UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

þ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended October 31, 2014

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______To _______

Commission file number: 333-156059

Minerco Resources, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

27-2636716

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

800 Bering Drive, Suite 201

Houston, TX 77057

(Address of principal executive offices)

(888) 473-5150

(Registrant’s telephone number, including area code)

_____________________________________________________

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesþ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (of for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o

|

Non-accelerated filer

|

o

|

|

Accelerated filer

|

o

|

Smaller reporting company

|

þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes þ No o

APPLICABLE ONLY TO CORPORATE ISSUERS

As of December 22, 2014 the registrant had 3,033,025,343 outstanding shares of its common stock.

Table of Contents

|

PART I – FINANCIAL INFORMATION

|

| |

|

|

|

|

|

Item 1. Financial Statements

|

|

|

3

|

|

|

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

|

13

|

|

|

Item 3. Quantitative and Qualitative Disclosures About Market Risk

|

|

|

21

|

|

|

Item 4. Controls and Procedures

|

|

|

22

|

|

| |

|

|

|

|

|

PART II – OTHER INFORMATION

|

| |

|

|

|

|

|

Item 1. Legal Proceedings

|

|

|

23

|

|

|

Item 2. Unregistered Sales of Equity Securities

|

|

|

23

|

|

|

Item 3. Defaults Upon Senior Securities

|

|

|

25

|

|

|

Item 4. Mine Safety Disclosures

|

|

|

25

|

|

|

Item 5. Other Information

|

|

|

25

|

|

|

Item 6. Exhibits

|

|

|

26

|

|

PART I – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

The unaudited interim financial statements of Minerco Resources, Inc. follow. All currency references in this report are to U.S. dollars unless otherwise noted.

| |

|

Index

|

|

|

Consolidated Balance Sheets (unaudited)

|

|

|

4

|

|

|

Consolidated Statements of Expenses (unaudited)

|

|

|

5

|

|

|

Consolidated Statements of Cash Flows (unaudited)

|

|

|

6

|

|

|

Consolidated Notes to the Unaudited Financial Statements (unaudited)

|

|

|

7

|

|

Minerco Resources, Inc.

Consolidated Balance Sheets

(unaudited)

| |

|

|

October 31,

|

|

|

July 31, |

|

| |

|

|

2014 |

|

|

2014 |

|

| |

|

|

(Successor)

|

|

|

(Predecessor)

|

|

| ASSETS |

|

|

|

|

|

|

|

|

Cash

|

|

$

|

58,330

|

|

$

|

-

|

|

| |

|

|

|

|

|

|

Accounts Receivable

|

|

|

664,831

|

|

|

509,377

|

|

| |

|

|

|

|

|

|

Inventory

|

|

|

440,052

|

|

|

333,236

|

|

| |

|

|

|

|

|

|

Prepaid Expenses, Current

|

|

|

190.937

|

|

|

24,802

|

|

| |

|

|

|

|

|

|

Current Assets

|

|

1,358,150

|

|

867,415

|

|

| |

|

|

|

|

|

|

|

|

Other Assets

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Investments

|

|

|

33,250

|

|

|

26,875

|

|

| |

|

|

|

|

|

|

|

|

Property and Equipment, net

|

|

|

145,757

|

|

|

147,802

|

|

| |

|

|

|

|

|

|

|

|

Prepaid Expenses, Noncurrent

|

|

|

250,000

|

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

Goodwill

|

|

|

727,145

|

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

Intangible Assets, net

|

|

|

103,248

|

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

Total Assets

|

|

$

|

2,617,550

|

|

$

|

1,042,092

|

|

| LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities

|

|

$ |

|

|

$ |

|

|

| |

|

|

|

|

|

|

|

|

Note Payable

|

|

|

|

|

|

180,958

|

|

| |

|

|

|

|

|

|

|

|

Accounts Payable – Related Party

|

|

|

|

|

|

- |

|

| |

|

|

|

|

|

|

|

| Convertible debt, net unamortized discount $296,219 |

|

|

|

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

Capital Lease Obligations, Current

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Line of Credit

|

|

|

|

|

|

134,190

|

|

| |

|

|

|

|

|

|

|

|

Derivative liabilities

|

|

|

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

Total Current Liabilities

|

|

|

3,560,292

|

|

|

1,840,641

|

|

| |

|

|

|

|

|

|

|

|

Capital Lease Obligations, Noncurrent

|

|

|

7,900

|

|

|

38,849

|

|

| |

|

|

|

|

|

|

|

|

Long-term Debt, net of current

|

|

|

1,350,000

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Total Liabilities

|

|

|

4,918,192

|

|

|

1,879,490

|

|

| |

|

|

|

|

|

|

|

|

Stockholders’ Deficit

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Series A Convertible Preferred stock, $0.001 par value, 25,000,000 shares authorized, 15,000,000 outstanding at October 31, 2014 for Successor and no shares authorized or issued at July 31, 2014 for Predecessor |

|

|

15,000

|

|

|

- |

|

| |

|

|

|

|

|

|

|

| Series B Convertible Preferred stock, $0.001 par value, 2,000,000 shares authorized, 1,436,000 outstanding at October 31, 2014 for Successor and no shares authorized or outstanding at July 31, 2014, respectively for Predecessor |

|

|

1,436

|

|

|

- |

|

| |

|

|

|

|

|

|

|

| Common stock, $0.001 par value, 3,500,000,000 shares authorized, 2,828,775,598 and outstanding at October 31, 2014 for Successor and no shares authorized or outstanding at July 31, 2014 for Predecessor |

|

|

2,828,776

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

Additional paid-in capital

|

|

|

19,692,285

|

|

|

85,470

|

|

| |

|

|

|

|

|

|

|

|

Accumulated Other Comprehensive Income (Loss)

|

|

|

(2,981

|

) |

|

(73,125 |

) |

| |

|

|

|

|

|

|

|

|

Accumulated deficit

|

|

|

(24,170,335 |

) |

|

(849,743 |

) |

| |

|

|

|

|

|

|

|

|

Total Minerco stockholders’ Deficit

|

|

|

(1,635,819 |

) |

|

(837,398 |

) |

| |

|

|

|

|

|

|

|

|

Noncontrolling Interest

|

|

|

(664,823 |

) |

|

- |

|

| |

|

|

|

|

|

|

|

|

Total Stockholders’ Deficit

|

|

|

(2,300,642 |

) |

|

(837,398 |

) |

| |

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders’ Deficit

|

|

$ |

2,617,550

|

|

$ |

1,042,092 |

|

The accompanying notes are an integral part of these unaudited consolidated financial statements

Minerco Resources, Inc.

