UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

|

Check the appropriate box:

|

| |

|

o

|

Preliminary Information Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

x

|

Definitive Information Statement

|

|

NORTH BAY RESOURCES INC.

|

|

(Name of Registrant As Specified In Its Charter)

|

| |

|

Payment of Filing Fee (Check the appropriate box):

|

| |

|

x

|

No fee required

|

| |

|

o

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11

|

| |

|

(1)

|

Title of each class of securities to which transaction applies:

|

| |

|

| |

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

| |

|

| |

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| |

|

| |

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

| |

|

| |

|

|

(5)

|

Total fee paid:

|

| |

|

| |

|

|

o

|

Fee paid previously with preliminary materials.

|

| |

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

| |

|

(1)

|

Amount Previously Paid:

|

| |

|

| |

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

| |

|

| |

|

|

(3)

|

Filing Party:

|

| |

|

| |

|

|

(4)

|

Date Filed:

|

| |

|

NORTH BAY RESOURCES INC.

2120 Bethel Road

Lansdale, PA 19446

NOTICE OF STOCKHOLDER ACTION TAKEN BY WRITTEN CONSENT

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE NOT REQUESTED TO SEND US A PROXY

To our stockholders:

NOTICE IS HEREBY GIVEN that the board of directors of North Bay Resources Inc., a Delaware corporation (which we refer to in this Notice as the “Company,” “we,” “us” or “our”), has approved, and the holders of a majority of the voting power of our outstanding capital stock have executed a Written Consent and Action of Stockholders in Lieu of a Meeting approving an amendment to our Certificate of Incorporation to effectuate a 1-for-200 reverse stock split of the Company’s issued and outstanding shares of common stock (the “Common Stock”) (the “Reverse Stock Split”).

The accompanying information statement (the “Information Statement”) is being furnished to our stockholders of record as of January 2, 2015 (the “Record Date”) for informational purposes only, pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations promulgated thereunder. Under the Delaware General Corporation Law and our by-laws, stockholder action may be taken by written consent without a meeting of stockholders. The affirmative vote of at least a majority of the voting power of our outstanding capital stock is necessary to approve the increase in the authorized share count.

Your consent is not required and is not being solicited. The accompanying Information Statement will serve as notice pursuant to the Exchange Act and Section 228(e) of the Delaware General Corporation Law of the approval of the amendment to the Certificate of Incorporation by less than the unanimous written consent of our stockholders.

| |

By Order of the Board,

|

| |

|

| |

/s/: Perry Leopold

|

|

|

Lansdale, PA

|

Perry Leopold

|

|

January 16, 2015

|

Chairman of the Board

|

NORTH BAY RESOURCES INC.

2120 Bethel Road

Lansdale, PA 19446

INFORMATION STATEMENT

Pursuant to Section 14(c) of the Securities Exchange Act of 1934

THIS INFORMATION STATEMENT IS BEING SENT TO YOU FOR INFORMATION PURPOSES ONLY AND NO VOTE OR OTHER ACTION OF THE COMPANY’S STOCKHOLDERS IS REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT.

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE NOT REQUESTED TO SEND US A PROXY.

North Bay Resources Inc., a Delaware corporation (which we refer to in this Information Statement as the “Company,” “we,” “us” or “our”), is sending you this Information Statement for the purpose of informing you, as one of our stockholders of record as of January 2, 2015 (the “Record Date”), in the manner required under Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Regulation 14C promulgated thereunder, that our board of directors (the “Board”) has previously approved, and the holders of a majority of the voting power of our outstanding capital stock, as permitted by our by-laws and Section 228 of the Delaware General Corporation Law, have previously executed a Written Consent and Action of Stockholders in Lieu of a Meeting approving an amendment (the “Amendment”) to our Certificate of Incorporation to effectuate a 1-for-200 reverse stock split of the Company’s issued and outstanding shares of Common Stock (the “Reverse Stock Split”). The number of authorized shares and the par value of our Common Stock shall remain unchanged.

What action was taken by written consent?

We obtained stockholder consent for an amendment to our Certificate of Incorporation to effectuate a 1-for-200 Reverse Stock Split of the Company’s issued and outstanding shares of Common Stock.

