UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of

Report (Date of earliest event reported): January 28, 2015

CANNAVEST CORP.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of incorporation) |

333-173215

(Commission File Number) |

80-0944970

(I.R.S. Employer Identification No.) |

2688 South Rainbow Boulevard, Suite B

Las Vegas, Nevada 89146

(Address

of principal executive offices)

(866) 290-2157

(Registrant’s telephone number, including area code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

[_] Written communications pursuant to

Rule 425 under the Securities Act (17 CFR 230.425)

[_] Soliciting material pursuant to Rule

14a-12 under the Exchange Act (17 CFR 240.14a -12)

[_] Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

[_] Pre-commencement communications pursuant

to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

Item 2.02 Results of Operations

and Financial Condition

The information set forth

in Item 7.01 of this Current Report on Form 8-K (“Current Report”), including Exhibit 99.1 attached hereto, is incorporated

by reference into this Item 2.02.

Item 3.02 Unregistered Sales

of Equity Securities

On January

28, 2015, the Company commenced an offering whereby the Company intends to sell up to $24 million of its restricted common stock

in a private placement to accredited investors at a price per share of $2.00 (the “Offering”). On January 28, 2015,

the Company sold an aggregate of 125,000 shares of its restricted common stock pursuant to the Offering to two investors for an

aggregate purchase price of $250,000.

The issuance

of the shares in connection with the Offering was exempt from registration under the Securities Act of 1933, as amended (the “Act”),

in reliance on exemptions from the registration requirements of the Act in transactions not involved in a public offering pursuant

to Rule 506(b) of Regulation D, as promulgated by the Securities and Exchange Commission under the Act.

The information set forth in Item 7.01

below is incorporated by reference into this Item 3.02.

Item 7.01 Regulation FD Disclosure

In connection with the Offering, on

January 28, 2015, the Company disclosed certain information to prospective investors in an offering memorandum (the

“Offering Memorandum”) and during an investor presentation to prospective investors with whom the Company has a

substantive pre-existing relationship. Some of the information in the Offering Memorandum and disclosed in the investor

presentation has not previously been disclosed publicly and is furnished as Exhibit 99.1 in the general form presented in the

Offering Memorandum.

Exhibit 99.1 is incorporated herein solely

for purposes of this Item 7.01 disclosure.

Exhibit 99.1 contains forward-looking statements.

These forward-looking statements are not guarantees of future performance and involve risks, uncertainties and assumptions that

are difficult to predict. Forward-looking statements are based upon assumptions as to future events that may not prove to be accurate.

Actual outcomes and results may differ materially from what is expressed in these forward-looking statements.

The information in Item 7.01 of this Current

Report on Form 8-K ("Current Report"), including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed

"filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act "),

or otherwise subject to the liabilities of such section. The information in Item 7.01 of this Current Report, including Exhibit

99.1, shall not be incorporated by reference into any filing under the Act or the Exchange Act, regardless of any incorporation

by reference language in any such filing. This Current Report will not be deemed an admission as to the materiality of any information

in this Current Report that is required to be disclosed solely by Regulation FD.

The information set forth in Item 3.02

above is incorporated by reference into this Item 7.01.

Item 9.01 Financial Statements and

Exhibits.

(d) Exhibits

| 99.1 | Excerpts from the Offering Memorandum. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Date:

January 29, 2015

| |

CANNAVEST CORP. |

| |

|

| |

By: |

/s/ Michael Mona, Jr. |

| |

|

Michael Mona, Jr.

President and Chief Executive Officer |

Exhibit 99.1

The following reprints in their entirety

certain sections of the confidential offering memorandum which contain previously undisclosed information.

Operating Summary

A five-year operating forecast is below.

| (in thousands) | |

| 2014 (est) | | |

| 2015 | | |

| 2016 | | |

| 2017 | | |

| 2018 | | |

| 2019 | |

| Revenues: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Oil Sales | |

| 8,416 | | |

| 16,869 | | |

| 29,364 | | |

| 46,983 | | |

| 70,474 | | |

| 98,664 | |

| Product Sales | |

| 1,815 | | |

| 4,986 | | |

| 12,875 | | |

| 20,601 | | |

| 30,901 | | |

| 43,261 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Revenues | |

| 10,231 | | |

| 21,855 | | |

| 42,240 | | |

| 67,584 | | |

| 101,375 | | |

| 141,926 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| COGS | |

| 4,297 | | |

| 9,260 | | |

| 19,405 | | |

| 35,819 | | |

| 52,715 | | |

| 72,382 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross Margin | |

| 5,934 | | |

| 12,595 | | |

| 22,835 | | |

| 31,764 | | |

| 48,660 | | |

| 69,544 | |

| | |

| 58.0 | % | |

| 57.6 | % | |

| 54.1 | % | |

| 53.0 | % | |

| 52.0 | % | |

| 51.0 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| SG&A | |

| 4,579 | | |

| 6,578 | | |

| 8,156 | | |

| 8,971 | | |

| 9,868 | | |

| 10,855 | |

| R&D | |

| 781 | | |

| 976 | | |

| 1,059 | | |

| 1,165 | | |

| 1,281 | | |

| 1,409 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| EBITDA | |

| 574 | | |

| 5,040 | | |

| 13,621 | | |

| 21,628 | | |

| 37,511 | | |

| 57,279 | |

The worldwide CBD opportunity is included

in the cannabis market, which is estimated to have a $50 billion market potential in the United States alone over the next 5-10

