As filed with the Securities and Exchange Commission on December 12, 2014

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Devon Energy Corporation

(Exact name of registrant as specified in its charter)

|

|

|

| Delaware |

|

73-1567067 |

| (State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer Identification Number) |

333 West Sheridan Avenue

Oklahoma City, OK 73102-5015

(405) 235-3611

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Lyndon C. Taylor

Executive Vice President and General Counsel

Devon Energy Corporation

333 West Sheridan Avenue

Oklahoma City, OK 73102-5015

(405) 235-3611

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Gregory A. Fernicola

Anthony G. Saldana

Skadden, Arps, Slate, Meagher & Flom LLP

1440 New York Avenue, NW

Washington, DC 20005

Telephone: (202) 371-7000

Facsimile: (202) 393-5670

Approximate date of commencement of

proposed sale to the public: From time to time after the effective date of this registration statement.

If the only

securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e)

under the Securities Act, check the following box. þ

If this Form

is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box. ¨

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of

the Exchange Act. (Check one):

|

|

|

|

|

|

|

| Large accelerated filer |

|

þ |

|

Accelerated filer |

|

¨ |

|

|

|

|

| Non-accelerated filer |

|

¨ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

¨ |

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

| |

Title of Each Class of

Securities to be Registered |

|

Amounts

to be

Registered (1) |

|

Proposed

Maximum

Offering Price

per Unit (1) |

|

Proposed

Maximum

Aggregate

Offering Price (1) |

|

Amount of

Registration Fee (1) |

| Common stock, par value $0.10 per share (2) |

|

|

|

|

|

|

|

|

| Preferred stock, par value $1.00 per share (2) |

|

|

|

|

|

|

|

|

| Debt securities |

|

|

|

|

|

|

|

|

| |

| |

| (1) |

An indeterminate aggregate initial offering price or number of securities of each identified class is being registered as may from time to time be offered at

indeterminate prices. Separate consideration may or may not be received for securities that are issuable on exercise, conversion or exchange of other securities. In accordance with Rules 456(b) and 457(r) under the Securities Act of 1933, as

amended, the Registrant is deferring payment of all of the registration fee. |

| (2) |

Shares of preferred stock and/or common stock may be issued in primary offerings or upon conversion of debt securities or preferred stock registered hereby.

|

PROSPECTUS

Devon Energy Corporation

COMMON STOCK, PREFERRED STOCK AND

DEBT SECURITIES

By this prospectus, Devon Energy Corporation may offer, from time to time, its common stock, preferred stock and debt securities. We will provide the specific terms of any securities to be offered in a

supplement to this prospectus, which may also add, update or change information contained in this prospectus. You should read this prospectus and any supplement carefully before investing.

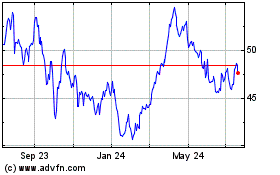

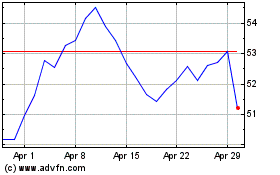

Our common stock, par value $0.10 per share, is listed on the New York Stock Exchange and its trading symbol is “DVN.” Each

prospectus supplement will indicate if the securities offered thereby will be listed on any securities exchange.

Investing

in securities involves risks. You should carefully read the risk factors included in the applicable prospectus supplement and in our periodic reports and other information filed with the Securities and Exchange Commission before investing in our

securities.

We may offer and sell these securities to or through one or more underwriters, dealers and agents, or

directly to purchasers, on a continuous or delayed basis through a public offering or negotiated purchases. The prospectus supplement for each offering will describe in detail the plan of distribution for that offering and will set forth the names

of any underwriters, dealers or agents involved in the offering and any applicable fees, commissions or discount arrangements.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of

this Prospectus is December 12, 2014.

TABLE OF CONTENTS

i

ABOUT THIS PROSPECTUS

This prospectus may not be used to sell securities unless it is accompanied by a prospectus supplement.

This prospectus is part of a registration statement we filed with the Securities and Exchange Commission, or the SEC, utilizing a shelf

registration process. Under this shelf registration process, we may sell the securities described in this prospectus in one or more offerings.

This prospectus provides you with a general description of the securities we may offer. Each time we sell offered securities, we will provide a prospectus supplement that will contain specific information

about the terms of that offering. The prospectus supplement may include additional risk factors or other special considerations applicable to those securities. The prospectus supplement may also add, update or change information contained in this

prospectus. If there is any inconsistency between the information in this prospectus and any prospectus supplement, you should rely on the information in the prospectus supplement. You should read both this prospectus and any prospectus supplement

together with additional information described under “Where You Can Find More Information.”

We have not authorized

any dealer, salesman or other person to give any information or to make any representation other than those contained or incorporated by reference in this prospectus and any accompanying prospectus supplement. You must not rely upon any information

or representation not contained or incorporated by reference in this prospectus or in any accompanying prospectus supplement. This prospectus and any accompanying prospectus supplement do not constitute an offer to sell or the solicitation of an

offer to buy any securities other than the securities to which they relate, nor do this prospectus and any accompanying prospectus supplement constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any

person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus and any accompanying prospectus supplement is accurate on any date subsequent to the date

set forth on the front of the document or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus and any accompanying prospectus

supplement is delivered or securities are sold on a later date.

Unless the context otherwise indicates, the terms

“Devon,” “we,” “us” and “our” in this prospectus mean Devon Energy Corporation, a Delaware corporation, and its consolidated subsidiaries.

DEVON ENERGY CORPORATION

Devon is an independent energy company engaged primarily in exploration, development and production of natural gas and oil. Our operations are concentrated in various North American onshore areas in the

United States and Canada. In March 2014, Devon, Crosstex Energy, Inc. and Crosstex Energy, LP (together with Crosstex Energy, Inc., “Crosstex”) completed a business combination to combine substantially all of Devon’s U.S. midstream

assets with Crosstex’s assets to form a new midstream business. The new business includes EnLink Midstream Partners, LP (the “MLP”), a master limited partnership, and EnLink Midstream, LLC (“EnLink”), which indirectly owns

the general partner of the MLP. Devon holds a controlling interest in the MLP and EnLink, which are both publicly traded entities. We continue to maintain significant marketing operations for our gas, crude oil and natural gas liquids

(“NGLs”) and midstream operations in Canada.

Our principal and administrative offices are located at 333 West

Sheridan Avenue, Oklahoma City, Oklahoma 73102-5015. Our telephone number at that location is (405) 235-3611.

