UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 29, 2015

|

SILVERSUN TECHNOLOGIES, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

|

|

000-50302

|

|

16-1633636

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

5 Regent Street, Suite 520

Livingston, New Jersey 07039

|

|

(Address of Principal Executive Offices)

|

(973) 758-9555

Registrant’s telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 3.03. Material Modifications to Rights of Security Holders.

The information set forth in Item 5.03 is incorporated by reference.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Resignation of Chief Financial Officer

On January 29, 2015, concurrently with the appointment of Mr. Crandall Melvin III as more fully described below, SilverSun Technologies, Inc. (the “Company”) was informed of Mark Meller’s resignation from his position as Chief Financial Officer (“CFO”) of the Company (the “Meller CFO Resignation”). Mr. Meller shall remain Chief Executive Officer, President and Director of the Company. The resignation is not the result of any disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

Appointment of Chief Financial Officer

On January 29, 2015, simultaneously with the Meller CFO Resignation, the Board of Directors (the “Board”) of the Company approved by unanimous written consent the appointment of Crandall Melvin III as CFO of the Company, effective immediately.

A brief description of Mr. Melvin’s relevant work experience appears below:

Crandall Melvin III, age 58, combines over 30 years of experience in public accounting and industry, holding a number of senior management positions following a 5 year career in retail, commercial banking and equipment leasing. Mr. Melvin is currently the CFO of SWK, the Company’s operating subsidiary.

From 2002 to 2006, Mr. Melvin was Co-Founder and Chief Operating Officer of AMP-Best Consulting, Inc. (“AMP-Best”), a company involved in software sales and implementation. AMP-Best was acquired by SWK Technologies in 2006. From 1993 to 2002, he worked in public accounting in Alaska and New York. Mr. Melvin is currently a Certified Public Accountant licensed in the State of New York and also holds the designation of Certified Global Management Accountant. Mr. Melvin is also currently a director of Community Baseball of Central New York, Inc. the Minor League AAA affiliate of The Washington Nationals. Mr. Melvin has also served on boards of directors of various not-for-profit organizations located in the Syracuse Area.

Mr. Melvin has an undergraduate degree from the University of Southern California and an MBA from Syracuse University with additional graduate studies from the University of Alaska at Anchorage.

In evaluating Mr. Melvin’s specific experience, qualifications, attributes and skills in connection with his appointment as CFO of the Company, the Company considered his expertise in accounting, finance and business execution, as well as his extensive experience as CFO of SWK and as co-founder and Chief Operating Officer of AMP-Best.

Appointment of Director

On January 29, 2015, the Board approved by unanimous written consent the appointment of Joseph Macaluso as a director of the Company, effective as of such date. Mr. Macaluso will also serve as the Chairman on the Audit Committee of the Board.

On January 29, 2015, the Company entered into a director agreement (“Director Agreement”) with Joseph Macaluso, pursuant to which Mr. Macaluso was appointed to the Board effective January 29, 2015. The Director Agreement may, at the option of the Board, be automatically renewed on such date that Mr. Macaluso is re-elected to the Board. Under the Director Agreement, Mr. Macaluso is to be paid a stipend of one thousand five hundred dollars ($1,500) per month, payable at the end of each fiscal quarter. Additionally, Mr. Macaluso shall receive warrants (the “Warrants”) to purchase such number of shares of the Company’s Common Stock, as shall equal (the “Formula”) (A) $20,000 divided by (B) the closing price of the Common Stock on the OTC Markets on the date of grant of the Warrant. The exercise price of the Warrant shall be the closing price on the date of the grant of such Warrant plus $0.01. The Warrant shall be fully vested upon receipt thereof.

A brief description of Mr. Macaluso’s relevant work experience appears below:

Joseph Macaluso, age 63, has over 30 years of experience in financial management. Mr. Macaluso has been and continues to be the Principal Accounting Officer of Tel-Instrument Electronics Corp., a developer and manufacturer of avionics test equipment for both the commercial and military markets since 2002. Previously, he had been involved in companies in the medical device and technology industries holding positions including Chief Financial Officer, Treasurer and Controller. He has a B.S. in Accounting from Fairfield University.

In evaluating Mr. Macaluso’s specific experience, qualifications, attributes and skills in connection with his appointment to Board, the Company considered his expertise in general management, finance, corporate governance and strategic planning, as well as his extensive experience in operations and mergers and acquisitions.

