UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 27, 2015

AMERICAN AIRLINES GROUP INC.

AMERICAN AIRLINES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-8400 |

|

75-1825172 |

| Delaware |

|

1-2691 |

|

13-1502798 |

| (State or other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 4333 Amon Carter Blvd., Fort Worth, Texas |

|

76155 |

| 4333 Amon Carter Blvd., Fort Worth, Texas |

|

76155 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code:

(817) 963-1234

(817)

963-1234

N/A

(Former name

or former address if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the

filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| ITEM 7.01. |

REGULATION FD DISCLOSURE. |

On January 27, 2015, American Airlines Group Inc. (the

“Company”) provided an update for investors presenting information relating to its financial and operational outlook for 2015. This investor presentation is located on the Company’s website at www.aa.com under “Investor

Relations.” The update is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 7.01,

including Exhibit 99.1, is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section and shall not be

deemed incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

| ITEM 9.01. |

FINANCIAL STATEMENTS AND EXHIBITS. |

(d) Exhibits.

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Investor Update |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, American Airlines Group Inc. has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

AMERICAN AIRLINES GROUP INC. |

|

|

|

|

| Date: January 27, 2015 |

|

|

|

By: |

|

/s/ Derek J. Kerr |

|

|

|

|

|

|

Derek J. Kerr |

|

|

|

|

|

|

Executive Vice President and |

|

|

|

|

|

|

Chief Financial Officer |

Pursuant to the requirements of the Securities Exchange Act of 1934, American Airlines, Inc. has duly caused this report to be

signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

AMERICAN AIRLINES, INC. |

|

|

|

|

| Date: January 27, 2015 |

|

|

|

By: |

|

/s/ Derek J. Kerr |

|

|

|

|

|

|

Derek J. Kerr |

|

|

|

|

|

|

Executive Vice President and |

|

|

|

|

|

|

Chief Financial Officer |

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Investor Update |

Exhibit 99.1

Investor Relations Update

January 27, 2015

General Overview

| |

• |

|

Pre-tax Margin - The Company expects its first quarter pre-tax margin (excluding special items) to be approximately 13 percent to 15 percent. |

| |

• |

|

Capacity - 2015 total system capacity is expected to be up approximately 2 percent to 3 percent vs. 2014 primarily due to larger average gauge aircraft and higher assumed completion factor. Full year domestic

capacity is expected to be up approximately 3 percent year-over-year, while international capacity is expected to be up approximately 1.5 percent vs. 2014. |

| |

• |

|

Cash - As of December 31, 2014, approximately $656 million of the Company’s unrestricted cash and short-term investment balance was held in Venezuelan bolivars. This balance includes approximately $621

million valued at 6.3 bolivars and approximately $35 million valued at 12.0 bolivars, with the rate depending on the date the Company submitted its repatriation request to the Venezuelan government. These rates are materially more favorable than the

exchange rates currently prevailing for other transactions conducted outside of the Venezuelan government’s currency exchange system. The Company’s cash balance held in Venezuelan bolivars decreased $65 million from the September 30,

2014 balance of $721 million. In the fourth quarter of 2014, the Company incurred an $11 million foreign currency loss related to the receipt of $23 million at a rate of 6.3 bolivars to the dollar for one of its 2012 repatriation requests originally

valued at a rate of 4.3 bolivars to the dollar. Accordingly, the Company revalued its remaining pending 2012 repatriation requests from 4.3 to 6.3 bolivars to the dollar resulting in additional foreign currency losses of $19 million. In total, the

Company recognized a $30 million special charge for these foreign currency losses in the fourth quarter of 2014. |

The Company

has significantly reduced capacity in this market. The Company is continuing to work with Venezuelan authorities regarding the timing and exchange rate applicable to the repatriation of funds held in local currency. The Company is monitoring this

situation closely and continues to evaluate its holdings of Venezuelan bolivars for additional foreign currency losses, which could be material.

