Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

December 24 2014 - 12:20PM

Edgar (US Regulatory)

|

|

|

|

PROSPECTUS SUPPLEMENT NO. 6

|

Filed Pursuant to Rule 424(b)(3)

|

|

(To Prospectus dated April 17, 2014)

|

Registration No. 333-166556

|

JONES SODA CO.

3,057,500 Shares of Common Stock underlying Warrants

This prospectus supplement amends and supplements the prospectus dated April 17, 2014, as previously supplemented (the “Prospectus”), which forms a part of our Post-Effective Amendment No. 4 to Registration Statement on Form S-1 (Registration Statement No. 333-166556) that was declared effective on April 17, 2014. The Prospectus relates to the sale and issuance of up to 3,057,500 shares of common stock of Jones Soda Co. to holders of outstanding warrants, upon exercise of such warrants.

On December 23, 2014, we filed with the Securities and Exchange Commission a current report on Form 8-K. This Supplement is being filed to update, amend and supplement the information included or incorporated by reference in the Prospectus with the information contained in the current report on Form 8-K. Accordingly, we have attached the Form 8-K to this Supplement.

You should read this Supplement in conjunction with the Prospectus, which is to be delivered with this Supplement. If there is any inconsistency between the information in the Prospectus and this Supplement, you should rely on the information in this Supplement.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 3 of the Prospectus for a discussion for the risks associated with our business. Also see “Cautionary Notice Regarding Forward-Looking Statements” in our annual report on Form 10-K and our latest quarterly report on Form 10-Q.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this Prospectus or this Supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus Supplement is December 24, 2014.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): December 18, 2014

Jones Soda Co.

(Exact Name of Registrant as Specified in Its Charter)

Washington

(State or Other Jurisdiction of Incorporation)

|

|

|

|

0-28820

|

52-2336602

|

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

1000 First Avenue South, Suite 100, Seattle, Washington

|

98134

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

(206) 624-3357

(Registrant's Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

◻Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

◻Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

◻Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

◻Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

On December 18, 2014, as amended and restated on December 22, 2014, Jones Soda Co. (the “Company”) entered into an amendment (the “Amendment”) to its existing revolving secured credit facility (the “Loan Facility”) with CapitalSource Business Finance Group, a dba of BFI Business Finance (the “Lender”).

The primary purpose of the Amendment is to provide for a minimum annual cumulative amount of interest of $30,000 to be paid to the Lender under the Loan Facility. The Amendment is effective as of December 27, 2014, with the renewal of the Loan Facility.

The foregoing description of the material terms of the Amendment is qualified in its entirety by reference to the Amendment & Restatement of First Modification to Loan and Security Agreement dated as of December 22, 2014, by and among Jones Soda Co. (USA) Inc., Jones Soda (Canada) Inc., and Lender, a copy of which is attached as Exhibit 10.1 to this Current Report and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

10.1

|

Amendment & Restatement of First Modification to Loan and Security Agreement dated as of December 22, 2014, by and among Jones Soda Co. (USA) Inc., JONES SODA (CANADA) Inc., and CapitalSource Business Finance Group, a dba of BFI Business Finance.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

JONES SODA CO.

(Registrant)

|

|

|

|

|

|

|

December 23, 2014

|

|

By:

|

/s/ Mark Miyata

|

|

|

|

|

|

Mark Miyata, Vice President of Finance

|

Exhibit Index

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

Amendment & Restatement of First Modification to Loan and Security Agreement dated as of December 22, 2014, by and among Jones Soda Co. (USA) Inc., JONES SODA (CANADA) Inc., and CapitalSource Business Finance Group, a dba of BFI Business Finance.

|

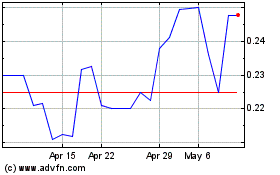

Jones Soda (QB) (USOTC:JSDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

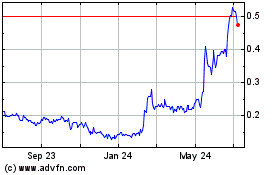

Jones Soda (QB) (USOTC:JSDA)

Historical Stock Chart

From Apr 2023 to Apr 2024