UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 8-K

______________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 2, 2015

______________________________

|

| | | | |

LIFEVANTAGE CORPORATION (Exact name of registrant as specified in its charter) |

______________________________

|

| | | | |

Colorado | | 001-35647 | | 90-0224471 |

(State or other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| |

9785 S. Monroe Street, Suite 300, Sandy, UT 84070 |

(Address of Principal Executive Offices and Zip Code) |

| | | | |

Registrant’s telephone number, including area code: (801) 432-9000 |

______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions |

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 2.02 | Results of Operations and Financial Condition. |

On February 4, 2015 LifeVantage Corporation (the “Company”) issued a press release announcing its financial results for the fiscal quarter ended December 31, 2014. A copy of the Company’s press release is attached as Exhibit 99.1 to this report and incorporated by reference.

The information furnished in this Item 2.02 and the exhibit hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

|

| |

Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On February 2, 2015, following mutual agreement with the Board of Directors of the Company, Douglas C. Robinson resigned from his role as President, Chief Executive Officer and Director effective immediately. On February 2, 2015, the Company issued a press release announcing this change, a copy of which is filed as Exhibit 99.2 hereto.

The Board of Directors formed a search committee to identify a qualified candidate to serve as the Company's next Chief Executive Officer. On an interim basis, the Board of Directors appointed Mr. Dave S. Manovich as Executive Vice Chairman of the Company and formed an interim Office of the President. The interim Office of the President will report directly to Mr. Manovich and will be comprised of the Company's senior operational officers: Shawn Talbott. Ph.D, Chief Science Officer, David Phelps, Chief Sales Officer, David Colbert, Chief Financial Officer, and Robert Urban, Chief Operating Officer. Mr. Manovich will act as the principal executive officer for SEC reporting purposes.

On February 2, 2015, the independent directors of the Company’s Board of Directors approved the material terms of Mr. Manovich’s compensation arrangement as interim Executive Vice Chairman, which includes (i) cash compensation of $30,000 per month; (ii) a grant of 50,000 shares of restricted stock that will vest in full on the first anniversary of the date of grant, subject to continued service with the Company; and (iii) reimbursing Mr. Manovich for his reasonable and customary expenses associated with establishing a temporary residency in Utah, including his expenses associated with commuting to Utah from his primary residence.

Mr. Manovich will continue to serve on the Company's Board of Directors but he will not receive compensation for his role as a director while serving as the Company's Executive Vice Chairman. Mr. Manovich resigned from the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. Mr. Manovich was replaced by Garry Mauro on the Audit Committee and by Richard Okumoto on the Compensation Committee. Michael Beindorff was appointed to replace Mr. Manovich as Chair of the Nominating and Corporate Governance Committee and George Metzger was newly appointed to that committee.

Mr. Manovich, age 63, has been a member of the Company's Board of Directors since January 2012. Mr. Manovich has extensive experience in finance management and oversight, executive sales and marketing operations as well as distribution management and development. He currently serves as Managing Partner of D&S Investments, a private investment entity focused on portfolio management for long term capital appreciation, a position he has held since 2006. From 2001 to 2006 Mr. Manovich was retired. From 1999 to 2001, he served as Chief Operating Officer and Senior Vice President of @Road Inc., a start-up wireless data services company. From 1998 to 1999, he served as a Partner of Union Atlantic, LC, an investment and venture capital merchant banking company. From 1997 to 1998, he served as Executive Vice President at Apple Computer where he was responsible for worldwide sales and support. From 1996 to 1997, he served as Vice President of Sales for Fujitsu P.C. where he was responsible for sales and channel development for the U.S., Canada, Central and Southern America and Caribbean markets. From 1985 to 1996, he served in various positions at Apple Computer, including as Vice President of U.S. consumer division, Director of Business Markets and Country Manager for the UK/Ireland as well as Regional & District Sales Manager in the U.S. From 1983 to 1985, he served as District Manager and franchise owner of Entre Computer. He served as Controller of the Federal Home Loan Bank of Seattle in 1983. Mr. Manovich began his career at Deloitte, Haskins & Sells, where he served as a Certified Public Accountant from 1979 to 1983. Mr. Manovich received his Bachelor of Science in Business Administration with an emphasis on Marketing and Management from the University of Montana and his Masters of Business Administration with an emphasis on Finance from the University of Montana.