Consolidated Statements of Comprehensive Income (Loss)

(unaudited)

| |

|

|

Period from October 25, 2014 to

October 31, 2014 (Successor)

|

|

|

|

Period from August 1, 2014 to October 24, 2014 (Predecessor)

|

|

|

|

Three Months

Ended

October 31, 2013 (Predecessor)

|

|

|

Sales

|

|

$ |

27,624 |

|

|

|

475,803 |

|

|

|

635,793 |

|

|

Cost of Goods Sold

|

|

|

20,415 |

|

|

|

335,197 |

|

|

|

477,650 |

|

|

Gross Profit (Loss)

|

|

|

7,209 |

|

|

|

140,606 |

|

|

|

158,143 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization and Depreciation

|

|

|

- |

|

|

|

11,021 |

|

|

|

11,021 |

|

|

Selling and Marketing

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

General and Administrative

|

|

|

28,111 |

|

|

|

261,935 |

|

|

|

307,937 |

|

|

Total Operating Expenses

|

|

|

28,111 |

|

|

|

272,956 |

|

|

|

318,958 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Income (Expenses):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Expense, net

|

|

|

(987 |

) |

|

|

(17,465 |

) |

|

|

(7,314 |

) |

|

Contract Term Fees

|

|

|

- |

|

|

|

|

|

|

|

2,000 |

|

|

Total Other Expenses

|

|

|

(987 |

) |

|

|

(17,465 |

) |

|

|

(5,314 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss

|

|

$ |

(21,889 |

) |

|

$ |

(149,815 |

) |

|

|

(166,219 |

) |

|

Net loss attributable to Noncontrolling interest

|

|

|

(14,287 |

) |

|

|

- |

|

|

|

- |

|

|

Net loss attributable to Minerco

|

|

$ |

(7,602 |

) |

|

$ |

(149,815 |

) |

|

|

(166,219 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock Dividends

|

|

$ |

15,122 |

|

|

|

- |

|

|

|

- |

|

|

Net loss attributable to common shareholders

|

|

|

(22,724 |

) |

|

|

(149,815 |

) |

|

|

(166,219 |

) |

|

Other Comprehensive Income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain (loss) on Available-for-sale Securities

|

|

|

2,981 |

|

|

|

9,356 |

|

|

|

- |

|

|

Total Other Comprehensive Income

|

|

$ |

2,981 |

|

|

|

9,356 |

|

|

|

- |

|

|

Other Comprehensive Income attributable to Noncontrolling interest

|

|

|

2,706 |

|

|

|

9,356 |

|

|

|

- |

|

|

Other Comprehensive Income attributable to Minerco

|

|

$ |

275 |

|

|

|

- |

|

|

|

- |

|

|

Total Comprehensive Income

|

|

|

(22,349 |

) |

|

|

(140,459 |

) |

|

|

(166,219 |

) |

|

Net Loss Per Common Share – Basic and Diluted

|

|

$ |

(0.00 |

) |

|

$ |

(0.00 |

) |

|

$ |

(0.00 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Common Shares Outstanding

|

|

|

2,806,530,749 |

|

|

|

2,606,221,621 |

|

|

|

1,312,097,247 |

|

The accompanying notes are an integral part of these unaudited consolidated financial statements

Minerco Resources, Inc.

Consolidated Statements of Cash Flows

(unaudited)

| |

|

The Period October 25, to

October 31, 2014

(Successor)

|

|

The Period August 1, 2014 to October 24, 2014

(Predecessor)

|

|

Three months

Ended

October 31, 2013

(Predecessor)

|

|

|

Cash Flows from Operating Activities

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Net income (loss) for the period

|

|

$

|

(21,889

|

) |

(149,815

|

) |

(166,129

|

) |

| |

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Net loss attributable to noncontrolling interest

|

|

|

14,287

|

|

|

|

-

|

|

|

Loss on AFS

|

|

|

(2,981

|

) |

|

|

-

|

|

| |

|

|

|

|

|

|

-

|

|

| |

|

|

|

|

|

|

-

|

|

|

Amortization and Depreciation

|

|

|

-

|

|

11,021

|

|

11,021

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Investment

|

|

|

2,981

|

|

|

|

-

|

|

| |

|

|

|

|

|

|

-

|

|

|

Accounts payable and accrued liabilities

|

|

|

|

|

5,349

|

|

83,056

|

|

|

Accounts Receivable

|

|

|

(231,190

|

) |

(125,038

|

) |

(164,679

|

) |

|

Inventory

|

|

|

76,878

|

|

156,366

|

|

143,277

|

|

|

Accounts payable- related party

|

|

|

221,960

|

|

|

|

-

|

|

|

Net Cash Used in Operating Activities

|

|

|

60,046

|

|

(102,117

|

) |

(93,454

|

) |

| |

|

|

|

|

|

|

|

|

|

Cash Flows from Investing Activities

|

|

|

|

|

|

|

|

|

|

Purchase of Property and Equipment

|

|

|

-

|

|

-

|

|

-

|

|

|

Acquisition of Business, net

|

|

|

|

|

-

|

|

-

|

|

| |

|

|

- |

|

-

|

|

|

|

|

Net Cash Used in Investing Activities

|

|

|

|

|

-

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

|

Cash Flows from Financing Activities

|

|

|

|

|

|

|

|

|

|

Proceeds from convertible notes, net

|

|

|

-

|

|

|

|

-

|

|

|

Proceeds from long-term debt

|

|

|

-

|

|

|

|

-

|

|

|

Repayments of Notes Payable

|

|

|

-

|

|

(27,500

|

) |

(14,000

|

) |

|

Proceeds from line of credit, net

|

|

|

-

|

|

-

|

|

128,562

|

|

|

Return of Capital to Members

|

|

|

-

|

|

|

|

(45,000

|

) |

|

Proceeds from Parent

|

|

|

-

|

|

150,000

|

|

-

|

|

|

Repayments of Line of Credit

|

|

|

(2,666

|

) |

(31,466

|

) |

-

|

|

|

Proceeds from Members

|

|

|

-

|

|

26,750

|

|

-

|

|

|

Repayments of Capital Lease

|

|

|

-

|

|

(14,717

|

) |

-

|

|

| |

|

|

|

|

|

|

|

|

|

Net Cash Provided by Financing Activities

|

|

|

(2,666

|

) |

103,067

|

|

69,562

|

|

| |

|

|

|

|

|

|

|

|

|

Net change in cash

|

|

|

57,380

|

|

950

|

|

(23,892

|

) |

| |

|

|

|

|

|

|

|

|

|

Cash, Beginning of Period

|

|

|

950

|

|

-

|

|

24,623

|

|

| |

|

|

|

|

|

|

|

|

|

Cash, End of Period

|

|

$

|

58,330

|

|

950

|

|

731

|

|

| |

|

|

|

|

|

|

|

|

|

Supplemental disclosures of cash flow information

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Cash paid for interest

|

|

|

-

|

|

17,465

|

|

7,314

|

|

|

Cash paid for income taxes

|

|

|

-

|

|

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

| Non-cash financing: |

|

|

|

|

|

|

|

|

| Net liabilities of Successor |

|

$ |

2,610,053 |

|

-

|

|

-

|

|

| Net liabilities of Predecessor |

|

$ |

1,811,546 |

|

- |

|

-

|

|

| Increase in fair value of assets due to acquisition |

|

$ |

43,956 |

|

- |

|

-

|

|

The accompanying notes are an integral part of these unaudited consolidated financial statements

Minerco Resources, Inc.

