UNITED STATES SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 10-K/A

ANNUAL REPORT PURSUANT TO SECTIONS

13 OR 15 (d) OF THE SECURITIES AND EXCHANGE ACT OF 1934

For the fiscal year ended September

30, 2014

Commission file number: 333-144504

| Pacific

Oil Company |

| (Exact

Name of Registrant as Specified in its Charter) |

| Nevada |

|

20-4057712 |

| (State or Other Jurisdiction of Incorporation

or Organization) |

|

(I.R.S. Employer Identification No.) |

| 9500

W. Flamingo Rd. Suite 205 |

| Las

Vegas, NV 89147 |

| (Address

of Principal Executive Offices) |

Registrant’s telephone number,

including area code: 1 702 555 7013

Securities registered pursuant to Section

12(b) of the Act: None

Securities registered pursuant to section

12(g) of the Act:

| Common

Stock, $0.001 par value |

| (Title

of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined

by Rule 405 of the Securities Act. Yes [ ] No [x]

Indicate by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Exchange Act. Yes [ ] No [x]

Indicate by check mark whether the registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period

that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [x] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation

S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information

statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the

registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or smaller reporting company. See the

definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated

filer |

[ ] |

|

Accelerated

filer |

[ ] |

| Non-accelerated

filer |

[ ] |

(Do not check if a smaller reporting company) |

Smaller reporting

company |

[x]. |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2

of the Exchange Act). Yes [ ] No [x]

For the year ended September 30, 2014, the issuer had revenues of $0.

The Company’s common stock, $0.001

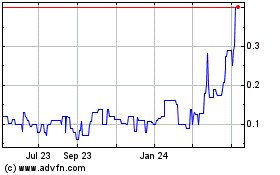

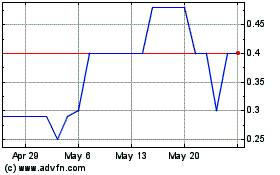

par value is traded on the OTCQB.

Aggregate market value of voting common

equity held by non-affiliates as of March 31, 2014: $7,026,475

The number of shares outstanding of

the issuer’s common stock, $0.001 par value, as of January 21, 2015 was 60,080,733 shares.

EXPLANATORY

NOTE

On January 13, 2014, the Company filed

its annual report on Form 10K for the year ended September 30, 2014 with the United States Securities and Exchange

Commission. Due to a miscommunication, the filing was completed without the consent of the Company’s independent public

accountants who had not at that time completed their audit of the financial statements included in the annual report on Form

10-K using professional standards and procedures conducted for such audits, as established by generally accepted auditing

standards. The Company’s independent public accountants have now completed their audit of these financial statements

and have consented to the filing of this Form 10-K/A. With the exception of certain changes to formatting and disclosures,

there have been no material changes to the content of this filing. The following changes have been made to the Form 10-K as

previously filed: the audit opinion of the previous independent registered accounting firm on page F-2 has been revised,

our disclosure concerning the number of shareholders in Item 5. Market for Our Common Equity Related Stockholder Matters and

Issuer Purchases of Equity Securities on page 6 has been updated, our disclosures of Significant Accounting Policies on pages

F-7 through F-11 have been expanded, our disclosure relating to Subsequent Events in Note 6 of our financial statements on

page F-14 has been updated together with a number of minor, immaterial corrections and formatting changes.

Pacific Oil Company

Form 10-K/A Annual Report

Table of Contents

| | |

| |

Page |

| PART I | |

| |

|

| | |

| |

|

| Item 1. | |

Business | |

5 |

| Item 1A. | |

Risk Factors | |

5 |

| Item 1B. | |

Unresolved Staff Comments | |

5 |

| Item 2. | |

Properties | |

5 |

| Item 3. | |

Legal Proceedings | |

5 |

| Item 4. | |

Mine Safety Disclosure | |

5 |

| | |

| |

|

| PART II | |

| |

|

| | |

| |

|

| Item 5. | |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

6 |

| Item 6. | |

Selected Financial Data | |

6 |

| Item 7. | |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

6 |

| Item 7A. | |

Quantitative and Qualitative Disclosures About Market Risk | |

9 |

| Item 8. | |

Financial Statements and Supplementary Data | |

9 |

| Item 9. | |

Change in and Disagreements with Accountants on Accounting and Financial Disclosure | |

9 |

| Item 9A(T). | |

Controls And Procedures | |

9 |

| Item 9B. | |

Other Information | |

10 |

| | |

| |

|

| PART III | |

| |

|

| | |

| |

|

| Item 10. | |

Directors, Executive Officers, and Corporate Governance | |

11 |

| Item 11. | |

Executive Compensation | |

12 |

| Item 12. | |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

12 |

| Item 13. | |

Certain Relationships and Related Transactions, and Director Independence | |

12 |

| Item 14. | |

Principal Accountant Fees and Services | |

12 |

| | |

| |

|

| PART IV | |

| |

|

| | |

| |

|

| Item 15. | |

Exhibits and Financial Statement Schedules | |

14 |

FORWARD LOOKING STATEMENT INFORMATION

Certain statements made in this

Annual Report on Form 10-K are “forward-looking statements” regarding the plans and objectives of management for future

operations. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results,

performance or achievements to be materially different from any future results, performance or achievements expressed or implied

by such forward-looking statements. The forward-looking statements included herein are based on current expectations that involve

numerous risks and uncertainties. Our plans and objectives are based, in part, on assumptions involving judgments with respect

to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult

or impossible to predict accurately and many of which are beyond our control. Although we believe that our assumptions underlying

the forward-looking statements are reasonable, any of the assumptions could prove inaccurate and, therefore, there can be no assurance

that the forward-looking statements included in this report will prove to be accurate. In light of the significant uncertainties

inherent in the forward-looking statements included herein particularly in view of the current state of our operations, the inclusion

of such information should not be regarded as a statement by us or any other person that our objectives and plans will be achieved.

Factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements

include, but are not limited to, the factors set forth herein under the headings “Business,” “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors”. We undertake no

obligation to revise or update publicly any forward-looking statements for any reason. The terms “we”, “our”,

“us”, or any derivative thereof, as used herein refer to Pacific Oil Company.

PART 1

ITEM 1. BUSINESS

CORPORATE BACKGROUND

Company History

Pacific Oil Company (the “Company”)

was originally incorporated in Nevada on December 5, 2005 (“inception’) as Kat Racing, Inc. On January 4, 2013, the

Articles of Incorporation of the Company were amended to change the name of the Company to Prairie West Oil & Gas, Ltd. On

July 26, 2013, the Company’s Articles of Incorporation were amended to change the name of the registrant to Pacific Oil

Company.

From the Company’s inception

until the Company’s transition into the oil and natural gas business in early 2013, Kat Racing’s business plan was

to design, manufacture, market, sell and distribute custom off-road racing and recreational vehicles and provide marketing and

lead services. Kat Racing never generated any revenue from this proposed business plan.

As the market for high end off road

vehicles suffered due to the downturn in the economy, Kat Racing sought to arrange the purchase of certain oil and gas properties

which were owned by Prairie West Oil and Gas Ltd., a Canadian company through a share exchange. Pursuant to this transaction,

the Company changed its name from Kat Racing to Prairie West Oil and Gas Ltd. This transaction was never completed. When it was

determined the acquisition would not be completed, the Company did not want to continue with the Prairie West name and changed

its name to Pacific Oil Company.

