IHS Inc. (NYSE: IHS), the leading global source of information

and analytics, today reported results for the fourth quarter and

fiscal year ended November 30, 2014.

For the fourth quarter ended November 30, 2014, IHS

reported:

- Revenue of $582 million, up 4 percent

from the prior-year period

- Total organic revenue growth of 4

percent, anchored by 6 percent subscription organic revenue

growth

- Adjusted EBITDA of $186 million, up 10

percent from the prior-year period, resulting in a margin expansion

of 170 basis points

- Adjusted earnings per diluted share

(Adjusted EPS) of $1.68, up 15 percent from the prior-year

period

- Full-year free cash flow conversion of

74 percent

Adjusted EBITDA, Adjusted EPS, and free cash flow are non-GAAP

financial measures used by management to measure operating

performance. These terms are defined elsewhere in this release.

Please see schedules appearing later in this release for

reconciliations of non-GAAP financial measures to the most directly

comparable GAAP measures.

Fourth Quarter and Fiscal Year 2014 Financial

Performance

Three months ended November 30,

Change Year ended November 30,

Change (in thousands, except percentages and per

share data) 2014 2013

$ % 2014

2013 $ % Revenue $

582,317 $ 559,675 $ 22,642 4 % $ 2,230,794 $

1,840,631 $ 390,163 21 % Net income $ 60,118 $ 40,810 $

19,308 47 % $ 194,549 $ 131,733 $ 62,816 48 % Adjusted EBITDA $

186,455 $ 169,565 $ 16,890 10 % $ 689,804 $ 561,768 $ 128,036 23 %

GAAP EPS $ 0.87 $ 0.60 $ 0.27 45 % $ 2.81 $ 1.95 $ 0.86 44 %

Adjusted EPS $ 1.68 $ 1.46 $ 0.22 15 % $ 5.90 $ 5.06 $ 0.84 17 %

Cash flow from operations $ 85,649 $ 151,786 $ (66,137 ) (44

)% $ 628,099 $ 496,155 $ 131,944 27 % Free cash flow $ 54,510 $

126,463 $ (71,953 ) (57 )% $ 513,646 $ 405,421 $ 108,225 27 %

“We were pleased to see organic growth that developed as we

expected and outlined on last quarter’s call,” said Scott Key, IHS

president and chief executive officer. “Our growth in the period

was broad-based, reflecting our strategy of being the global

multi-industry business information services leader.”

“Solid second-half margin expansion and full year cash flow

demonstrates the fundamental operating leverage in our business

model,” said Todd Hyatt, IHS chief financial officer. “These

attributes continue to provide us with significant operational

flexibility.”

Fourth Quarter and Fiscal Year 2014 Revenue

Performance

Fourth quarter 2014 revenue increased 4 percent compared to the

fourth quarter of 2013, and fiscal year 2014 revenue increased 21

percent compared to 2013. The components of revenue growth are

described below by segment and in total.

Increase in revenue Fourth quarter 2014 vs. fourth

quarter 2013 2014 vs. 2013 (All amounts

represent percentage points) Organic

Acquisitive

ForeignCurrency

Organic Acquisitive

ForeignCurrency

Americas 4 % — % (1 )% 4 % 23 % (1 )% EMEA 4 % 2 % — % 6 % 5 % 2 %

APAC 8 % 3 % (1 )% 4 % 5 % (1 )%

Total 4 %

1 % (1 )% 4 % 17

% — %

Excluding the effect of the BPVC engineering standard release in

the third quarter of 2013, full-year 2014 total organic revenue

growth was 5 percent.

The subscription-based business grew 6 percent organically in

the fourth quarter and fiscal year 2014 compared to the same

periods of 2013, as described in the following table.

Three months ended November 30,

Percent change Year ended November 30, Percent

change (in thousands, except percentages) 2014

2013 Total

Organic 2014 2013

Total Organic Subscription revenue $

443,769 $ 418,309 6 % 6 % $ 1,719,617 $ 1,404,984 22

% 6 % Non-subscription revenue 138,548 141,366 (2 )%

(2 )% 511,177 435,647 17 % (1 )% Total revenue $

582,317 $ 559,675 4 % 4 % $ 2,230,794 $

1,840,631 21 % 4 %

Excluding the effect of the BPVC engineering standard release in

the third quarter of 2013, full-year 2014 non-subscription organic

revenue growth was 1 percent and total organic revenue growth was 5

percent.

