UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date

of report (Date of earliest event reported): January 9, 2015

PERVASIP CORP.

(Exact name of registrant as specified in its

charter)

| New York |

000-04465 |

13-2511270 |

|

(State or other

jurisdiction of incorporation) |

(Commission File No.) |

(I.R.S. Employer Identification No.) |

430 North Street

White Plains, NY 10605

(Address of principal

executive offices)

(914)

750-9339

(Registrant’s telephone

number, including area code)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13-4(e) under the Exchange Act (17 CFR 240.13e-4(c))21723200

SECTION 1 – REGISTRANT’S

BUSINESS AND OPERATIONS

Item 1.01. Entry into a Material Definitive Agreement.

On January 14, 2014, Pervasip Corp.

(the “Company”) executed a settlement and release agreement (the “Agreement”) with the Pension Benefit

Guarantee Corporation (the “PBGC”), pursuant to which PBGC agreed to accept $100,000 in full satisfaction of all amounts

that had been due from Pervasip. The Company reported a liability to the PBGC in its August 31, 2014 Quarterly Report on Form 10-Q

of $1,987,255.

The following describes certain of the material

terms of the Agreement. The description below is not a complete description of the material terms of the transaction and is qualified

in its entirety by reference to the Agreement entered into in connection with the transaction, a copy of which is included as Exhibit

10.1 to this Current Report on Form 8-K:

Payments. The Company agreed

to pay the sum of $100,000 (the “Settlement Amount”) to the PBGC. On each of January 31, 2015, April 30, 2015, July

31, 2015 and October 31, 2015, the Company shall pay $25,000 to the PBGC.

PBGC Release. Upon receipt

of the Settlement Amount, the PBGC shall be deemed to have released the Company from any and all employer liability and fiduciary

liability.

On January 9, 2015, the

Company received a modification of the terms of a note payable to Diamond Remark, Inc., which was filed as Exhibit 4.1 to the Company’s

Current Report on Form 8-K, dated September 4, 2014. The modification delayed the requirement of a reverse split by January 31,

2015. Consequently, the Company has canceled plans to file for a reverse split.

SECTION 8 – OTHER EVENTS

Item 8.01 Other Events.

On January 14, 2015 the Company issued a press

release announcing the Agreement. A copy of the press release is attached hereto as Exhibit 99.1.

SECTION 9 – FINANCIAL STATEMENT AND

EXHIBITS

Item 9.01 Financial Statements and Exhibits.

(c) Exhibits.

Number Documents

| | Number |

| Documents |

| 10.1 |

| Settlement and Release Agreement by and between Pervasip Corp. and Pension Benefit Guaranty Corporation,

on January 14, 2015 |

| | |

| |

| | 99.1 |

| Press release of Pervasip Corp. dated January

14, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

PERVASIP CORP. |

| |

|

|

|

|

|

| |

|

|

|

|

|

| Date: January 14, 2015 |

|

By: |

/s/ Paul H. Riss |

|

| |

|

|

|

Name: Paul H. Riss |

|

| |

|

|

|

Title: Chief Executive Officer |

|

Exhibit

10.1

SETTLEMENT AND RELEASE AGREEMENT

THIS SETTLEMENT AND RELEASE AGREEMENT (this

“Agreement”) is entered into by and between the Pension Benefit Guaranty Corporation (the “PBGC”), Pervasip

Corp. d/b/a eLEC Communications Corp. f/k/a Sirco International Corporation (“Pervasip”) and Paul H. Riss (“Riss”

and collectively, the “Parties”) as of the 12th day of January, 2015 (the “Effective Date”).

RECITALS

WHEREAS, the PBGC is a United States government

corporation established under Title IV of the Employee Retirement Income Security Act of 1974, 29 U.S.C. §§ 1301-1461

(2012) (“ERISA”).

WHEREAS, Pervasip is a New

York corporation and, at all relevant times, was the administrator and contributing sponsor of the Sirco International Corporation

Employees’ Retirement Plan (“Pension Plan” or “Plan”) within the meaning of ERISA, 29 U.S.C. §§1002(16),

1301(a)(1), (13).

WHEREAS, the Pension Plan

was a single-employer defined benefit pension plan covered by Title IV of ERISA.

WHEREAS, Pervasip and the PBGC entered

into an agreement dated July 27, 2011, which terminated the Pension Plan, established the Plan termination date as September 30,

2010 and appointed the PBGC as the Plan’s statutory trustee.

WHEREAS, the PBGC asserts that, as the

contributing sponsor, Pervasip is liable for the Pension Plan’s unfunded benefit liabilities, unpaid minimum funding, and

unpaid premiums owed to the PBGC (collectively the “Employer Liabilities”).