On October 1, 2013, the Company issued

a newly appointed officer and director 38,100,000 shares of common stock of the Company to retain his services to attempt to secure

certain assets the Company needs to launch its oil and gas operations.

Employees

At September 30, 2014, the Company

had no full time employees.

ITEM 1A. RISK FACTORS

As a "smaller reporting company"

as defined by Item 10 of Regulation S-K, we are not required to provide information required by this Item.

ITEM 1B. UNRESOLVED STAFF COMMENTS

On September 30, 2013, the SEC Staff

comments issued pertaining to the Current Report on Form 8-K filed January 29, 2013, dated February 27, 2013, were released to

the EDGAR system. We have not resolved these comments.

ITEM 2. PROPERTIES

Our executive offices are located at

9500 W. Flamingo Rd. Suite 205, Las Vegas, NV 89147. The space is approximately 150 square feet and is provided by a shareholder

at no cost. We believe that this space is adequate for our needs at this time, and we believe that we will be able to locate additional

space in the future, if needed, on commercially reasonable terms.

ITEM 3. LEGAL PROCEEDINGS

We were not subject to any legal proceedings

during the twelve month periods ended September 30, 2014 or 2013, and no legal proceedings are currently pending or threatened

to the best of our knowledge.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable to our Company.

PART II

ITEM 5. MARKET FOR OUR COMMON EQUITY,

RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

| (a) | | Market Information. Our Common Stock is trading on the OTC Markets: OTCQB. |

| (b) | | Holders. As of September 30, 2014, there were 7 record holders of all of our

issued and outstanding shares of Common Stock. A substantially larger number of shareholders hold our shares in “street

name” but, as of the date of this report, we do not know exactly how many. Our transfer agent is Pacific Stock Transfer

in Las Vegas, Nevada. |

| (c) | | Dividend Policy. The Company has not declared or paid any cash dividends on

our Common Stock and do not intend to declare or pay any cash dividend in the foreseeable future. The payment of dividends, if

any, is within the discretion of the Board of Directors and will depend on our earnings, if any, our capital requirements and

financial condition and such other factors as the Board of Directors may consider. |

ITEM 6. SELECTED FINANCIAL DATA

As a smaller reporting company, as

defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Company is not

required to provide the information required by this item.

ITEM 7. MANAGEMENT’S DISCUSSION

AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Certain statements in this report

and elsewhere (such as in other filings by the Company with the Securities and Exchange Commission ("SEC"), press releases,

presentations by the Company of its management and oral statements) may constitute "forward-looking statements" within

the meaning of the Private Securities Litigation Reform Act of 1995. Words such as "expects," "anticipates,"

"intends," "plans," "believes," "seeks," "estimates," and "should,"

and variations of these words and similar expressions, are intended to identify these forward-looking statements. Actual results

may materially differ from any forward-looking statements. Factors that might cause or contribute to such differences include,

among others, competitive pressures and constantly changing technology and market acceptance of the Company's products and services.

The Company undertakes no obligation to publicly release the result of any revisions to these forward-looking statements, which

may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Pacific Oil Company was incorporated

on December 5, 2005 under the name Kat Racing, Inc.

From the Company’s inception

until the Company’s transition into the oil and natural gas business in early 2013, Kat Racing’s business plan was

to design, manufacture, market, sell and distribute custom off-road racing and recreational vehicles and provide marketing and

lead services. Kat Racing never generated any revenue from this proposed business plan.

As of the date of this document, we

have generated no revenues and substantial expenses. This resulted in a net loss of since inception, which is attributable to

financing and general and administrative expenses.

Since incorporation, we have financed

our operations primarily through minimal initial capitalization.

To date we have not implemented our

planned principal operations. The realization of sales revenues in the next 12 months is important in the execution of the plan

of operations. However, we cannot guarantee that we will generate such growth. If we do not produce sufficient cash flow to support

our operations over the next 12 months, we may need to raise additional capital by issuing capital stock in exchange for cash

in order to continue as a going concern. There are no formal or informal agreements to attain such financing. We cannot assure

any investor that, if needed, sufficient financing can be obtained or, if obtained, that it will be on reasonable terms. Without

realization of additional capital, it would be unlikely for operations to continue.

Pacific Oil’s management expects to conduct research and development on oil and

gas properties. As of September 30, 2014, the Company did not have specific plans to buy or sell any plant or equipment.

Our management does not anticipate

retaining any employees in the next 12 months. Currently, we believe the services provided by our officers and directors are sufficient

at this time.

The Company has not paid for expenses

on behalf of any director and believes this practice will not materially change.

OFF-BALANCE SHEET ARRANGEMENTS

The Company does not have any off-balance

sheet arrangements.

(ii) RESULTS OF OPERATIONS

Revenue

We recognized no revenue during the

twelve months ended September 30, 2014 and 2013, as we had no revenue generating activities during these periods.

General and Administrative

During the twelve months ended September

30, 2014, we incurred $5,495 in general and administrative expenses compared to $7,069 during the twelve months ended September

30, 2013. General and administrative expenses consist of fees charged for EDGAR services, office supplies, bank charges, among

other items.

Compensation Expense

On October 9, 2013, the Company issued

38,100,000 shares of its common stock to the President and CEO of the Company. The shares were valued at the amount determined

by a valuation expert at $0.0088 per share, or $335,280. There was no comparable compensation expense during the twelve months

ended September 30, 2013.

Professional Fees

During the twelve months ended September

30, 2014, we incurred professional fees of $19,410 compared to $31,569 during the twelve months ended September 30, 2013. Professional

fees include primarily transfer agent fees, accounting and legal. During the twelve months ended September 30, 2014, there were

fees paid to a valuation expert of $7,500. The decrease in fiscal 2014 as compared to fiscal 2013 is due to lack of activity in

fiscal 2014.

Interest Expense

Interest expense for the years ended

September 30, 2014 and 2013 were $3,866 and $29,116, respectively. During fiscal 2013, the convertible note payable was outstanding

for a full quarter but for fiscal 2014, it was only outstanding for four days, until October 4, 2013, In addition, interest was

being imputed on the related party accounts payable but the holders of the debt have agreed to waive interest charges on an ongoing

basis.

Change in fair value of derivative

As of September 30, 2013, the Company

had a derivative liability of $173,856. The liability was valued immediately before the conversion of the debt into shares

of our common stock as of October 4, 2013 resulting in a gain on the revaluation of the derivative of $2,380. For the year ended

September 30, 2013, the derivative agreement was entered into as of July 1, 2013 and was valued at inception and as of the end

of the period ended September 30, 2013, resulting in a loss on the revaluation of $96,032.

Gain on Debt Conversion

As of September 30, 2013, the Company

had recorded accounts payable in the amount of $16,519 for professional services. During the first quarter of fiscal 2014, the

Company issued 23,241 shares of its common stock in satisfaction of this amount due. The shares were valued at the amount determined

by a valuation expert at $0.0088 per share. Accordingly, the value of the shares was $205 and the Company recognized a gain of

$16,314 on the settlement of these accounts payable.