Consolidated Notes to the Financial Statements

(unaudited)

1. Basis of Presentation

The accompanying unaudited interim financial statements of Minerco Resources, Inc. (“Minerco” or the “Company”), have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules of the Securities and Exchange Commission (the “SEC”), and should be read in conjunction with the audited financial statements and notes thereto contained in Minerco’s Annual Report filed with the SEC on Form 10-K. In the opinion of management, all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of financial position and the results of operations for the interim periods presented have been reflected herein. The results of operations for interim periods are not necessarily indicative of the results to be expected for the full year. Consolidated Notes to the Financial Statements which substantially duplicate the disclosure contained in the audited financial statements for fiscal 2014 as reported in Minerco’s Form 10-K have been omitted.

|

On October 24, 2014, through its subsidiary, Level 5 Beverage Company, Inc.(the “Purchaser”) (“Level 5”), the Company entered into an Agreement (the “Membership Interest Purchase Agreement”) with Avanzar Sales and Distribution, LLC (“Company”), a California Limited Liability Company (“Avanzar”) to acquire an initial thirty percent (30%) equity position and fifty-one percent (51%) voting interest for the Purchase Price of $500,000 with an option to acquire an additional twenty-one percent (21%) interest and Second Option to acquire up to seventy-five percent (75%) of Avanzar. The acquisition broadens our base in the beverage industry through vertical integration. The acquisition was accounted for in accordance with ASC 805, Business Combinations.

|

The Acquisition has been accounted for in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) for business combinations and accordingly, the Company’s assets and liabilities, excluding deferred income taxes, were recorded using their fair value as of October 24, 2014. Under SEC rules, Avanzar is considered the predecessor business to Minerco given Avanzar’s significant size compared to Minerco at the date of acquisition

The basis of presentation is not consistent between the successor and predecessor entities and the financial statements are not presented on a comparable basis. As a result, the accompanying consolidated statements of operations, cash flows and comprehensive income (loss) are presented for two different reporting entities:

Successor — relates to the financial periods and balance sheets succeeding the Acquisition; and

Predecessor — relates to the financial periods preceding the Acquisition (prior to October 24, 2014).

Unless otherwise indicated, the “Company” as used throughout the remainder of the notes, refers to both the Successor and Predecessor.

2. Going Concern

Minerco Resources, Inc. (the “Company”) was incorporated in Nevada on June 21, 2007. The Company was engaged in the exploration stage from its June 21, 2007 (inception) to May 27, 2010. In May 2010, it shifted it focus to developing, producing, and providing clean, renewable energy solutions in Central America. On October 16, 2012, the Company added an additional line of business, Level 5 Beverage Company, Inc., a progressive specialty beverage retailer which is now its primary focus. The Company has decided to divest of itself of its clean, renewable energy projects in Central America. The Company has evaluated its clean energy projects in Central America and has determined they are too capital intensive to pursue at this time.

The Company has transitioned its focus to its specialty beverage market retailer, Level 5 Beverage Company, Inc. and its products.

These financial statements have been prepared on a going concern basis, which implies the Company will continue to realize it assets and discharge its liabilities in the normal course of business. During the three month period ended October 31, 2014, the Company has an accumulated deficit and minimal revenue. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, the ability of the Company to obtain necessary equity financing to continue operations, and the attainment of profitable operations. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern. These financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

The Company intends to fund operations through equity and debt financing arrangements, which may be insufficient to fund its capital expenditures, working capital and other cash requirements for the year ending July 31, 2015.

3. Accounting Policies

Revenue recognition – The Company recognizes revenue when persuasive evidence exists, services have been rendered, the sales price is fixed or determinable, and collectability is reasonable assured. This typically occurs when the product is shipped for our manufacturing business and when it is delivered for our distribution business.

Inventories - Inventories consist primarily of raw materials and packaging (which includes ingredients and supplies) and finished goods. Inventories are valued at the lower of cost or market. We determine cost on the basis of first-in, first-out methods.

Goodwill and Other Intangible Assets - We classify intangible assets into three categories: (1) intangible assets with definite lives subject to amortization, (2) intangible assets with indefinite lives not subject to amortization and (3) goodwill. We determine the useful lives of our identifiable intangible assets after considering the specific facts and circumstances related to each intangible asset. Factors we consider when determining useful lives include the contractual term of any agreement related to the asset, the historical performance of the asset, the Company's long-term strategy for using the asset, any laws or other local regulations which could impact the useful life of the asset, and other economic factors, including competition and specific market conditions. Intangible assets that are deemed to have definite lives are amortized, primarily on a straight-line basis, over their useful lives, generally ranging from 1 to 20 years. Refer to Note 4.

When facts and circumstances indicate that the carrying value of definite-lived intangible assets may not be recoverable, management assesses the recoverability of the carrying value by preparing estimates of sales volume and the resulting gross profit and cash flows. These estimated future cash flows are consistent with those we use in our internal planning. If the sum of the expected future cash flows (undiscounted and without interest charges) is less than the carrying amount, we recognize an impairment loss. The impairment loss recognized is the amount by which the carrying amount of the asset (or asset group) exceeds the fair value. We use a variety of methodologies to determine the fair value of these assets, including discounted cash flow models, which are consistent with the assumptions we believe hypothetical marketplace participants would use.

We test intangible assets determined to have indefinite useful lives, including trademarks, franchise rights and goodwill, for impairment annually, or more frequently if events or circumstances indicate that assets might be impaired. Our Company performs these annual impairment reviews as of the first day of our third fiscal quarter. We use a variety of methodologies in conducting impairment assessments of indefinite-lived intangible assets, including, but not limited to, discounted cash flow models, which are based on the assumptions we believe hypothetical marketplace participants would use. For indefinite-lived intangible assets, other than goodwill, if the carrying amount exceeds the fair value, an impairment charge is recognized in an amount equal to that excess.

The Company has the option to perform a qualitative assessment of indefinite-lived intangible assets, other than goodwill, prior to completing the impairment test described above. The Company must assess whether it is more likely than not that the fair value of the intangible asset is less than its carrying amount. If the Company concludes that this is the case, it must perform the testing described above. Otherwise, the Company does not need to perform any further assessment.

The goodwill impairment test consists of a two-step process, if necessary. The first step is to compare the fair value of a reporting unit to its carrying value, including goodwill. We typically use discounted cash flow models to determine the fair value of a reporting unit. The assumptions used in these models are consistent with those we believe hypothetical marketplace participants would use. If the fair value of the reporting unit is less than its carrying value, the second step of the impairment test must be performed in order to determine the amount of impairment loss, if any. The second step compares the implied fair value of the reporting unit's goodwill with the carrying amount of that goodwill. If the carrying amount of the reporting unit's goodwill exceeds its implied fair value, an impairment charge is recognized in an amount equal to that excess. The loss recognized cannot exceed the carrying amount of goodwill.

