UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November 26, 2014 (November 20, 2014)

Avis Budget Group, Inc.

(Exact name of registrant as specified in its charter)

|

| | | | | |

Delaware | | 001-10308 | | 06-0918165 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification Number) |

| | | | |

6 Sylvan Way Parsippany, NJ |

07054 |

(Address of Principal Executive Offices) | (Zip Code) |

| | | | |

(973) 496-4700 |

(Registrant’s telephone number, including area code) |

| | | | |

N/A |

(Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| | |

Item 1.01 | | Entry into a Material Definitive Agreement. |

On November 20, 2014, our Avis Budget Rental Car Funding (AESOP) LLC subsidiary completed an amendment and renewal of its asset-backed variable-funding financing facilities, known as the Series 2010-6 Notes, which provide a portion of the financing for our car rental fleet in the United States. The aggregate commitment of the purchaser groups of the 2010-6 facility was increased by $350 million for an aggregate maximum available amount of $2.85 billion. The Series 2010-6 facility is a two-year facility with an expiration date of November 30, 2016.

The foregoing summary does not purport to be complete and is qualified in its entirety by reference to the complete terms of the First Amendment to the Second Amended and Restated Series 2010-6 Supplement, a copy of which is filed as Exhibit 10.1 hereto which is incorporated herein by reference.

|

| | |

Item 2.03 | | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information described above under “Item 1.01 Entry into a Material Definitive Agreement” is incorporated herein by reference.

|

| | |

Item 9.01 | | Financial Statements and Exhibits. |

(d) Exhibits.

The following exhibits are filed as part of this report:

|

| | |

Exhibit No. | | Description |

10.1 | | First Amendment to the Second Amended and Restated Series 2010-6 Supplement, dated as of November 20, 2014, by and among Avis Budget Rental Car Funding (AESOP) LLC, as Issuer, Avis Budget Car Rental, LLC, as Administrator, JPMorgan Chase Bank, N.A., as Administrative Agent, the Non-Conduit Purchasers, the CP Conduit Purchasers, the APA Banks and the Funding Agents named therein and The Bank of New York Mellon Trust Company, N.A., as Trustee and as Series 2010-6 Agent. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereto duly authorized.

|

| | |

| AVIS BUDGET GROUP, INC. |

| By: | /s/ Bryon L. Koepke |

| Name: | Bryon L. Koepke |

| Title: | Senior Vice President and Chief Securities Counsel |

| | |

Date: November 26, 2014

AVIS BUDGET GROUP, INC.

CURRENT REPORT ON FORM 8-K

Report Dated November 26, 2014 (November 20, 2014)

EXHIBIT INDEX

|

| | |

Exhibit No. | | Description |

10.1 | | First Amendment to the Second Amended and Restated Series 2010-6 Supplement, dated as of November 20, 2014, by and among Avis Budget Rental Car Funding (AESOP) LLC, as Issuer, Avis Budget Car Rental, LLC, as Administrator, JPMorgan Chase Bank, N.A., as Administrative Agent, the Non-Conduit Purchasers, the CP Conduit Purchasers, the APA Banks and the Funding Agents named therein and The Bank of New York Mellon Trust Company, N.A., as Trustee and as Series 2010-6 Agent. |

FIRST AMENDMENT TO

THE SECOND AMENDED AND RESTATED SERIES 2010-6 SUPPLEMENT

This FIRST AMENDMENT TO THE SECOND AMENDED AND RESTATED SERIES 2010-6 SUPPLEMENT (this “Amendment”), dated as of November 20, 2014 amends the Second Amended and Restated Series 2010-6 Supplement (the “Series 2010-6 Supplement”), dated as of November 5, 2013, among AVIS BUDGET RENTAL CAR FUNDING (AESOP) LLC, a special purpose limited liability company established under the laws of Delaware (“ABRCF”), AVIS BUDGET CAR RENTAL, LLC, a limited liability company established under the laws of Delaware, as administrator (the “Administrator”), JPMORGAN CHASE BANK, N.A., a national banking association, as administrative agent (the “Administrative Agent”), the several banks set forth on Schedule I thereto as Non-Conduit Purchasers (each, a “Non-Conduit Purchaser”), the several commercial paper conduits listed on Schedule I thereto (each a “CP Conduit Purchaser”), the several banks set forth opposite the name of each CP Conduit Purchaser on Schedule I thereto (each an “APA Bank” with respect to such CP Conduit Purchaser), the several agent banks set forth opposite the name of each CP Conduit Purchaser on Schedule I thereto (each a “Funding Agent” with respect to such CP Conduit Purchaser), THE BANK OF NEW YORK MELLON TRUST COMPANY, N.A., a national banking association, as trustee (in such capacity, the “Trustee”) and as agent for the benefit of the Series 2010-6 Noteholders (in such capacity, the “Series 2010-6 Agent”), to the Second Amended and Restated Base Indenture, dated as of June 3, 2004, between ABRCF and the Trustee (as amended, modified or supplemented from time to time, exclusive of Supplements creating a new Series of Notes, the “Base Indenture”). All capitalized terms used herein and not otherwise defined herein shall have the respective meanings provided therefor in the Definitions List attached as Schedule I to the Base Indenture (as amended through the date hereof) or the Series 2010-6 Supplement, as applicable.