1

SPECIAL NOTE ON FORWARD-LOOKING STATEMENTS

This prospectus and the documents that we incorporate by reference contain certain forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Exchange Act, which are identified by the use of the words “believe,” “expect,” “anticipate,”

“estimate,” “will,” “contemplate,” “would” and similar expressions that contemplate future events. Such forward-looking statements are based on management’s reasonable current assumptions and

expectations. Numerous important factors, risks and uncertainties affect our operating results, including, without limitation, those contained in this prospectus, any prospectus supplement and the documents that we incorporate by reference, and

could cause our actual results, levels of activity, performance or achievement to differ materially from the results expressed or implied by these or any other forward-looking statements made by us or on our behalf. There can be no assurance that

future results will meet expectations. You should pay particular attention to the risk factors and cautionary statements referenced in the section of this prospectus, and in any prospectus supplement, entitled “Risk Factors.” You should

also carefully review the risk factors and cautionary statements described in the other documents we file from time to time with the SEC, specifically our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and our Current Reports on Form

8-K. We undertake no obligation to update any forward-looking statements.

RISK FACTORS

Investing in our securities involves a high degree of risk. Before making an investment decision and acquiring any

offered securities pursuant to this prospectus, you should carefully consider the information contained or incorporated by reference in this prospectus and in any accompanying prospectus supplement, including, without limitation, the risks described

in our most recent Annual Report on Form 10-K, which is incorporated herein by reference, the risk factors described under the caption “Risk Factors” in any applicable prospectus supplement and any risk factors set forth in our other

filings with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act. The occurrence of any of these risks might cause you to lose all or a part of your investment in the offered securities. See “Where You Can Find More

Information.”

USE OF PROCEEDS

Unless otherwise indicated in an accompanying prospectus supplement, we expect to use the net proceeds from the sale of the securities

offered by this prospectus for general corporate purposes, which may include, among other things:

| |

• |

|

the repayment of outstanding indebtedness; |

| |

• |

|

capital expenditures; and |

The precise amount and timing of the application of such proceeds will depend upon our funding requirements and the availability and cost of other funds.

2

RATIOS OF EARNINGS TO FIXED CHARGES AND EARNINGS TO COMBINED

FIXED CHARGES AND PREFERRED STOCK DIVIDENDS

The ratios of earnings to fixed charges and earnings to combined fixed

charges and preferred stock dividends for each of the periods set forth below have been completed on a consolidated basis and should be read in conjunction with Devon’s consolidated financial statements, including the accompanying notes

thereto, incorporated by reference in this prospectus.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year Ended December 31, |

|

|

Nine Months

Ended |

|

| |

|

2009 |

|

|

2010 |

|

|

2011 |

|

|

2012 |

|

|

2013 |

|

|

2014 |

|

| |

|

|

|

|

|

|

|

(Dollars in millions) |

|

|

|

|

| Ratio of earnings to fixed charges |

|

|

N/A |

|

|

|

8.71 |

|

|

|

10.74 |

|

|

|

N/A |

|

|

|

1.29 |

|

|

|

9.77 |

|

| Ratio of earnings to combined fixed charges and preferred stock dividends |

|

|

N/A |

|

|

|

8.71 |

|

|

|

10.74 |

|

|

|

N/A |

|

|

|

1.29 |

|

|

|

9.77 |

|

| Insufficiency of earnings to cover fixed charges |

|

$ |

4,574 |

|

|

|

N/A |

|

|

|

N/A |

|

|

$ |

319 |

|

|

|

N/A |

|

|

|

N/A |

|

| Insufficiency of earnings to cover combined fixed charges and preferred stock dividends |

|

$ |

4,574 |

|

|

|

N/A |

|

|

|

N/A |

|

|

$ |

319 |

|

|

|

N/A |

|

|

|

N/A |

|

N/A

means not applicable.

Our ratios of earnings to fixed charges and earnings to combined fixed charges and preferred stock

dividends were computed based on:

| |

• |

|

“earnings,” which consist of earnings from continuing operations before income taxes, plus fixed charges;

|

| |

• |

|

“fixed charges,” which consist of interest expense and one-third of rental expense estimated to be attributable to interest; and

|

| |

• |

|

“preferred stock dividends,” which consist of the amount of pre-tax earnings required to pay dividends on the outstanding preferred

stock. |

DESCRIPTION OF CAPITAL STOCK

General

Devon’s

authorized capital stock consists of:

| |

• |

|

1.0 billion shares of common stock, par value $0.10 per share, and |

| |

• |

|

4.5 million shares of preferred stock, par value $1.00 per share. |

As of November 30, 2014, there were 409,147,482 shares of common stock outstanding and no shares of preferred stock outstanding.

Common Stock

Holders of common stock will be entitled to receive dividends out of legally available funds when and if declared by our board of

directors. Subject to the rights of the holders of any outstanding shares of preferred stock, holders of shares of common stock will be entitled to cast one vote for each share held of record on all matters submitted to a vote of stockholders. They

will not be entitled to cumulative voting rights for the election of directors. The shares of common stock have no preemptive, conversion or other rights to subscribe for or purchase any of our securities. Upon our liquidation or dissolution, the

holders of shares of common stock are entitled to share ratably in any of our assets that remain after payment or provision for payment to creditors and holders of preferred stock.

3

Preferred Stock

The preferred stock may be issued in one or more series. Our board may establish attributes of any series, including the designation and number of shares in the series, dividend rates (cumulative or

noncumulative), voting rights, redemptions, conversion or preference rights, and any other rights and qualifications, preferences and limitations or restrictions on shares of a series. The issuance of preferred stock may have the effect of delaying,

deferring or preventing a change in control of Devon without any vote or action by the stockholders and may adversely affect the voting and other rights of the holders of shares of common stock. The specific terms of a particular series of preferred

stock will be described in a certificate of designation relating to that series.

Series A Junior Participating Preferred

Stock. We have designated 2.9

million shares of preferred stock as series A junior participating preferred stock.

DESCRIPTION OF

UNDESIGNATED PREFERRED STOCK

This summary of the undesignated preferred stock discusses terms and conditions that we

expect may apply to any series of the preferred stock that may be offered under this prospectus. The applicable prospectus supplement will describe the particular terms of each series of preferred stock actually offered. If indicated in the

prospectus supplement, the terms of any series may differ from the terms described below.

