UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 2)*

Shanda Games

Limited

(Name of Issuer)

Class A Ordinary Shares, par value US$0.01 per share

(Title of Class of Securities)

81941U105**

(CUSIP

Number)

Guan Ning

Orient Finance Holdings (Hong Kong) Limited

29/F, 100 Queen’s Road Central, Central

Hong Kong

(852) 3519

1188

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

November 24, 2014

(Date

of Event Which Requires Filing of This Statement)

If the filing

person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the

following box: ¨

Note. Schedules filed in paper format

shall include a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7 for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter disclosures provided in a prior cover page. |

| ** |

This CUSIP applies to the American Depositary Shares, evidenced by American Depositary Receipts, each representing two Class A ordinary shares. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of

the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

13D

|

|

|

|

|

|

|

| (1) |

|

Name of

reporting person Orient Finance Holdings (Hong Kong) Limited |

| (2) |

|

Check the appropriate box if a member

of a group (see instructions)

(a) x (b) ¨ |

| (3) |

|

SEC use only

|

| (4) |

|

Source of funds (see instructions)

AF, BK |

| (5) |

|

Check box if disclosure of legal

proceedings is required pursuant to Item 2(d) or 2(e) ¨ |

| (6) |

|

Citizenship or place of

organization Hong Kong |

| Number of

shares beneficially

owned by each

reporting person

with |

|

(7) |

|

Sole voting power

0 |

| |

(8) |

|

Shared voting power

0 |

| |

(9) |

|

Sole dispositive power

0 |

| |

(10) |

|

Shared dispositive power

0 |

| (11) |

|

Aggregate amount beneficially owned by each reporting person

0 |

| (12) |

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions) ¨ |

| (13) |

|

Percent of class represented by amount

in Row (11) 0.0% |

| (14) |

|

Type of reporting person (see

instructions) CO |

13D

|

|

|

|

|

|

|

| (1) |

|

Name of

reporting person Orient Hongtai (Hong Kong) Limited |

| (2) |

|

Check the appropriate box if a member

of a group (see instructions)

(a) x (b) ¨ |

| (3) |

|

SEC use only

|

| (4) |

|

Source of funds (see instructions)

AF, BK |

| (5) |

|

Check box if disclosure of legal

proceedings is required pursuant to Item 2(d) or 2(e) ¨ |

| (6) |

|

Citizenship or place of

organization Hong Kong |

| Number of

shares beneficially

owned by each

reporting person

with |

|

(7) |

|

Sole voting power

0 |

| |

(8) |

|

Shared voting power

61,776,334 shares

(1) |

| |

(9) |

|

Sole dispositive power

0 |

| |

(10) |

|

Shared dispositive power

61,776,334 shares

(1) |

| (11) |

|

Aggregate amount beneficially owned by each reporting person

61,776,334 shares (1) |

| (12) |

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions) ¨ |

| (13) |

|

Percent of class represented by amount

in Row (11) 14.0% (2) |

| (14) |

|

Type of reporting person (see

instructions) CO |

| (1) |

representing 61,776,334 Class A Ordinary Shares held by Orient Hongtai (Hong Kong) Limited, a Hong Kong company. |

| (2) |

percentage calculated based on total Class A Ordinary Shares outstanding as of October 20, 2014. As of October 20, 2014, 440,155,500 Class A Ordinary Shares (including Class A Ordinary Shares represented by American

Depositary Shares) (“ADSs”) and 97,518,374 Class B Ordinary Shares were outstanding. |

3

13D

|

|

|

|

|

|

|

| (1) |

|

Name of

reporting person Orient Zhisheng Investment Center (Shanghai) L.P. |

| (2) |

|

Check the appropriate box if a member

of a group (see instructions)

(a) x (b) ¨ |

| (3) |

|

SEC use only

|

| (4) |

|

Source of funds (see instructions)

AF, BK |

| (5) |

|

Check box if disclosure of legal

proceedings is required pursuant to Item 2(d) or 2(e) ¨ |

| (6) |

|

Citizenship or place of

organization The People’s Republic of

China |

| Number of

shares beneficially

owned by each

reporting person

with |

|

(7) |

|

Sole voting power

0 |

| |

(8) |

|

Shared voting power

61,776,334 shares

(1) |

| |

(9) |

|

Sole dispositive power

0 |

| |

(10) |

|

Shared dispositive power

61,776,334 shares

(1) |

| (11) |

|

Aggregate amount beneficially owned by each reporting person

61,776,334 shares (1) |

| (12) |

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions) ¨ |

| (13) |

|

Percent of class represented by amount

in Row (11) 14.0% (2) |

| (14) |

|

Type of reporting person (see

instructions) PN |

| (1) |

representing 61,776,334 Class A Ordinary Shares held by Orient Hongtai (Hong Kong) Limited, a Hong Kong company, which is directly wholly owned by Orient Zhisheng Investment Center (Shanghai) L.P., a PRC limited

partnership. |

| (2) |

percentage calculated based on total Class A Ordinary Shares outstanding as of October 20, 2014. As of October 20, 2014, 440,155,500 Class A Ordinary Shares (including Class A Ordinary Shares represented by ADSs) and

97,518,374 Class B Ordinary Shares were outstanding. |

4

13D

|

|

|

|

|

|

|

| (1) |

|

Name of

reporting person Orient Hongtai Capital Management (Shanghai) Co., Ltd. |

| (2) |

|

Check the appropriate box if a member

of a group (see instructions)

(a) x (b) ¨ |

| (3) |

|

SEC use only

|

| (4) |

|

Source of funds (see instructions)

AF, BK |

| (5) |

|

Check box if disclosure of legal

proceedings is required pursuant to Item 2(d) or 2(e) ¨ |

| (6) |

|

Citizenship or place of

organization The People’s Republic of

China |

| Number of

shares beneficially

owned by each

reporting person

with |

|

(7) |

|

Sole voting power

0 |

| |

(8) |

|

Shared voting power

61,776,334 shares

(1) |

| |

(9) |

|

Sole dispositive power

0 |

| |

(10) |

|

Shared dispositive power

61,776,334 shares

(1) |

| (11) |

|

Aggregate amount beneficially owned by each reporting person

61,776,334 shares (1) |

| (12) |

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions) ¨ |

| (13) |

|

Percent of class represented by amount

in Row (11) 14.0% (2) |

| (14) |

|

Type of reporting person (see

instructions) CO |

| (1) |

representing 61,776,334 Class A Ordinary Shares held by Orient Hongtai (Hong Kong) Limited, a Hong Kong company, which is directly wholly owned by Orient Zhisheng Investment Center (Shanghai) L.P., a PRC limited

partnership, whose general partners are Orient Hongtai Capital Management (Shanghai) Co., Ltd. and Orient Securities Capital Company Limited, each a PRC company. |

| (2) |

percentage calculated based on total Class A Ordinary Shares outstanding as of October 20, 2014. As of October 20, 2014, 440,155,500 Class A Ordinary Shares (including Class A Ordinary Shares represented by ADSs) and

97,518,374 Class B Ordinary Shares were outstanding. |

5

13D

|

|

|

|

|

|

|

| (1) |

|

Name of

reporting person Orient Hongzhi (Hong Kong) Limited |

| (2) |

|

Check the appropriate box if a member

of a group (see instructions)

(a) x (b) ¨ |

| (3) |

|

SEC use only

|

| (4) |

|

Source of funds (see instructions)

