UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): January 20, 2015

VAPOR CORP.

(Exact name of registrant as specified in

its charter)

|

Delaware |

|

001-36469 |

|

84-1070932 |

| (State of Incorporation) |

|

(Commission File

Number) |

|

(IRS Employer

Identification No.) |

|

3001 Griffin

Road, Dania Beach, Florida |

|

33312 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (888) 766-5351

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions

(see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

VAPOR CORP.

FORM 8-K

CURRENT REPORT

Item 1.01 Entry into a Material

Definitive Agreement

On January 20, 2015, Vapor Corp. (“Vapor”)

and Vaporin, Inc. (“Vaporin”) entered into a Securities Purchase Agreement (“Securities Purchase Agreement”)

with certain accredited investors providing for the sale of $350,000 of Vaporin’s Convertible Notes (the “Notes”).

The Notes accrue interest on the outstanding principal at an annual rate of 10%. The principal and accrued interest on the Notes

is due and payable on January 20, 2016. Assuming the merger between Vapor and Vaporin (the “Merger”) closes,

the Notes will be convertible into Vapor common stock at the lower of (i) $1.08 or (ii) a 15% discount to a 20-trading day VWAP

following the closing of the Merger (subject to a maximum issuance of 525,000 shares). If the Merger does not close, the Notes

will not be convertible into either Vapor’s or Vaporin’s stock. Investors were provided with standard piggyback registration

rights, which are conditioned on the Merger closing.

The Securities Purchase Agreement and

a form of the Note are filed as exhibits under Item 9.01 and are incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. |

|

Exhibit |

| |

|

|

| 10.1 |

|

Securities Purchase Agreement |

| 10.2 |

|

Form of Note |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

|

|

VAPOR CORP. |

| |

|

|

|

|

|

| Date: |

January 26, 2015 |

|

|

By: |

/s/ Harlan Press |

| |

|

|

|

Harlan Press |

| |

|

|

|

Chief Financial Officer |

Exhibit

Number |

|

Description |

| |

|

|

| 10.1 |

|

Securities Purchase Agreement |

| 10.2 |

|

Form of Note |

Exhibit 10.1

SECURITIES PURCHASE AGREEMENT

THIS SECURITIES PURCHASE

AGREEMENT (the “Agreement”) entered into as of this 20th day of January, 2015 (the “Effective Date”) by and

between the parties on the signature page to this Agreement (each, a “Purchaser”), Vaporin, Inc., a Delaware corporation

(“VAPO”) and Vapor Corp., a Delaware corporation. (“Vapor”), solely to the extent provided in Sections

2, 3, 6, 7 and 8 (collectively, the Purchaser, VAPO and Vapor are the “Parties”).

WHEREAS, this Agreement

contemplates a transaction in which the Purchaser will purchase from VAPO, and VAPO will sell to the Purchaser, up to $1 million

of a one-year convertible note (the “Note”) convertible into Vapor common stock only if the proposed merger between

VAPO and Vapor (the “Merger”) closes.

NOW, THEREFORE, in consideration

of the mutual promises contained herein, and for good and valuable consideration, the receipt and sufficiency of which is hereby

acknowledged, the Parties hereto agree as follows:

1. Sale

and Purchase. VAPO agrees to sell and the Purchaser agrees to purchase a one-year 10% Note for the consideration set forth

on the signature page to this Agreement. A copy of the form of Note is annexed as Exhibit A to this Agreement.

2. Conversion.

The Note shall be convertible into Vapor common stock at the lower of (i) $1.08 or (ii) a 15% discount to a 20-trading day VWAP

following the closing of the Merger. Provided, however, because of the Rules of the NASDAQ Stock Market in no event

shall more than 1,500,000 shares of common stock be issued if all $1 million is raised. If less than $1 million is raised, the

maximum number of shares shall be adjusted pro rata. For the purposes of this Agreement, “VWAP” means: for any date,

the price determined by the first of the following clauses that applies: (a) if the common stock is then listed or quoted on the

NASDAQ Stock Market or other applicable national securities exchange (any, a “Trading Market”), the daily volume weighted

average price of the common stock for such date (or the nearest preceding date) on the Trading Market on which the common stock

is then listed or quoted as reported by Bloomberg L.P. (based on a Trading Day from 9:30 a.m. (New York City time) to 4:02 p.m.

(New York City time)), (b) if prices for the common stock are then reported in the “Pink Sheets” published by

Pink OTC Markets, Inc. (or a similar organization or agency succeeding to its functions of reporting prices), the most recent bid

price per share of the common stock so reported, or (d) in all other cases, the fair market value of a share of common stock

as determined by an independent appraiser selected in good faith by the Purchaser of a majority in interest of the Notes then outstanding

and reasonably acceptable to Vapor, the fees and expenses of which shall be paid by Vapor.

3. Piggyback

Registration.