Net Loss

The Company incurred a net loss of

$345,557 for the year ended September 30, 2014, as compared to a net loss of $163,786 for fiscal 2013 due to the factors discussed

above.

The Company has earned no revenue or

profits to date, and the Company anticipates that it will continue to incur net losses for the foreseeable future.

We expect that our operating expenses

will increase as we are able to raise capital and further our business operations.

Despite our expectation of increased

revenues, we believe that we will operate at a net loss for 2015 as we increase our operating expenses in an attempt to further

implement our business plan.

Liquidity and Capital Resources

The Company's financial statements

are prepared using generally accepted accounting principles in the United States of America applicable to a going concern which

contemplates the realization of assets and liquidation of liabilities in the normal course of business. The Company has not yet

established an ongoing source of revenues sufficient to cover its operating costs and allow it to continue as a going concern.

The ability of the Company to continue as a going concern is dependent on the Company obtaining adequate capital to fund operating

losses until it becomes profitable. If the Company is unable to obtain adequate capital, it could be forced to cease operations.

During the period from December 5,

2005 (date of inception) through September 30, 2014, the Company has incurred an accumulated net loss of $730,127 and has not

attained profitable operations. The Company is dependent upon obtaining adequate financing to enable it to pursue its business

plan and manage its operations so that they are profitable.

As of September 30, 2014, the Company

had cash of $87 compared to cash of $820 as September 30, 2013.

The Company has limited financial resources

available, which has had an adverse impact on the Company's liquidity, activities and operations. These limitations have adversely

affected the Company's ability to obtain certain projects and pursue additional business. There is no assurance that the Company

will be able to raise sufficient funding to enhance the Company's financial resources sufficiently to generate volume for the

Company, or to engage in any significant research and development, or purchase plant or significant equipment.

Operating activities

Net cash used in operating activities

for the years ended September 30, 2014 and 2013 was $24,148 and $21,373, respectively. Cash was used to pay general and administrative

expenses and professional fees.

Investing activities

The Company used zero cash for investing

activities during fiscal 2014 and 2013.

Financing activities

During the years ended September 30,

2014 and 2013, the Company had net cash provided by financing activities of $23,415 and $20,612, consisting of amounts advanced

by related parties to pay operating expenses.

Management has been successful in raising sufficient funds to cover the Company’s

immediate expenses including the cost of auditing and filing required documents for 2014.

The Company as a whole may continue

to operate at a loss for an indeterminate period provided it can continue for fund these losses through new debt or equity funding.

In the process of carrying out its business plan, the Company will continue to identify new financial partners and investors.

However, it may determine that it cannot raise sufficient capital to support its business on acceptable terms, or at all. Accordingly,

there can be no assurance that any additional funds will be available on terms acceptable to the Company or at all.

The Company currently needs financing

in the amount of approximately $40,000 for the next twelve months. The funds will be used for operating expenses, general administrative,

marketing and payroll.

Commitments

The Company does not have any financial

commitments as of September 30, 2014.

Off-Balance Sheet Arrangements

As of September 30, 2014, the Company

has no off-balance sheet arrangements such as guarantees, retained or contingent interest in assets transferred, obligation under

a derivative instrument and obligation arising out of or a variable interest in an unconsolidated entity.

ITEM 7A. QUANTITATIVE AND QUALITATIVE

DISCLOSURES ABOUT MARKET RISK

As a smaller reporting company, as

defined in Rule 12b-2 of the Exchange Act, we are not required to provide the information required by this item.

ITEM 8. FINANCIAL STATEMENTS AND

SUPPLEMENTARY DATA

See the index to the Financial Statements

on page 14, beginning on page F-1.

ITEM 9. CHANGES IN AND DISAGREEMENTS

WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None.

ITEM 9A. CONTROLS AND PROCEDURES

Management is responsible for establishing

and maintaining adequate internal control over financial reporting (as defined in Exchange Act Rule 13a-15(f)). The Company’s

internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial

reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally

accepted in the United States of America. Because of its inherent limitations, internal control over financial reporting may not

prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk

that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures

may deteriorate. The Chief Executive Officer and Chief Financial Officer conducted an evaluation of the effectiveness of the Company’s

internal control over financial reporting as of September 30, 2014 using the criteria established in “ Internal Control

- Integrated Framework ” issued by the Committee of Sponsoring Organizations of the Treadway Commission ("COSO").

A material weakness is a deficiency,

or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that

a material misstatement of the Company’s annual or interim financial statements will not be prevented or detected on a timely

basis. In its assessment of the effectiveness of internal control over financial reporting as of September 30, 2014, the Company

determined that there were control deficiencies that constituted material weaknesses, as described below.

We do not have an Audit Committee – While not being legally obligated to have

an audit committee, it is the management’s view that such a committee, including a financial expert member, is an utmost

important entity level control over the Company’s financial statement. Currently the Board of Directors acts in the capacity

of the Audit Committee, and includes one member that is considered to be independent of management to provide the necessary oversight

over management’s activities.

| 1. | | We did not maintain appropriate cash controls – As of September 30, 2014, the

Company has not maintained sufficient internal controls over financial reporting for the cash process, including failure to segregate

cash handling and accounting functions, and did not require dual signature on the Company’s bank accounts. Alternatively,

the effects of poor cash controls were mitigated by the fact that the Company had limited transactions in their bank accounts. |

| 2. | | We did not implement appropriate information technology controls – As at September

30, 2014, the Company retains copies of all financial data and material agreements; however there is no formal procedure or evidence

of normal backup of the Company’s data or off-site storage of data in the event of theft, misplacement, or loss due to unmitigated

factors. |

Accordingly, the Company concluded

that these control deficiencies resulted in a reasonable possibility that a material misstatement of the annual or interim financial

statements will not be prevented or detected on a timely basis by the company’s internal controls.

As a result of the material weaknesses

described above, management has concluded that the Company did not maintain effective internal control over financial reporting

as of September 30, 2014 based on criteria established in Internal Control—Integrated Framework issued by COSO.

Changes in Internal Control over

Financial Reporting

There has been no change in our internal

control over financial reporting identified in connection with our evaluation we conducted of the effectiveness of our internal

control over financial reporting as of September 30, 2014, that occurred during our fourth fiscal quarter that has materially

affected, or is reasonably likely to materially affect, our internal control over financial reporting.

This annual report does not include

an attestation report of the Company’s registered public accounting firm regarding internal control over financial reporting.

Management’s report was not subject to attestation by the Company’s registered public accounting firm pursuant to

temporary rules of the SEC that permit the Company to provide only management’s report in this annual report.

ITEM 9B. OTHER INFORMATION

None.

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS

AND CORPORATE GOVERNANCE.

The following table sets forth information

concerning our officers and directors as of September 30, 2014:

| Name | |

Age | |

Position | |

Period of Service(1) |

| | |

| |

| |

|

| Anthony Sarvucci | |

43 | |

CEO, CFO, President, Director | |

Since January 2013 |

| Ed Loven | |

58 | |

Secretary, Director | |

Since October 2013*

|

Notes:

| (1) | | A Director will hold office until the next annual meeting of the stockholders. At

the present time, Officers are appointed by the Board of Directors and will hold office until he or she resigns or is removed

from office. The maximum number of directors we are authorized to have is at the discretion of the Board of Directors. However,

in no event may we have less than one director. Although we anticipate appointing additional directors, we have not identified

any such person(s). |

Background of Directors, Executive

Officers, Promoters and Control Persons

Anthony Sarvucci – Director,

Chief Executive Officer, Chief Financial Officer and President

Anthony currently serves as the Company's

president and is a member of the board of directors. During the period from 2004 to present, Anthony has been a consultant to

companies seeking financing.

