UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________

FORM 8-K

__________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 22, 2015

__________________________________________________

INFINERA CORPORATION

(Exact name of registrant as specified in its charter)

__________________________________________________

|

| | | | |

| | | | |

Delaware | | 001-33486 | | 77-0560433 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

140 Caspian Court

Sunnyvale, CA 94089

(Address of principal executive offices, including zip code)

(408) 572-5200

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

__________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 2.02 | Results of Operations and Financial Condition. |

On January 22, 2015, Infinera Corporation issued a press release announcing selected unaudited financial results for its fourth quarter and fiscal year ended December 27, 2014. A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished under Item 2.02 and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of the general incorporation language of such filing, except as shall be expressly set forth by specific reference in such a filing.

The press release furnished herewith as Exhibit 99.1 refers to certain non-GAAP financial measures. A reconciliation of these non-GAAP financial measures to the comparable GAAP financial measures is contained in the press release.

|

| |

Item 9.01 | Financial Statements and Exhibits. |

(d) | Exhibits. |

|

| | |

Exhibit No. | | Description |

| |

99.1 | | Press release dated January 22, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | |

| | | | INFINERA CORPORATION |

| | |

Date: January 22, 2015 | | By: | | /s/ BRAD FELLER |

| | | | Brad Feller Chief Financial Officer |

EXHIBIT INDEX

|

| | |

Exhibit No. | | Description |

| |

99.1 | | Press release dated January 22, 2015. |

Exhibit 99.1

Infinera Corporation Reports Fourth Quarter and Fiscal Year 2014 Financial Results

Sunnyvale, Calif., January 22, 2015 - Infinera Corporation (NASDAQ: INFN), provider of Intelligent Transport Networks, today released financial results for the fourth quarter and fiscal year ended December 27, 2014.

Revenue for the quarter was $186.3 million compared to $173.6 million in the third quarter of 2014 and $139.1 million in the fourth quarter of 2013.

GAAP gross margin for the quarter was 45.3% compared to 43.4% in the third quarter of 2014 and 40.2% in the fourth quarter of 2013. GAAP operating margin was 6.9% in the fourth quarter of 2014 compared to 4.3% in the third quarter of 2014 and an operating loss of 5.1% in the fourth quarter of 2013.

GAAP net income for the quarter was $8.4 million, or $0.06 per diluted share, compared to net income of $4.8 million, or $0.04 per diluted share, in the third quarter of 2014 and a net loss of $10.2 million, or $0.08 per share, in the fourth quarter of 2013.

Non-GAAP gross margin for the quarter was 46.1% compared to 44.2% in the third quarter of 2014 and 41.4% in the fourth quarter of 2013. Non-GAAP operating margin for the fourth quarter of 2014 was 11.0% compared to 8.6% in the third quarter of 2014 and 0.8% in the fourth quarter of 2013.

Non-GAAP net income for the quarter was $18.0 million, or $0.13 per diluted share, compared to net income of $14.2 million, or $0.11 per diluted share, in the third quarter of 2014 and a net loss of $0.2 million, or breakeven on an earnings per share basis, in the fourth quarter of 2013.

Revenue for the year was $668.1 million compared to $544.1 million in 2013.

GAAP gross margin for the year was 43.2% compared to 40.2% in 2013. GAAP operating margin for the year was 4.1% compared to an operating loss of 4.5% in 2013. GAAP net income for the year was $13.7 million or $0.11 per diluted share, compared to a net loss of $32.1 million or $0.27 per share in 2013.

Non-GAAP gross margin for the year was 44.0% compared to 41.6% in 2013. Non-GAAP operating margin for the year was 8.3% compared to 1.4% in 2013. Non-GAAP net income for the year was $49.8 million or $0.39 per diluted share, compared to net income of $4.0 million or $0.03 per diluted share in 2013.

The above non-GAAP measures exclude non-cash stock-based compensation expenses and the amortization of debt discount on Infinera’s convertible senior notes. A further explanation of the use of non-GAAP financial information and a reconciliation of the non-GAAP financial measures to the GAAP equivalents can be found at the end of this release.

“The fourth quarter capped off an exceptional year of winning footprint, taking care of customers and increasing profitability. Growing greater than 20% for a second consecutive year demonstrates the market’s acceptance of our differentiated products and the overall Infinera experience,” said Tom Fallon, Infinera's Chief Executive Officer. “As we evolve from a single-threaded product company to an end-to-end optical solutions company, I believe Infinera is better positioned than ever to serve more customers and address more opportunities.”