3.1 Subsequent

to the Merger but prior to the two year anniversary of the Effective Date, each time Vapor proposes for any reason to register

any of its common stock under the Securities Act of 1933 (“Securities Act”) in connection with the proposed offer and

sale of its common stock for money, either for its own account or on behalf of any other security holder (a “Proposed Registration”),

other than pursuant to a registration statement on Form S-4

or S-8, Vapor shall promptly give written notice

of such Proposed Registration to the Purchaser and shall offer the Purchaser the right to request inclusion of shares of common

stock underlying or issued upon exercise of the Note (the “Registrable Securities”) in the Proposed Registration. The

Purchaser shall have 10 days from the receipt of such notice to deliver to Vapor a written request specifying the number of Registrable

Securities the Purchaser intends to sell in the Proposed Registration and the Purchaser’s intended method of disposition.

3.2 In

the event that the Proposed Registration by Vapor is, in whole or in part, an underwritten public offering, Vapor shall so advise

the Purchaser as part of the written notice given pursuant to Section 3.1, and any request under Section 3.1 must specify that

the Purchaser’s Registrable Securities be included in the underwriting on the same terms and conditions as the shares of

common stock, if any, otherwise being sold through underwriters under such registration.

3.3 Upon

receipt of a written request pursuant to Section 3.1, Vapor shall promptly use commercially reasonable efforts to cause all such

Registrable Securities held by the Purchaser to be registered under the Securities Act (and included in any related qualifications

under blue sky laws or other compliance), to the extent required to permit sale or disposition as set forth in the Proposed Registration.

3.4 In

the event that the offering is to be an underwritten offering, if the Purchaser proposes to distribute its Registrable Securities

through such underwritten offering, then the Purchaser agrees to enter into an underwriting agreement with the underwriter or underwriters

selected for such underwriting by Vapor. Notwithstanding the foregoing, if in its good faith judgment, Purchaser or managing underwriter

determines and advises in writing that the inclusion of the Registrable Securities proposed to be included in the underwritten

public offering, together with any other issued and outstanding shares of common stock proposed to be included therein by holders

other than the Purchaser would interfere with the successful marketing of such securities, then the number of the Purchaser’s

Registrable Shares to be included in such underwritten public offering shall be reduced as determined by Vapor and the managing

underwriter.

3.5 Vapor’s

obligations under Section 3 are subject to the Purchaser promptly supplying to Vapor the necessary information with respect to

the Purchaser, its beneficial ownership of Vapor common stock and its proposed plan of distribution.

4. Representations

and Warranties of VAPO. As an inducement to the Purchaser to enter into this Agreement and consummate the transaction contemplated

hereby, VAPO hereby makes the following representations and warranties, each of which is materially true and correct on the date

hereof:

4.1 Organization.

VAPO is a corporation duly organized, validly existing, and in good standing under the laws of the State of Delaware and is duly

authorized to conduct business as currently conducted.

4.2 Authority.

VAPO has full power and authority to execute and deliver this

Agreement and to perform its obligations hereunder.

This Agreement constitutes the valid and legally binding obligation of VAPO, enforceable in accordance with its terms. The execution,

delivery, and performance of this Agreement and all other agreements contemplated hereby have been duly authorized by VAPO.

4.3 Non-Contravention.

The execution and delivery of this Agreement by VAPO and the observance and performance of the terms and provisions contained herein

do not constitute a violation or breach of any applicable law, or any provision of any other contract or instrument to which VAPO

is a party or by which it is bound, or any order, writ, injunction, decree, statute, rule, by-law or regulation applicable to VAPO.

4.4 Litigation.

There are no actions, suits, or proceedings pending or, to the best of VAPO’s knowledge, threatened, which could in any manner

restrain or prevent VAPO from effectually and legally selling the Note pursuant to the terms and provisions of this Agreement.

VAPO is not a party to any litigation except as has been disclosed in its Form 10-K filed with the Securities and Exchange Commission

(the “SEC”).

4.5 Brokers’

Fees. VAPO has no liability or obligation to pay fees or commissions to any broker, finder, or agent with respect to the transactions

contemplated by this Agreement.

4.6 Reporting

Company. VAPO is a publicly-held company subject to reporting obligations pursuant to Section 13 of the Securities Exchange

Act of 1934 (the “Exchange Act”) and has a class of common stock registered pursuant to Section 12(g) of the Exchange

Act.

4.7 SEC

Reports. VAPO has filed with the SEC all reports required to be filed since January 1, 2012, none of the reports filed with

the SEC contained any material statements which were not true and correct or omitted to state any statements of material fact necessary

in order to make the statements made not misleading.

4.8 Outstanding

Securities. All issued and outstanding shares of capital stock and equity interests in VAPO have been duly authorized and validly

issued and are fully paid and non-assessable.

4.9 No

Material Adverse Change. Since November 14, 2014 (filing date of the last Form 10-Q), there has not been individually or in

the aggregate a Material Adverse Change with respect to VAPO. For the purposes of this Agreement, “Material Adverse Change”

means any event, change or occurrence which, individually or together with any other event, change, or occurrence, could result

in a material adverse change on VAPO or material adverse change on its business, assets, financial condition, or results of operations.

Provided, however, a Material Adverse Change does not exist solely because (i) there are changes in the economy,

credit markets or capital markets, or (ii) changes generally affecting the industry in which VAPO operates.

