SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14C

(RULE 14C-101)

SCHEDULE 14C INFORMATION

INFORMATION STATEMENT PURSUANT TO SECTION 14(C) OF

THE SECURITIES EXCHANGE ACT OF 1934

Check the appropriate box:

|

¨

|

Preliminary Information Statement

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-5(d) (1))

|

|

x

|

Definitive Information Statement

|

|

GREENFIELD FARMS FOOD, INC.

|

|

(Name of Registrant As Specified In Charter)

|

Payment of Filing Fee (Check the appropriate box):

|

x

|

No fee required

|

|

|

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

| |

(1)

|

Title of each class of securities to which transaction applies:

|

| |

(2)

|

Aggregate number of securities to which the transaction applies:

|

| |

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

| |

(4)

|

Proposed maximum aggregate value of transaction:

|

|

¨

|

Fee paid previously with preliminary materials

|

|

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

| |

(1)

|

Amount previously paid:

|

| |

(2)

|

Form, Schedule or Registration Statement No.:

|

GREENFIELD FARMS FOOD, INC.

7315 EAST PEAKVIEW AVE

CENTENNIAL, COLORADO 80111

January 12, 2015

Dear Shareholder:

This Information Statement is furnished to holders of shares of common stock, $.001 par value (the "Common Stock") of Greenfield Farms Food, Inc. (the "Company"). We are sending you this Information Statement to inform you that on December 11, 2014, the Board of Directors of the Company unanimously adopted the following resolutions:

| |

1)

|

To seek shareholder approval to amend the Company's Articles of Incorporation to effect a reverse stock split of the Company's Common Stock, at the sole discretion of the Board of Directors, based upon a ratio of one-for-three hundred (1 for 300) shares at any time prior to March 31, 2015, with no change in the number of authorized shares.

|

Thereafter, on December 12, 2014, pursuant to the By-Laws of the Company, Certificate of Designation of Series D Preferred Stock and applicable Nevada law, Ronald Heineman, our Chief Executive Officer and holder of 1,000 shares of the Company’s Series D Preferred Stock, representing 100% of the total issued and outstanding Series D Preferred Stock, adopted a resolution to authorize the Board of Directors to enact the one share for three hundred share (1 for 300) reverse stock split. Pursuant to the Certificate of Designations for such Series D Preferred Stock, the holders of such Series D Preferred Stock are entitled to cast 51% of the vote on any matter submitted to the shareholders of the Company. The Board of Directors believes that the proposed reverse split is necessary for the Company because it provides the Company with the flexibility it needs to consider various strategic alternatives and permit the issuance of additional shares of stock to new investors or on the conversion of existing or new convertible securities. The reverse split will also increase the trading price of the Company’s common stock making it easier for market makers to maintain bid and ask sales prices sufficient to provide a more orderly trading market.

This proposal will not become effective until the date which shall be no sooner than the expiration of 20 days after the Information Statement is sent to stockholders and notification to and approval by FINRA of the same, but no later than March 31, 2015. In addition, notwithstanding approval of this proposal by the shareholders, the Board of Directors may, in its sole discretion, determine not to effect, and abandon, the reverse stock split without further action by our shareholders.

The Board of Directors believes that the proposed reverse stock split is beneficial to the Company because it provides the Company with the flexibility it needs to complete potential acquisitions consistent with its Business Plan and remain in compliance with certain covenants of outstanding loans.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE NOT REQUESTED

TO SEND US A PROXY

The enclosed Information Statement is being furnished to you to inform you that the foregoing action has been approved by the holders of a majority of the eligible voting shares of our Common Stock. The resolutions will not become effective before the date which is 20 days after this Information Statement was first mailed to shareholders. You are urged to read the Information Statement in its entirety for a description of the action taken by the Board of Directors and a majority of the shareholders of the Company.

This Information Statement is being mailed on or about January 16, 2015 to shareholders of record on January 2, 2015 (the "Record Date").

|

|

|

/s/ Ronald Heineman

|

|

|

|

|

Ronald Heineman, Chief Executive Officer

|

|

INFORMATION STATEMENT

PURSUANT TO SECTION 14(C)

OF THE SECURITIES EXCHANGE ACT OF 1934

AND RULE 14C-2 THEREUNDER

____________________________

January 12, 2015

____________________________

GREENFIELD FARMS FOOD, INC.