Fourth Quarter and Fiscal Year 2014 Segment

Performance

On a consolidated basis, IHS continued to deliver solid organic

revenue growth. Segment results were as follows:

- Americas. Fourth quarter revenue for

Americas increased $11 million, or 3 percent, to $380 million, and

included 7 percent organic growth for the subscription-based

business. Fourth quarter Adjusted EBITDA for Americas increased $9

million, or 7 percent, to $143 million. Fourth quarter operating

income for Americas increased $4 million, or 5 percent, to $95

million.

Fiscal year 2014 revenue for Americas increased $308 million, or

26 percent, to $1.470 billion. Fiscal year 2014 Adjusted EBITDA for

Americas increased $77 million, or 17 percent, to $535 million.

Fiscal year 2014 operating income for Americas increased $53

million, or 17 percent, to $356 million.

Americas results for fiscal year 2014 benefited from the

inclusion of R. L. Polk.

- EMEA. Fourth quarter revenue for EMEA

increased $7 million, or 5 percent, to $145 million, and included 5

percent organic growth for the subscription-based business. Fourth

quarter Adjusted EBITDA for EMEA increased $5 million, or 12

percent, to $43 million. Fourth quarter operating income for EMEA

increased $11 million, or 43 percent, to $36 million. EMEA profit

benefited from revenue growth and prior investment in scaled

infrastructure.

Fiscal year 2014 revenue for EMEA increased $66 million, or 14

percent, to $549 million. Fiscal year 2014 Adjusted EBITDA for EMEA

increased $41 million, or 35 percent, to $156 million. Fiscal year

2014 operating income for EMEA increased $49 million, or 60

percent, to $130 million.

- APAC. Fourth quarter revenue for APAC

increased $5 million, or 10 percent, to $57 million, and included 6

percent organic growth for the subscription-based business. Fourth

quarter Adjusted EBITDA for APAC increased $2 million, or 18

percent, to $17 million. Fourth quarter operating income for APAC

increased $2 million, or 16 percent, to $15 million.

Fiscal year 2014 revenue for APAC increased $17 million, or 9

percent, to $211 million. Fiscal year 2014 Adjusted EBITDA for APAC

increased $9 million, or 20 percent, to $54 million. Fiscal year

2014 operating income for APAC increased $7 million, or 16 percent,

to $49 million.

Outlook (forward-looking statement)

“This guidance reflects a thorough assessment of revenue risks

and opportunities in each of our end markets, including anticipated

slower revenue growth within the energy market,” said Mr. Hyatt.

“In addition, this guidance includes current momentum and growth in

the 60 percent of our business comprised of our non-energy product

offerings.”

For the year ending November 30, 2015, IHS expects:

- Revenue in a range of $2.36 billion to

$2.40 billion, including 6-7 percent organic growth on the

subscription base and neutral non-subscription organic growth;

- Adjusted EBITDA in a range of $750

million to $770 million; and

- Adjusted EPS in a range of $6.10 to

$6.30 per diluted share.

Additionally, for the year ending November 30, 2015, IHS

expects:

- Depreciation expense to be

approximately $82-86 million;

- Amortization expense related to

acquired intangible assets to be approximately $135-140

million;

- Net interest expense to be

approximately $70-75 million;

- Stock-based compensation expense to be

approximately $150-160 million;

- An adjusted tax rate of approximately

27-29 percent;

- An effective tax rate of approximately

23-25 percent; and

- Fully diluted shares to be

approximately 70 million.

The above outlook assumes no further currency movements,

acquisitions, divestitures, pension mark-to-market adjustments or

unanticipated events. See discussion of non-GAAP financial measures

at the end of this release.

As previously announced, IHS will hold a conference call to

discuss fourth quarter and fiscal year 2014 results on

January 13, 2015, at 8:00 a.m. EST. The conference call will

be simultaneously webcast on the company’s website: www.ihs.com.

