As filed with the Securities

and Exchange Commission on December 12 , 2014

Registration No.

333- 200457

UNITED STATES SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON D.C. 20549

____________________________

FORM S-1

AMENDMENT ONE

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

_____________________________

BIOHEART,

INC.

(Exact name of Registrant as specified in its

charter)

| Florida |

|

8731 |

|

65-0945967 |

| (State or other Jurisdiction |

|

|

|

|

| of

Incorporation or |

|

(Primary Standard Industrial |

|

(I.R.S. Employer |

| Organization) |

|

Classification Code Number) |

|

Identification No.)

|

13794 NW

4th Street,

Suite 212

Sunrise, Florida 33325

(954) 835-1500

(Address, including zip

code, and telephone number including area code, of Registrant’s principal

executive offices)

Mike Tomas, Chief

Executive Officer

Bioheart, Inc.

13794 NW

4th Street,

Suite 212

Sunrise, Florida 33325

(954) 835-1500

(Name, address, including

zip code, and telephone number, including area code, of agent for service)

Copies to:

Jill Arlene Robbins, P.A.

Jill Arlene Robbins

525-93rd Street

Surfside Florida, 33154

Telephone: (305) 531-1174

Facsimile: (305) 531-1274

Email:

jillarlene@jarepa.com

APPROXIMATE DATE OF

COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC:

From time to time after this Registration

Statement becomes effective.

If any of the securities

being registered on this Form are to be offered on a delayed or continuous basis

pursuant to Rule 415 under the Securities Act of 1933, as amended (the

“Securities Act”) check the following box: [X]

1

If this Form is filed to

register additional securities for an offering pursuant to Rule 462(b) under the

Securities Act, please check the following box and list the Securities Act

registration statement number of the earlier effective registration statement

for the same offering. [ ]

If this Form is a

post-effective amendment filed pursuant to Rule 462(c) under the Securities Act,

check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering.

[ ]

If this Form is a

post-effective amendment filed pursuant to Rule 462(d) under the Securities Act,

check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering.

[ ]

Indicate by check mark

whether the Registrant is a large accelerated filer, an accelerated filer, a

non-accelerated filer, or a small reporting company. See definitions of “large

accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule

12b-2 of the Exchange Act:

| Large accelerated filer [ ] |

Accelerated filer [ ] |

| Non-accelerated filer [ ] |

Smaller reporting company [ x ] |

| (Do

not check if a smaller reporting company) |

|

2

CALCULATION OF

REGISTRATION FEE

|

|

Proposed |

Proposed |

|

|

|

Maximum |

Maximum |

|

| Title of each class

of securities |

Amount to be |

Offering Price Per |

Aggregate |

Amount

of |

| to be Registered |

Registered

(1) |

Share |

Offering

Price |

Registration Fee |

| Common Stock, $.001 par

value |

87,812,591(2) |

$0.0161(6) |

$1,413,783 |

$164.28 |

| Common Stock, $.001 par

value |

31,000,000(3) |

$0.0161(6) |

$499,100 |

$58.00 |

| Common Stock, $.001 par

value |

9,109,128 (4) |

$0.0161(6) |

$146,657 |

$17.04 |

| Common Stock, $.001 par

value |

15,890,872(5) |

$0.0161(6) |

$255,843 |

$29.73 |

| Total |

143,812,591 |

$0.0161(6) |

$2,315,383 |

$269.05 (7) |

| |

(1) |

|

Represents shares

offered by the Selling Stockholder. Includes an indeterminable number of

additional shares of Common Stock, pursuant to Rule 416 under the

Securities Act that may be issued to prevent dilution from stock splits,

stock dividends or similar transaction that could affect the shares to be

offered by Selling Stockholder. |

|

(2) |

|

Consists of

87,812,591shares of Common Stock that we may issue to the Selling

Stockholder pursuant to draw downs under the Purchase Agreement with the

Selling Stockholder. |

|

(3) |

|

Consists of

31,000,000 shares of Common Stock issuable on conversion of convertible

promissory note held by the Selling Stockholder. |

|

(4) |

|

Consists of 9,109,128

shares of Common Stock issued to the Selling Stockholder as Initial

Commitment Shares as of October 27, 2014. |

|

(5) |

|

Consists of

15,890,872 shares of Common Stock issuable to the Selling Stockholder as

Additional Commitment Shares. |

|

(6) |

|

Estimated solely for

purposes of calculating the registration fee in accordance with Rule 457

under the Securities Act, using the average of the high and low prices as

reported on the OTC Markets marketplace on November 20th,

2014. |

|

(7) |

|

Previously paid. |

The Registrant hereby

amends this Registration Statement on such date or dates as may be necessary to

delay its effective date until the Registrant shall file a further amendment

which specifically states that this Registration Statement shall thereafter

become effective in accordance with Section 8(a) of the Securities Act or until

this Registration Statement shall become effective on such date as the

Commission, acting pursuant to said Section 8(a), may determine.

3

The information in this

Prospectus is not complete and may be changed. The Selling Stockholder may not

sell these securities until the Registration Statement filed with the Securities

and Exchange Commission is effective. This Prospectus is not an offer to sell

these securities and it is not soliciting an offer to buy these securities in

any state where the sale is not permitted.

PRELIMINARY PROSPECTUS,

SUBJECT TO COMPLETION, DATED ________, 2014

BIOHEART, INC.

143,813,591 Shares of

Common Stock (includes 9,109,128 shares issued October 27, 2014)

This prospectus relates to

the resale of up to 143,813,591 shares (includes 9,109,128 shares issued October 27,

2014) of our common stock, which may be offered by the

selling stockholder, Magna Equities II, LLC, a New York limited liability

company, or Magna. The shares of common stock being offered by the selling

stockholder are issuable (i) upon conversion of a senior convertible note in the

principal amount of $307,500, ( the “ Convertible Note ”) , that we issued to Magna

on October 7, 2014 and (ii) pursuant to a common stock purchase agreement dated

as of October 23, 2014 between us and Magna, or the Purchase

Agreement.

We are not selling any

securities under this prospectus and will not receive any of the proceeds from

the resale of shares of our common stock by the selling stockholder under this

prospectus, however, we have received gross proceeds of $205,000 from the sale

of the Convertible Note to Magna and we may receive gross proceeds of up to

$3,000,000 from sales of our common stock to Magna under the Purchase Agreement.

Magna may offer all or part

of the shares for resale from time to time through public or private

transactions, at either prevailing market prices or at privately negotiated

prices. We provide more information about how Magna may sell its shares of

common stock in the section titled “Plan of Distribution” on page 48. We will

pay the expenses incurred in connection with the offering described in this

prospectus, with the exception of brokerage expenses, fees, discounts and

commissions, which will be paid by the selling stockholder. Of 143,812,591

shares we issued 9,109,128 shares of our common stock to Magna as an initial

commitment fee for entering into the Purchase Agreement and we may issue

additional commitment shares to Magna under certain circumstances described in

this Prospectus. With respect to the shares of common stock that have been and

may be issued pursuant to the Purchase Agreement, Magna is an “underwriter”

within the meaning of Section 2(a) (11) of the Securities Act of 1933, as

amended, or the Securities Act, and with respect to any other shares of common

stock, Magna may be deemed to be an “underwriter” within the meaning of Section

2(a) (11) of the Securities Act.

