UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 20, 2015 (January 16, 2015)

ALTISOURCE PORTFOLIO SOLUTIONS S.A.

(Exact name of Registrant as specified in its charter)

|

Luxembourg |

|

001-34354 |

|

98-0554932 |

|

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

40, avenue Monterey

L-2163 Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive offices including zip code)

+352 2469 7900

(Registrant’s telephone number, including area code)

NOT APPLICABLE

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

Altisource Portfolio Solutions S.A. (the “Company”) has made available on its corporate website (www.altisource.com) the transcript from its investor call which was held on January 16, 2015. A copy of the transcript dated January 16, 2015 is filed herewith as Exhibit 99.1.

Item 7.01 Regulation FD Disclosure.

The information set forth under Item 2.02 of this Current Report on Form 8-K and the transcript filed herewith as Exhibit 99.1 are incorporated herein by reference.

The Company is furnishing this Form 8-K pursuant to Item 2.02, “Results of Operations and Financial Condition” and Item 7.01, “Regulation FD Disclosure.” The information contained in this Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit No. |

|

Description |

|

|

|

|

|

Exhibit 99.1 |

|

Altisource Portfolio Solutions S.A. Investor Call Transcript Dated January 16, 2015 |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: January 20, 2015

|

|

Altisource Portfolio Solutions S.A. |

|

|

|

|

|

|

By: |

/s/ Michelle D. Esterman |

|

|

Name: |

Michelle D. Esterman |

|

|

Title: |

Chief Financial Officer |

3

Exhibit 99.1

Investor Call

Altisource Portfolio Solutions S.A.

January 16, 2015; 11:00 a.m. EST

Company:

Michelle Esterman; Altisource Portfolio Solutions S.A.; CFO

Bill Shepro; Altisource Portfolio Solutions S.A.; CEO

Participants:

Dain Haukos; Piper Jaffray; Analyst

Henry Coffey; Sterne, Agee & Leach; Analyst

Leon Cooperman; Omega Advisors

Ryan Zacharia; Jacobs Asset Management; Analyst

Fred Small; Compass Point Research; Analyst

Ramin Kamali; Credit Suisse; Analyst

Evan Tindell; Ballentine Capital Management; Analyst

Larry Kossove; Tribe Capital; Analyst

Operator: Good day, ladies and gentlemen, welcome to the Altisource investor call. (Operator Instructions.) As a reminder this conference call is being recorded.

I will now introduce your host for today’s conference, Michelle Esterman, Chief Financial Officer. Please go ahead.

Michelle Esterman: Thank you, operator. We first want to remind you that a slide presentation we will refer to in this call is available on our website at www.Altisource.com. This provides additional information investors may find useful.

Our presentation today contains forward-looking statements made pursuant to the Safe Harbor provisions of the federal securities law. Statements in this conference call and in our slide presentation which are other than historical fact are forward-looking statements. These statements include those regarding future events, our Company performance or estimates or projections related to the future. Factors that might cause actual results to differ materially are discussed in our slide presentation. The Company disclaims any intent or obligation to publicly update or revise any forward-looking statements, regardless of whether new information becomes available, future developments occur or otherwise.

Our presentation today also includes estimates related to our fourth-quarter 2014 and full-year 2014 results. These estimates are unaudited and represent the most current information available to management. Since we have not yet completed our closing procedures for the quarter ended December 31, 2014, these estimates are preliminary, are based on management’s internal estimates, and are subject to further internal review by management and approval by our audit committee.

1

There can be no assurance that final fourth-quarter or full-year results will not differ materially from these estimated results. Accordingly, you should not place undue reliance on these estimates.

During the course of closing our financial statements for the quarter ended and year ended December 31, 2014, we may identify items that would require us to make adjustments that may be material to the results described in this presentation, and as a result, these estimates are subject to the risks and uncertainties inherent in forward-looking statements.

Joining me for today’s call is Bill Shepro, our Chief Executive Officer. In light of recent events, we wanted to provide an update to you on Altisource and our strategy. This morning Bill plans to discuss Altisource’s pricing to Ocwen for its services, our vision for the future of Altisource and our commitment to compliance. I will discuss Altisource’s preliminary, unaudited fourth quarter 2014 financial results, 2015 financial scenarios and our capital allocation plans.

Following the prepared remarks, we will also provide an opportunity for questions and answers. We believe that this will give you a better understanding of Altisource’s earnings power going forward.

I would now like to turn the call over to Bill.

Bill Shepro: Good morning and thank you for joining today’s call. Before we get into our presentation, we recognize that it has been a trying time for Altisource’s investors and employees. The leadership team is committed and more focused than ever on our diversification and growth initiatives while supporting Ocwen. I want to emphasize that we believe we have exciting opportunities on the horizon with our set of strategic growth initiatives as well as our ongoing business with Ocwen. We will discuss this growth strategy a bit later in the call but, at a high level, we are confident in our leadership team’s ability to execute against our growth initiatives and develop shareholder value.

I would also like to comment on our recent announcement that our Chairman, Bill Erbey, is stepping down from the Altisource Board. Bill leaves the Board and the Company in highly capable hands and well-positioned to execute on our vision to be a premier real estate and mortgage marketplace. We are very appreciative of Bill’s contributions and inspiration during his tenure.

Timo Vatto, our new Chairman, has been a member of the Altisource Board of Directors since 2009. Timo has a strong knowledge of the business and a deep appreciation of our customer-centric approach to building a diversified client base to increase long-term shareholder value.