NO VOTE OR OTHER ACTION OF THE COMPANY'S SHAREHOLDERS IS REQUIRED

IN CONNECTION WITH THIS INFORMATION STATEMENT.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED

NOT TO SEND US A PROXY

The Company is distributing this Information Statement to its shareholders in full satisfaction of any notice requirements it may have under Securities and Exchange Act of 1934, as amended, and applicable Nevada law. No additional action will be undertaken by the Company with respect to the receipt of written consents, and no dissenters' rights with respect to the receipt of the written consents, and no dissenters' rights under the Laws of Nevada are afforded to the Company's shareholders as a result of the adoption of these resolutions.

Expenses in connection with the distribution of this Information Statement, which are anticipated to be less than $5,000.00, will be paid by the Company.

DESCRIPTION OF THE CORPORATION

Greenfield Farms Food, Inc. (“GRAS” or the "Company") was incorporated under the laws of the State of Nevada on June 2, 2008. In October 2013, the Company entered into an Asset Purchase Agreement (the “Agreement”) with COHP, LLC (”COHP”) through which the Company acquired certain of the assets and liabilities of COHP including the operations of Carmela’s Pizzeria (“Carmela’s”) through a newly formed wholly-owned subsidiary Carmela’s Pizzeria CO, Inc. Carmela's Pizzeria presently has three Dayton, Ohio area locations offering authentic New York style pizza. Carmela's offers a full service menu for Dine In, Carry out and Delivery as well as pizza buffets in select stores.

The Company is currently considering a number of strategic business alternatives and believes that it may not have sufficient authorized, but unissued, shares of its Common Stock to facilitate the issuance of additional shares in connection with such alternatives and as required by the Company’s covenants in certain of its convertible debt instruments. As of this date, no new strategic business alternatives have been adopted or finalized. In order to facilitate any strategic business alternative, which may be essential to the Company’s continued operations, the Company's Board of Directors believes that the proposed increase in authorized capital is beneficial to the Company because it provides the Company with the flexibility it needs to adopt any such alternatives and continue to comply with its convertible debt covenants. At this time, the Company has not made any commitments with respect to any new strategic business alternative.

Effective September 22, 2014, the Board of Directors of the Company approved the issuance of 1,000 shares of Class D Preferred Stock (as defined and described below) (the “Class D Preferred Stock Shares”) to Mr. Ronald Heineman, the Company’s Chief Executive Officer and Director, or his assigns in consideration for services rendered to the Company and continuing to work for the Company without receiving significant payment for services and without the Company having the ability at the time to issue shares of common stock as the Company did not have sufficient authorized but unissued shares of common stock to allow for such issuance.

As a result of the issuance of the Class D Preferred Stock Shares to Mr. Heineman, or his assigns and the Super Majority Voting Rights (described below), Mr. Heineman obtained voting rights over the Company’s outstanding voting stock which provides him the right to vote up to 51% of the total voting shares able to vote on any and all shareholder matters. As a result, Mr. Heineman will exercise majority control in determining the outcome of all corporate transactions or other matters, including the election of Directors, mergers, consolidations, the sale of all or substantially all of the Company’s assets, and also the power to prevent or cause a change in control. The interests of Mr. Heineman may differ from the interests of the other stockholders and thus result in corporate decisions that are adverse to other shareholders. Additionally, it may be impossible for shareholders to remove Mr. Heineman as an officer or Director of the Company due to the Super Majority Voting Rights.

THE REVERSE SPLIT

The Board of Directors believes that it is in the best interest of the Company's shareholders and the Company for the Board to have the authority to maintain the Company’s authorized capital and to effect a reverse stock split of the Company's common shares in order to comply with default provisions of certain convertible promissory notes we have outstanding, make the Company more attractive for a potential financing transaction, and to pursue business expansion opportunities. In addition, the price of the Company’s common stock has recently been trading at or below $0.001 per share making it difficult for market makers of the Company’s common stock to maintain an orderly trading market. As a result of the current trading prices, there have been times in which there has been no bid for the Company’s common stock as a result of these low prices. The Board of Directors believes the reverse stock split will increase the price of the Company’s common stock sufficiently to allow for a more orderly trading market.

