TrustCo Announces CFO Transition

December 16 2014 - 4:21PM

Robert J. McCormick, President and Chief Executive Officer of

TrustCo Bank Corp NY (TrustCo) (Nasdaq:TRST) announced today that

Executive Vice President and Chief Financial Officer Robert T.

Cushing is retiring from the Company on May 31, 2015. Mr. Cushing

has assumed the new role of Chief Operating Officer and will assist

his successor in the orderly transition of the CFO responsibilities

through his retirement in May.

"Bob has been integral part of the Company for over 20 years.

His leadership of the Company's financial operation as CFO has been

a key component in the growth and success at TrustCo," said Robert

McCormick. "We wish him the best of luck in his retirement and he

will be missed."

Robert McCormick also announced today that Michael M. Ozimek,

has been named Senior Vice President and CFO. Mike has been with

TrustCo for twelve years and is a graduate of Siena College. Prior

to joining TrustCo Mike worked at the accounting firm KPMG. Mr.

McCormick noted "Bob and Mike have worked together for a number of

years and I am confident that the transition will go very smoothly.

We are pleased to have an individual of Mike's caliber assume the

role of CFO."

TrustCo Bank Corp NY is a $4.6 billion savings and loan holding

company. Its subsidiary, Trustco Bank, operates 143 offices in New

York, Florida, Massachusetts, New Jersey and Vermont.

In addition, the Bank's Financial Services Department offers a

full range of investment services, retirement planning and trust

and estate administration services.

The common shares of TrustCo are traded on The NASDAQ Global

Select Market under the symbol TRST.

Safe Harbor Statement

All statements in this news release that are not historical are

forward-looking statements within the meaning of the Securities

Exchange Act of 1934, as amended. Forward-looking statements can be

identified by words such as "anticipate," "intend," "plan," "goal,"

"seek," "believe," "project," "estimate," "expect," "strategy,"

"future," "likely," "may," "should," "will" and similar references

to future periods. Examples of forward-looking statements include,

among others, statements we make regarding our expectations for our

performance during the remainder of 2014 and for the growth of

loans and deposits throughout our branch network and our ability to

capitalize on economic changes in the areas in which we operate.

Such forward-looking statements are subject to factors that could

cause actual results to differ materially for TrustCo from those

discussed. TrustCo wishes to caution readers not to place undue

reliance on any such forward-looking statements, which speak only

as of the date made. The following important factors, among others,

in some cases have affected and in the future could affect

TrustCo's actual results and could cause TrustCo's actual financial

performance to differ materially from that expressed in any

forward-looking statement: our ability to continue to originate a

significant volume of one-to-four family mortgage loans in our

market areas; our ability to continue to maintain noninterest

expense and other overhead costs at reasonable levels relative to

income; the future earnings and capital levels of Trustco Bank and

the continued ability of Trustco Bank under regulatory rules to

distribute capital to TrustCo, which could affect our ability to

pay dividends; our ability to make accurate assumptions and

judgments regarding the credit risks associated with lending and

investing activities; the effect of changes in financial services

laws and regulations and the impact of other governmental

initiatives affecting the financial services industry; results of

examinations of Trustco Bank and TrustCo by our respective

regulators; the effects of, and changes in, trade, monetary and

fiscal policies and laws, including interest rate policies of the

Federal Reserve Board, inflation, interest rates, market and

monetary fluctuations; the perceived overall value of our products

and services by users, including in comparison to competitors'

products and services and the willingness of current and

prospective customers to substitute competitors' products and

services for our products and services; real estate and collateral

values; changes in accounting policies and practices, as may be

adopted by the bank regulatory agencies, the FASB or PCAOB; changes

in local market areas and general business and economic trends, as

well as changes in consumer spending and saving habits; our success

at managing the risks involved in the foregoing and managing our

business; and other risks and uncertainties under the heading "Risk

Factors" in our annual report on Form 10-K for the year ended

December 31, 2013, as amended, and, if any, in our subsequent

quarterly reports on Form 10-Q or other securities filings.

CONTACT: Kevin T. Timmons

Vice President/Treasurer

(518) 381-3607

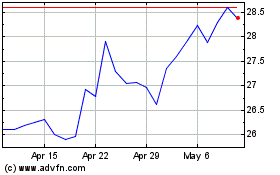

TrustCo Bank Corporation... (NASDAQ:TRST)

Historical Stock Chart

From Mar 2024 to Apr 2024

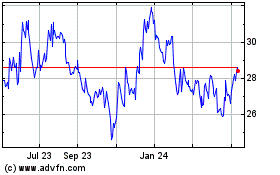

TrustCo Bank Corporation... (NASDAQ:TRST)

Historical Stock Chart

From Apr 2023 to Apr 2024