|

| |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

|

| | | |

Exhibit No. |

| | Description |

99.1 |

| | Press release issued by the Company on February 4, 2015 announcing its financial results for the fiscal quarter ended December 31, 2014. |

99.2 |

| | Press release issued by the Company on February 2, 2015 announcing changes to its executive leadership. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| |

Date: February 4, 2015 | LIFEVANTAGE CORPORATION By: /s/ Rob Cutler Name: Rob Cutler Title: General Counsel |

Revenue During First Six Months of Fiscal Year 2015, excluding Japan, Increased 4.5%

Repurchased $4.6 Million Common Stock in Second Quarter

Generated $13 Million of Adjusted EBITDA in the First Six Months of Fiscal Year 2015

Salt Lake City, UT, February 4, 2015, LifeVantage Corporation (NASDAQ: LFVN) today reported financial results for its second quarter and six months ended December 31, 2014.

Second Quarter Fiscal 2015 Highlights:

| |

• | Revenue was $48 million compared to $52 million in the prior year period; |

| |

• | Revenue, excluding Japan, increased by 1.6% compared to the prior year period; |

| |

• | Operating income was $3.1 million, compared to $5.2 million in the prior year period; |

| |

• | Repurchased $4.6 million or 3.5 million shares; and |

| |

• | Opened corporate office in Hong Kong. |

Dave S. Manovich, Executive Vice Chairman of LifeVantage stated, "We do not believe the overall second quarter results reflect the strength of our distribution network or our expanded, scientifically-validated product line. In order to improve upon these results and return to meaningful top line growth and reignite growth and enthusiasm in our Company we recently implemented executive changes within our management team.”

“During the second quarter, we achieved growth in several markets, including our core Americas market, but this was offset by lower sales primarily in Japan. We are disappointed that pressures in the Japan market continue to impact our overall performance and know we can do better in this market as proven by previous results. We are intensely focused on identifying and implementing corrective actions designed to stabilize our efforts in Japan and improve growth rates in our other countries as well.”

Mr. Manovich continued, “We are encouraged by our distributors’ and customers’ positive responses to our expanded product offerings, including Axio and TrueScience, but we need to do a better job of engaging with our distributors to ensure that we are taking the right steps to maximize the sales of our newest products. We also are making progress with our geographic expansion efforts. In the second quarter, we opened a corporate office in Hong Kong, which we expect will facilitate a more expedited process for purchasing and receiving products in the region. In addition, we remain on track to commence sales in Thailand during the current fiscal year.”

Second Quarter Fiscal 2015 Results

For the second fiscal quarter ended December 31, 2014, the Company reported revenue of $48.2 million, compared to $51.5 million for the same period in fiscal 2014. Revenue reflects an increase of 2% in the Americas, and a decrease in the Asia/Pacific region of 23%, primarily due to the decline in Japan. Revenue for the quarter was negatively impacted $1.6 million, or 3%, by foreign currency fluctuation.

Operating income for the second fiscal quarter of 2015 was $3.1 million, compared to $5.2 million in the second fiscal quarter of 2014. Additionally, Adjusted EBITDA was $4.2 million for the second fiscal quarter of 2015, compared to $6.4 million in the prior year period.

Commissions and incentives for the second fiscal quarter of 2015 were $23.2 million, or 48.1% of revenue, compared to $25.4 million, or 49.3% of revenue, in the same period last year. Selling, general and

administrative expenses (SG&A) for the second fiscal quarter of 2015 were $14.5 million, or 30.0% of revenue, compared to $13.0 million, or 25.3% of revenue, in the same period last year. The increase in SG&A expenses is a result of the Company continuing to invest in sales, marketing and product development initiatives, primarily due to its investment in the October 2014 Axio product launch.

Net income for the second fiscal quarter of 2015 was $1.5 million, or $0.01 per diluted share, calculated on 100.7 million fully diluted shares. This compares to net income in the second fiscal quarter of 2014 of $3.3 million, or $0.03 per diluted share, calculated on 112.4 million fully diluted shares.

Fiscal 2015 First Six Months Results

For the six months ended December 31, 2014, the Company reported net revenue of $99.9 million, compared to $102.9 million in the prior year period. Revenue in the Americas increased 4%, while revenue in Asia Pacific decreased 16% due primarily to lower sales in Japan. Revenue for the first six months of fiscal 2015 was negatively impacted $2.3 million, or 4%, by foreign currency fluctuation.