Turning to Altisource’s pricing to Ocwen. A recent analyst report has generated a lot of confusion on this topic and whether Altisource will need to reduce its pricing to Ocwen. Let me start by saying that we strive to provide services to Ocwen at rates comparable to the market and we firmly believe we charge Ocwen market rates for those services. Altisource has a long-term agreement with Ocwen that runs through 2025. The agreement provides that both Altisource and Ocwen have the ability to renegotiate pricing based on prevailing market

2

conditions. Further, Ocwen’s recent settlement with the DFS requires Ocwen to conduct market studies on the services Altisource provides. We welcome this requirement, agree that our pricing should be in line with market and firmly believe that it is.

We believe this because we have and will continue to conduct pricing studies. We have compared Altisource’s fees for its services to Ocwen with the fees the servicing platforms to Ocwen acquired were paying for similar services to fees of Altisource’s competitors to fees set forth by other servicers including the GSEs and medium and large commercial bank servicers as set forth in their public guidelines or on their websites and the fees that we charge other customers. We have found that there is a range of prices charged in the marketplace for our services and that our prices are comparable with the market when you compare like to like services.

Of course as with any relationship between a vendor and its customer, there has been in the past and there continues to be price negotiations between Ocwen and us. We are not aware of any changes as a result of these negotiations that would have a material impact on our financial results. We are confident in the fact that our pricing is in line with market but we should take a moment to address the claims made by some that our revenue and earnings could be materially impacted by a market-driven change to our pricing for certain of our services.

We believe these claims are based on either factually incorrect statements or the comparison of two different services on the improper assumption that the services are the same. While there are other examples of this, let me give you two we think are illustrative and useful.

With respect to Hubzu, improper comparisons have been made between real estate brokerage commissions paid by the seller and auction fees referred to as buyer’s premiums paid by the buyer. These are two distinct and different services and there is a different market price for each. One flawed statement made is that because Fannie Mae pays real estate agents 2.5% to list its properties for sale, Hubzu is going to need to reduce its buyer’s premium from 4.5% to 2.5%. This is incorrect. The reality is that Hubzu’s 4.5% buyer’s premium is already priced lower than the market’s 5% buyer’s premium.

For example, Auction.com, one of the largest and most widely used REO auction sites in the country markets REO for Fannie Mae and other large banks for a 5% buyer’s premium and a $2,500 minimum. In contrast, Hubzu charges less with a 4.5% buyer’s premium and a $625 minimum.

The second example relates to Altisource’s short sale service. The incorrect statement in this case is that all Ocwen short sales are required to be marketed for sale on Hubzu and that Altisource acts as the listing agent for all of these homes. For example in the fourth quarter of 2014, only 11% of Ocwen’s completed short sales were marketed on Hubzu and Altisource does not act as the listing agent for short sales.

More importantly Altisource’s short sale program has been a great success demonstrating that the increased transparency of an auction drives better outcomes. In fact in the fourth quarter of 2014, 53% of the short sale homes that sold on Hubzu generated an average of $17,000

3

more per home in proceeds to the homeowner and mortgage investors than the initial offer presented to Ocwen and most of the remaining 47% sold for an amount equal to the original offer.

As our largest customer, Ocwen is very important to us. We are committed to supporting Ocwen and complying with a consent agreement with the New York Department of Financial Services and we take our obligation to provide high-quality compliant and market rate services very seriously.

The second topic for today is our vision for the future of Altisource. While the growth we anticipated to experience through Ocwen has been muted, we have tremendous opportunities in front of us from our growth initiatives. First, Ocwen remains a very important component of our business and its existing non-GSE portfolio should provide a long runway of earnings for Altisource. As you can see on slide 2 using the assumptions outlined on slide 11, we estimate that Ocwen’s non-GSE portfolio generates service revenue for Altisource of $2.1 billion over the next five years.

Second, we have dedicated more resources to advance our customer diversification and growth initiatives. While we have been working on our growth initiatives for some time, we have historically had to balance this activity with the need to support Ocwen during a period of its own rapid growth. Given our current expectations relative to Ocwen going forward, we are increasing our focus on our strategic initiatives.

Turning to slide 3, I will briefly provide a description of each of these four initiatives. Our first initiative is expanding our innovative online real estate marketplace. The real estate market is large with approximately 5 million homes sold per year and approximately $50 billion of commissions related to these transactions. Most buyers and sellers of homes are using the Internet in some capacity during the home purchase or sales process and with Hubzu, Owners.com, and our other real estate services, we believe we can provide a compelling offering to help buyers and sellers of homes transact more easily and with greater transparency.

Our second initiative is growing our origination services and technologies. There is a tremendous opportunity to develop and distribute products to the Lenders One members in the largely underserved non-agency market as only approximately 40% of American households can qualify for an agency mortgage. The Lenders One members represent approximately 17% of the largely agency lending market and with the banks withdrawing from non-agency lending, the members have the potential to significantly increase their marketshare. The Lenders One members join the cooperative to make more money and we believe we have a largely untapped opportunity to strengthen the members’ competitive advantages and profitability through the use of Altisource’s and the preferred vendors’ services and technology.

Our third initiative is attracting new clients to our comprehensive default related businesses. This is also a very large market with close to 50 million outstanding mortgages in the United States and a percentage of these loans will always be delinquent even as the market returns to historical delinquency levels. We are one of only a few national service providers with an end-

4

to-end suite of default related offerings and technologies combined with a very strong focus on compliance and quality.

Our final initiative is growing our property management and renovation services business which today can provide renovation, repair and maintenance services in over 200 greater metropolitan areas. There remains a very large number of residential homes in banks and servicers’ portfolios that are not eligible for FHA and VA financing because of their current state of disrepair. This creates a significant value arbitrage by repairing these homes to meet the FHA or VA financing requirements. This expands the buyer pool for these homes to include first-time homebuyers. It also helps improve neighborhoods.

