UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the

Registrant x Filed by

a Party other than the Registrant ¨

Check the appropriate box:

|

|

|

| ¨ |

|

Preliminary Proxy Statement |

|

|

| ¨ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

| x |

|

Definitive Proxy Statement |

|

|

| ¨ |

|

Definitive Additional Materials |

|

|

| ¨ |

|

Soliciting Material under Rule 14a-12 |

F5 Networks, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

| x |

|

No fee required |

|

|

| ¨ |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

|

|

|

|

|

(1) |

|

Title of each class of securities to which transaction applies:

|

|

|

(2) |

|

Aggregate number of securities to which transaction applies:

|

|

|

(3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

(4) |

|

Proposed maximum aggregate value of transaction:

|

|

|

(5) |

|

Total fee paid:

|

|

|

| ¨ |

|

Fee paid previously with preliminary materials. |

|

|

| ¨ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing. |

|

|

|

|

|

(1) |

|

Amount Previously Paid:

|

|

|

(2) |

|

Form, Schedule or Registration Statement No.:

|

|

|

(3) |

|

Filing Party:

|

|

|

(4) |

|

Date Filed:

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on March 12, 2015

TO SHAREHOLDERS OF F5 NETWORKS,

INC.:

The annual meeting of shareholders of F5 Networks, Inc. (the “Company”) for fiscal year 2014 will be held on

March 12, 2015 at 11:00 a.m. Pacific Time at F5 Networks, Inc., 351 Elliott Avenue West, Seattle, Washington 98119 for the following purposes, as more fully described in the accompanying Proxy Statement:

1. to elect six (6) directors to hold office until the annual meeting of shareholders for fiscal year 2015;

2. to consider and act upon a proposal to approve the F5 Networks, Inc. 2014 Incentive Plan as amended and restated (the

“2014 Plan”) to increase the number of shares of common stock issuable under the 2014 Plan by an additional 2,250,000 shares;

3. to consider and act upon a proposal to approve the F5 Networks, Inc. 2011 Employee Stock Purchase Plan as amended and

restated (the “ESPP”) to increase the number of shares of common stock issuable under the ESPP by an additional 2,000,000 shares;

4. to ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm

for fiscal year 2015;

5. to conduct an advisory vote to approve the compensation of our named executive officers; and

6. to transact such other business as may properly come before the meeting and any adjournments or postponements

thereof.

Only shareholders of record at the close of business on January 6, 2015 are entitled to notice of, and to vote at, the

annual meeting.

By Order of the Board of Directors,

SCOT F. ROGERS

Secretary

Seattle,

Washington

January 16, 2015

YOUR

VOTE IS IMPORTANT!

Whether or not you attend the annual meeting, it is important that your shares be represented and voted at the meeting.

Therefore, please promptly vote and submit your proxy by phone, over the Internet, or by signing, dating, and returning the accompanying proxy card in the enclosed, prepaid, return envelope. If you decide to attend the annual meeting and are a

registered shareholder, or have obtained a “Legal Proxy” from your broker, you will be able to vote in person, even if you have previously submitted your proxy. Voting via the Internet is a valid proxy voting method under the laws of the

State of Washington (our state of incorporation).

Important Notice Regarding the Availability of Proxy Materials for

the Company’s Annual Meeting of Shareholders on March 12, 2015.

The F5 Networks, Inc. Proxy Statement and 2014 Annual Report to Shareholders are available online at

www.proxyvote.com and www.f5.com/about-us/investor-relations.

Please do not return the enclosed paper ballot if you are

voting over the Internet or by telephone.

|

|

|

| VOTE BY INTERNET |

|

VOTE BY TELEPHONE |

|

|

| www.proxyvote.com |

|

1-800-690-6903 via touch tone |

|

|

| 24 hours a day/7 days a week |

|

24 hours a day/7 days a week |

|

|

|

| Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Time on March 11, 2015. Have your proxy card in hand when you access the web site and follow the

instructions to obtain your records and to create an electronic voting instruction form. |

|

Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Time on March 11, 2015. Have your proxy card in hand when you call and then follow the instructions. |

Your cooperation is appreciated since a majority of the shares of Common Stock entitled to vote must be

represented, either in person or by proxy, to constitute a quorum for the conduct of business.

Please note that brokers may not vote

your shares on the election of directors or on the advisory vote on compensation or the proposals to approve the 2014 Incentive Plan and the 2011 Employee Stock Purchase Plan in the absence of your specific instructions as to how to vote. Please

vote your proxy so your vote can be counted.

2

PROXY SUMMARY

This summary highlights information contained elsewhere in the proxy statement. This summary does not contain all of the information that you should consider,

and you should read the entire proxy statement carefully before voting.

Annual Meeting of Shareholders

Time and Date — March 12, 2015 at 11:00 a.m. PT

Place — F5 Networks, Inc., 351 Elliott Avenue West, Seattle, Washington 98119

Record Date — Shareholders as of January 6, 2015 are entitled to vote

Meeting Agenda and Voting Matters

|

|

|

|

|

| Proposal |

|

Board Vote Recommendation |

|

Page References for More Detail |

| Proposal 1. To elect six (6) directors to hold office until the annual meeting of shareholders for fiscal year

2015 |

|

FOR (each nominee) |

|

pp. 44 |

| Proposal 2. To approve of the F5 Networks, Inc. 2014 Incentive Plan as amended and restated (the “2014 Plan”) to

increase the number of shares of common stock issuable under the 2014 Plan by an additional 2,250,000 shares |

|

FOR |

|

pp. 45-51 |

| Proposal 3. To consider and act upon a proposal to approve the F5 Networks, Inc. 2011 Employee Stock Purchase Plan as amended

and restated (the “ESPP”) to increase the number of shares of common stock issuable under the ESPP by an additional 2,000,000 shares |

|

FOR |

|

pp. 52-55 |

| Proposal 4. To ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public

accounting firm for fiscal year 2015 |

|

FOR |

|

pp. 56 |

| Proposal 5. To conduct an advisory vote to approve the compensation of our named executive officers |

|

FOR |

|

pp. 57-58 |

Board & Governance Highlights

|

|

|

| Independent Board Chair |

|

Majority Voting for All Directors |

|

|

| 8 of 9 Board Members (including nominees) are Independent |

|

Annual Board Self-Assessment Process |

|

|

| Recent Bylaw Amendment Declassifying Board — all Directors will be elected annually beginning at the annual meeting for fiscal year 2015 |

|

Independent Directors Meet Without Management Present |

|

|

| Share Ownership Guidelines for Executives & Directors |

|

Prohibition on Hedging, Pledging and Short Sale of Company Stock |

3

Performance Highlights

| |

• |

|

Record annual revenue $1.73 billion, up 17% over FY13. |

| |

• |

|

Product revenue growth of 17%. |

| |

• |

|

Record cash flows from operations of $549 million. |

| |

• |

|

Record net income of $311 million. |

Awards and Company Recognition

| |

• |

|

The Company was named one of the 25 Most Powerful Networking Companies by Network World. |

| |

• |

|

The Puget Sound Business Journal named CEO John McAdam its Executive of the Year. |

| |

• |

|

The Company received the Cloud Automation Award at VMworld 2014. |

| |

• |

|

The Company won the HP AllianceOne Partner of the Year Award for Network Optimization. |

4

F5 NETWORKS, INC.