Family Relationships

Mr. Melvin and Mr. Macaluso do not have any family relationships with any current officer or director of the Company.

Related Party Transactions

There are no applicable related party transactions.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

Effective on January 29, 2015, the Company filed a Certificate of Amendment to Fourth Amended and Restated Certificate of Incorporation (the “Amendment”) to effectuate a 1-for-30 reverse stock split of the Company’s common stock (the “Reverse Split”). The Amendment also combined the Class B Common Stock, par value $0.00001 per share and the Class A Common Stock, par value $0.00001 par value per share, into one class of general common stock, par value $0.00001 per share (the “Common Stock”). In addition, the Amendment reduced the number of authorized shares of Common Stock from 750,000,000 to 75,000,000.

On February 3, 2015, the Company received notice from Financial Industry Regulatory Authority (“FINRA”) that the Reverse Split has been approved and will take effect on February 4, 2015 (the “Effective Date”).

Immediately prior to the Reverse Split, the Company had 118,646,915 shares of common stock issued and outstanding. After the Reverse Split, the Company will have 3,954,898 shares of common stock issued and outstanding.

The above description of the Amendment does not purport to be complete and is qualified in its entirety by reference to the Amendment, which is attached hereto as Exhibit 3.1 to this Current Report on Form 8-K.

Item. 8.01 Other Items

The information set forth in Item 5.03 is incorporated by reference.

The Company’s shares will continue to trade on The OTC Markets under the symbol “SSNT” with the letter “D” added to the end of the trading symbol for a period of 20 trading days to indicate that the Reverse Split has occurred.

The Reverse Split has no impact on shareholders’ proportionate equity interests or voting rights in the Company or the par value of the Company’s common stock, which remains unchanged.

Item 9.01 Financial Statements and Exhibits.

(c) Exhibits

*filed herewith

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

SILVERSUN TECHNOLOGIES, INC.

|

Date: February 3, 2015

|

By:

|

/s/ Mark Meller

|

|

| |

|

Mark Meller

|

|

| |

|

President, Chief Executive Officer and

|

|

| |

|

Principal Accounting Officer

|

|

Exhibit 3.1

State of Delaware

Secretary of State

Division of Corporations

Delivered 03:32 PM 01/29/2015

FILED 03:27 PM 01/29/2015

SRV 150117327 - 3576719 FILE

STATE OF DELAWARE

CERTIFICATE OF AMENDMENT

OF CERTIFICATE OF INCORPORATION

SilverSun Technologies, Inc., a corporation incorporated under and by virtue of the General Corporation Law of the State of Delaware (the "Corporation") does hereby certify:

1. That Article III of the Fourth Amended and Restated Certificate of Incorporation of the Corporation is amended to read, in its entirety, as follows:

See Attached.

2. That the Board of Directors of the Corporation authorized and approved the foregoing amendment by unanimous written consent in lieu of a meeting on December 22, 2014, declaring said amendment to be advisable and presented it to the majority stockholder of the Corporation for consideration thereof.

3. That thereafter, the holder of the majority of the total voting power of all issued and outstanding voting capital of the Corporation authorized the amendment by written consent in lieu of a meeting on December 22, 2014.

4. The foregoing amendment has been duly adopted in accordance with the provisions of Sections 228 and 242 of the General Corporation Law of the State of Delaware.

IN WITNESS WHEREOF, the Corporation has caused this certificate to be signed this 29th day of January, 2015.

/s/ Mark Meller

Mark Meller

Chief Executive Officer

ARTICLE III

CAPITAL STOCK

Authorization. The Corporation shall have authority to issue 75,000,000 shares of common stock, par value $0.00001 per share ("Common Stock") and 1,000,000 shares of preferred stock, par value of $0.001 per share ("Preferred Stock").

PART A. COMMON STOCK

With respect to all matters upon which stockholders of the Corporation are entitled to vote or to which stockholders are entitled to give consent, the holders of the outstanding shares of Common Stock shall be entitled on each matter to cast one (1) vote in person or by proxy for each share of Common Stock standing in his, her or its name without regard to class, except as to those matters on which separate class voting is required by applicable law. There shall be no cumulative voting by stockholders. Holders of Common Stock have no preemptive, subscription, conversion or redemption rights. Upon liquidation, dissolution or winding up, the holders of Common Stock are entitled to receive net assets pro rata. Each holder of Common Stock is entitled to receive ratably any dividends declared by the Board out of funds legally available for the payment of dividends.