AF, BK |

| (5) |

|

Check box if disclosure of legal

proceedings is required pursuant to Item 2(d) or 2(e) ¨ |

| (6) |

|

Citizenship or place of

organization Hong Kong |

| Number of

shares beneficially

owned by each

reporting person

with |

|

(7) |

|

Sole voting power

0 |

| |

(8) |

|

Shared voting power

61,776,335 shares

(1) |

| |

(9) |

|

Sole dispositive power

0 |

| |

(10) |

|

Shared dispositive power

61,776,335 shares

(1) |

| (11) |

|

Aggregate amount beneficially owned by each reporting person

61,776,335 shares (1) |

| (12) |

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions) ¨ |

| (13) |

|

Percent of class represented by amount

in Row (11) 14.0% (2) |

| (14) |

|

Type of reporting person (see

instructions) CO |

| (1) |

representing 61,776,335 Class A Ordinary Shares held by Orient Hongzhi (Hong Kong) Limited, a Hong Kong company. |

| (2) |

percentage calculated based on total Class A Ordinary Shares outstanding as of October 20, 2014. As of October 20, 2014, 440,155,500 Class A Ordinary Shares (including Class A Ordinary Shares represented by ADSs) and

97,518,374 Class B Ordinary Shares were outstanding. |

6

13D

|

|

|

|

|

|

|

| (1) |

|

Name of

reporting person Orient Zhihui Investment Center (Shanghai) L.P. |

| (2) |

|

Check the appropriate box if a member

of a group (see instructions)

(a) x (b) ¨ |

| (3) |

|

SEC use only

|

| (4) |

|

Source of funds (see instructions)

AF, BK |

| (5) |

|

Check box if disclosure of legal

proceedings is required pursuant to Item 2(d) or 2(e) ¨ |

| (6) |

|

Citizenship or place of

organization The People’s Republic of

China |

| Number of

shares beneficially

owned by each

reporting person

with |

|

(7) |

|

Sole voting power

0 |

| |

(8) |

|

Shared voting power

61,776,335 shares

(1) |

| |

(9) |

|

Sole dispositive power

0 |

| |

(10) |

|

Shared dispositive power

61,776,335 shares

(1) |

| (11) |

|

Aggregate amount beneficially owned by each reporting person

61,776,335 shares (1) |

| (12) |

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions) ¨ |

| (13) |

|

Percent of class represented by amount

in Row (11) 14.0% (2) |

| (14) |

|

Type of reporting person (see

instructions) PN |

| (1) |

representing 61,776,335 Class A Ordinary Shares held by Orient Hongzhi (Hong Kong) Limited, a Hong Kong company, which is directly wholly owned by Orient Zhihui Investment Center (Shanghai) L.P., a PRC limited

partnership. |

| (2) |

percentage calculated based on total Class A Ordinary Shares outstanding as of October 20, 2014. As of October 20, 2014, 440,155,500 Class A Ordinary Shares (including Class A Ordinary Shares represented by ADSs) and

97,518,374 Class B Ordinary Shares were outstanding. |

7

13D

|

|

|

|

|

|

|

| (1) |

|

Name of

reporting person Orient Hongtai Capital Management (Beijing) Co., Ltd. |

| (2) |

|

Check the appropriate box if a member

of a group (see instructions)

(a) x (b) ¨ |

| (3) |

|

SEC use only

|

| (4) |

|

Source of funds (see instructions)

AF, BK |

| (5) |

|

Check box if disclosure of legal

proceedings is required pursuant to Item 2(d) or 2(e) ¨ |

| (6) |

|

Citizenship or place of

organization The People’s Republic of

China |

| Number of

shares beneficially

owned by each

reporting person

with |

|

(7) |

|

Sole voting power

0 |

| |

(8) |

|

Shared voting power

61,776,335 shares

(1) |

| |

(9) |

|

Sole dispositive power

0 |

| |

(10) |

|

Shared dispositive power

61,776,335 shares

(1) |

| (11) |

|

Aggregate amount beneficially owned by each reporting person

61,776,335 shares (1) |

| (12) |

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions) ¨ |

| (13) |

|

Percent of class represented by amount

in Row (11) 14.0% (2) |

| (14) |

|

Type of reporting person (see

instructions) CO |

| (1) |

representing 61,776,335 Class A Ordinary Shares held by Orient Hongzhi (Hong Kong) Limited, a Hong Kong company, which is directly wholly owned by Orient Zhihui Investment Center (Shanghai) L.P., a PRC limited

partnership, whose general partners are Orient Hongtai Capital Management (Beijing) Co., Ltd. and Orient Securities Capital Company Limited, each a PRC company. |

| (2) |

percentage calculated based on total Class A Ordinary Shares outstanding as of October 20, 2014. As of October 20, 2014, 440,155,500 Class A Ordinary Shares (including Class A Ordinary Shares represented by ADSs) and

97,518,374 Class B Ordinary Shares were outstanding. |

8

13D

|

|

|

|

|

|

|

| (1) |

|

Name of

reporting person Orient Ruide Capital Management (Shanghai) Co., Ltd. |

| (2) |

|

Check the appropriate box if a member

of a group (see instructions)

(a) x (b) ¨ |

| (3) |

|

SEC use only

|

| (4) |

|

Source of funds (see instructions)

AF, BK |

| (5) |

|

Check box if disclosure of legal

proceedings is required pursuant to Item 2(d) or 2(e) ¨ |

| (6) |

|

Citizenship or place of

organization The People’s Republic of

China |

| Number of

shares beneficially

owned by each

reporting person

with |

|

(7) |

|

Sole voting power

0 shares |

| |

(8) |

|

Shared voting power

123,552,669 shares

(1) |

| |

(9) |

|

Sole dispositive power

0 shares |

| |

(10) |

|

Shared dispositive power

123,552,669 shares

(1) |

| (11) |

|

Aggregate amount beneficially owned by each reporting person

123,552,669 shares (1) |

| (12) |

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions) ¨ |

| (13) |

|

Percent of class represented by amount

in Row (11) 28.1% (2) |

| (14) |

|

Type of reporting person (see

instructions) CO |

| (1) |

representing (i) 61,776,334 Class A Ordinary Shares held by Orient Hongtai (Hong Kong) Limited, a Hong Kong company, which is directly wholly owned by Orient Zhisheng Investment Center (Shanghai) L.P., a PRC limited

partnership, of which Orient Hongtai Capital Management (Shanghai) Co., Ltd. is a general partner, and (ii) 61,776,335 Class A Ordinary Shares held by Orient Hongzhi (Hong Kong) Limited, a Hong Kong company, which is directly wholly owned by Orient

Zhihui Investment Center (Shanghai) L.P., a PRC limited partnership, of which Orient Hongtai Capital Management (Beijing) Co., Ltd. is a general partner. Orient Hongtai Capital Management (Shanghai) Co., Ltd. and Orient Hongtai Capital Management

(Beijing) Co., Ltd. are direct wholly-owned subsidiaries of Orient Ruide Capital Management (Shanghai) Co., Ltd., a PRC company. |

| (2) |

percentage calculated based on total Class A Ordinary Shares outstanding as of October 20, 2014. As of October 20, 2014, 440,155,500 Class A Ordinary Shares (including Class A Ordinary Shares represented by ADSs) and

97,518,374 Class B Ordinary Shares were outstanding. |

9

13D

|

|

|

|

|

|

|

| (1) |

|

Name of

reporting person Orient Securities Capital Company Limited |

| (2) |

|

Check the appropriate box if a member

of a group (see instructions)

(a) x (b) ¨ |

| (3) |

|

SEC use only

|

| (4) |

|

Source of funds (see instructions)