401 Elliott Avenue West

Seattle, Washington 98119

PROXY

STATEMENT

FISCAL YEAR 2014 ANNUAL MEETING OF SHAREHOLDERS

F5 Networks, Inc. (the “Company”) is furnishing this Proxy Statement and the enclosed proxy in connection with the solicitation of

proxies by the Board of Directors of the Company (the “Board of Directors” or the “Board”) for use at the annual meeting of shareholders to be held on March 12, 2015, at 11:00 a.m., Pacific Time, at the Company offices

located at 351 Elliott Ave. West, Seattle, Washington 98119 and at any adjournments thereof (the “Annual Meeting”). As used herein, “we,” “us,” “our,” “F5” or the “Company” refers to F5

Networks, Inc., a Washington corporation. These materials are being mailed to shareholders on or about January 16, 2015. The Company’s principal executive offices are located at 401 Elliott Avenue West, Seattle, Washington 98119. The

Company’s telephone number at that location is 206-272-5555.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND THESE PROXY MATERIALS

Why am I receiving these materials?

You are receiving these materials because you are a shareholder of the Company as of the close of business on January 6, 2015 (the

“Record Date”) and are entitled to receive notice of the Annual Meeting and to vote on matters that will be presented at the meeting. This Proxy Statement contains important information regarding our Annual Meeting, the proposals on which

you are being asked to vote, information you may find useful in determining how to vote, and information about voting procedures.

How does the Board of Directors recommend that I vote?

The Board of Directors recommends that you vote:

| |

• |

|

FOR the election of A. Gary Ames, Sandra Bergeron, Jonathan Chadwick, Michael Dreyer, Peter Klein and Stephen Smith as directors to hold office until the annual meeting of shareholders for fiscal year 2015;

|

| |

• |

|

FOR the proposal to approve the F5 Networks, Inc. 2014 Incentive Plan as amended and restated (the “2014 Plan”) to increase the number of shares of common stock issuable under the 2014 Plan by an

additional 2,250,000 shares; |

| |

• |

|

FOR the proposal to approve the F5 Networks, Inc. 2011 Employee Stock Purchase Plan as amended and restated (the “ESPP”) to increase the number of shares of common stock issuable under the ESPP by an

additional 2,000,000 shares; |

| |

• |

|

FOR the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for fiscal year 2015; and |

| |

• |

|

FOR the approval, on an advisory basis, of the compensation of our named executive officers. |

Will there be any other items of business on the agenda?

The Company is not aware, as of the date of this Proxy Statement, of any matters to be voted upon at the Annual Meeting other than those stated

in this Proxy Statement and the accompanying Notice of Annual Meeting of Shareholders. If any other items of business or other matters are properly brought before the Annual Meeting,

5

your proxy gives discretionary authority to the persons named on the proxy card with respect to those items of business or other matters. The persons named on the proxy card intend to vote the

proxy in accordance with their best judgment.

Who is entitled to vote at the Annual Meeting?

Only holders of our common stock, no par value (the “Common Stock”), at the close of business on the Record Date may vote at the

Annual Meeting. We refer to the holders of Common Stock as “shareholders” throughout this proxy statement. Each shareholder is entitled to one vote for each share of Common Stock held as of the Record Date.

What constitutes a quorum, and why is a quorum required?

We need a quorum of shares of Common Stock eligible to vote to conduct business at our Annual Meeting. A quorum exists when at least a majority

of the outstanding shares entitled to vote at the close of business on the Record Date are represented at the Annual Meeting either in person or by proxy. As of the close of business on the Record Date, we had 72,674,016 shares of Common Stock

outstanding and entitled to vote at the Annual Meeting, meaning that 36,337,009 shares of Common Stock must be represented in person or by proxy to have a quorum. Abstentions and broker non-votes (as described below) will also count towards the

quorum requirement. Your shares will be counted toward the number needed for a quorum if you: (i) submit a valid proxy card or voting instruction form, (ii) give proper instructions over the telephone or on the Internet, or (iii) in

the case of a shareholder of record, attend the Annual Meeting in person.

What is the difference between holding shares as a

shareholder of record and as a beneficial owner?

| |

• |

|

Shareholder of Record. You are a shareholder of record if at the close of business on the Record Date your shares were registered directly in your name with American Stock Transfer, our transfer agent.

|

| |

• |

|

Beneficial Owner. You are a beneficial owner if at the close of business on the Record Date your shares were held by a brokerage firm or other nominee and not in your name. Being a beneficial owner means

that, like many of our shareholders, your shares are held in “street name.” As the beneficial owner, you have the right to direct your broker or nominee how to vote your shares by following the voting instructions your broker or other

nominee provides. If you wish to vote the shares you own beneficially at the meeting, you must first request and obtain a “legal proxy” from your broker or other nominee. If you do not provide your broker or nominee with instructions on

how to vote your shares or a legal proxy, your broker or nominee will be able to vote your shares with respect to some, but not all, of the proposals. Please see “What will happen if I do not vote my shares” and “What if I

do submit my proxy but do not specify how my shares are to be voted?” for additional information. |

How do I

vote?

Shareholders of Record. If you are a shareholder of record, there are several ways for you to vote your shares:

| |

• |

|

Voting by Mail. You may submit your vote by completing, signing and dating each proxy card received and returning it in the prepaid envelope. Sign your name exactly as it appears on the proxy card. Proxy

cards submitted by mail must be received no later than March 11, 2015 to be voted at the Annual Meeting. If you vote by telephone or on the Internet, please do not return your proxy card unless you wish to change your vote.

|

| |

• |

|

Voting by Telephone. You may vote by telephone by using the toll-free number listed on your proxy card. |

| |

• |

|

Voting on the Internet. You may vote on the Internet by using the voting portal found at www.proxyvote.com. As with telephone voting, you can confirm that your instructions have been properly

recorded. |

6

| |

• |

|

Voting in person at the Annual Meeting. You may vote your shares in person at the Annual Meeting. Even if you plan to attend the Annual Meeting in person, we recommend that you also submit your proxy card or

voting instructions or vote by telephone or via the Internet by the applicable deadline so that your vote will be counted if you later decide not to attend the meeting. |

Beneficial Owners. You may vote by the method explained on the proxy card or the information you receive from the broker, nominee

or other record holder.

Can I revoke or change my vote after I submit my proxy?

Yes. You may revoke or change your vote after submitting your proxy by one of the following procedures:

| |

• |

|

Delivering a proxy revocation or another proxy bearing a later date to the Secretary of the Company at 401 Elliott Avenue West, Seattle, Washington 98119 before or at the Annual Meeting; |

| |

• |

|

If you have voted by internet or telephone and still have your control number, you may change your vote via internet or telephone up until 11:59 p.m. Eastern Time the day before the Annual Meeting; |

| |

• |

|

Shareholders of Record by attending the Annual Meeting and voting in person; |

| |

• |

|

Beneficial Owners by obtaining a “legal proxy” from your broker or other nominee, attending the Annual Meeting and voting in person. |

Please note that attendance alone at the Annual Meeting will not revoke a proxy; you must actually vote in person at the meeting.

What will happen if I do not vote my shares?

| |

• |

|

Shareholders of Record. If you are the shareholder of record of your shares and you do not vote by mail, by telephone, via the Internet or in person at the Annual Meeting, your shares will not be voted at

the Annual Meeting. |

| |

• |

|

Beneficial Owners. If you are the beneficial owner of your shares, your broker or nominee may vote your shares only on those proposals on which it has discretion to vote. Under applicable stock exchange

rules, your broker or nominee does not have discretion to vote your shares on non-routine matters, which include Proposals 1, 2, 3 and 5. However, your broker or nominee does have discretion to vote your shares on routine matters such as

Proposal 4. |

What if I do submit my proxy but do not specify how my shares are to be voted?