Use of Non-GAAP Financial Measures

Non-GAAP results are presented only as a supplement to our

financial statements based on U.S. generally accepted accounting

principles (GAAP). Non-GAAP financial information is provided to

enhance the reader’s understanding of our financial performance,

but none of these non-GAAP financial measures are recognized terms

under GAAP and non-GAAP measures should not be considered in

isolation or as a substitute for financial measures calculated in

accordance with GAAP. Reconciliations of the most directly

comparable GAAP measures to non-GAAP measures, such as EBITDA,

Adjusted EBITDA, Adjusted net income, Adjusted EPS, and free cash

flow are provided within the schedules attached to this

release.

We use non-GAAP measures in our operational and financial

decision-making, believing that it is useful to exclude certain

items in order to focus on what we deem to be a more reliable

indicator of ongoing operating performance and our ability to

generate cash flow from operations. As a result, internal

management reports used during monthly operating reviews feature

the Adjusted EBITDA, Adjusted net income, Adjusted EPS, and free

cash flow metrics. We also believe that investors may find non-GAAP

financial measures useful for the same reasons, although investors

are cautioned that non-GAAP financial measures are not a substitute

for GAAP disclosures.

Because not all companies use identical calculations, our

presentation of non-GAAP financial measures may not be comparable

to other similarly-titled measures of other companies. However,

these measures can still be useful in evaluating our performance

against our peer companies because we believe the measures provide

users with valuable insight into key components of GAAP financial

disclosures.

IHS Forward-Looking Statements:

This release contains “forward-looking statements” within the

meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. Forward-looking

statements can be identified by words such as: “anticipate,”

“intend,” “plan,” “goal,” “seek,” “aim,” “strive,” “believe,”

“project,” “predict,” "estimate," "expect," “continue,” "strategy,"

"future," "likely," "may," “might,” "should," "will," the negative

of these terms and similar references to future periods. Examples

of forward-looking statements include, among others, statements we

make regarding guidance relating to net income, net income per

share, and expected operating results, such as revenue growth and

earnings.

Forward-looking statements are neither historical facts nor

assurances of future performance. Instead, they are based only on

our current beliefs, expectations and assumptions regarding the

future of our business, future plans and strategies, projections,

anticipated events and trends, the economy and other future

conditions. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks and

changes in circumstances that are difficult to predict and many of

which are outside of our control. Our actual results and financial

condition may differ materially from those indicated in the

forward-looking statements. Therefore, you should not rely on any

of these forward-looking statements. Important factors that could

cause our actual results and financial condition to differ

materially from those indicated in the forward-looking statements

include, among others, the following: economic and financial

conditions, including volatility in interest and exchange rates;

our ability to manage system failures, capacity constraints, and

cyber risks; our ability to successfully manage risks associated

with changes in demand for our products and services as well as

changes in our targeted industries; our ability to develop new

platforms to deliver our products and services, pricing, and other

competitive pressures, and changes in laws and regulations

governing our business; the extent to which we are successful in

gaining new long-term relationships with customers or retaining

existing ones and the level of service failures that could lead

customers to use competitors' services; our ability to successfully

identify and integrate acquisitions into our existing businesses

and manage risks associated therewith; our ability to satisfy our

debt obligations and our other ongoing business obligations; and

the other factors described under the caption “Risk Factors” in our

most recent annual report on Form 10-K, along with our other

filings with the U.S. Securities and Exchange Commission.

Any forward-looking statement made by us in this release is

based only on information currently available to us and speaks only

as of the date on which it is made. We undertake no obligation to

publicly update any forward-looking statement, whether written or

oral, that may be made from time to time, whether as a result of

new information, future developments or otherwise.

Please consult our public filings at www.sec.gov or www.ihs.com.

About IHS Inc. (www.ihs.com)

IHS Inc. (NYSE: IHS) is the leading source of information,

insight and analytics in critical areas that shape today’s business

landscape. Businesses and governments in more than 150 countries

around the globe rely on the comprehensive content, expert

independent analysis and flexible delivery methods of IHS to make

high-impact decisions and develop strategies with speed and

confidence. IHS has been in business since 1959 and became a

publicly traded company on the New York Stock Exchange in 2005.

Headquartered in Englewood, Colorado, USA, IHS is committed to

sustainable, profitable growth and employs about 8,800 people in 32

countries around the world.

IHS is a registered trademark of IHS Inc. All other company and

product names may be trademarks of their respective owners.

© 2015 IHS Inc. All rights reserved.

