UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 9, 2015

AMERICAN AIRLINES GROUP INC.

AMERICAN AIRLINES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-8400 |

|

75-1825172 |

| Delaware |

|

1-2691 |

|

13-1502798 |

| (State or other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 4333 Amon Carter Blvd., Fort Worth, Texas |

|

76155 |

| 4333 Amon Carter Blvd., Fort Worth, Texas |

|

76155 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code:

(817) 963-1234

(817)

963-1234

N/A

(Former name

or former address if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| ITEM 7.01 |

REGULATION FD DISCLOSURE. |

On February 9, 2015, American Airlines Group Inc.

(“American”) announced via press release certain traffic statistics for January 2015. A copy of American’s press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 7.01, including Exhibit 99.1, is being furnished and shall not be deemed to be “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section and shall not be deemed incorporated by reference into any registration statement or other document filed

pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

| ITEM 9.01. |

FINANCIAL STATEMENTS AND EXHIBITS. |

(d) Exhibits.

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press Release, dated February 9, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, American Airlines Group Inc. has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

AMERICAN AIRLINES GROUP INC. |

|

|

|

|

| Date: February 9, 2015 |

|

|

|

By: |

|

/s/ Derek J. Kerr |

|

|

|

|

|

|

Derek J. Kerr |

|

|

|

|

|

|

Executive Vice President and |

|

|

|

|

|

|

Chief Financial Officer |

Pursuant to the requirements of the Securities Exchange Act of 1934, American Airlines, Inc. has duly caused this report to be

signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

AMERICAN AIRLINES, INC. |

|

|

|

|

| Date: February 9, 2015 |

|

|

|

By: |

|

/s/ Derek J. Kerr |

|

|

|

|

|

|

Derek J. Kerr |

|

|

|

|

|

|

Executive Vice President and |

|

|

|

|

|

|

Chief Financial Officer |

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press Release, February 9, 2015. |

Exhibit 99.1

|

|

|

|

|

Corporate Communications

817-967-1577 mediarelations@aa.com

Investor Relations

817-931-3423 investor.relations@aa.com |

FOR RELEASE: Monday, February 9, 2015

AMERICAN AIRLINES GROUP REPORTS JANUARY TRAFFIC RESULTS

FORT WORTH, Texas – American Airlines Group (NASDAQ: AAL) today reported January 2015 traffic results.

American Airlines Group’s total revenue passenger miles (RPMs) for the month were 16.8 billion, down 2.8 percent versus January 2014. Total capacity was

21.5 billion available seat miles (ASMs), down 0.2 percent versus January 2014. Total passenger load factor was 78.2 percent for the month of January, down 2.1 percentage points versus January 2014.

Based on one month of actual data and two months of forecast, the Company continues to expect its first quarter 2015 consolidated passenger revenue per

available seat mile (PRASM) to be down approximately two percent to four percent. Due to the recent rise in fuel prices, the Company is currently forecasting its first quarter fuel price to be approximately 10 cents higher than its previous

guidance. The Company’s current estimate for first quarter fuel price is $1.81 to $1.86 per gallon versus its previous estimate of $1.71 to $1.76 per gallon. As a result, the Company now expects its first quarter pretax margin excluding special

items to be approximately 12 percent to 14 percent versus its previous guidance of 13 percent to 15 percent.

The following summarizes American Airlines

Group traffic results for the month ended January 31, 2015 and 2014, consisting of mainline-operated flights, wholly owned regional subsidiaries and operating results from capacity purchase agreements.

– more –

American Airlines Group Reports January 2015 Traffic

February 9, 2015

Page

2

American Airlines Group Traffic Results

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

January |

|

| |

|

2015 |

|

|

2014 |

|

|

Change |

|

| Revenue Passenger Miles (000) |

|

|

|

|

|

|

|

|

|

|

|

|

| Domestic |

|

|

9,689,505 |

|

|

|

10,077,527 |

|

|

|

(3.9 |

)% |

| Atlantic |

|

|

1,624,813 |

|

|

|

1,820,620 |

|

|

|

(10.8 |

)% |

| Latin America |

|

|

2,994,366 |

|

|

|

3,160,281 |

|

|

|

(5.3 |

)% |

| Pacific |

|

|

782,765 |

|

|

|

616,253 |

|

|

|

27.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| International |

|

|

5,401,944 |

|

|

|

5,597,154 |

|

|

|

(3.5 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mainline |

|

|

15,091,449 |

|

|

|

15,674,681 |

|

|

|

(3.7 |

)% |

| Regional |

|

|

1,726,029 |

|

|

|

1,630,301 |

|

|

|

5.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Revenue Passenger Miles |

|

|

16,817,478 |

|

|

|

17,304,982 |

|

|

|

(2.8 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Available Seat Miles (000) |