W I T N E S S E T H:

WHEREAS, pursuant to Section 12.2 of the Base Indenture, any Supplement thereto may be amended with the consent of ABRCF, the Trustee, any applicable Enhancement Provider and (x) in connection with (i) the extension of the due date for any repayment of principal of any Note or (ii) the modification of any applicable amount of Enhancement, each affected Noteholder and (y) in connection with certain other amendments, the Required Noteholders of a Series of Notes;

WHEREAS, pursuant to Section 11.11 of the Series 2010-6 Supplement, (x) the Series 2010-6 Supplement may be amended in accordance with Section 12.2 of the Base Indenture and (y) the requirement contained in Section 12.2 of the Base Indenture for consent by the Required Noteholders to the amendment of the Series 2010-6 Supplement shall be satisfied upon attaining the consent of the Requisite Noteholders;

WHEREAS, the parties desire to amend the Series 2010-6 Supplement to, among other things, (w) amend certain representations and covenants, (x) extend the Scheduled Expiration Date, (y) replace Schedule I thereto with a new Schedule I in the form of Schedule A to this Amendment and (z) modify certain required liquidity levels;

WHEREAS, ABRCF has requested the Trustee, the Series 2010-6 Agent, the Administrator, the Administrative Agent and the Series 2010-6 Noteholders to, and, upon the effectiveness of this Amendment, ABRCF, the Trustee, the Series 2010-6 Agent, the Administrator, the Administrative Agent and each Series 2010-6 Noteholder have agreed to, make the amendments described above as set forth herein;

NOW, THEREFORE, it is agreed:

1. Amendment of Definitions. (a) The following defined terms, as set forth in Article I(b) of the Series 2010-6 Supplement, are hereby amended and restated as follows, (i) by deleting each term thereof which is lined out and (ii) by inserting each term thereof which is double underlined:

“Discount” means, (a) with respect to any Match Funding CP Conduit Purchaser, the interest or discount component of the Commercial Paper issued by, or for the benefit of such Match Funding CP Conduit Purchaser to fund or maintain the CP Conduit Funded Amount with respect to such Match Funding CP Conduit Purchaser, including an amount equal to the portion of the face amount of the outstanding Commercial Paper issued to fund or maintain the CP Conduit Funded Amount with respect to such CP Conduit Purchaser that corresponds to the portion of the proceeds of such Commercial Paper that was used to pay the interest or discount component of maturing Commercial Paper issued to fund or maintain such CP Conduit Funded Amount, to the extent that such CP Conduit Purchaser has not received payments of interest in respect of such interest component prior to the maturity date of such maturing Commercial Paper, and including the portion of such interest or discount component constituting dealer or placement agent commissions and (b) with respect to any Pooled Funding CP Conduit Purchaser, the amount of interest or discount to accrue on or in respect of the Commercial Paper issued by, or for the benefit of, such Pooled Funding CP Conduit Purchaser allocated, in whole or in part, by the Funding Agent with respect to such Pooled Funding CP Conduit Purchaser, to fund the purchase or maintenance of the CP Conduit Funded Amount with respect to such Pooled Funding CP Conduit Purchaser (including, without limitation, any interest attributable to the commissions of placement agents and dealers in respect of such Commercial Paper and any costs associated with funding small or odd-lot amounts, to the extent that such commissions or costs are allocated, in whole or in part, to such Commercial Paper by such Funding Agent).

“Non-Deferrable Draw Amount” means, with respect to any Purchaser Group as of any Increase Date, an amount equal to the lesser of (i) the excess, if any, of (x) 2010% of the Maximum Purchaser Group Invested Amount with respect to such Purchaser Group over (y) the portion of any Increase Amounts funded by such Purchaser Group during the preceding thirty-five (35) days pursuant to a Non-Deferrable Increase Notice or, to the extent of any decrease pursuant to Section 2.3(e) in the Delayed Amount set forth in a Delayed Funding Notice delivered by such Purchaser Group, a Deferrable Increase Notice and (ii) the excess, if any, of (x) the Maximum Purchaser Group Invested Amount with respect to such Purchaser Group over (y) the sum of (1) the Purchaser Group Invested Amount with

respect to such Purchaser Group and (2) any unfunded Delayed Amounts with respect to such Purchaser Group, in each case as of such Increase Date.

“Pooled Funding CP Conduit Purchaser” means each CP Conduit Purchaser that is not (x) a Match Funding CP Conduit Purchaser (or that was a Match Funding Conduit Purchaser and that, after the Series 2010-6 Closing Date, notifies ABRCF and the Administrative Agent in accordance with Section 2.7(d) in writing that ABRCF may no longer be permitted to select CP Tranches in respect to the CP Conduit Funded Amount with respect to such CP Conduit Purchaser) or (y) a LIBOR Funding CP Conduit Purchaser.

“Retained Interest” means a material net economic interest, initially held in the form of a first loss position represented by the Administrator’s indirect ownership of 100% of the outstanding membership interests in ABRCF, AESOP Leasing and AESOP Leasing II and the associated indirect rights to residual cash flow under Section 3.2(f), in an initial amount of not less than 5% of the sum of (x) the AESOP I Operating Lease Loan Agreement Borrowing Base and (y) the AESOP II Loan Agreement Borrowing Base in accordance with the CRR text of Article 122a of the CRD.

“Scheduled Expiry Date” means, with respect to any Purchaser Group, November 30, 2016 2015, as such date may be extended in accordance with Section 2.6(b).

“Series 2010-6 Required Liquidity Amount” means, with respect to any Distribution Date, an amount equal to 2.002.05% of the Series 2010-6 Invested Amount on such Distribution Date (after giving effect to any payments of principal to be made on the Series 2010-6 Notes on such Distribution Date).

(b) Article (I)(b) of the Series 2010-6 Supplement is hereby amended by inserting the following defined terms in the appropriate alphabetical order:

“CRR” means Articles 404-410 of the Capital Requirements Regulation No. 575/2013 of the European Parliament and of the Council of 26 June 2013 and any related guidelines and regulatory technical standards or implementing technical standards published by the European Banking Authority and adopted by the European Commission.

“FATCA” shall mean The Foreign Account Tax Compliance Act as contained in Sections 1471 through 1474 of the Code, as amended, along with any regulations or official interpretations thereof and any agreement (including any intergovernmental agreement or any law implementing such intergovernmental agreement) entered into in connection therewith.

“Patriot Act” is defined in Section 11.26.

“Volcker Rule” means Section 13 of the U.S. Bank Holding Company Act of 1956, as amended, and the applicable rules and regulations thereunder.