AF, BK |

| (5) |

|

Check box if disclosure of legal

proceedings is required pursuant to Item 2(d) or 2(e) ¨ |

| (6) |

|

Citizenship or place of

organization The People’s Republic of

China |

| Number of

shares beneficially

owned by each

reporting person

with |

|

(7) |

|

Sole voting power

0 shares |

| |

(8) |

|

Shared voting power

123,552,669 shares

(1) |

| |

(9) |

|

Sole dispositive power

0 shares |

| |

(10) |

|

Shared dispositive power

123,552,669 shares

(1) |

| (11) |

|

Aggregate amount beneficially owned by each reporting person

123,552,669 shares (1) |

| (12) |

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions) ¨ |

| (13) |

|

Percent of class represented by amount

in Row (11) 28.1% (2) |

| (14) |

|

Type of reporting person (see

instructions) CO |

| (1) |

representing (i) 61,776,334 Class A Ordinary Shares held by Orient Hongtai (Hong Kong) Limited, a Hong Kong company, which is directly wholly owned by Orient Zhisheng Investment Center (Shanghai) L.P., a PRC limited

partnership, of which Orient Hongtai Capital Management (Shanghai) Co., Ltd. is a general partner, and (ii) 61,776,335 Class A Ordinary Shares held by Orient Hongzhi (Hong Kong) Limited, a Hong Kong company, which is directly wholly owned by Orient

Zhihui Investment Center (Shanghai) L.P., a PRC limited partnership, of which Orient Hongtai Capital Management (Beijing) Co., Ltd. is a general partner. Orient Hongtai Capital Management (Shanghai) Co., Ltd. and Orient Hongtai Capital Management

(Beijing) Co., Ltd. are direct wholly-owned subsidiaries of Orient Ruide Capital Management (Shanghai) Co., Ltd., a PRC company, which is directly wholly owned by Orient Securities Capital Company Limited, a PRC company. |

| (2) |

percentage calculated based on total Class A Ordinary Shares outstanding as of October 20, 2014. As of October 20, 2014, 440,155,500 Class A Ordinary Shares (including Class A Ordinary Shares represented by ADSs) and

97,518,374 Class B Ordinary Shares were outstanding. |

10

13D

|

|

|

|

|

|

|

| (1) |

|

Name of

reporting person Orient Securities Company Limited |

| (2) |

|

Check the appropriate box if a member

of a group (see instructions)

(a) x (b) ¨ |

| (3) |

|

SEC use only

|

| (4) |

|

Source of funds (see instructions)

AF, BK |

| (5) |

|

Check box if disclosure of legal

proceedings is required pursuant to Item 2(d) or 2(e) ¨ |

| (6) |

|

Citizenship or place of

organization The People’s Republic of

China |

| Number of

shares beneficially

owned by each

reporting person

with |

|

(7) |

|

Sole voting power

0 shares |

| |

(8) |

|

Shared voting power

123,552,669 shares

(1) |

| |

(9) |

|

Sole dispositive power

0 shares |

| |

(10) |

|

Shared dispositive power

123,552,669 shares

(1) |

| (11) |

|

Aggregate amount beneficially owned by each reporting person

123,552,669 shares (1) |

| (12) |

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions) ¨ |

| (13) |

|

Percent of class represented by amount

in Row (11) 28.1% (2) |

| (14) |

|

Type of reporting person (see

instructions) CO |

| (1) |

representing (i) 61,776,334 Class A Ordinary Shares held by Orient Hongtai (Hong Kong) Limited, a Hong Kong company, which is directly wholly owned by Orient Zhisheng Investment Center (Shanghai) L.P., a PRC limited

partnership, of which Orient Hongtai Capital Management (Shanghai) Co., Ltd. is a general partner, and (ii) 61,776,335 Class A Ordinary Shares held by Orient Hongzhi (Hong Kong) Limited, a Hong Kong company, which is directly wholly owned by Orient

Zhihui Investment Center (Shanghai) L.P., a PRC limited partnership, of which Orient Hongtai Capital Management (Beijing) Co., Ltd. is a general partner. Orient Hongtai Capital Management (Shanghai) Co., Ltd. and Orient Hongtai Capital Management

(Beijing) Co., Ltd. are direct wholly-owned subsidiaries of Orient Ruide Capital Management (Shanghai) Co., Ltd., a PRC company, which is directly wholly owned by Orient Securities Capital Company Limited, a PRC company, which is in turn directly

wholly owned by Orient Securities Company Limited, a PRC company. |

| (2) |

percentage calculated based on total Class A Ordinary Shares outstanding as of October 20, 2014. As of October 20, 2014, 440,155,500 Class A Ordinary Shares (including Class A Ordinary Shares represented by ADSs) and

97,518,374 Class B Ordinary Shares were outstanding. |

11

Introduction.

This statement on Schedule 13D/A (this “Statement”) amends the previous Schedule 13D filed by Orient Finance Holdings (Hong Kong)

Limited and Orient Securities Company Limited with the Securities and Exchange Commission on September 11, 2014, as amended and supplemented by the Amendment No. 1 filed under Schedule 13D/A on September 25, 2014 (the “Original

13D”) with respect to Shanda Games Limited (the “Issuer”). Except as amended and supplemented herein, the information set forth in the Original 13D remains unchanged. Capitalized terms used herein without definition have meanings

assigned thereto in the Original 13D.

| Item 2. |

Identity and Background. |

Item 2 is hereby amended and restated as follows:

(a)-(c) This Statement is being filed jointly by and on behalf of (a) Orient Finance Holdings (Hong Kong) Limited, a company

incorporated under the laws of Hong Kong (“Orient HK”), (b) Orient Hongtai (Hong Kong) Limited, a company incorporated under the laws of Hong Kong (“Hongtai HK”), (c) Orient Zhisheng Investment Center (Shanghai) L.P., a

limited partnership organized under the laws of the People’s Republic of China (“Orient Zhisheng”), (d) Orient Hongtai Capital Management (Shanghai) Co., Ltd., a company established under the laws of the People’s Republic of

China (“Hongtai Shanghai”), (e) Orient Hongzhi (Hong Kong) Limited, a company incorporated under the laws of Hong Kong (“Hongzhi HK”), (f) Orient Zhihui Investment Center (Shanghai) L.P., a limited partnership organized

under the laws of the People’s Republic of China (“Orient Zhihui”), (g) Orient Hongtai Capital Management (Beijing) Co., Ltd., a company established under the laws of the People’s Republic of China (“Hongtai

Beijing”), (h) Orient Ruide Capital Management (Shanghai) Co., Ltd., a company established under the laws of the People’s Republic of China (“Orient Ruide”), (i) Orient Securities Capital Company Limited, a company

established under the laws of the People’s Republic of China (“Orient Capital”) and (j) Orient Securities Company Limited, a company established under the laws of the People’s Republic of China (“Orient

Securities,” together with Orient HK, Hongtai HK, Orient Zhisheng, Hongtai Shanghai, Hongzhi HK, Orient Zhihui, Hongtai Beijing, Orient Ruide, and Orient Capital, the “Reporting Persons”), pursuant to their agreement to the joint

filing of this Statement, filed herewith as Exhibit 7.01.

Orient HK’s principal business is making equity investments in private and

public companies. Its principal business address, which also serves as its principal office, is 29/F, 100 Queen’s Road Central, Central, Hong Kong. Orient HK is directly wholly owned by Orient Securities.

Hongtai HK’s principal business is making equity investments in private and public companies. Its principal business address, which also

serves as its principal office, is 28-29/F, 100 Queen’s Road Central, Central, Hong Kong. Hongtai HK is directly wholly owned by Orient Zhisheng.