|

|

|

|

|

|

|

|

|

|

|

|

| Domestic |

|

|

12,175,418 |

|

|

|

12,241,906 |

|

|

|

(0.5 |

)% |

| Atlantic |

|

|

2,241,623 |

|

|

|

2,474,415 |

|

|

|

(9.4 |

)% |

| Latin America |

|

|

3,735,128 |

|

|

|

3,935,258 |

|

|

|

(5.1 |

)% |

| Pacific |

|

|

980,735 |

|

|

|

719,559 |

|

|

|

36.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| International |

|

|

6,957,486 |

|

|

|

7,129,232 |

|

|

|

(2.4 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mainline |

|

|

19,132,904 |

|

|

|

19,371,138 |

|

|

|

(1.2 |

)% |

| Regional |

|

|

2,373,740 |

|

|

|

2,186,570 |

|

|

|

8.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Available Seat Miles |

|

|

21,506,644 |

|

|

|

21,557,708 |

|

|

|

(0.2 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Load Factor (%) |

|

|

|

|

|

|

|

|

|

|

|

|

| Domestic |

|

|

79.6 |

|

|

|

82.3 |

|

|

|

(2.7 |

)pts |

| Atlantic |

|

|

72.5 |

|

|

|

73.6 |

|

|

|

(1.1 |

)pts |

| Latin America |

|

|

80.2 |

|

|

|

80.3 |

|

|

|

(0.1 |

)pts |

| Pacific |

|

|

79.8 |

|

|

|

85.6 |

|

|

|

(5.8 |

)pts |

| International |

|

|

77.6 |

|

|

|

78.5 |

|

|

|

(0.9 |

)pts |

| Mainline |

|

|

78.9 |

|

|

|

80.9 |

|

|

|

(2.0 |

)pts |

| Regional |

|

|

72.7 |

|

|

|

74.6 |

|

|

|

(1.9 |

)pts |

| Total Load Factor |

|

|

78.2 |

|

|

|

80.3 |

|

|

|

(2.1 |

)pts |

|

|

|

|

| Enplanements |

|

|

|

|

|

|

|

|

|

|

|

|

| Mainline |

|

|

11,225,335 |

|

|

|

11,731,323 |

|

|

|

(4.3 |

)% |

| Regional |

|

|

3,958,652 |

|

|

|

3,756,153 |

|

|

|

5.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Enplanements |

|

|

15,183,987 |

|

|

|

15,487,476 |

|

|

|

(2.0 |

)% |

|

|

|

|

| System Cargo Ton Miles (000) |

|

|

170,521 |

|

|

|

173,804 |

|

|

|

(1.9 |

)% |

Notes:

| 1) |

Canada, Puerto Rico and U.S. Virgin Islands are included in the domestic results. |

| 2) |

Latin America numbers include the Caribbean. |

| 3) |

Regional includes wholly owned subsidiaries and operating results from capacity purchase carriers. |

American Airlines Group Reports January 2015 Traffic

February 9, 2015

Page

3

About American Airlines Group

American Airlines Group (NASDAQ: AAL) is the holding company for American Airlines and US Airways. Together with wholly owned and third-party regional carriers

operating as American Eagle and US Airways Express, the airlines operate an average of nearly 6,700 flights per day to 339 destinations in 54 countries from its hubs in Charlotte, Chicago, Dallas/Fort Worth, Los Angeles, Miami, New York,

Philadelphia, Phoenix and Washington, D.C. The American Airlines AAdvantage and US Airways Dividend Miles programs allow members to earn miles for travel, vacation packages, car rentals, hotel stays and everyday purchases. Members of both programs

can redeem miles for tickets as well as upgrades to First Class and Business Class. In addition, AAdvantage members can redeem miles for vacation packages, car rentals, hotel stays and retail products. American is a founding member of the

oneworld alliance, whose members and members-elect serve nearly 1,000 destinations with 14,250 daily flights to 150 countries. Connect with American on Twitter @AmericanAir and at Facebook.com/AmericanAirlines and follow US Airways on Twitter

@USAirways.

Cautionary Statement Regarding Forward-Looking Statements and Information

This document includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements

may be identified by words such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “could,”

“should,” “would,” “continue,” “seek,” “target,” “guidance,” “outlook,” “if current trends continue,” “optimistic,” “forecast” and other similar

words. Such statements include, but are not limited to, statements about the expected first quarter pre-tax margin, the expected change in PRASM, and other statements that are not historical facts. These forward-looking statements are based on the

current objectives, beliefs and expectations of the Company, and they are subject to significant risks and uncertainties that may cause actual results and financial position and timing of certain events to differ materially from the information in

the forward-looking statements. The following factors, among others, could cause actual results and financial position and timing of certain events to differ materially from those described in the forward-looking statements: significant operating

losses in the future; downturns in economic conditions that adversely affect the Company’s business; the impact of continued periods of high volatility in fuel costs, increased fuel prices and significant disruptions in the supply of aircraft

fuel; competitive practices in the industry, including the impact of low cost carriers, airline alliances and industry consolidation; the challenges and costs of integrating operations and realizing anticipated synergies and other benefits of the

merger transaction with US Airways Group, Inc.; the Company’s substantial indebtedness and other obligations and the effect they could have on the Company’s business and liquidity; an inability to obtain sufficient financing or other

capital to operate successfully and in accordance with the Company’s current business plan; increased costs of financing, a reduction in the availability of financing and fluctuations in interest rates; the effect the Company’s high level

of fixed obligations may have on its ability to fund general corporate requirements, obtain additional financing and respond to competitive developments and adverse economic and industry conditions; the Company’s significant pension and other

post-employment benefit funding obligations; the impact of any failure to comply with the covenants contained in financing arrangements; provisions in credit card processing and other commercial agreements that may materially reduce the