We expect the prospectus supplement

for any preferred stock that we actually offer pursuant to this prospectus to include some or all of the following terms:

| |

• |

|

the designation of the series of preferred stock; |

| |

• |

|

the number of shares of preferred stock offered, the liquidation preference per share and the offering price of the preferred stock;

|

| |

• |

|

the dividend rate or rates of the shares, the method or methods of calculating the dividend rate or rates, the dates on which dividends, if declared,

will be payable, and whether or not the dividends are to be cumulative and, if cumulative, the date or dates from which dividends shall be cumulative; |

| |

• |

|

the amounts payable on shares of the preferred stock in the event of our voluntary or involuntary liquidation, dissolution or winding up;

|

| |

• |

|

the redemption rights and price or prices, if any, for the shares of preferred stock; |

| |

• |

|

the terms, and the amount, of any sinking fund or analogous fund providing for the purchase or redemption of the shares of preferred stock;

|

| |

• |

|

any restrictions on our ability to make payments on any of our capital stock if dividend or other payments are not made on the preferred stock;

|

| |

• |

|

any voting rights granted to the holders of the shares of preferred stock in addition to those required by Delaware law or our certificate of

incorporation; |

| |

• |

|

whether the shares of preferred stock will be convertible into shares of our common stock or any other class of our capital stock, and, if convertible,

the conversion price or prices, and any adjustment or other terms and conditions upon which the conversion shall be made; |

| |

• |

|

any other rights, preferences, restrictions, limitations or conditions relative to the shares of preferred stock permitted by Delaware law or our

certificate of incorporation; |

| |

• |

|

any listing of the preferred stock on any securities exchange; and |

| |

• |

|

the federal income tax considerations applicable to the preferred stock. |

4

Subject to our certificate of incorporation and to any limitations imposed by any then

outstanding preferred stock, we may issue additional series of preferred stock, at any time or from time to time, with such powers, preferences, rights and qualifications, limitations or restrictions as our board of directors determines, and without

further action of the stockholders, including holders of our then outstanding preferred stock, if any.

DESCRIPTION OF DEBT SECURITIES

The following description of the debt securities sets forth certain general terms and

provisions of the debt securities to which this prospectus and any prospectus supplement may relate. The particular terms of any series of debt securities and the extent to which the general provisions may apply to a particular series of debt

securities will be described in a prospectus supplement relating to that series. References in this section to “Devon” mean Devon Energy Corporation and not its subsidiaries.

Any debt securities offered by this prospectus will be issued under one or more indentures between Devon and a trustee. We have

summarized selected provisions of the indentures below. Devon senior debt securities are to be issued under an indenture between Devon and UMB Bank, National Association, as trustee (the “Devon senior indenture”), which is incorporated by

reference as an exhibit to the registration statement of which this prospectus forms a part. Devon subordinated debt securities are to be issued under an indenture (the “Devon subordinated indenture”), which is incorporated by reference as

an exhibit to the registration statement of which this prospectus forms a part. The Devon senior indenture and the Devon subordinated indenture are sometimes referred to herein, collectively, as the “indentures” and each, individually, as

an “indenture.” You should read the indentures for provisions that may be important to you.

Because we have

included only a summary of the indenture terms, you must read the indentures in full to understand every detail of the terms of the debt securities.

The indentures will not limit the amount of debt securities we may issue under them, and will provide that additional debt securities of any series may be issued up to the aggregate principal amount that

we authorize from time to time.

Unless otherwise indicated in the applicable prospectus supplement, we will issue the debt

securities in denominations of $2,000 and in integral multiples of $1,000 in excess thereof.

Principal and any premium and

interest in respect of the debt securities will be payable, and the debt securities will be transferable, at the corporate trust office of the trustee, unless we specify otherwise in the applicable prospectus supplement. At our option, however, we

may pay interest by mailing checks to the registered holders of the debt securities at their registered addresses.

We will

describe any special U.S. federal income tax and other considerations relating to the debt securities in the applicable prospectus supplement.

General

The prospectus

supplement relating to the particular series of debt securities being offered will specify the amounts, prices and terms of those debt securities. These terms may include:

| |

• |

|

the designation, aggregate principal amount and authorized denominations of the debt securities; |

| |

• |

|

the date or dates on which the debt securities will mature; |

| |

• |

|

the percentage of the principal amount at which the debt securities will be issued; |

| |

• |

|

the date on which the principal of the debt securities will be payable; |

5

| |

• |

|

the terms of the subordination of any series of Devon subordinated debt securities; |

| |

• |

|

whether the debt securities will be issued as registered securities, bearer securities or a combination of the two; |

| |

• |

|

whether the debt securities will be issued in the form of one or more global securities and whether such global securities will be issued in a

temporary global form or permanent global form; |

| |

• |

|

the currency or currencies or currency unit or units of two or more currencies in which debt securities are denominated, for which they may be

purchased, and in which principal and any premium and interest is payable; |

| |

• |

|

whether the currency or currencies or currency unit or units for which debt securities may be purchased or in which principal and any premium interest

may be paid is at our election or at the election of a purchaser, the manner in which an election may be made and its terms; |

| |

• |

|

the annual rate or rates, which may be fixed or variable, or the method of determining the rate or rates at which the debt securities will bear any

interest, whether by remarketing, auction, formula or otherwise; |

| |

• |

|

the date or dates from which any interest will accrue and the date or dates on which such interest will be payable; |

| |

• |

|

a description of any provisions providing for redemption, exchange or conversion of the debt securities at our option, at holder’s option or

otherwise, and the terms and provisions of such a redemption, exchange or conversion; |

| |

• |

|

information with respect to book-entry procedures relating to global debt securities; |

| |

• |

|

any sinking fund terms; |

| |

• |

|

whether and under what circumstances we will pay “additional amounts,” as defined in the indenture, on the debt securities to any holder; the

term “interest,” as used in this prospectus, includes any additional amounts; |

| |

• |

|

any events of default or covenants of Devon with respect to the debt securities of a certain series that are different from those described in this

prospectus; |

| |

• |

|

whether and under what circumstances any covenants in the indenture shall be subject to covenant defeasance; |

| |

• |

|

any deletions from, or modifications or additions to, the provisions of the indenture relating to satisfaction and discharge in respect of the debt

securities; |

| |

• |

|

any index or other method used to determine the amount of payments of principal of and any premium and interest on the debt securities; and

|

| |

• |

|

any other specific terms of the debt securities. |

We are not obligated to issue all debt securities of any one series at the same time. The debt securities of any one series may not bear interest at the same rate or mature on the same date.

If we sell any of the debt securities for foreign currencies or foreign currency units or if the principal of, or any premium or interest

on, any series of debt securities is payable in foreign currencies or foreign currency units, we will describe the restrictions, elections, tax consequences, specific terms and other information with respect to those debt securities in the

applicable prospectus supplement.

Except as may be described in the applicable prospectus supplement, the indenture will not

limit our ability to incur indebtedness or afford holders of debt securities protection in the event of a decline in our credit quality or if we are involved in a takeover, recapitalization or highly leveraged or similar transaction. The prospectus

6

supplement relating to the particular series of debt securities, to the extent not otherwise described in this prospectus, will include any information with respect to any deletions from,

modifications of or additions to the covenants or events of default described below and contained in the indenture, including any addition of a covenant or other provision providing event risk or similar protection.

Unless otherwise indicated in the applicable prospectus supplement, Devon’s obligation to pay the principal of, and any premium and

interest on, its senior debt securities will be unsecured and will rank equally with all of Devon’s other unsecured unsubordinated indebtedness.