Orient Zhisheng’s principal business is provision of investment management and consultancy services. Its principal business address,

which also serves as its principal office, is 36F, Building No. 2, Orient International Finance Center, 318 South Zhong Shan Road, Shanghai, the People’s Republic of China. Hongtai Shanghai and Orient Capital are its general partners.

Hongtai Shanghai’s principal business is acting as the general partner of Orient Zhisheng. Its principal business address, which also

serves as its principal office, is 36F, Building No. 2, Orient International Finance Center, 318 South Zhong Shan Road, Shanghai, the People’s Republic of China. Hongtai Shanghai is directly wholly owned by Orient Ruide.

12

Hongzhi HK’s principal business is making equity investments in private and public

companies. Its principal business address, which also serves as its principal office, is 28-29/F, 100 Queen’s Road Central, Central, Hong Kong. Hongzhi HK is directly wholly owned by Orient Zhihui.

Orient Zhihui’s principal business is provision of investment management and consultancy services. Its principal business address, which

also serves as its principal office, is 36F, Building No. 2, Orient International Finance Center, 318 South Zhong Shan Road, Shanghai, the People’s Republic of China. Hongtai Beijing and Orient Capital are its general partners.

Hongtai Beijing’s principal business is acting as the general partner of Orient Zhihui. Its principal business address, which also serves

as its principal office, is 1219, Techart Plaza, 30 Xue Yuan Road, Haidian District, Beijing, the People’s Republic of China. Hongtai Beijing is directly wholly owned by Orient Ruide.

Orient Ruide’s principal business is provision of investment management and consultancy services. Its principal business address, which

also serves as its principal office, is 36F, Building No. 2, Orient International Finance Center, 318 South Zhong Shan Road, Shanghai, the People’s Republic of China. Orient Ruide is directly wholly owned by Orient Capital.

Orient Capital’s principal business is making equity investments in private and public companies. Its principal business address, which

also serves as its principal office, is 36F, Building No. 2, Orient International Finance Center, 318 South Zhong Shan Road, Shanghai, the People’s Republic of China. Orient Capital is directly wholly owned by Orient Securities.

Orient Securities is a financial service firm providing securities brokerage, investment consultancy, and equity and debt financing services.

Its principal business address, which also serves as its principal office, is 22, 23, and 25-29F, Building No. 2, Orient International Finance Center, 318 South Zhong Shan Road, Shanghai, the People’s Republic of China.

Certain information required by this Item 2(a)-(c) and (f) concerning the directors and executive officers of Orient HK and

Orient Securities is set forth on Schedule A annexed hereto, which is incorporated herein by reference.

(d) None of the Reporting Persons

has been convicted in a criminal proceeding the past five years (excluding traffic violations or similar misdemeanors).

(e) During the

past five years, none of the Reporting Persons was a party to a civil proceeding of a judicial or administrative body of competent jurisdiction as a result of which such person was or is subject to a judgment, decree or final order enjoining future

violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

| Item 3. |

Source or Amount of Funds or Other Consideration. |

Item 3 is hereby amended and restated as

follows:

On August 31, 2014, SDG (as defined below) and Orient HK entered into the Orient Share Purchase Agreement (as defined

below), pursuant to which SDG agreed to sell, and Orient HK agreed to purchase, 123,552,669 Class A Ordinary Shares at US$3.45 per share for a total consideration of approximately US$426.3 million. Orient HK obtained the funds used to acquire

shares under the Orient Share Purchase Agreement from loans from Hongtai HK and Hongzhi HK and a bank loan.

13

On November 24, 2014, Orient HK and Hongtai HK entered into the Hongtai Share Purchase

Agreement (as defined below) and Orient HK and Hongzhi HK enter into the Hongzhi Share Purchase Agreement (as defined below), pursuant to which Orient HK agreed to sell, and Hongtai HK and Hongzhi HK agreed to purchase, 61,776,334 Class A

Ordinary Shares and 61,776,335 Class A Ordinary Shares, respectively. As the consideration for the shares acquired under the Hongtai Share Purchase Agreement and the Hongzhi Share Purchase Agreement, Orient HK was released from its repayment

obligations under the loans with Hongtai HK and Hongzhi HK, and assigned its repayment obligations under the bank loan to Hongtai HK and Hongzhi HK.

| Item 4. |

Purpose of Transaction. |

Item 4 is hereby amended and restated as follows:

On January 27, 2014, Shanda Interactive Entertainment Limited (“Shanda Interactive”) and Primavera Capital (Cayman) Fund I L.P.

(“Primavera”) (together with Shanda Interactive, the “Consortium” and each member in the Consortium, a “Consortium Member”) entered into a consortium agreement (the “Consortium Agreement”). Under the

Consortium Agreement, the Consortium Members agreed, among other things, (i) to jointly deliver a preliminary non-binding proposal (the “Proposal”) to the board of directors of the Issuer (the “Board”) to acquire the Issuer

in a going-private transaction (the “Transaction”), (ii) to deal exclusively with each other with respect to the Transaction until the earlier of (x) nine months after the date thereof, and (y) termination of the Consortium

Agreement by all Consortium Members, (iii) to use their reasonable efforts and cooperate in good faith to arrange debt financing to support the Transaction, and (iv) to cooperate and proceed in good faith to negotiate and consummate the

Transaction.

On January 27, 2014, Shanda SDG Investment Limited (“SDG”), a wholly-owned subsidiary of Shanda Interactive,

and Primavera entered into a share purchase agreement (the “Primavera Share Purchase Agreement”) pursuant to which SDG sold, and Primavera purchased, 28,959,276 Class A Ordinary Shares at US$2.7625 per Class A Ordinary Share.

On April 18, 2014, SDG and Perfect World Co., Ltd. (“Perfect World”) entered into a share purchase agreement (the “PW

Share Purchase Agreement”) pursuant to which SDG sold, and Perfect World purchased, 30,326,005 Class A Ordinary Shares at US$3.2975 per Class A Ordinary Share.

Concurrently with the execution of the PW Share Purchase Agreement, Shanda Interactive, Primavera and Perfect World entered into an adherence

agreement (the “PW Adherence Agreement”), pursuant to which Perfect World became a party to the Consortium Agreement and joined the Consortium.

On April 25, 2014, FV Investment Holdings (“FV Investment”), which is an affiliate of FountainVest Partners, Shanda

Interactive, Primavera and Perfect World entered into an adherence agreement (the “FV Adherence Agreement”), pursuant to which FV Investment became a party to the Consortium Agreement and joined the Consortium.

On May 19, 2014, CAP IV Engagement Limited (“Carlyle”), which is an affiliate of Carlyle Asia Partners IV, L.P., Shanda

Interactive, Primavera, Perfect World and FV Investment entered into an adherence agreement (the “Carlyle Adherence Agreement”), pursuant to which Carlyle became a party to the Consortium Agreement and joined the Consortium.

14

On August 31, 2014, SDG and Orient HK entered into a share purchase agreement (the

“Orient Share Purchase Agreement”) pursuant to which SDG agreed to sell, and Orient HK agreed to purchase, 123,552,669 Class A Ordinary Shares (the “Orient Purchase Shares”) at US$3.45 per Class A Ordinary Share (the

“Orient Purchase Price”) subject to the terms and conditions thereof. Pursuant to the Orient Share Purchase Agreement, if (i) a going-private transaction occurs within one year of the closing date of the sale of the Orient Purchase

Shares where Orient HK is part of the buyer consortium and the going-private price is higher than the Orient Purchase Price, or (ii) a going-private transaction occurs within one year of the closing date of the sale of the Orient Purchase

Shares where Orient HK is not part of the buyer consortium due to its own decision or election without SDG’s written consent and the going-private price is higher than the Orient Purchase Price, Orient shall pay SDG the difference between the

Orient Purchase Price and the going-private price with respect to all the Orient Purchase Shares. Pursuant to the Orient Share Purchase Agreement, if a going-private transaction is not consummated within one year of the closing date of the sale of

the Orient Purchase Shares solely due to SDG’s failure to vote in favor of such going-private transaction, SDG shall repurchase the Orient Purchase Shares at a per share price equal to the Orient Purchase Price. The purchase and sale of the

Orient Purchase Shares was completed on September 23, 2014.