Effective January 29, 2015, all issued and outstanding Class A Common Stock, par value $0.00001, shall be renamed "Common Stock" and such renaming shall have no effect on shareholder rights and preferences with respect to such shares.

Effective January 29, 2015, Class B Common stock is hereby cancelled, of which zero (0) shares are issued and outstanding.

Effective January 29, 2015, each thirty (30) shares of Common Stock issued and outstanding at such time shall be combined into one (1) share of Common Stock (the "Reverse Stock Split"). No fractional shares shall be issued upon such combination and reconstitution. If a fractional interest in a share of Common Stock would be deliverable upon such Reverse Stock Split, in lieu of fractional shares, the Corporation shall round up to the nearest whole number of shares in order to bring the number of shares held by such holder up to the next whole number of shares of Common Stock.

PART B. PREFERRED STOCK

SECTION 1

The Corporation's Board is authorized (by resolution and by filing an amendment to this Amended and Restated Certificate, and subject to limitations prescribed by the DGCL) to issue, from to time, shares of preferred stock in one or more series, to establish from time to time the number of shares to be included in each series, and to fix the designation, powers, preferences and other rights of the shares of each such series, and to fix the qualifications, limitations and restrictions thereon, including, but without limiting the generality of the foregoing, the following:

(1) the number of shares constituting that series and the distinctive designation of that series;

(2) the dividend rate on the shares of that series, whether dividends are cumulative, and,

if so, from which date or dates, and the relative rights of priority, if any, of payment of dividends on shares of that series;

(3) whether that series has voting rights, in addition to voting rights provided by law, and, if so, the terms of those voting rights;

(4) whether that series has conversion privileges, and, if so, the terms and conditions of conversion, including provisions for adjusting the conversion rate in such events as the Board;

(5) whether or not the shares of that series are redeemable, and, if so, the terms and conditions of redemption, including the dates upon or after which they are redeemable, and the amount per share payable in case of redemption, which amount may vary under different conditions and at different redemption dates;

(6) whether that series has a sinking fund for the redemption or purchase of shares of that series, and, if so, the terms and amount of such sinking fund;

(7) the rights of the shares of that series in the event of voluntary or involuntary liquidation, dissolution or winding up of the Corporation, and the relative rights of priority, if any, of payment to shares of that series, provided that the holders of preferred stock of each series shall be entitled to receive only that amount or those amounts as are fixed by the certificate of designation or by resolution of the Board providing for the issuance of that series; and

(8) any other relative powers, preferences and rights of that series, and qualifications, limitations or restrictions on that series.

SECTION 2

Two (2) shares of the Corporation's authorized but undesignated preferred stock shall be designated as Series A Convertible Preferred Stock, par value $0.001 per share ("Series A Preferred"), and have the voting and conversion set forth below:

(1) Conversion Rights. Each one share of Series A Preferred shall be converted into that number of shares of Common Stock as shall equal one percent (1%) of the issued and outstanding shares of Common Stock of the Corporation immediately following the time of the Conversion. Each share of Series A Preferred Stock shall convert into shares of Common Stock upon written demand of the Corporation, which demand shall be made no later than January 15, 2012, unless otherwise agreed by the mutual consent of the parties in writing.

(2) Voting Rights. Each share of Series A Preferred shall have voting rights equal to five billion (5,000,000,000) votes of Common Stock.

DIRECTOR AGREEMENT

This DIRECTOR AGREEMENT (this “Agreement”) is dated as of January 29, 2015, by and between SilverSun Technologies, Inc. a Delaware corporation (the “Company”), and Joseph Macaluso, an individual with an address at [●] (the “Director”).

WHEREAS, on January 29, 2015, the Company appointed the Director to a vacant seat on the Company’s Board of Directors (the “Board”) and desires to enter into this Agreement with the Director with respect to such appointment; and

WHEREAS, on January 29, 2015, the Company appointed the Director to serve as the Chairman of the Audit Committee of the Board; and

WHEREAS, the Director accepted such appointments and is willing to serve the Company on the terms set forth herein and in accordance with the provisions of this Agreement.