(c) Article (I)(b) of the Series 2010-6 Supplement is hereby amended by deleting the following defined term in its entirety:

“CRD” means European Union Directives 2006/48/EC and 2006/49/EC, as amended, and together with any official guidance provided by the Committee of European Banking Supervisors or the European Banking Authority, from time to time; provided, that any reference to the CRD (or any article or section thereof) shall be deemed to include any successor or replacement provisions included in any European Union directive or regulation subsequent to the European Union Directives 2006/48/EC or 2006/49/EC.

2. Amendment to Section 2.6(d). Section 2.6(d) of the Series 2010-6 Series Supplement is hereby amended and restated as follows, (i) by deleting each term thereof which is lined out and (ii) by inserting each term thereof which is double underlined:

(d) If, (w) after receiving a request for extension of its Scheduled Expiry Date from ABRCF pursuant to Section 2.6(b), a Non-Conduit Purchaser Group or the Funding Agent with respect to a CP Conduit Purchaser Group notifies ABRCF in writing of its decision not to extend its Scheduled Expiry Date as requested or fails to respond to ABRCF’s request within 30 days of its receipt of such request, (x) any Non-Conduit Purchaser Group or any CP Conduit Purchaser Group (or the Funding Agent with respect thereto, on behalf of such CP Conduit Purchaser Group) (a “Non-Consenting Purchaser Group”) fails to give its consent for any amendment or waiver requiring the consent of 100% of the Series 2010-6 Noteholders (or Purchaser Groups having Commitment Percentages aggregating 100%) or the consent of all affected Series 2010-6 Noteholders or Purchaser Groups (and such Purchaser Group is affected) and for which Holders of Series 2010-6 Notes representing at least a majority of the required voting percentage have consented, (y) after receiving a notice of Increase in accordance with Section 2.3(a), any Purchaser Group fails to fund the full amount of its Commitment Percentage of the related Increase Amount on the Increase Date (a “Non-Funding Purchaser Group”) or (z) any Affected Party with respect to any Non-Conduit Purchaser Group or any CP Conduit Purchaser Group (together with any Non-Extending Purchaser Group, Non-Consenting Purchaser Group or Non-Funding Purchaser Group, “Removed Purchaser Groups”) requests payment for any Article VII Costs payable under Section 7.1(e), at the request of ABRCF such Non-Conduit Purchaser Group or such CP Conduit Purchaser Group shall on a Distribution Date thereafter selected by ABRCF (or such other date as may be agreed by ABRCF, the Administrative Agent and such Non-Conduit Purchaser or the Funding Agent with respect to such CP Conduit Purchaser Group) assign all or any portion of their respective rights and obligations under this Supplement and the Series 2010-6 Notes pursuant to Section 11.1 to a replacement Purchaser Group selected by ABRCF upon payment by the replacement Purchaser Group (or upon payment by ABRCF as agreed to by ABRCF, the assignor and the assignee) of an amount equal to the sum of (i) the Purchaser Group Invested Amount with respect to such Removed Purchaser Group, and (ii) (A) if such Purchaser Group includes a Match Funding CP Conduit Purchaser, the sum of (x) all accrued and unpaid Discount on all outstanding Commercial Paper issued by, or for the benefit of, such Match Funding CP Conduit Purchaser to fund the CP Funded Amount with respect to such Match Funding CP Conduit Purchaser from the issuance date(s)

thereof to but excluding the date (the “Purchase Effective Date”) of the assignment to the replacement Purchaser Group and (y) the aggregate Discount to accrue on all outstanding Commercial Paper issued by, or for the benefit of, such Match Funding CP Conduit Purchaser to fund the CP Funded Amount with respect to such Match Funding CP Conduit Purchaser from and including the Purchase Effective Date to and excluding the maturity date of each CP Tranche with respect to such Match Funding CP Conduit Purchaser or (B) if such Removed Purchaser Group includes a Pooled Funding CP Conduit Purchaser, the sum of (x) the aggregate amount of accrued and unpaid Discount on or in respect of the Commercial Paper issued by, or for the benefit of, such Pooled Funding CP Conduit Purchaser allocated, in whole or in part, by the Funding Agent with respect to such Pooled Funding CP Conduit Purchaser, to fund the purchase or maintenance of the CP Funded Amount with respect to such Pooled Funding CP Conduit Purchaser as of the Purchase Effective Date and (y) the aggregate amount of Discount to accrue on or in respect of the Commercial Paper issued by, or for the benefit of, such Pooled Funding CP Conduit Purchaser allocated, in whole or in part, by the Funding Agent with respect to such Pooled Funding CP Conduit Purchaser, to fund the purchase or maintenance of the CP Funded Amount with respect to such Pooled Funding CP Conduit Purchaser from and including the Purchase Effective Date to and excluding the maturity dates of such Commercial Paper, and (iii) (A) if such Removed Purchaser Group is a Non-Conduit Purchaser Group, all accrued and unpaid interest on the Purchaser Group Invested Amount for such Non-Conduit Purchaser Group, calculated as the sum for each day from but excluding the last day of the Series 2010-6 Interest Period immediately preceding the Purchase Effective Date to but excluding the Purchase Effective Date of the product of (1) the Purchaser Group Invested Amount with respect to such Non-Conduit Purchaser on such day, times (2) the sum of the LIBO Rate with respect to each such day and the Program Fee Rate with respect to such Non-Conduit Purchaser Group divided by (3) 360, or (B) if such Removed Purchaser Group is a CP Conduit Purchaser Group, the sum of (1) all accrued and unpaid interest on the APA Bank Funded Amount with respect to such Purchaser Group, calculated at the Alternate Base Rate or the applicable Adjusted LIBO Rate plus the Applicable Margin as of the Purchase Effective Date and (2) if such CP Conduit Purchaser Group includes a LIBOR Funding CP Conduit Purchaser, all accrued and unpaid interest on the CP Conduit Funded Amount for such Non-Conduit CP Conduit Purchaser Group, calculated as the sum for each day from but excluding the last day of the Series 2010-6 Interest Period immediately preceding the Purchase Effective Date to but excluding the Purchase Effective Date of the product of (x) the CP Conduit Funded Amount with respect to such CP Conduit Purchaser Group on each such day, times (y) the LIBO Rate with respect to each such day with respect to such CP Conduit Purchaser Group divided by (z) 360, and (iv) if such Removed Group is a Conduit Purchaser Group, for each day from but excluding the last day of the Series 2010-6 Interest Period immediately preceding the Purchase Effective Date to but excluding the Purchase Effective Date, an amount equal to (x) the CP Funded Amount with respect to such Removed Purchaser Group on such day times (y) the Program Fee Rate divided by (z) 360, and (v) for each day from but excluding the last day of the Series 2010-6 Interest Period immediately preceding the Purchase Effective Date to but excluding the Purchase Effective Date, an amount equal to (x) the excess, if any, of the Commitment Amount with respect to such Removed Purchaser Group over the Purchaser Group Invested Amount with respect to such Purchaser Group on