The Reverse Stock Split will become effective on the date that we file the Certificate of Amendment to the Certificate of Incorporation of the Company (the “Amendment”) with the Secretary of State of the State of Delaware (the “Effective Date”). We intend to file the Amendment with the Secretary of State of the State of Delaware promptly after the twentieth (20th) day following the date on which this Information Statement is mailed to the Stockholders. Notwithstanding the foregoing, we are required to first notify FINRA of the intended Reverse Stock Split by filing the Issuer Company Related Action Notification Form no later than ten (10) days prior to the anticipated record date of such action.

We currently expect to file the Amendment on or about February 6, 2015. The form of Amendment to be filed with the Secretary of State of the State of Delaware is set forth as Appendix A to this information statement.

How many shares of voting stock were outstanding on January 2, 2015 (the “Record Date”)?

On the Record Date, the date we received the consent of our board of directors and the consent of the holders of a majority of the voting power of our outstanding capital stock, there were 1,832,698,209 shares of common stock outstanding, 4,000,000 shares of Series A Preferred Stock outstanding, and 100 shares of Series I Preferred Stock outstanding. Each outstanding share of the Series A Preferred Stock has 10 votes per share. The Series I Preferred Stock votes with the Common Stock as one class on all matters submitted to stockholders and are entitled to 80% of the aggregate voting power.

What vote was obtained to approve the amendment to the articles of incorporation described in this information statement?

We obtained the approval of the holders of 80.02% of the voting power of our outstanding capital stock.

Purposes of the Reverse Stock Split

The Company believes that the Reverse Stock Split will facilitate compliance with the new listing requirements of the OTCQB which went into effect in May, 2014, and which requires a company's stock to maintain a minimum bid price of $0.01. We also believe the Reverse Stock Split will enhance the acceptability of our Common Stock by institutional investors, the financial community and the investing public by increasing the trading price over what it would have been without the Reverse Stock Split. There can be no assurance, however, that our Common Stock will again be listed on the OTCQB or that any or all of these effects will occur.

Fractional Shares

No fractional shares of Common Stock will be issued as the result of the Reverse Stock Split. Instead, the Company will issue to the holders one additional share of Common Stock for each fractional share.

Principal Effects of the Reverse Stock Split

The Reverse Stock Split will not affect any stockholder's proportionate equity interest in the Company, except for negligible amounts resulting from the rounding up of fractional shares to the nearest whole share to avoid the issuance of fractional shares. The Reverse Stock Split will not affect the Company's total stockholder equity. All share and per share financial information would be retroactively adjusted following the Effective Date to reflect the Reverse Stock Split for all periods presented in future filings.

After the Reverse Stock Split, the Company's authorized but unissued and unreserved Common Stock will be approximately 6,360,144,108 shares of Common Stock, which will be available for future issuance by the board of directors without further action. The following table depicts the capitalization structure of the Company both pre-Reverse Stock Split and post-Reverse Stock Split as of the Record Date (the post-split shares of Common Stock may differ slightly based on the number of fractional shares):

|

Pre-Reverse Stock Split

|

| |

|

|

|

|

|

Authorized Shares of Common Stock

|

|

Issued Shares

|

|

Authorized but Unissued and Unreserved

|

|

7,500,000,000

|

|

1,832,698,209

|

|

263,301,791

|

| |

|

|

|

|

|

Post-Reverse Stock Split

|

| |

|

|

|

|

|

Authorized Shares

|

|

Issued Shares

|

|

Authorized but Unissued and Unreserved

|

|

7,500,000,000

|

|

9,163,491

|

|

6,360,144,108

|

The additional shares of Common Stock available for issuance by the Board could potentially be used for acquisitions, raising additional capital, stock options or other corporate purposes. The additional shares of Common Stock could be also used for potential strategic transactions, including, among other things, strategic partnerships and/or joint ventures, although there are no immediate plans to do so. Assurances cannot be provided that any such transactions will be consummated on favorable terms or at all, that they will enhance stockholder value or that they will not adversely affect the Company’s business or the trading price of the Common Stock. Any such issuance of additional shares of Common Stock could have the effect of diluting the earnings per share and book value per share of outstanding shares of Common Stock. Other than convertible notes and other agreements previously disclosed by the Company in its public filings, there is currently no plan, agreement or other understanding that could require the Company to issue shares of Common Stock.