5. Representations

and Warranties of the Purchaser. As an inducement to

VAPO to enter into this Agreement and to consummate

the transactions contemplated hereby, the Purchaser hereby makes the following representations and warranties, each of which is

materially true and correct on the date hereof and will be materially true and correct on the closing date:

5.1 Authority.

The Purchaser has full power and authority to execute and deliver this Agreement and to perform its obligations hereunder. This

Agreement constitutes the valid and legally binding obligation of the Purchaser, enforceable in accordance with its terms. The

execution, delivery, and performance of this Agreement and all other agreements contemplated hereby have been duly authorized by

the Purchaser.

5.2 Non-Contravention.

The execution and delivery of this Agreement by the Purchaser and the observance and performance of the terms and provisions of

this Agreement on the part of the Purchaser to be observed and performed will not constitute a violation of applicable law or any

provision of any contract or other instrument to which the Purchaser is a party or by which it is bound, or any order, writ, injunction,

decree statute, rule or regulation applicable to it;

5.3 Litigation

There are no actions, suits, or proceedings pending or, to the best of the Purchaser’s knowledge, threatened, which could

in any manner restrain or prevent the Purchaser from effectually and legally purchasing the Note pursuant to the terms and provisions

of this Agreement.

5.4 Brokers’

Fees. The Purchaser has no liability or obligation to pay fees or commissions to any broker, finder, or agent with respect

to the transactions contemplated by this Agreement.

5.5 Information.

The Purchaser has relied solely on the reports of VAPO filed with the SEC, other publicly available information and other written

and electronic information prepared by VAPO in making its decision to purchase the Note. The Purchaser acknowledges that the purchase

of the Note entails a high degree of risk including the risks highlighted in the risk factors contained in filings by VAPO with

the SEC including its annual report on Form 10-K for the year ended December 31, 2013 and the Form S-4 filed with the SEC relating

to the Merger, and in other publicly available information. The Purchaser represents that it has had an opportunity to ask questions

and receive answers from VAPO regarding the terms and conditions of this Agreement and the reasons for this offering, the business

prospects of VAPO, the risks attendant to VAPO’s business, and the risks relating to an investment in VAPO. The Purchaser

further acknowledges that pursuant to Section 517.061(11)(a)(3), Florida Statutes and Rule 3E-5090.05(a) thereunder, the Purchaser

has had an opportunity to obtain additional information (to the extent VAPO possesses such information and could acquire it without

unreasonable effort or expense) necessary to verify the accuracy of any information furnished to such Purchaser or to which the

Purchaser had access. VAPO will put such information in writing if requested by the Purchaser. The Purchaser acknowledges the receipt

(without exhibits) of or access to the reports filed with SEC at www.sec.gov which includes VAPO’s and Vapor’s

annual report on Form 10-K with respect to the year ended December 31, 2013 and quarterly reports on Form 10-Q for the quarter

ended March 31, 2014 and June 30, 2014 and September 30, 2014 and the Form S-4 (as

well as any other reports) filed prior to the

date of this Agreement. These reports will be made available to the Purchaser upon written request to VAPO.

5.6 Investment.

The Purchaser is acquiring the Note for its own account for investment and not with a view to, or for sale in connection with,

any distribution thereof, nor with any present intention of distribution or selling the same, and, except as contemplated by this

Agreement, and has no present or contemplated agreement, undertaking, arrangement, obligation, indebtedness or commitment providing

for the disposition thereof. The Purchaser understands that the Note may not be sold, transferred or otherwise disposed of without

registration under the Act or an exemption therefrom, and that in the absence of an effective registration statement covering the

Note or an available exemption from registration under the Act, the Note must be held indefinitely.

5.7 Restricted

Securities. The Purchaser understands that the Note is not registered under the Act in reliance on an exemption from registration

under the Act pursuant to Section 4(a)(2) thereof and Rule 506(b) thereunder and the Note will bear a restrictive legend.

5.8 Investment Experience.

The Purchaser represents that: it is an “accredited investor” within the meaning of the applicable rules and regulations

promulgated under the Act, for one of the reasons on the attached Exhibit B to this Agreement. The Purchaser represents

and acknowledges that: (i) it is experienced in evaluating and investing in private placement transactions in similar circumstances

(ii) it has such knowledge and experience in financial and business matters and is capable of evaluating the merits and risks of

the investment in the Note, (iii) it is able to bear the substantial economic risks of an investment the Note for an indefinite

period of time, (iv) it has no need for liquidity in such investment, (v) it can afford a complete loss of such investment, and

(vi) it has such knowledge and experience in financial, tax and business matters so as to enable it to utilize the information

made available to it in connection with the offering of the Note to evaluate the merits and risks of the purchase of the Note and

to make an informed investment decision with respect thereto.

5.9 No

General Solicitation. The offer to sell the Note was directly communicated to the Purchaser by VAPO. At no time was the Purchaser

presented with or solicited advertisement, articles, notice or other communication published in any newspaper, television or radio

or presented at any seminar or meeting, or any solicitation by a person not previously known to the undersigned in connection with

the communicated offer.

