor

Contacts: |

| |

|

| |

PondelWilkinson |

| |

Roger

Pondel | Matt Sheldon |

| |

investors@netsoltech.com |

| |

(310)

279-5980 |

| |

|

| |

Media

Contacts: |

| |

|

| |

PondelWilkinson |

| |

George

Medici | gmedici@pondel.com |

| |

(310)

279-5968 |

NetSol

Technologies Reports Fiscal 2015 Second Quarter Results

Second

Quarter Revenue Gains Reflect Early Momentum in NetSol’s Return to Growth

| |

● |

Revenue

Grew to $12.4 Million from $8.6 Million, with $5 Million in Gross Profit |

| |

|

|

| |

● |

Cash

and Cash Equivalents Increased to $13.5 Million from $11.5 Million at Fiscal Year-End |

| |

|

|

| |

● |

Company

Builds Out European Presence; Signs Two New Agreements in the Region |

Conference

Call Scheduled Today at 4:15 p.m. ET (1:15 p.m. PT)

CALABASAS,

Calif. – February 11, 2015 – NetSol Technologies, Inc. (NASDAQ: NTWK), a global provider of IT and enterprise software

solutions, today reported non-GAAP adjusted diluted earnings per share of $0.09 for the second quarter ended December 31, 2014,

compared with breakeven for the same period last year. The company reported net revenue of $12.4 million for the quarter, compared

with $8.6 million for the same period last year. GAAP loss per share for the 2015 fiscal second quarter was reduced to $0.14 from

a loss of $0.18 per share for the same period last year.

“Our

top-line growth for the second quarter reflected strong maintenance and services revenue, as well as the beginning of revenue

recognition for the $16 million contract announced in August of last year, further confirming that our resurgence is real,”

said Najeeb Ghauri, CEO. “Considering the implementation of contracts underway, we are fast approaching our fiscal 2013

record net revenue, a time marked by strong growth prior to our next-generation product transition period. Further adding to our

optimism are two recent developments in Europe, along with expanding relationships with clients in North America, and continued

growth in the Asia Pacific region both for NFS AscentTM and our legacy solutions.

“On

the bottom line, increased depreciation and amortization, reflecting the launch of NFS Ascent, and depreciation for the new building

on the NetSol campus, as well as investment in additional staff to support our growth objectives, impacted financial results on

a GAAP basis,” added Ghauri.

Fiscal

2015 Second Quarter Financial Results

The following

comparison refers to results for the fiscal 2015 second quarter versus the fiscal 2014 second quarter.

Total net

revenues improved to $12.4 million from $8.6 million, with license, maintenance and services revenue all contributing to the

increase.

| |

● |

License

revenue was $2.1 million, versus $456,000 in the same period last year primarily due to additional license sales for NFSTM; |

| |

|

|

| |

● |

Maintenance

revenue increased to $3.3 million from $2.9 million last year as a result of completed implementations; |

| |

|

|

| |

● |

Services

revenue improved to $5.6 million from $4.0 million in the same period last year as a result of incremental increases in NetSol’s

day rates for all skill sets, and additional deliveries of customer change requests; |

| |

|

|

| |

● |

Services

revenue – related party, reflecting revenue from NetSol’s joint venture with the Innovation Group – was

$1.4 million, compared with $1.3 million last year. |

Gross profit

improved to $5.0 million from $2.9 million last year.

Total

operating expenses amounted to $6.0 million, versus $4.4 million last year. The increase relates to higher selling and marketing

expenses and increased general and administrative costs as the company continues to invest in Germany, the U.K., Thailand and

China.

Total

operating loss was reduced to $1.0 million from $1.5 million last year.

GAAP

net loss was $1.4 million for the fiscal 2015 second quarter, equal to $0.14 per share, compared with a GAAP net loss of $1.6

million, or $0.18 per share, in the comparable period last fiscal year.