Interest Rates and Discounts

The debt securities will earn interest at a

fixed or floating rate or rates for the period or periods of time specified in the applicable prospectus supplement. Unless otherwise specified in the applicable prospectus supplement, the debt securities will bear interest on the basis of a 360-day

year consisting of twelve 30-day months.

We may sell debt securities at a substantial discount below their stated principal

amount, bearing no interest or interest at a rate that at the time of issuance is below market rates. We will describe the federal income tax consequences and special considerations that apply to those debt securities in the applicable prospectus

supplement.

Exchange, Registration and Transfer

Unless otherwise specified, debt securities of any series will be exchangeable for other debt securities of the same series and of like aggregate principal amount and tenor in different authorized

denominations.

You may present debt securities for registration of transfer, together with a duly executed form of transfer,

at the office of the security registrar or at the office of any transfer agent designated by us for that purpose with respect to any series of debt securities and referred to in the applicable prospectus supplement. This may be done without service

charge but upon payment of any taxes and other governmental charges as described in the indenture. The security registrar or the transfer agent will effect the transfer or exchange upon being satisfied with the documents of title and identity of the

person making the request. We may at any time designate additional transfer agents with respect to any series of debt securities.

In the event of any redemption, we will not be required to:

| |

• |

|

execute, register the transfer of or exchange debt securities of any series during a period beginning at the opening of business 15 days before any

selection of debt securities of that series to be redeemed and ending at the close of business on the day of mailing of the relevant notice of redemption; or |

| |

• |

|

execute, register the transfer of or exchange any debt security, or portion thereof, called for redemption, except the unredeemed portion of any debt

security being redeemed in part. |

Payment and Paying Agents

Unless we specify otherwise in the applicable prospectus supplement, we will pay the principal of, and any premium and interest on, debt

securities at the office of the paying agent or paying agents that we designate at various times. However, at our option, we may make interest payments by check mailed to the address, as it appears in the security register, of the person entitled to

the payments. Unless we specify otherwise in the applicable prospectus supplement, the Corporate Trust Office of the trustee in Kansas City, Missouri, will be designated as our sole paying agent for payments with respect to debt securities that are

issuable solely as registered securities.

7

All monies we pay to a paying agent for the payment of principal of, and any premium and

interest on, any debt security or coupon that remains unclaimed at the end of two years after becoming due and payable will be repaid to us. After that time, the holder of the debt security or coupon will look only to us for payments out of those

repaid amounts.

Global Securities

The debt securities of a series may be issued in whole or in part in the form of one or more global certificates that we will deposit with a depository identified in the applicable prospectus supplement,

or a custodian for such depository. Global securities may be issued in either registered or bearer form and in either temporary or permanent form. Unless and until it is exchanged in whole or in part for the individual debt securities it represents,

a global security may not be transferred except as a whole:

| |

• |

|

by the applicable depositary to a nominee of the depositary; |

| |

• |

|

by any nominee to the depositary itself or another nominee; or |

| |

• |

|

by the depositary or any nominee to a successor depositary or any nominee of the successor. |

We will describe the specific terms of the depositary arrangement with respect to a series of debt securities in the applicable

prospectus supplement. We anticipate that the following provisions will generally apply to depositary arrangements.

When we

issue a global security in registered form, the depositary for the global security or its nominee will credit, on its book-entry registration and transfer system, the respective principal amounts of the individual debt securities represented by that

global security to the accounts of participants that have accounts with the depositary. Those accounts will be designated by the dealers, underwriters or agents with respect to the underlying debt securities or by us if those debt securities are

offered and sold directly by us. Ownership of beneficial interests in a global security will be limited to participants or persons that may hold interests through participants. For interests of participants, ownership of beneficial interests in the

global security will be shown on records maintained by the applicable depositary or its nominee. For interests of persons other than participants, that ownership information will be shown on the records of participants. Transfer of that ownership

will be effected only through those records.

The laws of some states require that certain purchasers of securities take

physical delivery of securities in definitive form. These limits and laws may impair your ability to transfer beneficial interests in a global security.

As long as the depositary for a global security, or its nominee, is the registered owner of that global security, the depositary or nominee will be considered the sole owner or holder of the debt

securities represented by the global security for all purposes under the applicable indenture. Except as provided below, owners of beneficial interests in a global security:

| |

• |

|

will not be entitled to have any of the underlying debt securities registered in their names; |

| |

• |

|

will not receive or be entitled to receive physical delivery of any of the underlying debt securities in definitive form; and

|

| |

• |

|

will not be considered the owners or holders under the indenture relating to those debt securities. |

We will make payments of principal of, and any premium and interest on, individual debt securities represented by a global security

registered in the name of a depositary or its nominee to the depositary or its nominee as the registered owner of the global security representing such debt securities. Neither we, the trustee, any paying agent nor the registrar for the debt

securities will be responsible for any aspect of the records relating to or payments made by the depositary or any participants on account of beneficial interests of the global security.

8

We expect that the depositary or its nominee, upon receipt of any payment of principal,

premium or interest relating to a permanent global security representing any series of debt securities, immediately will credit participants’ accounts with the payments. Those payments will be credited in amounts proportional to the respective

beneficial interests of the participants in the principal amount of the global security as shown on the records of the depositary or its nominee. We also expect that payments by participants to owners of beneficial interests in the global security

held through those participants will be governed by standing instructions and customary practices. This is now the case with securities held for the accounts of customers in bearer form or registered in “street name.” Those payments will

be the sole responsibility of those participants.

If the depositary for a series of debt securities is at any time unwilling,

unable or ineligible to continue as depositary and we do not appoint a successor depositary within 90 days, we will issue individual debt securities of that series in exchange for the global security or securities representing that series. In

addition, we may at any time in our sole discretion determine not to have any debt securities of a series represented by one or more global securities. In that event, we will issue individual debt securities of that series in exchange for the global

security or securities. Further, if we specify, an owner of a beneficial interest in a global security may, on terms acceptable to us, the trustee and the applicable depositary, receive individual debt securities of that series in exchange for those

beneficial interests. The foregoing is subject to any limitations described in the applicable prospectus supplement. In that instance, the owner of the beneficial interest will be entitled to physical delivery of individual debt securities equal in

principal amount to the beneficial interest and to have the debt securities registered in its name. Those individual debt securities will be issued in denominations, unless we specify otherwise, of $2,000 and in integral multiples of $1,000 in

excess thereof.

For a description of the depositary arrangements for global securities held by The Depository Trust Company,

also known as DTC, see “Book-Entry Securities.”

