UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 38)*

Lighting

Science Group Corporation

(Name of Issuer)

Common Stock, par value $.001 per share

(Title of Class of Securities)

53224G103

(CUSIP Number)

Daniel Stencel

LED Holdings, LLC

co

Pegasus Capital Advisors, L.P.

99 River Road

Cos Cob, CT 06807

(203)

869-4400

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

November 14, 2014

(Date

of Event Which Requires Filing of this Statement)

If the filing

person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box. ¨

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for

other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page

shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

CUSIP No. 53224G103

|

|

|

|

|

|

|

| (1) |

|

Names of

reporting persons LED Holdings, LLC

26-0299414 |

| (2) |

|

Check the appropriate box if a member

of a group (see instructions)

(a) ¨ (b) ¨ |

| (3) |

|

SEC use only

|

| (4) |

|

Source of funds (see instructions)

OO |

| (5) |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| (6) |

|

Citizenship or place of

organization Delaware |

| Number of

shares beneficially

owned by each

reporting person

with |

|

(7) |

|

Sole voting power

20,972,495 |

| |

(8) |

|

Shared voting power

-0- |

| |

(9) |

|

Sole dispositive power

20,972,495 |

| |

(10) |

|

Shared dispositive power

-0- |

| (11) |

|

Aggregate amount beneficially owned by each reporting person

20,972,495 |

| (12) |

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions)

¨ |

| (13) |

|

Percent of class represented by amount

in Row (11) 10.0%(1) |

| (14) |

|

Type of reporting person (see

instructions) OO |

| (1) |

Based on 209,946,697 shares of common stock outstanding as of November 7, 2014, as disclosed in the Issuer’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (the

“SEC”) on November 14, 2014. |

CUSIP No. 53224G103

|

|

|

|

|

|

|

| (1) |

|

Names of

reporting persons PP IV (AIV) LED, LLC

26-0240524 |

| (2) |

|

Check the appropriate box if a member

of a group (see instructions)

(a) ¨ (b) ¨ |

| (3) |

|

SEC use only

|

| (4) |

|

Source of funds (see instructions)

OO |

| (5) |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| (6) |

|

Citizenship or place of

organization Delaware |

| Number of

shares beneficially

owned by each

reporting person

with |

|

(7) |

|

Sole voting power

154,089,828 |

| |

(8) |

|

Shared voting power

-0- |

| |

(9) |

|

Sole dispositive power

154,089,828 |

| |

(10) |

|

Shared dispositive power

-0- |

| (11) |

|

Aggregate amount beneficially owned by each reporting person

154,089,828 |

| (12) |

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions)

¨ |

| (13) |

|

Percent of class represented by amount

in Row (11) 73.4%(1) |

| (14) |

|

Type of reporting person (see

instructions) OO |

| (1) |

Based on 209,946,697 shares of common stock outstanding as of November 7, 2014, as disclosed in the Issuer’s Quarterly Report on Form 10-Q filed with the SEC on November 14, 2014. |

CUSIP No. 53224G103

|

|

|

|

|

|

|

| (1) |

|

Names of

reporting persons PP IV LED, LLC

26-0196366 |

| (2) |

|

Check the appropriate box if a member

of a group (see instructions)

(a) ¨ (b) ¨ |

| (3) |

|

SEC use only

|

| (4) |

|

Source of funds (see instructions)

OO |

| (5) |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| (6) |

|

Citizenship or place of

organization Delaware |

| Number of

shares beneficially

owned by each

reporting person

with |

|

(7) |

|

Sole voting power

154,089,828 |

| |

(8) |

|

Shared voting power

-0- |

| |

(9) |

|

Sole dispositive power

154,089,828 |

| |

(10) |

|

Shared dispositive power

-0- |

| (11) |

|

Aggregate amount beneficially owned by each reporting person

154,089,828 |

| (12) |

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions)

