As filed with the Securities and Exchange Commission on, December 30, 2014

Registration No. 333-__________

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

___________

CAMTEK LTD.

(Exact name of Registrant as specified in its charter)

|

Israel

(State or other jurisdiction

of incorporation or organization)

|

Not Applicable

(IRS Employer Identification No.)

|

Ramat Gavriel Industrial Zone

P.O. Box 544

Migdal Ha’Emek 23150, Israel

(972) 4-604-8100

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

___________

Camtek Ltd. 2003 Share Option Plan

Camtek Ltd. 2014 Share Option Plan

(Full title of the Plans)

___________

Camtek USA, Inc.

2000 Wyatt Dr.,

Santa Clara, CA 95054

(Name and address of agent for service)

(408) 986-9640

(Telephone number, including area code, of agent for service)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated Filer o

|

|

Non-accelerated filer x

|

Smaller reporting company o

|

Copies of all communications, including all communications sent to the agent for service, should be sent to:

|

Richard H. Gilden

Kramer Levin Naftalis & Frankel LLP

1177 Avenue of the Americas

New York, New York 10036

Tel: 212-715-9486

Fax: 212-715-8085

|

Shelly Blatt Zak, Adv.

Shibolet & Co.

Museum Tower, 4 Berkowitz Street,

Tel-Aviv 64238, Israel

Tel: + 972-3-777-8333

|

CALCULATION OF REGISTRATION FEE

Title of Securities to be Registered

|

|

Amount to be registered (3)

|

|

Proposed Maximum Offering Price per Share(4)

|

|

|

Proposed Maximum Aggregate Offering Price(4)

|

|

|

Amount of

Registration fee(4)

|

|

Ordinary Shares, NIS 0.01 par value

|

|

|

|

$ |

3.045 |

|

|

$ |

304,500 |

|

|

$ |

36.38 |

|

Ordinary Shares, NIS 0.01 par value

|

|

|

|

$ |

3.045 |

|

|

$ |

9,135,000 |

|

|

$ |

1,061.49 |

|

(1) 100,000 Ordinary Shares to be registered under the Camtek Ltd. 2003 Share Option Plan, including its sub-plans.

(2) 3,000,000 Ordinary Shares to be registered under the Camtek Ltd. 2014 Share Option Plan, including its sub-plans.

(3) This Registration Statement shall also cover any additional Ordinary Shares which become issuable under the Registrant’s 2003 and 2014 Share Option Plans, by reason of any share dividend, stock split, recapitalization or other similar transaction effected without the Registrant’s receipt of consideration which results in an increase in the number of the Registrant’s Ordinary Shares.

(4) Estimated in accordance with Rule 457(c) and 457(h) of the Securities Act of 1933, as amended, solely for the purpose of calculating the filing fee on the basis of $3.10 per share, which represents the average of the high and low prices of the Ordinary Shares as reported on the NASDAQ Global Market on December 23, 2014, which is within five (5) business days prior to the date of this Registration Statement.

EXPLANATORY NOTE

On February 27, 2004, Camtek Ltd. (the “Registrant”) filed with the Securities and Exchange Commission (the “Commission”) a Registration Statement on Form S-8 (File No. 333-113139) relating to 998,800 Ordinary Shares to be offered and sold under the Registrant’s 2003 Share Option Plan, 2003 Share Option Plan - Sub-Plan for Grantees Subject to United States Taxation, and 2003 Share Option Plan - Sub-Plan for Grantees Subject to Israeli Taxation (the “2003 Plans”). On May 11, 2011, the Registrant filed with the Commission a Registration Statement on Form S-8 (File No. 333-174165) relating to 600,000 additional Ordinary Shares to be offered and sold under the 2003 Plans.

The contents of such prior Registration Statements are incorporated herein by reference into this Registration Statement.

On November 12, 2014 the Registrant adopted the 2014 Share Option Plan, 2014 Share Option Plan - Sub-Plan for Grantees Subject to United States Taxation, and 2014 Share Option Plan - Sub-Plan for Grantees Subject to Israeli Taxation (the "2014 Plans").

This Registration Statement relates to an additional 100,000 Ordinary Shares to be offered and sold under the 2003 Plans, and to 3,000,000 Ordinary Shares to be offered and sold under the 2014 Plans.

