Amended Statement of Changes in Beneficial Ownership (4/a)

December 22 2014 - 6:03AM

Edgar (US Regulatory)

|

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue.

See

Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Cognate Bioservices, Inc.

|

2. Issuer Name

and

Ticker or Trading Symbol

NORTHWEST BIOTHERAPEUTICS INC

[

NWBO

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director

__

X

__ 10% Owner

_____ Officer (give title below)

_____ Other (specify below)

|

|

(Last)

(First)

(Middle)

7513 CONNELLEY DRIVE

|

3. Date of Earliest Transaction

(MM/DD/YYYY)

12/1/2013

|

|

(Street)

HANOVER, MD 21076

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

12/19/2014

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

___ Form filed by One Reporting Person

_

X

_ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

|

Common stock, par value $0.001 per share ("Common Stock")

(1)

(3)

|

12/1/2013

|

|

P

|

|

277199

|

A

|

(3)

|

10043749

|

D

|

|

|

Common Stock

(4)

|

12/31/2013

|

|

J

|

|

1330057

|

A

|

(4)

|

11373806

|

D

|

|

|

Common Stock

(5)

|

1/1/2014

|

|

P

|

|

238248

|

A

|

(5)

|

11612054

|

D

(2)

|

|

|

Common Stock

(6)

|

1/17/2014

|

|

P

|

|

5101366

|

A

|

(6)

|

16713420

|

D

|

|

|

Common Stock

(7)

|

1/31/2014

|

|

S

|

|

233344

|

D

|

$3.21

|

16480076

|

D

|

|

|

Common Stock

(8)

|

2/1/2014

|

|

P

|

|

500000

|

A

|

(8)

|

16980076

|

D

|

|

|

Common Stock

(9)

|

2/1/2014

|

|

P

|

|

287055

|

A

|

(9)

|

17267131

|

D

|

|

|

Common Stock

(7)

|

2/4/2014

|

|

S

|

|

233344

|

D

|

$3.21

|

17033787

|

D

|

|

|

Common Stock

(10)

|

2/7/2014

|

|

S

|

|

132540

|

D

|

$3.09

|

16901247

|

D

|

|

|

Common Stock

(10)

|

2/8/2014

|

|

S

|

|

79630

|

D

|

$3.09

|

16821617

|

D

|

|

Table II - Derivative Securities Beneficially Owned (

e.g.

, puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3)

|

2. Conversion or Exercise Price of Derivative Security

|

3. Trans. Date

|

3A. Deemed Execution Date, if any

|

4. Trans. Code

(Instr. 8)

|

5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

6. Date Exercisable and Expiration Date

|

7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4)

|

8. Price of Derivative Security

(Instr. 5)

|

9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4)

|

10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4)

|

11. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

(A)

|

(D)

|

Date Exercisable

|

Expiration Date

|

Title

|

Amount or Number of Shares

|

|

Warrants

(3)

|

$4

|

12/1/2013

|

|

P

|

|

138600

|

|

12/31/2013

|

12/31/2018

|

Common Stock

|

138600

|

(3)

|

138600

|

D

|

|

|

Warrants

(4)

|

$4

|

12/31/2013

|

|

J

|

|

665029

|

|

12/31/2013

|

12/31/2018

|

Common Stock

|

665029

|

(4)

|

665029

|

D

|

|

|

Warrants

(5)

|

$4.00

|

1/1/2014

|

|

P

|

|

119124

|

|

1/31/2014

|

1/31/2019

|

Common Stock

|

119124

|

(5)

|

126624

|

D

|

|

|

Warrants

(6)

|

$4.00

|

1/17/2014

|

|

P

|

|

2434012

|

|

1/17/2014

|

1/17/2019

|

Common Stock

|

2434012

|

(6)

|

2434012

|

D

|

|

|

Warrants

(6)

|

$3.20

|

1/17/2014

|

|

J

|

|

2817329

|

|

10/16/2012

|

10/16/2017

|

Common Stock

|

2817329

|

(6)

|

2817329

|

D

|

|

|

Warrants

(6)

|

$3.20

|

1/17/2014

|

|

J

|

|

374670

|

|

11/30/2014

|

11/30/2017

|

Common Stock

|

374670

|

(6)