| |

• |

|

Fuel - For the first quarter 2015, the Company expects to pay an average of between $1.71 and $1.76 per gallon of mainline jet fuel (including taxes). Forecasted volume and fuel prices are provided in the tables

below. |

| |

• |

|

Cargo / Other Revenue - Includes cargo revenue, frequent flyer revenue, ticket change fees, excess/overweight baggage fees, first and second bag fees, contract services, airport clubs and inflight service

revenues. |

| |

• |

|

Taxes / NOL - As of December 31, 2014, AAG had approximately $10.1 billion of net operating losses (NOLs) available to reduce future federal taxable income, substantially all of which are expected to be

available for use in 2015. The Company also had approximately $4.6 billion of NOLs available to reduce future state taxable income, substantially all of which are expected to be available for use in 2015. The Company’s net deferred tax asset,

which includes the NOLs, is subject to a full valuation allowance. As of December 31, 2014, the tax affected valuation allowances associated with federal and state NOLs approximate $4.5 billion and $0.3 billion, respectively. In accordance with

generally accepted accounting principles, utilization of NOLs to offset book taxable income reduces the net deferred tax asset and results in the release of corresponding valuation allowances, which offsets the tax provision on our income statement

dollar for dollar. The Company may be obligated to record and pay income tax related to certain states and foreign jurisdictions where NOLs may be limited or not available to be used. The Company currently expects this cash tax expense to be

approximately $10 million or less per quarter. |

| |

• |

|

Labor update - On December 13, 2014, the Company reached a five-year joint collective bargaining agreement (JCBA) with its flight attendants. On December 23, 2014, the JCBA pay rates were increased by

4% due to a corporate wide initiative announced on that day. The new pay rates were effective beginning on January 1, 2015. The Company estimates that its total flight attendant costs in 2015 will be approximately $200 million higher as a

result of this new agreement, of which $120 million was included in prior guidance. |

On January 3, 2015, the Company

reached a tentative agreement (TA) with its pilots on a five-year JCBA. That TA is currently subject to a membership ratification vote now scheduled to be completed by January 30. If the TA is ratified by January 30, 2015, new, higher pay

rates would be implemented retroactive to December 2, 2014. The Company estimates that a ratified contract by January 30 would increase its 2015 cost of pilot compensation and benefits by approximately $650 million (inclusive of $50

million for December 2014 which will be a special charge in the first quarter of 2015). If the pilots do not ratify the TA, a JCBA would be determined through binding arbitration scheduled to begin in late February. In that case, the Company would

anticipate no increase in its 2015 costs of pilot compensation and benefits resulting from the new contract because the agreement between the Company and the union that represents the pilots provides that the arbitration would be limited to the

determination of a cost neutral JCBA including no adjustments to pilot pay.

Please refer to the

footnotes and the forward looking statements page of this document for additional information

Mainline Update

January 27, 2015

Mainline Comments

| |

• |

|

Combined mainline data includes American Airlines and US Airways operated flights, and all operating expenses are for mainline operated flights only. Please refer to the following page for information pertaining to

regional data. |

| |

• |

|

Mainline capacity increase of 1.5 percent for the year is comprised of stage length related increase of approximately 2.5 percent, gauge related increase of approximately 2 percent and a departure related reduction of

approximately 3 percent. |

| |

• |

|

First quarter mainline CASM excluding special items and fuel is expected to be up 5% to 7%, slightly higher than full year guidance due to maintenance timing and a decline in year-over-year capacity. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1Q15E |

|

|

2Q15E |

|

|

3Q15E |

|

|

4Q15E |

|

|

FY15E |

|

| Mainline Guidance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Available Seat Miles (ASMs) (bil) |