If you are a shareholder of record and you submit a proxy, but you do not provide voting instructions, your shares will be voted:

| |

• |

|

FOR the election of A. Gary Ames, Sandra Bergeron, Jonathan Chadwick, Michael Dreyer, Peter Klein and Stephen Smith as directors to hold office until the annual meeting of shareholders for fiscal year 2015;

|

| |

• |

|

FOR the proposal to approve the F5 Networks, Inc. 2014 Incentive Plan as amended and restated (the “2014 Plan”) to increase the number of shares of Common Stock issuable under the 2014 Plan by an

additional 2,250,000 shares; |

| |

• |

|

FOR the proposal to approve the F5 Networks, Inc. 2011 Employee Stock Purchase Plan as amended and restated (the “ESPP”) to increase the number of shares of Common Stock issuable under the ESPP by an

additional 2,000,000 shares; |

| |

• |

|

FOR the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for fiscal year 2015; and |

| |

• |

|

FOR the approval, on an advisory basis, of the compensation of our named executive officers. |

7

What is the effect of an abstention or a “broker non-vote”?

Brokers or other nominees who hold shares of Common Stock for a beneficial owner have the discretion to vote on routine proposals when they

have not received voting instructions from the beneficial owner at least ten days prior to the Annual Meeting. A “broker non-vote” occurs when a broker or other nominee does not receive voting instructions from the beneficial owner and

does not have the discretion to direct the voting of the shares. If you abstain from voting on a proposal, or if a broker or nominee indicates it does not have discretionary authority to vote on a proposal, the shares will be counted for the purpose

of determining if a quorum is present, but will not be included in the vote totals with respect to the proposal. Furthermore, any abstention or broker non-vote will have no effect on the proposals to be considered at the Annual Meeting since these

actions do not represent votes cast by shareholders.

What is the vote required for each proposal?

|

|

|

|

|

| Proposal |

|

Vote Required* |

|

Broker Discretionary

Voting Allowed |

| Proposal 1 — Election of six (6) directors to hold office until the annual meeting of shareholders for fiscal year 2014 and

until his or her successor is elected and qualified |

|

Majority of Votes Cast |

|

No |

| Proposal 2 — To approve the F5 Networks, Inc. 2014 Incentive Plan as amended and restated (the “2014 Plan”) to increase

the number of shares of Common Stock issuable under the 2014 Plan by an additional 2,250,000 shares |

|

Majority of Votes Cast |

|

No |

| Proposal 3 — To approve the F5 Networks, Inc. 2011 Employee Stock Purchase Plan as amended and restated (the “ESPP”) to

increase the number of shares of Common Stock issuable under the ESPP by an additional 2,000,000 shares |

|

Majority of Votes Cast |

|

No |

| Proposal 4 — Advisory vote to ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent registered

public accounting firm for fiscal year 2015 |

|

Majority of Votes Cast |

|

Yes |

| Proposal 5 — Advisory vote to approve executive compensation |

|

Majority of Votes Cast |

|

No |

| * |

Under Washington law and the Company’s Third Amended and Restated Articles of Incorporation (the “Articles”) and Fourth Amended and Restated Bylaws (the “Bylaws”), if a quorum exists at the

meeting, a nominee for director in an uncontested election will be elected by the vote of the majority of votes cast. A majority of votes cast means that the number of shares cast “FOR” a director’s election exceeds the number of

votes cast “AGAINST” that director. If a director nominee who is an incumbent does not receive the requisite votes, that director’s term will end on the earliest of (i) the date on which the Board appoints an individual to fill

the office held by that director; (ii) 90 days after the date on which an inspector determines the voting results as to that director; or (iii) the date of the director’s resignation. With respect to Proposals 2, 3, 4, and

5, a majority of votes cast means that the number of votes cast “FOR” the matter exceeds the number of votes cast “AGAINST” the respective matter. |

With respect to Proposal 1, you may vote FOR the nominee, AGAINST the nominee, or you may vote ABSTAIN as to the nominee. The nominee

will be elected if he receives more FOR votes than AGAINST votes. Proxies may not be voted for more than six (6) directors and shareholders may not cumulate votes in the election of directors.

With respect to Proposals 2, 3, 4 and 5, you may vote FOR, AGAINST or ABSTAIN as to each proposal.

8

What happens if the Annual Meeting is adjourned or postponed?

Your proxy will still be effective and will be voted at the rescheduled Annual Meeting. You will still be able to change or revoke your proxy

until it is voted.

Who is making this proxy solicitation and paying for the costs of this proxy solicitation?

The Board of Directors of the Company is soliciting the proxies accompanying this Proxy Statement. The Company will pay all of the costs of

this proxy solicitation. However, you will need to obtain your own Internet access if you choose to access the proxy materials and/or vote over the Internet. In addition to mail solicitation, officers, directors, and employees of the Company may

solicit proxies personally or by telephone, without receiving additional compensation. The Company has retained Advantage Proxy to assist with the solicitation of proxies in connection with the Annual Meeting. The Company will pay Advantage Proxy

customary fees, which are expected to be $5,750 plus expenses. The Company, if requested, will pay brokers, banks, and other fiduciaries that hold shares of Common Stock for beneficial owners for their reasonable out-of-pocket expenses of forwarding

these materials to shareholders.

How can I find the results of the Annual Meeting?

We intend to announce preliminary voting results at the Annual Meeting and publish final results on a Form 8-K within four business days

of the Annual Meeting. The Form 8-K will be available on our website at www.f5.com under the “About F5 — Investor Relations — Corporate Governance — Governance Documents — View All SEC Filings” section.

9

BOARD OF DIRECTORS

The Board of Directors of the Company currently consists of eight (8) directors. The Board has voted to expand the size of the Board to

nine (9) directors as of the date of the Annual Meeting to include Peter Klein as a new director to be elected at the Annual Meeting. Should he be elected, Mr. Klein would begin serving as a director immediately after his election at the

Annual Meeting. In fiscal year 2013, a proposal to declassify the Board of Directors was approved by a majority of votes cast. As a result, beginning at the annual meeting of shareholders for fiscal year 2015, all members of the Board of Directors

will stand for reelection annually. Previously, the Board of Directors was divided into three classes. The Class I directors were Jonathan Chadwick, Michael Dreyer and Sandra Bergeron; the Class II directors were Deborah L. Bevier, Alan

J. Higginson and John McAdam; and the Class III directors were A. Gary Ames and Stephen Smith. At the Annual Meeting, the shareholders will vote on the election of six (6) directors, A. Gary Ames, Sandra Bergeron, Jonathan Chadwick,

Michael Dreyer, Peter Klein and Stephen Smith to serve until the annual meeting of shareholders for fiscal year 2015. Pursuant to the proposal to declassify the Board of Directors, the three Class II directors will serve until the Company’s

annual meeting for fiscal year 2015, after which, these directors or their respective successors will stand for election on an annual basis.

The Board of Directors has nominated A. Gary Ames, Sandra Bergeron, Jonathan Chadwick, Michael Dreyer, Peter Klein and Stephen Smith for

election to the Board of Directors at the Annual Meeting. The nominees have consented to serve as directors of the Company if elected. If a nominee declines to serve or becomes unavailable for any reason, or if a vacancy occurs before the election

(although we know of no reason to anticipate that this will occur), the proxies may be voted for a substitute nominee as the Company may designate.

Director Independence

The Nasdaq Listing

Rules require that a majority of the Company’s directors be “independent,” as defined by Nasdaq Listing Rule 5605(a)(2) and determined by the Board of Directors. The Board of Directors consults with the Company’s legal

counsel to ensure that the Board of Directors’ determinations are consistent with all relevant securities and other laws and regulations regarding the definition of “independent.” After a review of any relevant transactions or

relationships between each director, or any of his or her family members, and the Company, its senior management and its independent registered public accounting firm, the Board of Directors has determined that the following directors and nominees

are independent: A. Gary Ames, Sandra Bergeron, Deborah L. Bevier, Jonathan Chadwick, Michael Dreyer, Alan J. Higginson, Peter Klein and Stephen Smith. John McAdam is not considered independent because he is the Company’s President and Chief

Executive Officer.