While there is a lot of work to be done with these initiatives and there is no certainty we will succeed, we are optimistic and excited about each of these initiatives. Slide 4 sets forth the 2015 milestones we have established for each of these initiatives. Additionally, slides 12 and 13 provide information to assist you in developing your perspective on our 2015 service revenue and earnings. Michelle will discuss these further in a couple of minutes.

To achieve our strategic initiatives and grow Altisource with a diversified customer base, we have made key hires and established cross-functional teams that share common goals related to each of these initiatives. In this regard, this past September we hired Barbara Goose as our Chief Marketing Officer and this month we installed John Vella, a senior leader in the Equator business, as Altisource’s Chief Revenue Officer. With John’s deep industry experience, strong relationships and leadership skills, we are confident that the sales and marketing organizations and our very talented business unit leaders across the Altisource organization will develop the sales to drive our diversification initiatives.

The last topic I will cover is our commitment to providing compliant services and enhancing our compliance management system. Compliance is a central point of focus for our leadership team, business managers and operations personnel, all of whom are evaluated on compliance.

As a testament to our disciplined customer and compliance focus, we are pleased to have recently received an A+ accreditation from the Better Business Bureau for Nationwide Credit, one of our two businesses in the Financial Services segment and one of the larger asset recovery management companies in the United States.

I will now turn the call over to Michelle to discuss our financial results, 2015 financial scenarios and our capital allocation plans. Michelle?

Michelle Esterman: Thank you, Bill. The first topic I’ll discuss this morning is our fourth-quarter 2014 preliminary unaudited financial results. We plan to report Altisource’s complete fourth quarter and full year 2014 results next month. As you can see on slide 5, we estimate that fourth quarter 2014 service revenue is between $215 million and $225 million and pretax income attributable to Altisource is between zero and $4 million. Adding back amortization of intangible assets, adjusted pretax income attributable to Altisource in the fourth quarter of 2014 is between $9 million and $13 million.

5

We are not pleased with these results. At a very high level, outside of the discontinuation of the lender placed insurance business and the seasonally slower property inspection and preservation business, the decline in pretax income reflects comparatively higher costs, partially as a result of the money we spent to support our anticipated business growth and not a decline in revenue. To quickly address the change in our expectations for Ocwen’s growth and our initiatives, we’ve developed and started to execute on our plan that includes eliminating non-revenue-generating businesses, reducing vendor fees and eliminating staff to reduce costs. We have a very specific plan for expense reductions including the recent elimination of over 800 individual employee positions and hundreds of contractors across our geographical footprint.

If the plan had been complete at the beginning of the fourth quarter of 2014, we estimate that our expenses would have been approximately $20 million lower in the fourth quarter of 2014 and once fully implemented, we anticipate this to be a reasonable quarterly savings going forward.

We expect to substantially complete the implementation of our plan during the first quarter of 2015 and we will be a leaner organization, more focused on a smaller number of high impact initiatives. We believe that by rationalizing our initiatives we have a higher probability of success.

Turning to service revenue, fourth quarter 2014 service revenue of between $215 million and $225 million is lower than third quarter 2014 service revenue of $248 million. The decline in service revenue from the third quarter of 2014 primarily relates to the November 2014 discontinuation of the lender placed insurance brokerage business and the seasonal slowdown in the property inspection and preservation business.

Pretax income for the fourth quarter of 2014 has been impacted by a few key factors. Compared to the third quarter of 2014, the decline in pretax income is from lower service revenue, $8 million of higher costs in our Technology Services segment in part related to initiatives that experienced accelerated spending during the fourth quarter of 2014, and $11 million of higher bad debt expense primarily in our default management business. We recognized unusually high bad debt expense in the default management business generally as a result of a change in our customers’ business model and fourth quarter discussions with these customers that led us to believe that a portion of the receivables balance is no longer collectible.

We are not happy with the fourth quarter 2014 results. We believe they are an outlier and we are very focused on improving our performance. Simply stated, our fourth quarter costs are not in line with our current vision and expected growth. Recognizing that Ocwen is not likely to grow that much in the near-term, we right-sized the organization and are realigning our expenses for this new reality. We anticipate our earnings to reflect the benefit of these initiatives in the second quarter of 2015.

Given these changes, we are providing you with two scenarios and related assumptions to assist you in developing your perspective of our 2015 service revenue and earnings. While not

6

guidance, we believe the range of assumptions presented are reasonable based on the information we have available today including price discussions we’ve had with Ocwen and our cost-reduction initiatives. As you can see on slide 6, if we achieve the average result of the Scenario A and Scenario B assumptions outlined on slides 12 and 13, 2015 service revenue would be $870 million. Applying the margin assumptions outlined on slide 13, the average 2015 pretax income of Scenario A and Scenario B would be $96 million and adjusted diluted earnings per share would be $6.18. As you would expect, we anticipate that the first quarter’s pretax income will be lower than the average for the year due to the timing of the expense savings and the realignment costs.

We close 2014 as a very financially strong Company. As of December 31, 2014, we had cash of approximately $160 million, a covenant-lite loan that matures in December 2020, and a business that generates a tremendous amount of operating cash flow.

Given our business prospects, the second topic I will discuss is our capital allocation plan. To maximize long-term shareholder value, we intend to return a portion of our cash to our shareholders through share repurchases while retaining excess cash flow in the company. We think that this approach makes the most sense as we believe that Altisource’s stock is trading at a substantial discount to value, our anticipated share repurchases do not materially change Altisource’s risk profile and share repurchases are more tax efficient than a dividend. Of course nothing is without risk. In reaching our conclusion, we considered the risks associated with the servicing industry and Ocwen in particular. While we believe there is a remote likelihood that these risks will have a material impact on Altisource, it is not impossible. Therefore we will be prudent in our execution of the share repurchase program and plan to retain cash to give us a long runway to achieve our initiatives.