|

|

~56.5 |

|

|

|

~62.4 |

|

|

|

~63.6 |

|

|

|

~58.2 |

|

|

|

~240.7 |

|

|

|

|

|

|

|

| CASM ex fuel and special items (YOY % change) 1 |

|

|

+5% to +7 |

% |

|

|

+2% to +4 |

% |

|

|

+2% to +4 |

% |

|

|

+3% to +5 |

% |

|

|

+3% to +5 |

% |

|

|

|

|

|

|

| Cargo Revenues ($ mil) |

|

|

~200 |

|

|

|

~230 |

|

|

|

~225 |

|

|

|

~210 |

|

|

|

~865 |

|

| Other Revenues ($ mil) |

|

|

~1,200 |

|

|

|

~1,240 |

|

|

|

~1,230 |

|

|

|

~1,210 |

|

|

|

~4,880 |

|

|

|

|

|

|

|

| Average Fuel Price (incl. taxes) ($/gal) (as of 1/22/2015) |

|

|

1.71 to 1.76 |

|

|

|

1.67 to 1.72 |

|

|

|

1.74 to 1.79 |

|

|

|

1.76 to 1.81 |

|

|

|

1.72 to 1.77 |

|

| Fuel Gallons Consumed (mil) |

|

|

~857 |

|

|

|

~936 |

|

|

|

~938 |

|

|

|

~864 |

|

|

|

~3,595 |

|

|

|

|

|

|

|

| Interest Income ($ mil) |

|

|

~(8 |

) |

|

|

~(8 |

) |

|

|

~(9 |

) |

|

|

~(11 |

) |

|

|

~(35 |

) |

| Interest Expense ($ mil) 2 |

|

|

~213 |

|

|

|

~209 |

|

|

|

~203 |

|

|

|

~200 |

|

|

|

~825 |

|

|

|

|

|

|

|

| Other Non-Operating (Income)/Expense ($ mil) 2,3 |

|

|

~10 |

|

|

|

~1 |

|

|

|

~3 |

|

|

|

~3 |

|

|

|

~17 |

|

|

|

|

|

|

|

| CAPEX Guidance ($ mil) Inflow/(Outflow) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-Aircraft CAPEX |

|

|

~(250 |

) |

|

|

~(250 |

) |

|

|

~(250 |

) |

|

|

~(250 |

) |

|

|

~(1,000 |

) |

|

|

|

|

|

|

| Gross Aircraft CAPEX & PDPs |

|

|

~(1,423 |

) |

|

|

~(1,484 |

) |

|

|

~(1,045 |

) |

|

|

~(1,210 |

) |

|

|

~(5,162 |

) |

| Assumed Aircraft Financing |

|

|

~419 |

|

|

|

~203 |

|

|

|

~187 |

|

|

|

~188 |

|

|

|

~997 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Aircraft CAPEX & PDPs 4 |

|

|

~(1,005 |

) |

|

|

~(1,281 |

) |

|

|

~(858 |

) |

|

|

~(1,021 |

) |

|

|

~(4,166 |

) |

Notes:

| 1. |

CASM ex fuel and special items is a non-GAAP financial measure. Please see the GAAP to non-GAAP reconciliation at the end of this document. |

| 2. |

Excludes special items; please see the GAAP to non-GAAP reconciliation at the end of this document. |

| 3. |

Other Non-Operating (Income)/Expense includes primarily gains and losses from foreign currency. |

| 4. |

Numbers may not recalculate due to rounding. |

Please refer to the footnotes and the forward looking statements page of this document for additional information

Regional Update

January 27, 2015

Regional Comments

| |

• |

|

AAG receives feed from 10 regional airlines, including wholly owned subsidiaries Envoy, PSA Airlines and Piedmont Airlines. |

| |

• |

|

All operating expenses (including capacity purchase agreements) associated with regional operations are included within the regional non-fuel operating expense line item on the income statement. |

| |

• |

|

Regional capacity increase of 12 percent for the year is comprised of stage length related increase of approximately 1.5 percent, gauge related increase of approximately 5 percent and a departure related increase of

approximately 5.5 percent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1Q15E |

|

|

2Q15E |

|

|

3Q15E |

|

|

4Q15E |

|

|

FY15E |

|

| Regional Guidance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Available Seat Miles (ASMs) (bil) |