Adjusted

EBITDA (a non-GAAP measure) was $900,000, or $0.09 per adjusted diluted share, for the fiscal 2015 first quarter, which removed

$2.2 million in depreciation and amortization. This compares with adjusted EBITDA of $6,479, or breakeven per adjusted diluted

share, last year, which removed $1.6 million in depreciation and amortization.

The

reconciliation of adjusted EBITDA to net income, the most comparable financial measure based upon GAAP, as well as a further explanation

of adjusted EBITDA, is included in the financial tables at the end of this press release.

Fiscal

2015 First Half Financial Results

For

the first six months of fiscal 2015, total net revenue rose to $22.6 million compared to $17.5 million for the first six months

of fiscal 2014. The company reported a GAAP net loss of $3.2 million, or $0.34 per share, compared with a GAAP net loss of $2.7

million, or $0.30 per share, in the comparable period last year.

Adjusted

EBITDA (a non-GAAP measure) for the first six months of fiscal 2015 increased to $1.5 million, or $0.16 per adjusted diluted share,

which removed $4.6 million in depreciation and amortization. This compares with adjusted EBITDA of $310,000, or $0.03 per adjusted

diluted share, last year, which removed $2.9 million in depreciation and amortization.

At

September 30, 2014, cash and cash equivalents grew to $13.5 million from $11.5 million at June 30, 2014.

Recent

Highlights:

| |

● |

Expanded

presence in Europe with two new senior executives— Paul Stevens in the newly created position of chief information officer

– Europe, and Tim O’Sullivan as head of sales – Europe; |

| |

|

|

| |

● |

Signed

two new agreements in Europe, one with a major U.S. auto captive finance company, and the other with a major U.K-based asset

finance company; |

| |

|

|

| |

● |

Added

50 LeasePak license seats with a major U.S.-based auto captive leasing company; and |

| |

|

|

| |

● |

Attended

the Equipment Leasing and Finance Association and Auto Finance Summit conferences to demo NetSol’s next-generation financing

and leasing solution, NFS Ascent and NFS MobilityTM. |

Fiscal

2015 Second Quarter Conference Call

| |

When: |

Wednesday, February 11 |

| |

Time: |

4:15 p.m. Eastern Time |

| |

Phone: |

1-888-505-4369 (domestic) |

| |

|

1-719-325-2455 (international) |

A

live Webcast will be available online within the investor relations section of NetSol’s website at http://www.netsoltech.com,

where it will be archived for 90 days.

About

NetSol Technologies

NetSol

Technologies, Inc. (Nasdaq: NTWK) is a worldwide provider of IT and enterprise software solutions primarily serving the global

leasing and financing industry. The Company’s suite of applications are backed by 40 years of domain expertise and supported

by a committed team of more than 1000 professionals placed in eight strategically located support and delivery centers throughout

the world.

To

learn more about NetSol, visit www.netsoltech.com or watch the corporate video at https://www.youtube.com/user/netsolwebmaster.

Forward-Looking

Statements

This

press release may contain forward-looking statements relating to the development of the Company’s products and services

and future operation results, including statements regarding the Company that are subject to certain risks and uncertainties that

could cause actual results to differ materially from those projected. The words “expects,” “anticipates,”

variations of such words, and similar expressions, identify forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995, but their absence does not mean that the statement is not forward-looking. These statements are

not guarantees of future performance and are subject to certain risks, uncertainties, and assumptions that are difficult to predict.

Factors that could affect the Company’s actual results include the progress and costs of the development of products and

services and the timing of the market acceptance. The subject Companies expressly disclaim any obligation or undertaking to update

or revise any forward-looking statement contained herein to reflect any change in the company’s expectations with regard

thereto or any change in events, conditions or circumstances upon which any statement is based.