For example if we purchase 2.5 million shares or 12% of our current outstanding shares at approximately the current price and achieve the midpoint of our scenarios, we estimate that our net debt at the end of 2015 will be approximately $350 million. Repurchasing 2.5 million shares would increase each shareholder’s ownership of the company by 14%. We currently have 1.1 million shares remaining under our current shareholder authorization. We intend to seek further approvals as needed for additional plans as may be required by Luxembourg law.

In closing, we recognize that it’s been a trying time for Altisource’s investors and employees. The leadership team is committed and more focused than ever on our diversification and growth initiatives. In addition we believe Ocwen’s business provides a long runway of earnings for Altisource. We feel very good about our business and prospects.

At this time we’d like to open up the call for questions. Operator?

Questions and Answers

Operator: (Operator Instructions). Dain Haukos, Piper Jaffray.

Dain Haukos: Hi guys. Thanks for taking my questions. I’m on for Mike today. Just a couple of questions here. I’m curious on the service revenue from the Ocwen non-agency you guys had

7

said that it would be about $551 million projected for 2015. How does that tie in with the various scenarios? I think you had about $804 million in Scenario A for the service revenue. Can you give us a little bit more color on what makes up the $253 million between those two?

Michelle Esterman: Sure. So what we’re showing on slide 2 represents only the non-GSE loans in Ocwen’s portfolio and as you can see in the scenarios, there are a number of other sources of revenue including our other businesses and our Technology Services segment, Equator, Mortgage Builder as well as our origination related business, our residential asset management business, etc.

Dain Haukos: Okay, and how much of those would be like — is the majority of that going to be coming from businesses that you’re working to develop now? Or is it already a given?

Bill Shepro: So if you look, there’s a slide I don’t know what the number is, but there is in other default related service revenue. That includes our institutional customers so the recent client we acquired earlier this year as we continue to ramp that up. Other service revenue also includes our insurance loss draft business which is live today, our rental business which is live today, our recent acquisition of Owners.com. And then in the Technology Services segment, that includes Equator, our marketplace solutions business and Mortgage Builder. So yes there is some new revenue built in there and some new sales but there’s also some revenue that’s already in place or that we expect to be in place.

Dain Haukos: That’s great. And then lastly, what are — how difficult is the process going to be to get the share buyback authorization increased? Michelle, I think you had said earlier that you would have to go back to Luxembourg law. What’s the hurdles in getting that increased?

Michelle Esterman: Sure. So it requires — the Luxembourg law allows for 15% authorization of our outstanding shares at the time of shareholder approval so we would have to go to our shareholders and seek approval in order to increase the authorization.

Dain Haukos: Okay. Great, thanks.

Operator: Henry Coffey, Sterne Agee.

Henry Coffey: Yes, good morning, everyone, and thank you for hosting the call here. I think — I know it’s not guidance but I think the indication of likely outcomes is useful. Are there any of the product areas you’re exploring that are vulnerable to the kind of sudden changes that we saw with the lender placed product where there’s a potential for some form of controversial product offering of some like or how carefully has that been — all this been vetted with the Board?

Bill Shepro: Yes, Henry, we feel very good about the products and services that we’re in today. And the answer is no, we’re not aware of anything.

Henry Coffey: And now with the Ocwen business, how deeply hooked into that business are you? For example, just imagine a scenario in which someone bought the non-agency servicing,

8

would that still — would the loss mitigation business still stay with you? Would it travel, would there be a breakup fee or is that the kind of thing where a servicer can decide on any given day who they want to use?

Bill Shepro: So we have an agreement with Ocwen where Ocwen retains Altisource for the services that we provide today and that agreement extends to 2025. And so that agreement for the most part, it obligates Ocwen to hire us and we have an obligation to perform. So if Ocwen were to sell, for example, the GSE servicing which they discussed that we would no longer earn revenue on that unless whoever acquired that servicing rights hired us.

Henry Coffey: So the contracts don’t travel with the servicing?

Bill Shepro: Not with a service transfer.

Henry Coffey: Yes, that’s what I was asking. And then finally in terms of vetting out your pricing structures, I mean all bombastic rhetoric aside, have you had a chance to meet with the likes of the New York Department of Financial Services to explain what you’re doing at Hubzu? Have they looked at and acknowledged the value that you create and accepted that? Have you had similar discussions with others state AGs and mortgage regulatory bodies or — while it all makes sense to us, it also has to make sense to them. What is the status of that?

Bill Shepro: Henry, we at Altisource need to do a better job of making sure we get the message out around what we charge and how it compares to market and why we believe we’re actually market or in some cases better than market as we described with respect to Hubzu. So the answer is we’re not having any specific conversations with New York about this but we are working on how we can do a better job to get our message out that our fees are in line with the range of market that we described.

Henry Coffey: Have you found any of the various consumer advocates that are actually cheering your role in this equation, a major group that we could point to?

Bill Shepro: I’m sorry, Henry. Can you ask the question again?

Henry Coffey: Is there a major consumer advocate group or state AG or state agency that’s actually looked at what you’re doing and applauded the effort and sees it as a positive solution?

Bill Shepro: Yes, we’ve had some conversations with the MLSs and they understand our solution and were fine with it. I’d also say, Henry, that we do this work for others today. We have other institutional clients that we provide these services for and the pricing is right in line with what we charge Ocwen and those were deals that we’ve negotiated over the last year. But we need to do a better job getting our message out. That’s part of why we are having the call today to get our message out better to the investor community but we also need to do the same thing with the regulators and other stakeholders.

