Envestnet, Inc. Announces Exercise of Over-Allotment Option and Issuance of Additional Convertible Notes

December 18 2014 - 11:06AM

Business Wire

Envestnet, Inc. (NYSE:ENV) (the “Company”), a leading provider

of unified wealth management technology and services to investment

advisors and wealth managers, announced today that, in connection

with the Company’s public offering of 1.75% convertible notes due

2019 (the “Notes”), the underwriters have exercised in full their

option to purchase an additional $22.5 million aggregate principal

amount of the Notes. The issuance of the additional $22.5 million

aggregate principal amount of the Notes closed on December 18,

2014. The full exercise of the over-allotment option brings the

total aggregate principal amount of the Notes sold in the public

offering to $172.5 million.

Stifel, Credit Suisse and BMO Capital Markets acted as joint

book-running managers, and Sandler O’Neill + Partners, L.P., Sterne

Agee and William Blair acted as co-managers for the offering.

This announcement is neither an offer to sell nor a solicitation

of an offer to buy the Notes (or the shares of the Company’s common

stock into which the Notes are convertible), nor will there be any

offer, solicitation or sale in any jurisdiction in which such

offer, solicitation or sale is unlawful.

The offering was made only by means of a prospectus supplement

and accompanying prospectus. When available, you may get these

documents for free by visiting EDGAR on the SEC’s website at

www.sec.gov. Alternatively, copies of the prospectus supplement and

accompanying prospectus may be obtained by contacting Stifel,

Nicolaus & Company, Incorporated, Attention: Syndicate, One

Montgomery Street, Suite 3700, San Francisco, California 94104, by

telephone at (415) 364-2720 or by email to

syndprospectus@stifel.com; or by contacting Credit Suisse

Securities (USA) LLC, Attention: Prospectus Department, One Madison

Avenue, New York, NY 10010, by telephone at (800) 221-1037, or by

email to newyork.prospectus@credit-suisse.com; or by contacting BMO

Capital Markets Corp., Attention: Equity Syndicate Department, 3

Times Square, 27th Floor, New York, NY 10036, by telephone at (800)

414-3627 or by email to bmoprospectus@bmo.com.

Cautionary Statement

The statements in this release relating to the expected use of

proceeds from the offering are forward-looking statements made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. These statements involve risks and

uncertainties that could cause actual results to differ materially,

including, but not limited to, the anticipated use of the proceeds

of the offering, which could change as a result of market

conditions or for other reasons, and the impact of general

economic, industry or political conditions in the United States or

internationally. Factors that could cause such differences are

described in the Company’s prospectus supplement and the Company’s

periodic filings with SEC.

You are cautioned not to place undue reliance on the Company’s

forward-looking statements, which speak only as of the date such

statements are made. The Company does not undertake any obligation

to publicly update any forward-looking statements to reflect

events, circumstances or new information after this December 18,

2014 press release, or to reflect the occurrence of unanticipated

events.

About Envestnet

Envestnet, Inc. (NYSE: ENV) is a leading provider of unified

wealth management technology and services to investment advisors.

Our open-architecture platforms unify and fortify the wealth

management process, delivering unparalleled flexibility, accuracy,

performance and value. Envestnet solutions enable the

transformation of wealth management into a transparent,

independent, objective and fully-aligned standard of care, and

empower advisors to deliver better results.

Envestnet’s Advisor Suite® software empowers financial advisors

to better manage client outcomes and strengthen their practice.

Envestnet provides institutional-quality research and advanced

portfolio solutions through our Portfolio Management Consultants

group, Envestnet | PMC®. Envestnet | Tamarac provides leading

rebalancing, reporting and practice management software.

Envestnet, Inc.Investor

Relations312-827-3940investor.relations@envestnet.comorMedia

Relationsmediarelations@envestnet.com

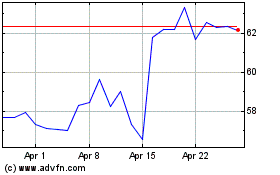

Envestnet (NYSE:ENV)

Historical Stock Chart

From Mar 2024 to Apr 2024

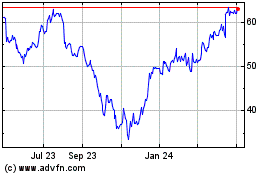

Envestnet (NYSE:ENV)

Historical Stock Chart

From Apr 2023 to Apr 2024