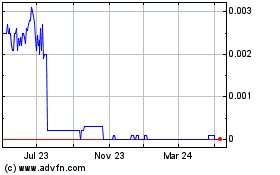

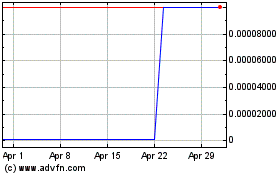

Our common stock is quoted

on the OTCQB Marketplace operated by OTC Markets Group Inc., or the OTCQB, under

the symbol “BHRT”. The last reported closing price of our common stock on the

OTCQB on December 11, 2014 was $0.0159 per share.

Investing in our common

stock involves a high degree of risk. Please see the sections entitled “Risk

Factors” on page 16 of this prospectus and “Part I—Item 1A Risk Factors” in our

Annual Report on Form 10-K for the year ended December 31, 2013.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or

disapproved of these securities, or determined if this prospectus is truthful or

complete. Any representation to the contrary is a criminal offense.

The date of this

prospectus is [_________], 2014.

You should rely only on the

information contained in this prospectus. We have not authorized any dealer,

salesperson or other person to provide you with information concerning us,

except for the information contained in this prospectus. The information

contained in this prospectus is complete and accurate only as of the date on the

front cover page of this prospectus, regardless of when the time of delivery of

this prospectus or the sale of any Common Stock occurs. The Selling Stockholder

may not sell the securities until the Registration Statement filed with the

Securities and Exchange Commission is effective. This prospectus is not an offer

to sell, nor is it a solicitation of an offer to buy, the Common Stock in any

jurisdiction in which the offer or sale is not permitted.

4

BIOHEART,

INC.

TABLE OF CONTENTS

| PART I: INFORMATION REQUIRED IN PROSPECTUS |

|

| Prospectus Summary |

6 |

| Risk

Factors |

16 |

| Cautionary Note Regarding

Forward-Looking Statements |

39 |

| Use

of Proceeds |

39 |

| Determination of Offering

Price |

40 |

| Selling Stockholder |

48 |

| Plan of Distribution |

48 |

| Description of Securities to be Registered |

73 |

| Interests of Named Experts and

Counsel |

74 |

| Legal Matters |

75 |

| Other Experts |

75 |

| Properties |

75 |

| Legal Proceedings |

76 |

| Market for Common Equity and Related Stockholder

Matters |

77 |

| Management’s Discussion and

Analysis of Financial Condition and Results of Operations |

77 |

| Directors and Executive Officers |

93 |

| Executive Compensation |

97 |

| Security Ownership of Certain Beneficial Owners and

Management |

102 |

| Certain Relationships, Related

Transactions and Director Independence |

105 |

| Disclosure of Commission Position on Indemnification for

Securities Act Liabilities |

107 |

| Where You Can Find More

Information |

107 |

| Index to Financial Statements |

108 |

| |

| PART II – INFORMATION NOT REQUIRED IN

PROSPECTUS |

110 |

| Other Expenses of Issuance and

Distribution |

110 |

| Indemnification of Directors and Officers |

110 |

| Recent Sales of Unregistered

Securities |

111 |

| Exhibits |

112 |

| Undertakings |

116 |

| Signatures |

119 |

You may only rely on the

information contained in this prospectus or that we have referred you to via

this prospectus. We have not authorized anyone to provide you with different or

further information. This prospectus does not constitute an offer to sell or a

solicitation of an offer to buy any securities other than the Common Stock

offered by this prospectus. This prospectus does not constitute an offer to sell

or a solicitation of an offer to buy any Common Stock in any circumstances in

which such offer or solicitation is unlawful. Neither the delivery of this

prospectus nor any sale made in connection with this prospectus shall, under any

circumstances, create any implication that there has been no change in our

affairs since the date of this prospectus or that the information contained

herein by reference thereto in this prospectus is correct as of any time after

its date.

5

PROSPECTUS SUMMARY

The following summary

highlights selected information contained in this prospectus. This summary does

not contain all the information you should consider before investing in the

Common Stock. Before making an investment decision, you should read the entire

prospectus carefully, including the "RISK FACTORS" section, the financial

statements and the notes to the financial statements. As used throughout this

Registration Statement and prospectus, the term “Registrant” refers to Bioheart,

Inc. and the terms "Company", "we," "us," or "our" refer to Bioheart, Inc. and

its consolidated subsidiaries unless the context otherwise requires.

Our Company

Overview

We are a biotechnology

company focused on the discovery, development and, subject to regulatory

approval, commercialization of autologous cell therapies for the treatment of

chronic and acute heart damage. Our lead product candidate is MyoCell, an

innovative clinical therapy designed to populate regions of scar tissue within a

patient’s heart with autologous muscle cells, or cells from a patient’s body,

for the purpose of improving cardiac function in chronic heart failure

patients.

Biotechnology Product

Candidates

Specific to biotechnology,

we are focused on the discovery, development and, subject to regulatory

approval, commercialization of autologous cell therapies for the treatment of

chronic and acute heart damage and peripheral vascular disease. MyoCell is a

clinical muscle-derived cell therapy designed to populate regions of scar tissue

within a patient’s heart with new living cells for the purpose of improving

cardiac function in chronic heart failure patients. Our most recent clinical

trials of MyoCell include the SEISMIC Trial, a completed 40-patient, randomized,

multicenter, controlled, Phase II-a study conducted in Europe and the MYOHEART

Trial, a completed 20-patient, multicenter, Phase I dose-escalation trial

conducted in the United States. We were approved by the U.S. Food and Drug

Administration (the “FDA”) to proceed with a 330-patient, multicenter Phase

II/III trial of MyoCell in North America and Europe (the “MARVEL Trial”). We

completed the MyoCell implantation procedure on the first patient in the MARVEL

Trial on October 24, 2007. Thus far, 20 patients, including 6 control patients,

have been treated. Initial results for the 20 patients were released at the

Heart Failure Society of American meeting in September, 2009, showing a

significant (35%) improvement in the 6 minute walk for those patients who were

treated, and no improvement for those who received a placebo. We are planning,

on the basis of these results, to request the FDA to consider the MARVEL Trial a

pivotal trial (pivotal from Phase II to Phase III) and to reduce the number of

patients in the trial to 150. No assurances can be provided that this request

will be approved. The SEISMIC, MYOHEART and MARVEL Trials have been designed to

test the safety and efficacy of MyoCell in treating patients with severe,

chronic damage to the heart. Upon regulatory approval of MyoCell, we intend to

generate revenue in the United States from the sale of MyoCell cell-culturing

services for treatment of patients by qualified physicians. Abroad, we are

identifying centers where it is already acceptable to use the Myocell treatment

so that greater numbers of patients with this problem can have access to

treatment.

We received approval from

the FDA in July of 2009 to conduct a Phase I safety study on 15 patients of a

combined therapy (Myocell with SDF-1), which we believe is the first approval of

a study combining gene and cell therapies. We initially commenced work on this

study, called the REGEN trial, during the first quarter of 2010. We suspended

activity on the trial in 2010 while seeking additional funding necessary to

conduct the trial. Work on the trial was reinitiated in 2011. Based on the

results of the trial, we intend to either incorporate the combined treatment

into the Marvel Trial, or continue with the Marvel Trial based on the use of

Myocell alone.

We are seeking to secure

sufficient funds to reinitiate enrollment in the MARVEL and REGEN trials. If we

successfully secure such funds, we intend to re-engage a contract research

organization, or CRO, investigators and certain suppliers to advance such

trials. We have initiated and enrolled our first patient in the MIRROR trial in

2013. The trial is very similar to the MARVEL trial but focusses on sites

outside the US. We will continue enrollment in the MIRROR trial once we have

secured sufficient funds.