The Company has the option to perform a qualitative assessment of goodwill prior to completing the two-step process described above to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount, including goodwill and other intangible assets. If the Company concludes that this is the case, it must perform the two-step process. Otherwise, the Company will forego the two-step process and does not need to perform any further testing.

Impairment charges related to intangible assets are generally recorded in the line item other operating charges or, to the extent they relate to equity method investees, in the line item equity income (loss) — net in our consolidated statements of income.

4. Intangible Assets

Intangible Assets, net, at October 31, 2014 and July 31, 2014 consists of:

| |

|

October 31, 2014

(Successor)

|

|

|

July 31, 2014

(Predecessor)

|

|

| |

|

|

|

|

|

|

|

VitaminFIZZ Name Licensing Rights

|

|

$

|

30,000

|

|

|

|

-

|

|

|

Vitamin Creamer

|

|

|

75,000

|

|

|

|

-

|

|

|

Accumulated Amortization

|

|

$

|

(1,752)

|

|

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

|

Intangible Assets, net

|

|

$

|

103,248

|

|

|

|

-

|

|

On February 26, 2013, the Company entered into an Agreement (the “Premium Product Development Agreement”) with Power Brands, LLC, a California Limited Liability Company (“Power Brands”) to render product development services for Level 5 Beverage Company, Inc. (“Level 5”). On February 26, 2013, the Company entered into an Agreement (the “Prototype Development Agreement”) with Power Brands to render prototype development services for Level 5. On November 21, 2013, through its subsidiary, Level 5 Beverage Company, Inc., the Company entered into an Agreement with VITAMINFIZZ, L.P, a California Limited Partnership where the Company acquired the exclusive rights in North America to use VitaminFIZZ® on and in connection with the marketing, distribution and sale of the Brand. On June 24, 2014, Level 5 Beverage Company, Inc., a subsidiary of Minerco Resources, Inc. entered into an Agreement, effective June 20, 2014, with Vitamin Creamer LP, a limited partnership, where, among other things, Level 5 bought all right, title and interest to the (i) the Trademark “Vitamin Creamer”, and (ii) formulas and certain other intellectual property rights related to the Brand and the Products. The Company amortization expense of $1,752 and $0 during the three months ended October 31, 2014 and 2013 respectively. The VitaminFIZZ Name Licensing Rights are being amortized over the remainder of the initial term of the 5 year licensing agreement. Vitamin Creamer was determined to have an indefinite useful life.

Minerco Resources, Inc.

Consolidated Notes to the Financial Statements

(unaudited)

5. Property and Equipment, Net

Equipment, net, at October 31, 2014 and July 31, 2014 consists of:

| |

Useful Life

|

|

October 31, 2014

(Successor)

|

|

|

July 31, 2014

(Predecessor)

|

|

| |

|

|

|

|

|

|

|

|

Furniture and Fixtures

|

5 years

|

|

$

|

6,297

|

|

|

|

-

|

|

|

Computer and Equipment

|

3 years

|

|

|

2,413

|

|

|

|

-

|

|

|

Leasehold Improvements

|

Remaining life of lease

|

|

|

830

|

|

|

|

-

|

|

|

Capital Leases

|

Term of lease

|

|

|

266,017

|

|

|

|

266,017

|

|

|

Accumulated Depreciation

|

|

|

|

(129,800

|

) |

|

|

(118,215

|

) |

| |

|

|

|

|

|

|

|

|

|

|

Property and Equipment, net

|

|

|

$

|

145,757

|

|

|

|

147,802

|

|

Depreciation expense was $0, $11,021 and $11,021 for the period October 25, to October 31, 2014, for the period August 1 to October 24, 2014 and for the three months ended October 31, 2013 respectively.

6. Inventory

Inventory, at October 31 and July 31,, 2014 consists of:

| |

|

October 31, 2014

(Successor)

|

|

|

July 31, 2014 (Predecessor)

|

|

| |

|

|

|

|

|

|

|

Raw Materials

|

|

$ |

175,674 |

|

|

|

- |

|

|

Work in progress

|

|

|

- |

|

|

|

- |

|

|

Finished Goods

|

|

|

268,378 |

|

|

|

333,236 |

|

|

Inventory, net

|

|

$ |

444,052 |

|

|

|

333,326 |

|

7. Prepaid Expenses

Prepaid Expenses, Current at October 31 and July 31, 2014 consists of:

| |

|

October 31, 2014 (Successor)

|

|

|

July 31, 2014 (Predecessor)

|

|

| |

|

|

|

|

|

|

|

Prepaid Product Marketing

|

|

$

|

164,113

|

|

|

|

-

|

|

|

Prepaid Rent

|

|

|

2,021

|

|

|

|

5,040

|

|

|

Prepaid Other

|

|

|

24,803

|

|

|

|

19,762

|

|

|

Prepaid Expenses

|

|

$

|

190,937

|

|

|

|

24,802

|

|

On the June 25, 2014, the Company through its subsidiary, Level 5 Beverage Company, Inc. (“Level 5”), entered into a Brand Licensing Agreement with VitaminFizz, LP (“Licensor”) which was effective November 21, 2013. Level 5 agreed to pay a licensing fee of $250,000 and no royalties shall be made to Licensor until such time as the aggregate royalty payments earned by Licensor exceed $250,000. The $250,000 has been classified as Prepaid Expenses, Noncurrent on the balance sheet.

8. Avanzar Acquisition

On October 24, 2014, through its subsidiary, Level 5 Beverage Company, Inc.(the “Purchaser”) (“Level 5”), the Company entered into an Agreement (the “Membership Interest Purchase Agreement”) with Avanzar Sales and Distribution, LLC (“Company”), a California Limited Liability Company (“Avanzar”) to acquire an initial thirty percent (30%) equity position and fifty-one percent (51%) voting interest for the Purchase Price of $500,000 with an option to acquire an additional twenty-one percent (21%) interest and Second Option to acquire up to seventy-five percent (75%) of Avanzar. The acquisition broadens our base in the beverage industry through vertical integration. The acquisition was accounted for in accordance with ASC 805, Business Combinations.

|

Purchase Price.

(a) The consideration payable by the Purchaser to Avanzar for the Initial Membership Interests acquired on the Initial Closing Date was Five Hundred Thousand Dollars ($500,000), of which One Hundred Fifty Thousand Dollars ($150,000) was paid in three equal payments of $50,000 on each of September 18, 2014, October 2, 2014 and October 21, 2014 and the remaining Three Hundred Fifty Thousand Dollars ($350,000) shall be payable as follows: (i) a cash payment of One Hundred Fifty Thousand Dollars ($150,000) paid on October 27, 2014; and (ii) a note in the principal aggregate amount of Two Hundred Thousand Dollars ($200,000) which provides that it is payable in four equal installments of Fifty Thousand Dollars ($50,000) each, with one installment to be paid on each of the following dates: 30 days, 60 days, 90 days and 120 days following October 24, 2014. The first installment of $50,000 was paid on November 25, 2014.

|

|

(b) The consideration payable by the Purchaser to Avanzar for the Option to acquire twenty-one percent (21%) of the Membership Interests to be acquired upon exercise of the Option shall be an aggregate amount of Four Hundred Thousand Dollars ($400,000) which shall be payable within five days of Company’s receipt of a notice from Purchaser of its exercise of the Option, if Purchaser exercises the Option.