The Company has a number of outstanding convertible promissory notes with variable pricing provisions that have matured or will mature in Q1 2015. If these notes are not repaid in cash and subsequently are converted to equity, the following table shows a summary as of the Record Date of the number of shares that may have to be issued at our expected post-split share price as of the anticipated Effective Date, and the number of shares that may need to be issued if our share price subsequently decreases by as much as 75%.

| |

|

|

Expected Share price on

effective post-split date ($)

|

|

|

25% decrease

in share price ($)

|

|

|

50% decrease

in share price ($)

|

|

|

75% decrease

in share price ($)

|

|

| |

Share price

|

|

$ |

|

|

|

|

0.02 |

|

|

$ |

0.015 |

|

|

$ |

0.01 |

|

|

$ |

0.005 |

|

|

Tangiers Note - Oct 2012

|

Issuance share price with Discount Applied (70%)

|

|

|

|

|

|

$ |

0.01400 |

|

|

$ |

0.01050 |

|

|

$ |

0.00700 |

|

|

$ |

0.00350 |

|

| |

Outstanding Balance Due

|

|

$ |

91,171 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Potential share issuance

|

|

|

|

|

|

|

6,512,214 |

|

|

|

8,682,952 |

|

|

|

13,024,429 |

|

|

|

26,048,857 |

|

|

JMJ Note - July 11, 2012

|

Issuance share price with Discount Applied (70%)

|

|

|

|

|

|

$ |

0.01400 |

|

|

$ |

0.01050 |

|

|

$ |

0.00700 |

|

|

$ |

0.00350 |

|

| |

Outstanding Balance Due

|

|

$ |

85,897 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Potential share issuance

|

|

|

|

|

|

|

6,135,500 |

|

|

|

8,180,667 |

|

|

|

12,271,000 |

|

|

|

24,542,000 |

|

|

Typenex Note - October 1, 2013

|

Issuance share price with Discount Applied (70%)

|

|

|

|

|

|

$ |

0.01400 |

|

|

$ |

0.01050 |

|

|

$ |

0.00700 |

|

|

$ |

0.00350 |

|

| |

Outstanding Balance Due

|

|

$ |

91,171 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Potential share issuance

|

|

|

|

|

|

|

6,512,214 |

|

|

|

8,682,952 |

|

|

|

13,024,429 |

|

|

|

26,048,857 |

|

|

LG Note 2 - February 3, 2014

|

Issuance share price with Discount Applied (70%)

|

|

|

|

|

|

$ |

0.01400 |

|

|

$ |

0.01050 |

|

|

$ |

0.00700 |

|

|

$ |

0.00350 |

|

| |

Outstanding Balance Due

|

|

$ |

33,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Potential share issuance

|

|

|

|

|

|

$ |

2,357,143 |

|

|

|

3,142,857 |

|

|

|

4,714,286 |

|

|

|

9,428,571 |

|

|

LG Note 3 - March 13, 2014

|

Issuance share price with Discount Applied (70%)

|

|

|

|

|

|

$ |

0.01400 |

|

|

$ |

0.01050 |

|

|

$ |

0.00700 |

|

|

$ |

0.00350 |

|

| |

Outstanding Balance Due

|

|

$ |

38,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Potential share issuance

|

|

|

|

|

|

|

2,750,000 |

|

|

|

3,666,667 |

|

|

|

5,500,000 |

|

|

|

11,000,000 |

|

|

Beaufort Note - March 27, 2014

|

Issuance share price with Discount Applied (70%)

|

|

|

|

|

|

$ |

0.01400 |

|

|

$ |

0.01050 |

|

|

$ |

0.00700 |

|

|

$ |

0.00350 |

|

| |

Outstanding Balance Due

|

|

$ |

1,640 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Potential share issuance

|

|

|

|

|

|

|

117,143 |

|

|

|

156,190 |

|

|

|

234,286 |

|

|

|

468,571 |

|

|

Caeser Note - April 10, 2014

|

Issuance share price with Discount Applied (70%)

|

|

|

|

|

|

$ |

0.01400 |

|

|

$ |

0.01050 |

|

|

$ |

0.00700 |

|

|

$ |

0.00350 |

|

| |

Outstanding Balance Due

|

|

$ |

34,486 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Potential share issuance

|

|

|

|

|

|

|

2,463,286 |

|

|

|

3,284,381 |

|

|

|

4,926,571 |

|

|

|

9,853,143 |

|

|

WHC Note - April 21, 2014

|

Issuance share price with Discount Applied (70%)

|

|

|

|

|

|

$ |

0.01400 |

|

|

$ |

0.01050 |

|

|

$ |

0.00700 |

|

|

$ |

0.00350 |

|

| |

Outstanding Balance Due

|

|

$ |

30,259 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Potential share issuance

