UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

December 15, 2014

Date of report (Date of earliest event reported)

Universal

Insurance Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-33251 |

|

65-0231984 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Commission

file number) |

|

(IRS Employer

Identification No.) |

1110 W. Commercial Boulevard, Fort Lauderdale, Florida 33309

(Address of Principal Executive Offices)

Registrant’s telephone number, including area code: (954) 958-1200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425). |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12). |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)). |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)). |

| ITEM 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensation Arrangements of Certain Officers |

On December 15, 2014, Universal Insurance Holdings, Inc. (“Company”) entered into amended employment agreements with Jon W. Springer,

Executive Vice President and Chief Operating Officer, and Stephen J. Donaghy, Chief Administrative Officer, extending their employment by one year through December 31, 2015.

Mr. Springer’s base salary will be frozen for 2015 and will remain $1,340,625. His annual incentive performance bonus for 2015 will be

determined by the same formula as in 2014, at 2.5% of the Company’s income before taxes, and will be awarded under the Company’s previously approved 2009 Omnibus Incentive Plan, as amended (“Plan”). Mr. Donaghy’s base

salary will also be frozen for 2015 and will remain $804,375. His annual incentive performance bonus for 2015 will be determined by the same formula as in 2014, at 1.5% of the Company’s net income, and will be awarded under the Plan.

Other than incidental technical clarifications, the amendments do not otherwise modify the terms of the existing employment agreements.

The Company’s Compensation Committee is undertaking a coordinated and comprehensive review of the Company’s executive compensation program following

the “say on pay” vote that passed by a narrow margin at the Company’s 2014 annual meeting of shareholders. In order to provide the necessary time and resources for such a review, the Compensation Committee approved the one-year

extensions of Messrs. Springer’s and Donaghy’s employment agreements, which would otherwise expire on December 31, 2014, and will coordinate their future agreements with that of Sean P. Downes, the Company’s Chairman, President

and Chief Executive Officer, whose employment agreement will also expire on December 31, 2015.

The preceding summary of the amendments does not

purport to be complete and is qualified in its entirety by reference to the full text of the amendments, which are attached hereto as Exhibits 10.1 and 10.2 and incorporated by reference.

| ITEM 9.01 |

Financial Statements and Exhibits |

(d) Exhibits:

|

|

|

| Exhibit No. |

|

Description |

|

|

| 10.1 |

|

Amendment No. 1 to Employment Agreement, dated December 15, 2014, between Jon W. Springer and the Company |

|

|

| 10.2 |

|

Amendment No. 1 to Employment Agreement, dated December 15, 2014, between Stephen J. Donaghy and the Company |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Date: December 16, 2014 |

|

|

|

|

|

UNIVERSAL INSURANCE HOLDINGS, INC. |

|

|

|

|

|

|

/s/ Sean P. Downes |

|

|

|

|

|

|

Sean P. Downes |

|

|

|

|

|

|

President and Chief Executive Officer |

Exhibit 10.1

EXECUTION VERSION

AMENDMENT NO. 1

TO EMPLOYMENT AGREEMENT

This Amendment No. 1 is made and entered into this 15th day of December, 2014 (the “Amendment

Date”), by Universal Insurance Holdings, Inc., a Delaware corporation (the “Company”), and Jon W. Springer (“Executive”).

WHEREAS, the Company and Executive have entered into an Employment Agreement, dated as of February 22, 2013 (the “Employment

Agreement”); and

WHEREAS, the Company and Executive desire to enter into this Amendment No. 1 to extend the term of

Executive’s employment with the Company, to make certain adjustments to Executive’s compensation pending the determination of a revised compensation program for the Company’s executive officers and to correct a technical error in the

Employment Agreement relating to the timing of payment of the pro rata bonus in the event of Executive’s termination without Cause or for Good Reason.

Accordingly, the parties agree as follows:

1. Capitalized terms not defined herein shall have the meanings set forth in the Employment Agreement.

2. Section 2 of the Employment Agreement is amended to extend the Term to December 31, 2015. Except as provided

herein, the Employment Agreement shall remain in full force and effect.

3. Effective January 1, 2015,

Section 4.1 of the Employment Agreement is deleted in its entirety and replaced with the following:

4.1 Base

Salary. Beginning January 1, 2015, the Company will pay Executive an annual base salary of $1,340,625, payable in accordance with the Company’s customary payroll practices (“Base Salary”), with no subsequent increases

during the Term unless the Compensation Committee provides otherwise subsequent to the Amendment Date.

