UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): 01/08/2015

SIGNET JEWELERS LIMITED

(Exact name of registrant as specified in its charter)

Commission

File Number: 1-32349

|

|

|

| Bermuda |

|

|

| (State or other jurisdiction

of incorporation) |

|

(IRS Employer

Identification No.) |

Clarendon House

2 Church Street

Hamilton

HM11

Bermuda

(Address of principal executive offices, including zip code)

441 296 5872

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition

On January 8, 2015, the Registrant issued a press release for its Holiday Season results for the eight weeks ended December 27, 2014. A copy of the

press release is attached hereto as Exhibit 99.1 to this Form 8-K.

The information in this Current Report on Form 8-K is being furnished pursuant to

Item 2.02 Results of Operations and Financial Condition. In accordance with General Instruction B.2 of Form 8-K, the information in this report shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except

as expressly stated by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

|

|

|

| Exhibit

No. |

|

Description |

|

|

| EX-99.1 |

|

Press release of Signet Jewelers Limited, dated January 8, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

SIGNET JEWELERS LIMITED |

|

|

|

|

| Date: January 08, 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

|

/s/ Michele Santana |

|

|

|

|

|

|

Michele Santana |

|

|

|

|

|

|

Chief Financial Officer |

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| EX-99.1 |

|

Press release of Signet Jewelers Limited, dated January 8, 2015 |

Exhibit 99.1

SIGNET HOLIDAY SEASON SAME STORE SALES INCREASE 3.6%

Signet Reaffirms Financial Guidance

HAMILTON, Bermuda, January 8, 2015 – Signet Jewelers Limited (“Signet”) (NYSE and LSE: SIG), the largest specialty retail jeweler

in the US, UK and Canada, today announced its sales for the eight weeks ended December 27, 2014 (“Holiday Season”) and reaffirmed guidance for the 13 weeks ending January 31, 2015 (“fourth quarter”) and the 52 weeks

ending January 31, 2015 (“Fiscal 2015”).

|

|

|

|

|

|

|

|

|

| Same Store Sales |

|

| |

|

Fiscal 2015 Holiday Season |

|

|

Fiscal 2014 Holiday Season |

|

| Sterling Jewelers division |

|

|

up 2.5 |

% |

|

|

up 4.9 |

% |

| Zale division |

|

|

up 3.5 |

% |

|

|

NA |

|

| UK Jewelry division |

|

|

up 9.7 |

% |

|

|

up 5.2 |

% |

| Signet |

|

|

up 3.6 |

% |

|

|

up 5.0 |

% |

Mark Light, Chief Executive Officer, commented: “Our Company performed well during the holiday period delivering

increased same store sales across all divisions driven by the continued successful execution of our product, marketing and omni-channel strategies. This is particularly pleasing given the amount of change we have dealt with during the course of the

fiscal year.

“Our UK division led our performance with an outstanding 9.7% comp increase – its best in 12 years and on top of a very strong

comp last year. These results were driven by fresh, trend-right merchandise offerings and strategic collaboration with the Sterling division. We were very pleased with the performance of our Zale division, which began to benefit from our investments

and initiatives in merchandising, store team member training, and advertising. In particular, our Vera Wang Love Collection and new TV advertising creative, we believe, were well received by customers. Our Sterling division performed well in a

highly promotional environment. We resisted deep promotions and protected profitability which helped enable us to reaffirm Signet’s financial guidance. I would like to thank all Signet team members very much for their dedication, hard work, and

fine execution of our strategies during the holiday selling period.”

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales change from previous year |

|

| Holiday Season

Fiscal 2015 |

|

Same

store

sales¹ |

|

|

Non-same

store

sales, net² |

|

|

Total sales

at constant

exchange

rate³ |

|

|

Exchange

translation

impact³ |

|

|

Total

sales |

|

|

Total sales

(in millions) |

|

|

|

|

|

|

|

|

| Kay |

|

|

3.4 |

% |

|

|

2.4 |

% |

|

|

5.8 |

% |

|

|

— |

|

|

|

5.8 |

% |

|

$ |

714.6 |

|

| Jared |

|

|

1.5 |

% |

|

|

3.5 |

% |

|

|

5.0 |

% |

|

|

— |

|

|

|

5.0 |

% |

|

$ |

336.2 |

|

| Regional brands |

|

|

(1.8 |

)% |

|

|

(11.8 |

)% |

|

|

(13.6 |

)% |

|

|

— |

|

|

|

(13.6 |

)% |

|

$ |

65.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sterling Jewelers division |