Company’s liquidity; the limitations of the Company’s historical consolidated financial information, which is not

American Airlines Group Reports January 2015 Traffic

February 9, 2015

Page

4

directly comparable to its financial information for prior or future periods; the impact of union disputes, employee strikes and other labor-related disruptions; any inability to maintain labor

costs at competitive levels; interruptions or disruptions in service at one or more of the Company’s hub airports; any inability to obtain and maintain adequate facilities, infrastructure and slots to operate the Company’s flight schedule

and expand or change its route network; the Company’s reliance on third-party regional operators or third-party service providers that have the ability to affect the Company’s revenue and the public’s perception about its services;

any inability to effectively manage the costs, rights and functionality of third-party distribution channels on which the Company relies; extensive government regulation, which may result in increases in the Company’s costs, disruptions to the

Company’s operations, limits on the Company’s operating flexibility, reductions in the demand for air travel, and competitive disadvantages; the impact of the heavy taxation to which the airline industry is subject; changes to the

Company’s business model that may not successfully increase revenues and may cause operational difficulties or decreased demand; the loss of key personnel or inability to attract and retain additional qualified personnel; the impact of

conflicts overseas, terrorist attacks and ongoing security concerns; the global scope of the Company’s business and any associated economic and political instability or adverse effects of events, circumstances or government actions beyond its

control, including the impact of foreign currency exchange rate fluctuations and limitations on the repatriation of cash held in foreign countries; the impact of environmental regulation; the Company’s reliance on technology and automated

systems and the impact of any failure of these technologies or systems; challenges in integrating the Company’s computer, communications and other technology systems; costs of ongoing data security compliance requirements and the impact of any

significant data security breach; losses and adverse publicity stemming from any accident involving any of the Company’s aircraft or the aircraft of its regional or codeshare operators; delays in scheduled aircraft deliveries, or other loss of

anticipated fleet capacity, and failure of new aircraft to perform as expected; the Company’s dependence on a limited number of suppliers for aircraft, aircraft engines and parts; the impact of changing economic and other conditions beyond the

Company’s control, including global events that affect travel behavior such as an outbreak of a contagious disease, and volatility and fluctuations in the Company’s results of operations due to seasonality; the effect of a higher than

normal number of pilot retirements and a potential shortage of pilots; the impact of possible future increases in insurance costs or reductions in available insurance coverage; the effect of several lawsuits that were filed in connection with the

merger transaction with US Airways Group, Inc. and remain pending; an inability to use NOL carryforwards; any impairment in the amount of goodwill the Company recorded as a result of the application of the acquisition method of accounting and an

inability to realize the full value of the Company’s and American Airlines’ respective intangible or long-lived assets and any material impairment charges that would be recorded as a result; price volatility of the Company’s common

stock; delay or prevention of stockholders’ ability to change the composition of the Company’s board of directors and the effect this may have on takeover attempts that some of the Company’s stockholders might consider beneficial; the

effect of provisions of the Company’s Certificate of Incorporation and Bylaws that limit ownership and voting of its equity interests, including its common stock; the effect of limitations in the Company’s Certificate of Incorporation on

acquisitions and dispositions of its common stock designed to protect its NOL carryforwards and certain other tax attributes, which may limit the liquidity of its common stock; and other economic, business, competitive, and/or regulatory

American Airlines Group Reports January 2015 Traffic

February 9, 2015

Page

5

factors affecting the Company’s business, including those set forth in the Company’s quarterly report on Form 10-Q for the period ending September 30, 2014 (especially in the

“Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections) and other risks and uncertainties listed from time to time in the Company’s filings with the SEC. Any

forward-looking statements speak only as of the date hereof or as of the dates indicated in the statements. The Company does not assume any obligation to publicly update or supplement any forward-looking statement to reflect actual results, changes

in assumptions or changes in other factors affecting these forward-looking statements except as required by law.

###

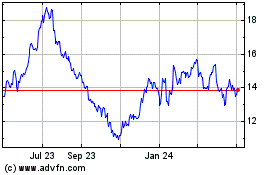

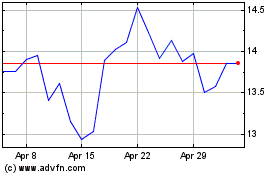

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Apr 2023 to Apr 2024