NOW, THEREFORE, in consideration of the mutual covenants contained herein, the parties hereto agree as follows:

1. Position. Subject to the terms and provisions of this Agreement, the Company shall cause the Director to be appointed, and the Director hereby agrees to serve the Company in such position upon the terms and conditions hereinafter set forth, provided, however, that the Director’s continued service on the Board after the initial one-year term on the Board shall be subject to any necessary approval by the Company’s stockholders.

2. Duties.

(a) During the Directorship Term (as defined herein), the Director shall make reasonable business efforts to attend all Board meetings, serve on appropriate subcommittees as reasonably requested by the Board, make himself available to the Company at mutually convenient times and places, attend external meetings and presentations, as appropriate and convenient, and perform such duties, services and responsibilities, and have the authority commensurate to such position.

(b) The Director will use his best efforts to promote the interests of the Company. The Company recognizes that the Director: (i) is or may become a full-time executive employee of another entity and that his responsibilities to such entity must have priority and (ii) sits or may sit on the board of directors of other entities. Notwithstanding the same, the Director will use reasonable business efforts to coordinate his respective commitments so as to fulfill his obligations to the Company and, in any event, will fulfill his legal obligations as a Director.

Other than as set forth above, the Director will not, without the prior notification to the Board, engage in any other business activity which could materially interfere with the performance of his duties, services and responsibilities hereunder or which is in violation of the reasonable policies established from time to time by the Company, provided that the foregoing shall in no way limit his activities on behalf of (y) any current employer and its affiliates or (z) the board of directors of any entities on which he currently sits. At such time as the Board receives such notification, the Board may require the resignation of the Director if it determines that such business activity does in fact materially interfere with the performance of the Director’s duties, services and responsibilities hereunder.

3. Compensation.

(a) Stipend. At the end of every fiscal quarter during the Directorship Term, the Director shall receive a stipend in the principal aggregate amount of one thousand five hundred dollars ($1,500) per month consisting of $1,000 per month for the Director’s service as a member of the Board and $500 per month for the Director’s service as the Chairman of the Audit Committee of the Board. The Stipend shall be pro-rated based on the number of days during such quarter that the Director was a member of the Board and Chairman of the Audit Committee, respectively.

(b) Warrants. Upon execution of this Agreement, the Director shall receive, a warrant (a “Warrant”) to purchase such number of shares of the Company’s common stock, par value $0.00001 per share (the “Common Stock”), as shall equal (A) $20,000 divided by (B) the closing price on the OTC Markets on the date of grant of the Warrant (the “Formula”). The exercise price of the Warrant shall be the closing price on the date of the grant of such Warrant (the “Grant Date”), plus $0.01. The Warrant shall be fully vested upon receipt thereof (the “Vesting Date”). Notwithstanding anything contained herein, the first Warrant to be issued pursuant to this Section 3 shall be issued no earlier than February 1, 2015.

Notwithstanding the foregoing, if the Director ceases to be a member of Board at any time during the Directorship Term for any reason whatsoever, then any un-vested portion of each Warrant issued shall be irrefutably forfeited.

All payments and other consideration made or provided to the Director under this Section 3 shall be made or provided without withholding or deduction of any kind, and the Director shall assume sole responsibility for discharging all tax or other obligations associated therewith.

(c) Expense Reimbursements. During the Directorship Term, the Company shall reimburse the Director for all reasonable out-of-pocket expenses incurred by the Director in attending any in-person meetings, provided that the Director complies with the generally applicable policies, practices and procedures of the Company for submission of expense reports, receipts or similar documentation of such expenses. Any reimbursements for allocated expenses (as compared to out-of-pocket expenses of the Director) must be approved in advance by the Company.

4. Directorship Term. The “Directorship Term,” as used in this Agreement, shall mean the period commencing on the date hereof and terminating on the earlier of the date of the next annual stockholders meeting and the earliest of the following to occur:

(a) the death of the Director;

(b) the termination of the Director from his membership on the Board by the mutual agreement of the Company and the Director;

(c) the removal of the Director from the Board by the majority stockholders of the Company; and

(d) the resignation by the Director from the Board.

5. Director’s Representation and Acknowledgment. The Director represents to the Company that his execution and performance of this Agreement shall not be in violation of any agreement or obligation (whether or not written) that he may have with or to any person or entity, including without limitation, any prior or current employer. The Director hereby acknowledges and agrees that this Agreement (and any other agreement or obligation referred to herein) shall be an obligation solely of the Company, and the Director shall have no recourse whatsoever against any stockholder of the Company or any of their respective affiliates with regard to this Agreement.