Conference Call Information

Infinera will host a conference call for analysts and investors to discuss its fourth quarter and fiscal year 2014 results and its outlook for the first quarter of 2015 today at 5:00 p.m. Eastern Time (2:00 p.m. Pacific Time). A live webcast of the conference call will also be accessible from the Investor Relations section of Infinera’s website at www.infinera.com. Following the webcast, an archived version will be available on the website for 90 days. To hear the replay, parties in the United States and Canada should call 1-888-568-0148. International parties can access the replay at 1-203-369-3900.

|

| | |

Contacts: | | |

Media: Anna Vue | | Investors: Jeff Hustis |

Tel. +1 (916) 595-8157 | | Tel. +1 (408) 213-7150 |

avue@infinera.com | | jhustis@infinera.com |

About Infinera

Infinera provides Intelligent Transport Networks for network operators, enabling reliable, easy to operate, high-capacity optical networks. Infinera leverages its unique large scale photonic integrated circuits to deliver innovative optical networking solutions for the most demanding network environments. Intelligent Transport Networks enable carriers, Cloud network operators, governments and enterprises to automate, converge and scale their data center, metro, long-haul and subsea optical networks. To learn more about Infinera visit www.infinera.com, follow us on Twitter @Infinera and read our latest blog posts at blog.infinera.com.

Forward-Looking Statements

This press release contains certain forward-looking statements based on current expectations, forecasts and assumptions that involve risks and uncertainties, including Infinera’s continued expectations of the market’s acceptance of our differentiated products and the overall Infinera experience; and Infinera’s belief that it is better positioned than ever to serve more customers and address more opportunities. These statements are based on information available to Infinera as of the date hereof and actual results could differ materially from those stated or implied due to risks and uncertainties. Such forward-looking statements can be identified by forward-looking words such as "anticipated," "believed," "could," "estimate," "expect," "intend," "may," "should," "will," and "would" or similar words. The risks and uncertainties that could cause Infinera’s results to differ materially from those expressed or implied by such forward-looking statements include delays in the development and introduction of Infinera’s products and market acceptance of these products; the effect of changes in product pricing or mix, and/or increases in component costs could have on Infinera’s gross margin; Infinera’s reliance on single-source suppliers; aggressive business tactics by Infinera’s competitors; Infinera’s ability to protect Infinera’s intellectual property; claims by others that Infinera infringes their intellectual property; war, terrorism, public health issues, natural disasters, and other circumstances that could disrupt supply, delivery or demand of products; Infinera’s ability to respond to rapid technological changes; and other risks detailed in Infinera’s SEC filings from time to time. More information on potential factors that may impact Infinera’s business are set forth in its Quarterly Report on Form 10-Q for the quarter ended on September 27, 2014 as filed with the SEC on October 29, 2014, as well as subsequent reports filed with or furnished to the SEC from time to time. These reports are available on Infinera’s website at www.infinera.com and the SEC’s website at www.sec.gov. Infinera assumes no obligation to, and does not currently intend to, update any such forward-looking statements.

Use of Non-GAAP Financial Information

In addition to disclosing financial measures prepared in accordance with U.S. Generally Accepted Accounting Principles (GAAP), this press release and the accompanying tables contain certain non-GAAP measures that exclude non-cash stock-based compensation expenses and amortization of debt discount on Infinera’s convertible senior notes. Infinera believes these adjustments are appropriate to enhance an overall understanding of its underlying financial performance and also its prospects for the future and are considered by management for the purpose of making operational decisions. In addition, these results are the primary indicators management uses as a basis for its planning and forecasting of future periods. The presentation of this additional information is not meant to be considered in isolation or as a substitute for net income (loss), basic and diluted net income (loss) per share, or gross margin prepared in accordance with GAAP. Non-GAAP financial measures are not based on a comprehensive set of accounting rules or principles and are subject to limitations. For a description of these non-GAAP financial measures and a reconciliation to the most directly comparable GAAP financial measures, please see the section titled, “GAAP to Non-GAAP Reconciliations.” Infinera anticipates disclosing forward-looking non-GAAP information in its conference call to discuss its fourth quarter and fiscal year 2014 results, including an estimate of non-GAAP earnings for the first quarter of 2015 that excludes non-cash stock-based compensation expenses and amortization of debt discount on Infinera’s convertible senior notes.