|

|

~7.27 |

|

|

|

~8.01 |

|

|

|

~8.19 |

|

|

|

~8.11 |

|

|

|

~31.58 |

|

| CASM ex fuel and special items (YOY % change) 1 |

|

|

-4% to -6 |

% |

|

|

-4% to -6 |

% |

|

|

-3% to -5 |

% |

|

|

-4% to -6 |

% |

|

|

-4% to -6 |

% |

|

|

|

|

|

|

| Average Fuel Price (incl. taxes) ($/gal) (as of 1/22/2015) |

|

|

1.75 to 1.80 |

|

|

|

1.71 to 1.76 |

|

|

|

1.78 to 1.83 |

|

|

|

1.80 to 1.85 |

|

|

|

1.76 to 1.81 |

|

| Fuel Gallons Consumed (mil) |

|

|

~169 |

|

|

|

~185 |

|

|

|

~189 |

|

|

|

~185 |

|

|

|

~728 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Regional Airlines

|

|

|

| Envoy 2 |

|

Mesa Airlines, Inc. |

| SkyWest Airlines, Inc. |

|

Piedmont Airlines, Inc. 2 |

| ExpressJet Airlines, Inc. |

|

PSA Airlines, Inc. 2 |

| Republic Airline Inc. |

|

Trans States Airlines, Inc. 3 |

| Air Wisconsin Airlines Corporation |

|

Compass Airlines, LLC 4 |

Notes:

| 1. |

CASM ex fuel and special items is a non-GAAP financial measure. Please see the GAAP to non-GAAP reconciliation at the end of this document. |

| 2. |

Wholly owned subsidiary of American Airlines Group Inc. |

| 3. |

Pro-rate agreement. Will also operate under a capacity purchase agreement beginning in May, 2015. |

| 4. |

Will begin operating under a capacity purchase agreement beginning in March, 2015. |

Please refer to the footnotes and the forward looking statements page of this document for additional information

Fleet Update

January 27, 2015

Fleet Comments

| |

• |

|

In 2015, the Company expects to take delivery of 74 mainline aircraft including 7 A319 aircraft, 35 A321 aircraft, 18 737-800 aircraft, 2 777-300ER aircraft, and 12 787-8 aircraft. In addition, the Company expects to

retire 104 aircraft, including 9 A320 aircraft, 37 757 aircraft, 6 767-200 aircraft, 9 767-300 aircraft and 43 MD80s by the end of 2015. |

| |

• |

|

In 2015, the Company expects to increase its regional fleet size by 21 CRJ900 aircraft and 29 E175 aircraft. The Company expects to remove and park 21 ERJ140 aircraft and retire 1 Dash 8-100 aircraft. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Mainline Ending Fleet Count 1 |

|

| |

|

2014A |

|

|

1Q15E |

|

|

2Q15E |

|

|

3Q15E |

|

|

4Q15E |

|

| A319 |

|

|

118 |

|

|

|

122 |

|

|

|

125 |

|

|

|

125 |

|

|

|

125 |

|

| A320 |

|

|

64 |

|

|

|

57 |

|

|

|

55 |

|

|

|

55 |

|

|

|

55 |

|

| A321 |

|

|

139 |

|

|

|

149 |

|

|

|

159 |

|

|

|

167 |

|

|

|

174 |

|

| A332 |

|

|

15 |

|

|

|

15 |

|

|

|

15 |

|

|

|

15 |

|

|

|

15 |

|

| A333 |

|

|

9 |

|

|

|

9 |

|

|

|

9 |

|

|

|

9 |

|

|

|

9 |

|

| B738 |

|

|

246 |

|

|

|

250 |

|

|

|

256 |

|

|

|

259 |

|

|

|

264 |

|

| B757 |

|

|

106 |

|

|

|

96 |

|

|

|

86 |

|

|

|

72 |

|

|

|

69 |

|

| B762 |

|

|

6 |

|

|

|

2 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| B763 |

|

|

58 |

|

|

|

57 |

|

|

|

56 |

|

|

|

49 |

|

|

|

49 |

|

| B772 |

|

|

47 |

|

|

|

47 |

|

|

|

47 |

|

|

|

47 |

|

|

|

47 |

|

| B773 |

|

|

16 |

|

|

|

17 |

|

|

|

17 |

|

|

|

17 |

|

|

|

18 |

|

| B788 |

|

|

— |

|

|

|

3 |

|

|

|

6 |

|

|

|

9 |

|

|

|

12 |

|

| E190 |

|

|

20 |

|

|

|

20 |

|

|

|

20 |

|

|

|

20 |

|

|

|

20 |

|

| MD80 |

|

|

139 |

|

|

|

132 |

|

|

|

109 |

|

|

|

96 |

|

|

|

96 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

983 |

|

|

|

976 |

|

|

|

960 |

|

|

|

940 |

|

|

|

953 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Regional Ending Fleet Count 1 |