The Company currently has several convertible notes outstanding with third party institutional investors, which totaled approximately $250,000 in principal amounts due at September 30, 2014. These notes are convertible into our common stock at various discounts to our market price ranging from 40% to 50% of the average of the lowest three closing bid prices in the ten (10) to thirty (30) trading day period prior to conversion, depending on the individual note. In addition, these notes require the Company to maintain sufficient authorized share reserves for future issuances in amounts up to five (5) times the number of shares that are actually issuable upon full conversion of the notes. Currently we have 3,950,000,000 shares of common stock authorized and 1,478,720,693 issued and outstanding with 2,296,219,533 shares reserved for issuance pursuant to various convertible note terms. The default provisions of the convertible notes provide that should the lender declare an Event of Default as a result of our inability to issue shares of stock upon conversion and/or our lack of sufficient authorized shares equaling five times the number issuable upon conversion, the principal balance of the notes would increase to 150% of the then outstanding principal balance of the notes. As of the date of this Information Statement, our lenders have not declared any Events of Default as they are aware we are pursuing the reverse split of our common stock.

The Board of Directors intends to effect a reverse stock split no sooner than 20 days following the mailing of this Information Statement to the Company's shareholders and only upon its determination that a reverse stock split would be in the best interests of the shareholders at that time, but prior to March 31, 2015. The Board of Directors would set the specific timing for such a split within the authority granted by the shareholders, but only following notification to and approval by FINRA.

Criteria to be Used for Decision to Apply the Reverse Stock Split

Upon effectiveness of the reverse stock split, the Board of Directors will be authorized to proceed with the reverse split in their discretion. In determining whether to proceed with the reverse split the Board of Directors will consider a number of factors, including market conditions, existing and expected trading prices of our common stock, our additional funding requirements and the amount of our authorized but unissued common stock. No further action on the part of shareholders will be required to either increase the Company’s authorized capital or to implement or abandon the reverse stock split. The Board of Directors reserves its right to elect not to proceed, and abandon, the reverse stock split if it determines, in its sole discretion, that this proposal is no longer in the best interests of the Company's shareholders.

ADVANTAGES AND DISADVANTAGES OF REVERSE SPLIT

There are certain advantages and disadvantages of completing the reverse split and not changing the Company's authorized common stock. The advantages include:

| |

·

|

The ability to raise capital by issuing capital stock under future financing transactions, if any.

|

| |

|

|

| |

·

|

To have shares of common stock available to pursue business expansion opportunities, if any.

|

| |

|

|

| |

·

|

To maintain compliance with covenants of certain convertible promissory notes currently outstanding including default provisions that provide for an increase in principal of at least 1.5 times the total amount due.

|

The disadvantages include:

| |

·

|

Dilution to the existing shareholders, including a decrease in our net income per share in future periods. This could cause the market price of our stock to decline.

|

| |

|

|

| |

·

|

Dilution to existing shareholders due to conversion to common stock from our currently outstanding promissory notes.

|

| |

|

|

| |

·

|

Our Series D Preferred notwithstanding, the issuance of authorized but unissued stock could be used to deter a potential takeover of the Company that may otherwise be beneficial to shareholders by diluting the shares held by a potential suitor or issuing shares to a shareholder that will vote in accordance with the desires of the Company's Board of Directors, at that time. A takeover may be beneficial to independent shareholders because, among other reasons, a potential suitor may offer such shareholders a premium for their shares of stock compared to the then-existing market price. The Company does not have any plans or proposals to adopt provisions or enter into agreements that may have material anti-takeover consequences.

|

CERTAIN RISK FACTORS ASSOCIATED WITH THE REVERSE STOCK SPLIT

There can be no assurance that the total market capitalization of the Company's Common Stock (the aggregate value of all Company’s Common Stock at the then market price) after the proposed reverse stock split will be equal to or greater than the total market capitalization before the proposed reverse stock split or that the per share market price of the Company's Common Stock following the reverse stock split will increase in proportion to the reduction in the number of shares of the Company's Common Stock outstanding before the reverse stock split.