(Tables

Follow)

###

NetSol

Technologies, Inc. and Subsidiaries

Consolidated

Balance Sheets

| | |

As of December 31, | | |

As of June 30, | |

| | |

2014 | | |

2014 | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 13,486,526 | | |

$ | 11,462,695 | |

| Restricted cash | |

| 90,000 | | |

| 2,528,844 | |

| Accounts receivable, net of allowance of $1,058,214 and $1,088,172 | |

| 7,706,162 | | |

| 5,403,165 | |

| Accounts receivable, net - related party | |

| 2,123,567 | | |

| 2,232,610 | |

| Revenues in excess of billings | |

| 3,098,226 | | |

| 2,377,367 | |

| Other current assets | |

| 2,564,116 | | |

| 2,857,879 | |

| Total current assets | |

| 29,068,597 | | |

| 26,862,560 | |

| Property and equipment, net | |

| 27,543,489 | | |

| 29,721,128 | |

| Intangible assets, net | |

| 26,030,664 | | |

| 28,803,018 | |

| Goodwill | |

| 9,516,568 | | |

| 9,516,568 | |

| Total assets | |

$ | 92,159,318 | | |

$ | 94,903,274 | |

| | |

| | | |

| | |

| LIABILITIES AND

STOCKHOLDERS' EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 4,971,101 | | |

$ | 5,234,887 | |

| Current portion of loans and obligations under capitalized leases | |

| 3,217,397 | | |

| 5,791,258 | |

| Unearned revenues | |

| 8,141,083 | | |

| 3,239,852 | |

| Common stock to be issued | |

| 721,592 | | |

| 347,518 | |

| Total current liabilities | |

| 17,051,173 | | |

| 14,613,515 | |

| Long term loans

and obligations under capitalized leases; less current maturities | |

| 1,082,310 | | |

| 1,532,080 | |

| Total liabilities | |

| 18,133,483 | | |

| 16,145,595 | |

| Commitments and

contingencies | |

| | | |

| | |

| Stockholders' equity: | |

| | | |

| | |

| Preferred stock, $.01 par value; 500,000 shares authorized; | |

| - | | |

| - | |

| Common stock, $.01 par value; 14,500,000 shares authorized; 9,743,850 and 9,150,889 issued and outstanding as

of December 31, 2014 and June 30, 2014 | |

| 97,439 | | |

| 91,509 | |

| Additional paid-in-capital | |

| 117,834,686 | | |

| 115,394,097 | |

| Treasury stock | |

| (415,425 | ) | |

| (415,425 | ) |

| Accumulated deficit | |

| (38,382,498 | ) | |

| (35,177,303 | ) |

| Stock subscription receivable | |

| (2,280,488 | ) | |

| (2,280,488 | ) |

| Other comprehensive loss | |

| (16,208,648 | ) | |

| (14,979,223 | ) |

| Total NetSol stockholders' equity | |

| 60,645,066 | | |

| 62,633,167 | |

| Non-controlling interest | |

| 13,380,769 | | |

| 16,124,512 | |

| Total stockholders'

equity | |

| 74,025,835 | | |

| 78,757,679 | |

| Total liabilities

and stockholders' equity | |

$ | 92,159,318 | | |

$ | 94,903,274 | |

NetSol

Technologies, Inc. and Subsidiaries

Consolidated

Statement of Operations

| | |

For the Three Months | | |

For the Six Months | |

| | |

Ended

December 31, | | |

Ended

December 31, | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| Net Revenues: | |