6. Representations

and Warranties of Vapor. As an inducement to the Purchaser to enter into this Agreement and consummate the transaction

contemplated hereby, Vapor hereby makes the following representations and warranties, each of which is materially true and correct

on the date hereof:

6.1 Organization.

Vapor is a corporation duly organized, validly existing, and in good standing under the laws of the State of Delaware and is duly

authorized to conduct business as currently conducted.

6.2 Authority.

Vapor has full power and authority to execute and deliver this

Agreement and to perform its obligations hereunder.

This Agreement constitutes the valid and legally binding obligation of Vapor, enforceable in accordance with its terms. The execution,

delivery, and performance of this Agreement and all other agreements contemplated hereby have been duly authorized by Vapor.

6.3 Non-Contravention.

The execution and delivery of this Agreement by Vapor and the observance and performance of the terms and provisions contained

herein do not constitute a violation or breach of any applicable law, or any provision of any other contract or instrument to which

Vapor is a party or by which it is bound, or any order, writ, injunction, decree, statute, rule, by-law or regulation applicable

to Vapor.

6.4 Litigation.

There are no actions, suits, or proceedings pending or, to the best of Vapor’s knowledge, threatened, which could in any

manner restrain or prevent Vapor from effectually and legally selling the Note pursuant to the terms and provisions of this Agreement.

Vapor is not a party to any litigation except as has been disclosed in its Form 10-K filed with the SEC.

6.5 Brokers’

Fees. Vapor has no liability or obligation to pay fees or commissions to any broker, finder, or agent with respect to the transactions

contemplated by this Agreement.

6.6 Reporting

Company. Vapor is a publicly-held company subject to reporting obligations pursuant to Section 13 of the Exchange Act and has

a class of common stock registered pursuant to Section 12(b) of the Exchange Act.

6.7 SEC

Reports. Vapor has filed with the SEC all reports required to be filed since January 1, 2012, none of the reports filed with

the SEC contained any material statements which were not true and correct or omitted to state any statements of material fact necessary

in order to make the statements made not misleading.

6.8 Outstanding

Securities. All issued and outstanding shares of capital stock and equity interests in Vapor have been duly authorized and

validly issued and are fully paid and non-assessable.

6.9 No

Material Adverse Change. Since November 14, 2014 (filing date of the last Form 10-Q), there has not been individually or in

the aggregate a Material Adverse Change with respect to Vapor. For the purposes of this Agreement, “Material Adverse Change”

means any event, change or occurrence which, individually or together with any other event, change, or occurrence, could result

in a material adverse change on Vapor or material adverse change on its business, assets, financial condition, or results of operations.

Provided, however, a Material Adverse Change does not exist solely because (i) there are changes in the economy,

credit markets or capital markets, or (ii) changes generally affecting the industry in which Vapor operates.

7. Survival

of Representations and Warranties and Agreements. All representations and warranties of the Parties contained in this Agreement

shall survive the

closing.

8. Indemnification.

8.1 Indemnification

Provisions for Benefit of the Purchaser. In the event VAPO breaches any of its representations, warranties, and/or covenants

contained herein and provided that the Purchaser make a written claim for indemnification against VAPO, then VAPO agrees to indemnify

the Purchaser from and against the entirety of any losses, damages, amounts paid in settlement of any claim or action, expenses,

or fees including court costs and reasonable attorneys' fees and expenses.

8.2 Indemnification

Provisions for Benefit of VAPO. In the event the Purchaser breaches any of its representations, warranties, and/or covenants

contained herein and provided that VAPO make a written claim for indemnification against the Purchaser, then the Purchaser agrees

to indemnify VAPO from and against the entirety of any losses, damages, amounts paid in settlement of any claim or action, expenses,

or fees including court costs and reasonable attorneys' fees and expenses.

8.3 Indemnification

Concerning Vapor. The foregoing provisions of Sections 8.1 and8.2 shall apply to Vapor if the Merger closes.

9. Post-Closing

Covenants. The Parties agree as follows with respect to the period following the closing:

9.1 General.

In case at any time after the closing any further action is necessary or desirable to carry out the purposes of this Agreement,

each of the Parties will take such further action (including the execution and delivery of such further instruments and documents)

as the other Party may request, all at the sole cost and expense of the requesting Party (unless the requesting Party is entitled

to indemnification therefore under Section 8).

9.2 Company.

VAPO hereby covenants that, after the closing, VAPO will, at the request of Purchaser, execute, acknowledge and deliver to the

Purchaser without further consideration, all such further assignments, conveyances, consents and other documents, and take such

other action, as the Purchaser may reasonably request (a) to transfer to, vest and protect in the Purchaser and its right, title

and interest in the Note, and (b) otherwise to consummate or effectuate the transactions contemplated by this Agreement.

10. Expenses.

Except as otherwise provided in this Agreement, all parties hereto shall pay their own expenses, including legal and accounting

fees, in connection with the transactions contemplated herein.

11. Severability.

In the event any parts of this Agreement are found to be void, the remaining provisions of this Agreement shall nevertheless be

binding with the same effect as though the void parts were deleted.