WHEREAS, the PBGC asserts that Pervasip

and Riss, as fiduciaries of the Plan, are liable for losses due to fiduciary breach (the “Fiduciary Liability”).

WHEREAS, Pervasip seeks to sell an interest

in Pervasip to an unrelated third party and asserts that the sale is not possible without a resolution of the Employer Liabilities

and Fiduciary Liability.

WHEREAS, the parties desire to resolve

the Employer Liabilities and Fiduciary Liability.

NOW THEREFORE, for good and valuable

consideration, the receipt and sufficiency of which is hereby acknowledged, the Parties agree as follows:

1. Payment to PBGC. Pervasip agrees

to pay the sum of $100,000.00 (the “Settlement Amount”) to the PBGC. On each of January 31, 2015, April 30, 2015, July

31, 2015 and October 31, 2015, Pervasip shall pay $25,000 to PBGC. Pervasip may prepay one or more of the foregoing payments in

whole or in part without any prepayment penalty, but any prepayment will be made without

discount.

2. Entirety of the Purchase Price.

Pervasip and Riss affirm that $100,000 is the entirety of the consideration being received for the sale of the interest in Pervasip

and that Riss is not receiving any other form of compensation for the sale.

3. The PBGC Release. Upon receipt

of the Settlement Amount, the PBGC shall be deemed to have released Pervasip from the Employer Liabilities and both Pervasip and

Riss from the Fiduciary Liability.

4. No Third-Party Beneficiaries.

This Agreement is for the exclusive benefit of the Parties. Nothing contained herein shall be construed as granting, vesting, creating

or conferring any right of action or any other right or benefit upon any other third-party .

5. Non Waiver. By entering into

this Agreement, the Parties are not waiving any rights to or defenses against any entity other than the Parties.

6. Representations and Warranties.

6.1 Pervasip hereby represents

and warrants that each of the following is true and correct as of the Effective Date:

(a) Pervasip has full power

and authority to enter into and perform its obligations under this Agreement and to carry out and consummate the transactions contemplated

by this Agreement.

(b) The execution, delivery

and performance by Pervasip of this Agreement has been duly authorized by all necessary corporate action.

(c) Pervasip’s execution

and delivery of this Agreement, performance of the obligations described herein and compliance with the Agreement’s terms

and provisions will not violate in any material respect any law applicable to Pervasip, the consequences of which violation could

reasonably be expected to have a material adverse effect on Pervasip’s ability to perform its obligations hereunder.

(d) This Agreement has been

duly executed by an authorized officer or other representative of Pervasip. This Agreement constitutes a legal, valid and binding

contract and agreement of Pervasip, and is enforceable by the PBGC against Pervasip in accordance with its terms.

6.2 Riss hereby represents

and warrants that each of the following is true and correct as of the Effective Date:

(a) Riss is one of the Parties

hereto.

(b) Riss understands the Agreement

and his obligations thereunder.

(c) Riss’s execution and

delivery of this Agreement, performance of the obligations described herein and compliance with the Agreement’s terms and

provisions will not violate in any material respect any law applicable to Riss, the consequences of which violation could reasonably

be expected to have a material adverse effect on Riss’ ability to perform his obligations hereunder.

6.3 The PBGC hereby represents

and warrants that each of the following representations and warranties is true and correct as of the Effective Date:

(a) The PBGC is a wholly owned

United States government corporation and an agency of the United States established under Title IV of ERISA. The PBGC has full

power and authority to enter into and perform its obligations under this Agreement and to carry out and consummate the transactions

contemplated by this Agreement.

(b) The PBGC’s execution,

delivery and performance of this Agreement has been duly authorized by all necessary corporate action and is within the PBGC’s

statutory authorization and authority.

(c) The PBGC’s execution

and delivery of this Agreement, the PBGC’s performance of its obligations under this Agreement and the PBGC’s compliance

with the terms and provisions of this Agreement: (i) will not violate in any material respect any law applicable to the PBGC or

any of its properties; and (ii) will not violate any provision of Title IV of ERISA or the PBGC’s By-Laws, other applicable

statutes, regulations and rules governing the PBGC or any material contract or agreement which is binding on the PBGC or its properties.

(d) This Agreement has been

duly executed by authorized officers or other representatives of the PBGC. This Agreement constitutes a legal, valid and binding

obligation and agreement of the PBGC and is enforceable against the PBGC in accordance with its terms, subject to general principles

of equity, regardless of whether considered in a proceeding in equity or at law.

7. Default.

7.1 Event of Default.

(a) Pervasip fails to pay within

30 days of the dates mandated, the sums required by paragraph 1 of this Agreement to PBGC.