6. Director Covenants.

(a) Unauthorized Disclosure. The Director agrees and understands that in the Director’s position with the Company, the Director has been and will be exposed to and receive information relating to the confidential affairs of the Company, including, but not limited to, technical information, business and marketing plans, strategies, customer information, other information concerning the Company’s products, promotions, development, financing, expansion plans, business policies and practices, and other forms of information considered by the Company to be confidential and in the nature of trade secrets. The Director agrees that during the Directorship Term and thereafter, the Director will keep such information confidential and will not disclose such information, either directly or indirectly, to any third person or entity without the prior written consent of the Company; provided, however, that (i) the Director shall have no such obligation to the extent such information is or becomes publicly known or generally known in the Company’s industry other than as a result of the Director’s breach of his obligations hereunder and (ii) the Director may, after giving prior notice to the Company to the extent practicable under the circumstances, disclose such information to the extent required by applicable laws or governmental regulations or judicial or regulatory process. This confidentiality covenant has no temporal, geographical or territorial restriction. Upon termination of the Directorship Term, the Director will promptly return to the Company and/or destroy at the Company’s direction all property, keys, notes, memoranda, writings, lists, files, reports, customer lists, correspondence, tapes, disks, cards, surveys, maps, logs, machines, technical data, other product or document, and any summary or compilation of the foregoing, in whatever form, including, without limitation, in electronic form, which has been produced by, received by or otherwise submitted to the Director in the course or otherwise as a result of the Director’s position with the Company during or prior to the Directorship Term, provided that the Company shall retain such materials and make them available to the Director if requested by him in connection with any litigation against the Director under circumstances in which (i) the Director demonstrates to the reasonable satisfaction of the Company that the materials are necessary to his defense in the litigation and (ii) the confidentiality of the materials is preserved to the reasonable satisfaction of the Company.

(b) Non-Solicitation. During the Directorship Term and for a period of three (3) years thereafter, the Director shall not interfere with the Company’s relationship with, or endeavor to entice away from the Company, any person who, on the date of the termination of the Directorship Term and/or at any time during the one year period prior to the termination of the Directorship Term, was an employee, agent, consultant, shareholder, manager, representative or customer of the Company or otherwise had a material business relationship with the Company.

(c) Remedies. The Director agrees that any breach of the terms of this Section 6 would result in irreparable injury and damage to the Company for which the Company would have no adequate remedy at law; the Director therefore also agrees that in the event of said breach or any threat of breach, the Company shall be entitled to an immediate injunction and restraining order to prevent such breach and/or threatened breach and/or continued breach by the Director and/or any and all entities acting for and/or with the Director, without having to prove damages or paying a bond, in addition to any other remedies to which the Company may be entitled at law or in equity. The terms of this paragraph shall not prevent the Company from pursuing any other available remedies for any breach or threatened breach hereof, including, but not limited to, the recovery of damages from the Director. The Director acknowledges that the Company would not have entered into this Agreement had the Director not agreed to the provisions of this Section 6.

(d) The provisions of this Section 6 shall survive any termination of the Directorship Term, and the existence of any claim or cause of action by the Director against the Company, whether predicated on this Agreement or otherwise, shall not constitute a defense to the enforcement by the Company of the covenants and agreements of this Section 6.

7. Indemnification. The Company agrees to indemnify the Director for his activities as a member of the Board to the extent permitted in the Company’s charter documents, including the Company’s bylaws and articles of incorporation.

8. Non-Waiver of Rights. The failure to enforce at any time the provisions of this Agreement or to require at any time performance by the other party hereto of any of the provisions hereof shall in no way be construed to be a waiver of such provisions or to affect either the validity of this Agreement or any part hereof, or the right of either party hereto to enforce each and every provision in accordance with its terms. No waiver by either party hereto of any breach by the other party hereto of any provision of this Agreement to be performed by such other party shall be deemed a waiver of similar or dissimilar provisions at that time or at any prior or subsequent time.

9. Notices. Every notice relating to this Agreement shall be in writing and shall be given by personal delivery or by registered or certified mail, postage prepaid, return receipt requested; to:

If to the Company:

SilverSun Technologies, Inc

5 Regent Street, Suite 520

Livingston, New Jersey 07039

Attn: Mark Meller

Telephone: (973) 758-6108

Facsimile: (973) 758-6120

with a copy (which shall not constitute notice) to:

Lucosky Brookman LLP

101 Wood Avenue South, 5th Floor

Woodbridge, New Jersey 08830

Attn: Joseph M. Lucosky, Esq.