Operating income for the first six months of fiscal 2015 was $10.9 million, compared to $10.2 million in the prior year period Additionally, Adjusted EBITDA was $13.0 million for the first six months of fiscal 2015, compared to $12.7 million in the prior year. First six months fiscal 2015 operating income and Adjusted EBITDA include the benefit of approximately $2 million from proceeds recovered and related to the Company's December 2012 product recall.

Net income for the first six months of fiscal 2015 was $6.2 million, or $0.06 per diluted share, compared to $6.5 million, or $0.06 per diluted share in the prior year period.

Balance Sheet & Liquidity

The Company generated $8.0 million of cash flow from operations in the first six months of fiscal 2015. Cash flow benefited from a one-time cash settlement of approximately $2 million in the first quarter. The $3.2 million increase in inventory is related to the Company’s recent product launches, TrueScience and Axio, and partially due to the recent decline in revenue. The Company's cash and cash equivalents at December 31, 2014 were $18.6 million, compared to $20.4 million at the end of fiscal year 2014. The Company repaid $2.3 million of debt during the first six months of fiscal 2015. During the first six months fiscal 2015, the Company has returned $6.6 million to shareholders by repurchasing a total of 4.9 million shares. The Company entered the third quarter with $4.4 million remaining on its current $7 million share repurchase program announced on November 6, 2014.

Fiscal Year 2015 Guidance

The Company is updating its guidance for fiscal year 2015. Due to the downward pressures related to Japan revenue, and a softening in our other markets the Company expects to generate revenue in the range of $185 million to $195 million in fiscal year 2015. The Company has modeled Japan to decline by approximately 40% with the remaining countries collectively impacting revenue from a negative 3.0% at the bottom end of our range, to a positive 4% at the top end of our range, on a year-over-year basis. The Company expects its operating margin to be in the range of 7% to 9% and earnings per diluted share in the range of $0.06 to $0.08, based on an estimated 101 million diluted shares and a 33% effective tax rate.

Conference Call Information

The Company will hold an investor conference call today at 2:30 p.m. Mountain time (4:30 p.m. Eastern time). Investors interested in participating in the live call can dial (888) 215-7015 from the U.S. International callers can dial (913) 643-4201. A telephone replay will be available approximately two hours after the call concludes and will be available through Friday, February 6, 2015, by dialing (877) 870-5176 from the U.S. and entering confirmation code 3120122, or (858) 384-5517 from international locations, and entering confirmation code 3120122.

There also will be a simultaneous, live webcast available on the Investor Relations section of the Company's web site at http://investor.lifevantage.com/events.cfm. The webcast will be archived for approximately 30 days.

About LifeVantage Corporation

LifeVantage Corporation (Nasdaq:LFVN), is a science based network marketing company that is dedicated to visionary science that looks to transform health, wellness and anti-aging internally and externally at the cellular level. The company is the maker of Protandim®, the Nrf2 Synergizer® patented dietary supplement, the TrueScience™ Anti-Aging Skin Care Regimen, Canine Health, and the AXIO™ energy product line. LifeVantage was founded in 2003 and is headquartered in Salt Lake City, Utah.

Forward Looking Statements

This document contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Words and expressions reflecting optimism, satisfaction or disappointment with current prospects, as well as words such as "believe," "hopes," "intends," "estimates," "expects," "projects," "plans," "anticipates," "look forward to" and variations thereof, identify forward-looking statements, but their absence does not mean that a statement is not forward-looking. Examples of forward-looking statements include, but are not limited to, statements we make regarding our future revenue, operating income, operating margins, earnings per share, cash flow from operations, our expansion and investment in new and existing international markets, our future results of operations in Japan and future investment and growth. Such forward-looking statements are not guarantees of performance and the Company's actual results could differ materially from those contained in such statements. These forward-looking statements are based on the Company's current expectations and beliefs concerning future events affecting the Company and involve known and unknown risks and uncertainties that may cause the Company's actual results or outcomes to be materially different from those anticipated and discussed herein. These risks and uncertainties include, among others, those discussed in greater detail in the Company's Annual Report on Form 10-K and the Company’s Quarterly Report on Form 10-Q under the caption "Risk Factors," and in other documents filed by the Company from time to time with the Securities and Exchange Commission. The Company cautions investors not to place undue reliance on the forward-looking statements contained in this document. All forward-looking statements are based on information currently available to the Company on the date hereof, and the Company undertakes no obligation to revise or update these forward-looking statements to reflect events or circumstances after the date of this document, except as required by law.