If the reverse stock split is effected, the resulting per-share stock price may not attract or satisfy potential acquisition targets and there is no guarantee that any transaction will be effected.

A decline in the market price of the Company's Common Stock after the reverse stock split may result in a greater percentage decline than would occur in the absence of a reverse stock split, and the liquidity of the Company's Common Stock could be adversely affected following such a reverse stock split.

IMPACT OF THE PROPOSED REVERSE STOCK SPLIT IF IMPLEMENTED

If the Board of Directors were to effect a reverse stock split, the Board of Directors would set the timing for the reverse stock split and publicly announce the effectiveness of the reverse stock split. No further action on the part of stockholders would be required to either implement or abandon the reverse stock split. If the Board of Directors does not implement the reverse stock split prior to March 31, 2015, the Board of Directors would not effect a reverse stock split without seeking additional stockholder approval. The Board of Director reserves its right to elect not to proceed with the reverse stock split if, in its sole discretion, this proposal is no longer in our best interests.

A reverse stock split refers to a reduction in the number of outstanding shares of a class of a corporation’s capital stock, which may be accomplished, as in this case, by reclassifying and combining all of our outstanding shares of common stock into a proportionately smaller number of shares. For example, with a 1-for-300 reverse stock split, a stockholder holding 30,000 shares of our common stock before the reverse stock split would hold 100 shares of our common stock immediately after the reverse stock split.

Common Stock Holdings

Each issued share of common stock immediately prior to the effective time of the reverse stock split will automatically be changed, as of the effective time of the reverse stock split, into a fraction of a share of common stock based on the exchange ratio determined by the Board of Directors. However, the total number of authorized shares of our common stock would not be reduced from the current total of 3,950,000,000.

Because the reverse stock split would apply to all issued shares of our common stock, the proposed reverse stock split would not alter the relative rights and preferences of existing stockholders nor affect any stockholder’s proportionate equity interest in the Company, except for stockholders that would otherwise receive fractional shares as described below.

The following table sets forth the approximate percentage reduction in the outstanding shares of our common stock and the approximate number of shares of our common stock that would be outstanding as a result of the reverse stock split, based on the approximately 1,500,000,000 shares of our common stock issued and outstanding as of January 12, 2015:

|

Proposed Reverse Stock Split Ratio

|

|

Percentage Reduction In Outstanding Shares

|

|

Shares Outstanding After Reverse Stock Split

|

|

1 for 300

|

|

96.7%

|

|

5,000,000

|

Stockholders should note that it is not possible to accurately predict the effect of the reverse stock split on the market prices for the common stock, and the history of reverse stock splits is varied. In particular, there is no assurance that the price per share of the common stock after the reverse stock split will increase in an amount proportionate to the decrease in the number of issued and outstanding shares, or will increase at all. In addition, there can be no assurance that any increase in the market price of our common stock immediately after the reverse stock split will be maintained for any period of time, especially given we expect further dilution will occur in the future as a result of common stock issuances upon conversion of convertible promissory notes. Even if an increased share price can be maintained, the reverse stock split may not achieve some or all of the other desired results summarized above. Further, because some investors may view the reverse stock split negatively, there can be no assurance that the actual implementation of the reverse stock split will not adversely affect the market price of the common stock.

The principal effect of the reverse stock split will be that:

| |

·

|

Based on the current number of issued and outstanding shares of the Company’s Common Stock, the number of shares of the Company's Common Stock issued and outstanding will be reduce from approximately 1,500,000,000 shares to approximately 5,000,000;

|

| |

|

|

| |

·

|

the number of shares that may be issued upon the exercise of conversion rights by holders of securities convertible into the Company's Common Stock will be reduced proportionately; and

|

| |

|

|

| |

·

|

proportionate adjustments will be made to the per-share exercise price and the number of shares issuable upon the exercise of all outstanding options or warrants entitling the holders to purchase shares of the Company's Common Stock, which will result in approximately the same aggregate price being required to be paid for such options upon exercise immediately preceding the reverse stock split; and

|

| |

|

|

| |

·

|

the number of authorized shares of Common Stock will continue to be 3,950,000,000 shares after the reverse split.