4. Effective

January 1, 2015, Section 4.2 of the Employment Agreement is deleted in its entirety and replaced with the following:

4.2 Annual Bonus. For 2015, Executive shall be entitled to receive a cash incentive award under Article X of the

Universal Insurance Holdings, Inc. 2009 Omnibus Incentive Plan, as it may be amended from time to time, in an amount equal to 2.5% of the Company’s income before taxes as reported in the Company’s Annual Report on Form 10-K for fiscal year

2015 (the “Annual Bonus”), which Annual Bonus shall be paid to Executive no later than March 15, 2016. For the avoidance of doubt, if Executive has earned an Annual Bonus under this Section 4.2, he need not be employed on

the Annual Bonus payment date to receive such Annual Bonus, provided, except as otherwise provided in the Employment Agreement, that he is employed through December 31, 2015.

Jon W. Springer

Amendment No. 1 to Employment Agreement

Page 2 of 4

5. Effective January 1, 2015, Section 4 of the Employment Agreement is amended to add a new Section 4.7 that reads in its

entirety:

4.7 The Compensation Committee will consider an equity grant to Executive in 2015 in accordance with its regular

equity grant policy.

6. Section 5.3 of the Employment Agreement is deleted in its entirety and replaced with the following:

5.3 Payment Upon Termination Without Cause. If during the Term the Company terminates Executive’s employment

without Cause (which may be done at any time without prior notice), the Company will pay Executive (i) on the sixtieth (60th) day following the date of such termination of employment, in

addition to the Accrued Obligations, (1) a lump-sum cash payment equal to Executive’s then-current Base Salary for a period of twelve (12) months and (2) a lump-sum cash payment equal to the cost of COBRA coverage for Executive

and his dependents for twelve (12) months, and (ii) no later than March 15 of the year following the year to which the Annual Bonus relates, payment for the prorated share of Executive’s Annual Bonus pursuant to Section 4.2,

based on the Company’s actual performance, for the year in which termination without Cause occurs; provided that Executive executes and delivers to the Company a valid and irrevocable release agreement in a form reasonably acceptable to the

Company by no later than forty-five (45) days following the date of such termination of employment without Cause. Additionally, any restricted stock award granted in accordance with Section 4.4 prior to the date of Executive’s

termination without Cause shall fully vest immediately prior to such termination without Cause; for the avoidance of doubt, Executive shall not be entitled to any award under Section 4.4 which has not been granted prior to such termination

without Cause. The Company will have no obligation to provide the benefits set forth in this Section 5.3 in the event that Executive breaches the provisions of Section 7.

7. Section 5.4 of the Employment Agreement is deleted in its entirety and replaced with the following:

5.4 Payment Upon Termination For Good Reason. If during the Term Executive terminates his employment with the Company

for Good Reason by giving notice as provided in this Section 5.4, the Company will pay Executive (i) on the sixtieth (60th) day following the date of such termination of employment,

in addition to the Accrued Obligations, (1) a lump-sum cash payment equal to Executive’s then-current Base Salary for a period of twelve (12) months, and (2) a lump-sum cash payment equal to the cost of COBRA coverage for

Executive and his dependents for twelve (12) months, and (ii) no later than March 15 of the year following the year to which the Annual Bonus relates, payment for the prorated share of Executive’s Annual Bonus pursuant to

Section 4.2, based on the Company’s actual performance, for the year in which termination for Good Reason occurs; provided that Executive executes and delivers to the Company within a valid and irrevocable release agreement in a form

reasonably acceptable to the Company by no later than forty-five (45) days

Jon W. Springer

Amendment No. 1 to Employment Agreement

Page 3 of 4

following the date of such

termination of employment for Good Reason. Additionally, any restricted stock award granted in accordance with Section 4.4 prior to the date of Executive’s termination for Good Reason shall fully vest immediately prior to such termination

with Good Reason; for the avoidance of doubt, Executive shall not be entitled to any award under Section 4.4 which has not been granted prior to such termination for Good Reason. Prior to the effectiveness of termination for Good Reason, the

Company shall be given thirty (30) calendar days’ prior written notice from Executive, specifically identifying the reasons which are alleged to constitute Good Reason for termination hereunder, and an opportunity to be heard by Executive

in the event the Company disputes such allegations and to cure such allegations; provided, however, that Executive shall have no obligation to remain employed by the Company following such thirty (30) calendar day notice period

unless such allegations are cured to Executive’s reasonable satisfaction. As used in this Section 5.4, “Good Reason” means any of the following without Executive’s prior written consent: (i) assignment to

Executive of duties materially inconsistent with Executive’s position hereunder; (ii) failure to pay Executive’s Base Salary in accordance with Section 4.1 hereof; (iii) failure to pay Executive’s Annual Bonus pursuant

to Section 4.2; (iv) requiring Executive to move his situs of employment more than twenty (20) miles from his situs of employment prior to such move; or (v) the Company’s material breach of this Agreement.