9

Henry Coffey: And are there plans in place to do that?

Bill Shepro: Yes, we are working on doing that, absolutely.

Henry Coffey: Well listen, thank you very much for holding this call.

Operator: Leon Cooperman, Omega Advisors.

Leon Cooperman: I think you’ve addressed this question but because of the importance of the question I want to hear you talk about it a little bit more. And having a sense of humor, what I’m trying to figure out to be honest with you and this is addressed to Bill for obvious reasons — whether your testicles are bigger than your brains or your brains are bigger than your testicles?

The Company has had a pattern of deciding to return 100% of its cash flow to its investors by repurchase and you thought your stock was cheap I believe when you spent $200 million at $104 and obviously that was a colossal misallocation of capital.

I look at the numbers and I’m smart enough to understand if you’re buying something back at $19 or $20 that you think can earn as much as $7.75 or as little as $4.35, it makes sense. But we have to obviously risk-adjust that. So my question is if you took the midpoint of those numbers of $6 on 20 million shares, you’re earning $120 million. If you took a third of that let’s say, take $40 million, that would equate to a dividend of $2 per share which would slap a yield on the stock at 10 and you would be able to buy back less stock but you would be able to still buy back almost 20% of the Company if you decide to take the remaining cash flow and buy back stock.

So I’d just like to hear that you guys have used very sharp pencils, have been very diligent and understand that the opportunity is so extremely attractive at the current price level basically that the notion of splitting the returning of cash to shareholders via a dividend and repurchase is less sensible than just going straight out for a stock repurchase.

Then secondly, what is the timeline for this repurchase to be effectuated? In other words I understand that there’s some need to get your 10-K out which will take time and then shareholder approval etc. but what are we looking at? Because at the end of the day I want us to buy the stock back cheap not expensive. I don’t want you to turn around and pay $30 or $40 for the stock when it’s been trading actively at $17, $18 or $19. So what is the timetable for us to get into the market?

Bill Shepro: Lee, this is Bill. I will start with your second question. So we’re working with our SEC Counsel now to determine whether or not we’ve disclosed enough information with this call to start the buyback program if we can open a window following this call. I don’t know the answer yet. If it is not following this call, it would be after our 10-K is issued and following the window opening after our 10-K is issued.

Leon Cooperman: I would just say this — excuse me for interrupting you. But I really don’t want to see the company being picked off. You came out — you made your statement. You made a statement for $200 million at $104 when you bought the stock back. You’ve now given a comprehensive forecast telling people what your plans are in terms of repurchase, telling people what you think your range of earnings is, telling people you think our stock is

10

significantly undervalued. Find a law firm that has common sense that says you have put enough information into the market that if you want to buy back stock you could buy back stock.

And based upon our track record of repurchase I can’t say we’re sitting on any kind of inside information. That again, a sense of humor.

Bill Shepro: We are certainly working on evaluating. Let me address your first question. We recognize, Lee that we repurchased shares during 2014 at prices that are higher — much higher than where the stock is trading today. But if you look, we have a five-year history of substantially growing our revenue and earnings and based on what we knew at that time we believed it made sense to repurchase shares.

Now if you look at where the share price is trading today which is roughly 3 times the midpoint of our adjusted 2015 earnings per share scenario that we just gave you today, we believe the stock is trading at a very substantial discount to its value.

So when you take a look — would you let me finish please?

When you take this into consideration along with our belief that the share buyback doesn’t materially change our risk profile and that a repurchase is more efficient than a dividend we think and along with our Board that a share buyback makes more sense. And keep in mind, Lee, that management and insiders own in excess of 30% of the stock. We’ve also received feedback from some of our other shareholders that are encouraging us to buy back shares.

Leon Cooperman: I understand that. I’m not against it. I understand all that, I understand the arithmetic. I just want to make sure that you’ve crossed every T, dotted every I and you understand what you’re doing. Because as I told you a year ago, stock repurchase only makes sense and only makes sense if you are buying back something that is significantly undervalued. And if it’s not undervalued then you have no business buying it back. And we’ve made a mistake for the last year and we just want to make sure that we’re not making another mistake now.

But I would say on your numbers it’s a no-brainer. And you should — and I believe very strongly that your stock is up 5 as we’re speaking because of this constructive call but the idea is to buy the stock back, give the information to all your shoulders at the same time which you’ve done and then buy it back when it’s cheap not when it’s expensive. And I can’t believe any reasonable law firm with common sense would not say you put enough information into the market that come Monday you would be able to do what you want to do. I’ve said enough. Thank you for listening. I appreciate it.

Operator: Ryan Zacharia, Jacobs Asset Management.

Ryan Zacharia: Thanks for taking the question. Just a couple. Have you guys contemplated at all a California license suspension of Ocwen in your forecast or other states for that matter?

11

Bill Shepro: Our understanding is that the likelihood of Ocwen losing its California servicing license is very low and that Ocwen is working expeditiously to resolve this issue. So that’s really all we have to comment as it pertains to California.

Ryan Zacharia: And so the NYDFS settlement cited it quote unquote inadequate and ineffective IT systems and personnel at Ocwen. Is that a direct condemnation of the REALServicing system? Is that the system that was being referenced there?

Bill Shepro: So Ryan, I guess if you’re asking — thanks for the question. First and foremost, very proud to support Ocwen with technologies and services that we believe have contributed to Ocwen’s success. We’re not going to get into the specifics on this call but Altisource and Ocwen have been and continue to work very closely together to help Ocwen achieve its objectives. Our objective as is Ocwen’s is to provide high-quality technologies and services so that Ocwen and our other customers can meet their obligations in this rapidly changing regulatory environment.