Events of Default

Unless otherwise specified in the applicable prospectus supplement, any one of the following events will constitute an “event of

default” under the indentures with respect to the debt securities of any series issued under the indentures:

| |

• |

|

if we fail to pay any interest on any debt security of that series when due, and the failure continues for 30 days; |

| |

• |

|

if we fail to pay principal of, or any premium on, the debt securities of that series when due and payable, either at maturity or otherwise;

|

| |

• |

|

if we fail to perform or we breach any of our other covenants or warranties in the applicable indentures or in the debt securities of that series,

other than a covenant or warranty included in the applicable indenture solely for the benefit of a series of securities other than the debt securities of that series, and that breach or failure continues for 60 days (subject to extension under

certain circumstances for another 120 days) after written notice as provided in the applicable indenture; |

| |

• |

|

certain events of bankruptcy, insolvency or reorganization involving us or certain of our subsidiaries; and |

| |

• |

|

any other event of default provided with respect to the debt securities of that series. |

If we fail to pay the principal of, or premium or interest on, the debt securities of any series or we fail to perform or breach any of

the other covenants or warranties applicable to the debt securities of that series but not applicable to all outstanding debt securities, and such event of default is continuing, either the trustee or the holders of not less than 25% in aggregate

principal amount of the outstanding debt securities of that series may declare the principal amount of, and any premium and interest on, the debt securities of that series to be due and payable immediately. If an event of default occurs due to

default in the performance of any other of the covenants and warranties applicable to all outstanding debt securities or pertaining to certain events of

9

bankruptcy, insolvency or reorganization, and the event of default is continuing, either the trustee or the holders of not less than 25% in principal amount of all debt securities then

outstanding (considered as one class), may declare the principal amount of, and any premium and interest on, all debt securities to be due and payable immediately. There is no automatic acceleration, even in the event of our bankruptcy, insolvency

or reorganization. At any time after a declaration of acceleration has been made, but before a judgment or decree for payment of money has been obtained by the trustee, we may cause such declaration of acceleration to be rescinded and annulled with

respect to the debt securities of any series if we deposit with the trustee an amount sufficient to pay all overdue interest on the debt securities of that series, the principal of and premium, if any, on the debt securities of that series that have

become due and payable otherwise than by such declaration of acceleration and all amounts due to the trustee and if all other events of default with respect to the debt securities of that series have been cured or waived.

Within 90 days after the occurrence of any event of default under the indentures with respect to the debt securities of any series issued

under that indenture, the trustee must transmit notice of the event of default to the holders of the debt securities of that series unless the event of default has been cured or waived. The trustee may withhold the notice, however, except in the

case of a payment default, if and so long as the board of directors, the executive committee or a trust committee of directors or responsible officers of the trustee has in good faith determined that the withholding of the notice is in the interest

of the holders of debt securities of that series.

If an event of default occurs and is continuing with respect to the debt

securities of any series, the trustee may in its discretion proceed to protect and enforce its rights and the rights of the holders of debt securities of that series by all appropriate judicial proceedings.

Subject to the duty of the trustee during any default to act with the required standard of care, the trustee is under no obligation to

exercise any of its rights or powers under the indenture at the request or direction of any of the holders of debt securities issued under that indenture, unless the holders offer the trustee reasonable indemnity. Subject to indemnifying the

trustee, and subject to applicable law and certain other provisions of the indenture, the holders of a majority in aggregate principal amount of the outstanding debt securities of a series issued under that indenture may direct the time, method and

place of conducting any proceeding for any remedy available to the trustee, or exercising any trust or power conferred on the trustee, with respect to the debt securities of that series.

Defeasance

Unless the applicable prospectus supplement provides otherwise,

any debt securities, or portion of the principal amount of the debt securities, will be deemed to have been paid for purposes of the applicable indentures, and, at our election, our entire indebtedness with respect to the debt securities, or portion

thereof, will be deemed to have been satisfied and discharged, if we have irrevocably deposited with the trustee or any paying agent other than us, in trust, money, certain eligible obligations, as defined in the applicable indentures, or a

combination of the two, sufficient to pay principal of and any premium and interest due and to become due on the debt securities or portions thereof.

The applicable prospectus supplement will describe, if applicable, our ability to be released from any of our covenant obligations under the indentures.

Modification and Waiver

The trustee under a particular indenture and Devon may, without the consent of holders, modify or waive provisions of that indenture for

certain purposes, including, among other things, curing ambiguities and maintaining the qualification of the applicable indenture under the Trust Indenture Act of 1939, as amended. The trustee under a particular indenture and Devon may modify or

waive certain provisions of that indenture with the consent of the holders of not less than a majority in aggregate principal amount of the debt securities of each

10

series issued under that indenture affected by the modification or waiver. However, the provisions of any indenture may not be waived or modified without the consent of the holders of each debt

security affected thereby if the modification or waiver would:

| |

• |

|

change the stated maturity of the principal of, or any installment of principal of or interest on, any debt security issued under that indenture;

|

| |

• |

|

reduce the principal amount of, or interest on, any debt security issued under the indenture, or change the method of calculating the interest on, or

reduce any premium payable upon the redemption of, any such debt security; |

| |

• |

|

change the coin or currency (or other property) in which any debt security issued under that indenture or any premium or any interest on that debt

security or any additional amounts with respect to that debt security is payable; |

| |

• |

|

impair the right to institute suit for the enforcement of any payment on or after the stated maturity of any debt securities issued under that

indenture or, in the case of redemption, on or after the redemption date; |

| |

• |

|

reduce the percentage and principal amount of the outstanding debt securities, the consent of the holders of which is required under that indenture in

order to take certain actions; or |

| |

• |

|

modify any of the provisions of Sections 12.02, 6.07 (6.06 in the case of the form of Devon subordinated indenture) and 8.13 of each indenture relating

to modifying the indenture, waiving certain covenants and waiving past defaults, respectively. |

The holders

of at least a majority in aggregate principal amount of outstanding debt securities of any series issued under an indenture may, on behalf of the holders of all debt securities of that series, waive our compliance with certain restrictive provisions

of that indenture. The holders of not less than a majority in aggregate principal amount of debt securities of any series issued under either of the indentures may, on behalf of all holders of debt securities of that series, waive any past default

and its consequences under that indenture with respect to the debt securities of that series, except:

| |

• |

|

a payment default with respect to debt securities of that series; or |

| |

• |

|

a default of a covenant or provision of that indenture that cannot be modified or amended without the consent of the holder of the debt securities of

that series. |

Consolidation, Merger and Sale of Assets

We may not consolidate with or merge into, or convey, transfer or lease our properties and assets substantially as an entirety to, any

person (as defined in the applicable indenture) unless:

| |

• |

|

the entity formed by the consolidation or into which we are merged, or the person which acquires by conveyance or transfer, or which leases,

substantially all of our properties and assets: |

| |

• |

|

is organized and validly existing under the laws of the United States, any domestic jurisdiction or the District of Columbia; and

|

| |

• |

|

expressly assumes our obligations on the debt securities and under the applicable indenture; |

| |

• |

|

immediately after the transaction becomes effective, no event of default, and no event that would become an event of default, will have occurred and be

continuing; and |

| |

• |

|

we have delivered to the trustee an officer’s certificate and opinion of counsel as provided in the applicable indenture.

|

11

Covenants

Unless otherwise specified in the prospectus supplement, the following covenants will apply to the senior debt securities issued by Devon. Various capitalized terms used within this “Covenants”

subsection are defined at the end of this subsection.