On September 1, 2014, Perfect World, FV Investment and Carlyle

withdrew from the Consortium pursuant to a withdrawal notice (the “Withdrawal Notice”). References to “Consortium” or “Consortium Members” after September 1, 2014 shall not include Perfect World, FV Investment and

Carlyle.

On September 1, 2014, Shanda Interactive, Primavera and Orient HK entered into an adherence agreement (the “Orient

Adherence Agreement”), pursuant to which Orient HK became a party to the Consortium Agreement and joined the Consortium. References to “Consortium” or “Consortium Members” after September 1, 2014 shall include Orient

HK.

On September 1, 2014, SDG and Shanghai Buyout Fund L.P., a limited partnership formed under the laws of the People’s

Republic of China (“Haitong”), entered into a share purchase agreement (the “Haitong Share Purchase Agreement I”) pursuant to which SDG agreed to sell, and Haitong agreed to purchase, 48,152,848 Class A Ordinary Shares (the

“Haitong Purchase Shares”) at US$3.45 per Class A Ordinary Share subject to the terms and conditions thereof. The purchase and sale of the Haitong Purchase Shares was completed on September 23, 2014.

Concurrently with the execution of the Haitong Share Purchase Agreement I, Primavera, Perfect World and Haitong entered into a share purchase

agreement (the “Haitong Share Purchase Agreement II”), pursuant to which Haitong agreed to purchase 28,959,276 and 30,326,005 Class A Ordinary Shares (collectively, the “Haitong Secondary Purchase Shares”) from Primavera and

Perfect World, respectively. The purchase and sale of the Haitong Secondary Purchase Shares was completed on September 23, 2014. In connection with the transaction, SDG, Primavera and Perfect World entered into a consent and release dated as of

September 1, 2014 (the “Consent and Release”), pursuant to which all remaining obligations of Primavera and its affiliates and SDG and its affiliates under the Primavera Share Purchase Agreement, and all remaining obligations of

Perfect World and its affiliates and SDG and its affiliates under the PW Share Purchase Agreement, as applicable, automatically terminated upon consummation of the transaction.

On September 1, 2014, Shanda Interactive, Primavera and Haitong entered into an adherence agreement (the “Haitong Adherence

Agreement”), pursuant to which Haitong became a party to the Consortium Agreement and joined the Consortium. References to “Consortium” or “Consortium Members” after September 1, 2014 shall include Haitong.

On September 1, 2014, SDG and Ningxia Zhongyincashmere International Group Co., Ltd., a company formed under the laws of the

People’s Republic of China (“Ningxia”), entered into a share purchase agreement (the “Ningxia Share Purchase Agreement”) pursuant to which SDG agreed to sell, and Ningxia agreed to purchase, 80,577,828 Class A Ordinary

Shares (the “Ningxia Purchase Shares”) at US$3.45 per Class A Ordinary Share subject to the terms and conditions thereof. The purchase and sale of the Ningxia Purchase Shares was completed on September 23, 2014.

15

On September 1, 2014, Shanda Interactive, Primavera and Ningxia entered into an adherence

agreement (the “Ningxia Adherence Agreement”), pursuant to which Ningxia became a party to the Consortium Agreement and joined the Consortium. References to “Consortium” or “Consortium Members” after September 1,

2014 shall include Ningxia.

On September 1, 2014, Primavera withdrew from the Consortium pursuant to a withdrawal notice (the

“Primavera Withdrawal Notice”). References to “Consortium” or “Consortium Members” after September 1, 2014 shall not include Primavera.

On October 27, 2014, the exclusivity period under the Consortium Agreement expired.

On November 24, 2014, Orient HK and Hongtai HK entered into a share purchase agreement (the “Hongtai Share Purchase Agreement”)

and Orient HK and Hongzhi HK enter into a share purchase agreement (the “Hongzhi Share Purchase Agreement”), pursuant to which Orient HK agreed to sell, and Hongtai HK and Hongzhi HK agreed to purchase, 61,776,334 Class A Ordinary

Shares and 61,776,335 Class A Ordinary Shares, respectively. As the consideration for the shares acquired under the Hongtai Share Purchase Agreement and the Hongzhi Share Purchase Agreement, Orient HK was released from its repayment obligations

under the loans with Hongtai HK and Hongzhi HK, and assigned its repayment obligations under a certain bank loan to Hongtai HK and Hongzhi HK.

Descriptions of the Consortium Agreement, the Primavera Share Purchase Agreement, the PW Share Purchase Agreement, the PW Adherence Agreement,

the FV Adherence Agreement, the Carlyle Adherence Agreement, the Orient Share Purchase Agreement, the Haitong Share Purchase Agreement I, the Ningxia Share Purchase Agreement, the Orient Adherence Agreement, the Haitong Adherence Agreement, the

Ningxia Adherence Agreement, the Withdrawal Notice, the Primavera Withdrawal Notice, the Haitong Share Purchase Agreement II, and the Consent and Release in this Statement are qualified in their entirety by reference to the Consortium Agreement, the

Primavera Share Purchase Agreement, the PW Share Purchase Agreement, the PW Adherence Agreement, the FV Adherence Agreement, the Carlyle Adherence Agreement, the Orient Share Purchase Agreement, the Haitong Share Purchase Agreement I, the Ningxia

Share Purchase Agreement, the Orient Adherence Agreement, the Haitong Adherence Agreement, the Ningxia Adherence Agreement, the Withdrawal Notice, the Primavera Withdrawal Notice, the Haitong Share Purchase Agreement II, the Consent and Release, the

Hongtai Share Purchase Agreement, and the Hongzhi Share Purchase Agreement, copies of which are filed as Exhibits 7.03, 7.04, 7.05, 7.06, 7.07,7.08, 7.09, 7.10, 7.11, 7.12, 7.13, 7.14, 7.15, 7.16, 7.17, 7.18, 7.19 and 7.20 hereto and incorporated

herein by reference in their entirety.

| Item 5. |

Interest in Securities of the Issuer. |

Item 5(a) – (b) is hereby amended and restated as

follows:

(a)-(b) The following disclosure assumes that there were a total of 440,155,500 Class A Ordinary Shares and 97,518,374

Class B Ordinary Shares outstanding as of October 20, 2014. Each Class A Ordinary Share is entitled to one vote per share and is not convertible into Class B Ordinary Shares. Each Class B Ordinary Share is entitled to 10 votes per share

and is convertible at any time into one Class A Ordinary Share at the election of its holder.