such day times (y) the Commitment Fee Rate as of such date divided by (z) 360, and (vi) all Article VII Costs then due and payable to such Removed Purchaser Group and (vii) without duplication, any other amounts then due and payable to such Removed Purchaser Group pursuant to this Supplement.

3. Amendment to Section 3.8(c). Section 3.8(c) of the Series 2010-6 Supplement is hereby amended and restated as follows, (i) by deleting each term thereof which is lined out and (ii) by inserting each term thereof which is double underlined:

(c) Series 2010-6 Letter of Credit Providers. The Administrator shall notify the Trustee in writing within one Business Day of becoming aware that the long-term senior unsecured debt rating of any Series 2010-6 Letter of Credit Provider has fallen below “BBB” as determined by DBRS (or, if such Series 2010-6 Letter of Credit Provider was not rated by DBRS at the time of issuance of the related Series 2010-6 Letter of Credit, if (x) the long-term senior unsecured debt rating of such Series 2010-6 Letter of Credit Provider has fallen below “Baa2” as determined by Moody’s and (y) the long-term senior unsecured debt rating of such Series 2010-6 Letter of Credit Provider has fallen below “BBB” as determined by Standard & Poor’s)any Series 2010-6 Letter of Credit Provider no longer qualifies as a Series 2010-6 Eligible Letter of Credit Provider. At such time the Administrator shall also notify the Trustee of (i) the greater of (A) the excess, if any, of the Series 2010-6 Required Enhancement Amount over the Series 2010-6 Enhancement Amount, excluding the available amount under the Series 2010-6 Letter of Credit issued by such Series 2010-6 Letter of Credit Provider, on such date, and (B) the excess, if any, of the Series 2010-6 Required Liquidity Amount over the Series 2010-6 Liquidity Amount, excluding the available amount under such Series 2010-6 Letter of Credit, on such date, and (ii) the amount available to be drawn on such Series 2010-6 Letter of Credit on such date. Upon receipt of such notice by the Trustee on or prior to 10:00 a.m. (New York City time) on any Business Day, the Trustee shall, by 12:00 noon (New York City time) on such Business Day (or, in the case of any notice given to the Trustee after 10:00 a.m. (New York City time), by 12:00 noon (New York City time) on the next following Business Day), draw on such Series 2010-6 Letter of Credit in an amount equal to the lesser of the amounts in clause (i) and clause (ii) of the immediately preceding sentence on such Business Day by presenting a Certificate of Termination Demand and shall cause the Termination Disbursement to be deposited in the Series 2010-6 Cash Collateral Account.

4. Amendment to Section 7.2. Section 7.2 of the Series 2010-6 Supplement is hereby amended by adding the following clause (i) to such section:

(i) If a payment made to a recipient would be subject to U.S. Federal withholding tax imposed by FATCA if such recipient were to fail to comply with the applicable reporting requirements of FATCA (including those contained in Section 1471(b) or 1472(b) of the Code, as applicable), such recipient shall deliver to the payor at the time or times prescribed by law and at such time or times reasonably requested by the payor such documentation prescribed by applicable law (including as prescribed by Section 1471(b)(3)(C)(i) of the Code and any agreements entered into pursuant to Section 1471(b)(1) of the Code) and such

additional documentation as reasonable requested by the payor as may be necessary for the payor to determine that such recipient has complied with such recipient’s obligations under FATCA and that such recipient is not subject to any such withholding. Notwithstanding any other provision herein, if ABRCF or the Administrative Agent is required to withhold taxes under FATCA, ABRCF and the Administrative Agent shall be authorized to deduct from payments to be made to the applicable recipient amounts representing taxes payable by such recipient under FATCA, as determined in the sole discretion of ABRCF or the Administrative Agent, and to remit such amounts to the applicable governmental authorities.

5. Amendment to Section 8.1. Section 8.1 of the Series 2010-6 Series Supplement is hereby amended by adding the following clause (d) to such section:

(d) ABRCF hereby represents and warrants to the Trustee, the Administrative Agent, each Funding Agent, each CP Conduit Purchaser, each APA Bank and each Non-Conduit Purchaser that ABRCF (i) is not deemed to be an “investment company” within the meaning of the Investment Company Act pursuant to Rule 3a-7 promulgated under the Investment Company Act and (ii) is not a “covered fund” as defined in the Volcker Rule.

6. Amendment to Section 8.1(c). Section 8.1(c) of the Series 2010-6 Series Supplement is hereby amended and restated as follows, (i) by deleting each term thereof which is lined out and (ii) by inserting each term thereof which is double underlined:

(c) The Administrator hereby represents and warrants to the Trustee, the Administrative Agent, each Non-Conduit Purchaser, each Funding Agent, each CP Conduit Purchaser and each APA Bank, as of the A&R Effective Date, as of each Increase Date and as of the date of delivery of each Monthly Noteholders Statement that (i) it continues to hold the Retained Interest on such date in accordance with Section 8.2(n) and (ii) it has not sold or subjected the Retained Interest to any credit risk mitigation or any short positions or any other hedge in a manner which would be contrary to the CRR Article 122a of the CRD.