Telephone: (732) 395-4400

Facsimile: (732) 395-4401

If to the Director:

Joseph Macaluso

[●]

[●]

Telephone: [●]

Either of the parties hereto may change their address for purposes of notice hereunder by giving notice in writing to such other party pursuant to this Section 9.

10. Binding Effect/Assignment. This Agreement shall inure to the benefit of and be binding upon the parties hereto and their respective heirs, executors, personal representatives, estates, successors (including, without limitation, by way of merger) and assigns. Notwithstanding the provisions of the immediately preceding sentence, neither the Director nor the Company shall assign all or any portion of this Agreement without the prior written consent of the other party.

11. Entire Agreement. This Agreement (together with the other agreements referred to herein) sets forth the entire understanding of the parties hereto with respect to the subject matter hereof and supersedes all prior agreements, written or oral, between them as to such subject matter.

12. Severability. If any provision of this Agreement, or any application thereof to any circumstances, is invalid, in whole or in part, such provision or application shall to that extent be severable and shall not affect other provisions or applications of this Agreement.

13. Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of New York, without reference to the principles of conflict of laws. All actions and proceedings arising out of or relating to this Agreement shall be heard and determined in any court in the State of New York and the parties hereto hereby consent to the jurisdiction of such courts in any such action or proceeding; provided, however, that neither party shall commence any such action or proceeding unless prior thereto the parties have in good faith attempted to resolve the claim, dispute or cause of action which is the subject of such action or proceeding through mediation by an independent third party.

14. Legal Fees. The parties hereto agree that the non-prevailing party in any dispute, claim, action or proceeding between the parties hereto arising out of or relating to the terms and conditions of this Agreement or any provision thereof (a “Dispute”), shall reimburse the prevailing party for reasonable attorney’s fees and expenses incurred by the prevailing party in connection with such Dispute; provided, however, that the Director shall only be required to reimburse the Company for its fees and expenses incurred in connection with a Dispute if the Director’s position in such Dispute was found by the court, arbitrator or other person or entity presiding over such Dispute to be frivolous or advanced not in good faith.

15. Modifications. Neither this Agreement nor any provision hereof may be modified, altered, amended or waived except by an instrument in writing duly signed by the party to be charged.

16. Tense and Headings. Whenever any words used herein are in the singular form, they shall be construed as though they were also used in the plural form in all cases where they would so apply. The headings contained herein are solely for the purposes of reference, are not part of this Agreement and shall not in any way affect the meaning or interpretation of this Agreement.

17. Counterparts. This Agreement may be executed in two or more counterparts, each of which shall be deemed to be an original but all of which together shall constitute one and the same instrument.

[-Signature Page Follows-]

IN WITNESS WHEREOF, the Company has caused this Director Agreement to be executed by authority of its Board of Directors, and the Director has hereunto set his hand, on the day and year first above written.

SILVERSUN TECHNOLOGIES, INC.

By: /s/ Mark Meller

Name: Mark Meller

Title: Chief Executive Officer

DIRECTOR

By: /s/ Joseph P. Macaluso

Joseph Macaluso

Exhibit 17.1

January 29, 2015

To the Members of the Board of

SilverSun Technologies, Inc.

Dear Gentlemen of the Board:

This letter shall serve as notice that effective January 29, 2015, I hereby resign from my position as Chief Financial Officer of SilverSun Technologies, Inc. (the “Company”). I shall retain my position as Chief Executive Officer, President and Director of the Company. This resignation is not the result of any disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

Sincerely,

/s/ Mark Meller

Mark Meller

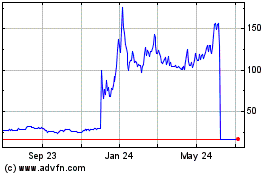

SilverSun Technologies (NASDAQ:SSNT)

Historical Stock Chart

From Mar 2024 to Apr 2024

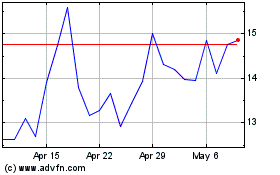

SilverSun Technologies (NASDAQ:SSNT)

Historical Stock Chart

From Apr 2023 to Apr 2024