16

Under the Hongtai Share Purchase Agreement and the Hongzhi Share Purchase Agreement, Hongtai HK

and Hongzhi HK acquired an aggregate of 123,552,669 Class A Ordinary Shares from Orient HK, which in turn acquired such shares under the Orient Share Purchase Agreement from the Class B Ordinary Shares held by SDG that were converted into

Class A Ordinary Shares on a one-to-one basis, representing approximately 23.0% of the combined total outstanding shares (including Class A Ordinary Shares and Class B Ordinary Shares) of the Issuer as of October 20, 2014.

| Item 7. |

Material to Be Filed as Exhibits. |

Item 7 is hereby amended and supplemented by amending Exhibit

7.01 and adding Exhibit 7.19 and Exhibit 7.20 to the end thereof:

|

|

|

| Exhibit 7.01: |

|

Joint Filing Agreement by and between the Reporting Persons dated November 28, 2014. |

|

|

| Exhibit 7.19: |

|

Hongtai Share Purchase Agreement dated November 24, 2014 (Translation). |

|

|

| Exhibit 7.20: |

|

Hongzhi Share Purchase Agreement dated November 24, 2014 (Translation). |

17

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this Statement is true,

complete and correct.

Dated: November 28, 2014

|

|

|

|

|

| Orient Finance Holdings (Hong Kong) Limited |

|

|

| By: |

|

/s/ Guan Ning |

|

|

Name: |

|

Guan Ning |

|

|

Title: |

|

Chief Executive Officer |

|

| Orient Hongtai (Hong Kong) Limited |

|

|

| By: |

|

/s/ Chen Bo |

|

|

Name: |

|

Chen Bo |

|

|

Title: |

|

Director |

|

| Orient Zhisheng Investment Center (Shanghai) L.P. |

| By Orient Hongtai Capital Management (Shanghai) Co., Ltd., its general partner |

|

|

| By: |

|

/s/ Chen Bo |

|

|

Name: |

|

Chen Bo |

|

|

Title: |

|

Director |

|

| By Orient Securities Capital Company Limited, its general partner |

|

|

| By: |

|

/s/ Pan Xinjun |

|

|

Name: |

|

Pan Xinjun |

|

|

Title: |

|

Chairman |

|

| Orient Hongtai Capital Management (Shanghai) Co., Ltd. |

|

|

| By: |

|

/s/ Chen Bo |

|

|

Name: |

|

Chen Bo |

|

|

Title: |

|

Director |

|

| Orient Hongzhi (Hong Kong) Limited |

|

|

| By: |

|

/s/ Chen Bo |

|

|

Name: |

|

Chen Bo |

|

|

Title: |

|

Director |

18

|

|

|

|

|

| Orient Zhihui Investment Center (Shanghai) L.P. |

| By Orient Hongtai Capital Management (Beijing) Co., Ltd., its general partner |

|

|

| By: |

|

/s/ Chen Bo |

|

|

Name: |

|

Chen Bo |

|

|

Title: |

|

Director |

|

| By Orient Securities Capital Company Limited, its general partner |

|

|

| By: |

|

/s/ Pan Xinjun |

|

|

Name: |

|

Pan Xinjun |

|

|

Title: |

|

Chairman |

|

| Orient Hongtai Capital Management (Beijing) Co., Ltd. |

|

|

| By: |

|

/s/ Chen Bo |

|

|

Name: |

|

Chen Bo |

|

|

Title: |

|

Director |

|

| Orient Ruide Capital Management (Shanghai) Co., Ltd. |

|

|

| By: |

|

/s/ Chen Bo |

|

|

Name: |

|

Chen Bo |

|

|

Title: |

|

Director |

|

| Orient Securities Capital Company Limited |

|

|

| By: |

|

/s/ Pan Xinjun |

|

|

Name: |

|

Pan Xinjun |

|

|

Title: |

|

Chairman |

|

| Orient Securities Company Limited |

|

|

| By: |

|

/s/ Jin Wenzhong |

|

|

Name: |

|

Jin Wenzhong |

|

|

Title: |

|

Chief Executive Officer |

19

Schedule A

Orient HK

Set forth below is certain

additional information concerning the directors and executive officers of Orient HK. The business address of each of such persons is 29/F 100 Queen’s Road Central, Central, Hong Kong, and each of such persons is a citizen of the People’s

Republic of China.

|

|

|

| NAME |

|

PRESENT PRINCIPAL OCCUPATION OR EMPLOYMENT |

| Yang Yucheng |

|

Director; vice president and board secretary of Orient Securities |

| Xiao Yintao |

|

Director; chairman of the board of supervisors of Orient Securities; director of Orient Capital |

| Jin Wenzhong |

|

Director; director and chief executive officer of Orient Securities |

| Li Jin’an |

|

Director; chief compliance officer and chief risk officer of Orient Securities |

| Guan Ning |

|

Director; chief executive officer |

| Yao Hua |

|

Director; deputy general manager |

Hongtai HK and Hongzhi HK

Set forth below is certain additional information concerning the directors of Hongtai HK and Hongzhi HK. The business address of each of such

persons is 28-29/F 100 Queen’s Road Central, Central, Hong Kong, and each of such persons is a citizen of the People’s Republic of China.

|

|

|

| NAME |

|

PRESENT PRINCIPAL OCCUPATION OR EMPLOYMENT |

| Chen Bo |

|

Director; director of Hongtai Shanghai, Hongtai Beijing, Orient Ruide and Orient Capital; general manager of Hongtai Shanghai, Orient Ruide and Orient Capital |

| Ma Yuntao |

|

Director; director and general manager of Hongtai Beijing |

Hongtai Shanghai

Set forth below is certain additional information concerning the director and general manager of Hongtai Shanghai. For the business address and

citizenship of such person, see description above.

|

|

|

| NAME |

|

PRESENT PRINCIPAL OCCUPATION OR EMPLOYMENT |

| Chen Bo |

|

See description above |

Hongtai Beijing

Set forth below is certain additional information concerning the directors and general manager of Hongtai Beijing. Except as otherwise

indicated, the business address of each of such persons is 1219, Techart Plaza, 30 Xue Yuan Road, Haidian District, Beijing, the People’s Republic of China.

|

|

|

| NAME |

|

PRESENT PRINCIPAL OCCUPATION OR EMPLOYMENT |

| Chen Bo |

|

See description above |

| Ma Yuntao |

|

See description above |

| Shi Jianmei |

|

Director |

20

Orient Ruide

Set forth below is certain additional information concerning the director and general manager of Orient Ruide. For the business address and

citizenship of such person, see description above.

|

|

|

| NAME |

|

PRESENT PRINCIPAL OCCUPATION OR EMPLOYMENT |

| Chen Bo |

|

See description above |

Orient Capital

Set forth below is certain additional information concerning the directors and general manager of Orient Capital. Except as otherwise

indicated, the business address of each of such persons is 28-29F, Building No. 2, Orient International Finance Center, 318 South Zhong Shan Rd., Shanghai, the People’s Republic of China, and each of such persons is a citizen of the

People’s Republic of China.

|

|

|

| NAME |

|

PRESENT PRINCIPAL OCCUPATION OR EMPLOYMENT |

| Pan Xinjun |

|

Chairman of the board of directors; chairman of the board of director of Orient Securities |

| Jin Wenzhong |

|

See description above |

| Du Weihua |

|

Director |

| Chen Bo |

|

See description above |

| Chen Guangming |

|

Director |

Orient Securities

Set forth below is certain additional information concerning the directors and executive officers of Orient Securities. Except as otherwise

indicated, the business address of each of such persons is 22, 23, and 25-29F, Building No. 2, Orient International Finance Center, 318 South Zhong Shan Rd., Shanghai, the People’s Republic of China, and each of such persons is a citizen

of the People’s Republic of China.