|

374670

|

D

|

|

|

Warrants

(6)

|

$3.20

|

1/17/2014

|

|

J

|

|

1451036

|

|

7/31/2015

|

7/31/2018

|

Common Stock

|

1451036

|

(6)

|

1451036

|

D

|

|

|

Warrants

(6)

|

$4.00

|

1/17/2014

|

|

J

|

|

111521

|

|

10/31/2015

|

10/31/2018

|

Common Stock

|

111521

|

(6)

|

111521

|

D

|

|

|

Warrants

(6)

|

$4.00

|

1/17/2014

|

|

J

|

|

128719

|

|

11/29/2015

|

11/29/2018

|

Common Stock

|

128719

|

(6)

|

128719

|

D

|

|

|

Warrants

(6)

|

$4.00

|

1/17/2014

|

|

J

|

|

138600

|

|

12/31/2015

|

12/31/2018

|

Common Stock

|

138600

|

(6)

|

138600

|

D

|

|

|

Warrants

(6)

|

$4.00

|

1/17/2014

|

|

J

|

|

665029

|

|

12/31/2015

|

12/31/2018

|

Common Stock

|

665029

|

(6)

|

665029

|

D

|

|

|

Warrants

(6)

|

$3.20

|

1/17/2014

|

|

P

|

|

2817329

|

|

1/17/2014

|

10/16/2020

|

Common Stock

|

2817329

|

(6)

|

2817329

|

D

|

|

|

Warrants

(6)

|

$3.20

|

1/17/2014

|

|

P

|

|

374670

|

|

1/17/2014

|

11/30/2020

|

Common Stock

|

374670

|

(6)

|

374670

|

D

|

|

|

Warrants

(6)

|

$3.20

|

1/17/2014

|

|

P

|

|

1451036

|

|

1/17/2014

|

7/31/2021

|

Common Stock

|

1451036

|

(6)

|

1451036

|

D

|

|

|

Warrants

(6)

|

$4.00

|

1/17/2014

|

|

P

|

|

111521

|

|

1/17/2014

|

10/31/2021

|

Common Stock

|

111521

|

(6)

|

111521

|

D

|

|

|

Warrants

(6)

|

$4.00

|

1/17/2014

|

|

P

|

|

128719

|

|

1/17/2014

|

11/29/2021

|

Common Stock

|

128719

|

(6)

|

128719

|

D

|

|

|

Warrants

(6)

|

$4.00

|

1/17/2014

|

|

P

|

|

138600

|

|

1/17/2014

|

12/31/2021

|

Common Stock

|

138600

|

(6)

|

138600

|

D

|

|

|

Warrants

(6)

|

$4.00

|

1/17/2014

|

|

P

|

|

665029

|

|

1/17/2014

|

12/31/2021

|

Common Stock

|

665029

|

(6)

|

665029

|

D

|

|

|

Warrants

(9)

|

$4.00

|

2/28/2014

|

|

P

|

|

143528

|

|

2/28/2014

|

2/28/2019

|

Common Stock

|

143528

|

(9)

|

143528

|

D

|

|

|

Explanation of Responses:

|

|

(

1)

|

The reporting persons may be deemed to be members of a group beneficially owning 10% or more of the shares of common stock ("Common Shares") of Northwest Biotherapeutics, Inc. (the "Company") within the meaning of Section 13(d) of the Securities Exchange Act of 1934. Except as set forth herein, the reporting persons disclaim beneficial ownership of securities except to the extent of their pecuniary interest therein, and this report shall not be deemed an admission that such a group exists or that the reporting persons are the beneficial owner of the securities of such group for purposes of Section 16 or any other purpose. Toucan General II, LLC ("Toucan GP") is the general partner of Toucan Capital Fund III, L.P. ("Toucan Capital" or "Fund III").

|

|

(

2)

|

By Cognate Bioservices, Inc. ("Cognate").

|

|

(

3)

|

On December 1, 2013, Cognate agreed to convert $1,108,797.24 of the Company's outstanding accounts payable owed to Cognate in exchange for 277,199 Common Shares and warrants to purchase 138,600 Common Shares at an initial exercise price of $4.00.