|

|

|

|

|

|

|

2,161,357 |

|

|

|

2,881,810 |

|

|

|

4,322,714 |

|

|

|

8,645,429 |

|

|

Typenex Note 2 - May 8, 2014

|

Issuance share price with Discount Applied (70%)

|

|

|

|

|

|

$ |

0.01400 |

|

|

$ |

0.01050 |

|

|

$ |

0.00700 |

|

|

$ |

0.00350 |

|

| |

Outstanding Balance Due

|

|

$ |

150,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Potential share issuance

|

|

|

|

|

|

|

10,714,286 |

|

|

|

14,285,714 |

|

|

|

21,428,571 |

|

|

|

42,857,143 |

|

|

LG Note 4 - May 9, 2014

|

Issuance share price with Discount Applied (70%)

|

|

|

|

|

|

$ |

0.01400 |

|

|

$ |

0.01050 |

|

|

$ |

0.00700 |

|

|

$ |

0.00350 |

|

| |

Outstanding Balance Due

|

|

$ |

37,400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Potential share issuance

|

|

|

|

|

|

|

2,671,429 |

|

|

|

3,561,905 |

|

|

|

5,342,857 |

|

|

|

10,685,714 |

|

|

JSJ Note - July 14 , 2014

|

Issuance share price with Discount Applied (58%)

|

|

|

|

|

|

$ |

0.01160 |

|

|

$ |

0.00870 |

|

|

$ |

0.00580 |

|

|

$ |

0.00290 |

|

| |

Outstanding Balance Due

|

|

$ |

100,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Potential share issuance

|

|

|

|

|

|

|

8,620,690 |

|

|

|

11,494,253 |

|

|

|

17,241,379 |

|

|

|

34,482,759 |

|

|

KBM Note - Aug 6 , 2014

|

Issuance share price with Discount Applied (75%)

|

|

|

|

|

|

$ |

0.015000 |

|

|

$ |

0.011250 |

|

|

$ |

0.007500 |

|

|

$ |

0.003750 |

|

| |

Outstanding Balance Due

|

|

$ |

83,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Potential share issuance

|

|

|

|

|

|

|

5,566,667 |

|

|

|

7,422,222 |

|

|

|

11,133,333 |

|

|

|

22,266,667 |

|

|

RSL Note - Aug 7 , 2014

|

Issuance share price with Discount Applied (80%)

|

|

|

|

|

|

$ |

0.01600 |

|

|

$ |

0.01200 |

|

|

$ |

0.00800 |

|

|

$ |

0.00400 |

|

| |

Outstanding Balance Due

|

|

$ |

20,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Potential share issuance

|

|

|

|

|

|

|

1,250,000 |

|

|

|

1,666,667 |

|

|

|

2,500,000 |

|

|

|

5,000,000 |

|

|

JMJ 2 - Sept 3, 2014

|

Issuance share price with Discount Applied (70%)

|

|

|

|

|

|

$ |

0.01400 |

|

|

$ |

0.01050 |

|

|

$ |

0.00700 |

|

|

$ |

0.00350 |

|

| |

Outstanding Balance Due

|

|

$ |

75,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Potential share issuance

|

|

|

|

|

|

|

5,357,143 |

|

|

|

7,142,857 |

|

|

|

10,714,286 |

|

|

|

21,428,571 |

|

|

KBM 2 - Sept 3, 2014

|

Issuance share price with Discount Applied (75%)

|

|

|

|

|

|

$ |

0.015000 |

|

|

$ |

0.011250 |

|

|

$ |

0.007500 |

|

|

$ |

0.003750 |

|

| |

Outstanding Balance Due

|

|

$ |

48,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Potential share issuance

|

|

|

|

|

|

|

3,200,000 |

|

|

|

4,266,667 |

|

|

|

6,400,000 |

|

|

|

12,800,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Shares

|

|

|

|

|

|

|

|

66,389,071 |

|

|

|

88,518,761 |

|

|

|

132,778,141 |

|

|

|

265,556,282 |

|

|

Potential % increase in dilution

|

|

|

|

|

|

|

|

724.50 |

% |

|

|

965.99 |

% |

|

|

1448.99 |

% |

|

|

2897.98 |

% |

Procedure for Effecting Reverse Stock Split and Exchange of Stock Certificates

We anticipate that the Reverse Stock Split will become effective on February 6, 2015, or as soon thereafter as is reasonably practicable (the “Effective Date”). Beginning on the Effective Date, each stock certificate representing pre-Reverse Stock Split shares of Common Stock will be deemed for all corporate purposes to evidence ownership of post-Reverse Stock Split shares of Common Stock.