(c) The consideration payable by the Purchaser to Avanzar for the Second Option Membership Interests to be acquired upon exercise of the Second Option (the “Second Option Purchase Price”) is equal to the greater of (i) an amount equal to three times the EBIT (earnings before interest and taxes) of Avanzar for the prior fiscal year; or (ii) One Million Seven Hundred Fifty Thousand Dollars ($1,750,000).

Avanzar Purchase Price Allocation

| |

|

October 24, 2014

|

|

| |

|

|

|

|

Purchase Price paid in Cash

|

|

$

|

300,000

|

|

| Payable to Avanzar |

|

|

200,000 |

|

|

Noncontrolling interest

|

|

|

530,006

|

|

|

Fair value of net assets (liabilities) acquired

|

|

|

(757,151)

|

|

|

Goodwill resulting from acquisition

|

|

$

|

727,145

|

|

Avanzar Condensed Statement of Net Assets Acquired

| |

|

October 24, 2014

|

| |

|

|

|

Cash

|

|

$ |

950 |

|

|

Inventory

|

|

|

235,826 |

|

|

Prepaids

|

|

|

24,802 |

|

|

Investments

|

|

|

36,231 |

|

|

Capital Leases

|

|

|

136,781 |

|

|

Account Receivables

|

|

|

619,415 |

|

|

Total Assets

|

|

|

1,054,005 |

|

|

AP & Accrued Liabilities

|

|

|

(1,485,183 |

) |

|

Line of Credit

|

|

|

(102,723 |

) |

|

Notes Payable

|

|

|

(153,458 |

) |

|

Capital Lease Obligations

|

|

|

(69,792 |

) |

|

Total Liabilities

|

|

|

(1,811,156 |

) |

| |

|

|

|

|

|

Fair value of net assets acquired

|

|

|

(757,151 |

) |

The following unaudited pro forma information presents a summary of Minerco’s Condensed Consolidated Statement of Operations for the respective periods, as if the acquisition and related financing of Avanzar occurred on August 1, 2013:

| |

Three months ended October 31, 2014

|

|

Three months ended October 31, 2013

|

|

|

| |

|

|

|

|

|

|

Revenues

|

$

|

503,427

|

|

635,793

|

|

|

|

Loss from Operations

|

|

(153,252

|

) |

(160,815

|

) |

|

|

Net loss

|

|

(171,354

|

) |

(166,219

|

) |

|

9. Investments

The Company owns equity securities through its subsidiary Avanzar which were received for services performed which it accounts for as available-for-sale securities. As of October 31, 2014, securities amounted to $23,250. Unrealized loss for the period October 25, 2014 to October 31, 2014 was $2,981. Additionally, we owned a 50% equity stake in a brand purchased for $10,000 in 2011 through our subsidiary Avanzar. The investment was accounted for as a cost method investment. The brand has not yet been released commercially and as of October 31, 2014, it is valued at $10,000.

10. Fair Value of Financial Instruments

ASC 820, “Fair Value Measurements”, requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. ASC 820 establishes a fair value hierarchy based on the level of independent, objective evidence surrounding the inputs used to measure fair value. A financial instrument’s categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. ASC 820 prioritizes the inputs into three levels that may be used to measure fair value:

Level 1 applies to assets or liabilities for which there are quoted prices in active markets for identical assets or liabilities.

Level 2 applies to assets or liabilities for which there are inputs other than quoted prices that are observable for the asset or liability such as quoted prices for similar assets or liabilities in active markets; quoted prices for identical assets or liabilities in markets with insufficient volume or infrequent transactions (less active markets); or model-derived valuations in which significant inputs are observable or can be derived principally from, or corroborated by, observable market data.

Level 3 applies to assets or liabilities for which there are unobservable inputs to the valuation methodology that are significant to the measurement of the fair value of the assets or liabilities.

The Company’s financial instruments consist principally of cash, accounts payable and accrued liabilities, and due to related party. Pursuant to ASC 820, the fair value of our cash equivalents is determined based on “Level 1” inputs, which consist of quoted prices in active markets for identical assets. The Company believes that the recorded values of all of the other financial instruments approximate their current fair values because of their nature and respective maturity dates or durations.

The following table sets forth by level with the fair value hierarchy the Company’s financial assets and liabilities measured at fair value on October 31, 2014.

| |

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Total

|

|

|

Assets

|

|

$

|

23,250

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Derivative Financial Instruments

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

1,142,203

|

|

|

$

|

1,142,203

|

|

The following table sets forth by level with the fair value hierarchy the Company’s financial assets and liabilities measured at fair value on July 31, 2014 for the Company pre-acquisition of Avanzar.

| |

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Total

|

|

|

Assets- None

|

|

$

|

23,250

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

23,250

|

|

|

Liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Derivative Financial Instruments

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

0

|

|

11. Convertible note payable and derivative liabilities

Prior the acquisition date and during the period August 1, 2014 to October 24, 2014, Minerco had received proceeds of $250,000 from a convertible promissory note. The note carries an interest rate of 8%. The note is convertible at a variable conversion price of 50% of the market price and shall be calculated using the lowest trading days during the preceding 20 days before conversion. Minerco also had $159,250 in convertible promissory notes in remaning outstanding balances as of October 24, 2014. These notes carry interest rates between 0% and 8% and are convertible at a variable conversion price of a fixed price of $0.00025 or 50% of the market price and shall be calculated using the lowest trading days during the preceding 5 to 20 days before conversion. The total principal due at October 24, 2014 and October 31, 2014 is $409,250 with an unamortized discount of $296,219 resulting in a balance of $113,031.

Avanzar does not have any derivative liabilities as of October 31, 2014 or July 31, 2014.

Due to their being no explicit limit to the number of shares to be delivered upon settlement of the above conversion options embedded in the Convertible Promissory Notes, the options are classified as derivative liabilities and recorded at fair value.

Derivative Liability:

The fair values of the convertible notes were determined to be $1,142,203 using a Black-Scholes option-pricing model. Upon the issuance dates of the Convertible Promissory Notes, $250,000 was recorded as debt discount and $235,037 was recorded as day one loss on derivative liability. During the three months ended October 31, 2014 and 2013, the Company recorded a loss on mark-to-market of the conversion options of $2,397,596 and $2,153,244, respectively. As of October 31, 2014 and July 31, 2014, the aggregate unamortized discount is $296,219 and $121,149, respectively.