IHS INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except for share and

per-share amounts)

As of As of November 30, 2014

November 30, 2013 (Unaudited) (Audited)

Assets Current assets: Cash and cash equivalents $ 153,156 $

258,367 Accounts receivable, net 421,374 459,263 Income tax

receivable 2,283 — Deferred subscription costs 51,021 49,327

Deferred income taxes 81,780 70,818 Other 60,973 43,065

Total current assets 770,587 880,840

Non-current assets: Property and equipment, net 301,419 245,566

Intangible assets, net 1,091,109 1,144,464 Goodwill 3,157,324

3,065,181 Other 27,991 23,562 Total non-current

assets 4,577,843 4,478,773 Total assets $ 5,348,430

$ 5,359,613

Liabilities and stockholders’

equity Current liabilities: Short-term debt $ 36,257 $ 395,527

Accounts payable 52,245 57,001 Accrued compensation 101,875 89,460

Accrued royalties 37,346 36,289 Other accrued expenses 131,147

98,187 Income tax payable — 9,961 Deferred revenue 596,187

560,010 Total current liabilities 955,057 1,246,435

Long-term debt 1,806,098 1,779,065 Accrued pension and

postretirement liability 29,139 27,191 Deferred income taxes

347,419 361,267 Other liabilities 51,171 38,692 Commitments and

contingencies Stockholders’ equity:

Class A common stock, $0.01 par value per

share, 160,000,000 sharesauthorized, 69,391,577 and 67,901,101

shares issued, and 68,372,176 and 67,382,298shares outstanding at

November 30, 2014 and November 30, 2013, respectively

694 679 Additional paid-in capital 956,381 788,670

Treasury stock, at cost: 1,019,401 and

518,803 shares at November 30, 2014 and November30, 2013,

respectively

(105,873 ) (45,945 ) Retained earnings 1,415,069 1,220,520

Accumulated other comprehensive loss (106,725 ) (56,961 ) Total

stockholders’ equity 2,159,546 1,906,963 Total

liabilities and stockholders’ equity $ 5,348,430 $ 5,359,613

IHS INC.

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands, except for per-share

amounts)

(Unaudited)

Three months ended November 30, Year ended

November 30, 2014 2013 2014

2013 Revenue $ 582,317 $

559,675 $ 2,230,794 $ 1,840,631

Operating expenses:

Cost of revenue (includes stock-based

compensation expense of$2,243; $2,646; $8,520 and $8,271 for the

three and twelve monthsended November 30, 2014 and 2013,

respectively)

221,973 217,406 879,051 748,184

Selling, general and administrative

(includes stock-basedcompensation expense of $37,393; $45,011;

$158,839 and $154,180for the three and twelve months ended November

30, 2014 and 2013,respectively)

215,513 215,807 828,158 680,989 Depreciation and amortization

52,798 50,950 202,145 158,737 Restructuring charges 2,869 2,175

9,272 13,458 Acquisition-related costs 884 5,369 1,901 23,428 Net

periodic pension and postretirement expense 2,432 4,895 6,774

11,619 Other expense, net (1,539 ) 2,279 (99 ) 6,012

Total operating expenses 494,930 498,881 1,927,202

1,642,427

Operating income 87,387 60,794

303,592 198,204 Interest income 251 392 988 1,271 Interest expense

(13,233 ) (16,226 ) (55,383 ) (44,582 ) Non-operating expense, net

(12,982 ) (15,834 ) (54,395 ) (43,311 ) Income from continuing

operations before income taxes 74,405 44,960 249,197 154,893

Provision for income taxes (14,287 ) (4,150 ) (54,648 ) (23,059 )

Income from continuing operations 60,118 40,810 194,549 131,834

Loss from discontinued operations, net — — —

(101 )

Net income $ 60,118 $ 40,810 $ 194,549

$ 131,733 Basic earnings per share: Income

from continuing operations $ 0.88 $ 0.61 $ 2.85 $ 1.98 Loss from

discontinued operations, net $ — $ — $ — $ —

Net income $ 0.88 $ 0.61 $ 2.85 $ 1.98

Weighted average shares used in computing basic earnings per

share 68,352 67,403 68,163 66,434

Diluted earnings per share: Income from continuing

operations $ 0.87 $ 0.60 $ 2.81 $ 1.95 Loss from discontinued

operations, net $ — $ — $ — $ — Net

income $ 0.87 $ 0.60 $ 2.81 $ 1.95

Weighted average shares used in computing diluted earnings per

share 69,281 68,416 69,120 67,442

IHS INC.