|

| |

|

2014A |

|

|

1Q15E |

|

|

2Q15E |

|

|

3Q15E |

|

|

4Q15E |

|

| CRJ200 |

|

|

138 |

|

|

|

138 |

|

|

|

138 |

|

|

|

138 |

|

|

|

138 |

|

| CRJ700 |

|

|

61 |

|

|

|

61 |

|

|

|

61 |

|

|

|

61 |

|

|

|

61 |

|

| CRJ900 |

|

|

77 |

|

|

|

84 |

|

|

|

95 |

|

|

|

98 |

|

|

|

98 |

|

| DASH 8-100 |

|

|

27 |

|

|

|

26 |

|

|

|

26 |

|

|

|

26 |

|

|

|

26 |

|

| DASH 8-300 |

|

|

11 |

|

|

|

11 |

|

|

|

11 |

|

|

|

11 |

|

|

|

11 |

|

| E170 |

|

|

20 |

|

|

|

20 |

|

|

|

20 |

|

|

|

20 |

|

|

|

20 |

|

| E175 |

|

|

80 |

|

|

|

87 |

|

|

|

91 |

|

|

|

100 |

|

|

|

109 |

|

| ERJ140 |

|

|

34 |

|

|

|

23 |

|

|

|

18 |

|

|

|

14 |

|

|

|

13 |

|

| ERJ145 |

|

|

118 |

|

|

|

118 |

|

|

|

118 |

|

|

|

118 |

|

|

|

118 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

566 |

|

|

|

568 |

|

|

|

578 |

|

|

|

586 |

|

|

|

594 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes:

| 1. |

All fleet counts include aircraft in temporary storage and aircraft that have yet to be returned to lessors. At the end of the first quarter, the Company expects to have nine aircraft in temporary storage for lease

return. |

Please refer to the footnotes and the

forward looking statements page of this document for additional information

Shares Outstanding

January 27, 2015

Shares Outstanding Comments

| |

• |

|

The estimated weighted average shares outstanding for 2015 are listed below. |

| |

• |

|

In the fourth quarter 2014, the Company repurchased $887 million of common stock, or 20.5 million shares. When combined with the $113 million of shares repurchased in the third quarter 2014, the Company repurchased

a total of 23.4 million shares at an average price of $42.72 per share in 2014. The Company’s $1 billion share repurchase program announced in July 2014 is now complete. |

| |

• |

|

On January 27, 2015 the Company announced that its Board has authorized an additional $2 billion share repurchase program to be completed by the end of 2016. |

2015 Shares Outstanding (shares mil) 1

|

|

|

|

|

|

|

|

|

| |

|

Shares |

|

| For Q1 |

|

Basic |

|

|

Diluted |

|

| Earnings |

|

|

698 |

|

|

|

719 |

|

| Net loss |

|

|

698 |

|

|

|

698 |

|

|

|

| |

|

Shares |

|

| For Q2-Q4 Average |

|

Basic |

|

|

Diluted |

|

| Earnings |

|

|

699 |

|

|

|

724 |

|

| Net loss |

|

|

699 |

|

|

|

699 |

|

|

|

| |

|

Shares |

|

| For FY 2015 Average |

|

Basic |

|

|

Diluted |

|

| Earnings |

|

|

699 |

|

|

|

722 |

|

| Net loss |

|

|

699 |

|

|

|

699 |

|

Notes:

| 1. |

Shares outstanding are based upon several estimates and assumptions, including average per share stock price and stock award activity and do not take into consideration any future share repurchases. The number of

shares in actual calculations of earnings per share will likely be different from those set forth above. |

Please refer to the footnotes and the forward looking statements page of this document for additional information

GAAP to Non-GAAP Reconciliation

January 27, 2015

The Company is providing disclosure of the reconciliation of reported non-GAAP financial measures to their

comparable financial measures on a GAAP basis. The Company believes that the non-GAAP financial measures provide investors the ability to measure financial performance excluding special items, which is more indicative of the Company’s ongoing

performance and is more comparable to measures reported by other major airlines. The Company believes that the presentation of mainline CASM excluding fuel and special items and regional CASM excluding fuel and special items is useful to investors

because both the cost and availability of fuel are subject to many economic and political factors beyond the Company’s control.