A copy of this press release can be found on the Investor Relations’ page of Infinera’s website at www.infinera.com.

Infinera Corporation and the Infinera logo are trademarks or registered trademarks of Infinera Corporation. All other trademarks used or mentioned herein belong to their respective owners.

Infinera Corporation

GAAP Condensed Consolidated Statements of Operations

(In thousands, except per share data)

(Unaudited) |

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 27, 2014 | | December 28, 2013 | | December 27, 2014 | | December 28, 2013 |

Revenue: | | | | | | | | |

Product | | $ | 158,492 |

| | $ | 115,102 |

| | $ | 572,276 |

| | $ | 465,424 |

|

Services | | 27,814 |

| | 23,990 |

| | 95,803 |

| | 78,698 |

|

Total revenue | | 186,306 |

| | 139,092 |

| | 668,079 |

| | 544,122 |

|

Cost of revenue: | | | | | | | | |

Cost of product | | 89,809 |

| | 73,385 |

| | 340,856 |

| | 295,715 |

|

Cost of services | | 12,154 |

| | 9,795 |

| | 38,919 |

| | 29,768 |

|

Total cost of revenue | | 101,963 |

| | 83,180 |

| | 379,775 |

| | 325,483 |

|

Gross profit | | 84,343 |

| | 55,912 |

| | 288,304 |

| | 218,639 |

|

Operating expenses: | | | | | | | | |

Research and development | | 37,349 |

| | 30,859 |

| | 133,484 |

| | 124,794 |

|

Sales and marketing | | 22,288 |

| | 19,857 |

| | 79,026 |

| | 72,778 |

|

General and administrative | | 11,840 |

| | 12,277 |

| | 48,452 |

| | 45,253 |

|

Total operating expenses | | 71,477 |

| | 62,993 |

| | 260,962 |

| | 242,825 |

|

Income (loss) from operations | | 12,866 |

| | (7,081 | ) | | 27,342 |

| | (24,186 | ) |

Other income (expense), net: | | | | | | | | |

Interest income | | 410 |

| | 287 |

| | 1,456 |

| | 923 |

|

Interest expense | | (2,835 | ) | | (2,634 | ) | | (11,021 | ) | | (6,061 | ) |

Other gain (loss), net: | | (348 | ) | | (336 | ) | | (1,365 | ) | | (1,141 | ) |

Total other income (expense), net | | (2,773 | ) | | (2,683 | ) | | (10,930 | ) | | (6,279 | ) |

Income (loss) before income taxes | | 10,093 |

| | (9,764 | ) | | 16,412 |

| | (30,465 | ) |

Provision for income taxes | | 1,683 |

| | 414 |

| | 2,753 |

| | 1,654 |

|

Net income (loss) | | $ | 8,410 |

| | $ | (10,178 | ) | | $ | 13,659 |

| | $ | (32,119 | ) |

Net income (loss) per common share: | | | | | | | | |

Basic | | $ | 0.07 |

| | $ | (0.08 | ) | | $ | 0.11 |

| | $ | (0.27 | ) |

Diluted | | $ | 0.06 |

| | $ | (0.08 | ) | | $ | 0.11 |

| | $ | (0.27 | ) |

Weighted average shares used in computing net income (loss) per common share: | | | | | | | | |

Basic | | 125,830 |

| | 119,743 |

| | 123,672 |

| | 117,425 |

|

Diluted | | 133,072 |

| | 119,743 |

| | 128,565 |

| | 117,425 |

|

Infinera Corporation

GAAP to Non-GAAP Reconciliations

(In thousands, except percentages and per share data)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 27, 2014 | | September 27, 2014 | | December 28, 2013 | | December 27, 2014 | | December 28, 2013 |

Reconciliation of Gross Profit: | | | | | | | | | | |

U.S. GAAP as reported | | $ | 84,343 |

| | $ | 75,302 |

| | $ | 55,912 |

| | $ | 288,304 |

| | $ | 218,639 |

|

Stock-based compensation(1) | | 1,472 |

| | 1,491 |

| | 1,695 |

| | 5,607 |

| | 7,496 |

|

Non-GAAP as adjusted | | $ | 85,815 |

| | $ | 76,793 |

| | $ | 57,607 |

| | $ | 293,911 |

| | $ | 226,135 |

|

Reconciliation of Gross Margin: | | | | | | | | | | |

U.S. GAAP as reported | | 45.3 | % | | 43.4 | % | | 40.2 | % | | 43.2 | % | | 40.2 | % |