6

In our pipeline, we have

multiple product candidates for the treatment of heart damage, including

autologous, adipose cell treatment for acute heart damage, chronic ischemia and

critical limb ischemia.

We hope to demonstrate that our

various product candidates are safe and effective complements to existing

therapies for chronic and acute heart damage as well as peripheral arterial

disease.

MyoCell/MyoCell

SDF-1

MyoCell is a clinical

therapy intended to improve cardiac function for those with congestive heart

failure and is designed to be utilized months or even years after a patient has

suffered severe heart damage due to a heart attack or other cause. We believe

that MyoCell has the potential to become a leading treatment for severe, chronic

damage to the heart due to its perceived ability to satisfy, at least in part,

what we believe to be an unmet demand for more effective and/or more affordable

therapies for chronic heart damage. MyoCell uses myoblasts, cells that are

precursors to muscle cells, from the patient’s own body. The myoblasts are

removed from a patient’s thigh muscle, isolated, grown through our proprietary

cell culturing process, and injected directly in the scar tissue of a patient’s

heart. A qualified physician performs this minimally invasive procedure using an

endoventricular catheter. We entered into an agreement with a Johnson &

Johnson company to use its NOGA® Cardiac Navigation System along with its

MyoStar™ injection catheter for the delivery of MyoCell in the MARVEL Trial.

When injected into scar

tissue within the heart wall, myoblasts have been shown to be capable of

engrafting in the damaged tissue and differentiating into mature skeletal muscle

cells. In a number of clinical and animal studies, the engrafted skeletal muscle

cells have been shown to express various proteins that are important components

of contractile function. By using myoblasts obtained from a patient’s own body,

we believe MyoCell is able to avoid certain challenges currently faced by other

types of cell-based clinical therapies including tissue rejection and instances

of the cells differentiating into cells other than muscle. Although a number of

therapies have proven to improve the cardiac function of a damaged heart, no

currently available treatment, to our knowledge, has demonstrated an ability to

generate new muscle tissue within the scarred regions of a heart.

We believe the market for

treating patients in NYHA Class II or NYHA Class III heart failure is

significant. According to the AHA Statistics and the European Society of

Cardiology Task Force for the Treatment of Chronic Heart Failure, in the United

States and Europe there are approximately 5.2 million and 9.6 million,

respectively, patients with heart failure. The AHA Statistics further indicate

that, after heart failure is diagnosed, the one-year mortality rate is high,

with one in five dying and that 80% of men and 70% of women under age 65 who

have heart failure will die within eight years. We believe that approximately

60% of heart failure patients are in either NYHA Class II or NYHA Class III

heart failure based upon a 1999 study entitled “Congestive Heart Failure Due to

Diastolic or Systolic Dysfunction – Frequency and Patient Characteristics in an

Ambulatory Setting” by Diller, PM, et. al.

MyoCell SDF-1 is intended

to be an improvement to MyoCell. MyoCell SDF-1 is similar to MyoCell except that

the myoblast cells to be injected for use in MyoCell SDF-1 will be modified

prior to injection by an adenovirus vector or non-viral vector so that they will

release extra quantities of the SDF-1 protein, which expresses angiogenic

factors. AdipoCell is a patient-derived cell therapy proposed for the treatment

of acute myocardial infarction, chronic heart ischemia, and lower limb ischemia.

We hope to demonstrate that these product candidates are safe and effective

complements to existing therapies for chronic and acute heart damage.

MyoCath

The MyoCath was developed

by Bioheart co-founder Robert Lashinski specifically for delivering new cells to

damaged tissue. It is a deflecting tip needle injection catheter that has a

larger needle which is 25 gauge for better flow rates and less leakage than

systems that are 27 gauge. This larger needle allows for thicker compositions to

be injected which helps with cell retention in the heart. Also, the MyoCath

needle has more fluoroscopic brightness than the normally used nitinol needle,

enabling superior visualization during the procedure. Seeing the needle well

during injections enables the physician who is operating the catheter to

pinpoint targeted areas more precisely, thus improving safety. The MyoCath competes well with other biological

delivery systems on price and efficiency and allows the physician to utilize

standard fluoroscopy and echo equipment found in every cath lab. The MyoCath is

used to inject cells into cardiac tissue in therapeutic procedures to treat

chronic heart ischemic and congestive heart failure. We are currently utilizing

a contract manufacturer to produce catheters as needed.

7

AdipoCell

Bioheart has successfully

completed various trials using adipose stem cells. We have completed the Phase 1 Angel Trial for AdipoCell

(adipose derived stem cells). Five patients were enrolled and treated in the

second quarter of 2013. At the twelve (12) month time point, patients

demonstrated a statistically significant average improvement in ejection

fraction (EF) by echocardiogram.

At the three (3) month time

point, 100% of the patients demonstrated either improvement or stayed the same.

After three (3) months, patients showed an average absolute improvement of 3

percentage points in EF. The patients continued to improve from 3 months to 6

months with a statistically significant average absolute improvement of 10

percentage points (p=0.01) and at the 12 month follow up patients showed this

same level of improvement (p=0.01) .

We have also initiated

several Institutional Review Board studies in 2013 using adipose derived stem

cells for various indications including dry macular degeneration, degenerative

disc disease, erectile dysfunction and chronic obstructive pulmonary disease.

In the second quarter of

2014, we announced the treatment of a patient in Honduras with congestive heart

failure using AdipoCell and MyoCell. This was the first patient treated in the

world using a combination of stem cells.

We have begun two clinical

trials in India. The first cardiac patient has successfully been enrolled and

treated in India using AdipoCell™ or adipose derived stem cells. The second

trial will involve the combination of AdipoCell and MyoCell® or muscle derived

stem cells for congestive heart failure patients. These trials are active and

ongoing

Trading Market

Our common stock, par value

$0.001 per share, commenced trading on February 19, 2008, on the NASDAQ Global

Market under the symbol “BHRT”. Effective June 11, 2008, we transferred the

listing of our common stock to the NASDAQ Capital Market and then, during the

course of 2009 our stock was delisted from NASDAQ and commenced quotation on the

OTC Markets under the symbol “BHRT.QB”.

Corporate Information

We were incorporated in

Florida in 1999 under the name Bioheart, Inc. and continue to be a Florida

corporation.

Our principal executive

offices are located at 13794 NW 4th Street, Suite 212, Sunrise,

Florida 33325. Our telephone number is (954) 835-1500.

Our website address is

www.bioheartinc.com. Our

website and the information contained on our website are not incorporated into

this prospectus or the Registration Statement of which it forms a part. Further,

our references to the URLs for our website are intended to be inactive textual

references only.

8

Recent

Developments

Senior Convertible

Note Financing with Magna Equities II, LLC

Note Purchase Agreement

and Convertible Note

On October 7, 2014, we entered into a securities purchase

agreement with Magna, which we refer to as the Note Purchase Agreement. The Note

Purchase Agreement provides that, upon the terms and subject to the conditions

set forth in the Note Purchase Agreement, Magna will purchase from us the

Convertible Note with an initial principal amount of $307,500 for a purchase

price of $205,000, representing an approximately 33.33% original issue discount.

We issued the Convertible Note to Magna on October 7, 2014.