So if changes or improvements are requested by Ocwen, Ryan, we’re committed to doing everything we can to help Ocwen meet its obligations.

Ryan Zacharia: So might that result in an elevated expense that isn’t contemplated in the forecast or do you think that that’s reflected in your expectations?

Bill Shepro: Yes, so Ryan, we’ve reflected the elevated spend already — we’ve reflected what we expect that spend to be in our numbers and that is not an area — we’ve cut costs and have a plan to cut costs. That is not an area where we’re planning to cut costs and that is reflected in our numbers.

Ryan Zacharia: Okay. And then sorry, just two more questions. So the low end of the guidance, is that reflecting $14 million of revenue from the GSE business that Ocwen says at some point — I understand it might go beyond 2015 — but at some point going to exit the GSE servicing?

Bill Shepro: So Ryan, we put two scenarios together and it’s only our best estimate. We have no specific information as to how we think the GSE portfolio will roll off and we don’t have any further comment other than that.

Bill Shepro: Sorry, go ahead, Ryan.

Ryan Zacharia: No, no, no. I’m sorry. Michelle, go ahead. Was she not going to say something?

Bill Shepro: Ryan the other comment is that if you look at the Scenario A and Scenario B, Scenario A is all the assumptions being at the low end and Scenario B is all the assumptions at the high-end.

Ryan Zacharia: Okay. And then just the last question is just on Lenders One, do you know how many members are on a competing LOS that may be offers access to a vendor network that might make it more difficult for you guys to penetrate in terms of number of services that you guys offer like if they are on Encompass360? There’s a whole network where they can get doc

12

prep and title and all that stuff. So is there some kind of impediment to achieving the penetration that you guys think just because of where people currently do most of their origination?

Bill Shepro: Ryan, look, with respect first of all, about — let’s talk about Lenders One for a minute or our origination business. There were strong headwinds going into 2014. One was in late 2013. I talked about this on an earlier conference call. There was a loss of an affinity partner that provided our origination group with very high-margin revenue. And the second was approximately a 40% decline — 42% decline in originations in 2014 compared to 2013. Despite these headwinds, we made really good progress in our origination business which is going to position us well for the future.

We grew the Lenders One membership to 280 members and in the first two weeks of this year, we added five new members. We added five new preferred investors last year and we re-signed seven other preferred investors whose contracts were expiring.

We signed seven new preferred vendors and we re-signed 11 existing partners whose contracts were expiring. We signed agreements with 30 new clients in our Loan QC and underwriting business and we established a relationship with one of the major MI firms where we performed contract underwriting for their non-delegated customers.

We also acquired Mortgage Builder. That’s one of those loan origination systems that you were referring to. They have approximately 200 customers, 52 of which are also Lenders One members. We’re also making good progress developing an online tool to help our members optimize their use of Lenders One and its preferred partners and investors. And we also anticipate releasing our electronic ordering tool to the members by the end of this year.

So while our numbers don’t show a lot of improvement last year given the headwinds we had, we actually made some pretty good progress and we think that positions us really well for this coming year.

Ryan Zacharia: Great, thanks.

Operator: Fred Small, Compass Point.

Fred Small: Hey, good morning. Thanks for doing the call. I think it’s helpful for shareholders to have an understanding of the current — your current views on the business.

I have a couple of questions, probably three or four but starting with the drivers of the margin difference between Scenarios A in B, I guess it’s on a pretax margin sort of 7%, 8% versus 14% in Scenario B. What are the big differences there? Well that’s the first question.

Michelle Esterman: Sure. So I think you’ll see that within each segment we’ve given margin ranges that are a little bit tighter — well in some cases tighter. And then the consolidated margin obviously results on the application of each of the assumptions at the low end applied to each of the segments and working down. It’s really within each of those you could have a

13

different margin result depending on what your mix of services are and your level of achievement of the assumptions that we’ve laid out.

Fred Small: Okay, got it. On the margin guidance for the Mortgage Services segment, what’s the majority of the increase versus where we are now? I mean I guess pretax was 35%, 36% in Q3. And we’re going back to what you have it here, 40%.

Michelle Esterman: Sure. So mortgage services reflects really a change in the mix of services that we’re providing as well as all of our other non-default related businesses, the origination business, the rental property management business, etc.

Fred Small: And where does the lender placed insurance business rank in terms of higher or lower margin for that segment?

Bill Shepro: Yes, Fred, that’s a higher margin.

Fred Small: Okay so you’re getting rid of a really high margin business and margins are still going to go up in that segment so I’m just trying to understand what drives it higher?

Michelle Esterman: I think what you’re seeing in mortgage services is it was about 32% for 2014 and two ends of the range that we provided were 30% and 32%. So the high end was equal to 2014.

Fred Small: Okay. So the 40% on slide 11, is it —

Michelle Esterman: Sorry, slide 11 is providing

Fred Small: What does that relate to?

Michelle Esterman: Sure, so slide 11 just relates to our default related services on the non-GSE portfolio. These are the assumptions that correlate to the slide that shows the five-year projections on the PLS portfolio and our default related services.

Fred Small: So that’s just default related which does not include — and that does not — include lender-placed insurance

Bill Shepro: Fred, correct, and the other services that we provide inside the company bring that number down is the point. That’s why the margin (multiple speakers)

Fred Small: Right. Okay, understood. Got it. And just another question on those in case I missed a footnote in the deck, are the pretax margins that are in the deck here either on a segment basis or a consolidated basis including or excluding D&A?

Michelle Esterman: Depreciation and amortization?

Fred Small: Yes.