12. Counterparts.

This Agreement may be executed in one or more counterparts,

each of which shall be deemed an original but

all of which together shall constitute one and the same instrument. The execution of this Agreement may be by actual or facsimile

signature.

13. Benefit.

This Agreement shall be binding upon and inure to the benefit of the parties hereto and their legal representatives, successors

and assigns. Nothing in this Agreement, expressed or implied, is intended to confer on any person other than the Parties or their

respective heirs, successors and assigns any rights, remedies, obligations, or other liabilities under or by reason of this Agreement.

14. Notices

and Addresses. All notices, offers, acceptance and any other acts under this Agreement (except payment) shall be in writing,

and shall be sufficiently given if delivered to the addressees in person, by FedEx or similar overnight next business day delivery,

or by email followed by overnight next business day delivery, as follows:

| To VAPO: |

Vaporin, Inc. |

| |

4400 Biscayne Blvd. |

| |

Suite 850 |

| |

Miami, FL 33137 |

| |

Attention: Mr. James Martin |

| |

Email: jmartin@vaporin.com |

| |

|

| To Vapor: |

Vapor Corp. |

| |

3001 Griffin Road |

| |

Dania Beach, FL 33312 |

| |

Attention: Mr. Jeffrey Holman |

| |

Email: jeff.holman@vapor-corp.com |

| To the Purchaser: |

The address set forth on the signature page attached hereto |

or to such other address as any of them, by

notice to the other may designate from time to time.

15. Attorney's

Fees. In the event that there is any controversy or claim arising out of or relating to this Agreement, or to the interpretation,

breach or enforcement thereof, and any action or arbitration proceeding is commenced to enforce the provisions of this Agreement,

the prevailing party shall be entitled to a reasonable attorney's fee, including the fees on appeal, costs and expenses.

16. Governing

Law; Venue. This Agreement and any dispute, disagreement, or issue of construction or interpretation arising hereunder

whether relating to its execution, its validity, the obligations provided therein or performance shall be governed or interpreted

according to the laws of the State of Florida. Any proceeding or action shall only be commenced in Broward County, Florida or the

United States District Court for the Southern District of Florida. The parties hereto irrevocably and unconditionally submit to

the exclusive jurisdiction of such courts and agree to take any and all future action necessary to submit to the jurisdiction of

such courts.

17. Oral

Evidence. This Agreement constitutes the entire Agreement between the parties and supersedes all prior oral and written

agreements between the parties hereto with respect to the subject matter hereof. Neither this Agreement nor any provision hereof

may be changed, waived, discharged or terminated orally, except by a statement in writing signed by the party or parties against

whom enforcement or the change, waiver discharge or termination is sought.

18. Assignment.

No Party hereto shall assign its rights or obligations under this Agreement without the prior written consent of the other Party.

19. Section

Headings. Section headings herein have been inserted for reference only and shall not be deemed to limit or otherwise affect,

in any matter, or be deemed to interpret in whole or in part any of the terms or provisions of this Agreement.

FLORIDA LAW PROVIDES THAT WHEN SALES ARE

MADE TO FIVE OR MORE PERSONS IN FLORIDA, ANY SALE MADE IN FLORIDA IS VOIDABLE BY THE PURCHASER WITHIN THREE DAYS AFTER THE FIRST

TENDER OF CONSIDERATION IS MADE BY SUCH PURCHASER TO VAPO, AN AGENT OF VAPO OR AN ESCROW AGENT OR WITHIN THREE DAYS AFTER THE AVAILABILITY

OF THAT PRIVILEGE IS COMMUNICATED TO SUCH PURCHASER, WHICHEVER OCCURS LATER. ALL SALES IN THIS OFFERING ARE SALES IN FLORIDA. PAYMENTS

FOR TERMINATED SUBSCRIPTIONS VOIDED BY PURCHASERS AS PROVIDED FOR IN THIS PARAGRAPH WILL BE PROMPTLY REFUNDED WITHOUT INTEREST.

NOTICE SHOULD BE GIVEN TO VAPO TO THE ATTENTION OF JAMES MARTIN AT THE ADDRESS SET FORTH IN SECTION 14 OF THIS AGREEMENT.

[Signature Page Attached]

IN WITNESS WHEREOF the

parties hereto have set their hand and seals as of the above date.

| |

VAPO: |

| |

|

| |

By: |

/s/ Jim Martin |

| |

James Martin, |

| |

Chief Financial Officer |

| |

|

| |

VAPOR: |

| |

|

| |

By: |

/s/ Jeffrey Holman |

| |

Jeffrey Holman, |

| |

Chief Executive Officer |

| |

|

| |

PURCHASER: |

| |

NIHI Partners, LLC |

| |

|

| |

By: |

/s/ Frederick Wahl |

| |

Frederick Wahl, Manager |

| |

(Print Name and Title) |

Amount of Note Purchased: $ 100,000

IN WITNESS WHEREOF the

parties hereto have set their hand and seals as of the above date.

