UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 6, 2015

Flotek Industries, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-13270 |

|

90-0023731 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 10603 W. Sam Houston Pkwy N., Suite 300

Houston, Texas |

|

77064 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (713) 849-9911

NOT APPLICABLE

(Former

name or former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On January 6, 2015, Flotek Industries, Inc. (the “Company”) issued a press release providing preliminary financial information

for the quarter ended December 31, 2014 and announcing that it will hold a conference call to discuss its operating results. The January 6, 2015 press release is furnished herewith as Exhibit 99.1 to this Form 8-K and is incorporated

herein by reference.

The information furnished pursuant to Item 2.02 of this Current Report on Form 8-K and in Exhibit 99.1 shall

not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, is not subject to the liabilities of that section and is not deemed incorporated by reference in any filing of the

Company’s under the Securities Act, except as otherwise expressly stated in such filing

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

| Exhibit Number |

|

Description |

|

|

| 99.1 |

|

Press release dated January 6, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

FLOTEK INDUSTRIES, INC. |

|

|

|

| Date: January 6, 2015 |

|

|

|

/s/ H. Richard Walton |

|

|

|

|

H. Richard Walton |

|

|

|

|

Executive Vice President and Chief Financial Officer |

EXHIBIT INDEX

|

|

|

| Exhibit Number |

|

Description |

|

|

| 99.1 |

|

Press release dated January 6, 2015. |

Exhibit 99.1

FOR IMMEDIATE RELEASE

CONTACT: Investor Relations

(713)

849-9911

IR@flotekind.com

Flotek Industries Announces Select, Preliminary Fourth Quarter Financial

Results, Year-End Earnings Release and Conference Call Schedule and

Additional Corporate Presentations

HOUSTON,

January 6, 2015 /PRNewswire/ — Flotek Industries, Inc. (NYSE: FTK - News) this morning announced preliminary, select financial results for the quarter ended December 31, 2014 and the Company’s schedule for its

fourth quarter and year-end earnings release and conference call. The Company also announced additional upcoming corporate presentations.

Fourth

Quarter Preliminary, Select Financial Results

While still finalizing financial results for the quarter ended December 31, 2014, Flotek believes

that revenue in the fourth quarter will exceed $122 million, a record for the Company. In addition, the Company expects Energy Chemical Technologies revenues for the quarter to exceed $74 million and quarterly Drilling Technologies revenues to be

greater than $31 million.

“The record performance by Flotek is clear indication of the importance of value-added products and services in all phases

of the energy price cycle as well as the opportunities created by the focus and effort of the entire Flotek team, especially given the tumult created by the swoon in energy prices and softening oilfield activity, concerns over year-end spending and

the impact of the November and December holidays,” said John Chisholm, Chairman, President and Chief Executive Officer of Flotek. “We remain especially pleased with the strength in Energy Chemical Technologies revenues, where sequential

growth should exceed 10% and year-over-year growth should be at least 30%. The introduction of FracMaxTM – our patent-pending, proprietary software application that provides conclusive,

empirical evidence of the efficacy of our Complex nano-Fluid® completion chemistries – has significantly increased interest in

CnF® chemistries over the last several months. We expect that momentum to continue as we introduce new applications and greater reach of our FracMax analytical package in the coming

weeks.”

Enterprise-wide gross margins should exceed 40% for the quarter ended December 31, 2014, an increase from the third quarter as Company

initial initiatives to improve logistics as well as product mix provided incremental benefits.

“Continued activity acceleration in the fourth

quarter was ahead of our expectations across energy operating segments,” added Chisholm. “While we are aware of concerns over weak commodity prices, our chemistry prospect book remains as robust as it has been in recent memory and, through

the use of FracMax, our validation calendar remains strong. In addition, we continue to gain traction with our new Stemulator® technology, which should provide additional revenue opportunities

into 2015. Moreover, the commercial testing of our horizontal “measurement while drilling” tool, TelePulse™ (a member of the TeledriftTM family), has progressed, and we expect

initial commercial rentals in the coming months.”

“While we continue to watch unprecedented energy commodity price volatility vigilantly and understand we are

not immune from the impact such weakness has on our commercial activity, we also believe that the ability to make better, more productive wells in a time of price weakness is more important than ever, and our data empirically prove that using CnF in

completions provides ubiquitous improvement in well productivity,” concluded Chisholm.