(b) Any affirmations, representations,

or warranties made in this Agreement are false, including but limited to paragraphs 2 and 6.

7.2 Remedy for Default. Upon an event

of default, Pervasip and Riss agree that:

(a) The period within which

PBGC may institute proceedings, if any, against Pervasip or Riss with regard to the Employer and Fiduciary Liabilities or any other

ERISA liabilities relating to the Pension Plan is extended to and including July 27, 2015.

(b) To the extent that any statute

of limitations might otherwise bar PBGC from commencing court proceedings against Pervasip or Riss, relating to the Pension Plan,

that statute of limitations shall not be a bar from commencing such court proceedings until July 27, 2015.

(c) They will neither assert

nor rely on any statute of limitations as a defense against any court proceedings brought by PBGC on or before July 27, 2015, with

regard to the Pension Plan.

8. Entire Agreement. This Agreement (a)

constitutes the full and complete agreement between the Parties, and no other agreements, representations, promises or covenants

other than those contained herein have been made by the Parties and (b) supersedes all previous negotiations and agreements between

the Parties, if any.

9. Counterpart

and Electronic or Facsimile Signatures. This Agreement may be executed in counterparts and electronic and/or facsimile signatures

shall be deemed legal and binding for all purposes.

10. Governing

Law. To the extent not in conflict with ERISA or any applicable Federal law, this Agreement shall be governed by and construed

under, and in accordance with, the laws of the State of the State of New York.

IN WITNESS WHEREOF,

the parties do hereby execute this Agreement as of the date first set forth above.

| PERVASIP CORP. |

PENSION BENEFIT GUARANTY CORPORATION |

| |

|

| By: /s/ Paul H. Riss |

By: /s/ Robert D. Bacon |

| Paul H. Riss |

Robert D. Bacon |

| Title: Chief Executive Officer |

Title: Deputy Director,

Corporate Finance and Restructuring Department |

PAUL H. RISS

By: /s/ Paul H. Riss

Exhibit 99.1

FOR IMMEDIATE RELEASE

Pervasip Announces Agreement to Reduce

Debt by $1.9 million

WHITE PLAINS, NEW YORK – January

14, 2015 – Pervasip Corp. (OTCQB: PVSP) (“Pervasip” or the “Company”) announced today that it

executed an agreement with Pension Benefit Guarantee Corporation (the “PBGC”), pursuant to which PBGC agreed to accept

$100,000 in full satisfaction of $2.0 million in amounts that had been due from Pervasip.

“Finalizing this agreement is an

important first step in our previously announced restructuring and acquisition plans,” said Paul Riss, Pervasip’s chief

executive officer. “Reducing the majority of our outstanding liabilities is critical to our ability to raise new capital

and to complete acquisitions to expand our existing operations. We are currently in discussions with our lenders for this purpose,

and we hope to reduce significant additional liabilities in the near term.”

The terms of the Company’s agreement

with PBGC are disclosed in a Current Report on Form 8-K to be filed today, a copy of which can be viewed online at: http://www.sec.gov/cgi-bin/browse-edgar?company=pervasip&owner=exclude&action=getcompany,

and which additionally reports that the Company’s reverse stock split previously planned for January 31, 2015 has been cancelled.

About Pervasip Corp.

Pervasip delivers mobile VoIP and video

telephone service anywhere in the world that has a stable broadband connection. In addition to international telephone numbers

from 57 countries for mobile phone users, with unlimited inbound calling, it offers several international outbound calling plans,

including some of the lowest rates to international mobile phones.

Forward Looking Statements

The information contained herein includes

forward-looking statements. These statements relate to future events or to our future financial performance, and involve known

and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance, or achievements

to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these

forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown

risks, uncertainties and other factors which are, in some cases, beyond our control and which could, and likely will, materially

affect actual results, levels of activity, performance or achievements. Any forward-looking statement reflects our current views

with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to our operations,

results of operations, growth strategy and liquidity. We assume no obligation to publicly update or revise these forward-looking

statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking

statements, even if new information becomes available in the future.

Additional

Information

Pervasip Corp.

Paul H. Riss,

CEO

phriss@pervasip.com

914-750-9339

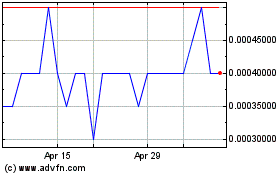

Pervasip (PK) (USOTC:PVSP)

Historical Stock Chart

From Mar 2024 to Apr 2024

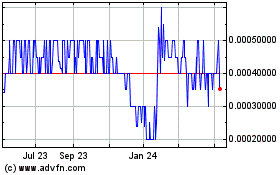

Pervasip (PK) (USOTC:PVSP)

Historical Stock Chart

From Apr 2023 to Apr 2024