The following table summarizes the derivative liabilities included in the consolidated balance sheet at October 31, 2014:

| |

|

|

|

|

|

Balance at July 31, 2014 (pre-merger)

|

|

|

650,135

|

|

|

Debt discount

|

|

|

250,000

|

|

|

Day one loss on fair value

|

|

|

235,037

|

|

|

Loss on change in fair value

|

|

|

2,397,596

|

|

|

Write off due to conversion

|

|

|

(2,390,565

|

)

|

|

Balance at October 24, 2014 (pre-merger)

|

|

$

|

1,142,203

|

|

| Balance at October 31, 2014 (Successor) |

|

|

1,142,203 |

|

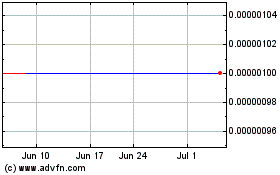

Pursuant to ASC 815, “Derivatives and Hedging,” the Company recognized the fair value of the embedded conversion feature of all the notes of $1,142,203. The initial fair value of the derivative liability was determined using the Black Scholes option pricing model with a quoted market price of $0.0045 to $0.012, a conversion price of $0.00025 to $0.0018, expected volatility of 27% to 246%, no expected dividends, an expected term of one year and a risk-free interest rate of 0.01% to 0.10%. The discount on the convertible loan is accreted over the term of the convertible loan. During the period October 25, 2014 to ended October 31, 2014, the Company recorded accretion of $0.

12. Debt

Prior to the Acquisition date of October 24, 2014, Minerco had outstanding balances of $1,350,000 on its line of credit and $25,000 in notes payable under Level 5. Both of these are described below.

Minerco Line of Credit

On May 1, 2014, Minerco Resources, Inc. (“we” or the “Company”) entered into an Agreement (the “Line of Credit”) with Post Oak, LLC (the “Lender”), where, among other things, the Company and Lender entered into a Line of Credit Financing Agreement in the principal sum of up to Two Million Dollars ($2,000,000.00), or such lesser amount as may be borrowed by the Company as Advances under this line of credit (the “Line of Credit”). As of October 24 and 31, 2014, the Company had $1,350,000 outstanding under the line of credit respectively.

The summary of the Line of Credit is as:

This Line of Credit bears interest at the rate of ten percent (10.00%) per annum.

The entire outstanding principal amount of this Line of Credit is due and payable on April 30, 2016 (the “Maturity Date”).

Advances. Subject to the provisions of Section 2 below, the Company has the right, at any time or from time to time prior to the Maturity Date to request loans and advances from the Lender (individually an “Advance” and collectively, the “Advances”). Each such Advance is to be considered a legal promissory note, is to be in the amount of $250,000, and is to be reflected on Schedule A to this Line of Credit and initialed as received by an officer or director of the Company. The Lender is not be under any obligation to make advances under this Line of Credit.

Use of Proceeds. All proceeds received by the Company from each Advance made by the Lender under this Line of Credit are to be used by the Company for expenses incurred by the Company in connection with working capital and any other operating expenses determined to be necessary by the Company.

Interest Payments, Balloon Payment. Company pays interest at the rate of ten percent (10.00%) per annum, calculated on a per day basis for each Advance made by Lender, and Company is obligated to make one interest payment in twelve (12) months and one interest payment in eighteen (18) months. Company is obligated to make a payment for the entire unpaid balance of all Advances, plus any accrued unpaid interest, as per a “balloon” payment, in two (2) years from the date of the Line of Credit.

Security. As security for the Line of Credit, immediately upon the first Advance made by Lender to Company, Company is obligated to cause and/or direct Preferred Class “C” Shares of Minerco Resources, Inc. (“MINE”) to be issued to Lender. The amount of shares shall be sufficient to provide adequate security to the Lender for any Advances made to Company, and is to be reasonably determined by the parties at a later date. Company agreed to contact its transfer agent Worldwide Stock Transfer to initiate this issuance, with all proper corporate approvals. The Company has not yet created a Preferred Class C Shares.

Level 5 Notes Payable

During the year ended July 31, 2014, Level 5 received proceeds of $50,000 from promissory notes. These notes have an interest rate of 10% and mature between July 6, 2014 and July 24, 2014. The total principal due as of October 24 and 31, 2014 is $25,000 respectively.

Avanzar Notes Payable

Avanzar has received proceeds from various unrelated third parties and these notes have an interest rate of between 8% and 12% and mature between February 28, 2015 and December 31, 2015. The total principal due as of October 31, 2014 is $153,458. A schedule of the notes payable are below:

|

Principal at 7/31/2014

|

|

Principal at 10/31/2014

|

|

Interest Rate

|

|

Maturity

|

| $ |

20,000 |

|

$ |

20,000 |

|

8 |

% |

February 28, 2015

|

| $ |

20,000 |

|

$ |

20,000 |

|

8 |

% |

February 28, 2015

|

| $ |

10,000 |

|

$ |

10,000 |

|

8 |

% |

February 28, 2015

|

| $ |

20,000 |

|

$ |

20,000 |

|

8 |

% |

February 28, 2015

|

| $ |

49,970 |

|

$ |

49,970 |

|

12 |

% |

August 31, 2015

|

| $ |

10,000 |

|

$ |

10,000 |

|

Non-interest bearing

|

|

On Demand

|

| $ |

20,000 |

|

$ |

20,000 |

|

8 |

% |

December 31, 2015

|

| $ |

10,988 |

|

$ |

3,488 |

|

Non-interest bearing

|

|

On Deomand

|

| $ |

20,000 |

|

$ |

0 |

|

8 |

% |

February 28, 2015

|

The holders of the non-on demand notes above with maturity dates have the right to convert the unpaid principal at maturity into conversion units at the rate of one dollar and no cents. If the holders convert, these conversions do not impact the equity ownership of the Company, they will come out of the pre-existing members’ equity ownership.

Avanzar Line of Credit

On May 27, 2014, Avanzar signed a line of credit with BFS West Capital for a principal amount of $168,000 payable over 15 months. As of October 31, 2014, $100,057 is outstanding.

13. Common Stock

Prior to the Acquisition date of October 24, 2014, Minerco had issued the below shares during the period August 1, 2014 to October 24, 2014.

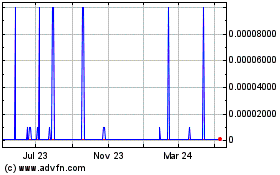

During the period August 1, 2014 to October 25, 2014, the Company issued 318,359,495 common shares for the conversion of $124,428 convertible promissory notes. These notes converted at conversion rates between $0.00025 and $0.0026.

On August 8, 2014, the Company issued 250,000 common shares for consulting services. The shares vested immediately. The fair value of these shares was determined to be $2,850 and was expensed as stock compensation.

On September 3, 2014, the Company issued 10,000,000 common shares for consulting services. The shares vested immediately. The fair value of these shares was determined to be $82,000 and was expensed as stock compensation.