|

|

|

| NAME |

|

PRESENT PRINCIPAL OCCUPATION OR EMPLOYMENT |

| Pan Xinjun |

|

See description above |

| Jin Wenzhong |

|

See description above |

| Song Xuefeng |

|

Director; assistant general manager of Shenergy (Group) Company Limited (“Shenergy Group”), a PRC-based investment holding company investing principally in power, energy, natural gas and high-tech industries |

| Zhang Qian |

|

Director; general manager of a subsidiary of Shenergy Group |

| Wu Junhao |

|

Director; general manager in the financial management department of Shenergy Group |

| Zhou Donghui |

|

Director; deputy head in the financial management department of Shanghai Tobacco Group Co., Ltd., a PRC-based tobacco company |

| Jia Yifan |

|

Director; party branch secretary of the Oriental Morning Post, a Chinese newspaper based in Shanghai |

| Xu Chao |

|

Director; chief economist and head in the investment management department of Shanghai Electric Group Co., Ltd, an equipment manufacturing company in China |

21

|

|

|

| Chen Bichang |

|

Director; general manager of Shanghai Post Co., Ltd., a Chinese postal service company |

| Zhou Yao |

|

Director; general manager in the construction management center of Shanghai Jinqiao (Group) Co., Ltd., construction company based in Shanghai, China |

| Xu Guoxiang |

|

Independent director; dean of Applied Statistics Study Center of Shanghai University of Finance and Economics |

| Li Huizhen |

|

Independent director |

| Lu Xiongwen |

|

Independent director; dean of School of Management of Fudan University |

| Chen Xinyuan |

|

Independent director; dean of School of Accountancy of Shanghai University of Finance and Economics |

| Li Zhiqiang |

|

Independent director; founding partner of Jin Mao Partners, a PRC-based law firm |

| Wang Guobin |

|

Vice president |

| Yang Yucheng |

|

See description above |

| Shu Hong |

|

Vice president |

| Li Jin’an |

|

See description above |

| Ma Ji |

|

Chief investment banking officer |

| Zhang Jianhui |

|

Chief financial officer |

| Qi Lei |

|

Chief investment officer |

22

Exhibit 7.01

Joint Filing Agreement

In accordance with Rule 13d-1(k) promulgated under the Securities Exchange Act of 1934, as amended, the undersigned hereby agree to the joint

filing with all other Reporting Person (as such term is defined in the Schedule 13D/A referred to below) on behalf of each of them of a statement on Schedule 13D/A (including amendments thereto) with respect to the Class A ordinary shares, par

value US$0.01 per share and the Class B ordinary shares, par value US$0.01 per share of Shanda Games Limited, a Cayman Islands company, and that this Agreement may be included as an Exhibit to such joint filing. This Agreement may be executed in any

number of counterparts all of which, taken together, shall constitute one and the same instrument.

[Signature page to follow]

IN WITNESS WHEREOF, the undersigned hereby execute this Agreement as of November 28, 2014.

|

|

|

|

|

| Orient Finance Holdings (Hong Kong) Limited |

|

|

| By: |

|

/s/ Guan Ning |

|

|

Name: |

|

Guan Ning |

|

|

Title: |

|

Chief Executive Officer |

|

| Orient Hongtai (Hong Kong) Limited |

|

|

| By: |

|

/s/ Chen Bo |

|

|

Name: |

|

Chen Bo |

|

|

Title: |

|

Director |

|

| Orient Zhisheng Investment Center (Shanghai) L.P. |

| By Orient Hongtai Capital Management (Shanghai) Co., Ltd., its general partner |

|

|

| By: |

|

/s/ Chen Bo |

|

|

Name: |

|

Chen Bo |

|

|

Title: |

|

Director |

|

| By Orient Securities Capital Company Limited, its general partner |

|

|

| By: |

|

/s/ Pan Xinjun |

|

|

Name: |

|

Pan Xinjun |

|

|

Title: |

|

Chairman |

|

| Orient Hongtai Capital Management (Shanghai) Co., Ltd. |

|

|

| By: |

|

/s/ Chen Bo |

|

|

Name: |

|

Chen Bo |

|

|

Title: |

|

Director |

|

| Orient Hongzhi (Hong Kong) Limited |

|

|

| By: |

|

/s/ Chen Bo |

|

|

Name: |

|

Chen Bo |

|

|

Title: |

|

Director |

-2-

|

|

|

|

|

| Orient Zhihui Investment Center (Shanghai) L.P. |

| By Orient Hongtai Capital Management (Beijing) Co., Ltd., its general partner |

|

|

| By: |

|

/s/ Chen Bo |

|

|

Name: |

|

Chen Bo |

|

|

Title: |

|

Director |

|

| By Orient Securities Capital Company Limited, its general partner |

|

|

| By: |

|

/s/ Pan Xinjun |

|

|

Name: |

|

Pan Xinjun |

|

|

Title: |

|

Chairman |

|

| Orient Hongtai Capital Management (Beijing) Co., Ltd. |

|

|

| By: |

|

/s/ Chen Bo |

|

|

Name: |

|

Chen Bo |

|

|

Title: |

|

Director |

|

| Orient Ruide Capital Management (Shanghai) Co., Ltd. |

|

|

| By: |

|

/s/ Chen Bo |

|

|

Name: |

|

Chen Bo |

|

|

Title: |

|

Director |

|

| Orient Securities Capital Company Limited |

|

|

| By: |

|

/s/ Pan Xinjun |

|

|

Name: |

|

Pan Xinjun |

|

|

Title: |

|

Chairman |

|

| Orient Securities Company Limited |

|

|

| By: |

|

/s/ Jin Wenzhong |

|

|

Name: |

|

Jin Wenzhong |

|

|

Title: |

|

Chief Executive Officer |

-3-

Exhibit 7.19

Share Transfer Agreement

(Translation)

This SHARE TRANSFER

AGREEMENT (this “Agreement”) dated as of November 24, 2014 (the “Signing Date”) is made by and among:

| |

(1) |

Orient Hongtai (Hong Kong) Limited, a company incorporated and existing under the laws of Hong Kong (the “Transferee”), and |

| |

(2) |

Orient Finance Holdings (Hong Kong) Limited, a company incorporated and existing under the laws of Hong Kong (the “Transferor”). |

WHEREAS:

| |

(1) |

The Transferor owns 61,776,334 Class A Ordinary Shares (the “Target Shares”) of Shanda Games Limited (the “Company”) as of the Signing Date; |

| |

(2) |

The Transferor agrees to transfer to the Transferee, and the Transferee agrees to purchase from the Transferor, the Target Shares; |

| |

(3) |

Pursuant to the Collection of Investment Amount and Loan Agreement entered into between the Transferor and the Transferee in September 2014 (the “Collection of Investment Amount and Loan Agreement”),

the Transferee loaned to the Transferor a sum of US$106,631,000 (the “Loan”); and |

| |

(4) |

Pursuant to the Loan Agreement between the Transferor and Bank of Shanghai Co., Ltd. (“Bank of Shanghai”) on September 23, 2014 (the “Loan Agreement”), the Transferor borrowed from

Bank of Shanghai a sum of US$213,000,000 and shall pay relevant interest accrued thereon. |

AGREEMENT:

1.1 Transfer

Subject to the terms and conditions set forth in this Agreement, the Transferor agrees to transfer as of the Closing Date (as

defined below) to the Transferee an aggregate of 61,776,334 Class A Ordinary Shares of the Company and the Transferee agrees to accept the Target Shares.

The Target Shares owned by the Transferor, including all the relevant rights and obligations thereunder, as of the Signing

Date, shall be transferred to the Transferee.