| | | |

| | | |

| | | |

| | |

| License fees | |

$ | 2,100,715 | | |

$ | 455,616 | | |

$ | 3,685,268 | | |

$ | 2,708,183 | |

| Maintenance fees | |

| 3,329,587 | | |

| 2,867,195 | | |

| 6,178,228 | | |

| 5,247,604 | |

| Services | |

| 5,567,826 | | |

| 3,974,591 | | |

| 9,965,783 | | |

| 7,294,814 | |

| Services - related party | |

| 1,354,476 | | |

| 1,256,899 | | |

| 2,750,476 | | |

| 2,224,442 | |

| Total net revenues | |

| 12,352,604 | | |

| 8,554,301 | | |

| 22,579,755 | | |

| 17,475,043 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues: | |

| | | |

| | | |

| | | |

| | |

| Salaries and consultants | |

| 4,298,900 | | |

| 3,160,760 | | |

| 8,415,117 | | |

| 6,420,551 | |

| Travel | |

| 590,353 | | |

| 347,670 | | |

| 1,012,224 | | |

| 736,255 | |

| Depreciation and amortization | |

| 1,800,753 | | |

| 1,120,363 | | |

| 3,602,320 | | |

| 2,046,678 | |

| Other | |

| 662,046 | | |

| 1,006,465 | | |

| 1,336,909 | | |

| 1,695,009 | |

| Total cost of revenues | |

| 7,352,052 | | |

| 5,635,258 | | |

| 14,366,570 | | |

| 10,898,493 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 5,000,552 | | |

| 2,919,043 | | |

| 8,213,185 | | |

| 6,576,550 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Selling and marketing | |

| 1,574,955 | | |

| 893,781 | | |

| 2,707,315 | | |

| 1,948,922 | |

| Depreciation and amortization | |

| 438,003 | | |

| 430,947 | | |

| 1,018,776 | | |

| 857,564 | |

| General and administrative | |

| 3,911,754 | | |

| 2,997,431 | | |

| 7,587,510 | | |

| 6,404,431 | |

| Research and development cost | |

| 80,437 | | |

| 55,114 | | |

| 146,702 | | |

| 113,802 | |

| Total operating expenses | |

| 6,005,149 | | |

| 4,377,273 | | |

| 11,460,303 | | |

| 9,324,719 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (1,004,597 | ) | |

| (1,458,230 | ) | |

| (3,247,118 | ) | |

| (2,748,169 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income and

(expenses) | |

| | | |

| | | |

| | | |

| | |

| Loss on sale of assets | |

| (69,543 | ) | |

| (175,237 | ) | |

| (80,595 | ) | |

| (189,032 | ) |

| Interest expense | |

| (47,265 | ) | |

| (92,738 | ) | |

| (120,358 | ) | |

| (161,955 | ) |

| Interest income | |

| 106,078 | | |

| 39,931 | | |

| 163,997 | | |

| 72,785 | |

| Gain (loss) on foreign currency exchange

transactions | |

| (421,082 | ) | |

| 96,039 | | |

| (341,862 | ) | |

| 1,207,462 | |

| Other income | |

| 18,162 | | |

| 59 | | |

| 18,539 | | |

| 665 | |

| Total other income (expenses) | |

| (413,650 | ) | |

| (307,786 | ) | |

| (360,279 | ) | |

| 763,277 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss before

income taxes | |

| (1,418,247 | ) | |

| (1,766,016 | ) | |

| (3,607,397 | ) | |

| (1,984,892 | ) |

| Income tax provision | |

| (87,683 | ) | |

| (29,270 | ) | |

| (127,759 | ) | |

| (40,401 | ) |

| Net loss from continuing

operations | |

| (1,505,930 | ) | |

| (1,795,286 | ) | |

| (3,735,156 | ) | |

| (2,025,293 | ) |

| Loss from discontinued

operations | |

| - | | |

| (145,527 | ) | |

| - | | |

| (378,468 | ) |

| Net loss | |

| (1,505,930 | ) | |

| (1,940,813 | ) | |

| (3,735,156 | ) | |

| (2,403,761 | ) |

| Non-controlling interest | |

| 138,764 | | |

| 313,905 | | |

| 529,961 | | |

| (320,262 | ) |

| Net loss attributable

to NetSol | |

$ | (1,367,166 | ) | |

$ | (1,626,908 | ) | |

$ | (3,205,195 | ) | |

$ | (2,724,023 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Amount attributable