About Non-GAAP Financial Measures

We define Non-GAAP EBITDA as earnings before interest expense, income taxes, depreciation and amortization and Non-GAAP Adjusted EBITDA as earnings before interest expense, income taxes, depreciation and amortization, stock compensation expense and other income, net. Non-GAAP EBITDA and Non-GAAP Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies.

We are presenting Non-GAAP EBITDA and Non-GAAP Adjusted EBITDA because management believes that they provide additional ways to view our operations when considered with both our GAAP results and the reconciliation to net income, which we believe provides a more complete understanding of our business than could be obtained absent this disclosure. Non-GAAP EBITDA and Non-GAAP Adjusted EBITDA are presented solely as a supplemental disclosure because: (i) we believe it is a useful tool for investors to assess the operating performance of the business without the effect of these items; (ii) we believe that investors will find this data useful in assessing shareholder value; and (iii) we use Non-GAAP EBITDA and Non-GAAP Adjusted EBITDA internally as a benchmark to evaluate our operating performance or compare our performance to that of our competitors. The use of Non-GAAP EBITDA and Non-GAAP Adjusted EBITDA has limitations and you should not consider these measures in isolation from or as an alternative to the relevant GAAP measure of net income prepared in accordance with GAAP, or as a measure of profitability or liquidity.

The tables set forth below present Non-GAAP EBITDA and Non-GAAP Adjusted EBITDA which are non-GAAP financial measures to Net Income, our most directly comparable financial measure presented in accordance with GAAP.

Investor Relations Contact:

Cindy England (801) 432-9036

Director of Investor Relations

-or-

John Mills (646) 277-1254

Partner, ICR INC

|

| | | | | | | | |

LIFEVANTAGE CORPORATION AND SUBSIDIARIES |

CONSOLIDATED BALANCE SHEETS |

(Unaudited) |

| | | | |

(In thousands, except per share data) | As of |

ASSETS | Dec. 31, 2014 | | June 30, 2014 |

Current assets | | | |

| Cash and cash equivalents | $ | 18,647 |

| | $ | 20,387 |

|

| Accounts receivable | 1,106 |

| | 1,317 |

|

| Income tax receivable | 2,320 |

| | 4,681 |

|

| Inventory | 12,099 |

| | 8,826 |

|

| Current deferred income tax asset | 158 |

| | 158 |

|

| Prepaid expenses and deposits | 4,288 |

| | 4,604 |

|

| Total current assets | 38,618 |

| | 39,973 |

|

| | | | |

| Property and equipment, net | 6,533 |

| | 6,941 |

|

| Intangible assets, net | 1,946 |

| | 2,014 |

|

| Deferred debt offering costs, net | 1,229 |

| | 1,353 |

|

| Long-term deferred income tax asset | 1,285 |

| | 1,285 |

|

| Other long-term assets | 1,443 |

| | 2,433 |

|

TOTAL ASSETS | $ | 51,054 |

| | $ | 53,999 |

|

LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

Current liabilities | | | |

| Accounts payable | $ | 4,002 |

| | $ | 2,854 |

|

| Commissions payable | 6,718 |

| | 7,594 |

|

| Other accrued expenses | 6,136 |

| | 7,554 |

|

| Current portion of long-term debt | 4,700 |

| | 4,700 |

|

| | | | |

| Total current liabilities | 21,556 |

| | 22,702 |

|

| | | | |

Long-term debt | | | |

| Principal amount | 23,775 |

| | 26,125 |

|

| Less: unamortized discount | (955 | ) | | (1,052 | ) |

| Long-term debt, net of unamortized discount | 22,820 |

| | 25,073 |

|

| Other long-term liabilities | 2,131 |

| | 2,234 |

|

| Total liabilities | 46,507 |

| | 50,009 |

|

Commitments and contingencies - Note 6 | | | |

Stockholders' equity | | | |

| Preferred stock - par value $.001 per share, 50,000 shares authorized; no shares issued or outstanding | 0 |

| | 0 |

|

| Common stock - par value $.001 per share, 250,000 shares authorized and 98,836 and 102,173 issued and outstanding as of December 31, 2014 and June 30, 2014, respectively | 99 |