American Airlines Group Inc GAAP to Non-GAAP Reconciliation

($ mil except ASM and CASM data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1Q15 Range |

|

|

2Q15 Range |

|

|

3Q15 Range |

|

|

4Q15 Range |

|

|

FY15 Range |

|

| |

|

Low |

|

|

High |

|

|

Low |

|

|

High |

|

|

Low |

|

|

High |

|

|

Low |

|

|

High |

|

|

Low |

|

|

High |

|

|

|

|

|

|

|

|

|

|

|

|

| Mainline |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mainline operating expenses 1 |

|

$ |

6,787 |

|

|

$ |

6,931 |

|

|

$ |

7,005 |

|

|

$ |

7,159 |

|

|

$ |

7,049 |

|

|

$ |

7,202 |

|

|

$ |

6,718 |

|

|

$ |

6,862 |

|

|

$ |

27,577 |

|

|

$ |

28,172 |

|

| Less mainline fuel |

|

|

1,465 |

|

|

|

1,508 |

|

|

|

1,563 |

|

|

|

1,610 |

|

|

|

1,632 |

|

|

|

1,679 |

|

|

|

1,521 |

|

|

|

1,564 |

|

|

|

6,181 |

|

|

|

6,361 |

|

| Less special items |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mainline operating expense excluding fuel and special items |

|

|

5,321 |

|

|

|

5,423 |

|

|

|

5,442 |

|

|

|

5,549 |

|

|

|

5,417 |

|

|

|

5,523 |

|

|

|

5,197 |

|

|

|

5,298 |

|

|

|

21,396 |

|

|

|

21,811 |

|

|

|

|

|

|

|

|

|

|

|

|

| Mainline CASM (cts) 1 |

|

|

12.01 |

|

|

|

12.27 |

|

|

|

11.23 |

|

|

|

11.47 |

|

|

|

11.08 |

|

|

|

11.32 |

|

|

|

11.54 |

|

|

|

11.79 |

|

|

|

11.46 |

|

|

|

11.70 |

|

|

|

|

|

|

|

|

|

|

|

|

| Mainline CASM excluding fuel and special items (Non-GAAP) (cts) |

|

|

9.42 |

|

|

|

9.60 |

|

|

|

8.72 |

|

|

|

8.89 |

|

|

|

8.52 |

|

|

|

8.68 |

|

|

|

8.93 |

|

|

|

9.10 |

|

|

|

8.89 |

|

|

|

9.06 |

|

|

|

|

|

|

|

|

|

|

|

|

| Mainline ASMs (bil) |

|

|

56.5 |

|

|

|

56.5 |

|

|

|

62.4 |

|

|

|

62.4 |

|

|

|

63.6 |

|

|

|

63.6 |

|

|

|

58.2 |

|

|

|

58.2 |

|

|

|

240.7 |

|

|

|

240.7 |

|

|

|

|

|

|

|

|

|

|

|

|

| Regional |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Regional operating expenses |

|

$ |

1,432 |

|

|

$ |

1,464 |

|

|

$ |

1,506 |

|

|

$ |

1,541 |

|

|

$ |

1,544 |

|

|

$ |

1,579 |

|

|

$ |

1,543 |

|

|

$ |

1,578 |

|

|

$ |

6,013 |

|

|

$ |

6,150 |

|

| Less regional fuel expense |

|

|

296 |

|

|

|

304 |

|

|

|

316 |

|

|

|

326 |

|

|

|

336 |

|

|

|

346 |

|

|

|

333 |

|

|

|

342 |

|

|

|

1,282 |

|

|

|

1,318 |

|

| Less special items |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Regional operating expenses excluding fuel and special items |