Ed Loven − Director and

Secretary

Mr. Loven has 30 years of experience

in the oil & gas industry with focus on seismic assets related to exploration and commercial exploitation. Mr. Loven was a

partner at The Sandex Group since 1985. Mr. Loven has industry experience throughout the Western Canadian Basin and Territories.

Mr. Loven is presently an active member

of Discovery Drilling Funds, focusing on E & P opportunities in North America and internationally.

Compensation and Audit Committees

As we only have two board members and

given our limited operations, we do not have separate or independent audit or compensation committees. Our Board of Directors

has determined that it does not have an “audit committee financial expert,” as that term is defined in Item 407(d)(5)

of Regulation S-K. In addition, we have not adopted any procedures by which our shareholders may recommend nominees to our Board

of Directors.

Section 16(a) Beneficial Ownership

Reporting Compliance

Section 16(a) of the Exchange Act requires

our directors and executive officers and persons who beneficially own more than ten percent of our Common Stock (collectively,

the “Reporting Persons”) to report their ownership of and transactions in our Common Stock to the SEC. Copies of these

reports are also required to be supplied to us. To our knowledge, during the fiscal year ended September 30, 2014 the Reporting

Persons did not comply with applicable Section 16(a) reporting requirements. Specifically, Anthony Sarvucci, owner of approximately

63.45% of our Common Stock, failed to file all such reports.

Code of Ethics

We have not adopted a Code of Ethics

given our limited operations. We expect that our Board of Directors following a merger or other acquisition transaction will adopt

a Code of Ethics.

ITEM 11. EXECUTIVE COMPENSATION

Anthony Sarvucci is our Chief Executive

Officer, Chief Financial Officer and a Director. Edward Loven is our Secretary, Treasurer and a Director. They do not receive

any cash compensation for their services rendered on our behalf. However, Anthony Sarvucci received 38,100,000 shares of the Company’s

common stock in October 2013, valued at $335,280. Neither received any other compensation during the years ended September 30,

2014 or 2013. No officer or director is required to make any specific amount or percentage of his business time available to us.

Director Compensation

We do not currently pay any cash fees

to our directors, nor do we pay director’s expenses in attending board meetings.

Employment Agreements

We are not a party to any employment

agreements.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth certain

information as of September 30, 2014 regarding the number and percentage of our Common Stock (being our only voting securities)

beneficially owned by each officer, director, each person (including any “group” as that term is used in Section 13(d)(3)

of the Exchange Act) known by us to own 5% or more of our Common Stock, and all officers and directors as a group.

| Class | |

Name & Address of Certain Beneficial Owners | |

Amount of Beneficial Ownership | |

Percent of Class |

| | |

| |

| |

|

| Common | |

Anthony Sarvucci, | |

38,123,000 | |

63.45% |

| | |

224-24881 Alicia Parkway | |

| |

|

| | |

Laguna Hills, CA 92653 | |

| |

|

| | |

| |

| |

|

| Common | |

Officers and Directors as a Group | |

| |

63.45% |

Unless otherwise indicated, we have

been advised that all individuals or entities listed have the sole power to vote and dispose of the number of shares set forth

opposite their names. For purposes of computing the number and percentage of shares beneficially owned by a security holder, any

shares which such person has the right to acquire within 60 days of September 30, 2014 are deemed to be outstanding, but those

shares are not deemed to be outstanding for the purpose of computing the percentage ownership of any other security holder. We

currently do not maintain any equity compensation plans.

ITEM 13. CERTAIN RELATIONSHIPS AND

RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

Our Board of Directors consists solely

of Anthony Sarvucci and Edward Loven. Ed Loven is independent as such term is defined by a national securities exchange or an

inter-dealer quotation system.

Various related party transactions

are reported throughout the notes to our financial statements and should be considered incorporated by reference herein.

ITEM 14. PRINCIPAL ACCOUNTANT FEES

AND SERVICES

Cutler & Co., LLC is our independent

registered public accounting firm for the year ended September 30, 2014. M&K CPAS, PLLC was our independent registered public

accounting firm for the year ended September 30, 2013 and through the quarter ended December 31, 2013.

Audit Fees

The aggregate fees billed by Cutler

& Co., LLC and M&K CPAS, PLLC for professional services rendered for the audit of our annual financial statements and

review of financial statements included in our quarterly reports on Form 10-Q or services that are normally provided in connection

with statutory and regulatory filings were $6,000 and $6,750 for the fiscal years ended September 30, 2014 and 2013.

Pre-Approval Policy

We do not currently have a standing audit committee. The above services were approved

by our Board of Directors.

PART IV

Item 15. Exhibits and Financial

Statement Schedules

(a) The following documents are filed

as part of this Report:

| 1. | | Financial Statements. The following financial statements and the report

of our independent registered public accounting firm, are filed herewith. |

| · | | Report of Independent Registered Public Accounting Firm (2014) |

F-1 |

| · | | Report of Independent Registered Public Accounting Firm (2013) |

F-2 |

| · | | Balance Sheets at September 30, 2014 and 2013 |

F-3 |

| · | | Statements of Operations for the years ended September 30, 2014 and 2013 |

F-4 |

| · | | Statements of Changes in Stockholders’ Deficiency for the years ended September 30, 2014 and 2013 |

F-5 |

| · | | Statements of Cash Flows for the years ended September 30, 2014 and 2013 |

F-6 |

| · | | Notes to Financial Statements |

F-7 - F-14 |

| 2. | | Financial Statement Schedules. |

Schedules are omitted because the information required is not applicable or the

required information is shown in the financial statements or notes thereto.

| 3. | | Exhibits Incorporated by Reference or Filed with this Report. |

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Board of Directors

Pacific Oil Company

9500 W. Flamingo Rd. Suite 205

Las Vegas, NV 89147

We have audited the accompanying balance sheet of Pacific Oil Company as

of September 30, 2014 and the related statement of operations, changes in stockholders' deficiency and cash flows for the

year then ended. These financial statements are the responsibility of the Company's management. Our responsibility is to

express an opinion on these financial statements based on our audit. The financial statements as of September 30, 2013 and as

of the year then ended were audited by another auditor who expressed an unqualified opinion on March 11, 2014.

We conducted our audit in accordance with

the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform

the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company

is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit

included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate

in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control

over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence

supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates

made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable

basis for our opinion.

In our opinion, the financial statements referred

to above present fairly, in all material respects, the financial position of Pacific Oil Company as of September 30, 2014 and

the results of its operations and its cash flows for the years then ended in conformity with accounting principles generally accepted

in the United States of America.

The accompanying financial statements have

been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements the

Company suffered a loss from operations during the year ended September 30, 2014, has yet to establish a reliable, consistent

and proven source of revenue to meet its operating costs on an ongoing basis and currently does not have sufficient available

funding to fully implement its business plan. These factors raise substantial doubt about its ability to continue as a going concern.