$40,000 of the outstanding principal amount of the Convertible

Note (together with any accrued and unpaid interest with respect to such portion

of the principal amount) will be automatically extinguished (without any cash

payment by us) upon the filing of the registration statement of which this

prospectus is a part, following the closing of the Note Purchase Agreement . In

addition, $62,500 of the outstanding principal amount of the Convertible Note

(together with any accrued and unpaid interest with respect to such portion of

the principal amount) will be automatically extinguished (without any cash

payment by us) if (i) the registration statement of which this prospectus is a

part is declared effective by the SEC on or prior to the earlier of (A) the

120th calendar day after October 7, 2014 and (B) the fifth business

day after the date we are notified by the Securities and Exchange Commission, or

the Commission, that the registration statement will not be reviewed or will not

be subject to further review, and this prospectus is available for use by Magna

for the resale by Magna of all of the shares of our common stock issued or

issuable upon conversion of the Convertible Note and (ii) no event of default

under the Convertible Note or an event that with the passage of time or giving

of notice would constitute an event of default under the Convertible Note has

occurred on or prior to such date.

The Convertible Note

matures on August 7, 2015 and, in addition to the approximately 33.33% original

issue discount, accrues interest at the rate of 12% per year. The Convertible

Note is convertible at any time, in whole or in part, at Magna’s option into

shares of our common stock at a fixed conversion price of $0.01035 per share,

subject to adjustment pursuant to the “full ratchet” and standard anti-dilution

provisions contained in the Convertible Note. This conversion price represents a

discount of approximately 55% from the lowest trading price our common stock

during the five trading days prior to October 7, 2014, the date we issued the

Convertible Note to Magna. At no time will Magna be entitled to convert any

portion of the Convertible Note to the extent that after such conversion, Magna

(together with its affiliates) would beneficially own more than 4.99% of our

common stock (as calculated pursuant to Section 13(d) of the Securities Exchange

Act of 1934, as amended, or the Exchange Act, and the rules and regulations

thereunder).

The Convertible Note

includes customary event of default provisions, and provides for a default

interest rate of 18%. Upon the occurrence of an event of default, Magna may

require us to pay in cash the “Event of Default Redemption Price” which is

defined in the Convertible Note to mean the greater of (i) the product of (A)

the amount to be redeemed multiplied by (B) 140% (or 100% if an insolvency

related event of default) and (ii) the product of (X) the conversion price in

effect at that time multiplied by (Y) the product of (1) 140% (or 100% if an

insolvency related event of default) multiplied by (2) the greatest closing sale

price of our common stock on any trading day during the period commencing on the

date immediately preceding such event of default and ending on the date we make

the entire payment required to be made under this provision.

We have the right at any

time to redeem all, but not less than all, of the total outstanding amount then

remaining under the Convertible Note in cash at a price equal to 140% of the

total amount of the Convertible Note then outstanding.

The Note Purchase Agreement

contains customary representations, warranties and covenants by, among and for

the benefit of the parties. We also agreed to pay up to $30,000 of reasonable

attorneys' fees and expenses incurred by Magna in connection with the

transaction. The Note Purchase Agreement also provides for indemnification of

Magna and its affiliates in the event that Magna incurs losses, liabilities,

obligations, claims, contingencies, damages, costs and expenses related to a

breach by us of any of our representations, warranties or covenants under the

Note Purchase Agreement.

The issuance of the

Convertible Note to Magna under the Note Purchase Agreement was exempt from the

registration requirements of the Securities Act pursuant to the exemption for

transactions by an issuer not involving any public offering under Section 4(a)

(2) of the Securities Act and Rule 506 of Regulation D promulgated under the Securities Act.

9

Note Registration Rights

Agreement

In connection with the

execution of the Note Purchase Agreement, on October 7, 2014, we also

entered into a registration rights agreement with Magna , which we refer to as the Note

Registration Rights Agreement. Pursuant to the Note Registration Rights

Agreement, we agreed to file the registration statement of which this prospectus

is a part with the Commission to register for resale 31,000,000 shares of our

common stock into which the Convertible Note may be converted, and have it

declared effective at the earlier of (i) the 120th calendar day after

October 7, 2014 and (ii) the fifth business day after the date we are notified

by the Commission that the registration statement will not be reviewed or will

not be subject to further review.

We have agreed to file with

the Commission one or more additional registration statements to cover all of

the securities required to be registered under the Note Registration Rights

Agreement that are not covered by this prospectus, in each case, as soon as

practicable, but in no event later than the applicable filing deadline for such

additional registration statements as provided in the Note Registration Rights

Agreement.

We also agreed, among other

things, to indemnify Magna from certain liabilities and fees and expenses of

Magna incident to our obligations under the Note Registration Rights Agreement,

including certain liabilities under the Securities Act. Magna has agreed to

indemnify and hold harmless us and each of our directors, officers and persons

who control us against certain liabilities that may be based upon written

information furnished by Magna to us for inclusion in the registration statement

of which this prospectus is a part, including certain liabilities under the

Securities Act.

Equity Enhancement

Program with Magna Equities II, LLC

Common Stock Purchase

Agreement

On October 23, 2014, which

we refer to as the Closing Date, we entered into the Purchase Agreement with

Magna. The Purchase Agreement provides that, upon the terms and subject to the

conditions set forth therein, Magna is committed to purchase up to $3,000,000,

which we refer to as the Total Commitment, worth of our common stock, which we

refer to as the Shares, over the 24-month term of the Purchase Agreement.

From time to time over the

term of the Purchase Agreement, commencing on the trading day immediately

following the date on which the registration statement of which this prospectus

is a part is declared effective by the Commission, we may, in our sole

discretion, provide Magna with a draw down notice, each referred to as a Draw

Down Notice, to purchase a specified dollar amount of Shares, which we refer to

as the Draw Down Amount, with each draw down subject to the limitations

discussed below. The maximum dollar amount of Shares requested to be purchased

pursuant to any single Draw Down Notice cannot exceed the lesser of (i) 300% of

the average daily trading volume of our common stock for the 10 trading days

immediately preceding the date of the Draw Down Notice and (ii) $500,000, which

we refer to as the Maximum Draw Down Amount. We may not deliver any Draw Down

Notice to Magna if the Initial Purchase Price (described below) with respect to

the Shares subject to such Draw Down Notice is less than $0.0025 (subject to

adjustment for any stock splits, stock combinations, stock dividends,

recapitalizations and other similar transactions) as of the date the applicable

Draw Down Notice is received by Magna, which we refer to as the Draw Down

Exercise Date.

Once presented with a Draw

Down Notice, Magna is required to purchase the applicable Draw Down Amount at

the applicable “Purchase Price”, which is defined in the Purchase Agreement as

the lesser of:

- the Initial Purchase Price, which is defined as a price equal to 93% of

the lowest of (i) the arithmetic average of the three lowest daily volume

weighted average prices for our common stock, or VWAP, during the 10

consecutive trading days ending on the trading day immediately preceding the

applicable Draw Down Exercise Date, (ii) the arithmetic average of the three

lowest closing sale prices for our common stock during the 10 consecutive

trading days ending on the trading day immediately preceding the applicable Draw Down Exercise Date

and (iii) the closing sale price for our common stock on the trading day

immediately preceding the applicable Draw Down Exercise Date (in each case, to

be appropriately adjusted for any stock splits, stock combinations, stock

dividends, recapitalizations and other similar transactions); and

10

- the True-Up Purchase Price, which is

defined as a price equal to 93% of the arithmetic average of the three lowest

daily VWAPs during the applicable True-Up Pricing Period (described below) (to

be appropriately adjusted for any stock splits, stock combinations, stock

dividends, recapitalizations and other similar transactions), provided that in

no event will the True-Up Purchase Price be less than $0.001.