14

Michelle Esterman: Okay, yes it takes into consideration depreciation and amortization expense.

Fred Small: So those expenses are included in the cost side that you used to get the margin numbers?

Michelle Esterman: That’s correct.

Fred Small: Okay.

Michelle Esterman: It’s in the GAAP pretax margin.

Fred Small: Got it. With Ocwen announcing that it will sell its agency MSRs over time, can you walk through whether or not that makes it tougher to grow the origination related services revenue line through Lenders One and leverage the Lenders One platform if a lot of the business that they are doing is related to agency?

Bill Shepro: Fred, I don’t think it’s going to have that much of an impact at all on that business. We do a little bit of work for Ocwen on the origination side and some of the refinance activity. But I don’t think that’s going to have a meaningful impact on us at all.

Fred Small: Okay, thanks. And then the last one — well actually sorry two more. One, how much of a slowdown in the pace of loan liquidations or property sales are you expecting as a result of the third-party review of the internal review group with the National Mortgage Monitor or the new DFS Monitor at Ocwen?

Bill Shepro: Fred, I think that question is better asked of Ocwen than Altisource.

Fred Small: Is there a slowdown baked into the projections here?

Bill Shepro: We do an estimate of what we think the delinquency rates are going to be and I think even this time we gave you what we believe the loan level CPR as opposed to UPB CPR would be and so that’s our best guess.

Fred Small: Okay, got it. Thanks. And then the last question, the one thing that a lot of people I think have been trying to figure out that I’ve spoken to has been if you look at what happened with or what Green Tree did after failing tests with the monitor, they switched technology providers and moved their servicing to MSP. Can the monitor push Ocwen to change servicing technology providers and is there a recourse payment to Altisource in that scenario?

Bill Shepro: Fred, we think that’s a very, very unlikely event to happen and we think there’s a lot of advantages and benefits to using our technology and that’s allowed Ocwen to be a leader in the space for a very long period of time. So we think it’s a very unlikely event.

15

Fred Small: In that event is there a recourse payment to Altisource?

Bill Shepro: Fred, I’m not going to go into the specifics of our agreement between Altisource and Ocwen and give you some legal opinions here. We think it’s a very remote event.

Fred Small: Okay, great. Thank you very much for taking my questions.

Operator: Ramin Kamali, Credit Suisse.

Ramin Kamali: Hi, good afternoon. Thanks, Bill thanks Michelle for hosting this call. Just a couple of clarifications and some questions just to follow-up from previous callers. So I believe you said you have $160 million of cash currently. Is that correct?

Michelle Esterman: Right.

Ramin Kamali: 1-6-0, is that as of the end of December or is that currently?

Michelle Esterman: That is as of the end of December.

Ramin Kamali: And have you bought back any additional shares since the end of the last quarter or that’s kind of been halted?

Michelle Esterman: We purchased shares during October and disclosed what that amount was in our earnings call in October but have not repurchased since then.

Ramin Kamali: Okay. Just curious with $600 million of debt on the balance sheet, has the Company considered potentially buying back some of the debt at a discount?

Bill Shepro: We’re going to evaluate whether it makes some sense to opportunistically buy back some of the debt. That’s a conversation we’ll have with the Board and something we’re going to evaluate.

Ramin Kamali: Okay and just some other additional questions about the projection for 2015. I guess some of the callers have hinted at it but just trying to get a better sense. So with Ocwen formally saying that they are selling or monetizing a lot of their agency business, has that been factored at all into 2015 or should we assume that that happens post-2015?

Michelle Esterman: So we outlined in our assumption slide the number of GSE loans we included in each scenario to be sold by Ocwen or transferred off of REALServicing. I think in Scenario A we assumed 600,000 and in Scenario B 300,000 as a loan count.

Bill Shepro: And those are our assumptions not Ocwen’s.

Ramin Kamali: So that’s not natural runoff. Those are MSR sales?

Michelle Esterman: Right.

16

Bill Shepro: Correct.

Ramin Kamali: And I guess you have a number of initiatives to grow the business. So in both Scenarios A in B, what’s the actual dollar amount of expected revenue from the new business and what’s legacy business that continues to roll off?

Bill Shepro: We’re not breaking that out today.

Michelle Esterman: You can see in the scenario slide what our preliminary 2014 results were for each of the numbers and I think if you work through the math, the assumptions that we’ve given you would assist you in arriving at the numbers that we’ve included in the financials for those two scenarios.

Ramin Kamali: Okay, just to reiterate that, given the strong liquidity position, I guess management should probably consider looking at some of the debt at a discount. That’s all I have.

Bill Shepro: We appreciate your views and we’re certainly talking to the Board about it.

Operator: Evan Tindell, Ballantine Capital.

Evan Tindell: Actually all my questions have been asked and answered.

Operator: Dain Haukos, Piper Jaffray.

Dain Haukos: Hi guys. Thanks for taking my questions. I’m on for Mike. But I was just curious, Bill you had mentioned this before. The top 10 financial institution, that relationship, have the referrals that you’ve been getting, have those been coming in as expected? I think previously you had said around 200 to 400 a month. Have you seen that come as that relationship has blossomed? And then how is the sales cycle coming for the next-gen REALServicing platform to other third-party clients other than Ocwen?

Bill Shepro: Well to answer your first question, yes, that top 10 bank, the referrals are coming and we are beginning to sell assets. I don’t think we had discussed on any call starting to sell our next-gen REALServicing platform. That’s not something we have previously discussed.

Dain Haukos: Thank you.

Operator: Larry Kossove, Tribe Capital.