|

Odd Lot Transactions

It is likely that some of our stockholders will own “odd-lots” of fewer than 100 shares following a reverse stock split. A purchase or sale of less than 100 shares (an “odd lot” transaction) may result in incrementally higher trading costs through certain brokers, particularly “full service” brokers, and generally may be more difficult than a “round lot” sale (i.e., sales denominated in units of 100 shares). Therefore, those stockholders who own less than 100 shares following a reverse stock split may be required to pay somewhat higher transaction costs and may experience some difficulties or delays should they then determine to sell their shares of common stock. The Board of Directors believes, however, that these potential effects are outweighed by the potential benefits of the reverse stock split.

Authorized Shares

The reverse stock split would affect all issued and outstanding shares of the Company's Common Stock and outstanding rights to acquire the Company's Common Stock. Upon the effectiveness of the reverse stock split, the number of authorized shares of the Company's Common Stock that are not issued or outstanding would increase due to the reduction in the number of shares of the Company's Common Stock issued and outstanding based on the reverse stock split ratio selected by the Board of Directors. As of January 12, 2015, we had 3,950,000,000 shares of authorized Common Stock and 1,478,720,693 shares of Common Stock issued and outstanding and 50,000,000 shares of authorized Preferred Stock of which 141,623 shares were issued and outstanding. Following the reverse split, if enacted, we will continue to have 3,950,000,000 shares of authorized Common Stock and 4,939,069 shares of Common Stock issued and outstanding together with 50,000,000 shares of authorized Preferred Stock. Authorized but unissued shares will be available for issuance, and we will certainly issue such shares in the future, primarily through convertible note conversions.

These additional shares would be available for issuance from time to time for corporate purposes such as convertible note conversions, capital-raising transactions and acquisitions of companies or other assets, as well as for issuance upon conversion or exercise of securities such as convertible preferred stock, convertible debt, warrants or options convertible into or exercisable for common stock. We believe that the availability of the additional shares will provide us with the flexibility to meet business needs as they arise, to take advantage of favorable opportunities and to respond effectively in a changing corporate environment. In addition to share issuances from convertible notes, we may elect to issue shares of common stock to raise equity capital, to make acquisitions using stock, to establish strategic relationships with other companies, to adopt additional employee benefit plans or reserve additional shares for issuance under such plans, where the Board of Directors determines it advisable to do so, without the necessity of soliciting further stockholder approval, subject to applicable stockholder vote requirements under Nevada corporation law. If we issue additional shares for any of these purposes, the aggregate ownership interest of our current stockholders, and the interest of each such existing stockholder, would be diluted, possibly substantially.

The additional shares of our common stock that would become available for issuance upon an effective reverse stock split could also be used by us to oppose a hostile takeover attempt or delay or prevent a change of control or changes in or removal of our management, including any transaction that may be favored by a majority of our stockholders or in which our stockholders might otherwise receive a premium for their shares over then-current market prices or benefit in some other manner. For example, without further stockholder approval, the Board of Directors could strategically sell shares of common stock in a private transaction to purchasers who would oppose a takeover or favor our current Board of Directors. Although the increased proportion of authorized but unissued shares to issued shares could, under certain circumstances, have an anti-takeover effect, the reverse stock split is not being proposed in order to respond to a hostile takeover attempt or to any attempt to obtain control of the Company.

Effect on Fractional Shareholders

All fractional interests resulting from the reverse split will be rounded up to the nearest whole share.

Effect on Registered and Beneficial Shareholders

Upon a reverse stock split, we intend to treat shareholders holding the Company's Common Stock in "street name", through a bank, broker or other nominee, in the same manner as registered shareholders whose shares are registered in their names. Banks, brokers or other nominees will be instructed to effect the reverse stock split for their beneficial holders holding the Company's Common Stock in "street name." However, these banks, brokers or other nominees may have different procedures than registered shareholders for processing the reverse stock split. If you hold your shares with a bank, broker or other nominee and if you have any questions in this regard, we encourage you to contact your nominee.

