|

|

|

| Prospectus Supplement No. 25 (to

Prospectus dated May 30, 2013) |

|

Filed pursuant to Rule 424(b)(4)

Registration No. 333-187508 |

125,000 Shares of Series A Convertible Preferred Stock

12,500,000 Shares of Common Stock Underlying the Preferred Stock

Warrants to Purchase up to 6,250,000 Shares of Common Stock and

6,250,000 Shares of Common Stock Underlying the Warrants

ARCA biopharma, Inc.

This prospectus supplement supplements the prospectus dated May 30, 2013 (the “Prospectus”), as supplemented by that certain

Prospectus Supplement No. 1 dated July 17, 2013 (“Supplement No. 1”), by that certain Prospectus Supplement No. 2 dated July 19, 2013 (“Supplement No. 2”), by that certain Prospectus Supplement

No. 3 dated July 24, 2013 (“Supplement No. 3”), by that certain Prospectus Supplement No. 4 dated July 30, 2013 (“Supplement No. 4”), by that certain Prospectus Supplement No. 5 dated August 6,

2013 (“Supplement No. 5”), by that certain Prospectus Supplement No. 6 dated September 4, 2013 (“Supplement No. 6”), by that certain Prospectus Supplement No. 7 dated September 23, 2013 (“Supplement No. 7”), by that

certain Prospectus Supplement No. 8 dated October 29, 2013 (“Supplement No. 8”), by that certain Prospectus Supplement No. 9 dated November 6, 2013 (“Supplement No. 9”), by that certain Prospectus Supplement No. 10 dated November

13, 2013 (“Supplement No. 10”), by that certain Prospectus Supplement No. 11 dated November 21, 2013 (“Supplement No. 11”), by that certain Prospectus Supplement No. 12 dated December 5, 2013 (“Supplement No. 12”),

by that certain Prospectus Supplement No. 13 dated January 8, 2014 (“Supplement No. 13”), by that certain Prospectus Supplement No. 14 dated February 10, 2014 (“Supplement No. 14”), by that certain Prospectus Supplement No. 15

dated February 12, 2014 (“Supplement No. 15”), by that certain Prospectus Supplement No. 16 dated February 18, 2014 (“Supplement No. 16”), by that certain Prospectus Supplement No. 17 dated March 3, 2014 (“Supplement No.

17”), by that certain Prospectus Supplement No. 18 dated March 20, 2014 (“Supplement No. 18”), by that certain Prospectus Supplement No. 19 dated May 13, 2014 (“Supplement No. 19”), by that certain Prospectus Supplement No.

20 dated June 9, 2014 (“Supplement No. 20”), by that certain Prospectus Supplement No. 21 dated August 13, 2014 (“Supplement No. 21”), by that certain Prospectus Supplement No. 22 dated August 18, 2014 (“Supplement No.

22”), by that certain Prospectus Supplement No. 23 dated November 12, 2014 (“Supplement No. 23”), and by that certain Prospectus Supplement No. 24 dated December 1, 2014 (“Supplement No. 24”, and together with Supplement No.

1, Supplement No. 2, Supplement No. 3, Supplement No. 4, Supplement No. 5, Supplement No. 6, Supplement No. 7, Supplement No. 8, Supplement No. 9, Supplement No. 10, Supplement No. 11, Supplement No. 12, Supplement No. 13, Supplement No. 14,

Supplement No. 15, Supplement No. 16, Supplement No. 17, Supplement No. 18, Supplement No. 19, Supplement No. 20, Supplement No. 21, Supplement No. 22, and Supplement No. 23, the “Supplements”), which form a part of our Registration

Statement on Form S-1 (Registration No. 333-187508). This prospectus supplement is being filed to update and supplement the information in the Prospectus and the Supplements with the information contained in our current report on Form 8-K,

filed with the Securities and Exchange Commission (the “Commission”) on December 10, 2014 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

The Prospectus, the Supplements and this prospectus supplement relate to the offer and sale of up to 125,000 shares of Series A Convertible

Preferred Stock (“Preferred Stock”) which are convertible into 12,500,000 shares of Common Stock, warrants to purchase up to 6,250,000 shares of our Common Stock and 6,250,000 shares of Common Stock underlying the warrants.

This prospectus supplement should be read in conjunction with the Prospectus and the Supplements.