Stock-based compensation(1) | | 0.8 | % | | 0.8 | % | | 1.2 | % | | 0.8 | % | | 1.4 | % |

Non-GAAP as adjusted | | 46.1 | % | | 44.2 | % | | 41.4 | % | | 44.0 | % | | 41.6 | % |

Reconciliation of Income (Loss) from Operations: | | | | | | | | | | |

U.S. GAAP as reported | | $ | 12,866 |

| | $ | 7,480 |

| | $ | (7,081 | ) | | $ | 27,342 |

| | $ | (24,186 | ) |

Stock-based compensation(1) | | 7,547 |

| | 7,371 |

| | 8,174 |

| | 28,394 |

| | 31,976 |

|

Non-GAAP as adjusted | | $ | 20,413 |

| | $ | 14,851 |

| | $ | 1,093 |

| | $ | 55,736 |

| | $ | 7,790 |

|

Reconciliation of Operating Margin: | | | | | | | | | | |

U.S. GAAP as reported | | 6.9 | % | | 4.3 | % | | (5.1 | )% | | 4.1 | % | | (4.5 | )% |

Stock-based compensation(1) | | 4.1 | % | | 4.3 | % | | 5.9 | % | | 4.2 | % | | 5.9 | % |

Non-GAAP as adjusted | | 11.0 | % | | 8.6 | % | | 0.8 | % | | 8.3 | % | | 1.4 | % |

Reconciliation of Net Income (Loss): | | | | | | | | | | |

U.S. GAAP as reported | | $ | 8,410 |

| | $ | 4,843 |

| | $ | (10,178 | ) | | $ | 13,659 |

| | $ | (32,119 | ) |

Stock-based compensation(1) | | 7,547 |

| | 7,371 |

| | 8,174 |

| | 28,394 |

| | 31,976 |

|

Amortization of debt discount(2) | | 2,006 |

| | 1,956 |

| | 1,814 |

| | 7,730 |

| | 4,164 |

|

Non-GAAP as adjusted | | $ | 17,963 |

| | $ | 14,170 |

| | $ | (190 | ) | | $ | 49,783 |

| | $ | 4,021 |

|

Net Income (Loss) per Common Share - Basic: | | | | | | | | | | |

U.S. GAAP as reported | | $ | 0.07 |

| | $ | 0.04 |

| | $ | (0.08 | ) | | $ | 0.11 |

| | $ | (0.27 | ) |

Non-GAAP as adjusted | | $ | 0.14 |

| | $ | 0.11 |

| | $ | — |

| | $ | 0.40 |

| | $ | 0.03 |

|

Net Income (Loss) per Common Share - Diluted: | | | | | | | | | | |

U.S. GAAP as reported | | $ | 0.06 |

| | $ | 0.04 |

| | $ | (0.08 | ) | | $ | 0.11 |

| | $ | (0.27 | ) |

Non-GAAP as adjusted(3) | | $ | 0.13 |

| | $ | 0.11 |

| | $ | — |

| | $ | 0.39 |

| | $ | 0.03 |

|

Weighted Average Shares Used in Computing Net Income (Loss) per Common Share - U.S . GAAP: | | | | | | | | | | |

Basic | | 125,830 |

| | 124,378 |

| | 119,743 |

| | 123,672 |

| | 117,425 |

|

Diluted | | 133,072 |

| | 128,964 |

| | 119,743 |

| | 128,565 |

| | 117,425 |

|

Weighted Average Shares Used in Computing Net Income (Loss) per Common Share - Non-GAAP: | | | | | | | | | | |

Basic | | 125,830 |

| | 124,378 |

| | 119,743 |

| | 123,672 |

| | 117,425 |

|

Diluted(3) | | 133,072 |

| | 128,964 |

| | 125,134 |

| | 128,565 |

| | 122,167 |

|

_____________________________

| |

(1) | Stock-based compensation expense is calculated in accordance with the fair value recognition provisions of Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation – Stock Compensation effective January 1, 2006. The following table summarizes the effects of stock-based compensation related to employees and non-employees (in thousands): |

|

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 27, 2014 | | September 27, 2014 | | December 28, 2013 | | December 27, 2014 | | December 28, 2013 |