Stock Ownership Guidelines for Directors

In October 2010, the Board of Directors adopted stock ownership guidelines for the Company’s directors and executive officers. Directors

are required to own shares of Common Stock equal in value to five times the directors’ annual cash retainer. Directors are required to achieve this ownership level within three years of joining the Board or, in the case of directors serving at

the time the guidelines were adopted, within three years of the date of adoption of these guidelines. Shares of Common Stock that count toward satisfaction of the guidelines include shares purchased on the open market, shares obtained through stock

option exercises, shares obtained through grants of Restricted Stock Units, and shares beneficially owned in a trust, by a spouse and/or minor children. Shares owned by directors are valued at the greater of (i) the price at the time of

acquisition/purchase or (ii) the current market value.

Nominees and Continuing Directors

The following individuals have been nominated for election to the Board of Directors or will continue to serve on the Board of Directors after

the Annual Meeting:

John McAdam, age 63, has served as our President, Chief Executive Officer and a director since July 2000.

Prior to joining us, Mr. McAdam served as General Manager of the Web server sales business at International

10

Business Machines Corporation from September 1999 to July 2000. From January 1995 until August 1999, Mr. McAdam served as the President and Chief Operating Officer of Sequent Computer

Systems, Inc., a manufacturer of high-end open systems, which was sold to International Business Machines Corporation in September 1999. Mr. McAdam serves as a director of Tableau Software, a publicly-held company that provides business

intelligence software, and Apptio, a privately-held company that provides technology business management. Mr. McAdam holds a B.S. in Computer Science from the University of Glasgow, Scotland.

Mr. McAdam has led the Company for over fourteen years. Since his appointment as President and Chief Executive Officer, the

Company’s annual revenues have grown from $108.6 million in fiscal year 2000 to $1.73 billion in fiscal year 2014. He has been the driving force behind the strategies and execution which have resulted in the Company’s history of

strong operating results and significant growth in shareholder value. Mr. McAdam brings to the Board of Directors a comprehensive knowledge of and valuable insight into the Company’s technology, strategy, competitive opportunities,

operations, financial position, and relationships within the industry analyst and investment communities. He is the sole member of management on the Board of Directors and serves a critical role in the communication between the Board of Directors

and the Company’s senior management team.

Alan J. Higginson, age 67, has served as Board of Directors chair since April

2004, and as one of our directors since May 1996. Mr. Higginson served as Chairman of Hubspan, Inc., an e-business infrastructure provider, from September 2009 to March 2012. He served as President and Chief Executive Officer of Hubspan from

August 2001 to September 2007. From November 1995 to November 1998, Mr. Higginson served as President of Atrieva Corporation, a provider of advanced data backup and retrieval technology. Mr. Higginson also serves as a director of Pivot3,

Inc., a privately-held company that develops and markets shared storage and virtual server appliances, and Clarity Health Services, a privately-held company that provides web-based health care coordination services. Mr. Higginson also served as

a director of adeptCloud Inc., a privately-held company that provides cloud-based collaboration services. Mr. Higginson holds a B.S. in Commerce and an M.B.A. from Santa Clara University.

Mr. Higginson has over 30 years of experience as a senior executive in a wide range of both public and private software and other

technology companies. His experience includes leading worldwide sales organizations and the management of international joint ventures and distribution channels. He has also been active in a number of software and technology industry associations,

and as an advisor to early-stage technology companies. Mr. Higginson joined our Board of Directors shortly after the Company was founded. His deep understanding of the Company’s historical and current business strategies, objectives and

technologies provides an important and insightful perspective for our Board of Directors.

A. Gary Ames, age 70, has

served as one of our directors since July 2004. Mr. Ames served as President and Chief Executive Officer of MediaOne International, a provider of broadband and wireless communications from July 1995 until his retirement in June of 2000. From

January 1990 to July 1995, he served as President and Chief Executive Officer of US West Communications, a regional provider of residential and business telephone services, and operator and carrier services. Mr. Ames also serves as a director

of MMGL Corporation (formally known as Schnitzer Investment Corp.), a privately-held investment firm with interests in commercial, industrial and multi-family properties, real estate development projects, ocean shipping, and other industries.

Mr. Ames served as a director of Tektronix, Inc., a publicly-traded supplier of test, measurement, and monitoring products, from 1993 to 2008; SuperValu, Inc., a publicly-traded food and drug retailer, from 2006 to 2010 and iPass, Inc., a

publicly-traded enterprise mobility company, from 2002 to 2010. Mr. Ames holds a B.A. in Finance from Portland State University.

Mr. Ames has extensive experience as a senior executive and chief executive officer in the telecommunications industry in the United

States, South America, Europe and Asia. He provides to the Board of Directors valuable insight into large telecommunications enterprises, which are an important customer base for the Company. For over twenty years, Mr. Ames has served on a

number of other boards, as chairman of compensation and governance committees, and as a member of public company audit committees. Mr. Ames

11

brings to the Board of Directors expertise and insight as a former chief executive officer, broad experience as director at a wide range of companies and international business experience. His

experience as a chief executive officer and member of public company audit committees qualifies him as an “audit committee financial expert” as defined in Item 407 of Regulation S-K.

Deborah L. Bevier, age 63, has served as one of our directors since July 2006. Ms. Bevier has been the principal of D.L.

Bevier Consulting LLC, an organizational and management consulting firm, since 2004. Prior to that time, from 1996 until 2003, Ms. Bevier served as a director, President and Chief Executive Officer of Laird Norton Financial Group and its

predecessor companies, an independent financial advisory services firm. From 1973 to 1996, Ms. Bevier held numerous leadership positions with KeyCorp, including chairman and Chief Executive Officer of Key Bank of Washington. Ms. Bevier

served on the board of directors of Outerwall, Inc. (formerly Coinstar, Inc.), a publicly-traded multi-national provider of services to retailers from 2002 to 2014. She served on the board of directors of Fisher Communications, Inc., a

publicly-traded media and communications company, from 2003 to 2010, and Puget Sound Bank, a commercial bank, from 2006 to 2008. Ms. Bevier holds a B.S. in Economics from SUNY New Paltz and a graduate degree from Stonier Graduate School of

Banking at Rutgers University.

Ms. Bevier has over 36 years of experience with both public and private companies in a wide

range of areas including finance, banking, management, and organizational operations. Ms. Bevier’s experience as a director of public companies in the consumer services, communications, and media industries enables her to bring a valuable

perspective to our Board of Directors. In addition to Ms. Bevier’s broad background, her extensive strategic, corporate governance, and compensation expertise makes her well qualified to serve on our Board of Directors.

Jonathan Chadwick, age 48, has served as one of our directors since August 2011. Mr. Chadwick is currently Executive Vice

President and Chief Financial Officer/Chief Operating Officer at VMware. Prior to joining VMware, Mr. Chadwick served as the Chief Financial Officer of Skype and as a corporate vice president of Microsoft Corporation after its acquisition of

Skype in October 2011. Mr. Chadwick joined Skype from McAfee where he was Executive Vice President and Chief Financial Officer from June 2010 until February 2011. From 1997 to 2010, he held various finance roles at Cisco Systems, including

senior vice president, Chief Financial Officer — Global Customer Markets, Senior Vice President, Corporate Controller and Principal Accounting Officer, and Vice President, Corporate Finance & Planning. He also worked for

Coopers & Lybrand in various roles in the US and UK. Mr. Chadwick is a Chartered Accountant in England and holds an honors degree in electrical and electronic engineering from the University of Bath, UK.