PART II

Information Required in the Registration Statement

Item 3. Incorporation of Documents by Reference

The Registrant hereby incorporates by reference in this Registration Statement the following documents:

(a) The Registrant’s Annual Report on Form 20-F for the fiscal year ended December 31, 2013 filed with the Commission on March 4, 2014;

(b) The Registrant’s Reports of Foreign Issuer on Form 6-K filed with the Commission on January 6, 2014, February 3, 2014, February 13, 2014, February 20, 2014, March 10, 2014, March 27, 2014, April 7, 2014, April 24, 2014, May 1, 2014, June 12, 2014, July 3, 2014, July 7, 2014, July 29, 2014, September 2, 2014, September 10, 2014, October 6, 2014, October 20, 2014, October 29, 2014, November 12, 2014, November 25, 2014, December 1, 2014 and December 9, 2014;

(c) The description of the Registrant’s Ordinary Shares contained in the Registrant’s Registration Statement on Form 8-A filed pursuant to Section 12(g) of the Exchange Act on July 21, 2000.

All documents subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, prior to the filing of a post-effective amendment to this Registration Statement which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be part hereof from the date of filing of such documents.

Item 4. Description of Securities

Not Applicable.

Item 5. Interests of Named Experts and Counsel

Not Applicable.

Item 6. Indemnification of Directors and Officers

The Registrant’s Articles provide that, subject to the provisions of the Israeli Companies Law and Securities Law, the Registrant may:

|

|

(1)

|

Obtain insurance for its office holders covering liability for any act performed in their respective capacities as an office holder with respect to:

|

· A violation of the duty care to the Registrant or to another person;

· A breach of fiduciary duty, provided that the office holder acted in good faith and had reasonable grounds to assume that the act would not cause the Registrant harm;

· A monetary liability imposed on an officer holder for the benefit of another person; and

· Expenses incurred by an office holder in relation to an administrative proceeding instituted against him or her or payment required to be made to an injured party.

|

|

(2)

|

Indemnify its officer holders for a: (i) financial liability imposed or approved by a court, after the liability has been incurred or in advance; (ii) reasonable legal fees incurred by the office holder as a result of an investigation or proceeding instituted against him or her by a competent authority concluded in certain events defined in the Israeli Companies Law; (iii) reasonable legal fees incurred by the office holder in proceedings instituted against him or her by the Registrant, on its behalf or by a third party, in connection with criminal proceedings in which the office holder was acquitted, or as a result of a conviction for a crime that does not require proof of criminal intent; and (iv) expenses incurred by an office holder in relation to an administrative proceeding or payment required to be made to an injured party, pursuant to certain provisions of the Israeli Securities Law.

|

An advance undertaking to indemnify an office holder must be limited to categories of events that can be reasonably foreseen, and to an amount which is reasonable under the circumstances, as determined by the board of directors. The total aggregate retroactive indemnification amount that the Registrant may pay its office holders shall not exceed an amount equal to 25% of the shareholders' equity at the time of indemnification.

|

|

(3)

|

The Registrant may exempt, in advance, an office holder from all or part of his or her responsibility for damages occurring as a result of a breach of his or her duty of care. .

|

Notwithstanding the foregoing, the Registrant may not insure, indemnify or exempt an office holder for any breach of his or her fiduciary duty (except that the Registrant may insure or indemnify an office holder if acted in good faith having reasonable cause to assume that such act would not prejudice the interests of the Registrant), for a violation of his or her duty of care if the act was committed recklessly or with intent, for any act committed with the intent to realize improper personal gain, or for any fine imposed on the office holder, except as provided above.

As required under Israeli law, the Registrant’s Compensation Committee, board of directors and - with respect to office holders who are directors of the Registrant - also shareholders, have approved the indemnification and insurance of our office holders, as well as the resolutions necessary both to exempt its office holders in advance from any liability for damages arising from a breach of their duty of care to the Registrant, and to provide them with the indemnification undertakings and insurance coverage they have received from the Registrant in accordance with the Registrant’s Articles.

Item 7. Exemption from Registration Claimed

Not Applicable.

Item 8. Exhibits

|

Exhibit Number

|

Description

|

|

4.1

|

Memorandum of Association of Registrant (incorporated herein by reference to Exhibit 3.1 to Amendment No. 1 to the Registrant’s Registration Statement on Form F-1, File No. 333-12292, filed with the Securities and Exchange Commission on July 21, 2000).

|

|

4.2

|

Articles of Registrant, as amended October 24, 2011 (incorporated herein by reference to Exhibit 1.2 to the Annual Report on Form 20-F for the fiscal year ended December 31, 2012 filed with the Commission on April 11, 2013).

|

|

5

|

Opinion of Shibolet & Co.

|

|

23.1

|

Consent of Shibolet & Co. (contained in their opinion constituting Exhibit 5).

|

|

23.2

|

Consent of Somekh Chaikin, Independent Registered Public Accounting Firm, a member firm of KPMG International.

|

|

24.1

|

Power of Attorney (included in signature page).