Accordingly, because the

Purchase Price for Shares subject to any Draw Down Notice is the lesser of the

Initial Purchase Price and the True-Up Purchase Price, and since we cannot

deliver any Draw Down Notice to Magna if the Initial Purchase Price would be

less than $0.0025, the Purchase Price for Shares subject to any Draw Down Notice

will never be less than $0.001 per Share.

The applicable settlement

date, or Settlement Date, with respect to a Draw Down Notice will occur within

one trading day following the Draw Down Exercise Date. On the applicable

Settlement Date for a draw down, we will issue to Magna a number of Shares,

rounded to the nearest whole Share, equal to (i) the Draw Down Amount that we

requested from Magna, divided by (ii) the applicable Initial Purchase Price,

against simultaneous payment by Magna to us in an amount equal to (A) the number

of Shares we issued to Magna on the Settlement Date, multiplied by (B) the

applicable Initial Purchase Price.

With respect to a Draw Down

Notice, on the trading day, which we refer to as the True-Up Date, immediately

following the eight-consecutive trading day period commencing on the trading day

immediately following the applicable Settlement Date for such Draw Down Notice,

which we refer to as the True-Up Pricing Period, a calculation of the True-Up

Purchase Price and the Purchase Price will occur. On the Trading Day immediately

following the True-Up Date, which we refer to as the True-Up Settlement Date, we

will issue to Magna the Additional Shares, if any, in respect of the applicable

Draw Down Notice. “Additional Shares” is defined in the Purchase Agreement as a

number of Shares (to be appropriately adjusted for any stock splits, stock

combinations, stock dividends, recapitalizations and other similar

transactions), rounded to the nearest whole Share, equal to the greater of (I)

zero and (II) the difference of (i) the quotient of (x) the total aggregate

purchase price for Shares we received on the Settlement Date with respect to the

applicable Draw Down Notice divided by (y) the True-Up Purchase Price, less (ii)

the number of Shares we issued to Magna on the applicable Settlement Date with

respect to the applicable Draw Down Notice. Magna is not required to return any

Shares to us in the event the True-Up Purchase Price is greater than the Initial

Purchase Price.

We are prohibited from

issuing a Draw Down Notice if (i) the amount requested in such Draw Down Notice

exceeds the Maximum Draw Down Amount, (ii) the sale of Shares pursuant to such

Draw Down Notice would cause us to issue or sell or Magna to acquire or purchase

an aggregate dollar value of Shares that would exceed the Total Commitment, or

(iii) the sale of Shares pursuant to the Draw Down Notice would cause us to sell

or Magna to purchase an aggregate number of shares of our common stock which

would result in beneficial ownership by Magna of more than 9.99% of our common

stock (as calculated pursuant to Section 13(d) of the Exchange Act, and the

rules and regulations thereunder). We cannot make more than one draw down during

the period commencing on any Draw Down Exercise Date and ending on the

applicable True-Up Date for such draw down, and we must allow at least two

trading days to elapse between the applicable True-Up Date for a draw down and

the delivery of any Draw Down Notice for any other draw down.

Magna has agreed that

during the term of the Purchase Agreement, neither Magna nor any of its

affiliates will, directly or indirectly, engage in any short sales involving our

securities or grant any option to purchase, or acquire any right to dispose of

or otherwise dispose for value of, any of our common stock or any securities

convertible into or exercisable or exchangeable for our common stock, or enter

into any swap, hedge or other similar agreement that transfers, in whole or in

part, the economic risk of ownership of any of our common stock.

11

The Purchase Agreement contains customary representations, warranties and

covenants by, among and for the benefit of the parties. The Purchase Agreement

may be terminated at any time by the mutual written consent of the parties.

Unless earlier terminated, the Purchase Agreement will terminate automatically

on the earliest to occur of (i) the first day of the month next following the

24-month anniversary of the date on which the registration statement of which

this prospectus is a part is declared effective by the Commission, (ii) the date

on which Magna purchases the Total Commitment worth of common stock under the

Purchase Agreement and (iii) the date on which our common stock ceases to be

listed or quoted on an eligible trading market under the Purchase Agreement.

Under certain circumstances set forth in the Purchase Agreement, we and Magna

each may terminate the Purchase Agreement on one trading day’s prior written

notice to the other, without fee, penalty or cost.

We paid to Magna a commitment fee for entering into the Purchase

Agreement equal to $150,000 (or 5.0% of the Total Commitment under the Purchase

Agreement) in the form of 9,109,128 restricted shares of our common stock, which

we refer to as the Initial Commitment Shares, calculated using a per share price

of $0.016467, representing the arithmetic average of the three lowest daily

VWAPs during the 10-consecutive-trading day period immediately preceding the

Closing Date. In addition, promptly following the effective date of the

registration statement of which this prospectus is a part, we are required to

issue to Magna additional shares of our common stock, which we refer to as the

Additional Commitment Shares, equal to the greater of (i) zero and (ii) the

difference of (a) the quotient of (x) $150,000 divided by (y) the greater of (1)

the arithmetic average of the three lowest daily VWAPs during the

10-consecutive-trading day period ending on and including the effective date of

the registration statement of which this prospectus is a part and (2) $0.006,

less (ii) 9,109,128, provided that in no event will we issue more than an

aggregate of 15,890,872 shares of our common stock, subject to adjustment for

any stock splits, stock combinations, stock dividends, recapitalizations and

other similar transactions, as Additional Commitment Shares. The Initial

Commitment Shares, together with 15,890,872 Additional Commitment Shares, are

being registered for resale in the registration statement of which this

prospectus is a part. We sometimes in this prospectus refer to the Initial

Commitment Shares and the Additional Commitment Shares, collectively, as the

Commitment Shares.

We also agreed to pay up to $25,000 of reasonable attorneys' fees and

expenses (exclusive of disbursements and out-of-pocket expenses) incurred by

Magna in connection with the preparation, negotiation, execution and delivery of

the Purchase Agreement and related transaction documentation. Further, if we

issue a Draw Down Notice and fail to deliver the shares to Magna on the

applicable Settlement Date or True-Up Settlement Date, we agreed to pay Magna,

in addition to all other remedies available to Magna under the Purchase

Agreement, an amount in cash equal to 2.0% of the purchase price of such shares

for each 30-day period the shares are not delivered, plus accrued interest.

The Purchase Agreement also provides for indemnification of Magna and its

affiliates in the event that Magna incurs losses, liabilities, obligations,

claims, contingencies, damages, costs and expenses related to a breach by us of

any of our representations and warranties under the Purchase Agreement or the

other related transaction documents or any action instituted against Magna or

its affiliates due to the transactions contemplated by the Purchase Agreement or

other transaction documents, subject to certain limitations.