This prospectus supplement updates and supplements the information in the Prospectus and the Supplements. If there is any inconsistency between the information in the Prospectus, the Supplements and this prospectus supplement, you should rely on the

information in this prospectus supplement.

Our common stock is traded on the Nasdaq Global Market under the trading symbol

“ABIO.” On December 10, 2014, the last reported sale price of our common stock was $0.98 per share.

Investing in our

securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 5 of the Prospectus and beginning on page 20 of our quarterly report on Form

10-Q for the period ended September 30, 2014 before you decide whether to invest in shares of our common stock.

Neither the

Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a

criminal offense.

The date of this prospectus supplement is December 10, 2014

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 10, 2014 (December 10, 2014)

ARCA biopharma, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

000-22873 |

|

36-3855489 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

11080 CirclePoint Road, Suite 140, Westminster, CO 80020

(Address of Principal Executive Offices) (Zip Code)

(720) 940-2200

(Registrant’s telephone number, including area code)

Not Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 8 — Other Events

Item 8.01. Other Events.

On December 10, 2014,

ARCA biopharma, Inc. (“ARCA”) announced that the U.S. Food and Drug Administration, Office of Orphan Drug Products Development has granted orphan drug designation to rNAPc2 as a potential treatment of viral hemorrhagic fever post-exposure

to Ebola virus. The press release is furnished as Exhibit 99.1 hereto, the contents of which are incorporated herein by reference.

Section 9

— Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

| Exhibit Number |

|

Description |

|

|

| 99.1 |

|

Press Release titled “ARCA biopharma Receives FDA Orphan Drug Designation for rNAPc2 as a Potential Treatment for Ebola” dated December 10, 2014. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated: December 10, 2014

|

|

|

| ARCA biopharma, Inc.

(Registrant) |

|

|

| By: |

|

/s/ Christopher Ozeroff |

|

|

Name: Christopher Ozeroff |

|

|

Title: SVP and General Counsel |

INDEX TO EXHIBITS

|

|

|

| Exhibit Number |

|

Description |

|

|

| 99.1 |

|

Press Release titled “ARCA biopharma Receives FDA Orphan Drug Designation for rNAPc2 as a Potential Treatment for Ebola” dated December 10, 2014. |

Exhibit 99.1

ARCA BIOPHARMA RECEIVES FDA ORPHAN DRUG DESIGNATION FOR RNAPC2 AS A POTENTIAL TREATMENT FOR EBOLA

rNAPc2 Previously Demonstrated Post-Exposure Efficacy in NHP Models of Ebola HFV

rNAPc2 Previously Tested in Over 700 Human Patients in Nine Phase 1 and 2

Cardiovascular Disease Clinical Trials

rNAPc2

Potentially Inhibits the Human Body’s Catastrophic Response to Hemorrhagic

Fever Viruses Like Ebola

Westminster, CO, December 10, 2014 – ARCA biopharma, Inc. (Nasdaq: ABIO), a biopharmaceutical company developing genetically-targeted

therapies for cardiovascular diseases, today announced that the U.S. Food and Drug Administration (FDA) Office of Orphan Products Development has granted orphan drug designation to rNAPc2 as a potential treatment of viral hemorrhagic fever

post-exposure to Ebola virus. The drug candidate has previously demonstrated post-exposure efficacy in non-human primate models of Ebola hemorrhagic fever virus (HFV). rNAPc2 was originally developed as a cardiovascular therapy for thrombosis and

other indications. As a result, it has an extensive human clinical record, and has been safely tested in over 700 human patients in nine Phase 1 and 2 clinical trials for cardiovascular disease.

Orphan drug designation is granted by the FDA Office of Orphan Products Development to novel drugs or biologics that treat rare diseases or conditions

affecting fewer than 200,000 individuals in the U.S. The designation provides the drug developer with a seven-year period of U.S. marketing exclusivity upon marketing approval, as well as certain financial incentives that can help support its

development.

About rNAPc2

rNAPc2 (Recombinant

Nematode Anticoagulation Protein c2) is a potent and selective inhibitor of tissue factor (TF), the protein responsible for initiating the extrinsic coagulation pathway, the primary coagulation mechanism in humans. The rationale for rNAPc2 as a HFV

therapy arises from the role of TF in HFV mediated disseminated intravascular coagulation (DIC), an often fatal complication of the HFV disease syndrome that leads to spontaneous hemorrhage. Previous research studies have shown that abnormal

activation of TF is a common element of the host response to infection from Ebola, Marburg and other HFVs. This activation of TF results in a systemic consumption coagulopathy and related inflammation, which is believed to be partially responsible

for the high morbidity and mortality caused by these infections. rNAPc2 was identified as a potential therapeutic for HFV infection because of its unique mechanism of action in inhibiting TF.