to NetSol common shareholders: | |

| | | |

| | | |

| | | |

| | |

| Loss from continuing

operations | |

$ | (1,367,166 | ) | |

$ | (1,481,381 | ) | |

$ | (3,205,195 | ) | |

$ | (2,345,555 | ) |

| Loss from discontinued

operations | |

| - | | |

| (145,527 | ) | |

| - | | |

| (378,468 | ) |

| Net

loss | |

$ | (1,367,166 | ) | |

$ | (1,626,908 | ) | |

$ | (3,205,195 | ) | |

$ | (2,724,023 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share: | |

| | | |

| | | |

| | | |

| | |

| Net loss per share from continuing operations: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.14 | ) | |

$ | (0.16 | ) | |

$ | (0.34 | ) | |

$ | (0.26 | ) |

| Diluted | |

$ | (0.14 | ) | |

$ | (0.16 | ) | |

$ | (0.34 | ) | |

$ | (0.26 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share from discontinued operations: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | - | | |

$ | (0.02 | ) | |

$ | - | | |

$ | (0.04 | ) |

| Diluted | |

$ | - | | |

$ | (0.02 | ) | |

$ | - | | |

$ | (0.04 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per common share | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.14 | ) | |

$ | (0.18 | ) | |

$ | (0.34 | ) | |

$ | (0.30 | ) |

| Diluted | |

$ | (0.14 | ) | |

$ | (0.18 | ) | |

$ | (0.34 | ) | |

$ | (0.30 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of shares outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 9,654,334 | | |

| 9,056,024 | | |

| 9,433,829 | | |

| 9,006,015 | |

| Diluted | |

| 9,654,334 | | |

| 9,056,024 | | |

| 9,433,829 | | |

| 9,006,015 | |

NetSol

Technologies, Inc. and Subsidiaries

Consolidated

Statement of Cash Flows

| | |

For the Six Months | |

| | |

Ended December 31, | |

| | |

2014 | | |

2013 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (3,735,156 | ) | |

$ | (2,403,761 | ) |

| Adjustments to reconcile net loss to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 4,621,096 | | |

| 3,144,948 | |

| Provision for bad debts | |

| - | | |

| 259,306 | |

| Share of net loss from investment under equity method | |

| - | | |

| 166,648 | |

| Loss on sale of assets | |

| 80,595 | | |

| 189,032 | |

| Stock issued for services | |

| 606,536 | | |

| 640,247 | |

| Fair market value of warrants and stock options granted | |

| 311,244 | | |

| 158,783 | |

| Changes in operating assets and liabilities:

| |

| | | |

| | |

| Accounts receivable | |

| (2,279,774 | ) | |

| (1,246,995 | ) |

| Accounts receivable - related party | |

| 40,907 | | |

| (842,503 | ) |

| Revenues in excess of billing | |

| (765,672 | ) | |

| 8,612,283 | |

| Other current assets | |

| 286,838 | | |

| 367,741 | |

| Accounts payable and accrued expenses | |

| 59 | | |

| 1,388,473 | |

| Unearned revenue | |

| 4,857,469 | | |

| 2,228,992 | |

| Net cash provided by operating activities

| |

| 4,024,142 | | |

| 12,663,194 | |

| |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchases of property and equipment | |

| (1,772,866 | ) | |

| (6,059,596 | ) |

| Sales of property and equipment | |

| 179,904 | | |

| 78,678 | |

| Purchase of non-controlling interest in subsidiaries | |

| (577,222 | ) | |

| (17,853 | ) |

| Increase in intangible assets | |

| - | | |

| (2,312,919 | ) |

| Net cash used in

investing activities | |

| (2,170,184 | ) | |

| (8,311,690 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from sale of common stock | |

