UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 14, 2015

Wabash National Corporation

(Exact name of registrant

as specified in its charter)

| Delaware |

|

1-10883 |

|

52-1375208 |

| (State or other jurisdiction of incorporation) |

|

(Commission File No.) |

|

(IRS Employer Identification No.) |

| |

|

|

|

|

| 1000

Sagamore Parkway South, Lafayette, Indiana |

|

47905 |

| (Address

of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code:

(765) 771-5300

_________________

Not applicable

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

INFORMATION TO BE INCLUDED IN THE REPORT

Section 2 – Financial Information

Item 2.02 Results of Operations

and Financial Condition.

On January 14, 2015, Wabash National Corporation

(the “Company”) issued a press release updating and raising the guidance previously provided on the Company’s

full year expectations for 2014. A copy of the Registrant’s press release is attached as Exhibit 99.1 and is incorporated

herein by reference.

This information shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that

section, and is not incorporated by reference into any filing of Wabash National Corporation, whether made before or after the

date of this report, regardless of any general incorporation language in the filing.

Section 9 – Financial Statements

and Exhibits

Item 9.01 Financial Statements

and Exhibits.

(d) Exhibits:

99.1 Wabash National

Corporation press release dated January 14, 2015.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

| |

|

|

|

|

| |

|

WABASH NATIONAL CORPORATION |

|

| |

|

|

|

|

| Date: January 14, 2015 |

|

By: |

/s/ Jeffery L. Taylor

Jeffery L. Taylor

Senior Vice President and Chief Financial Officer |

|

EXHIBIT INDEX

| |

|

|

|

|

| Exhibit No. |

|

Description |

| |

|

|

|

|

| 99.1 |

|

Wabash National Corporation Press Release dated January 14, 2015 |

Exhibit 99.1

| Media Contact: Tom Rodak

Vice President, Corporate Marketing

(765) 771-5555

tom.rodak@wabashnational.com

|

|

| |

Investor Relations:

Jeffery Taylor

Senior Vice President & Chief

Financial Officer

(765) 771-5438

jeff.taylor@wabashnational.com

|

FOR IMMEDIATE RELEASE

Wabash National Raises Full Year 2014

Outlook

| · | Full year 2014 trailer shipments exceeded

prior guidance mid-point by more than 2,000 units, raising full year shipments to more than 57,300 units |

| · | Strong fourth quarter performance leads

to record full year net sales, estimated to be $1.86 billion, a 14% year over year increase |

| · | Full year GAAP diluted earnings per

share expected to be $0.83-$0.85, an increase of approximately 24-27% over prior year |

LAFAYETTE, Ind. – January 14,

2015 – Wabash National Corporation (NYSE: WNC), a diversified industrial

manufacturer and North America’s leading producer of semi-trailers and liquid transportation systems, today is updating

and raising the guidance previously provided on its full year expectations for 2014. Full year new trailer shipments exceeded

57,300 units, above our previously provided full year guidance of 54,500 to 56,000 new trailers, driven by stronger than

anticipated customer pick-ups in all areas of the business. As a result, consolidated net sales for the full year 2014 are estimated

to be approximately $1.86 billion, an increase of approximately 14 percent as compared to the previous year. Full year GAAP

earnings are now anticipated to be in the range of $0.83 to $0.85 per diluted share as Wabash benefited from the higher

volumes and improved operational performance.

Dick Giromini, president and chief executive

officer, stated, “We are very pleased with the exceptional performance in the fourth quarter as trailer and equipment shipments

exceeded our expectations as favorable weather conditions, compared to the prior year period, provided support to these efforts.

With an exceptionally strong backlog and continued operating improvements, we were able to deliver our third consecutive record-setting

quarter and another all-time record year.”

The information above is preliminary and

is subject to change as final results are completed. As a result, actual results could be materially different from these estimates.

Furthermore, the information above is only a summary of certain estimates and does not contain all information necessary for an

understanding of the Company’s operating performance for 2014 or its financial condition as of December 31, 2014. Wabash

is scheduled to release its fourth quarter and full year 2014 results, which will include additional information on operating performance

and financial condition, on Tuesday, February 3, 2015, after the close of the financial markets.

About Wabash National Corporation

Headquartered in Lafayette, Indiana, Wabash

National Corporation (NYSE: WNC) is a diversified industrial manufacturer and North America’s leading producer of semi trailers

and liquid transportation systems. Established in 1985, the Company specializes in the design and production of dry freight vans,

refrigerated vans, platform trailers, liquid tank trailers, intermodal equipment, engineered products, and composite products.

Its innovative products are sold under the following brand names: Wabash National®, Transcraft®,

Benson®, DuraPlate®, ArcticLite®, Walker Transport, Walker Defense Group, Walker Barrier

Systems, Walker Engineered Products, Brenner® Tank, Beall®, Garsite, Progress Tank, TST®,

Bulk Tank International and Extract Technology®. To learn more, visit www.wabashnational.com.

Safe Harbor Statement

This press release

contains certain forward-looking statements, as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking

statements convey our current expectations or forecasts of future events. All statements contained in this press release other

than statements of historical fact are forward-looking statements. These forward-looking statements are subject to risks and uncertainties

that could cause actual results to differ materially from those implied by the forward-looking statements. Readers should review

and consider the various disclosures made by the Company in its filings with the Securities and Exchange Commission, including

the risks and uncertainties described therein.

# # #

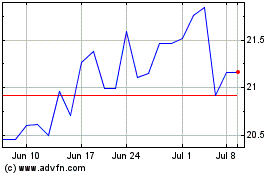

Wabash National (NYSE:WNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

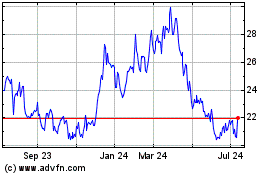

Wabash National (NYSE:WNC)

Historical Stock Chart

From Apr 2023 to Apr 2024