1.2 Purchase Price

The parties agree on the transfer price as follows:

| |

(1) |

The amount loaned to the Transferor by the Transferee shall set off a portion of the purchase price. The Collection of Investment Amount and Loan Agreement, including all the rights and obligations thereunder, shall be

terminated as of the Signing Date; |

| |

(2) |

Having been approved by Bank of Shanghai in writing, the Transferor’s repayment obligations of the sum of US$106,500,000 shall be transferred to the Transferee as of the Signing Date, as a result of which the

Transferee shall be liable for repayment to Bank of Shanghai the principal amount and the interest accrued thereon, which shall set off a portion of the purchase price; and |

| |

(3) |

The amounts under paragraphs (1) and (2) above shall constitute the total purchase price for the Target Shares. |

1.3 Closing

The transfer of the Target Shares shall be completed on the Signing Date by way of delivery of relevant documents by each party

to the other, or on such other date and at such other venue agreed by the Transferee and the Transferor in writing (the “Closing,” the date of the Closing, the “Closing Date”).

| |

2. |

Representations and Warranties |

2.1 Transferor’s Representations and

Warranties: The Transferor legally owns the title to the Target Shares immediately prior to the Closing Date.

2.2

Transferee’s Representations and Warranties: The Transferee has the authority to accept the Target Shares and tender the purchase price.

2.3 Representations and Warranties made by both parties: Both parties undertake that, if the transaction cannot be completed due to the

fault of either party, both parties shall resolve the remaining issues in relation to the transaction through consultation based on the principles of fairness and reasonableness.

3.1 Governing Law. This Agreement is governed by Hong Kong law.

3.2 Dispute Resolution. Each party agrees that any dispute in relation to or arising out of the construction, formation,

performance and breach of this Agreement shall be submitted to Hong Kong International Arbitration Centre (“HKIAC”) for arbitration in accordance with its then effective arbitration rules (the “Rules”) by one

arbitrator. The arbitrator shall be appointed by HKIAC and shall be qualified to practice in Hong Kong. The language of the arbitration shall be English. The arbitral award made by the arbitration tribunal shall be final and binding on the parties

to such dispute.

[The Remainder of this Page Intentionally Left Blank.]

-2-

IN WITNESS WHEREOF, the parties have caused this Agreement to be executed as of the date first written above.

|

|

|

| Transferee |

| Orient Hongtai (Hong Kong) Limited |

|

|

| By: |

|

/s/ Chen Bo |

| Name: |

|

Chen Bo |

| Title: |

|

Director |

|

| Transferor |

| Orient Finance Holdings (Hong Kong) Limited |

|

|

| By: |

|

/s/ Yang Yucheng |

| Name: |

|

Yang Yucheng |

| Title: |

|

Director |

-3-

Exhibit 7.20

Share Transfer Agreement

(Translation)

This SHARE TRANSFER

AGREEMENT (this “Agreement”) dated as of November 24, 2014 (the “Signing Date”) is made by and among:

| |

(1) |

Orient Hongzhi (Hong Kong) Limited, a company incorporated and existing under the laws of Hong Kong (the “Transferee”), and |

| |

(2) |

Orient Finance Holdings (Hong Kong) Limited, a company incorporated and existing under the laws of Hong Kong (the “Transferor”). |

WHEREAS:

| |

(1) |

The Transferor owns 61,776,335 Class A Ordinary Shares (the “Target Shares”) of Shanda Games Limited (the “Company”) as of the Signing Date; |

| |

(2) |

The Transferor agrees to transfer to the Transferee, and the Transferee agrees to purchase from the Transferor, the Target Shares; |

| |

(3) |

Pursuant to the Collection of Investment Amount and Loan Agreement entered into between the Transferor and the Transferee in September 2014 (the “Collection of Investment Amount and Loan Agreement”),

the Transferee loaned to the Transferor a sum of US$106,631,000 (the “Loan”); and |

| |

(4) |

Pursuant to the Loan Agreement between the Transferor and Bank of Shanghai Co., Ltd. (“Bank of Shanghai”) on September 23, 2014 (the “Loan Agreement”), the Transferor borrowed from

Bank of Shanghai a sum of US$213,000,000 and shall pay relevant interest accrued thereon. |

AGREEMENT:

1.1 Transfer

Subject to the terms and conditions set forth in this Agreement, the Transferor agrees to transfer as of the Closing Date (as

defined below) to the Transferee an aggregate of 61,776,335 Class A Ordinary Shares of the Company and the Transferee agrees to accept the Target Shares.

The Target Shares owned by the Transferor, including all the relevant rights and obligations thereunder, as of the Signing

Date, shall be transferred to the Transferee.

1.2 Purchase Price

The parties agree on the transfer price as follows:

| |

(1) |

The amount loaned to the Transferor by the Transferee shall set off a portion of the purchase price. The Collection of Investment Amount and Loan Agreement, including all the rights and obligations thereunder, shall be

terminated as of the Signing Date; |

| |

(2) |

Having been approved by Bank of Shanghai in writing, the Transferor’s repayment obligations of the sum of US$106,500,000 shall be transferred to the Transferee as of the Signing Date, as a result of which the

Transferee shall be liable for repayment to Bank of Shanghai the principal amount and the interest accrued thereon, which shall set off a portion of the purchase price; and |

| |

(3) |

The amounts under paragraphs (1) and (2) above shall constitute the total purchase price for the Target Shares. |

1.3 Closing

The transfer of the Target Shares shall be completed on the Signing Date by way of delivery of relevant documents by each party

to the other, or on such other date and at such other venue agreed by the Transferee and the Transferor in writing (the “Closing,” the date of the Closing, the “Closing Date”).

| |

2. |

Representations and Warranties |

2.1 Transferor’s Representations and

Warranties: The Transferor legally owns the title to the Target Shares immediately prior to the Closing Date.

2.2

Transferee’s Representations and Warranties: The Transferee has the authority to accept the Target Shares and tender the purchase price.

2.3 Representations and Warranties made by both parties: Both parties undertake that, if the transaction cannot be completed due to the

fault of either party, both parties shall resolve the remaining issues in relation to the transaction through consultation based on the principles of fairness and reasonableness.

3.1 Governing Law. This Agreement is governed by Hong Kong law.

3.2 Dispute Resolution. Each party agrees that any dispute in relation to or arising out of the construction, formation,

performance and breach of this Agreement shall be submitted to Hong Kong International Arbitration Centre (“HKIAC”) for arbitration in accordance with its then effective arbitration rules (the “Rules”) by one

arbitrator. The arbitrator shall be appointed by HKIAC and shall be qualified to practice in Hong Kong. The language of the arbitration shall be English. The arbitral award made by the arbitration tribunal shall be final and binding on the parties

to such dispute.

[The Remainder of this Page Intentionally Left Blank.]

-2-

IN WITNESS WHEREOF, the parties have caused this Agreement to be executed as of the date first written above.

|

|

|

| Transferee |

| Orient Hongzhi (Hong Kong) Limited |

|

|

| By: |

|

/s/ Chen Bo |

| Name: |

|

Chen Bo |

| Title: |

|

Director |

|

| Transferor |

| Orient Finance Holdings (Hong Kong) Limited |

|

|

| By: |

|

/s/ Yang Yucheng |

| Name: |

|

Yang Yucheng |

| Title: |

|

Director |

-3-

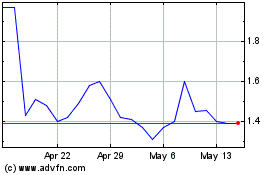

GameSquare (NASDAQ:GAME)

Historical Stock Chart

From Mar 2024 to Apr 2024

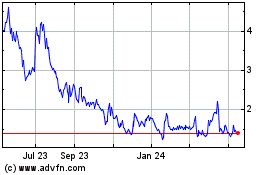

GameSquare (NASDAQ:GAME)

Historical Stock Chart

From Apr 2023 to Apr 2024