Effect on Registered Certified Shares

Some of our registered shareholders hold all their shares in certificate form. If any of your shares are held in certificate form, you will not be required to exchange your certificate for a new one evidencing the post-reverse stock split shares. Shareholders who wish to exchange their pre-reverse stock split certificates may do so by contacting the Company's s transfer agent, West Coast Stock Transfer at 731 N. Vulcan Avenue, Suite 205, Encinitas, CA 92024, or (619) 664-4780 to complete such exchange at their own expense.

SHAREHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND ARE NOT REQUIRED TO SUBMIT ANY CERTIFICATE(S) TO THE COMPANY OR ITS TRANSFER AGENT.

Accounting Matters

The stated capital attributable to the Company's Common Stock on its balance sheet will be unchanged. The per-share net income or loss and net book value of the Company's Common Stock will be restated because there will be fewer shares of the Company's Common Stock outstanding.

Procedure for Effecting Reverse Stock Split

If the Board of Directors decides to implement the reverse stock split at any time prior to March 31, 2015, the Company will promptly file a Certificate of Change with the Nevada Secretary of State to amend our existing Articles of Incorporation. The reverse stock split will become effective on the date of filing the Certificate of Amendment, which is referred to as the "effective date." Beginning on the effective date, each certificate representing pre-reverse stock split shares will be deemed for all corporate purposes to evidence ownership of post-reverse stock split shares.

Absence of Dissenters’ Rights of Appraisal

Neither the adoption by the Board of Directors, nor the approval by the shareholders, of the Reverse Split provides shareholders any right to dissent and obtain appraisal of or payment for such shareholder’s shares under Section 78 of the Revised Nevada Statutes, the Articles of Incorporation or the Bylaws.

Federal Income Tax Consequences

The following is a summary of certain material U.S. federal income tax consequences of the reverse stock split, if implemented. The summary is based on the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), applicable Treasury Regulations, judicial authority, and administrative rulings effective as of the date of hereof. These laws and authorities are subject to change, possibly on a retroactive basis. The discussion below does not address any state, local or foreign tax consequences of the reverse stock split, nor does it address any consequences under non-income tax laws or under any tax treaty. We have not sought and will not seek an opinion of counsel or a ruling from the Internal Revenue Service regarding the federal income tax consequences of a reverse stock split.

The following discussion is intended only as a summary of the material U.S. federal income tax consequences of the reverse stock split and does not purport to be a complete analysis or listing of all of the potential tax. In particular, this discussion does not deal with all U.S. federal income tax considerations that may be relevant to each of our stockholders in light of their particular circumstances, such as stockholders who exercise dissenters’ rights, who are treated as partnerships or otherwise as pass-through entities for U.S. federal income tax purposes, who are dealers in securities, who are traders in securities who have elected the mark-to-market method of accounting, who are subject to the alternative minimum tax provisions of the Internal Revenue Code, who are financial institutions or insurance companies, who are “S corporations”, who are “regulated investment companies”, who are “real estate investment trusts”, who are tax-exempt organizations, who are tax-qualified retirement plans, who are governments or agencies or instrumentalities thereof, who are eligible to treat their shares of Company common stock as “qualified small business stock”, who do not hold their Company common stock as a capital asset at the time of the reverse stock split, who acquired their Company common stock in connection with common stock option or common stock purchase plans or in other compensatory transactions, who hold Company common stock as part of an integrated investment (including a “straddle”) comprised of Company common stock and one or more other positions, who hold our common stock subject to the constructive sale provisions of Section 1259 of the Internal Revenue Code, who are expatriates or certain former long-term residents of the U.S., who are “controlled foreign corporations”, who are “passive foreign investment companies”, who are corporations that accumulate earnings to avoid U.S. federal income tax, or who have a functional currency other than the U.S. dollar. This summary does not address the tax effects of the reverse stock split to holders of Company options or warrants. Those stockholders, if any, are encouraged to consult their own tax advisors.

