UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 5, 2015

Dynavax Technologies Corporation

(Exact name of registrant as specified in its charter)

Commission File Number: 001-34207

|

Delaware |

|

33-0728374 |

|

(State or other jurisdiction of |

|

(IRS Employer |

|

incorporation) |

|

Identification No.) |

2929 Seventh Street, Suite 100

Berkeley, CA 94710-2753

(Address of principal executive offices, including zip code)

(510) 848-5100

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02. Departure of Directors or Certain Officers; Elections of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

(b) Departure of Directors or Certain Officers

Denise M. Gilbert, Ph.D., will retire from the Board of Directors (the “Board”) of Dynavax Technologies Corporation (“Dynavax” or the “Company”), following the Company’s Audit Committee meeting presently scheduled to be held on February 26, 2015.

(c) Election of Directors

Effective February 5, 2015, the Board of Dynavax appointed Laura Brege as a Class I director to serve until the 2016 Annual Meeting of Stockholders. Upon Ms. Gilbert’s retirement, Ms. Brege will become Chair of the Audit Committee. Pursuant to the terms of an offer letter between Dynavax and Ms. Brege and the compensation policies of Dynavax with respect to outside directors, Ms. Brege received the following as of her date of appointment:

1. Pursuant to the Dynavax 2004 Non-Employee Director Option Program and the 2005 Non-Employee Director Cash Compensation Program, as amended (the “Directors’ Plan”), Ms. Brege was granted an initial non-qualified stock option to purchase 2,000 shares of Dynavax common stock, with an exercise price equal to the fair market value on the date of grant, vesting over four years in equal annual installments;

2. Pursuant to the Directors’ Plan, Ms. Brege will be eligible to receive a non-qualified option to purchase up to an additional 7,500 shares of Dynavax common stock immediately following each annual meeting of Dynavax’s stockholders (with respect to the first such grant, the option will be pro-rated in accordance with the terms of the Directors’ Plan), with an exercise price equal to the fair market value on the date of grant, vesting on the first anniversary of the grant; and

3. Pursuant to the Directors’ Plan, Ms. Brege will receive an annual retainer of $40,000 as a member of the Board of Directors and $20,000 as Chairman of the Audit Committee, payable in equal quarterly installments in arrears.

A copy of the press release relating to Ms. Brege’s appointment is attached hereto as Exhibit 99.1.

(e) Compensation Arrangements of Certain Officers and Directors

On February 5, 2015, upon the recommendation of the Compensation Committee, the Board approved 2015 base salaries and 2014 bonuses for the executive officers of the Company, including the named executive officers. The Board delegated approval of 2015 equity awards to the Compensation Committee. On February 9, 2015, the Compensation Committee approved equity awards for the named executive officers, composed of options with an exercise price equal to the fair market value on the date of grant, one half of which would be contingent on stockholder approval of an increase in the number of shares available under the 2011 Equity Incentive Plan.

The Board and the Compensation Committee annually evaluate the performance of Dynavax’s executive officers and determine their compensation based on their performance and on the compensation of others in competitive positions at similar life sciences companies. The 2014 compensation program included a cash bonus target based on pre-defined target payouts as a percentage of corporate performance as well as individual performance. Executive equity compensation was based on each executive’s performance based on previously-disclosed Company guidelines.

The approved 2015 base salaries, 2014 bonuses and 2015 equity awards are as set forth below:

|

|

|

|

|

|

|

|

|

|

|

Name and Title |

|

2015 Base Salary |

|

2014 Bonus |

|

2015 Stock Option Award(1) |

|

|

|

|

|

|

|

|

|

|

|

Eddie Gray |

$ |

566,500 |

$ |

432,600 |

|

225,000 |

|

|

Chief Executive Officer |

|

|

|

|

|

|

|

|

Robert L. Coffman, Ph.D. |

$ |

453,200 |

$ |

286,000 |

|

75,000 |

|

|

Senior Vice President and Chief Scientific Officer |

|

|

|

|

|

|

|

|

Robert Janssen, M.D. |

$ |

369,513 |

$ |

246,641 |

|

56,000 |

|

|

Chief Medical Officer and Vice President, Clinical Development and Regulatory Affairs |

|

|

|

|

|

|

|

|

David Novack |

$ |

375,000 |

$ |

208,575 |

|

75,000 |

|

|

Senior Vice President, Operations and Quality |

|

|

|

|

|

|

|

|

Michael S. Ostrach |

$ |

390,000 |

$ |

221,345 |

|

67,000 |

|

|

Vice President, Chief Business Officer, General Counsel and Principal Financial Officer |

|

|

|

|

|

|

|

___________

|

(1) |

Stock options with an exercise price per share of $16.00, representing the closing price on the grant date of February 9, 2015. All options will vest over four (4) years with one fourth (1/4) of the shares subject to the option vesting twelve months after the grant date, and one forty-eighth (1/48) of the shares subject to the option vesting on the last day of each month thereafter. One half of the options will be subject to approval by our stockholders of an increase in the number of shares available under the 2011 Equity Incentive Plan. |