| 1,610,000 | | |

| - | |

| Proceeds from the exercise of stock options and warrants | |

| 116,400 | | |

| 560,500 | |

| Proceeds from exercise of subsidiary options | |

| - | | |

| 311,709 | |

| Restricted cash | |

| 2,438,844 | | |

| (660,672 | ) |

| Dividend paid by subsidiary to Non controlling interest | |

| (780,106 | ) | |

| (266,343 | ) |

| Proceeds from bank loans | |

| 57,405 | | |

| 1,276,505 | |

| Payments on capital lease obligations and loans - net | |

| (2,867,974 | ) | |

| (781,756 | ) |

| Net cash provided by financing activities

| |

| 574,569 | | |

| 439,943 | |

| Effect of exchange rate changes | |

| (404,696 | ) | |

| (1,084,723 | ) |

| Net increase in cash and cash equivalents | |

| 2,023,831 | | |

| 3,706,724 | |

| Cash and cash equivalents, beginning of the period | |

| 11,462,695 | | |

| 7,874,318 | |

| Cash and cash equivalents, end of period | |

$ | 13,486,526 | | |

$ | 11,581,042 | |

NetSol

Technologies, Inc. and Subsidiaries

Reconciliation

to GAAP

| | |

Three Months | | |

Three Months | | |

Six Months | | |

Six Months | |

| | |

Ended | | |

Ended | | |

Ended | | |

Ended | |

| | |

December 31, 2014 | | |

December 31, 2013 | | |

December 31, 2014 | | |

December 31, 2013 | |

| | |

| | |

| | |

| | |

| |

| Net Income (loss) before preferred dividend, per GAAP | |

$ | (1,367,166 | ) | |

$ | (1,626,908 | ) | |

$ | (3,205,195 | ) | |

$ | (2,724,023 | ) |

| Income Taxes | |

| 87,683 | | |

| 29,270 | | |

| 127,759 | | |

| 40,401 | |

| Depreciation and amortization | |

| 2,238,756 | | |

| 1,551,310 | | |

| 4,621,096 | | |

| 2,904,242 | |

| Interest expense | |

| 47,265 | | |

| 92,738 | | |

| 120,358 | | |

| 161,955 | |

| Interest (income) | |

| (106,078 | ) | |

| (39,931 | ) | |

| (163,997 | ) | |

| (72,785 | ) |

| EBITDA | |

$ | 900,460 | | |

$ | 6,479 | | |

$ | 1,500,021 | | |

$ | 309,790 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted Average number of shares outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 9,654,334 | | |

| 9,056,024 | | |

| 9,433,829 | | |

| 9,006,015 | |

| Diluted | |

| 9,654,334 | | |

| 9,089,846 | | |

| 9,433,829 | | |

| 9,039,838 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic EBITDA | |

$ | 0.09 | | |

$ | 0.00 | | |

$ | 0.16 | | |

$ | 0.03 | |

| Diluted EBITDA | |

$ | 0.09 | | |

$ | 0.00 | | |

$ | 0.16 | | |

$ | 0.03 | |

Although

the net EBITDA income is a non-GAAP measure of performance, we are providing it because we believe it to be an important supplemental

measure of our performance that is commonly used by securities analysts, investors, and other interested parties in the evaluation

of companies in our industry. It should not be considered as an alternative to net income, operating income or any other financial

measures calculated and presented, nor as an alternative to cash flow from operating activities as a measure of our liquidity.

It may not be indicative of the Company’s historical operating results nor is it intended to be predictive of potential

future results.

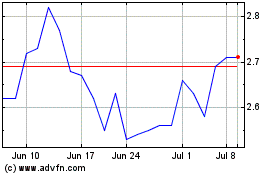

NetSol Technologies (NASDAQ:NTWK)

Historical Stock Chart

From Mar 2024 to Apr 2024

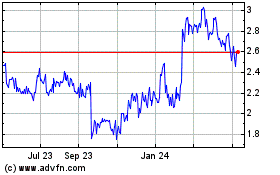

NetSol Technologies (NASDAQ:NTWK)

Historical Stock Chart

From Apr 2023 to Apr 2024