Liens

Neither Devon nor any of its Restricted Subsidiaries may incur, issue, assume or guarantee any Debt that is secured by a Mortgage on any

Principal Property or on any shares of stock or Indebtedness of any Restricted Subsidiary of Devon, without first effectively providing that the securities (together with, if Devon so determines, any other indebtedness of Devon or its Restricted

Subsidiaries that is not subordinate in right of payment to the prior right of payment in full of the securities) will be secured equally and ratably with, or prior to, the incurred, issued, assumed or guaranteed secured Debt, for so long as this

secured Debt remains so secured.

This limitation on the incurrence, issuance, assumption or guarantee of any Debt secured by

a Mortgage will not apply to, and there will be excluded from any secured Debt in any computation under this covenant, Debt secured by:

| |

• |

|

Mortgages existing at the date of the indenture; |

| |

• |

|

Mortgages on property of, or on any shares of stock or Indebtedness of, any entity existing at the time the entity is merged into or consolidated with

Devon or becomes a Restricted Subsidiary of Devon; |

| |

• |

|

Mortgages in favor of Devon or any of its Restricted Subsidiaries; |

| |

• |

|

Mortgages securing only Debt owed by one of our Restricted Subsidiaries to us and/or to one or more of our other Restricted Subsidiaries;

|

| |

• |

|

Mortgages on property, shares of stock or Indebtedness: |

(a) existing at the time of acquisition thereof, including acquisitions through merger, consolidation or other

reorganization;

(b) to secure the payment of all or any part of the purchase price thereof or construction

thereon; or

(c) to secure any Debt incurred prior to, at the time of, or within one year after the later of

the acquisition, the completion of construction or the commencement of full operation of the property or within one year after the acquisition of the shares or Indebtedness for the purpose of financing all or any part of the purchase price thereof

or construction thereon;

provided that, if a commitment for the financing is obtained prior to or within this one-year period,

the applicable Mortgage will be deemed to be included in this clause whether or not the Mortgage is created within this one-year period;

| |

• |

|

Mortgages in favor of the United States, any state thereof, Canada, or any province thereof, or any department, agency or instrumentality or political

subdivision of any of the foregoing, or in favor of any other country or any political subdivision thereof; |

| |

• |

|

Mortgages on minerals or geothermal resources in place, or on related leasehold or other property interests, that are incurred to finance development,

production or acquisition costs, including, but not limited to, Mortgages securing advance sale obligations; |

| |

• |

|

Mortgages on equipment used or usable for drilling, servicing or operating oil, gas, coal or other mineral properties or geothermal properties;

|

| |

• |

|

Mortgages required by any contract or statute in order to permit Devon or any of its subsidiaries to perform any contract or subcontract made with or

at the request of the United States, any state thereof, Canada, any province thereof, or in favor of any other country or any political subdivision thereof, or any department, agency or instrumentality of any of the foregoing;

|

12

| |

• |

|

any Mortgage resulting from the deposit of moneys or evidence of indebtedness in trust for the purpose of defeasing Debt of Devon or any of its

Restricted Subsidiaries or secured Debt of Devon or any of its Restricted Subsidiaries the net proceeds of which are used, substantially concurrent with the funding thereof, and taking into consideration, among other things, required notices to be

given to the holders of the outstanding securities in connection with the refunding, refinancing or repurchase thereof, and the required corresponding durations thereof, to refund, refinance or repurchase all of the outstanding securities, including

the amount of all accrued interest thereon and reasonable fees and expenses and premiums, if any, incurred by Devon or any of its Restricted Subsidiaries in connection therewith; |

| |

• |

|

any “Ordinary Course Mortgages” arising, and only so long as continuing, in the ordinary course of our business; and

|

| |

• |

|

any extension, renewal or replacement, or successive extensions, renewals or replacements, of any Mortgage referred to in the foregoing clauses of this

covenant, so long as the extension, renewal or replacement Mortgage is limited to all or a part of the same property, including any improvements on the property, shares of stock or Indebtedness that secured the Mortgage so extended, renewed or

replaced. |

Notwithstanding anything mentioned above, Devon and any one or more of its Restricted

Subsidiaries may incur, issue, assume or guarantee Debt secured by Mortgages that would otherwise be subject to the above restrictions if the aggregate amount of the Debt secured by the Mortgages, together with the outstanding principal amount of

all other secured Debt of Devon and its Restricted Subsidiaries that would otherwise be subject to the above restrictions, does not exceed 15% of Consolidated Net Tangible Assets.

The following transactions shall not be deemed to create Debt secured by a Mortgage:

| |

• |

|

the sale or other transfer of oil, gas, coal or other minerals in place for a period of time until, or in an amount such that, the transferee will

realize therefrom a specified amount of money, however determined, or a specified amount of oil, gas, coal or other minerals, or the sale or other transfer of any other interest in property of the character commonly referred to as an oil, gas, coal

or other mineral payment or a production payment, and including, in any case, overriding royalty interests, net profit interests, reversionary interests and carried interests and other similar burdens on production; and |

| |

• |

|

the sale or other transfer by Devon or any of its Restricted Subsidiaries of properties to a partnership, joint venture or other entity whereby Devon

or the Restricted Subsidiary would retain partial ownership of the properties. |

Definitions

“Consolidated Net Tangible Assets” means, calculated as of the date of the financial statements for the most recently

ended fiscal quarter or fiscal year, as applicable, prior to the date of determination, the aggregate amount of assets of Devon, less applicable reserves and other properly deductible items but including investments in non-consolidated entities,

after deducting therefrom:

| |

• |

|

all current liabilities, excluding any portion thereof constituting Funded Debt by reason of being renewable or extendible at the option of the obligor

beyond 12 months from the date of determination; and |

| |

• |

|

all goodwill, trade names, trademarks, patents, unamortized debt discount and expenses and other like intangibles, all as set forth on a consolidated

balance sheet of Devon and computed in accordance with accounting principles generally accepted in the United States. |

“Debt” means indebtedness for money borrowed.

13

“Funded Debt” means all Debt of Devon or any of its subsidiaries for money

borrowed which is not by its terms subordinated in right of payment to the prior payment in full of the securities or to Devon’s full and unconditional guarantee in respect thereof, as applicable, having a maturity of more than 12 months from

the date as of which the amount thereof is to be determined or having a maturity of fewer than 12 months but by its terms being:

| |

• |

|

renewable or extendible beyond 12 months from such date at the option of the obligor; or |

| |

• |

|

issued in connection with a commitment by a bank or other financial institution to lend so that the indebtedness is treated as though it had a maturity

in excess of 12 months pursuant to accounting principles generally accepted in the United States. |

“Indebtedness” means Debt and the deferred purchase price of property or assets purchased.