On September 4, 2014, the Company issued 12,000,000 common shares for consulting services. The shares vested immediately. The fair value of these shares was determined to be $94,800 and was expensed as stock compensation.

On September 4, 2014, the Company issued 8,000,000 common shares for consulting services. The shares vested immediately. The fair value of these shares was determined to be $63,200 and was expensed as stock compensation.

On September 8, 2014, the Company issued 250,000 common shares for consulting services. The shares vested immediately. The fair value of these shares was determined to be $1,725 and was expensed as stock compensation.

On September 16, 2014, the Company issued 1,000,000 common shares under the Key Employee and Distributor Incentive Plan in two (2) transactions. The shares vested immediately. The fair value of these shares was determined to be $6,700 and was expensed as stock compensation.

On October 8, 2014, the Company issued 250,000 common shares for consulting services. The shares vested immediately. The fair value of these shares was determined to be $1,625 and was expensed as stock compensation.

During the period October 25, to October 31, 2014, the Company issued, 35,237,980 common shares for the conversion of $32,357 convertible promissory notes. These notes converted at conversion rates between $0.00025 and $0.00255.

14. Preferred Stock

The preferred stock may be divided into and issued in series. The Board of Directors of the Company is authorized to divide the authorized shares of preferred stock into one or more series, each of which shall be so designated as to distinguish the shares thereof from the shares of all other series and classes.

On January 11, 2011, the Company effected 25,000,000 shares of unclassified preferred stock.

On January 11, 2011, the Company designated 15,000,000 shares of its preferred stock as Class A Convertible Preferred Stock (“Class A Stock”). Each share of Class A Stock is convertible into 10 shares of common stock, has 100 votes, has no dividend rights except as may be declared by the Board of Directors, and has a liquidation preference of $1.00 per share.

Dividends

The Series B Shares accrue dividends at the rate per annum equal to 8% of the Stated Value which initially is ten dollars per share payable in cash; provided that after an initial public offering of the Company’s common stock the dividends may be paid at the option of the Company in cash or additional shares of common stock.

Conversion

Each Series B Share (together with any accrued but unpaid dividends thereon) is convertible into shares of Common Stock at the option of the holder at any time at a conversion price per share equal to the sum of the Stated Value a divided by the Conversion Price, subject to adjustment as described below. The initial Conversion Price shall be equal to .02. The Series B Shares automatically convert to common stock immediately prior to the closing of a firmly underwritten public offering for gross offering proceeds of at least $10,000,000 or upon the consent of two-thirds of the holders of Series B Shares.

Redemption

The Company has the right to redeem the Series B Shares at any time at a price per share equal to the Stated Value multiplied by 125%.

Liquidation

In the event of a liquidation, dissolution or winding up of the Company and other Liquidation Events as defined in the Certificate of Designations, holders of Series B Shares are entitled to receive from proceeds remaining after distribution to the Company’s creditors and prior to the distribution to holders of Common Stock but junior to the Series A Preferred Stock the (x) Stated Value (as adjusted for any stock splits, stock dividends, reorganizations, recapitalizations and the like) held by such holder and (y) all accrued but unpaid dividends on such shares.

Anti-Dilution

The Series B Shares are entitled to weighted average anti-dilution protection under certain circumstances specified in the Certificate of Designations.

Voting

Except as otherwise required by law and except as set forth below, holders of Series B Shares will, on an as-converted basis, vote together with the Common Stock as a single class. Each holder of Series B Shares is entitled to cast the number of votes equal to five times the number of shares of Common Stock into which such shares of Series B Shares could be converted at the record date for determining stockholders entitled to vote at the meeting.

On September 10, 2014, the Company issued 500,000 Class B convertible preferred shares to its Chief Executive Officer valued at $0.0062 or $1,550,000. The Company recognized this as compensation and will amortize this over the duration of the employment agreement which ends on July 31, 2019.

On September 10, 2014, the Company issued 500,000 Class B convertible preferred shares to its Chief Financial Officer valued at $0.0062 or $1,550,000. The Company recognized this as compensation and will amortize this over the duration of the employment agreement which ends on July 31, 2019.

During the period October 25, 2014 to October 31, 2014, the Company had $15,122 in preferred dividends.

Minerco Resources, Inc.

Consolidated Notes to the Financial Statements

(unaudited)

15. Related Parties

As of October 31, 2014, the Company owes its current Chief Executive Officer $70,161 ($13,911 – pre-merger July 31, 2014) in accrued salary ($18,750 per month) and $100,044 ($3,178 – pre-merger July 31, 2014) for advances made to the Company. The company owes its current Chief Financial Officer $10,000 ($2,500 – pre-merger July 31, 2014) in accrued salary ($12,500 per month. The company owes its former Chief Executive Officer $0. The advances are due on demand and non interest bearing. Avanzar has no monies owed related parties as of October 31, 2014 or July 31, 2014.

Minerco Resources, Inc.

Consolidated Notes to the Financial Statements

(unaudited)

16. Commitments

Capital Leases

We have a capital leases for property and equipment through our subsidiary Avanzar. At October 31, 2014, total future minimum payments on our capital lease were as follows:

|

2015

|

|

$

|

45,954

|

|

|

2016

|

|

|

22,081

|

|

|

2017

|

|

|

1,757

|

|

|

Total

|

|

$

|

69,792

|

|

Operating Leases

We have an operating lease for Arizona office. At October 31, 2014, total future minimum payments on our operating lease were as follows:

|

2015

|

|

$

|

9,194

|

|

|

2016

|

|

|

1,022

|

|

|

Total

|

|

$

|

10,216

|

|

Brand Licensing Agreements

VITAMINFIZZ ®

On November 21, 2013, through its subsidiary, Level 5 (“Level 5”), the Company entered into an Agreement with VITAMINFIZZ, L.P (“Licensor”), a California Limited Partnership where Level 5acquires the exclusive rights in North America to use VitaminFIZZ® on and in connection with the marketing, distribution and sale of the Brand. Level 5 agreed to pay a licensing fee of $250,000 and no royalties shall be made to Licensor until such time as the aggregate royalty payments earned by Licensor exceed $250,000. Licensor retained a 49% equity interest in all net revenue. A milestone payment of $1,000,000 is due to Licensor when net sales exceed $25,000,000.

VITAMIN CREAMER ®

On June 24, 2014, Level 5 Beverage Company, Inc. (“Buyer”), a subsidiary of Minerco Resources, Inc. entered into an Agreement, effective June 20, 2014, with Vitamin Creamer LP (“Seller”), a limited partnership, where, among other things, Level 5 bought all right, title and interest to the (i) the Trademark “Vitamin Creamer”, and (ii) formulas and certain other intellectual property rights related to the Brand and the Products. The purchase price is $100,000 of which $50,000 was paid during 2014 and $50,000 is due within 24 months after closing. Seller retained a 5% equity interest in all net profits.

Employment Agreements

On September 10, 2014, the Company entered into an exclusive employment agreement with V. Scott Vanis to serve as our Chief Executive Officer, President and Secretary.