Mr. Chadwick has extensive experience as a finance executive in the computer networking and security software industries. In addition,

his background in high growth enterprises and significant corporate transactions brings an important and valuable perspective to our Board of Directors. As a chief financial officer of a major multi-national enterprise, his expertise in accounting

and financial controls qualifies him as an “audit committee financial expert” as defined in Item 407 of Regulation S-K.

Michael Dreyer, age 51, has served as one of our directors since October 2012. Mr. Dreyer is currently the Chief Operating

Officer, Group and President, Americas for Monitise, a technology leader in mobile banking. Prior to joining Monitise, he was the Chief Information Officer at Visa Inc. from July, 2005 to March, 2014 where he was responsible for the

company’s systems and technology platforms. Before joining Visa Inc., he was Chief Information Officer of Inovant, where he oversaw the development and management of Visa’s global systems technology. Previously, Mr. Dreyer held

executive positions at VISA USA as Senior Vice President of processing and emerging products, and Senior Vice President of commercial solutions. He has also held senior positions at American Express, Prime Financial, Inc., Federal Deposit Insurance

Corporation, Downey Savings, Bank of America, and the Fairmont Hotel Management Company. Mr. Dreyer received an M.B.A. and a B.A. in psychology from Washington State University.

12

Mr. Dreyer has extensive experience as an information technology executive. He brings to our

Board of Directors valuable insights regarding data center operations and the role of our technology in the data center, as well as an understanding of data traffic management technologies, data security, and other networking technology trends.

Mr. Dreyer’s information technology and data management expertise combined with his background as a senior executive in the financial industry make him well qualified to serve on our Board of Directors.

Stephen Smith, age 58, has served as one of our directors since January 2013. Mr. Smith is currently Chief Executive Officer and

President, and a member of the board of directors of Equinix, Inc., a provider of global data center services. Prior to joining Equinix in April 2007, Mr. Smith served as Senior Vice President at HP Services, a business segment of

Hewlett-Packard Co., from January 2005 to October 2006. Prior to joining Hewlett-Packard Co., Mr. Smith served as Vice President of Global Professional and Managed Services at Lucent Technologies Inc., a communications solutions provider.

Mr. Smith also held various management and sales positions during his 17 years with Electronic Data Systems Corporation (“EDS”), a business and technology solutions company, including Chief Sales Officer, President of EDS

Asia-Pacific, and President of EDS Western Region. Mr. Smith served on the board of directors of Volterra Semiconductor Corporation, a publicly-traded company from January 2012 to October 2013. He previously served as a director of the public

company 3PAR Inc. and as a director of the privately-held company Actian during the past five years. Mr. Smith graduated from the U.S. Military Academy at West Point and holds a B.S. in Engineering.

The combination of Mr. Smith’s experience as chief executive officer and director of a public company, and his executive leadership

and management experience at technology services and critical infrastructure companies make him well-qualified to serve on our Board of Directors. He brings to our Board of Directors a deep understanding of competitive technologies and of the role

and value of our technology in data centers.

Sandra Bergeron, age 56, has served as one of our directors since January 2013. From

2004 until 2012, Ms. Bergeron was a venture partner at Trident Capital, Inc., a venture capital firm. Ms. Bergeron currently serves on the board of directors of Qualys, Inc., a publicly-traded provider of cloud security and compliance

solutions; Sophos, Inc., a privately-held provider of IT security and data protection products; and TraceSecurity, a privately-held provider of cloud-based security solutions and IT governance, risk and compliance management solutions where she also

serves as chairman. Ms. Bergeron previously served on the board of directors of TriCipher, a privately-held secure access management company acquired by VMware in August 2010 and ArcSight, Inc., a publicly-traded security and compliance

management company acquired by Hewlett-Packard Company in September 2010. Ms. Bergeron holds a B.A. in Business Administration from Georgia State University and a M.B.A. from Xavier University.

Ms. Bergeron has extensive experience in network and data security and related public policy issues. She has a national reputation as an

expert on computer security matters. In addition, she has extensive experience as a director of public and private technology companies, and as an executive managing product development and sales teams in the computer and internet security

industries.

Peter Klein, age 52, has been nominated by the Board to be elected at the Annual Meeting to serve as a new director

for the Company. Mr. Klein has almost 25 years of experience as a senior finance executive. He served as Chief Financial Officer of WME, a global leader in sports and entertainment marketing, from January 2014 until June

2014. Prior to that, he served as Chief Financial Officer of Microsoft Corporation from November 2009 until May 2013. Mr. Klein spent over 11 years at Microsoft, including roles as Chief Financial Officer of the Server and Tools and

Microsoft Business Divisions. From 1990 until 2002 Mr. Klein held senior finance roles with McCaw Cellular Communications, Orca Bay Capital, Asta Networks and Homegrocer.com. Mr. Klein holds a B.A. from Yale University and an MBA from

the University of Washington. He currently serves on the board of directors of Apptio Inc., a private software company.

13

Mr. Klein’s extensive experience as a finance executive in a variety of technology

companies, including experience as the Chief Financial Officer of the world’s largest software company, and experience managing the finance function for significant enterprises with diverse operating models brings an important and valuable

perspective to our Board of Directors.

There are no family relationships among any of the Company’s directors or executive officers.

None of the corporations or other organizations referred to in the biographical information set forth above is a parent, subsidiary or other affiliate of the Company.

14

CORPORATE GOVERNANCE

Committees of the Board of Directors

The

Board of Directors has standing Audit, Compensation, and Nominating and Corporate Governance Committees (collectively, the “Standing Committees”). Each of the Standing Committees has a charter, copies of which are available on our website

at www.f5.com under the “About F5 — Investor Relations — Corporate Governance” section.

Audit

Committee. As described more fully in the Audit Committee charter, the functions of the Audit Committee include selecting, evaluating and, if necessary, replacing the Company’s independent registered public accounting firm; reviewing

and approving the planned scope, proposed fee arrangements and results of the annual audit; approving any proposed non-audit services to be provided by the independent registered public accounting firm; overseeing the adequacy of accounting and

financial controls; reviewing the independence of the independent registered public accounting firm; and overseeing the Company’s financial reporting process on behalf of the Board of Directors. The Audit Committee members are

Messrs. Chadwick (chairman) and Dreyer, and Mss. Bergeron and Bevier. Mr. Ames also served on the Audit Committee during a portion of fiscal year 2014. The Board of Directors has determined that Mr. Chadwick is an “audit

committee financial expert” as defined in Item 407 of Regulation S-K. Each current member of the Audit Committee is, and each member of the Audit Committee during fiscal year 2014 was, an independent director as defined by the Nasdaq

Listing Rules (as independence is currently defined in Rule 5605(a)(2)).