“Mortgage” means and includes any mortgage, pledge, lien, security interest, conditional sale or other title retention

agreement or other similar encumbrance.

“Offshore” means the lands beneath the navigable waters of the U.S.

or Canada, or the continental shelf of the U.S. or Canada.

“Ordinary Course Mortgages” means:

| |

• |

|

Mortgages for taxes, assessments or governmental charges or levies on the property of Devon or any Restricted Subsidiary if the same shall not at the

time be delinquent or thereafter can be paid without penalty, or are being contested in good faith and by appropriate proceedings and for which adequate reserves in accordance with generally accepted accounting principles shall have been set aside

on Devon’s books; |

| |

• |

|

Mortgages imposed by law, such as carriers’, warehousemen’s, landlords’ and mechanics’ liens and other similar liens arising in the

ordinary course of business which secure obligations not more than 60 days past due or which are being contested in good faith by appropriate proceedings and for which adequate reserves in accordance with generally accepted accounting principles

shall have been set aside on Devon’s books; |

| |

• |

|

Mortgages arising out of pledges or deposits under worker’s compensation laws, unemployment insurance, old age pensions, or other social security

or retirement benefits, or similar legislation; |

| |

• |

|

Utility easements, building restrictions and such other encumbrances or charges against real property as are of a nature generally existing with

respect to properties of a similar character and which do not in any material way affect the marketability of the same or interfere with the use thereof in the business of Devon or any Restricted Subsidiary, as the case may be;

|

| |

• |

|

Mortgages arising under operating agreements or similar agreements in respect of obligations which are not yet due or which are being contested in good

faith by appropriate proceedings; |

| |

• |

|

Mortgages reserved in oil, gas and/or mineral leases for bonus or rental payments and for compliance with the terms of such leases;

|

| |

• |

|

Mortgages pursuant to partnership agreements, oil, gas and/or mineral leases, farm-out-agreements, division orders, contracts for the sale, purchase,

exchange, or processing of oil, gas and/or other hydrocarbons, unitization and pooling declarations and agreements, operating agreements, development agreements, area of mutual interest agreements, forward sale agreements, oil and gas delivery

obligations, and other agreements which are customary in the oil, gas and other mineral exploration, development and production business and in the business of processing of gas and gas condensate production of the extraction of products therefrom;

|

| |

• |

|

Mortgages on personal property (excluding the capital stock or indebtedness of any Restricted Subsidiary) securing indebtedness maturing not more than

one year from the date of its creation; and |

14

| |

• |

|

Mortgages relating to a judgment or other court-ordered award or settlement as to which Devon has not exhausted its appellate rights.

|

“Principal Property” means any oil, gas or mineral producing property, or any refining,

processing, smelting or manufacturing facility located in the U.S., Canada or Offshore, other than:

| |

• |

|

property employed in transportation, distribution or marketing; |

| |

• |

|

information and electronic data processing equipment; or |

| |

• |

|

any property that, in the opinion of the Board of Directors of Devon, is not materially important to the total business conducted by Devon and its

subsidiaries as an entirety. |

“Restricted Subsidiary” means Devon Financing Company, L.L.C.

and any other subsidiary of Devon:

| |

• |

|

a substantial portion of the property of which is located, or a substantial portion of the business of which is carried on, within the U.S., Canada or

Offshore; |

| |

• |

|

that owns or leases under a capital lease any Principal Property; and |

| |

• |

|

that has Stockholders’ Equity exceeding 5% of Consolidated Net Tangible Assets. |

“Stockholders’ Equity” means, with respect to any corporation, partnership, joint venture, association, joint stock

company, limited liability company, unlimited liability company, trust, unincorporated organization or government, or any agency or political subdivision thereof, stockholders’ equity, as computed in accordance with accounting principles

generally accepted in the United States.

The Trustee

We may appoint a separate trustee for any series of debt securities. In the description of a series of debt securities, the term “trustee” refers to the trustee appointed with respect to such

series of debt securities. The trustee may be a depository for funds and perform other services for, and may transact other banking business with, Devon and its subsidiaries in the normal course of business.

Subordination of Subordinated Debt Securities

Our obligations pursuant to any Devon subordinated debt securities will be unsecured and will be subordinate and junior in priority of payment to certain of our other indebtedness to the extent described

in a prospectus supplement. The Devon subordinated indenture does not limit the amount of senior indebtedness we may incur. It also does not limit us from issuing any other secured or unsecured debt.

15

BOOK-ENTRY SECURITIES

Unless otherwise specified in the applicable prospectus supplement, we will issue securities, other than our common stock, to investors

in the form of one or more book-entry certificates registered in the name of a depository or a nominee of a depository. Unless otherwise specified in the applicable prospectus supplement, the depository will be DTC. We have been informed by DTC that

its nominee will be Cede & Co., or Cede. Accordingly, Cede is expected to be the initial registered holder of all securities that are issued in book-entry form.

No person that acquires a beneficial interest in securities issued in book-entry form will be entitled to receive a certificate representing those securities, except as set forth in this prospectus or in

the applicable prospectus supplement. Unless and until definitive securities are issued under the limited circumstances described below, all references to actions by holders or beneficial owners of securities issued in book-entry form will refer to

actions taken by DTC upon instructions from its participants, and all references to payments and notices to holders or beneficial owners will refer to payments and notices to DTC or Cede, as the registered holder of such securities.

DTC has informed us that it is:

| |

• |

|

a limited-purpose trust company organized under New York banking laws; |

| |

• |

|

a “banking organization” within the meaning of the New York banking laws; |

| |

• |

|

a member of the Federal Reserve System; |

| |

• |

|

a “clearing corporation” within the meaning of the New York Uniform Commercial Code; and |

| |

• |

|

a “clearing agency” registered under the Securities Exchange Act. |

DTC has also informed us that it was created to:

| |

• |

|

hold securities for “participants;” and |

| |

• |

|

facilitate the computerized settlement of securities transactions among participants through computerized electronic book-entry changes in

participants’ accounts, thereby eliminating the need for the physical movement of securities certificates. |

Participants have accounts with DTC and include securities brokers and dealers, banks, trust companies and clearing corporations. Indirect access to the DTC system also is available to indirect

participants such as banks, brokers, dealers and trust companies that clear through or maintain a custodial relationship with a participant, either directly or indirectly.