7. Amendment to Section 8.2(n). Section 8.2(n) of the Series 2010-6 Series Supplement is hereby amended and restated as follows (i) by deleting each term thereof which is lined out and (ii) by inserting each term thereof which is double underlined:

| |

(n) | the Administrator agrees, for the benefit of each Series 2010-6 Noteholder that is required to comply with the requirements of the CRR Article 122a of the CRD that it shall: |

(i) hold and maintain the Retained Interest in an amount and in a manner as required or permitted by Paragraph 1 of Article 405 of the CRR 1(b) of Article 122a of the CRD for so long as the Series 2010-6 Notes are outstanding and not change the manner in which it retains the Retained Interest except to the extent permitted under such Paragraph 1Article 122a of the CRD;

(ii) not sell the Retained Interest or subject the Retained Interest to any credit risk mitigation or any short positions or any other hedge, in each case, except to the

extent permitted under Paragraph 1 of Article 405 of the CRR in a manner that would be contrary to Article 122a of the CRD;

(iii) in connection with and accompanying each Monthly Noteholders Statement, confirm to the Trustee that it continues to comply with this subsection (i) and (ii) of this Section 8.2(n);

(iv) promptly provide notice to each such Series 2010-6 Noteholder in the event that it fails to comply with subsection (i) or (ii) of this Section 8.2(n);

(v) promptly notify each Series 2010-6 Noteholder of any material change to the form or other terms or characteristics of the Retained Interest since the delivery of the most recent Monthly Noteholders Statement; and

(vi) provide any and all information requested by any Series 2010-6 Noteholder that any such Series 2010-6 Noteholder would reasonably require in order for such Series 2010-6 Noteholder to comply with its obligations under the CRR Article 122a of the CRD; provided that compliance by the Administrator with this clause (vi) shall be at the expense of the requesting Series 2010-6 Noteholder.

8. Amendment to Section 11.1(h). Section 11.1(h) of the Series 2010-6 Series Supplement is hereby amended and restated as follows, by inserting each term thereof which is double underlined:

(h) Notwithstanding any other provision of this Supplement to the contrary, (i) any Non-Conduit Purchaser, any APA Bank or any Program Support Provider may at any time pledge or grant a security interest in all or any portion of its rights under its Series 2010-6 Note and this Supplement to secure obligations of such Non-Conduit Purchaser, such APA Bank or such Program Support Provider to a Federal Reserve Bank or other central bank and (ii) any CP Conduit Purchaser may at any time pledge or grant a security interest in all or any portion of its rights under the Series 2010-6 Note held by its Funding Agent to secure obligations of such CP Conduit Purchaser under its Commercial Paper, in each case without notice to or consent of the Administrative Agent, the Issuer or the Administrator; provided that no such pledge or grant of a security interest shall release a Non-Conduit Purchaser, a CP Conduit Purchaser or an APA Bank from any of its obligations hereunder or substitute any such pledgee or grantee for such Non-Conduit Purchaser, such CP Conduit Purchaser or such APA Bank as a party hereto.

9. Amendment to Section 11.11. Section 11.11 of the Series 2010-6 Series Supplement is hereby amended and restated as follows, by inserting each term thereof which is double underlined:

This Supplement may be modified or amended from time to time in accordance with the terms of the Base Indenture; provided, however, that if, pursuant to the terms of the Base Indenture or this Supplement, the consent of the Required Noteholders is required for an amendment or modification of this Supplement, such requirement shall be satisfied if s

uch amendment or modification is consented to by the Requisite Noteholders; provided, further, that any amendment that would materially and adversely affect any Series 2010-6 Noteholder shall also require that Standard & Poor’s has confirmed that such amendment shall not result in a withdrawal or downgrade of the rating of the Commercial Paper issued by, or for the benefit of, any CP Conduit Purchaser whose Commercial Paper is rated by Standard & Poor’s at the time of such amendment.

10. Amendment to Article XI. Article XI of the Series 2010-6 Supplement is hereby amended by adding the following Section 11.26 thereto:

Section 11.26. U.S. Patriot Act Notice. Each Funding Agent and Non-Conduit Purchaser that is subject to the requirements of the U.S. Patriot Act (Title III of Pub.: 107-56 (the “Patriot Act”) hereby notifies ABRCF that, pursuant to Section 326 thereof, it is required to obtain, verify and record information that identifies ABRCF, including the name and address of ABRCF and other information allowing such Funding Agent and Non-Conduit Purchaser to identify ABRCF in accordance with the Patriot Act.

11. Amendment of Schedule I. Schedule I of the 2010-6 Supplement is hereby deleted in its entirety and substituted with Schedule I, as it appears in Schedule A hereto.

12. Consent to Master Exchange Agreement Amendment. Exhibit K of the 2010-6 Supplement is hereby deleted in its entirety and substituted with Exhibit K, as it appears in Schedule B hereto. Each Series 2010-6 Noteholder, by executing this Amendment, hereby agrees and consents to the execution of the amendment to the Master Exchange Agreement substantially in the form attached as Schedule B hereto. Such agreement and consent will apply to the proposed amendment set forth in Exhibit K, individually, and the failure to adopt any of the proposed amendments set forth in Exhibits J, K, L, M, N and O of the Series 2010-6 Supplement will not revoke the agreement and consent with respect to any other amendment.

13. Direction. By their signatures hereto, each of the undersigned (excluding The Bank of New York Mellon Trust Company, N.A., in its capacity as Trustee and Series 2010-6 Agent) hereby authorize and direct the Trustee and Series 2010-6 Agent to execute this Amendment and take any and all further action necessary or appropriate to give effect to the transaction contemplated hereby.

