Robert Rush Assumes Role of Chief Risk Officer of Two Harbors Investment Corp.

November 26 2014 - 8:30AM

Business Wire

Two Harbors Investment Corp. (NYSE: TWO) announced

today that, effective January 1, 2015, Robert Rush will assume the

role of the company’s Chief Risk Officer. Paul Richardson, who has

served as the company’s Chief Risk Officer over the past several

years, will remain in his role as Partner and Chief Risk Officer

for Pine River Capital Management L.P., the parent of the company’s

external manager.

“We are excited to congratulate Bob on his promotion to Chief

Risk Officer. He has done an outstanding job as our Managing

Director, Risk Management, and this is a natural transition for Bob

and Paul,” stated Thomas Siering, Two Harbors’ President and Chief

Executive Officer. “We wish to sincerely thank Paul for his

invaluable service to Two Harbors and we look forward to continuing

to collaborate with him in the future.”

Mr. Rush has served as Two Harbors’ Managing Director, Risk

Management, since September 2013. Prior to joining the company, Mr.

Rush held a variety of positions at UBS AG in New York. During

2013, he was a Managing Director and Director of Risk Strategy for

the Non-Core and Legacy Group, the unit established to oversee UBS’

exit from capital-inefficient businesses. From 2009 to 2012, he

served as Head of Risk Analytics for the StabFund Investment

Management Group, focusing on fundamental/technical analytics and

interest rate risk management for a multi-billion portfolio of

residential and commercial loans, RMBS, CMBS and ABS. From 2007 to

2008, Mr. Rush served as the Head CDO and Esoteric Asset Trader for

the UBS Workout Group, and from 2006 to 2007, he co-managed the

ABS/CMBS Derivatives Structuring Team within the Global CDO Group.

Prior to his time at UBS, he served in various investment

management and research positions. Mr. Rush holds a B.S. in

Mathematics from Fordham University, an M.S. in Operations Research

& Statistics from Rensselaer Polytechnic Institute, and a Ph.D.

in Decision Sciences & Engineering Systems from Rensselaer

Polytechnic Institute.

Two Harbors Investment Corp.

Two Harbors Investment Corp., a Maryland corporation, is a real

estate investment trust that invests in residential mortgage-backed

securities, residential mortgage loans, mortgage servicing rights

and other financial assets. Two Harbors is headquartered in New

York, New York, and is externally managed and advised by PRCM

Advisers LLC, a wholly owned subsidiary of Pine River Capital

Management L.P. Additional information is available at

www.twoharborsinvestment.com.

Additional Information

Stockholders of Two Harbors and other interested persons may

find additional information regarding the company at the Securities

and Exchange Commission’s Internet site at www.sec.gov or by

directing requests to: Two Harbors Investment Corp., 590 Madison

Avenue, 36th floor, New York, NY 10022, telephone 612-629-2500.

Two Harbors Investment Corp.Investors:July Hugen, Investor

Relations, 612-629-2514july.hugen@twoharborsinvestment.com

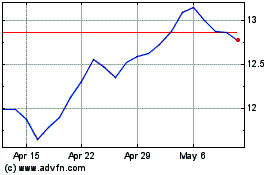

Two Harbors Investment (NYSE:TWO)

Historical Stock Chart

From Mar 2024 to Apr 2024

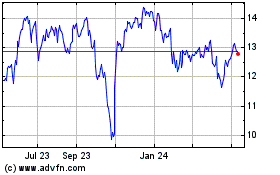

Two Harbors Investment (NYSE:TWO)

Historical Stock Chart

From Apr 2023 to Apr 2024