Registration Rights Agreement

In connection with the execution of the Purchase Agreement, on the

Closing Date, we and Magna also entered into a registration rights agreement

dated as of the Closing Date, which we refer to as the Registration Rights

Agreement. Pursuant to the Registration Rights Agreement, we agreed to file the

registration statement of which this prospectus is a part with the Commission to

register for resale 143,812,591 shares of our common stock, which includes the

9,109,128 issued on October 27, 2014 as Initial Commitment Shares and 15,890,872

Additional Commitment Shares, on or prior to December 8, 2014, which we refer to

as the Filing Deadline, and have it declared effective at the earlier of (A) the

90th calendar day after the earlier of (1) the Filing Deadline and

(2) the date on which the registration statement of which this prospectus is a

part is filed with the Commission and (B) the fifth business day after the date

the Company is notified by the Commission that the registration statement will

not be reviewed or will not be subject to further review, which we refer to as

the Effectiveness Deadline. The effectiveness of the registration statement of

which this prospectus is a part is a condition precedent to our ability to sell

common stock to Magna under the Purchase Agreement.

12

We have agreed to file with the Commission one or more additional

registration statements to cover all of the securities required to be registered

under the Registration Rights Agreement that are not covered by this prospectus,

in each case, as soon as practicable, but in no event later than the applicable

filing deadline for such additional registration statements as provided in the

Registration Rights Agreement.

We also agreed, among other things, to indemnify Magna from certain

liabilities and fees and expenses of Magna incident to our obligations under the

Registration Rights Agreement, including certain liabilities under the

Securities Act. Magna has agreed to indemnify and hold harmless us and each of

our directors, officers and persons who control us against certain liabilities

that may be based upon written information furnished by Magna to us for

inclusion in the registration statement of which this prospectus is a part,

including certain liabilities under the Securities Act.

Transfer

Agent

The Transfer Agent for our Common Stock is Continental Stock Transfer and

Trust Company, 17 Battery Place, New York, New York 10004.

The Offering

As of November 20, 2014, there were 560,564,622 shares of our common

stock outstanding, of which 554,375,697 shares were held by non-affiliates.

Although the Purchase Agreement provides that we may sell up to $3,000,000 of

our common stock to Magna, only 143,812,591 shares of our common stock are being

offered under this prospectus, which represents (i) 31,000,000 shares of common

stock that may be issued to Magna upon conversion of the Convertible Note, (ii)

9,109,128 shares of common stock that we issued to Magna as Initial Commitment

Shares on October 27, 2014, (iii) a maximum of 15,890,872 shares of common stock

that we may be required to issue to Magna as Additional Commitment Shares and

(iv) 87,812,591 shares of common stock that we may issue to Magna as Shares

pursuant to draw downs under the Purchase Agreement. If all of the 143,812,591

shares offered under this prospectus were issued and outstanding as of November

20, 2014, such shares would represent approximately 20.7% of the total number of

shares of our common stock outstanding and 20.9% of the total number of

outstanding shares of our common stock held by non-affiliates, in each case as

of November 20, 2014.

At an assumed purchase price of $0.01460 (equal to 93% of the closing

price of our common stock of $0.01570 on November 10, 2014), and assuming the

sale by us to Magna of all of the 87,812,591 Shares, or approximately 15.7% of

our issued and outstanding common stock, being registered hereunder pursuant to

draw downs under the Purchase Agreement, we would receive only approximately

$1,282,064 in gross proceeds. Furthermore, we may receive substantially less

than $1,282,064 in gross proceeds from the financing due to our share price,

discount to market and other factors relating to our common stock. If we elect

to issue and sell more than the 87,812,591 Shares offered under this prospectus

to Magna, which we have the right, but not the obligation, to do, we must first

register for resale under the Securities Act any such additional Shares, which

could cause additional substantial dilution to our stockholders. Based on the

above assumptions, we would be required to register an additional approximately

117,666,849 shares of our common stock to obtain the balance of $1,717,936 of

the Total Commitment that would be available to us under the Purchase Agreement.

We currently have authorized and available for issuance 2,000,000,000 shares of

our common stock pursuant to our Amended Articles of Incorporation . The number of shares of our common

stock ultimately offered for resale by Magna is dependent upon a number of

factors, including the extent to which Magna converts the Convertible Note into

shares of our common stock and the number of Shares we ultimately issue and sell

to Magna under the Purchase Agreement.

The Total Commitment of $3,000,000 was determined based on numerous

factors, including our estimated operating expenses for the next two years.

While it is difficult to estimate the likelihood that we will need the full

Total Commitment, we presently believe that we may need the full Total

Commitment under the Purchase Agreement.

13

Common stock offered by

Selling Stockholder

143,812,591 shares of

common stock, consisting of:

- 31,000,000 shares of common

stock that we may issue to Magna upon conversion of the Convertible Note;

- 9,109,128 shares of common stock that

we issued to Magna as Initial Commitment Shares on October 27, 2014;

- a maximum of 15,890,872 shares of

common stock that we may be required to issue to Magna as Additional

Commitment Shares; and

- 87,812,591 shares of common stock that

we may issue to Magna as Shares pursuant to draw downs under the Purchase

Agreement.

Common stock outstanding

before the offering

569,891,761 shares of

common stock (includes 9,109,128 shares issued to Magna Equities II LLC on

October 27, 2014).

Common stock outstanding

after the offering

704,595,224 shares of

common stock.

We will not receive any

proceeds from the sale of shares by the selling stockholder. However, we have

received gross proceeds of $205,000 from the sale of the Convertible Note to

Magna and we may receive gross proceeds of up to $3,000,000 from the sale of

Shares to Magna pursuant to the Purchase Agreement. The net proceeds received

from the sale of the Convertible Note to Magna and from the sale of Shares

pursuant to the Purchase Agreement will be used for general corporate and

working capital purposes and acquisitions or assets, businesses or operations or

for other purposes that our Board of Directors, in its good faith deem to be in

the best interest of the company and its stockholders.

14

The common stock offered hereby

involves a high degree of risk and should not be purchased by investors who

cannot afford the loss of their entire investment. See “Risk Factors”.

15

RISK FACTORS

You should carefully

consider the risks described below as well as other information provided to you

in this document, including information in the section of this document entitled

“Information Regarding Forward Looking Statements.” If any of the following

risks actually cause the occurrence of adverse circumstances, the Company’s

business, financial condition or results of operations could be materially

adversely affected, the value of the Company’s Common Stock could decline and

you may lose all or part of your investment.

Risks Related to Our

Business

We are a development

stage life sciences company with a limited operating history and a history of

net losses and negative cash flows from operations. We may never be profitable,

and if we incur operating losses and generate negative cash flows from

operations for longer than expected, we may be unable to continue operations.

Risks Related to Our

Financial Position and Need for Additional Financing

We will need to

secure additional financing in order to continue to finance our operations. If

we are unable to secure additional financing on acceptable terms, or at all, we

may be forced to curtail or cease our operations.

As of September 30, 2014, we had cash and cash equivalents of

approximately $46,592 and an accumulated capital deficit of approximately

$119,428,183. As such, our existing cash resources are insufficient to finance

even our immediate operations. Accordingly, we will need to secure additional

sources of capital to develop our business and product candidates as planned. We

are seeking substantial additional financing through public and/or private

financing, which may include equity and/or debt financings, research grants and

through other arrangements, including collaborative arrangements. As part of

such efforts, we may seek loans from certain of our executive officers,

directors and/or current shareholders. We may also seek to satisfy some of our

obligations to the guarantors of our loan with Seaside National Bank &

Trust, or the Guarantors, through the issuance of various forms of securities or

debt on negotiated terms. However, financing and/or alternative arrangements

with the Guarantors may not be available when we need it, or may not be

available on acceptable terms.