|

|

2.5 |

% |

|

|

1.7 |

% |

|

|

4.2 |

% |

|

|

— |

|

|

|

4.2 |

% |

|

$ |

1,116.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Zales Jewelers |

|

|

3.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

351.5 |

|

| Gordon’s Jewelers |

|

|

(2.4 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

26.2 |

|

| Zale US Jewelry |

|

|

3.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

377.7 |

|

| Peoples Jewellers |

|

|

7.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

75.3 |

|

| Mappins |

|

|

0.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

12.6 |

|

| Zale Canada Jewelry |

|

|

6.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

87.9 |

|

| Zale Jewelry |

|

|

3.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

465.6 |

|

| Piercing Pagoda |

|

|

0.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

55.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Zale division4 |

|

|

3.5 |

% |

|

|

NA |

|

|

|

NA |

|

|

|

NA |

|

|

|

NA |

|

|

$ |

521.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| H.Samuel |

|

|

8.1 |

% |

|

|

0.2 |

% |

|

|

8.3 |

% |

|

|

(4.5 |

)% |

|

|

3.8 |

% |

|

$ |

121.7 |

|

| Ernest Jones |

|

|

11.9 |

% |

|

|

0.9 |

% |

|

|

12.8 |

% |

|

|

(4.7 |

)% |

|

|

8.1 |

% |

|

$ |

93.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| UK Jewelry division |

|

|

9.7 |

% |

|

|

0.5 |

% |

|

|

10.2 |

% |

|

|

(4.6 |

)% |

|

|

5.6 |

% |

|

$ |

215.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other5 segment |

|

|

— |

|

|

|

NM |

|

|

|

NM |

|

|

|

— |

|

|

|

NM |

|

|

$ |

2.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Signet |

|

|

3.6 |

% |

|

|

42.7 |

% |

|

|

46.3 |

% |

|

|

(1.0 |

)% |

|

|

45.3 |

% |

|

$ |

1,854.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

| 1. |

Based on stores opened for at least 12 months. |

| 2. |

Includes all sales from stores not open for 12 months. |

| 4. |

Same store sales presented for Zale Division to provide comparative performance measures. Year-over-year results not applicable because Signet did not own Zale division in prior year. |

| 5. |

Includes sales from Signet’s diamond sourcing initiative. NM - not meaningful. |

| • |

|

In the Sterling Jewelers division, branded bridal and select diamond fashion jewelry collections performed well. These increases were partially offset by softness in the sale of lower-price-point fashion jewelry

collections. |

| • |

|

Zale division results were driven primarily by incremental investments in marketing, branded merchandise, and strength in Canada. Diamond collections in bridal and fashion performed particularly well. |

| • |

|

UK Jewelry division sales increased due to growth in diamonds including branded bridal. Other drivers included beads, watches, and the growing popularity of Black Friday-style shopping. |

Signet’s omni-channel strategy was successful during the holiday season. Ecommerce sales increased 90.9%, and, excluding the Zale division, increased

20.0%. As a percent of Signet’s holiday season’s total sales, ecommerce increased 160 basis points. Each division delivered higher ecommerce growth and penetration relative to total sales.

Financial Guidance:

Signet reaffirmed its financial

guidance announced in its third quarter earnings release on November 25, 2014.

|

|

|

| Fourth Quarter Fiscal 2015 |

|

|

| Same store sales |

|

3.0% to 4.0% |

| EPS |

|

$2.69 to $2.83 |

| Adjustments: |

|

|

| Purchase accounting adjustments |

|

($0.17) to ($0.15) |

| Transaction costs |

|

($0.09) to ($0.07) |

| Adjusted EPS (EPS less adjustments) |

|

$2.95 to $3.05 |

Adjusted EPS are expected to be favorably impacted by Zale operations in the fourth quarter Fiscal 2015 by $0.36 to $0.40.

|

|

|

| Fiscal 2015 |

|

|

| EPS |

|

$4.59 to $4.72 |

| Adjusted EPS |

|

$5.51 to $5.61 |

|

|

| Effective tax rate |

|

29.3% |

| Weighted average common shares outstanding |

|

80.2 million |

|

|

| Capital expenditures |

|

$230 million to $240 million

(reduced from $240

million to $250 million) |

|

|

| Net selling square footage growth |

|

45.0% to 47.5% |

Adjusted EPS are expected to be favorably impacted by Zale operations in Fiscal 2015 by $0.20 to $0.24.

| • |

|

The capital expenditures will be driven primarily by new Kay and Jared stores, store remodels, and approximately $55 million directed to the Zale division for information technology infrastructure and stores.

|

| • |

|

The net selling square footage growth will be driven by the following projected store count changes: |

| |

• |

|

Sterling Jewelers division up 75 to 85 gross, 35 to 45 net |

| |

• |

|

UK Jewelry division approximately unchanged |

| |

• |

|

Zale division 1,550 to 1,560 |

2

Quarterly Dividend:

Reflecting the Board’s confidence in the strength of the business, its ability to invest in growth initiatives, and the Board’s commitment to

building long-term shareholder value, a quarterly cash dividend of $0.18 per Signet Common Share has been declared for the fourth quarter of Fiscal 2015, payable on February 26, 2015 to shareholders of record on January 30, 2015, with an

ex-dividend date of January 29, 2015.