| |

VAPO: |

| |

|

| |

By: |

/s/ Jim Martin |

| |

James Martin, |

| |

Chief Financial Officer |

| |

|

| |

VAPOR: |

| |

|

| |

By: |

/s/ Jeffrey Holman |

| |

Jeffrey Holman, |

| |

Chief Executive Officer |

| |

|

| |

PURCHASER: |

| |

|

| |

By: |

/s/ Benjamin Nickoll |

| |

Benjamin Nickoll |

| |

(Print Name and Title) |

Amount of Note Purchased: $ 75,000

IN WITNESS WHEREOF the

parties hereto have set their hand and seals as of the above date.

| |

VAPO: |

| |

|

| |

By: |

/s/ Jim Martin |

| |

James Martin, |

| |

Chief Financial Officer |

| |

|

| |

VAPOR: |

| |

|

| |

By: |

/s/ Jeffrey Holman |

| |

Jeffrey Holman, |

| |

Chief Executive Officer |

| |

|

| |

PURCHASER: |

| |

BNCA 2011 Directed Irrecovable Trust |

| |

JP Morgan Trust Company of Delaware, as trustee |

| |

|

| |

By: |

/s/ Jennifer C. Tigani |

| |

Jennifer C. Tigani, Vice President |

| |

(Print Name and Title) |

Amount of Note Purchased: $ 75,000

IN WITNESS WHEREOF the

parties hereto have set their hand and seals as of the above date.

| |

VAPO: |

| |

|

| |

By: |

/s/ Jim Martin |

| |

James Martin, |

| |

Chief Financial Officer |

| |

|

| |

VAPOR: |

| |

|

| |

By: |

/s/ Jeffrey Holman |

| |

Jeffrey Holman, |

| |

Chief Executive Officer |

| |

|

| |

PURCHASER: |

| |

John F. Nickoll Marital Trust |

| |

|

| |

By: |

/s/ John F. Nickoll |

| |

John F. Nickoll, Trustee |

| |

(Print Name and Title) |

Amount of Note Purchased: $ 50,000

IN WITNESS WHEREOF the

parties hereto have set their hand and seals as of the above date.

| |

VAPO: |

| |

|

| |

By: |

/s/ James Martin |

| |

James Martin, |

| |

Chief Financial Officer |

| |

|

| |

VAPOR: |

| |

|

| |

By: |

/s/ Jeffrey Holman |

| |

Jeffrey Holman, |

| |

Chief Executive Officer |

| |

|

| |

PURCHASER: |

| |

Kestrel Foundation |

| |

|

| |

By: |

/s/ Benjamin Nickoll |

| |

Benjamin Nickoll, Trustee |

| |

(Print Name and Title) |

Amount of Note Purchased: $ 50,000

Exhibit A

Convertible Note

Exhibit B

Accredited Investor

For Individual Investors Only:

(1) I

am an accredited investor because I have an individual net worth, or my spouse and I have combined net worth, in excess of $1,000,000.

For purposes of calculating net worth under this paragraph (1), (i) the primary residence shall not be included as an asset, (ii)

to the extent that the indebtedness that is secured by the primary residence is in excess of the fair market value of the primary

residence, the excess amount shall be included as a liability, and (iii) if the amount of outstanding indebtedness that is secured

by the primary residence exceeds the amount outstanding 60 days prior to the execution of this Subscription Agreement, other than

as a result of the acquisition of the primary residence, the amount of such excess shall be included as a liability.

(2a) I am an accredited

investor because I had individual income (exclusive of any income attributable to my spouse) of more than $200,000 in the last

two completed years and I reasonably expect to have an individual income in excess of $200,000 this year.

(2b) Alternatively,

my spouse and I have joint income in excess of $300,000 in each applicable year.

(3) I

am a director or executive officer of the Company.

Other Investors:

(4) The

undersigned is one of the following: any bank as defined in Section 3(a)(2) of the Securities Act whether acting in its individual

or fiduciary capacity; any broker or dealer registered pursuant to section 15 of the Securities Exchange Act of 1934; insurance

company as defined in Section 2(13) of the Securities Act; investment company registered under the Investment Company Act of 1940

or a business development company as defined in Section 2(a)(48) of that Act; Small Business Investment Company licensed by the

U.S. Small Business Administration under Section 301(c) or (d) of the Small Business Investment Act of 1958; any plan established

and maintained by a state, its political subdivisions, or any agency or instrumentality of a state or its political subdivisions,

for the benefit of its employees, if such plan has total assets in excess of $5,000,000; employee benefit plan within the meaning

of Title I of the Employee Retirement Income Security Act of 1974, if the investment decision is made by a plan fiduciary, as defined

in Section 3(21) of such Act, which is either a bank, savings and loan association, insurance company, or registered investment

advisor, or if the employee benefit plan has total assets in excess of $5,000,000, or if a self-directed plan, with investment

decisions made solely by persons that are accredited investors.

(5) The

undersigned is a private business development company as defined in Section 202(a)(22) of the Investment Advisors Act of 1940.

(6) The

undersigned is a organization described in Section 501(c)(3) of the Internal Revenue Code, corporation, Massachusetts or similar

business trust or partnership, not formed for the specific purpose of acquiring the securities offered, with total assets in excess

of $5,000,000.