Larry Kossove: Hi guys, it’s Larry Kossove. I work with Greg. I just wanted to maybe review if you can — I know this question was just asked a minute ago. On the buyback and on the leverage plan, I just checked through the fourth quarter call — the third quarter call. I don’t actually see where you disclosed what you bought back in October. So if you can maybe help us with those numbers.

17

And then in terms of the lever, you also I think mentioned before in your comments getting the debt level down. I think you maybe said 200 if I remember correctly. Can you just go through that again how you get the debt levels down?

And then I think there’s also implied in the weighted average share count coming down over next year would obviously imply a big buyback. With only $88 million of equity left as of the third quarter just on the balance sheet, how much could you really buy back? Would you go to a negative equity position? What are the covenants in some of that debt outstanding? Thank you.

Bill Shepro: So just on the share buyback and I’m going from memory, it would be in the transcript maybe not in the press release or the slides. I think we bought back in October $45 million roughly of shares. I’m sorry 475,000 shares and we also bought Owners.com, closed on that transaction in the fourth quarter is another use of cash. But looking into 2015, we think we’re going to generate a lot of free cash flow and so we think that the plan we’ve proposed is the right plan.

Larry Kossove: And that’s what you’re including in your assumptions to get the debt levels down?

Bill Shepro: Correct. Sorry — we didn’t say we’re getting — what Michelle told you on the call and we might be able to find this section of the script, but as we talked about where our net debt would be at the end of the year basically the debt less whatever cash would be on the balance sheet.

Larry Kossove: Oh so that’s the buildup of cash. Okay.

Bill Shepro: Exactly.

Larry Kossove: Okay, thank you.

Operator: Henry Coffey, Sterne Agee.

Henry Coffey: Yes, thanks for taking my follow-up call. When you normally release earnings, we have the slide deck with all the metrics and dynamics showing essentially inputs into — by various product areas. I assume we’ll get that later when you file the Q or —? And I also I guess I’m guessing you have access to the data now. With the lender-placed product gone in the servicing area, how have revenue per — how have revenue per loans changed in the fourth quarter?

Bill Shepro: So Henry, we’re giving you in our two scenarios what we expect the revenue per loan to be. That reflects the loss of lender-placed insurance. There’s also a footnote you should read. It also reflects it’s likely we’re going to change the way in which we get paid for one of our services so that some of the revenue will now also show up in service revenue whereas before it was only showing up in revenue. And that’s why that number increased in terms of revenue per loan. So we recommend you use that.

18

Michelle Esterman: We will be including the full set of operating metrics that we typically provide you when we release in February.

Henry Coffey: There’s obviously — it’s very difficult as an outsider looking in to assess the viability of any technology. When it comes to the Lenders One platform, one, can you talk — what as outsiders can we look at to understand why someone would choose your platform versus someone else’s?

And then I’m curious about your initiatives in the non-agency area. Are you going to bring the capacity at close off a broker’s balance sheet so that all the QM risk etc. resides with someone else or is this going to just be a technology product that makes sure that the broker gets all the facts right?

Bill Shepro: So Henry, first of all, there’s a couple of things in our origination business. We have Lenders One, which is a cooperative, Wholesale One, the new cooperative we started, Mortgage Builder, which is a loan origination system. And then we have the mortgage services that we provide like valuation or title insurance in escrow for originators. Those are probably the major products.

We believe we have a compelling product offering. With respect to Mortgage Builder, they probably were unable to compete as well because they weren’t backed by a strong parent as they are backed by today. But look, that’s only one tool in our toolkit here in order to generate origination services business for us. But we believe the Mortgage Builder technology is very good technology and can compete with the other loan origination systems on the marketplace. But that’s just one piece of the puzzle in terms of our origination business.

Henry Coffey: What about the non-agency? You discussed about using some non-agency.

Bill Shepro: Yes, sure. So one of the things we do for the members of Lenders One is we call them preferred investors. They are basically correspondent lenders that buy loans from the members of Lenders One. We think there’s a very large opportunity to bring some of the non-agency correspondent lenders to the Lenders One members. And so we earn a fee for making that connection essentially and we also typically provide services not always but typically provide services to assist either the banker or the correspondent lender in originating those loans. So we see that as a really unique opportunity for us as this market evolves.

Henry Coffey: I’ve got a question in an email. Have you quantified what the change was between revenue levels and reported results? Revenue was off but not that much and then obviously we’re looking at a much lower pretax income than one would have assumed.

Bill Shepro: Yes, if you go back to the transcript of the call, we give you a pretty good explanation of why revenue — it wasn’t a revenue issue, it was primarily a cost issue. The revenue issue is around two things, Henry. One was the discontinuation of the lender-placed insurance business. The second was the seasonal slowdown in our inspection business and then

19

we had some higher costs, we had some higher charge-offs than we normally had charge-off expense. But if you reread the transcript I think you’ll get a pretty good summary.

Henry Coffey: Thank you.

Operator: Thank you. That is all the time we have for questions today. I’d like to turn the call back over to Michelle Esterman for any further remarks.

Michelle Esterman: Thank you for joining the call today. Have a great day.

Operator: Ladies and gentlemen, thank you for participating in today’s conference. This concludes today’s program. You may all disconnect. Everyone have a great day.

20

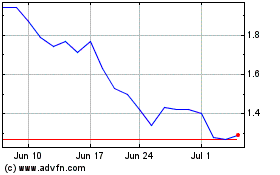

Altisource Portfolio Sol... (NASDAQ:ASPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

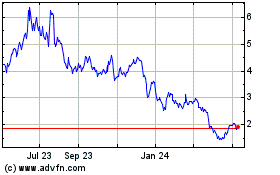

Altisource Portfolio Sol... (NASDAQ:ASPS)

Historical Stock Chart

From Apr 2023 to Apr 2024