14. This Amendment is limited as specified and, except as expressly stated herein, shall not constitute a modification, acceptance or waiver of any other provision of the Series 2010-6 Supplement.

15. This Amendment shall become effective on the date (the “2014 Extension Amendment Effective Date”) that is the later of (a) the date hereof or (b) the first date on which each of the following have occurred: (i) each of ABRCF, the Administrator, the Administrative Agent and each Series 2010-6 Noteholder shall have executed and delivered this Amendment to the Trustee, and the Trustee shall have executed this Amendment, (ii) each Non-Conduit Purchaser and each Funding Agent shall have received a copy of a letter, in form and substance satisfactory to such Non-Conduit Purchaser or Funding Agent, from DBRS stating that the long-term rating of

at least “A” has been assigned by DBRS to the Series 2010-6 Notes, (iii) each Non-Conduit Purchaser and each Funding Agent shall have received a copy of a letter, in form and substance satisfactory to such Non-Conduit Purchaser and Funding Agent, from DBRS, and ABRCF and the Trustee shall have received a copy of a letter from Moody’s, in each case stating that this Amendment to the Series 2010-6 Supplement will not result in a reduction or withdrawal of the rating (in effect immediately before the effectiveness of this Amendment) of any outstanding Series of Notes with respect to which it is a Rating Agency, (iv) each Funding Agent shall have received a letter, in form and substance satisfactory to such Funding Agent, from each of Moody’s, Standard & Poor’s and/or Fitch, as applicable, confirming the commercial paper rating of the related CP Conduit Purchaser after the effectiveness of this Amendment, (v) all certificates and opinions of counsel required under the Base Indenture or by the Series 2010-6 Noteholders shall have been delivered to the Trustee and the Series 2010-6 Noteholders, as applicable, (vi) ABRCF shall have issued and directed the Trustee to authenticate, and the Trustee shall have authenticated, a Series 2010-6 Note in the name of each Non-Conduit Purchaser and each Funding Agent with respect to each Purchaser Group in an amount equal to the Maximum Purchaser Group Invested Amount with respect to such Purchaser Group (after giving effect to the effectiveness of this Amendment), and shall have delivered such Series 2010-6 Note to such Non-Conduit Purchaser or Funding Agent, as applicable, (vii) each Purchaser Group shall have been paid all amounts due to it pursuant to Section 18 hereof and (viii) the Administrative Agent and each Purchaser Group shall have received payment of any fees payable to it in connection with this Amendment.

16. Pursuant to Section 2.6(e) of the Series 2010-6 Supplement, ABRCF hereby adds Gresham Receivables (No. 28) Limited as an Additional CP Conduit Purchaser, Gresham Receivables (No. 28) Limited as the Related Additional APA Bank, and Lloyds Bank plc as the related Additional Funding Agent, with the applicable Maximum Purchaser Group Invested Amount set forth on Schedule A to this Amendment. The Purchaser Group Addition Date with respect to such additions shall be the 2014 Extension Amendment Effective Date. By its execution hereof, (x) the Administrative Agent consents to such additions and (y) the Administrative Agent and each other Purchaser Group waive any advance notice requirement pursuant to Section 2.6(e) of the Series 2010-6 Supplement in connection with such additions. The administrative information with respect to such additional Purchaser Group is set forth on Schedule C hereto.

17. Each existing Purchaser Group, by its execution of this Amendment, hereby acknowledges and consents to an increase on the 2014 Extension Amendment Effective Date of its Maximum Purchaser Group Invested Amount pursuant to Section 2.6(a) of the Series 2010-6 Supplement to the extent that such Maximum Purchaser Group Invested Amount is increased in accordance with the amendment and restatement of Schedule I pursuant to this Amendment.

18. On the 2014 Extension Amendment Effective Date, each Non-Conduit Purchaser and each CP Conduit Purchaser and the Funding Agent and the APA Banks with respect to such CP Conduit Purchaser shall be deemed hereby to make or accept, as applicable, an assignment and assumption of a portion of the Series 2010-6 Invested Amount, as directed by the Administrative Agent, with the result being that after giving effect thereto, the Purchaser Group Invested Amount with respect to each such Purchaser Group shall equal the product of (x) Series 2010-6 Invested Amount on the 2014 Extension Amendment Effective Date and (y) the Commitment Percentage of

such Purchaser Group on the 2014 Extension Amendment Effective Date after giving effect to the effectiveness of this Amendment and the changes in the Maximum Purchaser Group Invested Amounts made hereby and in furtherance hereof. No Purchaser Group shall be required to make any assignment of any portion of its Purchaser Group Invested Amount unless such assigning Purchaser Group shall receive in cash an amount equal to the reduction in its Purchaser Group Invested Amount.

19. From and after the 2014 Extension Amendment Effective Date, all references to the Series 2010-6 Supplement shall be deemed to be references to the Series 2010-6 Supplement as amended hereby.

20. This Amendment may be executed in separate counterparts by the parties hereto, each of which when so executed and delivered shall be an original but all of which shall together constitute one and the same instrument.

21. THIS AMENDMENT AND THE RIGHTS AND OBLIGATIONS OF THE PARTIES HEREUNDER SHALL BE CONSTRUED IN ACCORDANCE WITH AND GOVERNED BY THE LAWS OF THE STATE OF NEW YORK.