If we are unable to secure additional financing in the near term, we may

be forced to:

- curtail or abandon our existing

business plans;

- reduce our headcount;

- default on our debt

obligations;

- file for bankruptcy;

- seek to sell some or all of our

assets; and/or

- cease our operations.

If we are forced to take any of these steps, any investment in our common

stock may be worthless.

Our ability to obtain

additional debt financing and/or alternative arrangements, with the Guarantors

or otherwise, may be limited by the amount of, terms and restrictions of our

then current debt. For instance, we do not anticipate repaying our Northstar

loan (described below) until its scheduled maturity. Accordingly, until such

time, we will generally be restricted from, among other things, incurring

additional indebtedness or liens, with limited exceptions. See “We have a substantial amount of

debt...” Additional debt

financing, if available, may involve restrictive covenants that limit or further

limit our operating and financial flexibility and prohibit us from making

distributions to shareholders.

If we raise additional capital and/or secure alternative arrangements,

with the Guarantors or otherwise, by issuing equity, equity-related or

convertible securities, the economic, voting and other rights of our existing

shareholders may be diluted, and those newly issued securities may be issued at

prices that are a significant discount to current and/or then prevailing market

prices. In addition, any such newly issued securities may have rights superior

to those of our common stock. If we obtain additional capital through

collaborative arrangements, we may be required to relinquish greater rights to

our technologies or product candidates than we might otherwise have or become

subject to restrictive covenants that may affect our business.

16

Our independent

registered public accounting firm has expressed substantial doubt about our

ability to continue as a going concern.

Our independent registered public accounting firm issued its report dated

March 24, 2014 in connection with the audit of our financial statements as of

December 31, 2013, which included an explanatory paragraph describing the

existence of conditions that raise substantial doubt about our ability to

continue as a going concern. In addition, our notes to our unaudited financial

statement for the period ended September 30, 2014 included an explanatory

paragraph describing the existence of conditions that raise substantial doubt

about our ability to continue as a going concern. If we are not able to continue

as a going concern, it is likely that holders of our common stock will lose all

of their investment. Our financial statements do not include any adjustments

that might result from the outcome of this uncertainty.

Current Adverse

Economic Conditions have had a negative impact on our ability to obtain

additional financing. Our inability to obtain additional financing would have a

significant adverse effect on our operations.

In early 2008, as the United States economy began to weaken and there

were increased doubts about the ability of borrowers to pay debts. Housing

values began to fall and marginal loans were first to default, triggering the

sub-prime lending crisis. Financial institutions responded by tightening their

lending policies with respect to counterparties determined to have sub-prime

mortgage risk. This tightening of institutional lending policies led to the

failure of major financial institutions late in the third quarter of 2008.

Continued failures, losses, and write-downs at major financial institutions

through 2013 intensified concerns about credit and liquidity risks and have

resulted in a sharp reduction in overall market liquidity. The global credit

crisis threatens the stability of the global economy and has adversely impacted

consumer confidence and spending. We believe this global credit crisis has also

had a negative impact on our ability to obtain additional financing. As

discussed above, our inability to obtain additional financing would have a

significant adverse effect on our operations, results and financial condition.

We are a development

stage life sciences company with a limited operating history and a history of

net losses and negative cash flows from operations. We may never be profitable,

and if we incur operating losses and generate negative cash flows from

operations for longer than expected, we may be unable to continue

operations.

We are a development stage life sciences company and have a limited

operating history, limited capital, limited sources of revenue and have incurred

losses since inception. Our operations to date have been limited to organizing

our company, developing and engaging in clinical trials of our MyoCell product

candidate, expanding our pipeline of complementary product candidates through

internal development and third party licenses, expanding and strengthening our

intellectual property position through internal programs and third party

licenses and recruiting management, research and clinical personnel.

Consequently, it may be difficult to predict our future success or viability due

to our lack of operating history. Since inception, we have generated substantial

net losses, including net losses of approximately $3.1 million, $4.0 million,

$4.7 million, $5.2 million, and $4.4 million in 2013, 2012, 2011, 2010 and 2009,

respectively, net loss of approximately 2.4 million for the quarter ended

September 30, 2014 and substantial negative cash flows from operations. We

anticipate that we will continue to incur significant and increasing net losses

and negative cash flows from operations for the foreseeable future as we:

- establish a distribution network for

and commence distribution of certain products for which we have acquired

distribution rights;

- resume full scale enrollment of the

MARVEL and REGEN Trials;

- continue research and development and

undertake new clinical trials with respect to our pipeline product candidates,

including clinical trials related to MyoCell SDF-1;

- seek to raise additional

capital;

- apply for regulatory approvals;

17

- make capital expenditures to increase

our research and development and cell culturing capabilities;

- add operational, financial and

management information systems and personnel and develop and protect our

intellectual property;

- make payments pursuant to license

agreements upon achievement of certain milestones; and

- establish sales and marketing

capabilities to commercialize products for which we obtain regulatory

approval, if any.

Our limited experience in conducting and managing preclinical development

activities, clinical trials and the application process necessary to obtain

regulatory approvals might prevent us from successfully designing or

implementing a preclinical study or clinical trial. If we do not succeed in

conducting and managing our preclinical development activities or clinical

trials, or in obtaining regulatory approvals, we might not be able to

commercialize our product candidates, or might be significantly delayed in doing

so, which will materially harm our business.

Our ability to generate revenues from any of our product candidates will

depend on a number of factors, including our ability to successfully complete

clinical trials, obtain necessary regulatory approvals and implement our

commercialization strategy. In addition, even if we are successful in obtaining

necessary regulatory approvals and bringing one or more product candidates to

market, we will be subject to the risk that the marketplace will not accept

those products. We may, and anticipate that we will need to, transition from a

company with a research and development focus to a company capable of supporting

commercial activities and we may not succeed in such a transition.

Because of the numerous risks and uncertainties associated with our

product development and commercialization efforts, we are unable to predict the

extent of our future losses or when or if we will become profitable. Our failure

to successfully commercialize our product candidates or to become and remain

profitable could impair our ability to raise capital, expand our business,

diversify our product offerings and continue our operations.

All of our product

candidates are in an early stage of development and we may never succeed in

developing and/or commercializing them. We depend heavily on the success of our

MyoCell product candidate. If we are unable to commercialize MyoCell or any of

our other product candidates or experience significant delays in doing so, our

business may fail.

- We have invested a significant portion

of our efforts and financial resources in our MyoCell product candidate and

depend heavily on its success. MyoCell is currently in the clinical testing

stage of development, although we have suspended work under our clinical

trials as we seek to raise sufficient funds to complete the trials.

- We need to devote significant

additional research and development, financial resources and personnel to

develop commercially viable products, obtain regulatory approvals and

establish a sales and marketing infrastructure.

- We are likely to encounter hurdles and

unexpected issues as we proceed in the development of MyoCell and our other

product candidates. There are many reasons that we may not succeed in our

efforts to develop our product candidates, including the possibility that:

- our product candidates will be deemed

ineffective, unsafe or will not receive regulatory approvals;

- our product candidates will be too

expensive to manufacture or market or will not achieve broad market

acceptance;

- others will hold proprietary rights

that will prevent us from marketing our product candidates; or

- our competitors will market products

that are perceived as equivalent or superior.

18

Our approach of using

cell-based therapy for the treatment of heart damage is risky and unproven and

no products using this approach have received regulatory approval in the United

States or Europe.