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

The following exhibit is furnished herewith:

99.1 Press Release, dated February 6, 2015, titled "Dynavax Announces Laura Brege has Joined Board of Directors and Denise Gilbert will Retire”

Signature(s)

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

Dynavax Technologies Corporation |

|

Date February 11, 2015 |

|

By: /s/ DAVID JOHNSON |

|

|

|

David Johnson

Vice President |

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

EX-99.1 |

|

Press Release, dated Feb 6, 2015, titled “Dynavax Announces Laura Brege has Joined Board of Directors and Denise Gilbert will Retire” |

Exhibit 99.1

DYNΛVAX

INNOVATING IMMUNOLOGY

2929 Seventh Street, Suite 100

Berkeley, CA 94710

|

|

|

|

Contact: |

|

|

|

Michael Ostrach |

|

|

|

Chief Business and Principal Financial Officer |

|

|

|

510-665-7257 |

|

|

|

mostrach@dynavax.com |

|

|

Dynavax Announces Laura Brege Has Joined Board of Directors and Denise Gilbert Will Retire

BERKELEY, CA -- 02/6/15 -- Dynavax Technologies Corporation (NASDAQ: DVAX) announced today the appointment of Laura Brege to its Board of Directors and Audit Committee. Denise Gilbert, a director and the Chair of the Audit Committee since 2004, will retire from her positions with the company following the next Audit Committee meeting, whereupon Ms. Brege will become Chair of the Committee.

Ms. Brege is President and Chief Executive Officer of Nodality Inc. She has over 20 years of executive management experience in the pharmaceutical, biotechnology and venture capital industries. Prior to joining Nodality in 2012, Ms. Brege held several senior-level positions at Onyx Pharmaceuticals, Inc., including Executive Vice President and Chief Operating Officer. While at Onyx she led multiple functions, including commercialization, strategic planning, corporate development, and medical, scientific and government affairs. Prior to Onyx, Ms. Brege was a General Partner at Red Rock Capital Management, a venture capital firm specializing in early stage financing for technology companies. Previously, Ms. Brege was SVP and Chief Financial Officer at COR Therapeutics. Earlier in her career, she served as Chief Financial Officer at Flextronics, Inc. and Treasurer of The Cooper Companies, Inc. She serves on the Board of Directors of Acadia Pharmaceuticals, Inc., Aratana Therapeutics, Inc. and Pacira Pharmaceuticals, Inc. Ms. Brege earned her undergraduate degrees from Ohio University (Honors Tutorial College) and her MBA degree from the University of Chicago.

"We are grateful for the extraordinary skill, insight and effort Denise devoted to her roles as a director and Audit Committee Chair. We will miss her very much. Laura Brege’s financial background and extensive executive experience in the biotechnology industry will be of great utility to our Board and Audit Committee as we advance toward commercial activities and broaden our immuno-oncology efforts," said Arnold Oronsky, Chairman of the Dynavax Board.

About Dynavax

Dynavax, a clinical-stage biopharmaceutical company, uses TLR biology to discover and develop novel vaccines and therapeutics in the areas of infectious and inflammatory diseases and oncology. Dynavax's lead product candidate is HEPLISAV-B™, a Phase 3 investigational adult hepatitis B vaccine. For more information visit www.dynavax.com.

# # #

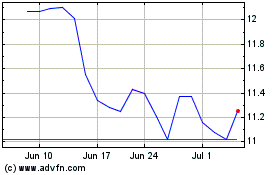

Dynavax Technologies (NASDAQ:DVAX)

Historical Stock Chart

From Mar 2024 to Apr 2024

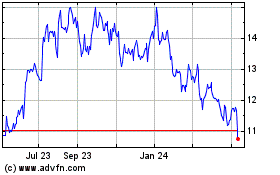

Dynavax Technologies (NASDAQ:DVAX)

Historical Stock Chart

From Apr 2023 to Apr 2024