Compensation Committee. The Compensation

Committee conducts an annual review to determine whether the Company’s executive compensation program is meeting the goals and objectives set by the Board of Directors. The Compensation Committee recommends for approval by the Board of

Directors the compensation for the Chief Executive Officer and directors, including salaries, incentive compensation levels and stock awards, and reviews and approves compensation proposals made by the Chief Executive Officer for the other executive

officers. The Compensation Committee may form and delegate authority to subcommittees and may delegate authority to one or more designated members of the Compensation Committee or of the Board of Directors or to Company officers to perform certain

of its duties on its behalf. The Compensation Committee members are Ms. Bevier (chair) and Messrs. Ames, Dreyer, Higginson and Smith. Each current member of the Compensation Committee is, and each member of the Compensation Committee

during fiscal year 2014 was, an independent director as defined by the Nasdaq Listing Rules. In fiscal year 2014, the Compensation Committee retained an outside independent compensation consultant, Towers Watson, to advise the Compensation Committee

on executive compensation issues. Towers Watson provides the Compensation Committee peer and survey group cash and equity compensation data, including 50th and 75th percentile base salary, total cash, long-term incentive and total direct

compensation data. For additional information about the Compensation Committee and the information provided by Towers Watson to the Compensation Committee, see the description of the Compensation Committee’s activities in the “Executive

Compensation — Compensation Discussion and Analysis” section. The Compensation Committee has determined that the work of Towers Watson has not raised any conflict of interest as defined in Item 407 of Regulation S-K.

Nominating and Corporate Governance Committee. The functions of the Nominating and Corporate Governance Committee (the

“Nominating Committee”) are to identify new potential Board members, recommend Board nominees, evaluate the Board’s performance, and provide oversight of corporate governance and ethical conduct. The Nominating Committee members are

Messrs. Ames (chairman), Higginson and Smith, and Ms. Bergeron. Each current member of the Nominating Committee is, and each member of this committee during fiscal year 2014 was, an independent director as defined by the Nasdaq Listing

Rules.

Board Leadership

The Company

currently separates the roles of Chief Executive Officer and Chairman of the Board. Mr. McAdam, the President and Chief Executive Officer, is responsible for setting the strategic direction of the Company and for the day-to-day leadership and

performance of the Company. Mr. Higginson, the Chairman of

15

the Board, sets the agenda for and presides at Board meetings, and coordinates the Board’s communications with Mr. McAdam and the Company’s senior management team. The Board

believes this current structure balances the needs for the President and Chief Executive Officer to run the Company on a day-to-day basis with the benefit provided to the Company by Mr. Higginson’s perspective as an independent member of

the Board.

Risk Oversight

Assessing

and managing risk is the responsibility of the Company’s senior management team. The Board of Directors oversees certain aspects of the Company’s risk management efforts, and reviews and consults at each of the regular quarterly Board

meetings with the Company’s senior management team and the Company’s Vice President of Internal Audit on strategic and operational opportunities, challenges and risks faced by the Company. In fiscal year 2010, the Company implemented an

enterprise risk management program. The Company retained Ernst & Young to assist the Company in performing an enterprise risk assessment to identify key strategic, operating, legal and compliance, and financial risks, evaluate the

significance of those risks, formulate a risk profile which identified relevant risk levels and management control efforts, and develop action plans to address these key risks. The Company’s senior management team regularly reviews and

evaluates these key risks and the effectiveness of the Company’s risk management programs, and reported back to the Audit Committee and the full Board of Directors on a regular basis during fiscal year 2014. In addition, the Audit Committee

oversees the Company’s financial risk exposures, financial reporting, and internal controls. The Compensation Committee oversees the Company’s executive compensation programs, monitors the administration of the Company’s various

equity compensation plans, and conducts compensation-related risk assessments. The Nominating Committee oversees risk related to the Company’s overall corporate governance profile and ratings; board and committee composition and structure; and

director independence. Each Committee presents regular reports to the full Board of Directors. The Board’s role in risk oversight has not had any effect on the Board’s leadership structure.

Compensation Committee Interlocks and Insider Participation

The following directors served as members of the Compensation Committee during some or all of fiscal year 2014: Ms. Bevier

(chair), Messrs. Ames, Dreyer, Higginson, and Smith. None of these persons has at any time been an officer or employee of the Company. During fiscal year 2014, none of the Company’s executive officers served as a member of the board of

directors or compensation committee of any entity that has had one or more executive officers that served as a member of the Company’s Board of Directors or Compensation Committee.

Related Person Transactions Policy and Procedures

As set forth in the written charter of the Audit Committee of the Board of Directors, any related person transaction involving a Company

director or executive officer must be reviewed and approved by the Audit Committee. Any member of the Audit Committee who is a related person with respect to a transaction under review may not participate in the deliberations or vote on the approval

or ratification of the transaction. Related persons include any director or executive officer, certain shareholders and any of their “immediate family members” (as defined by SEC regulations). To identify any related person transaction,

the Company requires each director and executive officer to complete a questionnaire each year requiring disclosure of any prior or proposed transaction with the Company in which the director, executive officer or any immediate family member might

have an interest. Each director and executive officer is directed to notify the Company’s Executive Vice President and General Counsel of any such transaction that arises during the year, and the Company’s Chief Financial Officer reports

to the Audit Committee on a quarterly basis regarding any potential related person transaction. In addition, the Board of Directors determines on an annual basis which directors meet the definition of independent director under the Nasdaq Listing

Rules and reviews any director relationship that would potentially interfere with his or her exercise of independent judgment in carrying out the responsibilities of a director. A copy of the Company’s “Policy and Procedures for Approving

Related-Person Transactions” is available on our website at www.f5.com under the “About F5 — Investor Relations — Corporate Governance” section.

16

Certain Relationships and Related Person Transactions

The Company’s Articles limit the liability of the Company’s directors for monetary damages arising from their conduct as directors,

except to the extent otherwise required by the Articles of Incorporation and the Washington Business Corporation Act. The Articles also provide that the Company may indemnify its directors and officers to the fullest extent permitted by Washington

law, including in circumstances in which indemnification is otherwise discretionary under Washington law. The Company has entered into indemnification agreements with the Company’s directors and certain officers for the indemnification of, and

advancement of expenses to, these persons to the fullest extent permitted by law. The Company also intends to enter into these agreements with the Company’s future directors and certain future officers.

Meetings of the Board of Directors and Standing Committees; Attendance at Annual Meeting

The Company’s Board of Directors met or acted by unanimous written consent 9 times during fiscal year 2014. The Audit Committee met 11

times and the Compensation Committee met or acted by unanimous written consent 11 times. During fiscal year 2014, the Nominating and Corporate Governance Committee met 4 times. The outside directors met 3 times during fiscal 2014, with no members of

management present. Each member of the Board of Directors attended 75% or more of the Board of Directors meetings during fiscal year 2014. Each member of the Board of Directors who served on one or more of the Standing Committees attended at least

75% of the total number of meetings of the Standing Committees on which the director served during fiscal year 2014. All directors are also expected to be present at the Company’s annual meetings of shareholders. All directors attended the

Company’s annual meeting of shareholders for fiscal year 2013 except Messrs. Chadwick and Smith.

Director Nomination

Criteria for Nomination to the Board of Directors. The Nominating Committee considers the appropriate balance of experience, skills

and characteristics required of the Board of Directors, and seeks to ensure that at least a majority of the directors are independent under the Nasdaq Listing Rules, that members of the Company’s Audit Committee meet the financial literacy

requirements under the Nasdaq Listing Rules and that at least one of them qualifies as an “audit committee financial expert” under the rules of the Securities and Exchange Commission. Nominees for director are selected on the basis of

their depth and breadth of experience, integrity, ability to work effectively as part of a team, understanding of the Company’s business environment, and willingness to devote adequate time to Board duties.

In evaluating director candidates, regardless of the source of the nomination, the Nominating Committee will consider, in accordance with its

Charter, the composition of the Board as a whole, the requisite characteristics (including independence, diversity, skills and experience) of each candidate, and the performance and continued tenure of incumbent Board members. With respect to

diversity, we broadly construe diversity to mean not only diversity of race, gender and ethnicity, but also diversity of opinions, perspectives, and professional and personal experiences. Nominees are not discriminated against on the basis of race,

religion, national origin, sexual orientation, disability or any other basis proscribed by law. The board believes that the backgrounds and qualifications of the directors, considered as a group, should provide a significant composite mix of

experience, knowledge and abilities that will allow the Board to fulfill its responsibilities. The Board therefore considers diversity in identifying nominees for director, but does not have a separate policy directed toward diversity.