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In thousands)

(Unaudited)

Year ended November 30, 2014

2013 Operating activities: Net income $ 194,549 $

131,733 Reconciliation of net income to net cash provided by

operating activities: Depreciation and amortization 202,145 158,737

Stock-based compensation expense 167,359 162,451 Impairment of

assets — 1,629 Excess tax benefit from stock-based compensation

(13,297 ) (14,334 ) Net periodic pension and postretirement expense

6,774 11,619 Pension and postretirement contributions (13,452 )

(13,299 ) Deferred income taxes (10,285 ) (34,312 ) Change in

assets and liabilities: Accounts receivable, net 36,418 (24,427 )

Other current assets

(8,834

) (672 ) Accounts payable (11,425 ) (10,069 ) Accrued expenses

36,073

50,753 Income tax payable 6,254 65,887 Deferred revenue 29,713

10,378 Other liabilities 6,107 81

Net cash

provided by operating activities 628,099 496,155

Investing activities: Capital expenditures on property and

equipment (114,453 ) (90,734 ) Acquisitions of businesses, net of

cash acquired (210,395 ) (1,487,034 ) Intangible assets acquired

(714 ) — Change in other assets (4,608 ) 1,347 Settlements of

forward contracts 6,159 4,524

Net cash used in

investing activities (324,011 ) (1,571,897 )

Financing

activities: Proceeds from borrowings 2,485,000 1,375,000

Repayment of borrowings (2,817,236 ) (268,909 ) Payment of debt

issuance costs (18,994 ) (17,360 ) Excess tax benefit from

stock-based compensation 13,297 14,334 Proceeds from the exercise

of employee stock options — 549 Repurchases of common stock (59,928

) (97,164 )

Net cash provided by (used in) financing

activities (397,861 ) 1,006,450 Foreign exchange impact

on cash balance (11,438 ) (17,349 ) Net increase (decrease) in cash

and cash equivalents (105,211 ) (86,641 ) Cash and cash equivalents

at the beginning of the period 258,367 345,008 Cash

and cash equivalents at the end of the period $ 153,156 $

258,367

IHS INC.

SUPPLEMENTAL REVENUE DISCLOSURE

(In thousands)

(Unaudited)

Three months ended November 30, Percent change

Year ended November 30, Percent change 2014

2013 Total

Organic 2014 2013

Total Organic Revenue by

segment: Americas $ 379,626 $ 368,510 3 % 4 % $

1,470,282 $ 1,162,582 26 % 4 % EMEA 145,233 138,711 5 % 4 % 549,061

483,373 14 % 6 % APAC 57,458 52,454 10 % 8 % 211,451

194,676 9 % 4 %

Total revenue $ 582,317

$ 559,675 4 % 4 % $ 2,230,794 $ 1,840,631 21 %

4 %

Revenue by transaction type: Subscription $

443,769 $ 418,309 6 % 6 % $ 1,719,617 $ 1,404,984 22 % 6 %

Non-subscription 138,548 141,366 (2 )% (2 )% 511,177

435,647 17 % (1 )%

Total revenue $ 582,317

$ 559,675 4 % 4 % $ 2,230,794 $ 1,840,631

21 % 4 %

Revenue by product category:

Resources $ 236,734 $ 234,584 1 % 2 % $ 927,211 $ 865,125 7 % 5 %

Industrials 198,058 181,626 9 % 7 % 736,394 427,623 72 % 4 %

Horizontal products 147,525 143,465 3 % 3 % 567,189

547,883 4 % 3 %

Total revenue $ 582,317

$ 559,675 4 % 4 % $ 2,230,794 $ 1,840,631 21 %

4 %

Excluding the effect of the BPVC engineering standard release in

the third quarter of 2013, full-year 2014 non-subscription organic

revenue growth was 1 percent, Horizontal products organic revenue

growth was 4 percent, and total organic revenue growth was 5

percent.

Resources Q4 organic revenue growth includes organic

subscription revenue growth of 6 percent (8 percent when normalized

for Q4 2013 past due renewal revenue catchups).

IHS INC.