Conference Call:

There will be a conference call today at 8:30 a.m. ET (1:30 p.m. GMT and 5:30 a.m. PT) and a simultaneous audio webcast and slide presentation available at

www.signetjewelers.com. The slides are available to be downloaded from the website ahead of the conference call. The call details are:

|

|

|

|

|

| Dial-in |

|

1 (877) 201 0168 |

|

Access code: 58434354 |

A replay of the conference call and a transcript of the call will be posted on Signet’s website as soon as is practical

after the call has ended and will be available for one year.

|

|

|

|

|

| Contact: |

|

James Grant, VP - Investor Relations, Signet Jewelers |

|

1 (330) 668 5412 |

| Press: |

|

Alecia Pulman, ICR, Inc. |

|

1 (203) 682 8224 |

Investor Relations Program Details

Signet will present at the ICR XChange Conference in Orlando, Florida on Monday, January 12, 2015, at 10:00 a.m. ET. The presentation will be webcast live

and available for replay on www.signetjewelers.com.

About Signet Jewelers and Safe Harbor Statement

Signet Jewelers Limited is the largest specialty jewelry retailer in the US, UK and Canada. Signet’s Sterling Jewelers division operates over 1,500 stores

in all 50 states primarily under the name brands of Kay Jewelers and Jared The Galleria Of Jewelry. Signet’s UK division operates approximately 500 stores primarily under the name brands of H.Samuel and Ernest Jones. Signet’s Zale division

operates nearly 1,600 locations in the US and Canada primarily under the name brands of Zales, Peoples, and Piercing Pagoda. Further information on Signet is available at www.signetjewelers.com. See also www.kay.com, www.jared.com,

www.hsamuel.co.uk, www.ernestjones.co.uk, www.zales.com, www.peoplesjewellers.com and www.pagoda.com.

This release contains

statements which are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements, based upon management’s beliefs and expectations as well as on assumptions made by and data currently

available to management, include statements regarding, among other things, Signet’s results of operation, financial condition, liquidity, prospects, growth, strategies and the industry in which Signet operates. The use of the words

“expects,” “intends,” “anticipates,” “estimates,” “predicts,” “believes,” “should,” “potential,” “may,” “forecast,” “objective,”

“plan,” or “target,” and other similar expressions are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance and are subject to a number of risks and

uncertainties, including but not limited to general economic conditions, risks relating to Signet being a Bermuda corporation, the merchandising, pricing and inventory policies followed by Signet, the reputation of Signet and its brands, the level

of competition in the jewelry sector, the cost and availability of diamonds, gold and other precious metals, regulations relating to customer credit, seasonality of Signet’s business, financial market risks, deterioration in customers’

financial condition, exchange rate fluctuations, changes in consumer attitudes regarding jewelry, management of social, ethical and environmental risks, security breaches and other disruptions to Signet’s information technology infrastructure

and databases, inadequacy in and disruptions to internal controls and systems, changes in assumptions used in making accounting estimates relating to items such as extended service plans and pensions, the impact of the acquisition of Zale

Corporation on relationships, including with employees, suppliers, customers and competitors, the impact of stockholder litigation with respect to the acquisition of Zale Corporation, and our ability to successfully integrate Zale’s operations

and to realize synergies from the transaction.

For a discussion of these and other risks and uncertainties which could cause actual results to

differ materially from those expressed in any forward-looking statement, see the “Risk Factors” section of Signet’s Fiscal 2014 Annual Report on Form 10-K filed with the SEC on March 27, 2014 and the “Risk Factors”

section of Signet’s Quarterly Report on Form 10-Q filed with the SEC on December 8, 2014. Signet undertakes no obligation to update or revise any forward-looking statements to reflect subsequent events or circumstances, except as required

by law.

3

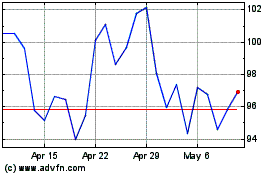

Signet Jewelers (NYSE:SIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

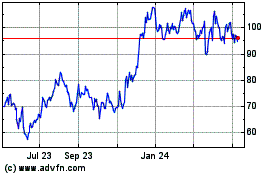

Signet Jewelers (NYSE:SIG)

Historical Stock Chart

From Apr 2023 to Apr 2024