¨ |

| (13) |

|

Percent of class represented by amount

in Row (11) 73.4%(1) |

| (14) |

|

Type of reporting person (see

instructions) OO |

| (1) |

Based on 209,946,697 shares of common stock outstanding as of November 7, 2014, as disclosed in the Issuer’s Quarterly Report on Form 10-Q filed with the SEC on November 14, 2014. |

CUSIP No. 53224G103

|

|

|

|

|

|

|

| (1) |

|

Names of

reporting persons PEGASUS PARTNERS IV, LP

20-8228643 |

| (2) |

|

Check the appropriate box if a member

of a group (see instructions)

(a) ¨ (b) ¨ |

| (3) |

|

SEC use only

|

| (4) |

|

Source of funds (see instructions)

OO |

| (5) |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| (6) |

|

Citizenship or place of

organization Delaware |

| Number of

shares beneficially

owned by each

reporting person

with |

|

(7) |

|

Sole voting power

249,116,311(1) |

| |

(8) |

|

Shared voting power

-0- |

| |

(9) |

|

Sole dispositive power

249,116,311(1) |

| |

(10) |

|

Shared dispositive power

-0- |

| (11) |

|

Aggregate amount beneficially owned by each reporting person

249,116,311(1) |

| (12) |

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions)

¨ |

| (13) |

|

Percent of class represented by amount

in Row (11) 83.3%(1)(2) |

| (14) |

|

Type of reporting person (see

instructions) PN |

| (1) |

Includes common stock issuable upon the conversion of 15,577 shares of Series I Convertible Preferred Stock at a ratio of approximately 1,053 shares of common stock for each share of Series I Convertible

Preferred Stock, 19,657 shares of Series J Convertible Preferred Stock at a ratio of approximately 1,053 shares of common stock for each share of Series J Convertible Preferred Stock and 19,657 warrants at a ratio of approximately 2,650

shares of common stock for each warrant. |

| (2) |

Based on 209,946,697 shares of common stock outstanding as of November 7, 2014, as disclosed in the Issuer’s Quarterly Report on Form 10-Q filed with the SEC on November 14, 2014. |

CUSIP No. 53224G103

|

|

|

|

|

|

|

| (1) |

|

Names of

reporting persons LSGC Holdings LLC

27-3651400 |

| (2) |

|

Check the appropriate box if a member

of a group (see instructions)

(a) ¨ (b) ¨ |

| (3) |

|

SEC use only

|

| (4) |

|

Source of funds (see instructions)

OO |

| (5) |

|

Check if disclosure of legal

proceedings is required pursuant to items 2(d) or 2(e) ¨ |

| (6) |

|

Citizenship or place of

organization Delaware |

| Number of

shares beneficially

owned by each

reporting person

with |

|

(7) |

|

Sole voting power

154,089,828 |

| |

(8) |

|

Shared voting power

-0- |

| |

(9) |

|

Sole dispositive power

154,089,828 |

| |

(10) |

|

Shared dispositive power

-0- |

| (11) |

|

Aggregate amount beneficially owned by each reporting person

154,089,828 |

| (12) |

|

Check if the aggregate amount in row

(11) excludes certain shares (see instructions)

¨ |

| (13) |

|

Percent of class represented by amount

in row (11) 73.4%(1) |

| (14) |

|

Type of reporting person (see

instructions) OO |

| (1) |

Based on 209,946,697 shares of common stock outstanding as of November 7, 2014, as disclosed in the Issuer’s Quarterly Report on Form 10-Q filed with the SEC on November 14, 2014. |

CUSIP No. 53224G103

|

|

|

|

|

|

|

| (1) |

|

Names of

reporting persons: LSGC Holdings II LLC

45-3443986 |

| (2) |

|

Check the appropriate box if a member

of a group (see instructions):

(a) ¨ (b) ¨ |

| (3) |

|

SEC use only:

|

| (4) |

|

Source of funds (see

instructions): OO |

| (5) |

|

Check if disclosure of legal

proceedings is required pursuant to items 2(d) or 2(e): ¨ |

| (6) |

|

Citizenship or place of

organization: Delaware |

| Number of

shares beneficially

owned by each

reporting person

with |

|

(7) |

|

Sole voting power:

92,056,786(1) |

| |

(8) |

|

Shared voting power:

-0- |

| |

(9) |

|

Sole dispositive power:

92,056,786(1) |

| |

(10) |

|

Shared dispositive power:

-0- |

| (11) |

|

Aggregate amount beneficially owned by each reporting person:

92,056,786(1) |

| (12) |

|

Check if the aggregate amount in row

(11) excludes certain shares (see instructions):

¨ |

| (13) |

|

Percent of class represented by amount

in row (11): 30.8%(1)(2) |

| (14) |

|

Type of reporting person (see

instructions): OO |

| (1) |

Includes common stock issuable upon the conversion of 15,577 shares of Series I Convertible Preferred Stock at a ratio of approximately 1,053 shares of common stock for each share of Series I Convertible

Preferred Stock, 19,657 shares of Series J Convertible Preferred Stock at a ratio of approximately 1,053 shares of common stock for each share of Series J Convertible Preferred Stock and 19,657 warrants at a ratio of approximately

2,650 shares of common stock for each warrant. |

| (2) |

Based on 209,946,697 shares of common stock outstanding as of November 7, 2014, as disclosed in the Issuer’s Quarterly Report on Form 10-Q filed with the SEC on November 14, 2014. |

CUSIP No. 53224G103

|

|

|

|

|

|

|

| (1) |

|

Names of

reporting persons: PCA LSG Holdings, LLC

45-3836143 |

| (2) |

|

Check the appropriate box if a member

of a group (see instructions):

(a) ¨ (b) ¨ |

| (3) |

|

SEC use only:

¨ |

| (4) |

|

Source of funds (see

instructions): OO |

| (5) |

|

Check if disclosure of legal

proceedings is required pursuant to items 2(d) or 2(e): ¨ |

| (6) |

|

Citizenship or place of

organization: Delaware |

| Number of

shares beneficially

owned by each

reporting person

with |

|

(7) |

|

Sole voting power:

81,838,372 (1) |

| |

(8) |

|

Shared voting power:

-0- |

| |

(9) |

|

Sole dispositive power:

81,838,372 (1) |

| |

(10) |

|

Shared dispositive power:

-0- |

| (11) |

|

Aggregate amount beneficially owned by each reporting person:

81,838,372 (1) |

| (12) |

|

Check if the aggregate amount in row

(11) excludes certain shares (see instructions):

¨ |

| (13) |

|

Percent of class represented by amount

in row (11): 28.2%(1)(2) |

| (14) |

|

Type of reporting person (see

instructions): OO |

| (1) |

Includes common stock issuable upon the conversion of 18,316 shares of Series I Convertible Preferred Stock at a ratio of approximately 1,053 shares of common stock for each share of Series I Convertible

Preferred Stock, 16,500 shares of Series J Convertible Preferred Stock at a ratio of approximately 1,053 shares of common stock for each share of Series J Convertible Preferred Stock and 16,500 warrants at a ratio of approximately 2,650 shares

of common stock for each warrant. |

| (2) |

Based on 209,946,697 shares of common stock outstanding as of November 7, 2014, as disclosed in the Issuer’s Quarterly Report on Form 10-Q filed with the SEC on November 14, 2014. |

CUSIP No. 53224G103

|

|

|

|

|

|

|

| (1) |

|

Names of

reporting persons PEGASUS INVESTORS IV, LP

20-8228567 |

| (2) |

|

Check the appropriate box if a member

of a group (see instructions)

(a) ¨ (b) ¨ |

| (3) |

|

SEC use only

|

| (4) |

|

Source of funds (see instructions)