Our transfer agent, Colonial Stock Transfer, will act as exchange agent (the “Exchange Agent”) for purposes of implementing the exchange of stock certificates. Holders of pre-Reverse Stock Split shares of Common Stock are asked to surrender to the Exchange Agent stock certificates representing pre-Reverse Stock Split shares of Common Stock in exchange for stock certificates representing post-Reverse Stock Split shares of Common Stock in accordance with the procedures set forth in the letter of transmittal enclosed with this Information Statement. No new stock certificates will be issued to a Stockholder until such Stockholder has surrendered the outstanding stock certificate(s) held by such Stockholder, together with a properly completed and executed letter of transmittal.

Stockholders whose shares are held in brokerage accounts or in a street name need not submit Old Common Stock certificates for exchange as those shares will automatically reflect the new share amount based on the Reverse Stock Split. Any stockholder whose Old Common Stock certificate has been lost, destroyed or stolen will be entitled to issuance of a New Common Stock certificate upon compliance with such requirements as the Company and the Exchange Agent customarily apply in connection with lost, stolen or destroyed certificates.

Further, prior to filing the amendment to the Certificate of Incorporation reflecting the Reverse Stock Split, we intend to notify the Financial Industry Regulatory Authority (“FINRA”) by filing the Issuer Company Related Action Notification Form no later than ten (10) days prior to our anticipated effective date of February 6, 2015, for the Reverse Stock Split.

STOCKHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATES AND SHOULD NOT SUBMIT ANY CERTIFICATES WITHOUT THE LETTER OF TRANSMITTAL.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following tables set forth certain information regarding the beneficial ownership of our Common Stock as of January 2, 2015, of (i) each person known to us to beneficially own more than 10% of Common Stock, (ii) our directors, (iii) each named executive officer, and (iv) all directors and named executive officers as a group. As of January 2, 2015, there were a total of 1,832,698,209 shares of Common Stock outstanding. Each share of Common Stock is entitled to one vote on matters on which holders of voting stock of the Company are eligible to vote. The column entitled “Percentage of Outstanding Common Stock” shows the percentage of voting common stock beneficially owned by each listed party.

The number of shares beneficially owned is determined under the rules promulgated by the SEC, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under those rules, beneficial ownership includes any shares as to which a person or entity has sole or shared voting power or investment power plus any shares which such person or entity has the right to acquire within sixty (60) days of January 2, 2015, through the exercise or conversion of any stock option, convertible security, warrant or other right. Unless otherwise indicated, each person or entity named in the table has sole voting power and investment power (or shares such power with that person’s spouse) with respect to all shares of capital stock listed as owned by that person or entity.

|

Title Of Class

|

|

Name And Address Of Beneficial Owner (1)

|

|

Amount And Nature

Of Beneficial

Ownership (2)

|

|

Approximate

Ownership

Percent of

Class (%)**

|

|

|

Total

Voting

Percent of

Class (%)**

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All executive officers and directors as a group (2 persons)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

** The percentages listed for each shareholder assume the exercise or exchange by that shareholder only, of his or its entire convertible or exchangeable security (including options or warrants), as the case may be, and thus include the shares underlying said convertible or exchangeable security (including options or warrants). However, the percentages do not assume the exercise of all convertible or exchangeable securities (including options or warrants) by all the shareholders holding such securities.

|

(1)

|

The address for the above identified officers and directors of the Company is c/o North Bay Resources Inc., 2120 Bethel Road, Lansdale, PA 19446.

|

|

(2)

|

Mr. Leopold, the Company’s CEO and Chairman owns 4,000,000 shares of the Company’s Series A Preferred Stock. Each outstanding share of the Series A Preferred Stock has 10 votes per share, and may be converted to shares of common at a ratio of 5 to 1, which would thus convert to 20,000,000 shares of common stock. The Series A Preferred Stock was issued in August 2009. Mr. Leopold is prohibited from converting any of his Preferred Stock without providing the Company with at least 61 days advance notice.