Management's plans in regard to these matters are also described in Note 2. The financial statements do not include any adjustments

that might result from the outcome of this uncertainty.

Wheat Ridge, Colorado

January 2, 2015

9605 West 49th Ave., Suite 200, Wheat Ridge,

Colorado 80033 ~ Phone 303-968-3281 ~ Fax 303-456-7488 ~www.cutlercpas.com

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

To the Board of Directors

Pacific Oil Company

(formerly Kat Racing, Inc.)

(A Development Stage Company)

We have audited the accompanying balance

sheets of Pacific Oil Company (formerly known as Kat Racing, Inc, a Development Stage Company) as of September 30, 2013 (restated),

and the related statements of operations, changes in stockholders’ deficit, and cash flows for the years ended September

30, 2013 (restated). These financial statements are the responsibility of the Company's management. Our responsibility is to express

an opinion on these financial statements based on our audits.

We conducted our audits in accordance

with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform

the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company

is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit

included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate

in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control

over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting

the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant

estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide

a reasonable basis for our opinion.

In our opinion, the financial statements

referred to above present fairly, in all material respects, the financial position of Pacific Oil Company as of September 30,

2013 (restated), and the results of its operations and cash flows for the periods described above in conformity with U.S. generally

accepted accounting principles.

The accompanying financial statements have been prepared assuming that the Company

will continue as a going concern. As discussed in Note 2 to the financial statements, the Company has incurred an

accumulated net loss from operations, which raises substantial doubt about its ability to continue as a going concern.

Management's plans regarding those matters also are described in Note 2. The financial statements do not include any

adjustments that might result from the outcome of this uncertainty.

/s/ M&K CPAS, PLLC

www.mkacpas.com

Houston, Texas

March 11, 2014

PACIFIC OIL COMPANY

(formerly Kat Racing, Inc. and Prairie

West Oil & Gas, Ltd.)

Balance Sheets

| | |

| |

September 30, |

| | |

September 30,

2014 | |

2013

(Restated) |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT ASSETS | |

| | | |

| | |

| Cash | |

$ | 87 | | |

$ | 820 | |

| Total Current Assets | |

| 87 | | |

| 820 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 87 | | |

$ | 820 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' DEFICIT | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Accounts payable | |

$ | 1,702 | | |

$ | 17,265 | |

| Advances payable - related party | |

| 66,670 | | |

| 43,255 | |

| Note payable - related party | |

| 1,174 | | |

| — | |

| Convertible note payable - related party, net of discount of $0 and

$57,618, respectively | |

| — | | |

| 20,206 | |

| Derivative liability | |

| — | | |

| 173,856 | |

| Total Current Liabilities | |

| 69,546 | | |

| 254,582 | |

| | |

| | | |

| | |

| Total Liabilities | |

| 69,546 | | |

| 254,582 | |

| | |

| | | |

| | |

| STOCKHOLDERS' DEFICIT | |

| | | |

| | |

| | |

| | | |

| | |

| Preferred stock: $0.001 par value; 5,000,000 shares authorized, -0- and -0- shares issued and outstanding, respectively | |

| — | | |

| — | |

| Common stock: $0.001 par value; 70,000,000 shares authorized, 60,080,733

and 57,490 shares issued and outstanding, respectively | |

| 60,080 | | |

| 57 | |

| Additional paid-in capital | |

| 600,588 | | |

| 130,751 | |

| Accumulated Deficit | |

| (730,127 | ) | |

| (384,570 | ) |

| Total Stockholders' Deficit | |

| (69,459 | ) | |

| (253,762 | ) |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT | |

$ | 87 | | |

$ | 820 | |

The accompanying notes are an integral

part of these financial statements.

PACIFIC OIL COMPANY

(formerly Kat Racing, Inc. and Prairie

West Oil & Gas, Ltd.)

Statements of Operations

| | |

For the Year Ended September 30, |

| | |

2014 | |

2013

(Restated) |

| | |

| | | |

| | |

| REVENUES | |

$ | — | | |

$ | — | |

| | |

| | | |

| | |

| OPERATING EXPENSES | |

| | | |

| | |

| General and administrative | |

| 5,695 | | |

| 7,069 | |

| Compensation expense | |

| 335,280 | | |

| — | |

| Professional fees | |

| 19,410 | | |

| 31,569 | |

| Total operating expenses | |

| 360,385 | | |

| 38,638 | |

| | |

| | | |

| | |

| OTHER INCOME (EXPENSE) | |

| | | |

| | |

| Interest expense | |

| (3,866 | ) | |

| (29,116 | ) |

| Change in fair value of derivative | |

| 2,380 | | |

| (96,032 | ) |

| Gain on conversion of accounts payable | |

| 16,314 | | |

| — | |

| Total other income (expense) | |

| 14,828 | | |

| (125,148 | ) |

| | |

| | | |

| | |

| NET LOSS | |

$ | (345,557 | ) | |

$ | (163,786 | ) |

| | |

| | | |

| | |

| BASIC AND DILUTED LOSS PER SHARE | |

$ | (0.01 | ) | |

$ | (2.85 | ) |

| | |

| | | |

| | |

| WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING - BASIC AND DILUTED | |

| 58,595,359 | | |

| 57,490 | |

The accompanying notes are an integral

part of these financial statements.

PACIFIC OIL COMPANY

(formerly Kat Racing, Inc. and Prairie

West Oil & Gas, Ltd.)

Statements of Changes in Stockholders’

Deficiency

| | |

Common Stock | |

Additional Paid-In | |

Accumulated | |

Total Stockholders’ |

| | |

Shares | |

Amount | |

Capital | |

Deficiency | |

Deficiency |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, September 30, 2012 | |

| 57,490 | | |

$ | 57 | | |

$ | 121,840 | | |

$ | (220,784 | ) | |

$ | (98,886 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Imputed interest on related party payable | |

| — | | |

| — | | |

| 8,911 | | |

| — | | |

| 8,910 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss for the year September 30, 2013 | |

| — | | |

| — | | |

| — | | |

| (163,786 | ) | |

| (163,786 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, September 30, 2013 (Restated) | |

| 57,490 | | |

| 57 | | |

| 130,751 | | |

| (384,570 | ) | |

| (253,762 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Imputed interest on related party payable | |

| — | | |

| — | | |

| 1,655 | | |

| — | | |

| 1,655 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Common stock issued for services | |

| 38,100,000 | | |

| 38,100 | | |

| 297,180 | | |

| — | | |

| 335,280 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Common stock issued for related party conversion of note payable | |

| 21,900,002 | | |

| 21,900 | | |

| 170,820 | | |

| — | | |

| 192,720 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Settlement of accounts payable with shares | |

| 23,241 | | |

| 23 | | |

| 182 | | |

| — | | |

| 205 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss for the year ended September 30, 2014 | |

| — | | |

| — | | |

| — | | |

| (345,557 | ) | |

| (345,557 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, September 30, 2014 | |

| 60,080,733 | | |

$ | 60,080 | | |

$ | 600,588 | | |

$ | (730,127 | ) | |

$ | (69,459 | ) |

The accompanying notes are

an integral part of these financial statements.