During the quarter Flotek repurchased 621,726 shares of its

common stock at an average price of $16.74 per share for an aggregate total of approximately $10.4 million. The repurchase was made pursuant to a $25 million share repurchase program authorized by the Company’s Board of Directors in November,

2012.

As of December 31, 2014, the Company’s balance on its revolving line of credit was $8.5 million.

“From a balance sheet perspective, we continue to generate significant cash and, even with our meaningful repurchase program, remain well positioned to

prudently allocate capital as opportunities arise,” said Chisholm. “We continue to be disciplined in our approach to reinvesting capital, looking for opportunities that will continue our commitment to strategic investments that stand in

support of Flotek’s goals of remaining an energy technology leader as well as adding value for our shareholders. We will continue to consider all opportunities that we believe create durable value across the pricing cycle.”

Fourth Quarter and Full-Year, 2014 Earnings Release and Conference Call Schedule

Flotek will host a conference call on Thursday, January 29, 2015 at 7:30 a.m. Central Standard Time to discuss its financial and operating results for the

three- and twelve-months ended December 31, 2014. Flotek intends to provide dial-in information through a press release on January 28, 2015.

Flotek plans to file its 10-K after the market close on Wednesday, January 28, 2015. In addition, the Company will provide additional details regarding

operating results in a press release after the market close on January 28, 2015

Investor and Analyst Winter Meeting – Florida

Flotek will host investors and analysts at its annual Florida investor days on February 2, 2014. The meeting will consist of presentation by business unit

leaders as well as a tour of the Company’s Florida Chemical processing, manufacturing and research facilities in central Florida.

For more

information, please email ir@flotekind.com.

Presentation at Independent Petroleum Association of America – Oil and Gas Investment

Symposium—Florida

Flotek will make a presentation at the IPAA Florida Oil and Gas Investment Symposium on Tuesday, February 3, 2015. John

Chisholm, Chairman, President and Chief Executive Officer of Flotek, will present to conference attendees.

The presentation will be webcast live and can

be accessed from Flotek’s website, www.flotekind.com. The presentation slides will be available on the Flotek website coincident with the conference presentation.

About Flotek Industries, Inc.

Flotek is a global

developer and distributor of a portfolio of innovative oilfield technologies, including specialty chemicals and down-hole drilling and production equipment. It serves major and independent companies in the domestic and international oilfield service

industry. Flotek Industries, Inc. is a publicly traded company headquartered in Houston, Texas, and its common shares are traded on the New York Stock Exchange under the ticker symbol “FTK.”

For additional information, please visit Flotek’s web site at www.flotekind.com.

Forward-Looking Statements

Certain statements set forth in this Press Release constitute forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933

and Section 21E of the Securities Exchange Act of 1934) regarding Flotek Industries, Inc.’s business, financial condition, results of operations and prospects. Words such as expects, anticipates, intends, plans, believes, seeks, estimates

and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this Press Release.

Although forward-looking statements in this Press Release reflect the good faith judgment of management, such statements can only be based on facts and

factors currently known to management. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking

statements. Factors that could cause or contribute to such differences in results and outcomes include, but are not limited to, demand for oil and natural gas drilling services in the areas and markets in which the Company operates, competition,

obsolescence of products and services, the Company’s ability to obtain financing to support its operations, environmental and other casualty risks, and the impact of government regulation.

Further information about the risks and uncertainties that may impact the Company are set forth in the Company’s most recent filings on Form 10-K

(including without limitation in the “Risk Factors” Section), and in the Company’s other SEC filings and publicly available documents. Readers are urged not to place undue reliance on these forward-looking statements, which speak only

as of the date of this Press Release. The Company undertakes no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Press Release.

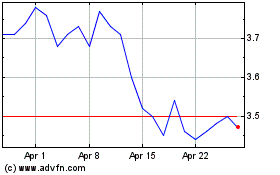

Flotek Industries (NYSE:FTK)

Historical Stock Chart

From Mar 2024 to Apr 2024

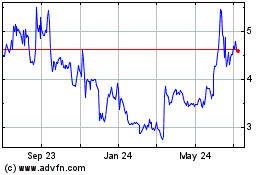

Flotek Industries (NYSE:FTK)

Historical Stock Chart

From Apr 2023 to Apr 2024