|

|

(3)

|

Mr. Leopold owns 100 shares of the Company’s Series I Preferred Stock. Each outstanding share of the Series I Preferred Stock represents its proportionate share of eighty per cent (80%) of all votes entitled to be voted and which is allocated to the outstanding shares of Series I Preferred Stock. These shares are not convertible into common stock or any commodities. The Series I Preferred Stock was issued in February 2007. These shares were issued our Chief Executive Officer, Mr. Perry Leopold, in February 2007 as an anti-takeover measure to insure that Mr. Leopold maintains control of the Company during periods when the Company’s stock may be severely undervalued and subject to hostile takeover in the open market. As specified in the Certificate of Designation filed by the Company with the Delaware Secretary of State in February 2007, ”the outstanding shares of Series I Preferred Stock shall vote together with the shares of common stock of the Corporation as a single class and, regardless of the number of shares of Series I Preferred Stock outstanding and as long as at least one of such shares of Series I Preferred Stock is outstanding, shall represent eighty percent (80%) of all votes entitled to be voted at any annual or special meeting of shareholders of the Corporation or action by written consent of shareholders. Each outstanding share of the Series I Preferred Stock shall represent its proportionate share of the 80% that is allocated to the outstanding shares of Series I Preferred Stock. The Series I preferred shares supersede any other shares that Mr. Leopold may own so that any additional securities that Mr. Leopold may own do not increase his 80% voting rights, and are therefore included within the 80%.

|

Voting Power of Principal Stockholders and Officers

The following table sets forth information as of the Record Date and the date of this Information Statement, with respect to the beneficial ownership of our Officers and Directors and their associated voting power of the common stock holders:

| |

|

Common Stock

|

|

Percent

|

|

|

Series I Preferred

|

|

Percent

|

|

Total

|

|

|

|

Name

|

|

Number of Shares

|

|

of Class

|

|

|

Number of Shares

|

|

of Class

|

|

Voting Power

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Includes 22,130,228 shares of common stock and 4,000,000 shares of the Company’s Series A Preferred Stock owned by Mr. Leopold, the Company’s CEO and Chairman. Each outstanding share of the Series A Preferred Stock has 10 votes per share, and may be converted to shares of common at a ratio of 5 to 1, which would thus convert to 20,000,000 shares of common stock. The Series A Preferred Stock was issued in August 2009. Mr. Leopold is prohibited from converting any of his Preferred Stock without providing the Company with at least 61 days advance notice.

|

|

(2)

|

Mr. Leopold owns 100 shares of the Company’s Series I Preferred Stock. Each outstanding share of the Series I Preferred Stock represents its proportionate share of eighty per cent (80%) of all votes entitled to be voted and which is allocated to the outstanding shares of Series I Preferred Stock. These shares are not convertible into common stock or any commodities. The Series I Preferred Stock was issued in February 2007.

|

DISSENTER’S RIGHTS

Under the Delaware General Corporate Law, holders of shares of common stock are not entitled to dissenters’ rights with respect to any aspect of the Amendment, and we will not independently provide holders with any such right.

FORWARD-LOOKING STATEMENTS AND INFORMATION

This Information Statement includes forward-looking statements. You can identify the Company’s forward-looking statements by the words “expects,” “projects,” “believes,” “anticipates,” “intends,” “plans,” “predicts,” “estimates” and similar expressions.

The forward-looking statements are based on management’s current expectations, estimates and projections about us. The Company cautions you that these statements are not guarantees of future performance and involve risks, uncertainties and assumptions that we cannot predict. In addition, the Company has based many of these forward-looking statements on assumptions about future events that may prove to be inaccurate. Accordingly, actual outcomes and results may differ materially from what the Company has expressed or forecast in the forward-looking statements.

You should rely only on the information the Company has provided in this Information Statement. The Company has not authorized any person to provide information other than that provided herein. The Company has not authorized anyone to provide you with different information. You should not assume that the information in this Information Statement is accurate as of any date other than the date on the front of the document.

EXPENSE OF INFORMATION STATEMENT

The expenses of this Information Statement will be borne by us, including expenses in connection with the preparation and availability of this Information Statement and all related materials. It is contemplated that brokerage houses, custodians, nominees, and fiduciaries will be requested to forward this Information Statement to the beneficial owners of our common stock held of record by such person and that we will reimburse them for their reasonable expenses incurred in connection therewith. Additional copies of this Information Statement may be obtained at no charge by writing us at: 2120 Bethel Road, Lansdale, PA 19446, Attn: Corporate Secretary.