PACIFIC OIL COMPANY

(formerly Kat Racing, Inc. and Prairie

West Oil & Gas, Ltd.)

Statements of Cash Flows

| | |

For the Year Ended September 30, |

| | |

2014 | |

2013

(Restated) |

| | |

| | | |

| | |

| OPERATING ACTIVITIES | |

| | | |

| | |

| Net loss | |

$ | (413,041 | ) | |

$ | (163,786 | ) |

| Adjustments to reconcile net loss to net cash used by operating activities: | |

| | | |

| | |

| Shares issued for services | |

| 335,280 | | |

| — | |

| Amortization of debt discount on convertible note | |

| 2,212 | | |

| 20,206 | |

| Change in fair value of derivative | |

| (2,380 | ) | |

| 96,032 | |

| Gain on conversion of accounts payable | |

| (16,314 | ) | |

| — | |

| Imputed interest | |

| 1,655 | | |

| 8,910 | |

| Changes in operating assets and liabilities | |

| | | |

| | |

| Increase (decrease) in accounts payable | |

| 956 | | |

| 17,265 | |

| Net Cash Used in Operating Activities | |

| (24,148 | ) | |

| (21,373 | ) |

| | |

| | | |

| | |

| INVESTING ACTIVITIES | |

| — | | |

| — | |

| | |

| | | |

| | |

| Net Cash Provided by (Used in) Investing Activities | |

| — | | |

| — | |

| | |

| | | |

| | |

| FINANCING ACTIVITIES | |

| | | |

| | |

| Borrowing from related parties | |

| 23,415 | | |

| 21,790 | |

| Repayment on related party debt | |

| — | | |

| (1,178 | ) |

| Net Cash Provided by Financing Activities | |

| 23,415 | | |

| 20,612 | |

| | |

| | | |

| | |

| NET INCREASE (DECREASE) IN CASH | |

| (733 | ) | |

| (761 | ) |

| | |

| | | |

| | |

| CASH AT BEGINNING OF PERIOD | |

| 820 | | |

| 1,581 | |

| | |

| | | |

| | |

| CASH AT END OF PERIOD | |

$ | 87 | | |

$ | 820 | |

| | |

| | | |

| | |

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION | |

| | | |

| | |

| | |

| | | |

| | |

| CASH PAID FOR: | |

| | | |

| | |

| Interest | |

$ | — | | |

$ | — | |

| Income Taxes | |

$ | — | | |

$ | — | |

| | |

| | | |

| | |

| Non Cash Activities | |

| | | |

| | |

| Settlement of accounts payable with stock | |

$ | 205 | | |

$ | — | |

The accompanying notes are an integral

part of these financial statements.

PACIFIC OIL COMPANY

(FORMERLY KAT RACING,

INC. AND PRAIRIE WEST OIL & GAS, LTD.)

NOTES TO AUDITED FINANCIAL STATEMENTS

FOR THE TWELVE MONTHS ENDED SEPTEMBER

30, 2014 AND 2013

1. SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES

Nature of Business

Pacific Oil Company (the “Company”)

was incorporated in the State of Nevada on December 5, 2005 as Kat Racing, Inc. From the Company’s inception until the Company’s

transition into the oil and natural gas business in early 2013, Kat Racing’s business plan was to design, manufacture, market,

sell and distribute custom off-road racing and recreational vehicles and provide marketing and lead services. Kat Racing never

generated any revenue from this proposed business plan.

Since early 2013, the Company has adopted

a new business plan to identify, acquire, own and operate oil and gas properties in western Canada. The Company has not acquired

any oil and gas properties or realized any revenues to date.

The Company has adopted a September

30 fiscal year end.

Use of Estimates and Assumptions

The preparation of financial statements

in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management

to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets

and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting

period. The Company regularly evaluates estimates and assumptions related to the deferred income tax asset valuation allowances.

The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes

to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of

assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results

experienced by the Company may differ materially and adversely from the Company’s estimates. To the extent there are material

differences between the estimates and the actual results, future results of operations will be affected.

Basic and Diluted Loss per Share

The Company computes loss per share

in accordance with ASC-260, “Earnings per Share” which requires presentation of both basic and diluted earnings per

share on the face of the statement of operations. Basic loss per share is computed by dividing net loss available to common shareholders

by the weighted average number of outstanding common shares during the period. Diluted loss per share gives effect to all dilutive

potential common shares outstanding during the period. Dilutive loss per share excludes all potential common shares if their effect

is anti-dilutive.

The Company has previously had potentially

dilutive debt instruments outstanding in the form of convertible notes payable – related party. However, as the Company

has incurred losses since inception, these potentially dilutive shares of common stock have been excluded from the calculation

of loss per share as their effect would have been anti-dilutive. Consequently, there were no differences between basic and diluted

weighted average shares outstanding as of September 30, 2014 and 2013.

PACIFIC OIL COMPANY

(FORMERLY KAT RACING,

INC. AND PRAIRIE WEST OIL & GAS, LTD.)

NOTES TO AUDITED FINANCIAL STATEMENTS

FOR THE TWELVE MONTHS ENDED SEPTEMBER

30, 2014 AND 2013

1. SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES (continued)

Revenue Recognition

The Company will recognize revenue in accordance with Accounting Standards Codification

No. 605, Revenue Recognition (“ASC-605”). ASC-605 requires that four basic criteria must be met before revenue can

be recognized:: (1) persuasive evidence of an arrangement exists; (2) delivery has occurred; (3) the selling price is fixed and

determinable; and (4) collectability is reasonably assured. Determination of criteria (3) and (4) are based on management’s

judgment regarding the fixed nature of the selling prices of the products delivered and the collectability of those amounts. Provisions

for discounts and rebates to customers, estimated returns and allowances, and other adjustments are provided for in the same period

the related sales are recorded. The Company defers any revenue for which the product has not been delivered or is subject to refund

until such time that the Company and the customer jointly determine that the product has been delivered or no refund will be required.

Fair Value Measurements

The Company adopted ASC No. 820-10

(ASC 820-10), Fair Value Measurements. ASC 820-10 relates to financial assets and financial liabilities.

ASC 820-10 defines fair value, establishes

a framework for measuring fair value in accounting principles generally accepted in the United States of America (GAAP), and expands

disclosures about fair value measurements. The provisions of this standard apply to other accounting pronouncements that require

or permit fair value measurements and are to be applied prospectively with limited exceptions.

ASC 820-10 defines fair value as the

price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants

at the measurement date. This standard is now the single source in GAAP for the definition of fair value, except for the fair

value of leased property. ASC 820-10 establishes a fair value hierarchy that distinguishes between (1) market participant assumptions

developed based on market data obtained from independent sources (observable inputs) and (2) an entity’s own assumptions,

about market participant assumptions that are developed based on the best information available in the circumstances (unobservable

inputs). The fair value hierarchy consists of three broad levels, which gives the highest priority to unadjusted quoted prices

in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The

three levels of the fair value hierarchy under ASC 820-10 are described below:

| • | | Level 1. Observable inputs such as quoted prices in active markets; |

| • | | Level 2. Inputs, other than the quoted prices in active markets, that are observable

either directly or indirectly; and |

| • | | Level 3. Unobservable inputs in which there is little or no market data, which require

the reporting entity to develop its own assumptions. |

The following table presents assets

and liabilities that are measured and recognized at fair value as of September 30, 2013, on a recurring basis:

| Description | |

Level 1 | |

Level 2 | |

Level 3 | |

Gains (Losses) |

| | |

| | | |

| | | |

| | | |

| | |

| Derivative Liability | |

$ | — | | |

$ | — | | |

$ | 173,856 | | |

$ | (96,032 | ) |

| Total | |

$ | — | | |

$ | — | | |

$ | 173,856 | | |

$ | (96,032 | ) |

PACIFIC OIL COMPANY

(FORMERLY KAT RACING,

INC. AND PRAIRIE WEST OIL & GAS, LTD.)