(7) The

undersigned is a trust, with total assets in excess of $5,000,000, not formed for the specific purpose of acquiring the securities

offered, whose purchase is directed by a sophisticated person as described in Rule 506(b)(2)(ii) of the Securities Act.

(8) The

undersigned is an entity in which all of the equity owners are accredited investors.

Exhibit 10.2

THIS NOTE AND THE SECURITIES ISSUABLE UPON

CONVERSION OF THIS NOTE HAVE NOT BEEN REGISTERED UNDER THE FEDERAL OR ANY STATE SECURITIES LAWS AND MAY NOT BE SOLD, TRANSFERRED

OR HYPOTHECATED IN ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT UNDER SUCH LAWS AS MAY BE APPLICABLE OR, AN OPINION OF COUNSEL

TO THE COMPANY, THAT AN EXEMPTION FROM SUCH APPLICABLE LAWS EXIST.

NOTE

| $__________ |

Issuance Date: ____ ___, 2015 |

| |

Maturity Date: One year from the Issuance Date |

FOR VALUE RECEIVED,

Vaporin, Inc. (the “Company”), a Delaware corporation, hereby promises to pay to the order of ___________ (the “Holder”),

the principal sum of $________ together with interest thereon at 10% per annum. The principal of this Note (this “Note”)

and the interest is due and payable on the Maturity Date (as defined above). While in default, this Note shall bear interest at

the rate of 18% per annual or such maximum rate of interest allowable under the laws of the State of Florida. Payments shall be

made in lawful money of the United States. This Note may be prepaid without the express written consent of the Holder at any time

on 30 days’ prior written notice to the Holder. This Note is being issued in conjunction with the execution of that certain

Securities Purchase Agreement dated as of the Issuance Date (the “Securities Purchase Agreement”).

1. Conversion to Vapor Corp.

Common Stock. If the proposed merger with Vapor Corp. (“Vapor”) is consummated, this Note shall be convertible

into shares of Vapor common stock as provided for under the Securities Purchase Agreement. If the Vapor merger is not effectuated

or the issuance of the shares underlying this Note is not approved by Vapor shareholders, this Note shall not be convertible.

| 2. | Anti-Dilution Protection. |

(a) In the event, prior to the payment

of this Note, that the Company shall issue any of its shares of common stock as a stock dividend or shall subdivide the number

of outstanding shares of common stock into a greater number of shares, then, in either of such events, the Conversion Price shall

be increased proportionately; and, conversely, in the event that the Company shall reduce the number of outstanding shares of common

stock by combining such shares into a smaller number of shares, then, in such event, the Conversion Price shall be decreased proportionately.

Any dividend paid or distributed upon the common stock in shares of any other class of capital stock of the Company or securities

convertible into shares of common stock shall be treated as a dividend paid in common stock. In the event that the Company shall

pay a dividend consisting of the securities of any other entity or in cash or other property, upon the next conversion of this

Note, the Holder shall receive the securities, cash, or property which the Holder would have

been entitled to if the conversion occurred

immediately prior to the record date of such dividend.

(b) In the event, prior to the payment

of this Note, that the Company shall be recapitalized by reclassifying its outstanding common stock (other than into shares of

common stock with a different par value, or by changing its outstanding shares of common stock to shares without par value), or

in the event the Company or a successor corporation, partnership, limited liability company or other entity (any of which is defined

as a “Corporation”) shall consolidate or merge with or convey all or substantially all of its, or of any successor

Corporation's property and assets to any other Corporation or Corporations (any such other Corporation being included within the

meaning of the term “successor Corporation” used in the context of any consolidation or merger of any other Corporation

with, or the sale of all or substantially all of the property of any such other Corporation to, another Corporation or Corporations),

or in the event of any other material change in the capital structure of the Company or of any successor Corporation by reason

of any reclassification, reorganization, recapitalization, consolidation, merger, conveyance or otherwise, then, as a condition

of any such reclassification, reorganization, recapitalization, consolidation, merger or conveyance, a prompt, proportionate, equitable,

lawful and adequate provision shall be made whereby in lieu of the securities of the Company theretofore issuable upon the conversion

of this Note, the Holder upon conversion shall receive the securities or assets as may be issued or paid as a result of the foregoing;

and in any such event, the rights of the Holder of this Note to any adjustment in the number of shares of common stock obtainable

upon conversion of this Note, as provided, shall continue and be preserved in respect of any shares, securities or assets which

the Holder becomes entitled to obtain. Notwithstanding anything herein to the contrary, this Section 2 shall not apply to a merger

with a subsidiary provided the Company is the continuing Corporation or involving a subsidiary merger and provided further

such merger does not result in any reclassification, capital reorganization or other change of the securities issuable under this

Note. The foregoing provisions of this Section 2(b) shall apply to successive reclassifications, capital reorganizations and changes

of securities and to successive consolidations, mergers, sales or conveyances.