No company has yet been successful in its efforts to obtain regulatory

approval in the United States or Europe of a cell-based therapy product for the

treatment of heart damage. Cell-based therapy products, in general, may be

susceptible to various risks, including undesirable and unintended side effects,

unintended immune system responses, inadequate therapeutic efficacy or other

characteristics that may prevent or limit their approval by regulators or

commercial use. Many companies in the industry have suffered significant

setbacks in advanced clinical trials, despite promising results in earlier

trials. One of our competitors exploring the use of skeletal myoblasts ceased

enrolling new patients in its European Phase II clinical trial based on the

determination of its monitoring committee that there was a low likelihood that

the trial would result in the hypothesized improvement in heart function.

Although our clinical research to date suggests that MyoCell may improve the

contractile function of the heart, we have not yet been able to demonstrate a

mechanism of action and additional research is needed to precisely identify such

mechanism.

Four clinical trials are unsuccessful or

significantly delayed, or if we do not complete our clinical trials, we will not

receive regulatory approval for or be able to commercialize our product

candidates.

We cannot market any product candidate until regulatory agencies grant

approval or licensure. In order to obtain regulatory approval for the sale of

any product candidate, we must, among other requirements, provide the FDA and

similar foreign regulatory authorities with preclinical and clinical data that

demonstrate to the satisfaction of regulatory authorities that our product

candidates are safe and effective for each indication under the applicable

standards relating to such product candidate. The preclinical studies and

clinical trials of any product candidates must comply with the regulations of

the FDA and other governmental authorities in the United States and similar

agencies in other countries.

Even if we achieve positive interim results in clinical trials, these

results do not necessarily predict final results, and positive results in early

trials may not be indicative of success in later trials. For example, MyoCell

has been studied in a limited number of patients to date. Even though our early

data has been promising, we have not yet completed any large-scale pivotal

trials to establish the safety and efficacy of MyoCell. A number of participants

in our clinical trials have experienced serious adverse events adjudicated or

determined by trial investigators to be potentially attributable to MyoCell. See

“ – Our product candidates may

never be commercialized due to unacceptable side effects and increased mortality

that may be associated with such product candidates.” There is a risk that safety concerns relating

to our product candidates or cell-based therapies in general will result in the

suspension or termination of our clinical trials.

We may experience numerous unforeseen events during, or as a result of,

the clinical trial process that could delay or prevent regulatory approval

and/or commercialization of our product candidates, including the following:

- the FDA or similar foreign regulatory

authorities may find that our product candidates are not sufficiently safe or

effective or may find our cell culturing processes or facilities

unsatisfactory;

- officials at the FDA or similar

foreign regulatory authorities may interpret data from preclinical studies and

clinical trials differently than we do;

- our clinical trials may produce

negative or inconclusive results or may not meet the level of statistical

significance required by the FDA or other regulatory authorities, and we may

decide, or regulators may require us, to conduct additional preclinical

studies and/or clinical trials or to abandon one or more of our development

programs;

- the FDA or similar foreign regulatory

authorities may change their approval policies or adopt new regulations;

- there may be delays or failure in

obtaining approval of our clinical trial protocols from the FDA or other

regulatory authorities or obtaining institutional review board approvals or

government approvals to conduct clinical trials at prospective sites

19

- we, or regulators, may suspend or

terminate our clinical trials because the participating patients are being

exposed to unacceptable health risks or undesirable side effects;

- we may experience difficulties in

managing multiple clinical sites;

- enrollment in our clinical trials for

our product candidates may occur more slowly than we anticipate, or we may

experience high drop-out rates of subjects in our clinical trials, resulting

in significant delays;

- we may be unable to manufacture or

obtain from third party manufacturers sufficient quantities of our product

candidates for use in clinical trials; and

- our product candidates may be deemed

unsafe or ineffective, or may be perceived as being unsafe or ineffective, by

healthcare providers for a particular indication.

In the SEISMIC Trial, we experienced delays attributable to slower than

anticipated enrollment of patients. We may continue to experience difficulties

in enrolling patients in our clinical trials, which could increase the costs or

affect the timing or outcome of these trials and could prevent us from

completing these trials.

Failures or perceived failures in our clinical trials would delay and may

prevent our product development and regulatory approval process, make it

difficult for us to establish collaborations, negatively affect our reputation

and competitive position and otherwise have a material adverse effect on our

business.

Our product

candidates may never be commercialized due to unacceptable side effects and

increased mortality that may be associated with such product

candidates.

Possible side effects of our product candidates may be serious and

life-threatening. A number of participants in our clinical trials of MyoCell

have experienced serious adverse events potentially attributable to MyoCell,

including six patient deaths and 18 patients experiencing irregular heartbeats.

A serious adverse event is generally an event that results in significant

medical consequences, such as hospitalization, disability or death, and must be

reported to the FDA. The occurrence of any unacceptable serious adverse events

during or after preclinical and clinical testing of our product candidates could

temporarily delay or negate the possibility of regulatory approval of our

product candidates and adversely affect our business. Both our trials and

independent trials have reported the occurrence of irregular heartbeats in

treated patients, a significant risk to patient safety. We and our competitors

have also, at times, suspended trials studying the effects of myoblasts, at

least temporarily, to assess the risk of irregular heartbeats, and it has been

reported that one of our competitors studying the effect of myoblast

implantation prematurely discontinued a study because of the high incidence of

irregular heartbeats. While we believe irregular heartbeats may be manageable

with the use of certain prophylactic measures including an ICD, and

antiarrhythmic drug therapy, these risk management techniques may not prove to

sufficiently reduce the risk of unacceptable side effects.

Although our early results suggest that patients treated with MyoCell do

not face materially different health risks than heart failure patients with

similar levels of damage to the heart who have not been treated with MyoCell, we

are still in the process of seeking to demonstrate that our product candidates

do not pose unacceptable health risks. We have not yet treated a sufficient

number of patients to allow us to make a determination that serious unintended

consequences will not occur.

20

We depend on third

parties to assist us in the conduct of our preclinical studies and clinical

trials, and any failure of those parties to fulfill their obligations could

result in costs and delays and prevent us from obtaining regulatory approval or

successfully commercializing our product candidates on a timely basis, if at

all.

We engage consultants and CROs to help design, and to assist us in

conducting, our preclinical studies and clinical trials and to collect and

analyze data from those studies and trials. The consultants and contract

research organizations we engage interact with clinical investigators to enroll

patients in our clinical trials. As a result, we depend on these consultants and

CROs to perform the studies and trials in accordance with the investigational

plan and protocol for each product candidate and in compliance with regulations

and standards, commonly referred to as “good clinical practice”, for conducting,

recording and reporting results of clinical trials to assure that the data and results are credible and

accurate and the trial participants are adequately protected, as required by the

FDA and foreign regulatory agencies. We may face delays in our regulatory

approval process if these parties do not perform their obligations in a timely

or competent fashion or if we are forced to change service providers. The risk

of delays is heightened for our clinical trials conducted outside of the United

States, where it may be more difficult for us to ensure that studies are

conducted in compliance with foreign regulatory requirements. Any third parties

that we hire to conduct clinical trials may also provide services to our

competitors, which could compromise the performance of their obligations to us.

If these third parties do not successfully carry out their duties or meet

expected deadlines, or if the quality, completeness or accuracy of the data they

obtain is compromised due to their failure to adhere to our clinical trial

protocols or for other reasons, our clinical trials may be extended, delayed or

terminated or may otherwise prove to be unsuccessful. If there are delays or