The following discussion does not address the tax consequences of transactions effectuated prior to, concurrent with or after the reverse stock split (whether or not such transactions are in connection with the reverse stock split). Stockholders are encouraged to consult their own tax advisors regarding the tax consequences to them of any transactions undertaken prior to, concurrent with or after the reverse stock split.

For purposes of this discussion, the term “U.S. Holder” means a beneficial owner of shares of Company common stock that is any of the following:

| |

·

|

an individual treated as a U.S. citizen or resident for U.S. federal income tax purposes;

|

| |

|

|

| |

·

|

a corporation (or other entity taxable as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States, any state thereof, or the District of Columbia;

|

| |

|

|

| |

·

|

an estate, the income of which is subject to U.S. federal income taxation regardless of its source;

|

| |

|

|

| |

·

|

a trust if a U.S. court can exercise primary supervision over the trust’s administration and one or more U.S. persons have the authority to control all substantial decisions of the trust; or

|

| |

|

|

| |

·

|

a trust in existence on August 20, 1996 that has a valid election in effect under applicable Treasury Regulations to be treated as a U.S. person.

|

If a partnership holds shares of Company common stock, the tax treatment of a partner generally will depend on the status of the partner and on the activities of the partnership. Partners of partnerships holding Company common stock should consult their tax advisors.

PLEASE CONSULT YOUR OWN TAX ADVISOR CONCERNING THE CONSEQUENCES OF THE REVERSE STOCK SPLIT IN YOUR PARTICULAR CIRCUMSTANCES UNDER THE INTERNAL REVENUE CODE AND THE LAWS OF ANY OTHER TAXING JURISDICTION.

Tax Consequences to U.S. Holders of Common Stock.

We believe that the reverse stock split will qualify as a “reorganization” under Section 368(a)(1)(E) of the Internal Revenue Code. Accordingly, provided that the fair market value of the post-reverse stock split shares is equal to the fair market value of the pre-reverse stock split shares surrendered in the reverse stock split:

| |

·

|

A U.S. Holder will not recognize any gain or loss as a result of the reverse stock split (except to the extent of cash received in lieu of a fractional share).

|

| |

|

|

| |

·

|

A U.S. Holder’s aggregate tax basis in his, her or its post-reverse stock split shares will be equal to the aggregate tax basis in the pre-reverse stock split shares exchanged therefor, reduced by the amount of the adjusted basis of any pre-reverse stock split shares exchanged for such post-reverse stock split shares that is allocated to any fractional share for which cash is received.

|

| |

|

|

| |

·

|

A U.S. Holder’s holding period for the post-reverse stock split shares will include the period during which such stockholder held the pre-reverse stock split shares surrendered in the reverse stock split.

|

Tax Consequences to the Company. We do not expect to recognize any taxable gain or loss as a result of the reverse stock split.

Distribution and Costs

The Company will pay the cost of preparing, printing and distributing this Information Statement. Only one Information Statement will be delivered to multiple shareholders sharing an address, unless contrary instructions are received from one or more of such shareholders. Upon receipt of a written request at the address noted above, the Company will deliver a single copy of this Information Statement and future shareholder communication documents to any shareholders sharing an address to which multiple copies are now delivered.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our voting securities by (i) any person or group owning more than 5% of any class of voting securities, (ii) each director, (iii) our Chief Executive Officer, President and Chief Financial Officer, and (iv) all executive officers and directors as a group as of January 12, 2015.

Amount and Nature of Beneficial Ownership

|

Name of Beneficial Owner

|

|

Number of Shares Beneficially

Owned (1) |

|

|

Preferred

Stock (2) |

|

|

Warrants |

|

|

Total Shares Beneficially Owned (6) |

|

|

Percent of

Class (7) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Darren Dulsky (3)

|

|

|

24,883,823

|

|

|

|

0

|

|

|

|

25,633,821

|

|

|

|

50,517,644

|

|

|

|

3.4

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ronald Heineman (3)(4)

Chief Executive Officer

|

|

|

24,883,823

|

|

|

|

1,000

|

|

|

|

25,633,821

|

|

|

|

50,517,644

|

|

|

|

54.4

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Henry Fong (2)(5)(6)(7)