|

Item 9. Undertakings

(a) The undersigned Registrant hereby undertakes:

|

|

(1)

|

To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

|

|

|

(i)

|

to include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

|

|

|

(ii)

|

to reflect in the prospectus of any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the "Calculation of Registration Fee" table in the effective registration statement;

|

|

|

(iii)

|

to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

|

provided, however, that paragraphs (1)(i) and (1)(ii) do not apply if the information required to be included in a post-effective amendment by those clauses is contained in periodic reports filed by the Registrant pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the Registration Statement.

|

|

(2)

|

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

|

(3)

|

To remove from registration by means of a post-effective amendment of any of the securities being registered which remain unsold at the termination of the offering.

|

|

|

(4)

|

If the registration is a foreign private issuer, to file a post-effective amendment to the registration statement to include any financial statements required by §210.3-19 of this chapter at the start of any delayed offering or throughout a continuous offering. Financial statements and information otherwise required by Section 10(a)(3) of the Act need not be furnished, provided that the registrant includes in the prospectus, by means of a post-effective amendment, financial statements required pursuant to this paragraph (a)(4) and other information necessary to ensure that all other information in the prospectus is at least as current as the date of those financial statements. Notwithstanding the foregoing, with respect to registration statements on Form F-3 (§239.33 of this chapter), a post-effective amendment need not be filed to include financial statements and information required by Section 10(a)(3) of the Act or § 210.3-19 of this chapter if such financial statements and information are contained in periodic reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the Form F-3.

|

|

|

(b)

|

The undersigned Registrant hereby undertakes that for purposes of determining any liability under the Securities Act of 1933, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

|

(h)

|

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person of the Registrant in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

|

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933 the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Migdal Ha’Emek, Israel on this 29 day of December, 2014.

| |

CAMTEK LTD.

|

|

| |

By: |

/s/ Rafi Amit

|

|

| |

|

Rafi Amit

|

|

| |

|

Chairman of the Board of Directors & Chief Executive Officer

|

|

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS:

That each person whose signature appears below, does hereby constitute and appoint Rafi Amit and Moshe Eisenberg and each of them acting alone, the lawful attorneys-in-fact and agents with full power and authority to do any and all acts and things and to execute any and all instruments which said attorneys and agents, and any one of them acting alone, determine may be necessary or advisable or required to comply with the Securities Act of 1933, as amended, and any rules or regulations or requirements of the Securities and Exchange Commission in connection with this Registration Statement. Without limiting the generality of the foregoing power and authority, the powers granted include the power and authority to sign the names of the undersigned officers and directors in the capacities indicated below to this Registration Statement, to any and all amendments, both pre-effective and post-effective, and supplements to this Registration Statement, and to any and all instruments or documents filed as part of or in conjunction with this Registration Statement or amendments or supplements thereof, and each of the undersigned hereby ratifies and confirms that any or all said attorneys and agents, or any one of them, shall do or cause to be done by virtue hereof. This Power of Attorney may be signed in several counterparts.

IN WITNESS WHEREOF, each of the undersigned have executed this power of attorney as of the date indicated.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed below by the following persons in the capacities and on the dates indicated.

|

Signature

|

|

Title

|

Date

|

| |

|

|

|

|

/s/ Rafi Amit

|

|

Chairman of the Board of Directors and Chief

|

December 29, 2014

|

|

Rafi Amit

|

|

Executive Officer (Principal Executive Officer) |

|

|

/s/ Moshe Eisenberg

|

|

Vice President and Chief Financial Officer

|

December 29, 2014

|

|

Moshe Eisenberg

|

|

(Principal Account Officer) |

|

|

/s/ Yotam Stern

|

|

Director

|

December 29, 2014

|

|

Yotam Stern

|

|

|

|

|

/s/ Gabriela Heller

|

|

Director

|

December 29, 2014

|

|

Gabriela Heller

|

|

|

|

|

/s/Rafi Koriat

|

|

Director

|

December 29, 2014

|

|

Rafi Koriat

|

|

|

|

|

/s/ Eran Bendoly

|

|

Director

|

December 29, 2014

|

|

Eran Bendoly

|

|

|

|

|

AUTHORIZED REPRESENTATIVE IN THE UNITED STATES

Camtek USA, Inc.

2000 Wyatt Dr.

Santa Clara, CA 95054

|

|

|

/s/ Moshe Eisenberg

|

|

President

|

December 29, 2014

|

|

Moshe Eisenberg

|

|

|

|

INDEX TO EXHIBITS

The following is a list of exhibits filed as part of this Registration Statement:

|

Exhibit Number

|

Description

|

|

4.1

|

Memorandum of Association of Registrant (incorporated herein by reference to Exhibit 3.1 to Amendment No. 1 to the Registrant’s Registration Statement on Form F-1, File No. 333-12292, filed with the Securities and Exchange Commission on July 21, 2000).

|

|

4.2

|

Articles of Registrant, as amended October 24, 2011 (incorporated herein by reference to Exhibit 1.2 to the Annual Report on Form 20-F for the fiscal year ended December 31, 2012 filed with the Commission on April 11, 2013).

|

|

5

|

Opinion of Shibolet & Co.

|

|

23.1

|

Consent of Shibolet & Co. (contained in their opinion constituting Exhibit 5).

|

|

23.2

|

Consent of Somekh Chaikin, Independent Registered Public Accounting Firm, a member firm of KPMG International.

|

|

24.1

|

Power of Attorney (included in signature page).

|

EXHIBIT 5.0

[Shibolet & Co. letterhead]

Tel Aviv, December 29, 2014

Ref: C-59-10

Camtek Ltd.