Cost of revenue | | $ | 500 |

| | $ | 492 |

| | $ | 489 |

| | $ | 1,921 |

| | $ | 1,871 |

|

Research and development | | 2,439 |

| | 2,270 |

| | 2,725 |

| | 8,927 |

| | 10,900 |

|

Sales and marketing | | 1,960 |

| | 1,982 |

| | 1,965 |

| | 7,477 |

| | 7,624 |

|

General and administration | | 1,676 |

| | 1,628 |

| | 1,789 |

| | 6,383 |

| | 5,956 |

|

| | 6,575 |

| | 6,372 |

| | 6,968 |

| | 24,708 |

| | 26,351 |

|

Cost of revenue - amortization from balance sheet* | | 972 |

| | 999 |

| | 1,206 |

| | 3,686 |

| | 5,625 |

|

Total stock-based compensation expense | | $ | 7,547 |

| | $ | 7,371 |

| | $ | 8,174 |

| | $ | 28,394 |

| | $ | 31,976 |

|

_____________________________

| |

* | Stock-based compensation expense deferred to inventory and deferred inventory costs in prior periods and recognized in the current period. |

| |

(2) | Under GAAP, certain convertible debt instruments that may be settled in cash on conversion are required to be separately accounted for as liability (debt) and equity (conversion option) components of the instrument in a manner that reflects the issuer’s non-convertible debt borrowing rate. Accordingly, for GAAP purposes, we are required to amortize as a debt discount an amount equal to the fair value of the conversion option that was recorded in equity as interest expense on our $150 million 1.75% convertible debt issuance in May 2013 over the term of the notes. These amounts have been adjusted in arriving at our non-GAAP results because management believes that this non-cash expense is not indicative of ongoing operating performance and provides a better indication of our underlying business performance. |

| |

(3) | Diluted shares used to calculate net loss per share on a non-GAAP basis provided for informational purposes only. |

Infinera Corporation

Condensed Consolidated Balance Sheets

(In thousands, except par values)

(Unaudited) |

| | | | | | | | |

| | December 27, 2014 | | December 28,

2013 |

ASSETS | | | | |

Current assets: | | | | |

Cash and cash equivalents | | $ | 86,495 |

| | $ | 124,330 |

|

Short-term investments | | 239,628 |

| | 172,660 |

|

Accounts receivable, net of allowance for doubtful accounts of $38 in 2014 and $43 in 2013 | | 154,596 |

| | 100,643 |

|

Inventory | | 146,500 |

| | 123,685 |

|

Prepaid expenses and other current assets | | 24,636 |

| | 17,752 |

|

Total current assets | | 651,855 |

| | 539,070 |

|

Property, plant and equipment, net | | 81,566 |

| | 79,668 |

|

Long-term investments | | 59,233 |

| | 64,419 |

|

Cost-method investment | | 14,500 |

| | 9,000 |

|

Long-term restricted cash | | 5,460 |

| | 3,904 |

|

Other non-current assets | | 5,402 |

| | 4,865 |

|

Total assets | | $ | 818,016 |

| | $ | 700,926 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | |

Current liabilities: | | | | |

Accounts payable | | $ | 61,533 |

| | $ | 39,843 |

|

Accrued expenses | | 26,441 |

| | 22,431 |

|

Accrued compensation and related benefits | | 38,795 |

| | 33,899 |

|

Accrued warranty | | 12,241 |

| | 12,374 |

|

Deferred revenue | | 35,321 |

| | 32,402 |

|

Total current liabilities | | 174,331 |

| | 140,949 |

|

Long-term debt | | 116,894 |

| | 109,164 |

|

Accrued warranty, non-current | | 14,799 |

| | 10,534 |

|

Deferred revenue, non-current | | 10,758 |

| | 4,888 |

|

Other long-term liabilities | | 19,327 |

| | 17,581 |

|

Commitments and contingencies | | | | |

Stockholders’ equity: | | | | |

Preferred stock, $0.001 par value | | | | |

Authorized shares - 25,000 and no shares issued and outstanding | | — |

| | — |

|

Common stock, $0.001 par value | | | | |

Authorized shares - 500,000 as of December 27, 2014 and December 28, 2013 | | | | |