The agreement is for a term of five years and one month beginning retroactively on July 9, 2014 and ending July 31, 2019. An Extension to the Term must be agreed upon in writing and executed by the Company and Mr. Vanis no later than 5 p.m. Eastern Standard Time on July 31, 2019.

Mr. Vanis will be paid a salary of $225,000 per annum beginning on July 9, 2014. If revenues exceed $25 million, then Mr. Vanis’ salary will be increased to $450,000 per annum. If revenues exceed $50 million, then Mr. Vanis’ salary will be increased to $675,000 per annum.

Mr. Vanis was issued 500,000 shares of Series B Preferred stock, upon the effective date of the agreement.

If Mr. Vanis voluntarily terminates his employment with the Company or if a petition for Chapter 7 bankruptcy is filed by the Company resulting in an adjudication of bankruptcy within 12 months of the date of the agreement, all shares granted will be cancelled. If Mr. Vanis voluntarily terminates his employment with the Company or if a petition for Chapter 7 bankruptcy is filed by the Company resulting in an adjudication of bankruptcy after twelve months and before 24 months of the date of the agreement, Four Hundred Thousand (400,000) shares granted to him will be returned.

If Mr. Vanis voluntarily terminates his employment with the Company or if a petition for Chapter 7 bankruptcy is filed by the Company resulting in an adjudication of bankruptcy after twenty four months and before 36 months of the date of the agreement, Three Hundred Thousand (300,000) s shares granted to him will be returned.

If Mr. Vanis voluntarily terminates his employment with the Company or if a petition for Chapter 7 bankruptcy is filed by the Company resulting in an adjudication of bankruptcy after thirty six months and before 48 months of the date of the agreement, Two Hundred Thousand (200,000) shares granted to him will be returned.

If there is a sale of all or substantially all of the assets or a merger in which the Company is not the surviving entity, Mr. Vanis will be entitled to receive an additional amount of shares of common stock in the Company which would equal Five percent (5%) of the final value of the transaction.

Further, Mr. Vanis will be entitled to such additional bonus, if any, as may be granted by the Board (with Mr. Vanis abstaining from any vote thereon) or compensation or similar committee thereof in the Board's (or such committee's) sole discretion based upon Employee's performance of his Services under the Agreement.

On September 10, 2014, the Company entered into an exclusive employment agreement with Sam J Messina III to serve as our Chief Financial Officer, and Treasurer.

The agreement is for a term of five years and one month beginning retroactively on July 1, 2014 and ending July 31, 2019. An Extension to the Term must be agreed upon in writing and executed by the Company and Mr. Messina no later than 5 p.m. Eastern Standard Time on July 31, 2019.

Mr. Messina will be paid a salary of $150,000 per annum beginning on July 1, 2014. If revenues exceed $25 million, then Mr. Messina’s salary will be increased to $300,000 per annum. If revenues exceed $50 million, then Mr. Messina’s salary will be increased to $450,000 per annum.

Mr. Messina was issued 500,000 shares of Series B Preferred stock, upon the effective date of the agreement.

If Mr. Messina voluntarily terminates his employment with the Company or if a petition for Chapter 7 bankruptcy is filed by the Company resulting in an adjudication of bankruptcy within 12 months of the date of the agreement, all shares granted will be cancelled. If Mr. Messina voluntarily terminates his employment with the Company or if a petition for Chapter 7 bankruptcy is filed by the Company resulting in an adjudication of bankruptcy after twelve months and before 24 months of the date of the agreement, Four Hundred Thousand (400,000) shares granted to him will be returned.

If Mr. Messina voluntarily terminates his employment with the Company or if a petition for Chapter 7 bankruptcy is filed by the Company resulting in an adjudication of bankruptcy after twenty four months and before 36 months of the date of the agreement, Three Hundred Thousand (300,000) s shares granted to him will be returned.

If Mr. Messina voluntarily terminates his employment with the Company or if a petition for Chapter 7 bankruptcy is filed by the Company resulting in an adjudication of bankruptcy after thirty six months and before 48 months of the date of the agreement, Two Hundred Thousand (200,000) shares granted to him will be returned.

If there is a sale of all or substantially all of the assets or a merger in which the Company is not the surviving entity, Mr. Messina will be entitled to receive an additional amount of shares of common stock in the Company which would equal Three percent (3%) of the final value of the transaction.

Further, Mr. Messina will be entitled to such additional bonus, if any, as may be granted by the Board (with Mr. Messina abstaining from any vote thereon) or compensation or similar committee thereof in the Board's (or such committee's) sole discretion based upon Employee's performance of his Services under the Agreement.

17. Noncontolling Interest

The Company owns 70.3% of its subsidiary Level 5 Beverage Company, Inc (“Level 5”). The remaining 29.7% is owned by unrelated third parties. Level 5 owns 30% equity interest and 51% voting control of Avanzar Sales and Distrubtion, LLC. The net loss attributable to noncontrolling interest for the period October 25, 2014 to October 31, 2014 was $14,287.

18. Subsequent Events

|

a)

|

On November 3, 2014, the Company through its subsidiary, Level 5 Beverage Company, Inc., entered into an Agreement with JD’s Food Group, Ltd., a company incorporated in the United Kingdom to exclusively distribute our VitaminFIZZ ® brand of enhanced sparking water in the Territory of the United Kingdom.

|

|

b)

|

On November 4, 2014, the Company issued 9,730,487 common shares for the conversion of $20,000 pursuant to a convertible promissory note dated March 31, 2014.

|

|

c)

|

On November 8, 2014, the Company issued 250,000 common shares pursuant to a consulting agreement.

|

|

d)

|

On November 17, 2014, the Company issued 15,529,173 common shares for the conversion of $20,000 pursuant to a convertible promissory note dated March 31, 2014.

|

|

e)

|

On November 19, 2014, the Company issued 35,000,000 common shares for the conversion of $8,750 pursuant to a convertible promissory note dated July 23, 2012.

|

|

f)

|

On November 24, 2014, the Company issued 18,273,486 common shares for the conversion of $20,000 pursuant to a convertible promissory note dated March 31, 2014.

|

|

g)

|

On December 1, 2014, the Company issued 25,000,000 common shares for the conversion of $6,250 pursuant to a convertible promissory note dated July 23, 2012.

|

|

h)

|

On December 2, 2014, the Company issued 34,500,000 common shares for the conversion of $8,625 pursuant to a convertible promissory note dated July 23, 2012.

|

|

i)

|

On December 4, 2014, the Company issued 19,492,643 common shares for the conversion of $20,000 pursuant to a convertible promissory note dated March 31, 2014.

|

|

j)

|

On December 8, 2014, the Company issued 250,000 common shares pursuant to a consulting agreement.

|

|

k)

|

On December 12, 2014, the Company issued 34,500,000 common shares for the conversion of $8,625 pursuant to a convertible promissory note dated July 23, 2012.

|

|

l)

|