Persons that are not participants or indirect participants but desire to buy, sell or otherwise transfer ownership of or interests in securities may do so only through participants and indirect

participants. Under the book-entry system, beneficial owners may experience some delay in receiving payments, as payments will be forwarded by our agent to Cede, a nominee for DTC. These payments will be forwarded to DTC’s participants, which

thereafter will forward them to indirect participants or beneficial owners. Beneficial owners will not be recognized by the applicable registrar, transfer agent, trustee or depositary as registered holders of the securities entitled to the benefits

of the certificate, the indenture or any deposit agreement. Beneficial owners that are not participants will be permitted to exercise their rights as an owner only indirectly through participants and, if applicable, indirect participants.

Under the current rules and regulations affecting DTC, DTC will be required to make book-entry transfers of securities among

participants and to receive and transmit payments to participants. Participants and indirect participants with whom beneficial owners of securities have accounts are also required by these rules to make book-entry transfers and receive and transmit

such payments on behalf of their respective account holders.

16

Because DTC can act only on behalf of participants, who in turn act only on behalf of other

participants or indirect participants, and on behalf of certain banks, trust companies and other persons approved by it, the ability of a beneficial owner of securities issued in book-entry form to pledge those securities to persons or entities that

do not participate in the DTC system may be limited due to the unavailability of physical certificates for the securities.

DTC has advised us that it will take any action permitted to be taken by a registered holder of any securities under the certificate, the

indenture or any deposit agreement only at the direction of one or more participants to whose accounts with DTC the securities are credited.

According to DTC, it has provided information with respect to DTC to its participants and other members of the financial community for informational purposes only and is not intended to serve as a

representation, warranty or contract modification of any kind.

Unless otherwise specified in the applicable prospectus

supplement, a book-entry security will be exchangeable for definitive securities registered in the names of persons other than DTC or its nominee only if:

| |

• |

|

DTC notifies us that it is unwilling or unable to continue as depository for the book-entry security or DTC ceases to be a clearing agency registered

under the Securities Exchange Act at a time when DTC is required to be so registered; or |

| |

• |

|

we execute and deliver to the applicable registrar, transfer agent, trustee and/or depositary an order complying with the requirements of the

certificate, the indenture or any deposit agreement that the book-entry security will be so exchangeable. |

Any book-entry security that is exchangeable in accordance with the preceding sentence will be exchangeable for securities registered in

such names as DTC directs.

If one of the events described in the immediately preceding paragraph occurs, DTC is generally

required to notify all participants of the availability through DTC of definitive securities. Upon surrender by DTC of the book-entry security representing the securities and delivery of instructions for re-registration, the registrar, transfer

agent, trustee or depositary, as the case may be, will reissue the securities as definitive securities. After reissuance of the securities, such persons will recognize the beneficial owners of such definitive securities as registered holders of

securities.

Except as described above:

| |

• |

|

a book-entry security may not be transferred except as a whole book-entry security by or among DTC, a nominee of DTC and/or a successor depository

appointed by us; and |

| |

• |

|

DTC may not sell, assign or otherwise transfer any beneficial interest in a book-entry security unless the beneficial interest is in an amount equal to

an authorized denomination for the securities evidenced by the book-entry security. |

None of Devon, the

trustees, any registrar and transfer agent or any depository, or any agent of any of them, will have any responsibility or liability for any aspect of DTC’s or any participant’s records relating to, or for payments made on account of,

beneficial interests in a book-entry security.

17

PLAN OF DISTRIBUTION

We may sell the securities through agents, underwriters or dealers, or directly to one or more purchasers without using underwriters or

agents.

We may designate agents who agree to use their reasonable efforts to solicit purchases for the period of their

appointment or to sell securities on a continuing basis.

If we use underwriters for a sale of securities, the underwriters

will acquire the securities for their own accounts. The underwriters may resell the securities in one or more transactions, including negotiated transactions, at a fixed public offering price or at varying prices determined at the time of sale. The

obligations of the underwriters to purchase the securities will be subject to the conditions set forth in the applicable underwriting agreement. The underwriters will be obligated to purchase all the securities offered if any of those securities are

purchased. Any initial public offering price and any discounts or concessions allowed or re-allowed or paid to dealers will be described in the applicable prospectus supplement and may be changed from time to time.

Underwriters, dealers and agents that participate in the distribution of the securities may be underwriters as defined in the Securities

Act and any discounts or commissions they receive from us and any profit on their resale of the securities may be treated as underwriting discounts and commissions under the Securities Act. The applicable prospectus supplement will identify any

underwriters, dealers or agents and will describe their compensation. We may have agreements with the underwriters, dealers and agents to indemnify them against certain civil liabilities, including liabilities under the Securities Act. Underwriters,

dealers and agents may engage in transactions with or perform services for us or our subsidiaries in the ordinary course of their businesses.

Unless otherwise specified in the applicable prospectus supplement, each class or series of securities will be a new issue with no established trading market, other than the common stock, which is listed

on the New York Stock Exchange. We may elect to list any other class or series of securities on any exchange, but we are not obligated to do so. It is possible that one or more underwriters may make a market in a class or series of securities, but

the underwriters will not be obligated to do so and may discontinue any market making at any time without notice. We cannot give any assurance as to the liquidity of the trading market for any of the securities.

LEGAL MATTERS

Certain legal matters in connection with the securities will be passed upon for us by Skadden, Arps, Slate, Meagher & Flom LLP and for any underwriters by legal counsel named in the prospectus

supplement.

EXPERTS

The consolidated financial statements of Devon and its subsidiaries as of December 31, 2013 and 2012 and for each of the years in

the three-year period ended December 31, 2013, and management’s assessment of the effectiveness of internal control over financial reporting as of December 31, 2013, have been incorporated by reference herein in reliance upon the

report of KPMG LLP, independent registered public accounting firm, incorporated by reference herein, and upon the authority of said firm as experts in accounting and auditing.

Certain information with respect to Devon’s oil and gas reserves derived from the reports of LaRoche Petroleum Consultants, Ltd. and Deloitte LLP, independent consulting petroleum engineers, has been

incorporated by reference herein upon the authority of said firms as experts with respect to matters covered by such reports and in giving such reports.

18

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission. You

may read and copy any reports, statements or other information we file at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference

rooms. Our SEC filings are also available to the public from commercial document retrieval services and at the website maintained by the SEC at “http://www.sec.gov.”

We filed with the SEC a registration statement on Form S-3 with respect to the securities offered by this prospectus. This prospectus is a part of that registration statement. As allowed by SEC rules,

this prospectus does not contain all the information you can find in the registration statement or the exhibits to the registration statement. Instead, the SEC allows us to “incorporate by reference” information into this prospectus, which

means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, except for any information superseded by

information in, or incorporated by reference in, this prospectus.

This prospectus incorporates by reference the documents set

forth below that we have previously filed with the SEC. These documents contain important information about Devon.

| |

1. |

Our Annual Report on Form 10-K for the year ended December 31, 2013. |

| |

2. |

Our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2014, June 30, 2014 and September 30, 2014. |

| |

3. |

Our Definitive Proxy Statement filed April 22, 2014. |

| |

4. |