years. The worldwide market opportunity is estimated at $200 billion over the same timeframe. The immediate addressable CBD market

is currently comprised of the following channels:

| · | Medical Marijuana Dispensaries (approximately

2,500 locations currently in U.S.) |

| · | Early adopters – e-commerce sites |

| · | Early adopters – retail brick &

mortar (Pharmaca) |

Within 1-2 years, we believe the CBD market

will expand significantly with the addition of the following channels:

Cash Flow Summary

A five-year cash flow including the financing

source and use of funds is below.

| (in thousands) | |

| 2015 | | |

| 2016 | | |

| 2017 | | |

| 2018 | | |

| 2019 | |

| Source of Funds | |

| | | |

| | | |

| | | |

| | | |

| | |

| EBITDA | |

| 5,040 | | |

| 13,621 | | |

| 21,628 | | |

| 37,511 | | |

| 57,279 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Proceeds from Financing | |

| 24,000 | | |

| – | | |

| – | | |

| – | | |

| – | |

| Total Source of Funds | |

| 29,040 | | |

| 13,621 | | |

| 21,628 | | |

| 37,511 | | |

| 57,279 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Use of Funds | |

| | | |

| | | |

| | | |

| | | |

| | |

| Financing costs | |

| (1,500 | ) | |

| – | | |

| – | | |

| – | | |

| – | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Inventory purchases | |

| (17,000 | ) | |

| (6,000 | ) | |

| (6,000 | ) | |

| (6,000 | ) | |

| (6,000 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Working capital change | |

| (3,642 | ) | |

| (3,498 | ) | |

| (4,324 | ) | |

| (5,732 | ) | |

| (6,858 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| PP&E/Other | |

| (500 | ) | |

| (1,000 | ) | |

| (1,100 | ) | |

| (1,200 | ) | |

| (1,300 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Estimated Corp tax | |

| (1,616 | ) | |

| (5,048 | ) | |

| (8,251 | ) | |

| (14,604 | ) | |

| (22,512 | ) |

| Total Use of Funds | |

| (24,259 | ) | |

| (15,546 | ) | |

| (19,675 | ) | |

| (27,536 | ) | |

| (36,670 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| BB - Cash | |

| 1,500 | | |

| 6,282 | | |

| 4,357 | | |

| 6,310 | | |

| 16,284 | |

| EB - Cash | |

| 6,282 | | |

| 4,357 | | |

| 6,310 | | |

| 16,284 | | |

| 36,893 | |

The primary cash flow needs are to finance

inventory purchases and finance expansion of revenues through increased credit sales (working capital).

CannaVest Strategic Plan –

The next 5 years

1. Increase brand

awareness of Company’s proprietary consumer products and raw materials – “Mainstream CBD as a dietary and beauty

product ingredient.”

2. Expand the market

of innovators, formulators, product development and consumers of CBD products worldwide.

3. Invest in Company

infrastructure to produce, market and distribute CBD products worldwide.

4. Expand our internally

developed product offerings containing natural, hemp-based CBD.

5. Expand our worldwide

network of hemp farmers.

6. Establish the

infrastructure to grow hemp domestically.

7. Scale-up our

manufacturing process and QA/QC systems to ensure the safety, quality and supply of CBD for the expanding worldwide customer base.

8. Continue to monitor

the industry and evaluate strategic acquisitions that will provide additional capabilities to maintain our dominant position in

growing, harvesting, and processing hemp-derived products.

Financial Information

The Company is seeking to raise $24 million

to expand operations and finance working capital needs. The two most significant working capital areas include inventory purchases

($17M in 2015) and financing of working capital ($3.6M in 2015). Our ability to finance our working capital needs will allow the

Company to maintain its dominant supply chain position in the industry and to further expand the market by increasing credit sales.

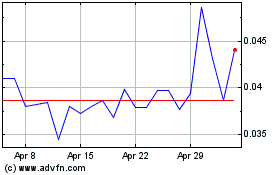

CV Sciences (QB) (USOTC:CVSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

CV Sciences (QB) (USOTC:CVSI)

Historical Stock Chart

From Apr 2023 to Apr 2024