Shareholder Proposals for Nominees. The Nominating Committee will consider written proposals from shareholders for nominees for

director. Any such nominations should be submitted to the Nominating Committee c/o the Corporate Secretary and should include the following information: (a) all information relating to such nominee that is required to be disclosed pursuant

to Regulation 14A under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (including such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected);

(b) the name(s) and address(es) of the shareholders(s) making the nomination and the number of shares of Common Stock that are owned beneficially

17

and of record by such shareholders(s); (c) appropriate biographical information and a statement as to the qualification of the nominee and (d) any information required by the Bylaws of

the Company. Such nominations should be submitted in the time frame described in the Bylaws of the Company and under the caption “Shareholder Proposals for the Annual Meeting for Fiscal Year 2015” below.

Process for Identifying and Evaluating Nominees. The process for identifying and evaluating nominees to fill vacancies on the

Board of Directors is initiated by conducting an assessment of critical Company and Board needs, based on the present and future strategic objectives of the Company and the specific skills required for the Board as a whole and for each Board

Committee. A third-party search firm may be used by the Nominating Committee to identify qualified candidates. These candidates are evaluated by the Nominating Committee by reviewing the candidates’ biographical information and qualifications

and checking the candidates’ references. Serious candidates meet with all members of the Board and as many of the Company’s executive officers as practical. Using the input from such interviews and the information obtained by the

Nominating Committee, the full Board determines whether to appoint a candidate to the Board.

The Nominating Committee will evaluate the

skills and experience of existing Board members against the Company’s critical needs in making recommendations for nomination by the full Board of candidates for election by the shareholders. The nominees to the Board of Directors described in

this Proxy Statement were approved unanimously by the Company’s directors. Ms. Bergeron and Mr. Smith, who joined the Board in January 2013 were recommended by third-party search firms the Nominating Committee retained at the expense

of the Company in fiscal year 2012. Mr. Klein was recommended by a third party search firm retained by the Nominating Committee at the Company’s expense in fiscal year 2015. The third-party search firms were provided guidance as to the

particular skills, experience and other characteristics the Nominating Committee was seeking in potential candidates. The third-party search firms identified a number of potential candidates, including Ms. Bergeron and Messrs. Klein and

Smith, and prepared background materials on these candidates, which were provided to the members of the Nominating Committee for their review. The third-party search firms interviewed those candidates the Nominating Committee determined merited

further consideration, and assisted in arranging interviews of selected candidates with members of the Nominating Committee, other members of the Board of Directors, and certain of the Company’s executive officers. The third-party search firms

also completed reference checks on the candidates.

The Nominating Committee expects that a similar process will be used to evaluate

nominees recommended by shareholders. However, to date, the Company has not received any shareholder’s proposal to nominate a director.

Communications with Directors

Shareholders who wish to communicate with our directors may do so by contacting them c/o Corporate Secretary, F5 Networks, Inc., 401

Elliott Avenue West, Seattle, Washington 98119. As set forth in the Company’s Corporate Governance Guidelines, a copy of which may be found under the “About F5 — Investor Relations — Corporate Governance” section of our

website, www.f5.com, these communications will be forwarded by the Corporate Secretary to a Board member, Board committee or the full Board of Directors as appropriate.

Code of Ethics for Senior Financial Officers

We have adopted a Code of Ethics for Senior Financial Officers that applies to certain of our senior officers, including our Chief Executive

Officer and Chief Financial Officer. The Code of Ethics for Senior Financial Officers is posted under the “About F5 — Investor Relations — Corporate Governance” section of the Company’s website, www.f5.com. A copy of

the Code of Ethics may be obtained without charge by written request to the Company’s Corporate Secretary. We also have a separate Code of Business Conduct and Ethics that applies to all of the Company’s employees, which may also be found

under the “About F5 — Investor Relations — Corporate Governance” section of our website.

18

Compensation Risk Assessment

The Compensation Committee and Company management have reviewed the Company’s compensation plans and programs and have concluded that none

of these plans or programs is reasonably likely to have a material adverse effect on the Company. In making this evaluation, the Compensation Committee reviewed the key elements of each of the Company’s compensation programs and the means by

which any potential risks are mitigated, including through various elements in the Company’s enterprise risk management program. The Company’s compensation programs include a mix of base salary, cash incentive compensation, and long-term

equity compensation. The incentive compensation and performance-based annual equity awards programs for the executive officers include both revenue and EBITDA targets intended to ensure that the executive officers appropriately manage operating

risks, avoid excessive risk-taking, and maintain the Company’s gross margin and operating margin targets while growing its revenue base.

Compensation Committee Report

The

Compensation Committee has reviewed and discussed with management the Company’s “Compensation Discussion and Analysis.” Based on this review and discussions, the Compensation Committee recommended to the Board of Directors that the

“Compensation Discussion and Analysis” be included in this Proxy Statement and the Company’s Annual Report to Shareholders on Form 10-K for the fiscal year ended September 30, 2014.

Members of the Compensation Committee:

A. Gary Ames

Deborah L. Bevier, Chair

Michael L. Dreyer

Alan J. Higginson

Stephen Smith

19

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Introduction

This

Compensation Discussion and Analysis provides information about the fiscal year 2014 compensation program for our fiscal year 2014 named executive officers (sometimes referred to herein as NEOs) who are as follows:

John McAdam, President and Chief Executive Officer (and our principal executive officer)

Andrew Reinland, Executive Vice President and Chief Financial Officer (and our principal financial officer)

Karl Triebes, Executive Vice President of Product Development and Chief Technical Officer

Edward J. Eames, Executive Vice President of Business Operations

Manuel Rivelo, Executive Vice President of Strategic Solutions

Executive Summary

Fiscal year 2014, was a year of challenges and change in the application delivery networking industry with continuing explosive growth of

applications and new devices, evolving security threats, and demands for faster deployment all pushing traditional IT models to their limits. In response, customers are modernizing their computing environments and adopting software-defined

architectures, hybrid computing solutions and consuming “as-a-service” offerings. To address these evolutionary trends, the Company introduced its Synthesis Architecture for Software Defined Application Services and executed on this

new strategy to drive strong growth in fiscal year 2014.

Select Business Highlights for Fiscal Year 2014

Top Line / Bottom Line Results

| |

• |

|

Record annual revenue $1.73 billion, up 17% over fiscal year 2013. |

| |

• |

|

Product revenue growth of 17%. |

| |

• |

|

Record cash flows from operations of $549 million. |

| |

• |

|

Record net income of $311 million. |

Shareholder Value Creation

| |

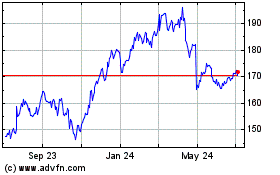

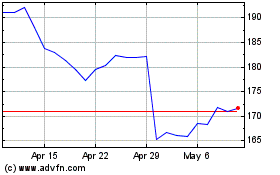

• |

|

1, 3 and 5 year TSRs of 38.4%, 67.1% and 199.6% respectively. |

| |

• |

|

Executed approximately $650 million in share repurchases over fiscal year 2014. |