NOTES TO AUDITED FINANCIAL STATEMENTS

FOR THE TWELVE MONTHS ENDED SEPTEMBER

30, 2014 AND 2013

1. SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES (continued)

The carrying value of cash, accounts

payable, accounts payable – related party and note payable related party approximates their fair value due to the short-term

maturity of these financial instruments.

Income Taxes

The Company provides for income taxes in accordance

with FASB standards, which requires the use of an asset and liability approach in accounting for income taxes. Deferred tax assets

and liabilities are recorded based on the differences between the financial statement and tax bases of assets and liabilities,

as well as for net operating loss carry forwards.

In assessing the realizability of deferred

tax assets, the Company considers whether it is more likely than not that some portion or all of the deferred tax assets will not

be realized. The ultimate realization of deferred tax assets is dependent upon the generation of future taxable income. Due to

the Company’s history of losses, the deferred tax assets are fully offset by a valuation allowance as of September 30, 2014

and 2013.

The provision for income taxes differs from

the amounts which would be provided by applying the statutory federal income tax rate of 34% to the net loss before provision

for income taxes for the following reasons:

| |

|

September 30, 2014 |

|

September 30, 2013

(Restated) |

| Income tax benefit at statutory rate |

|

$ |

117,500 |

|

|

$ |

55,700 |

|

| |

|

|

|

|

|

|

|

|

| Valuation allowance |

|

|

(117,500 |

) |

|

|

(55,700 |

) |

| |

|

|

|

|

|

|

|

|

| Income tax expense per books |

|

$ |

-0- |

|

|

$ |

-0- |

|

Net deferred tax assets consist of the following

components as of:

| Deferred tax asset: |

|

|

September 30, 2014 |

|

|

|

September 30, 2013

(Restated) |

|

| Benefit of net operating losses carried forward |

|

$ |

248,250 |

|

|

$ |

86,279 |

|

| Less: Valuation

allowance |

|

|

(248,250 |

) |

|

|

(86,279 |

) |

| |

|

|

|

|

|

|

|

|

| Net deferred tax asset |

|

$ |

-0- |

|

|

$ |

-0- |

|

At September 30, 2014, the Company had federal

tax basis net operating loss carry forwards for federal income tax purposes of approximately $730,000. Net operating losses for

federal income tax purposes may be carried back for two years and forward for twenty years. The net operating losses would expire

in varying amounts from September 30, 2025 to 2034. However, due to the change in ownership provisions of the Tax Reform Act of

1986, net operating loss carry forwards begin to expire in 2025. The Company has no uncertain tax positions.

Reclassifications

Certain amounts in the 2013 financial statements may have been reclassified

to conform to the 2014 presentation.

PACIFIC OIL COMPANY

(FORMERLY KAT RACING,

INC. AND PRAIRIE WEST OIL & GAS, LTD.)

NOTES TO AUDITED FINANCIAL STATEMENTS

FOR THE TWELVE MONTHS ENDED SEPTEMBER

30, 2014 AND 2013

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Comprehensive Income (Loss)

The Company has no component of other comprehensive income (loss). Accordingly, net

loss equals comprehensive loss for the years ended September 30, 2014 and 2013.

Advertising Costs

The Company follows the policy of charging

the costs of advertising to expenses incurred. The Company incurred $0 in advertising costs during the years ended September 30,

2014 and 2013.

Cash and Cash Equivalents

For purposes of the Statement of Cash

Flows, the Company considers all highly liquid instruments purchased with a maturity of three months or less to be cash equivalents

to the extent the funds are not being held for investment purposes.

Impairment of Long-Lived Assets

The Company continually monitors events

and changes in circumstances that could indicate carrying amounts of long-lived assets may not be recoverable. When such events

or changes in circumstances are present, the Company assesses the recoverability of long-lived assets by determining whether the

carrying value of such assets will be recovered through undiscounted expected future cash flows. If the total of the future cash

flows is less than the carrying amount of those assets, the Company recognizes an impairment loss based on the excess of the carrying

amount over the fair value of the assets.

Assets to be disposed of are reported

at the lower of the carrying amount or the fair value less costs to sell.

Concentration of Credit Risk

Financial instruments and related items, which potentially subject the Company to concentrations

of credit risk are cash and cash equivalents. The Company places its cash and temporary cash investments with credit quality institutions.

At times, such investments may be in excess of FDIC insurance limits. As of September 30, 2014 and 2013, there were no deposits

in excess of federally insured limits.

Stock-based Compensation

The Company records stock based compensation

in accordance with the guidance in ASC Topic 718 (Accounting for Share Based Payments) which requires the Company to recognize

expenses related to the fair value of its employee stock option awards. This eliminates accounting for share-based compensation

transactions using the intrinsic value and requires instead that such transactions be accounted for using a fair-value-based method.

The Company recognizes the cost of all share-based awards on a graded vesting basis over the vesting period of the award. Stock-based

awards to non-employees are accounted for using the fair value method.

PACIFIC OIL COMPANY

(FORMERLY KAT RACING,

INC. AND PRAIRIE WEST OIL & GAS, LTD.)

NOTES TO AUDITED FINANCIAL STATEMENTS

FOR THE TWELVE MONTHS ENDED SEPTEMBER

30, 2014 AND 2013

1. SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES (continued)

Development Stage Company

The Company is in the development stage

as defined under the then current Financial Accounting Standards Board (“FASB”) Accounting Standards Codification

(“ASC”) 915-205 “Development-Stage Entities,” and among the additional disclosures required as a development

stage company are that our financial statements were identified as those of a development stage company, and that the statements

of operations, movement in stockholders’ equity (deficit) and cash flows disclosed activity since the date of our inception

(December 5, 2005) as a development stage company. Effective June 10, 2014 FASB changed its regulations with respect to Development

Stage Entities and these additional disclosures are no longer required for annual reporting periods beginning after December 15,

2014 with the option for entities to early adopt these new provisions. The Company has elected to early adopt these provisions

and consequently these additional disclosures are not included in these financial statements.

Recent Account Pronouncements

The Company does not believe that other than disclosed, recently issued, but not yet

adopted, accounting pronouncements will have a material impact on its financial position, results of operations or cash flows.