P.O. Box 631

Migdal Haemek, 10556

Israel

Re: Camtek Ltd. – Registration Statement on Form S-8

Ladies and Gentlemen:

We refer to the registration statement on Form S-8 (the “Registration Statement”), filed by Camtek Ltd., an Israeli Company (the "Company"), with the Securities and Exchange Commission under the Securities Act of 1933, as amended (the "Act"), relating to the registration of: (1) 100,000 of the Company's Ordinary Shares, nominal value NIS 0.01 each (the “Shares”), authorized for issuance under the Company’s 2003 Share Option Plan, 2003 Share Option Plan - Sub-Plan for Grantees Subject to United States Taxation, and 2003 Share Option Plan - Sub-Plan for Grantees Subject to Israeli Taxation (the “2003 Plans”); and (2) 3,000,000 Shares authorized for issuance under the Company’s 2014 Share Option Plan, 2014 Share Option Plan - Sub-Plan for Grantees Subject to United States Taxation, and 2014 Share Option Plan - Sub-Plan for Grantees Subject to Israeli Taxation (the “2014 Plans”).

This opinion is being furnished in accordance with the requirements of Item 8 of Form S-8 and Item 601(b)(5)(i) of Regulation S-K.

In our capacity as the Company's Israeli counsel in connection with the preparation and filing of the Registration Statement, we have examined copies of the Company’s Articles of Association, as amended, the 2003 Plans and the 2014 Plans (collectively, the “Plans"), protocols of meetings of the board of directors of the Company and its shareholders with respect to the Plans and other corporate records, instruments and documents we have considered necessary or appropriate for the purpose of this opinion, which were presented to us by the Company, and such matters of Israeli law we have considered necessary or appropriate for the purpose of rendering this opinion. We have assumed that the Company presented to us all such protocols and documents relating to or having any bearing on the Plans.

In our examination, we have assumed the genuineness of all signatures, the legal capacity of all natural persons, the correctness and completeness of certificates of public officials and the representations set forth therein, the authenticity of all documents submitted to us as originals and the conformity to authentic original documents of all documents submitted to us as copies.

Based upon and subject to the foregoing, we are of the opinion that the Shares being registered pursuant to this Registration Statement have been duly and validly authorized for issuance, and if, and when, issued pursuant to the terms and conditions of the Plans, such Shares will be validly issued, fully paid and nonassessable.

We are members of the Israeli Bar and we are opining herein as to the effect on the subject matter only of the internal laws of the State of Israel, and we express no opinion with respect to the applicability thereto, or the effect thereon, of the laws of any other jurisdiction.

This opinion letter is rendered as of the date first written above and we disclaim any obligation to advise you of facts, circumstances, events or developments, including, without limitation, in the law, which hereafter may be brought to our attention and which may alter, affect or modify the opinion expressed herein. Our opinion is expressly limited to the matters set forth above and we render no opinion, whether by implication or otherwise, as to any other matters relating to the Company, the Plans, or the Shares.

We consent to the filing of this opinion letter as Exhibit 5.0 to the Registration Statement. This consent is not to be construed as an admission that we are a party whose consent is required to be filed with the Registration Statement under Section 7 of the Act or the rules and regulations promulgated thereunder.

| |

Very truly yours,

/s/ Shibolet & Co.

Advocates & Notary

|

EXHIBIT 23.2

[Somekh Chaikin letterhead]

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors

Camtek Ltd:

We consent to the use of our report incorporated by reference herein.

/s/ Somekh Chaikin

Certified Public Accountants (Israel)

A Member firm of KPMG International

Tel Aviv, Israel

December 29, 2014

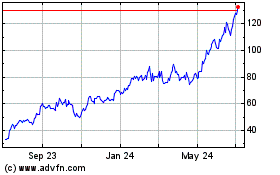

Camtek (NASDAQ:CAMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

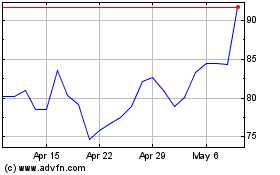

Camtek (NASDAQ:CAMT)

Historical Stock Chart

From Apr 2023 to Apr 2024