Chief Financial Officer

|

|

|

0

|

|

|

|

70,715

|

|

|

|

|

|

|

|

4,950,050

|

|

|

|

0.3

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All Executive Officers and Directors as a Group

(2 persons) (2)(3)(4)(5)(6)(7)

|

|

|

24,883,823

|

|

|

|

71,715

|

|

|

|

25,633,821

|

|

|

|

55,467,694

|

|

|

|

54.6

|

%

|

_________________

|

(1)

|

As of January 12, 2015, 1,478,720,693 shares of our common stock were outstanding. Beneficial ownership is determined in accordance with the rules of the SEC, and includes general voting power and/or investment power with respect to securities. Shares of common stock subject to options or warrants currently exercisable or exercisable within 60 days of the record date are deemed outstanding for computing the beneficial ownership percentage of the person holding such options or warrants but are not deemed outstanding for computing the beneficial ownership percentage of any other person. Except as indicated by footnote, the persons named in the table above have the sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them.

|

|

|

|

|

(2)

|

In March 2011, the Company authorized the issuance of up to 100,000 shares of $0.001 par value Series A Convertible Voting Preferred Stock (the "Series A Preferred") of which there were 96,623 shares outstanding as of December 31, 2014. Each share of Series A Preferred is convertible into 70 shares of common stock. If all shares of Series A Preferred were to be converted to shares of common stock as of December 31, 2014, a total of 6,763,610 shares would be issued to the holders of the Series A Preferred including 4,950,050 that would be beneficially owned by Mr. Fong through his wife. The Series A Preferred also carries voting rights on an "as if converted" basis.

|

|

|

|

|

|

In September 2014, the Company authorized the issuance of up to 1,000 shares of $0.001 par value Series D Preferred Stock. The Mr. Heineman as holder of the Series D Preferred Stock is entitled to cast 51% of the vote on any matter submitted to the shareholders of the Company.

|

|

|

|

|

(3)

|

Includes warrants exercisable until October 2018 at the following exercise prices: 8,544,607 at $0.015; 8,544,607 at $0.02; and 8,544,607 at $0.025.

|

|

|

|

|

(4)

|

Includes 24,883,823 shares held by a trust owned by Mr. Heineman’s spouse.

|

|

|

|

|

(5)

|

Includes 70,715 shares of Series A Preferred Stock owned by a company controlled by Mr. Fong's spouse.

|

|

|

|

|

(6)

|

Includes 4,950,050 shares of common stock issuable upon conversion of Series A owned by Mr. Fong’s spouse

|

|

|

|

|

(7)

|

The Series D Preferred Stock held by Mr. Heineman has the right, voting as a class, to vote 51% of the vote on any and all shareholder matters. Therefore 51% is added to Mr. Heineman’s 3.4% ownership respresenting total voting power of 54.4%.

|

Information with respect to beneficial ownership is based upon information furnished by each shareholder or contained in filings made with the Securities and Exchange Commission. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities.

FINANCIAL AND OTHER INFORMATION

For detailed information on our corporation, including financial statements, you may refer to our Form l0-KSB and Forms 10-QSB filed with the SEC. Copies of these documents and other SEC filings are available on the SEC's EDGAR database at www.sec.gov.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed by the undersigned hereunto authorized.

|

Dated: January 12, 2015

|

|

/s/ Ronald Heineman

|

|

| |

|

Ronald Heineman, Chief Executive Officer

|

|

10

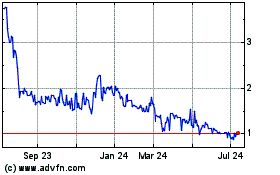

Integrated Ventures (QB) (USOTC:INTV)

Historical Stock Chart

From Mar 2024 to Apr 2024

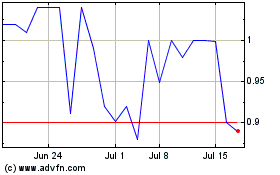

Integrated Ventures (QB) (USOTC:INTV)

Historical Stock Chart

From Apr 2023 to Apr 2024