Issued and outstanding shares - 126,160 as of December 27, 2014 and 119,887 as of December 28, 2013 | | 126 |

| | 120 |

|

Additional paid-in capital | | 1,077,225 |

| | 1,025,661 |

|

Accumulated other comprehensive loss | | (4,618 | ) | | (3,486 | ) |

Accumulated deficit | | (590,826 | ) | | (604,485 | ) |

Total stockholders’ equity | | 481,907 |

| | 417,810 |

|

Total liabilities and stockholders’ equity | | $ | 818,016 |

| | $ | 700,926 |

|

Infinera Corporation

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited) |

| | | | | | | | |

| | Twelve Months Ended |

| | December 27, 2014 | | December 28,

2013 |

Cash Flows from Operating Activities: | | | | |

Net income (loss) | | $ | 13,659 |

| | $ | (32,119 | ) |

Adjustments to reconcile net income (loss) to net cash used in operating activities: | | | | |

Depreciation and amortization | | 25,917 |

| | 24,562 |

|

Amortization of debt discount and issuance costs | | 8,395 |

| | 4,522 |

|

Amortization of premium on investments | | 3,772 |

| | 1,539 |

|

Stock-based compensation expense | | 28,394 |

| | 31,976 |

|

Other gain | | (9 | ) | | (276 | ) |

Changes in assets and liabilities: | | | | |

Accounts receivable | | (53,951 | ) | | 6,341 |

|

Inventory | | (25,486 | ) | | (3,036 | ) |

Prepaid expenses and other assets | | (8,324 | ) | | (3,162 | ) |

Accounts payable | | 18,810 |

| | (20,202 | ) |

Accrued liabilities and other expenses | | 11,866 |

| | 11,272 |

|

Deferred revenue | | 8,788 |

| | 7,337 |

|

Accrued warranty | | 4,132 |

| | 6,426 |

|

Net cash provided by operating activities | | 35,963 |

| | 35,180 |

|

Cash Flows from Investing Activities: | | | | |

Purchase of available-for-sale investments | | (302,398 | ) | | (288,140 | ) |

Purchase of cost-method investment | | (5,500 | ) | | — |

|

Proceeds from sale of available-for-sale investments | | 28,481 |

| | 2,850 |

|

Proceeds from maturities and calls of investments | | 208,051 |

| | 125,624 |

|

Purchase of property and equipment | | (23,122 | ) | | (21,065 | ) |

Change in restricted cash | | (1,571 | ) | | (69 | ) |

Net cash used in investing activities | | (96,059 | ) | | (180,800 | ) |

Cash Flows from Financing Activities: | | | | |

Proceeds from issuance of debt, net | | — |

| | 144,469 |

|

Proceeds from issuance of common stock | | 24,707 |

| | 23,185 |

|

Minimum tax withholding paid on behalf of employees for net share settlement | | (1,846 | ) | | (1,544 | ) |

Net cash provided by financing activities | | 22,861 |

| | 166,110 |

|

Effect of exchange rate changes on cash | | (600 | ) | | (826 | ) |

Net change in cash and cash equivalents | | (37,835 | ) | | 19,664 |

|

Cash and cash equivalents at beginning of period | | 124,330 |

| | 104,666 |

|

Cash and cash equivalents at end of period | | $ | 86,495 |

| | $ | 124,330 |

|

Supplemental disclosures of cash flow information: | | | | |

Cash paid for income taxes, net of refunds | | $ | 1,697 |

| | $ | 2,135 |

|

Cash paid for interest | | $ | 2,625 |

| | $ | 1,320 |

|

Supplemental schedule of non-cash financing activities: | | | | |

Transfer of inventory to fixed assets | | $ | 2,569 |

| | $ | 5,458 |

|

Warrant exercise | | $ | — |

| | $ | 500 |

|

Infinera Corporation

Supplemental Financial Information

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q1'13 | | Q2’13 | | Q3'13 | | Q4'13 | | Q1'14 | | Q2'14 | | Q3'14 | | Q4'14 |

Revenue ($ Mil) | | $ | 124.6 |

| | $ | 138.4 |

| | $ | 142.0 |

| | $ | 139.1 |

| | $ | 142.8 |

| | $ | 165.4 |

| | $ | 173.6 |

| | $ | 186.3 |

|

Gross Margin % (1) | | 35.9 | % | | 38.9 | % | | 49.2 | % | | 41.4 | % | | 41.8 | % | | 43.3 | % | | 44.2 | % | | 46.1 | % |