| | 102 |

|

| Additional paid-in capital | 116,300 |

| | 115,244 |

|

| Accumulated deficit | (111,657 | ) | | (111,240 | ) |

| Accumulated other comprehensive loss | (195 | ) | | (116 | ) |

| Total stockholders’ equity | 4,547 |

| | 3,990 |

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 51,054 |

| | $ | 53,999 |

|

|

| | | | | | | | | | | | | | | |

LIFEVANTAGE CORPORATION AND SUBSIDIARIES |

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME |

(Unaudited) |

| | | | | | | |

| For the Three Months Ended December 31, | | For the Six Months Ended December 31, |

| 2014 | | 2013 | | 2014 | | 2013 |

(In thousands, except per share data) | | | | | | | |

Revenue, net | $ | 48,247 |

| | $ | 51,538 |

| | $ | 99,880 |

| | $ | 102,866 |

|

Cost of sales | 7,486 |

| | 7,944 |

| | 13,165 |

| | 15,753 |

|

Gross profit | 40,761 |

| | 43,594 |

| | 86,715 |

| | 87,113 |

|

| | | | | | | |

Operating expenses: | | | | | | | |

Commissions and incentives | 23,195 |

| | 25,399 |

| | 47,769 |

| | 50,798 |

|

Selling, general and administrative | 14,476 |

| | 13,029 |

| | 28,091 |

| | 26,079 |

|

Total operating expenses | 37,671 |

| | 38,428 |

| | 75,860 |

| | 76,877 |

|

Operating income | 3,090 |

| | 5,166 |

| | 10,855 |

| | 10,236 |

|

| | | | | | | |

Other income (expense): | | | | | | | |

Interest expense | (785 | ) | | (833 | ) | | (1,593 | ) | | (836 | ) |

Other income (expense), net | (246 | ) | | 468 |

| | (43 | ) | | 509 |

|

Total other income (expense) | (1,031 | ) | | (365 | ) | | (1,636 | ) | | (327 | ) |

Income before income taxes | 2,059 |

| | 4,801 |

| | 9,219 |

| | 9,909 |

|

Income tax expense | (587 | ) | | (1,519 | ) | | (3,031 | ) | | (3,371 | ) |

Net income | $ | 1,472 |

| | $ | 3,282 |

| | $ | 6,188 |

| | $ | 6,538 |

|

Net income per share: | | | | | | | |

Basic | $ | 0.02 |

| | $ | 0.03 |

| | $ | 0.06 |

| | $ | 0.06 |

|

Diluted | $ | 0.01 |

| | $ | 0.03 |

| | $ | 0.06 |

| | $ | 0.06 |

|

Weighted average shares outstanding: | | | | | | | |

Basic | 97,694 |

| | 105,770 |

| | 98,624 |

| | 110,218 |

|

Diluted | 100,716 |

| | 112,392 |

| | 101,663 |

| | 117,363 |

|

| | | | | | | |

Other comprehensive loss, net of tax: | | | | | | | |

Foreign currency translation adjustment | (136 | ) | | (192 | ) | | (79 | ) | | (466 | ) |

Other comprehensive loss, net of tax: | $ | (136 | ) | | $ | (192 | ) | | $ | (79 | ) | | $ | (466 | ) |

Comprehensive income | $ | 1,336 |

| | $ | 3,090 |

| | $ | 6,109 |

| | $ | 6,072 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

LIFEVANTAGE CORPORATION AND SUBSIDIARIES |

Revenue by Region |

(Unaudited) |

| | | | | | | | | | | | | | | | | |

| | For the Three Months Ended December 31, | | | For the Six Months ended December 31, |

| | 2014 | | 2013 | | | 2014 | | 2013 |

(In thousands) | | | | | | | | | | | | | | | | | |

Americas | | $ | 35,040 |

| | 73% | | $ | 34,418 |

| | 67% | | | $ | 71,496 |

| | 72% | | $ | 68,916 |

| | 67% |

Asia/Pacific | | 13,207 |

| | 27% | | 17,120 |

| | 33% | | | 28,384 |

| | 28% | | 33,950 |

| | 33% |

Total | | $ | 48,247 |

| | 100% | | $ | 51,538 |

| | 100% | | | $ | 99,880 |

| | 100% | | $ | 102,866 |

| | 100% |

| | | | | | | | | | | | | | | | | |

| | Active Independent Distributors (1) | | | | | | | | | |

| | (Unaudited) | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | December 31 | | | | | | | | | |