8. Except as expressly amended herein, the terms and conditions of the Employment Agreement shall continue in full force and effect.

[signatures on following page]

IN WITNESS WHEREOF, the parties hereto, intending to be legally bound hereby, have executed this

Amendment No. 1 as of the day and year first above mentioned.

|

|

|

|

|

|

|

|

|

|

|

Executive: |

|

|

|

|

/s/ Jon W. Springer |

|

|

|

|

|

|

Jon W. Springer |

|

|

|

|

UNIVERSAL INSURANCE HOLDINGS, INC. |

|

|

|

|

/s/ Sean P.

Downes |

|

|

|

|

|

|

Sean P. Downes |

|

|

|

|

|

|

President and Chief Executive Officer |

Exhibit 10.2

EXECUTION VERSION

AMENDMENT NO. 1

TO EMPLOYMENT AGREEMENT

This Amendment No. 1 is made and entered into this 15th day of December, 2014 (the “Amendment

Date”), by Universal Insurance Holdings, Inc., a Delaware corporation (the “Company”), and Stephen J. Donaghy (“Executive”).

WHEREAS, the Company and Executive have entered into an Employment Agreement, dated as of March 21, 2013 (the “Employment

Agreement”); and

WHEREAS, the Company and Executive desire to enter into this Amendment No. 1 to extend the term of

Executive’s employment with the Company and to make certain adjustments to Executive’s compensation pending the determination of a revised compensation program for the Company’s executive officers.

Accordingly, the parties agree as follows:

1. Capitalized terms not defined herein shall have the meanings set forth in the Employment Agreement.

2. Section 2 of the Employment Agreement is amended to extend the Term to December 31, 2015. Except as provided

herein, the Employment Agreement shall remain in full force and effect.

3. Effective January 1, 2015,

Section 4.1 of the Employment Agreement is deleted in its entirety and replaced with the following:

4.1 Base

Salary. Beginning January 1, 2015, the Company will pay Executive an annual base salary of $804,375, payable in accordance with the Company’s customary payroll practices (“Base Salary”), with no subsequent increases

during the Term unless the Compensation Committee provides otherwise subsequent to the Amendment Date.

4. Effective

January 1, 2015, Section 4.2 of the Employment Agreement is deleted in its entirety and replaced with the following:

4.2 Annual Bonus. For 2015, Executive shall be entitled to receive a cash incentive award under Article X of the

Universal Insurance Holdings, Inc. 2009 Omnibus Incentive Plan, as it may be amended from time to time, in an amount equal to 1.5% of the Company’s net income as reported in the Company’s Annual Report on Form 10-K for fiscal year 2015

(the “Annual Bonus”), which Annual Bonus shall be paid to Executive no later than March 15, 2016. For the avoidance of doubt, if Executive has earned an Annual Bonus under this Section 4.2, he need not be employed on the

Annual Bonus payment date to receive such Annual Bonus, provided that he is employed through December 31, 2015.

Stephen J. Donaghy

Amendment No. 1 to Employment Agreement

Page 2 of 3

5. Effective January 1, 2015, Section 4 of the Employment Agreement is amended to add a new Section 4.9 that reads in its

entirety:

4.9 The Compensation Committee will consider an equity grant to Executive in 2015 in accordance with its regular

equity grant policy.

6. Except as expressly amended herein, the terms and conditions of the Employment Agreement shall continue in full

force and effect.

[signatures on following page]

IN WITNESS WHEREOF, the parties hereto, intending to be legally bound hereby, have executed this

Amendment No. 1 as of the day and year first above mentioned.

|

| Executive: |

|

| /s/ Stephen J. Donaghy |

| Stephen J. Donaghy |

|

| UNIVERSAL INSURANCE HOLDINGS, INC. |

|

| /s/ Sean P. Downes |

| Sean P. Downes |

| President and Chief Executive Officer |

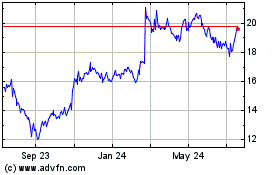

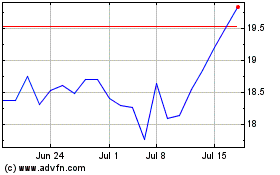

Universal Insurance (NYSE:UVE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Universal Insurance (NYSE:UVE)

Historical Stock Chart

From Apr 2023 to Apr 2024