|

|

1,136 |

|

|

|

1,160 |

|

|

|

1,190 |

|

|

|

1,215 |

|

|

|

1,208 |

|

|

|

1,233 |

|

|

|

1,210 |

|

|

|

1,236 |

|

|

|

4,732 |

|

|

|

4,832 |

|

|

|

|

|

|

|

|

|

|

|

|

| Regional CASM (cts) |

|

|

19.69 |

|

|

|

20.14 |

|

|

|

18.80 |

|

|

|

19.23 |

|

|

|

18.85 |

|

|

|

19.28 |

|

|

|

19.02 |

|

|

|

19.46 |

|

|

|

19.04 |

|

|

|

19.48 |

|

|

|

|

|

|

|

|

|

|

|

|

| Regional CASM excluding fuel and special items (Non-GAAP) (cts) |

|

|

15.62 |

|

|

|

15.96 |

|

|

|

14.85 |

|

|

|

15.17 |

|

|

|

14.74 |

|

|

|

15.05 |

|

|

|

14.92 |

|

|

|

15.24 |

|

|

|

14.98 |

|

|

|

15.30 |

|

|

|

|

|

|

|

|

|

|

|

|

| Regional ASMs (bil) |

|

|

7.27 |

|

|

|

7.27 |

|

|

|

8.01 |

|

|

|

8.01 |

|

|

|

8.19 |

|

|

|

8.19 |

|

|

|

8.11 |

|

|

|

8.11 |

|

|

|

31.58 |

|

|

|

31.58 |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest Expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest Expense |

|

|

213 |

|

|

$ |

213 |

|

|

|

209 |

|

|

$ |

209 |

|

|

$ |

203 |

|

|

$ |

203 |

|

|

$ |

200 |

|

|

$ |

200 |

|

|

$ |

825 |

|

|

$ |

825 |

|

| Less special items |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest Expense excluding special items |

|

|

213 |

|

|

|

213 |

|

|

|

209 |

|

|

|

209 |

|

|

|

203 |

|

|

|

203 |

|

|

|

200 |

|

|

|

200 |

|

|

|

825 |

|

|

|

825 |

|

|

|

|

|

|

|

|

|

|

|

|

| Other Non-Operating (Income)/Expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other non-operating (income)/expense |

|

|

10 |

|

|

$ |

10 |

|

|

$ |

1 |

|

|

$ |

1 |

|

|

$ |

3 |

|

|

$ |

3 |

|

|

$ |

3 |

|

|

$ |

3 |

|

|

$ |

17 |

|

|

$ |

17 |

|

| Less special items |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other non-operating (income)/expense excluding special items |

|

|

10 |

|

|

|

10 |

|

|

|

1 |

|

|

|

1 |

|

|

|

3 |

|

|

|

3 |

|

|

|

3 |

|

|

|

3 |

|

|

|

17 |

|

|

|

17 |

|

Notes: Amounts may not recalculate due to rounding.

| (1) |

Forecasted mainline operating expenses exclude special items. |

Please refer to the footnotes and the forward looking statements page of this document for additional information

Forward Looking Statements

January 27, 2015

Cautionary Statement Regarding Forward-Looking Statements

This document includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements

may be identified by words such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “could,”

“should,” “would,” “continue,” “seek,” “target,” “guidance,” “outlook,” “if current trends continue,” “optimistic,” “forecast” and other similar

words. Such statements include, but are not limited to, statements about future financial and operating results, our plans, objectives, estimates, expectations and intentions, and other statements that are not historical facts. These forward-looking

statements are based on the current objectives, beliefs and expectations of the Company, and they are subject to significant risks and uncertainties that may cause actual results and financial position and timing of certain events to differ

materially from the information in the forward-looking statements. The following factors, among others, could cause actual results and financial position and timing of certain events to differ materially from those described in the forward-looking

statements: significant operating losses in the future; downturns in economic conditions that adversely affect the Company’s business; the impact of continued periods of high volatility in fuel costs, increased fuel prices and significant

disruptions in the supply of aircraft fuel; competitive practices in the industry, including the impact of low cost carriers, airline alliances and industry consolidation; the challenges and costs of integrating operations and realizing anticipated

synergies and other benefits of the merger transaction with US Airways Group, Inc.; the Company’s substantial indebtedness and other obligations and the effect they could have on the Company’s business and liquidity; an inability to obtain

sufficient financing or other capital to operate successfully and in accordance with the Company’s current business plan; increased costs of financing, a reduction in the availability of financing and fluctuations in interest rates; the effect

the Company’s high level of fixed obligations may have on its ability to fund general corporate requirements, obtain additional financing and respond to competitive developments and adverse economic and industry conditions; the Company’s

significant pension and other post-employment benefit funding obligations; the impact of any failure to comply with the covenants contained in financing arrangements; provisions in credit card processing and other commercial agreements that may