2. GOING CONCERN

The Company's financial statements

are prepared using generally accepted accounting principles in the United States of America applicable to a going concern which

contemplates the realization of assets and liquidation of liabilities in the normal course of business. The Company has not yet

established an ongoing source of revenues sufficient to cover its operating costs and allow it to continue as a going concern,

has incurred losses of $730,127 through September 30, 2014 and had a working capital deficit of $69,460 and a total shareholder

deficit of $69,459 at September 30, 2014. Accordingly, there is substantial doubt about the Company’s ability to continue

as a going concern. The ability of the Company to continue as a going concern is dependent on the Company obtaining adequate capital

to fund operating losses until it becomes profitable. If the Company is unable to obtain adequate capital, it could be forced

to cease operations.

In order to continue as a going concern,

the Company will need, among other things, additional capital resources. Management's plan is to obtain such resources for the

Company by obtaining capital from management and significant shareholders sufficient to meet its minimal operating expenses and

seeking equity and/or debt financing. However management cannot provide any assurances that the Company will be successful in

accomplishing any of its plans.

The ability of the Company to continue as a going concern is dependent upon its ability

to successfully accomplish the plans described in the preceding paragraph and eventually secure other sources of financing and

attain profitable operations. The accompanying financial statements do not include any adjustments that might be necessary if

the Company is unable to continue as a going concern.

3. COMMON STOCK

On April 25, 2013 the board of director

authorized a reverse stock split of 1 for 100. All share amounts have been adjusted for retroactively.

On October 1, 2013 the Company issued

38,100,000 shares to a newly appointed officer and director which resulted in a change in control of the Company. The shares were

valued at $335,280 or $0.0088 per share, and this expense has been recognized as stock based compensation in our statement of

operations. The value of these shares was determined by a valuation expert.

PACIFIC OIL COMPANY

(FORMERLY KAT RACING,

INC. AND PRAIRIE WEST OIL & GAS, LTD.)

NOTES TO AUDITED FINANCIAL STATEMENTS

FOR THE TWELVE MONTHS ENDED SEPTEMBER

30, 2014 AND 2013

3. COMMON STOCK (continued)

On October 4, 2013, the Company issued

21,900,002 shares of its common stock to satisfy an outstanding convertible note payable and its bifurcated derivative liability.

The outstanding convertible note payable relieved was $76,650, less unamortized discount of $57,618, along with its bifurcated

derivative liability of $171,476. The shares were valued at $192,720, or $0.0088 per share. These shares were valued by a valuation

expert as there had been no active market trading of the Company’s stock at the date of the conversion. The following table

summarizes allocation of the common shares issued in this transaction:

| Derivative liability | |

$ | 171,476 | |

| Convertible notes payable | |

| 76,650 | |

| Unamortized discount on convertible notes payable | |

| (57,618 | ) |

| Interest expense to October 4, 2013 | |

| 2,212 | |

| Value of shares issued to settle liabilities | |

$ | 192,720 | |

On December 31, 2013, the Company issued

23,241 shares of its common stock in settlement of accounts payable, relating to services provided to the Company in the amount

of $16,519. The Company valued the shares at $0.0088 as determined by the valuation expert, or $205. The Company recognized a

gain on the conversion of $16,314.

4. RELATED PARTY TRANSACTIONS

In support of the Company’s efforts

and cash requirements, it may rely on advances from related parties until such time that the Company can support its operations

or attains adequate financing through sales of its equity or traditional debt financing. There is no formal written commitment

for continued support by officers and directors or shareholders. Amounts represent advances or amounts paid in satisfaction of

liabilities. The advances are considered temporary in nature and have not been formalized by a promissory note.

The Company had received $66,671 and $43,255 as of September 30, 2014 and September

30, 2013 (restated), respectively as advances from related parties to fund ongoing operations. In addition, as of September 30,

2014, a related party note payable balance was $1,174. All of the related party accounts and note payable are non-interest bearing,

unsecured and due upon demand. The Company had recorded imputed interest expense at 8% on the payable as additional paid in capital.

During the years ended September 30, 2014 and 2013, the imputed interest was $1,655 and $8,910, respectively.

5. CONVERTIBLE NOTES PAYABLE – RELATED PARTY AND DERIVATIVE LIABILITIES

On July 1, 2013, the Company issued

convertible notes payable to a related party in the amount of $77,824 that provided for the issuance of convertible notes with

variable conversion provisions. The conversion terms of the convertible notes were variable based on certain factors, such as

the future price of the Company’s common stock. Therefore, the number of shares of common stock issuable upon conversion

of the promissory note was indeterminate. Due to the fact that the number of shares of common stock issuable could exceed the

Company’s authorized share limit, the equity environment is tainted and all additional convertible debentures and warrants

are included in the value of the derivative. Pursuant to ASC 815-15 Embedded Derivatives, the fair values of the variable conversion

option and warrants and shares to be issued were recorded as derivative liabilities on the issuance date.

PACIFIC OIL COMPANY

(FORMERLY KAT RACING,

INC. AND PRAIRIE WEST OIL & GAS, LTD.)

NOTES TO AUDITED FINANCIAL STATEMENTS

FOR THE TWELVE MONTHS ENDED SEPTEMBER

30, 2014 AND 2013

5. CONVERTIBLE NOTES PAYABLE - RELATED PARTY AND DERIVATIVE LIABILITIES (continued)

The fair values of the Company’s

derivative liabilities were estimated at the issuance date and were revalued at each subsequent reporting date, using a lattice

model. The Company recorded a discount on the convertible note payable, related party of $57,618, leaving a net balance of $20,206,

and current derivative liabilities of $173,856 at September 30, 2013. The change in fair value of the derivative liabilities resulted

in a gain of $2,380 and $96,032 for the years ended September 30, 2014 and 2013, respectively, which has been reported as gain

from changes in fair value of derivative liabilities in other income (expense) in the statements of operations.

On October 4, 2013, the Company issued

29,100,002 shares of its common stock to the note holders to satisfy $76,650 of the total outstanding convertible notes payable

of $77,824.(See Note 4 above.) Effective January 1, 2014, the Company, with the consent of the holder of the remaining note convertible

– related party totaling $1,174, amended the terms of the note payable to remove the conversion feature. The remaining $2,632

balance of the derivative liability relating to the note payable was credited to gain from changes in fair value of derivative

liabilities in other income on removal of the conversion feature from the note payable – related party.

The following presents the derivative

liability value at September 30, 2014 and September 30, 2013:

| | |

September 30, 2014 | |

September 30, 2013 |

| Convertible Note - Related party | |

$ | — | | |

$ | 173,856 | |

The following is a summary of changes

in the fair market value of the derivative liability during year ended September 30, 2014 and the year ended September 30, 2013:

| Balance, September 30, 2012 | |

$ | — | |

| Increase in derivative value due to issuance of convertible note | |

| 168,812 | |

| Change in fair market value of derivative liabilities due to the mark to market adjustment | |

| 5,044 | |

| Balance, September 30, 2013 | |

| 173,856 | |

| Debt Conversion | |

| (171,476 | ) |

| Change in fair market value of derivative liabilities due to the mark to market adjustment | |

| 252 | |

| Cancellation of the conversion feature | |

| (2,632 | ) |

| Balance at September 30, 2014 | |

$ | — | |

Key inputs and

assumptions used to value the convertible notes payable issued during the year ended September 30, 2013:

| • | | The underlying stock price was used as the fair value of the common stock; |

| • | | The note amount as of issuance on July 1, 2013 and September 30, 2013, was $77,823.50.