| | 2014 | | 2013 | | | | | | | | | |

Americas | | 44,000 |

| | 66% | | 43,000 |

| | 62% | | | | | | | | | |

Asia/Pacific | | 23,000 |

| | 34% | | 26,000 |

| | 38% | | | | | | | | | |

Total | | 67,000 |

| | 100% | | 69,000 |

| | 100% | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | Active Preferred Customers (2) | | | | | | | | | |

| | (Unaudited) | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | December 31 | | | | | | | | | |

| | 2014 | | 2013 | | | | | | | | | |

Americas | | 97,000 |

| | 82% | | 110,000 |

| | 81% | | | | | | | | | |

Asia/Pacific | | 22,000 |

| | 18% | | 25,000 |

| | 19% | | | | | | | | | |

Total | | 119,000 |

| | 100% | | 135,000 |

| | 100% | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

(1) Active Independent Distributors have purchased product in the prior three months for retail or personal consumption. |

(2) Active Preferred Customers have purchased product in the prior three months for personal consumption only. |

|

| | | | | | | | | | | | | | | |

LIFEVANTAGE CORPORATION AND SUBSIDIARIES |

Reconciliation of GAAP Net Income to Non-GAAP Adjusted EBITDA: |

| | | | | | | |

| For the Three Months Ended December 31, | | For the Six Months Ended December 31, |

| 2014 | | 2013 | | 2014* | | 2013 |

(In thousands) | | | | | | | |

GAAP Net income | $ | 1,472 |

| | $ | 3,282 |

| | $ | 6,188 |

| | $ | 6,538 |

|

Interest Expense | 785 |

| | 833 |

| | 1,593 |

| | 836 |

|

Provision for income taxes | 587 |

| | 1,519 |

| | 3,031 |

| | 3,371 |

|

Depreciation and amortization | 580 |

| | 498 |

| | 1,165 |

| | 997 |

|

Non-GAAP EBITDA: | 3,424 |

| | 6,132 |

| | 11,977 |

| | 11,742 |

|

Adjustments: | | | | | | | |

Stock compensation expense | 495 |

| | 707 |

| | 969 |

| | 1,475 |

|

Other (income) expense, net | 246 |

| | (468 | ) | | 43 |

| | (509 | ) |

Total adjustments | 741 |

| | 239 |

| | 1,012 |

| | 966 |

|

Non-GAAP Adjusted EBITDA | $ | 4,165 |

| | $ | 6,371 |

| | $ | 12,989 |

| | $ | 12,708 |

|

| | | | | | | |

*Six months ended December 31, 2014 results include approximately $2M of a one-time pretax benefit from settlement proceeds. | | | | | | | |

LIFEVANTAGE CORPORATION ANNOUNCES EXECUTIVE LEADERSHIP CHANGE

- Independent Director Dave S. Manovich to serve as Executive Vice Chairman -

- Board forms search committee for new CEO -

SALT LAKE CITY -- February 2, 2015 -- LifeVantage Corporation (“LifeVantage” or the “Company”) (NASDAQ: LFVN) announced today the appointment of Dave S. Manovich, an independent director of the Company, as Executive Vice Chairman, effective immediately. The Board and Douglas C. Robinson mutually agreed that Mr. Robinson will step down from his role as President, Chief Executive Officer and Board Member, effective immediately. The Board has formed a search committee to identify a qualified candidate to serve as the Company’s next CEO.

Furthermore, the Board has created an interim Office of the President consisting of LifeVantage's Senior Operational Officers to provide seamless leadership continuity and continued execution across the Company’s strategic initiatives and oversee day to day operations. Dave Manovich will oversee the Office of the President and manage the strategic and tactical direction of the Company's operations until a new CEO has been appointed.

The Interim Office of the President will be made up of Shawn Talbott (Chief Science Officer), David Phelps (Chief Sales Officer), David Colbert (Chief Financial Officer) and Bob Urban (Chief Operating Officer). Additionally the other members of the senior executive team, Rob Cutler (General Counsel and Corporate Secretary) and Michelle Oborn (Vice President of Human Resources), will also report directly to Dave Manovich.

“On behalf of the entire company, I would like to thank Doug Robinson for his leadership and contributions to LifeVantage over the last five years,” said Gary Mauro, Chairman of the Board. “We appreciate his hard work and dedication to growing our company’s footprint, ensuring our transition from retail to network marketing, positioning our distributors for the next phase of growth and strengthening our product line. We wish him the best in his future endeavors.