Previously, pilot studies of rNAPc2 in non-human primates demonstrated potential efficacy against two of the most

deadly known HFVs, Ebola and Marburg. The results of these studies demonstrated that, when administered as a post-exposure therapy, rNAPc2 showed evidence of efficacy in improving survival and inhibiting the DIC process. Additionally, in these

studies, rNAPc2 demonstrated anti-inflammatory and anti-viral properties.

ARCA is currently exploring options for the development of rNAPc2 including

seeking development partners, out-licensing the compound and applying for grant or government funding. ARCA is not actively developing rNAPc2 for any indications and has no plans to begin such development without securing a partnership, an

out-licensing agreement or receiving grant or government funding.

rNAPc2 Publications

| |

1. |

Geisbert TW, Hensley LE, Jahrling PB, Larsen T, Geisbert JB, Paragas J, Young HA, Fredeking TM, Rote WE, Vlasuk GP. Treatment of Ebola virus infection with a recombinant inhibitor of factor VIIa/tissue factor: a study

in rhesus monkeys. Lancet. 2003;362(9400):1953-8. |

| |

2. |

Geisbert TW, Daddario-DiCaprio KM, Geisbert JB, Young HA, Formenty P, Fritz EA, Larsen T, Hensley LE. Marburg virus Angola infection of rhesus macaques: pathogenesis and treatment with recombinant nematode anticoagulant

protein c2. J Infect Dis. 2007;196 Suppl 2:S372-81. |

About ARCA biopharma

ARCA biopharma is dedicated to developing genetically-targeted therapies for cardiovascular diseases. The Company’s lead product candidate, GencaroTM (bucindolol hydrochloride), is an investigational, pharmacologically unique beta-blocker and mild vasodilator being developed for atrial fibrillation. ARCA has identified common genetic variations

that it believes predict individual patient response to Gencaro, giving it the potential to be the first genetically-targeted atrial fibrillation prevention treatment. ARCA has a collaboration with Medtronic, Inc. for support of the GENETIC-AF

trial. For more information please visit www.arcabiopharma.com.

Safe Harbor Statement

This press release contains “forward-looking statements” for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of

1995. These statements include, but are not limited to, statements regarding, the potential for rNAPc2 to be developed for, or to effectively treat hemorrhagic fever viruses, including Ebola, the potential for genetic variations to predict

individual patient response to Gencaro, Gencaro’s potential to treat atrial fibrillation, future treatment options for patients with atrial fibrillation, and the potential for Gencaro to be the first genetically-targeted atrial fibrillation

prevention treatment. Such statements are based on management’s current expectations and involve risks and uncertainties. Actual results and performance could differ materially from those projected in the forward-looking statements as a

result of many factors, including, without limitation, the risks and uncertainties associated with: the Company’s financial resources and whether they will be sufficient to meet the

Company’s business objectives and operational requirements; results of earlier clinical trials may not be confirmed in future trials, the protection and market exclusivity provided by the Company’s intellectual property; risks related to

the drug discovery and the regulatory approval process; and, the impact of competitive products and technological changes. These and other factors are identified and described in more detail in ARCA’s filings with the SEC, including without

limitation the Company’s annual report on Form 10-K for the year ended December 31, 2013, and subsequent filings. The Company disclaims any intent or obligation to update these forward-looking statements.

Investor & Media Contact:

Derek Cole

720.940.2163

derek.cole@arcabiopharma.com

###

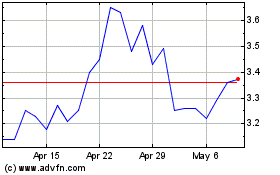

ARCA Biopharma (NASDAQ:ABIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

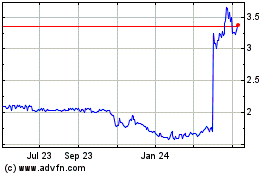

ARCA Biopharma (NASDAQ:ABIO)

Historical Stock Chart

From Apr 2023 to Apr 2024