Revenue Composition: | | | | | | | | | | | | | | | | |

Domestic % | | 63 | % | | 64 | % | | 73 | % | | 54 | % | | 78 | % | | 82 | % | | 70 | % | | 58 | % |

International % | | 37 | % | | 36 | % | | 27 | % | | 46 | % | | 22 | % | | 18 | % | | 30 | % | | 42 | % |

Customers >10% of Revenue | | 1 |

| | — |

| | 3 |

| | 1 |

| | 2 |

| | 2 |

| | 1 |

| | 1 |

|

Cash Related Information: | | | | | | | | | | | | | | | | |

Cash from (Used in) Operations ($ Mil) | | $ | (21.3 | ) | | $ | 17.9 |

| | $ | 12.8 |

| | $ | 25.8 |

| | $ | (15.4 | ) | | $ | 10.3 |

| | $ | 22.3 |

| | $ | 18.7 |

|

Capital Expenditures ($ Mil) | | $ | 4.9 |

| | $ | 4.5 |

| | $ | 4.2 |

| | $ | 7.5 |

| | $ | 5.6 |

| | $ | 4.4 |

| | $ | 4.4 |

| | $ | 8.8 |

|

Depreciation & Amortization ($ Mil) | | $ | 6.3 |

| | $ | 6.3 |

| | $ | 5.9 |

| | $ | 6.0 |

| | $ | 6.3 |

| | $ | 6.5 |

| | $ | 6.5 |

| | $ | 6.6 |

|

DSO’s | | 82 |

| | 64 |

| | 56 |

| | 66 |

| | 68 |

| | 66 |

| | 71 |

| | 76 |

|

Inventory Metrics: | | | | | | | | | | | | | | | | |

Raw Materials ($ Mil) | | $ | 12.2 |

| | $ | 9.8 |

| | $ | 12.1 |

| | $ | 14.3 |

| | $ | 13.2 |

| | $ | 11.2 |

| | $ | 11.6 |

| | $ | 15.2 |

|

Work in Process ($ Mil) | | $ | 53.1 |

| | $ | 41.0 |

| | $ | 45.7 |

| | $ | 49.2 |

| | $ | 47.8 |

| | $ | 40.6 |

| | $ | 44.4 |

| | $ | 50.0 |

|

Finished Goods ($ Mil) | | $ | 65.7 |

| | $ | 70.5 |

| | $ | 65.7 |

| | $ | 60.2 |

| | $ | 65.5 |

| | $ | 79.1 |

| | $ | 74.8 |

| | $ | 81.3 |

|

Total Inventory ($ Mil) | | $ | 131.0 |

| | $ | 121.3 |

| | $ | 123.5 |

| | $ | 123.7 |

| | $ | 126.5 |

| | $ | 130.9 |

| | $ | 130.8 |

| | $ | 146.5 |

|

Inventory Turns (2) | | 2.4 |

| | 2.8 |

| | 2.3 |

| | 2.6 |

| | 2.6 |

| | 2.9 |

| | 3.0 |

| | 2.7 |

|

Worldwide Headcount | | 1,219 |

| | 1,238 |

| | 1,296 |

| | 1,318 |

| | 1,346 |

| | 1,396 |

| | 1,456 |

| | 1,495 |

|

| |

(1) | Amounts reflect non-GAAP results. Non-GAAP adjustments include non-cash stock-based compensation expense. |

| |

(2) | Infinera calculates non-GAAP inventory turns as annualized non-GAAP cost of revenue before adjustments for non-cash stock-based compensation expense divided by the average inventory for the quarter. |

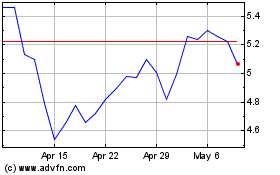

Infinera (NASDAQ:INFN)

Historical Stock Chart

From Mar 2024 to Apr 2024

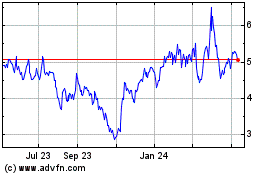

Infinera (NASDAQ:INFN)

Historical Stock Chart

From Apr 2023 to Apr 2024