DELIVERY OF INFORMATION TO A SHARED ADDRESS

If you and one or more stockholders share the same address, it is possible that only one Information Statement was delivered to your address. Any registered shareholder who wishes to receive a separate copy of the Information Statement at the same address now or in the future may mail a request to receive separate copies to the Company at 2120 Bethel Road, Lansdale, PA 19446, Attn: Corporate Secretary, or call the Company at (215) 661-1100 and we will promptly deliver the Information Statement to you upon your request. Stockholders who received multiple copies of this Information Statement at a shared address and who wish to receive a single copy may direct their request to the same address.

ADDITIONAL INFORMATION

The Company will provide upon request and without charge to each shareholder receiving this Information Statement a copy of the Company's Annual Report on Form 10-K filed on March 17, 2014, as amended, which includes audited financial statements for the period ended December 31, 2013 and 2012 and the quarterly reports on Form 10-Q for the quarters ended March 31, 2014, June 30, 2014, and September 30, 2014, including the financial statements and financial statement schedule information included therein, as filed with the Commission. The Company is subject to the informational requirements of the Exchange Act, and in accordance therewith files reports, proxy statements and other information including annual and quarterly reports on Form 10-K and 10-Q (the “1934 Act Filings”) with the Commission. Reports and other information filed by the Company can be inspected and copied at the public reference facilities maintained at the Commission at 100 F Street, N.E., Washington, DC 20549. Copies of such material can be obtained upon written request addressed to the Commission, Public Reference Section, 100 F Street, N.E., Washington, D.C. 20549, at prescribed rates. The Commission maintains a web site on the Internet (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the Commission through the Electronic Data Gathering, Analysis and Retrieval System (“EDGAR”). Please call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference facilities.

| |

By Order of the Board,

|

| |

|

|

| |

/s/: Perry Leopold

|

|

|

Lansdale, PA

|

Perry Leopold

|

|

January 16, 2015

|

Chairman of the Board

|

Appendix A

STATE OF DELAWARE

CERTIFICATE OF AMENDMENT

OF CERTIFICATE OF INCORPORATION

The corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware does hereby certify:

FIRST: That at a meeting of the Board of Directors of North Bay Resources Inc. resolutions were duly adopted setting forth a proposed amendment of the Certificate of Incorporation of said corporation, declaring said amendment to be advisable and calling a meeting of the stockholders of said corporation for consideration thereof. The resolution setting forth the proposed amendment is as follows:

RESOLVED, that the Certificate of Incorporation of this corporation be amended by changing the Article thereof numbered "FOURTH" so that, as amended, the paragraph below shall be inserted immediately following the first paragraph of said Article and shall read as follows:

“At the initial date and time of the effectiveness of this Certificate of Amendment (the “Reverse Stock Split Effective Time”), the following recapitalization (the “Reverse Stock Split”) shall occur: each two hundred (200) shares of Common Stock of the Corporation issued and outstanding immediately prior to the Reverse Stock Split Effective Time shall be exchanged and combined into one (1) share of Common Stock. The Reverse Stock Split will be effected on a certificate-by-certificate basis, and any fractional shares resulting from such combination shall be rounded up to the nearest whole share on a certificate-by-certificate basis. The Reverse Stock Split shall occur automatically without any further action by the holders of the shares of Common Stock affected thereby.”

SECOND: That thereafter, pursuant to resolution of its Board of Directors, a special meeting of the stockholders of said corporation was duly called and held upon notice in accordance with Section 222 of the General Corporation Law of the State of Delaware at which meeting the necessary number of shares as required by statute were voted in favor of the amendment.

THIRD: That said amendment was duly adopted in accordance with the provisions of Section 242 of the General Corporation Law of the State of Delaware.

IN WITNESS WHEREOF, said corporation has caused this certificate to be signed this __ day of ____, 2015.

|

By:

|

/s/ Perry Leopold

|

| |

Authorized Officer

|

| |

|

|

Title:

|

CEO/Chairman of the Board

|

| |

|

|

Name:

|

Perry Leopold

|

| |

Print or Type

|

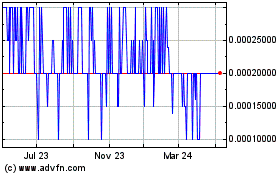

North Bay Resources (PK) (USOTC:NBRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

North Bay Resources (PK) (USOTC:NBRI)

Historical Stock Chart

From Apr 2023 to Apr 2024