(c) In the event the Company, at

any time while this Note shall remain outstanding, shall sell all or substantially all of its assets, or dissolve, liquidate, or

wind up its affairs, prompt, proportionate, equitable, lawful and adequate provision shall be made as part of the terms of any

such sale, dissolution, liquidation, or winding up such that the Holder of this Note may thereafter receive, upon exercise hereof,

in lieu of the securities of the Company which it would have been entitled to receive, the same kind and amount of any shares,

securities or assets as may be issuable, distributable or payable upon any such sale, dissolution, liquidation or winding up with

respect to each common share of the Company; provided, however, that in the event of any such sale, dissolution,

liquidation or winding up, the conversion provisions of this Note shall terminate on a date fixed by the Company, such date so

fixed to be not earlier than 6:00 p.m., New York time, on the 30th day after the date on which notice of such termination of conversion

provisions of this Note has been given by mail to the Holder of this Note at such Holder's address as it appears on the books of

the Company. For the avoidance of doubt, if the proposed merger with Vapor is consummated, Vapor shall assume this Note.

3. Event of Default. In the

event of any failure to pay this Note when due, the Company shall commence any case, proceeding or other action under any existing

or future law of

any jurisdiction, domestic or foreign,

relating to bankruptcy, insolvency, reorganization, or relief of debtors, seeking to have an order for relief entered with respect

to it, or seeking to adjudicate it as bankrupt or insolvent, or seeking reorganization, arrangement, adjustment, winding-up, liquidation,

dissolution, composition or other relief with respect to its debts, or seeking appointment of a receiver, custodian, trustee or

other similar official for it or for all or any substantial part of its assets; or there shall be commenced against the Company,

any case, proceeding or other action which results in the entry of an order for relief or any such adjudication or appointment

remains undismissed, undischarged or unbounded for a period of 30 days after service upon the Company; or there shall be commenced

against the Company, any case, proceeding or other action seeking issuance of a warrant of attachment, execution, restraint or

similar process against all or any substantial part of its assets which results in the entry of an order for any such relief which

shall not have been vacated, discharged, or stayed or bonded pending appeal within 10 days from the entry thereof after service

upon the Company; or the Company shall make an assignment for the benefit of creditors; or the Company shall take any action indicating

its consent to, approval of, or acquiescence in, or in furtherance of, any of the foregoing; then, or any time thereafter during

the continuance of any of such events, the entire unpaid balance of this Note then outstanding, together with accrued interest

thereon, if any, shall be and become immediately due and payable without notice of demand by Holder.

4. Investment Intent. The

Holder, by acceptance of this Note, warrants and represents that it is acquiring this Note and the underlying common stock for

its own account, for investment and not with a view to, or for resale in connection with, the distribution thereof. The Holder

has no present intention of reselling or distributing them after any period of time. The acquisition of the securities for investment

is consistent with Holder’s financial needs.

(a) All makers and endorsers now

or hereafter becoming parties hereto jointly and severally waive demand, presentment, notice of non-payment and protest.

(b) This Note may not be changed

or terminated orally, but only with an agreement in writing, signed by the parties against whom enforcement of any waiver, change,

modification, or discharge is sought with such agreement being effective and binding only upon attachment hereto.

(c) This Note and the rights and

obligations of the Holder and of the undersigned shall be governed and construed in accordance with the laws of the State of Delaware.

(d) Any action brought by either

party against the other concerning this Note shall be brought only in the state or federal courts of Florida and venue shall be

in the County of Broward or the Southern District of Florida. The parties to this Note hereby irrevocably waive any objection

to jurisdiction and venue of any action instituted hereunder and shall not assert any defense based on lack of jurisdiction or

venue or based upon forum non conveniens.

(e) In the event that there is any

controversy or claim arising out of or relating to this Note, or to the interpretation, breach or enforcement thereof, and any

action or proceeding is

commenced to enforce the provisions of

this Note, the prevailing party shall be entitled to reasonable attorneys’ fees, costs and expenses (including such fees

and costs on appeal).

(f) Upon any endorsement, assignment,

or other transfer of this Note by the Holder or by operation of law, the term “Holder,” as used herein, shall mean

such endorsee, assignee, or other transferee or successor to the Holder, then becoming the holder of this Note. This Note shall

inure to the benefit of the Holder and its successors and assigns and shall be binding upon the undersigned and their successors

and assigns.

(g) In the event that any interest

paid on this Note is deemed to be in excess of the then legal maximum rate, then that portion of the interest payment representing

an amount in excess of the then legal maximum rate shall be deemed a payment of principal and applied against the principal of

this Note, and any surplus thereafter shall immediately be refunded to the Holder.

[Signature Page Follows]

IN WITNESS WHEREOF,

the Company has caused this Note to be executed as of the date aforesaid.

| |

By: |

|

|

| |

|

James Martin, |

|

| |

|

Chief Financial Officer |

|

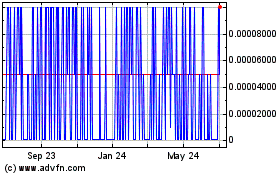

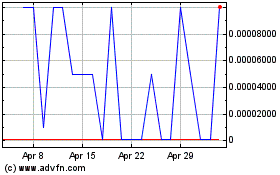

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Apr 2023 to Apr 2024