Schedule A to First Amendment

SCHEDULE I TO SECOND AMENDED AND RESTATED SERIES 2010-6 SUPPLEMENT

CP Conduit Purchaser Groups

|

| | | | | | | | | | | |

|

|

CP Conduit |

APA Bank |

Funding Agent |

APA Bank Percentage | Maximum Purchaser Group Invested Amount |

Conduit Type | Purchased Percentage |

1. | Liberty Street Funding LLC | The Bank of Nova Scotia | The Bank of Nova Scotia | 100 | % |

| $200,000,000 |

| Pooled Funding Conduit Purchaser | 7.02 | % |

2. | Chariot Funding LLC | JPMorgan Chase Bank, N.A. | JPMorgan Chase Bank, N.A. | 100 | % |

| $325,000,000 |

| LIBOR Funding Conduit Purchaser | 11.40 | % |

3. | Atlantic Asset Securitization LLC | Credit Agricole Corporate and Investment Bank | Credit Agricole Corporate and Investment Bank | 100 | % |

| $2,250,000,000 |

| Pooled Funding Conduit Purchaser | 7.89 | % |

4. | Charta, LLC | Citibank, N.A. | Citibank, N.A. | 100 | % |

| $250,000,000 |

| Pooled Funding Conduit Purchaser | 8.77 | % |

|

| | | | | | | | | | | |

|

CP Conduit |

APA Bank |

Funding Agent |

APA Bank Percentage | Maximum Purchaser Group Invested Amount |

Conduit Type | Purchased Percentage |

5. | Versailles Assets LLC | Versailles Assets LLC | Natixis, New York Branch | 100% | $100,000,000 | Pooled Funding Conduit Purchaser | 3.51% |

6. | Victory Receivables Corporation | The Bank of Tokyo-Mitsubishi UFJ, Ltd. | The Bank of Tokyo-Mitsubishi UFJ, Ltd. | 100 | % |

| $100,000,000 |

| Pooled Funding Conduit Purchaser | 3.51 | % |

7. | Fairway Finance Company, LLC | Bank of Montreal | BMO Capital Markets Corp. | 100 | % |

| $125,000,000 |

| Pooled Funding Conduit Purchaser | 4.39 | % |

8. | Gresham Receivables (No. 28) Limited | Gresham Receivables (No. 28) Limited | Lloyds Bank plc | 100 | % |

| $100,000,000 |

| Pooled Funding Conduit Purchaser | 3.51 | % |

Non-Conduit Purchasers

|

| | | | | | |

| Non-Conduit Purchaser | Maximum Purchaser Group Invested Amount | Purchased Percentage |

1. | Bank of America, National Association |

| $225,000,000 |

| 7.89 | % |

2. | Deutsche Bank AG, New York Branch |

| $300,000,000 |

| 10.53 | % |

3. | Royal Bank of Canada |

| $200,000,000 |

| 7.02 | % |

4. | The Royal Bank of Scotland plc |

| $275,000,000 |

| 9.65 | % |

5. | Barclays Bank PLC |

| $275,000,000 |

| 9.65 | % |

6. | SunTrust Bank |

| $150,000,000 |

| 5.26 | % |

Schedule B to First Amendment

EXHIBIT K

FORM OF SECOND AMENDMENT TO THE MASTER EXCHANGE AGREEMENT

Schedule C to First Amendment

ADMINISTRATIVE INFORMATION FOR ADDITIONAL PURCHASER GROUP

Contact Information

Lloyds Bank plc

10 Gresham Street

3rd Floor

London, UK

Attention: Edward Leng, Head of Conduit Management

Telecopier: +44 20 7158 6585

Account Information

The Bank of New York

ABA No.: 021 000 018

Account Number: 2432368400

Reference: Gresham 28 AESOP

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed by their respective duly authorized officers as of the date above first written.

AVIS BUDGET RENTAL CAR FUNDING (AESOP), LLC, as Issuer

By: /s/ Rochelle Tarlowe

Name: Rochelle Tarlowe

Title: Vice President and Treasurer

First Amendment to the Second A&R Series 2010-6 Supplement

THE BANK OF NEW YORK MELLON TRUST COMPANY, N.A., as Trustee and

Series 2010-6 Agent

By: /s/ Mitchell L. Brumwell

Name: Mitchell L. Brumwell

Title: Vice President and Treasurer

First Amendment to the Second A&R Series 2010-6 Supplement

JPMORGAN CHASE BANK, N.A., as Administrative Agent

By: /s/ Catherine V. Frank

Name: Catherine V. Frank

Title: Managing Director

First Amendment to the Second A&R Series 2010-6 Supplement

AGREED, ACKNOWLEDGED AND CONSENTED:

LIBERTY STREET FUNDING LLC,

as a CP Conduit Purchaser under the Series

2010-6 Supplement

By: /s/ Jill A. Russo

Name: Jill A. Russo

Title: Vice President

THE BANK OF NOVA SCOTIA,

as a Funding Agent and an APA Bank under

the Series 2010-6 Supplement

By: /s/ Norman Last

Name: Norman Last

Title: Managing Director

First Amendment to the Second A&R Series 2010-6 Supplement

CHARTA, LLC (as successor to Charta Corporation),

as a CP Conduit Purchaser under the Series 2010-6 Supplement

By: Citibank, N.A., as

Attorney-in-fact

By: /s/ Linda Moses

Name: Linda Moses

Title: Vice President

CITIBANK, N.A., as

an APA Bank under the Series 2010-6 Supplement

By: /s/ Karrie L. Truglia

Name: Karrie L. Truglia

Title: Vice President

CITIBANK, N.A.,

as a Funding Agent under the Series 2010-6 Supplement

By: /s/ Karrie L. Truglia

Name: Karrie L. Truglia

Title: Vice President

First Amendment to the Second A&R Series 2010-6 Supplement

CHARIOT FUNDING LLC,

as a CP Conduit Purchaser under the Series

2010-6 Supplement

By: /s/ Catherine V. Frank

Name: Catherine V. Frank

Title: Managing Director

JPMORGAN CHASE BANK, N.A.,

as a Funding Agent under the Series

2010-6 Supplement

By: /s/ Catherine V. Frank

Name: Catherine V. Frank

Title: Managing Director

JPMORGAN CHASE BANK, N.A.,

as an APA Bank under the Series 2010-6

Supplement

By: /s/ Catherine V. Frank

Name: Catherine V. Frank

Title: Managing Director

First Amendment to the Second A&R Series 2010-6 Supplement

DEUTSCHE BANK AG, NEW YORK BRANCH,

as a Non-Conduit Purchaser under the Series

2010-6 Supplement

By: /s/ Joseph McElroy

Name: Joseph McElroy

Title: Director

By: /s/ Colin Bennett

Name: Colin Bennett

Title: Director

First Amendment to the Second A&R Series 2010-6 Supplement

ATLANTIC ASSET SECURITIZATION LLC,

as a CP Conduit Purchaser under the Series

2010-6 Supplement

By: /s/ Konstantina Kourmpetis

Name: Kostantina Kourmpetis

Title: Managing Director

By: /s/ Michael Regan

Name: Michael Regan

Title: Managing Director

CREDIT AGRICOLE CORPORATE AND INVESTMENT BANK,

as a Funding Agent and an APA Bank under the

Series 2010-6 Supplement

By: /s/ Konstantina Kourmpetis

Name: Kostantina Kourmpetis

Title: Managing Director

By: /s/ Michael Regan

Name: Michael Regan

Title: Managing Director

First Amendment to the Second A&R Series 2010-6 Supplement

THE ROYAL BANK OF SCOTLAND PLC,

as a Non-Conduit Purchaser under the Series

2010-6 Supplement

by: RBS Securities Inc., as agent

By: /s/ David J. Donofrio

Name: David J. Donofrio

Title: Director

First Amendment to the Second A&R Series 2010-6 Supplement

BANK OF AMERICA, NATIONAL ASSOCIATION,

as a Non-Conduit Purchaser under the Series

2010-6 Supplement

By: /s/ Brendan Feeney

Name: Brendan Feeney

Title Vice President

First Amendment to the Second A&R Series 2010-6 Supplement

ROYAL BANK OF CANADA,

as Non-Conduit Purchaser under the Series

2010-6 Supplement

By: /s/ Janine D. Marsini

Name: Janine D. Marsini

Title: Authorized Signatory

By: /s/ Kevin P. Wilson

Name: Kevin P. Wilson

Title: Authorized Signatory

First Amendment to the Second A&R Series 2010-6 Supplement

BARCLAYS BANK PLC,

as a Non-Conduit Purchaser under the Series

2010-6 Supplement

By: /s/ Laura Spichiger

Name: Laura Spichiger

Title: Director

First Amendment to the Second A&R Series 2010-6 Supplement

VERSAILLES ASSETS LLC,

as a CP Conduit Purchaser and an APA Bank under the Series

2010-6 Supplement

by: Global Securitization Services, LLC, its Manager

By: /s/ Bernard J. Angelo

Name: Bernard J. Angelo

Title: Senior Vice President

NATIXIS, NEW YORK BRANCH,

as a Funding Agent under the

Series 2010-6 Supplement

By: /s/ Chad Johnson

Name: Chad Johnson

Title: Manager Director

By: /s/ David S. Bondy

Name: David S. Bondy

Title: Managing Director

First Amendment to the Second A&R Series 2010-6 Supplement

VICTORY RECEIVABLES CORPORATION,

as CP Conduit Purchaser under the 2010-6 Supplement

By: /s/ David V. DeAngelis

Name: David V. DeAngelis

Title: Vice President

THE BANK OF TOKYO-MITSUBISHI UFJ, LTD.,

as a Funding Agent under the

Series 2010-6 Supplement

By: /s/ Christopher Pohl

Name: Christopher Pohl

Title: Managing Director

THE BANK OF TOKYO-MITSUBISHI UFJ, LTD.,

as an APA Bank under the

Series 2010-6 Supplement

By: /s/ George Stoecklein

Name: George Stoecklein

Title: Director

First Amendment to the Second A&R Series 2010-6 Supplement

SUNTRUST BANK,

as a Non-Conduit Purchaser under the Series

2010-6 Supplement

By: /s/ David Hufnagel

Name: David Hufnagel

Title: Vice President

First Amendment to the Second A&R Series 2010-6 Supplement

BANK OF MONTREAL ,

as an APA Bank under the

Series 2010-6 Supplement

By: /s/ Amy K. Dumser

Name: Amy K. Dumser

Title: Director

FAIRWAY FINANCE COMPANY, LLC,

as a CP Conduit Purchaser under the

Series 2010-6 Supplement

By: /s/ Lori Gebron

Name: Lori Gebron

Title: Vice President

BMO CAPITAL MARKETS CORP.,

as Funding Agent under the

Series 2010-6 Supplement

By: /s/ John Pappano

Name: John Pappano

Title: Managing Director

First Amendment to the Second A&R Series 2010-6 Supplement

GRESHAM RECEIVABLES (NO. 28) LIMITED,

as an APA Bank under the

Series 2010-6 Supplement

By: /s/ Ariel Pinel

Name: Ariel Pinel

Title: Director

GRESHAM RECEIVABLES (NO. 28) LIMITED,

as a CP Conduit Purchaser under the

Series 2010-6 Supplement

By: /s/ Ariel Pinel

Name: Ariel Pinel

Title: Director

LLOYDS BANK PLC,

as Funding Agent under the

Series 2010-6 Supplement

By: /s/ Thomas Spary

Name: Thomas Spary

Title: Director

First Amendment to the Second A&R Series 2010-6 Supplement

AVIS BUDGET CAR RENTAL, LLC,

as Administrator

By: /s/ Rochelle Tarlowe

Name: Rochelle Tarlowe

Title: Vice President and Treasurer

First Amendment to the Second A&R Series 2010-6 Supplement

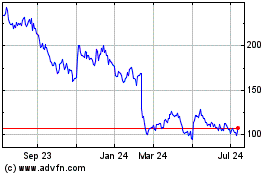

Avis Budget (NASDAQ:CAR)

Historical Stock Chart

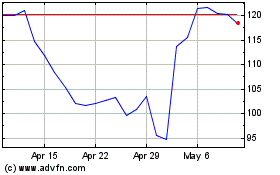

From Mar 2024 to Apr 2024

Avis Budget (NASDAQ:CAR)

Historical Stock Chart

From Apr 2023 to Apr 2024