RECONCILIATION OF CONSOLIDATED NON-GAAP

FINANCIAL MEASUREMENTS TO

MOST DIRECTLY COMPARABLE GAAP FINANCIAL

MEASUREMENTS

(In thousands, except for per-share

amounts)

(Unaudited)

Three months ended November 30, Year ended

November 30, 2014 2013

2014 2013 Net

income $ 60,118 $ 40,810 $ 194,549 $ 131,733 Interest income

(251 ) (392 ) (988 ) (1,271 ) Interest expense 13,233 16,226 55,383

44,582 Provision for income taxes 14,287 4,150 54,648 23,059

Depreciation 19,106 15,104 68,347 48,799 Amortization related to

acquired intangible assets 33,692 35,846 133,798

109,938

EBITDA (1)(6) $ 140,185 $

111,744 $ 505,737 $ 356,840 Stock-based compensation expense 39,636

47,657 167,359 162,451 Restructuring charges 2,869 2,175 9,272

13,458 Acquisition-related costs 884 5,369 1,901 23,428 Impairment

of assets — — — 1,629 Loss on sale of assets — — 2,654 1,241 Loss

on debt extinguishment 1,422 — 1,422 — Pension mark-to-market and

settlement expense 1,459 2,620 1,459 2,620 Loss from discontinued

operations, net — — — 101

Adjusted

EBITDA (2)(6) $ 186,455 $ 169,565 $

689,804 $ 561,768

Three months ended

November 30, Year ended November 30, 2014

2013 2014 2013 Net

income $ 60,118 $ 40,810 $ 194,549 $ 131,733 Stock-based

compensation expense 39,636 47,657 167,359 162,451 Amortization

related to acquired intangible assets 33,692 35,846 133,798 109,938

Restructuring charges 2,869 2,175 9,272 13,458 Acquisition-related

costs 884 5,369 1,901 23,428 Impairment of assets — — — 1,629 Loss

on sale of assets — — 2,654 1,241 Loss on debt extinguishment 1,422

— 1,422 — Pension mark-to-market and settlement expense 1,459 2,620

1,459 2,620 Loss from discontinued operations, net — — — 101 Income

tax effect on adjusting items (23,558 ) (34,396 ) (104,511 )

(105,463 )

Adjusted net income (3) $ 116,522 $

100,081 $ 407,903 $ 341,136

Adjusted

EPS (4)(6) $ 1.68 $ 1.46 $ 5.90 $

5.06 Weighted average shares used in computing Adjusted EPS

69,281 68,416 69,120 67,442

Three months ended November 30, Year ended November

30, 2014 2013 2014

2013 Net cash provided by operating

activities $ 85,649 $ 151,786 $ 628,099 $ 496,155 Capital

expenditures on property and equipment (31,139 ) (25,323 ) (114,453

) (90,734 )

Free cash flow (5)(6) $ 54,510 $

126,463 $ 513,646 $ 405,421

IHS INC.

RECONCILIATION OF SEGMENT NON-GAAP

FINANCIAL MEASUREMENTS TO

MOST DIRECTLY COMPARABLE GAAP FINANCIAL

MEASUREMENTS

(In thousands)

(Unaudited)

Three months ended November 30, 2014 Americas

EMEA APAC

Shared Services Total Operating

income $ 94,935 $ 35,540 $ 15,205 $ (58,293 ) $ 87,387

Adjustments: Stock-based compensation expense — — — 39,636 39,636

Depreciation and amortization 42,937 6,568 1,393 1,900 52,798

Restructuring charges 2,441 421 7 — 2,869 Acquisition-related costs

802 82 — — 884 Loss on debt extinguishment 1,422 — — — 1,422

Pension mark-to-market expense — — — 1,459

1,459

Adjusted EBITDA $ 142,537 $ 42,611

$ 16,605 $ (15,298 ) $ 186,455

Three months

ended November 30, 2013 Americas EMEA APAC

Shared Services Total Operating income $

90,789 $ 24,789 $ 13,125 $ (67,909 ) $ 60,794 Adjustments:

Stock-based compensation expense — — — 47,657 47,657 Depreciation

and amortization 39,644 8,631 868 1,807 50,950 Restructuring

charges 1,038 1,003 134 — 2,175 Acquisition-related costs 1,785

3,584 — — 5,369 Pension mark-to-market expense — — —

2,620 2,620

Adjusted EBITDA $ 133,256 $

38,007 $ 14,127 $ (15,825 ) $ 169,565

Year

ended November 30, 2014 Americas EMEA APAC

Shared Services Total Operating income $

356,310 $ 129,766 $ 48,792 $ (231,276 ) $ 303,592 Adjustments:

Stock-based compensation expense — — — 167,359 167,359 Depreciation

and amortization 167,351 22,730 4,798 7,266 202,145 Restructuring

charges 5,776 3,096 400 — 9,272 Acquisition-related costs 1,498 403

— — 1,901 Loss on sale of assets 2,654 — — — 2,654 Loss on debt

extinguishment 1,422 — — — 1,422 Pension mark-to-market expense —

— — 1,459 1,459

Adjusted EBITDA

$ 535,011 $ 155,995 $ 53,990 $ (55,192 ) $

689,804

Year ended November 30, 2013 Americas

EMEA APAC Shared Services Total

Operating income $ 303,803 $ 81,048 $ 42,089 $ (228,736 ) $

198,204 Adjustments: Stock-based compensation expense — — — 162,451

162,451 Depreciation and amortization 123,477 25,688 2,363 7,209

158,737 Restructuring charges 9,354 3,530 574 — 13,458

Acquisition-related costs 19,552 3,876 — — 23,428 Impairment of

assets 1,629 — — — 1,629 Loss on sale of assets — 1,241 — — 1,241

Pension mark-to-market expense — — — 2,620

2,620

Adjusted EBITDA $ 457,815 $ 115,383

$ 45,026 $ (56,456 ) $ 561,768 (1) EBITDA is

defined as net income plus or minus net interest, plus provision

for income taxes, depreciation, and amortization. (2) Adjusted

EBITDA further excludes primarily non-cash items and other items

that we do not consider to be useful in assessing our operating

performance (e.g., stock-based compensation expense, restructuring

charges, acquisition-related costs, asset impairment charges, gain

or loss on sale of assets, gain or loss on debt extinguishment,

pension mark-to-market and settlement expense, and income or loss

from discontinued operations). All of the items included in the

reconciliation from net income to Adjusted EBITDA are either

non-cash items or items that we do not consider to be useful in

assessing our operating performance. In the case of the non-cash

items, we believe that investors can better assess our operating

performance if the measures are presented without such items

because, unlike cash expenses, these adjustments do not affect our

ability to generate free cash flow or invest in our business. For

example, by excluding depreciation and amortization from EBITDA,

users can compare operating performance without regard to different

accounting determinations such as useful life. In the case of the

other items, we believe that investors can better assess operating

performance if the measures are presented without these items

because their financial impact does not reflect ongoing operating

performance. (3) Adjusted net income is defined as net income plus

primarily non-cash items and other items that management does not

consider to be useful in assessing our operating performance (e.g.,

stock-based compensation expense, amortization related to acquired

intangible assets, restructuring charges, acquisition-related

costs, asset impairment charges, gain or loss on sale of assets,

gain or loss on debt extinguishment, pension mark-to-market and

settlement expense, and income or loss from discontinued

operations, all net of the related tax effects). (4) Adjusted EPS

is defined as Adjusted net income (as defined above) divided by

diluted weighted average shares. (5) Free cash flow is defined as

net cash provided by operating activities less capital

expenditures. (6) EBITDA, Adjusted EBITDA, Adjusted EPS, and free

cash flow are used by many of our investors, research analysts,

investment bankers, and lenders to assess our operating

performance. For example, a measure similar to Adjusted EBITDA is

required by the lenders under our term loan and revolving credit

agreements.

IHS Inc.News Media Contact:Dan Wilinsky, +1

303-397-2468dan.wilinsky@ihs.comorInvestor Relations

Contact:Eric Boyer, +1 303-397-2969eric.boyer@ihs.com

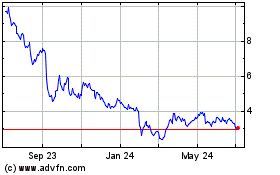

IHS (NYSE:IHS)

Historical Stock Chart

From Mar 2024 to Apr 2024

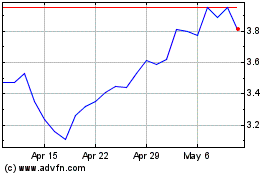

IHS (NYSE:IHS)

Historical Stock Chart

From Apr 2023 to Apr 2024