materially reduce the Company’s liquidity; the limitations of the Company’s historical consolidated financial information, which is not directly comparable to its financial information for prior or future periods; the impact of union

disputes, employee strikes and other labor-related disruptions; any inability to maintain labor costs at competitive levels; interruptions or disruptions in service at one or more of the Company’s hub airports; any inability to obtain and

maintain adequate facilities, infrastructure and slots to operate the Company’s flight schedule and expand or change its route network; the Company’s reliance on third-party regional operators or third-party service providers that have the

ability to affect the Company’s revenue and the public’s perception about its services; any inability to effectively manage the costs, rights and functionality of third-party distribution channels on which the Company relies; extensive

government regulation, which may result in increases in the Company’s costs, disruptions to the Company’s operations, limits on the Company’s operating flexibility, reductions in the demand for air travel, and competitive

disadvantages; the impact of the heavy taxation to which the airline industry is subject; changes to the Company’s business model that may not successfully increase revenues and may cause operational difficulties or decreased demand; the loss

of key personnel or inability to attract and retain additional qualified personnel; the impact of conflicts overseas, terrorist attacks and ongoing security concerns; the global scope of the Company’s business and any associated economic and

political instability or adverse effects of events, circumstances or government actions beyond its control, including the impact of foreign currency exchange rate fluctuations and limitations on the repatriation of cash held in foreign countries;

the impact of environmental regulation; the Company’s reliance on technology and automated systems and the impact of any failure of these technologies or systems; challenges in integrating the Company’s computer, communications and other

technology systems; costs of ongoing data security compliance requirements and the impact of any significant data security breach; losses and adverse publicity stemming from any accident involving any of the Company’s aircraft or the aircraft

of its regional or codeshare operators; delays in scheduled aircraft deliveries, or other loss of anticipated fleet capacity, and failure of new aircraft to perform as expected; the Company’s dependence on a limited number of suppliers for

aircraft, aircraft engines and parts; the impact of changing economic and other conditions beyond the Company’s control, including global events that affect travel behavior such as an outbreak of a contagious disease, and volatility and

fluctuations in the Company’s results of operations due to seasonality; the effect of a higher than normal number of pilot retirements and a potential shortage of pilots; the impact of possible future increases in insurance costs or reductions

in available insurance coverage; the effect of several lawsuits that were filed in connection with the merger transaction with US Airways Group, Inc. and remain pending; an inability to use NOL carryforwards; any impairment in the amount of goodwill

the Company recorded as a result of the application of the acquisition method of accounting and an inability to realize the full value of the Company’s and American Airlines’ respective intangible or long-lived assets and any material

impairment charges that would be recorded as a result; price volatility of the Company’s common stock; delay or prevention of stockholders’ ability to change the composition of the Company’s board of directors and the effect this may

have on takeover attempts that some of the Company’s stockholders might consider beneficial; the effect of provisions of the Company’s Certificate of Incorporation and Bylaws that limit ownership and voting of its equity interests,

including its common stock; the effect of limitations in the Company’s Certificate of Incorporation on acquisitions and dispositions of its common stock designed to protect its NOL carryforwards and certain other tax attributes, which may limit

the liquidity of its common stock; and other economic, business, competitive, and/or regulatory factors affecting the Company’s business, including those set forth in the Company’s quarterly report on form 10-Q for the period ended

September 30, 2014 (especially in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections) and other risks and uncertainties listed from time to time in

our filings with the SEC. Any forward-looking statements speak only as of the date hereof or as of the dates indicated in the statements. The Company does not assume any obligation to publicly update or supplement any forward-looking statement to

reflect actual results, changes in assumptions or changes in other factors affecting these forward-looking statements except as required by law.

Please refer to the footnotes and the forward looking statements page of this document for additional information

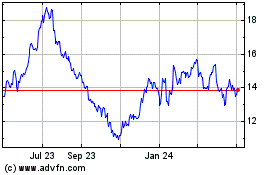

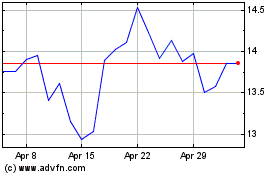

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Apr 2023 to Apr 2024