Commercial

and Operational Performance

| |

• |

|

Successful rollout of Synthesis vision for Software Defined Application Services and supporting reference architectures and new licensing models, including the Company’s Good/Better/Best pricing model, in support

of this new hybrid architecture. |

| |

• |

|

Continued to expand the Company’s total addressable market with the successful acquisition of Defense.net. |

| |

• |

|

F5 positioned as the leader in Gartner’s Magic Quadrant for Application Delivery Controller vendors. |

| |

• |

|

4% year over year market share growth to 49% of the application delivery controller (ADC) market according to Del Oro. |

20

| |

• |

|

Introduction of various new hardware platforms including the VIPRION 2200 which is the industry’s first modular Application Delivery Controller chassis in an appliance footprint (2U), giving customers

unparalleled price/performance in its class. |

Compensation Policies and Practices Linked to Shareholder Value Creation

and Mitigation of Risk

| |

• |

|

No excise tax gross ups — the Company does not provide for “golden parachute” excise tax gross-ups upon a change in control of the Company. |

| |

• |

|

Double trigger change of control agreements — the Company’s change of control agreements with its executives contain a “double trigger” feature. |

| |

• |

|

The Company offers only modest perquisites to its executive officers that are supported by a business interest and which are consistent with broad-based benefit plans that are available to other employees.

|

| |

• |

|

Independent compensation consultant — the Committee retains an independent compensation consulting firm which provides no other services to the Company other than services for the Committee. |

| |

• |

|

Stock Ownership Guidelines — the Board and Company executives are subject to stock ownership requirements that encourage alignment with the interests of the shareholders. |

| |

• |

|

Clawback policy — incentive compensation for certain executives may be subject to recoupment in the event the Company restates its reported financial results to correct a material accounting error on an interim or

annual financial statement included in a report on Form 10-Q or 10-K due to material noncompliance with a financial reporting requirement. |

| |

• |

|

No hedging or pledging of stock — executive officers are prohibited from entering into hedging or pledging transactions or trading in puts, calls or other derivatives of the Company’s Common Stock or otherwise

engaging in short sales of Common Stock of the Company. |

| |

• |

|

No re-pricing of options — under the terms of the F5 Networks, Inc. 2014 Incentive Plan, the re-pricing of underwater options is prohibited absent shareholder approval. |

| |

• |

|

Annual Advisory Vote on Executive Compensation. |

Results of 2013 Shareholder Advisory Vote

on Executive Compensation

In evaluating the Company’s executive compensation program for fiscal year 2014, the Compensation

Committee of the Board of Directors (the “Committee”) considered the shareholder annual advisory vote on executive compensation for fiscal year 2013 which was approved by over 95% of the votes cast. The Committee believes this vote

reflects a high level of approval of the executive compensation program. The Committee carefully considers feedback from shareholders regarding the Company’s executive compensation, including the results of the shareholders’ annual

advisory vote on executive compensation. The Company also meets regularly with shareholders and analysts. Shareholders are invited to express their views to the Committee, including as described above under the heading “Communications with

Directors.”

Updates to our Executive Compensation Program in Fiscal Year 2014

In fiscal year 2014, the Compensation Committee of the Board of Directors (the “Committee”) continued its focus on increasing

the weight of incentive based cash compensation for the NEOs. The Committee believes that the focus on shifting cash compensation to be more heavily weighted on incentive based compensation serves to drive strong financial performance which is a

crucial element of maintaining and growing shareholder value. As discussed below in “Factors Considered — Benchmarking”, the Committee seeks to align the total cash compensation of the NEOs at or near 50th percentile for

comparable executive officers in the Company’s peer group. As the NEOs other than Mr. McAdam were below this measure, the Committee chose to increase the incentive based cash compensation to close the gap. Accordingly, the Committee

elected to increase performance

21

based cash compensation by increasing target bonuses in a range of 20 to 30% for the named executive officers other than Mr. McAdam, while providing only modest increases to the base cash

compensation for the NEOs ranging from 4 to 5% for fiscal year 2014. Therefore, the resulting total cash compensation increases of 16% to 23% for the NEOs other than Mr. McAdam were more heavily weighted towards incentive based

compensation. These increases also more closely aligned the NEOs with the 50th percentile in total cash compensation of the Peer Group executives. The Compensation Committee also elected to have Mr. McAdam’s base salary remain flat and

again focus on incentive compensation by increasing Mr. McAdam’s cash incentive compensation from 120% of his base salary to 130% of his base salary for an increase in total cash compensation of 6%. Also consistent with its philosophy of

utilizing incentive based compensation to drive shareholder value, the Committee decided to adjust the performance goals for incentive based compensation in 2014 by increasing the weighting for the revenue portion of the performance goals from 50%

to 70% of the target. The Committee felt incenting top line revenue growth was closely aligned with driving shareholder value in today’s market environment.

Executive Compensation Program Objectives

The objectives of our executive compensation program are to correlate executive compensation with the Company’s business objectives,

performance and the creation of shareholder value, and to enable the Company to attract, retain and reward key executive officers who contribute to its long-term success. We believe the total direct compensation our named executive officers received

in fiscal year 2014 as set forth in the Summary Compensation Table on page 32 is consistent with and reflects these objectives.

Fiscal Year 2014 Corporate Performance

The Company’s total annual revenue in fiscal year 2014, $1.73 billion, was the highest ever and an increase of 17% over fiscal year 2013.

Cash flow from operating activities was $549 million and net income was $311 million, both the highest in the Company’s history. We maintained very strong GAAP gross margins and operating margins throughout fiscal year 2014. GAAP

gross margin and GAAP operating margin were 82.1% and 28.5% respectively for fiscal year 2014. GAAP operating margin improved in the second half of fiscal year 2014. The Company continued to maintain a very strong balance sheet, ending the fiscal

year with cash and investments totaling approximately $1.1 billion.

In fiscal year 2014, the Company continued to achieve strong operating results while enhancing its

technology and market leadership positions. The Company continued to deliver long-term shareholder value. During the Company’s five most recent fiscal years, shareholder value increased at a compounded annual growth

22

rate of 25%, while comparable rates for the Nasdaq Composite Index, Nasdaq Computer Index and the S&P 500 index were 18%, 19% and 16% respectively, and 10% for the Peer Group Companies. Our

share price growth rates were 38%, 67% and 200% as of September 30 over the past one, three and five year time periods. Comparable growth rates for the Nasdaq Composite Index were 21%, 93% and 124% respectively; 33%, 92% and 141% respectively

for the Nasdaq Computer Index; 20%, 86% and 107% respectively for the S&P 500 Index, and 6%, 50%, and 58% respectively for the Peer Group Companies.

Prepared by Zacks Investment Research, Inc. Used with permission. All rights reserved. Copyright 1980-2015 Index Data:

Copyright Standard and Poor’s, Inc. and Copyright NASDAQ OMX, Inc. Used with permission. All rights reserved.

Compensation

Philosophy

We design the compensation programs for our executive officers to link compensation to improvements in the

Company’s financial performance and the creation of shareholder value. We achieve this objective through a compensation program that:

| |

• |

|

provides a competitive total compensation package that enables the Company to attract, motivate, reward and retain executive officers who contribute to the Company’s success; |

| |

• |

|

links incentive compensation to the performance of the Company and aligns the interests of executive officers with the long-term interests of shareholders; and |

| |

• |

|

establishes incentives that relate to the Company’s quarterly, annual and long-term business strategies and objectives. |

The Compensation Committee believes that the Company’s executive compensation should also reflect each executive officer’s

qualifications, experience, role and personal performance, and the Company’s performance achievements. Regarding the Company’s incentive compensation and performance-based equity awards programs, the Compensation Committee continues to

believe that revenue and EBITDA are the most appropriate measurements for these programs as the Company’s ability to deliver consistent and strong financial performance is of crucial importance in maintaining and growing shareholder value, and