“We are very pleased Dave Manovich has accepted the position of Executive Vice Chairman and we believe this change will lead to greater success for our distributors and improved long-term growth for our shareholders. We have a very strong management team and distributor base and are confident that the leadership transition will be seamless,” concluded Mr. Mauro.

“After having discussions with the Board, I have concluded that it is in the best interests of the Company to step down from my position as President, CEO and Board Member,” said Mr. Robinson. “I am incredibly proud of what we have achieved during my tenure, and while I will miss everyone at LifeVantage, I’m confident the Company’s exceptional team of talented employees, distributors and leadership will ensure its best days are ahead.”

Mr. Manovich has been an investor in LifeVantage for over a decade, an independent member of LifeVantage’s Board of Directors since January 2012 and has extensive experience in executive sales and marketing operations and distribution management and development. He currently serves as Managing Partner of D&S Investments, a private investment entity and has held several executive level positions throughout his career with leading technology companies including COO of @Road Inc., Executive Vice President for worldwide sales at Apple Computer and Vice President of Sales for Fujitsu P.C. Mr. Manovich received an MBA in Finance and started his career as a CPA with Deloitte, Haskins and Sells.

Conference Call Information

The Company will hold an investor conference call on February 4th to discuss 2nd quarter fiscal 2014 results at 2:30 p.m. Mountain Time (4:30 p.m. Eastern Time). Investors interested in participating in the live call can dial (888) 215-7015 from the U.S. International callers can dial (913) 643-4201. A telephone replay will be available approximately two hours after the call concludes and will be available through Friday, February 6, 2015, by dialing (877) 870-5176 from the U.S. and entering confirmation code 3120122, or (858) 384-5517 from international locations, and entering confirmation code 3120122.

There also will be a simultaneous, live webcast available on the Investor Relations section of the Company's web site at http://investor.lifevantage.com/events.cfm. The webcast will be archived for approximately 30 days.

About LifeVantage Corporation

LifeVantage Corporation (NASDAQ: LFVN), is a science based network marketing company that is dedicated to visionary science that looks to transform health, wellness and anti-aging internally and externally at the cellular level. The company is the maker of Protandim®, the Nrf2 Synergizer® patented dietary supplement, the TrueScience™ Anti-Aging Skin Care Regimen, Canine Health, and the AXIO™ energy product line. LifeVantage was founded in 2003 and is headquartered in Salt Lake City, Utah.

Forward Looking Statements

This document contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Words and expressions reflecting optimism, satisfaction or disappointment with current prospects, as well as words such as "believe," "hopes," "intends," "estimates," "expects," "projects," "plans," "anticipates," "look forward to" and variations thereof, identify forward-looking statements, but their absence does not mean that a statement is not forward-looking. Examples of forward-looking statements include, but are not limited to, statements we make regarding our leadership transition, future growth and distributor success. Such forward-looking statements are not guarantees of performance and the Company's actual results could differ materially from those contained in such statements. These forward-looking statements are based on the Company's current expectations and beliefs concerning future events affecting the Company and involve known and unknown risks and uncertainties that may cause the Company's actual results or outcomes to be materially different from those anticipated and discussed herein. These risks and uncertainties include, among others, those discussed in greater detail in the Company's Annual Report on Form 10-K and the Company’s Quarterly Report on Form 10-Q under the caption "Risk Factors," and in other documents filed by the Company from time to time with the Securities and Exchange Commission. The Company cautions investors not to place undue reliance on the forward-looking statements contained in this document. All forward-looking statements are based on information currently available to the Company on the date hereof, and the Company undertakes no obligation to revise or update these forward-looking statements to reflect events or circumstances after the date of this document, except as required by law.

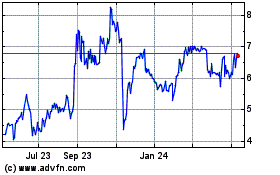

Lifevantage (NASDAQ:LFVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

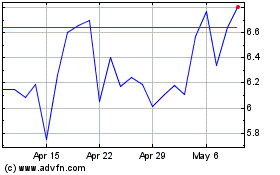

Lifevantage (NASDAQ:LFVN)

Historical Stock Chart

From Apr 2023 to Apr 2024