|

|

(

4)

|

On December 31, 2013, Cognate agreed to convert an aggregate of $5,320,228 of the Company's outstanding accounts payable owed to Cognate from past periods totaling more than half a year in exchange for 1,330,057 Common Shares and warrants to purchase 665,029 Common Shares at an initial exercise price of $4.00.

|

|

(

5)

|

On January 1, 2014, the Company became obligated to convert $1,012,992.36 of the Company's outstanding accounts payable owed to Cognate in exchange for 238,248 Common Shares and warrants to purchase 119,124 Common Shares at an initial exercise price of $4.00.

|

|

(

6)

|

On January 17, 2014, in connection with certain agreements with Cognate, the Company issued one-time initiation payments of an aggregate of 5,101,366 Common Shares and warrants to purchase 2,434,012 Common Shares at an initial exercise price of $4.00. Also on such date, the Company agreed to extend the exercise period of all current and past warrants held by Cognate for three years from their existing expiration date.

|

|

(

7)

|

Cognate previously entered into a $1.5 million convertible debt financing with unrelated third party investors, secured by Cognate assets, and provided the proceeds of the financings for Northwest Biotherapeutics' programs. The debt was convertible, at the investors' election, into Common Shares owned by Cognate. The third party investors elected to convert the debt and receive repayment in Common Shares rather than in cash and therefore, on each of January 31, 2014 and February 4, 2014, Cognate distributed 233,344 Common Shares to a third party to settle the debt.

|

|

(

8)

|

On February 1, 2014, the Company became obligated to issue Cognate 500,000 Common Shares as payment for certain milestones.

|

|

(

9)

|

On February 1, 2014, the Company became obligated to convert $1,148,220.36 of the Company's outstanding accounts payable owed to Cognate in exchange for 287,055 Common Shares and warrants to purchase 143,528 Common Shares at an initial exercise price of $4.00.

|

|

(

10)

|

On February 7, 2014, Cognate awarded 132,540 Common Shares to one of its managers, as an Equity Award, vesting over time, as part of the manager's compensation and on February 8, 2014, Cognate awarded 79,630 Common Shares to another one of its managers, as an Equity Award, vesting over time, as part of the manager's compensation.

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

Cognate Bioservices, Inc.

7513 CONNELLEY DRIVE

HANOVER, MD 21076

|

|

X

|

|

|

Toucan Capital Fund III, L.P.

4800 MONTGOMERY LANE, SUITE 800

BETHESDA, MD 20814

|

|

X

|

|

|

Toucan General II, LLC

4800 MONTGOMERY LANE, SUITE 800

BETHESDA, MD 20814

|

|

X

|

|

|

Toucan Partners, LLC

4800 MONTGOMERY LANE, SUITE 800

BETHESDA, MD 20814

|

|

X

|

|

|

Powers Linda F

4800 MONTGOMERY LANE, SUITE 800

BETHESDA, MD 20814

|

X

|

X

|

Chairperson, CEO

|

|

Hemphill Robert F Jr.

4800 MONTGOMERY LANE, SUITE 800

BETHESDA, MD 20814

|

|

X

|

|

|

Signatures

|

|

Cognate Bioservices, Inc., by its director, /s/ Linda Powers

|

|

12/22/2014

|

|

**

Signature of Reporting Person

|

Date

|

|

Toucan Capital Fund III, L.P., by its managing director, /s/ Linda Powers

|

|

12/22/2014

|

|

**

Signature of Reporting Person

|

Date

|

|

Toucan General II, LLC, by its managing director, /s/ Linda Powers

|

|

12/22/2014

|

|

**

Signature of Reporting Person

|

Date

|

|

Toucan Partners, LLC, by its managing member, /s/ Linda Powers

|

|

12/22/2014

|

|

**

Signature of Reporting Person

|

Date

|

|

/s/ Linda Powers

|

|

12/22/2014

|

|

**

Signature of Reporting Person

|

Date

|

|

/s/ Robert Hemphill, Jr.

|

|

12/22/2014

|

|

**

Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person,

see

Instruction 4(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations.

See

18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient,

see

Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

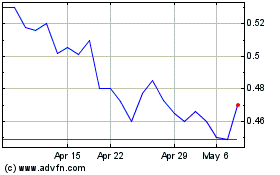

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Apr 2023 to Apr 2024