OO |

| (5) |

|

Check if disclosure of legal

proceedings is required pursuant to items 2(d) or 2(e) ¨ |

| (6) |

|

Citizenship or place of

organization Delaware |

| Number of

shares beneficially

owned by each

reporting person

with |

|

(7) |

|

Sole voting power

249,116,311(1) |

| |

(8) |

|

Shared voting power

-0- |

| |

(9) |

|

Sole dispositive power

249,116,311(1) |

| |

(10) |

|

Shared dispositive power

-0- |

| (11) |

|

Aggregate amount beneficially owned by each reporting person

249,116,311(1) |

| (12) |

|

Check if the aggregate amount in row

(11) excludes certain shares (see instructions)

¨ |

| (13) |

|

Percent of class represented by amount

in row (11) 83.3%(1)(2) |

| (14) |

|

Type of reporting person (see

instructions) PN |

| (1) |

Includes common stock issuable upon the conversion of 15,577 shares of Series I Convertible Preferred Stock at a ratio of approximately 1,053 shares of common stock for each share of Series I Convertible

Preferred Stock, 19,657 shares of Series J Convertible Preferred Stock at a ratio of approximately 1,053 shares of common stock for each share of Series J Convertible Preferred Stock and 19,657 warrants at a ratio of approximately

2,650 shares of common stock for each warrant. |

| (2) |

Based on 209,946,697 shares of common stock outstanding as of November 7, 2014, as disclosed in the Issuer’s Quarterly Report on Form 10-Q filed with the SEC on November 14, 2014. |

CUSIP No. 53224G103

|

|

|

|

|

|

|

| (1) |

|

Names of

reporting persons PEGASUS INVESTORS IV GP, LLC

20-8228323 |

| (2) |

|

Check the appropriate box if a member

of a group (see instructions)

(a) ¨ (b) ¨ |

| (3) |

|

SEC use only

|

| (4) |

|

Source of funds (see instructions)

OO |

| (5) |

|

Check if disclosure of legal

proceedings is required pursuant to items 2(d) or 2(e) ¨ |

| (6) |

|

Citizenship or place of

organization Delaware |

| Number of

shares beneficially

owned by each

reporting person

with |

|

(7) |

|

Sole voting power

254,116,311(1) |

| |

(8) |

|

Shared voting power

-0- |

| |

(9) |

|

Sole dispositive power

254,116,311(1) |

| |

(10) |

|

Shared dispositive power

-0- |

| (11) |

|

Aggregate amount beneficially owned by each reporting person

254,116,311(1) |

| (12) |

|

Check if the aggregate amount in row

(11) excludes certain shares (see instructions)

¨ |

| (13) |

|

Percent of class represented by amount

in row (11) 83.6%(1)(2) |

| (14) |

|

Type of reporting person (see

instructions) OO |

| (1) |

Includes common stock issuable upon the conversion of 15,577 shares of Series I Convertible Preferred Stock at a ratio of approximately 1,053 shares of common stock for each share of Series I Convertible

Preferred Stock, 19,657 shares of Series J Convertible Preferred Stock at a ratio of approximately 1,053 shares of common stock for each share of Series J Convertible Preferred Stock, 19,657 warrants at a ratio of approximately 2,650

shares of common stock for each warrant and a warrant to purchase 5,000,000 shares of common stock held by Pegasus Capital Partners IV, L.P. |

| (2) |

Based on 209,946,697 shares of common stock outstanding as of November 7, 2014, as disclosed in the Issuer’s Quarterly Report on Form 10-Q filed with the SEC on November 14, 2014. |

CUSIP No. 53224G103

|

|

|

|

|

|

|

| (1) |

|

Names of

reporting persons PEGASUS CAPITAL, LLC

06-1463162 |

| (2) |

|

Check the appropriate box if a member

of a group (see instructions)

(a) ¨ (b) ¨ |

| (3) |

|

SEC use only

|

| (4) |

|

Source of funds (see instructions)

OO |

| (5) |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| (6) |

|

Citizenship or place of

organization Connecticut |

| Number of

shares beneficially

owned by each

reporting person

with |

|

(7) |

|

Sole voting power

340,954,683 (1) |

| |

(8) |

|

Shared voting power

-0- |

| |

(9) |

|

Sole dispositive power

340,954,683 (1) |

| |

(10) |

|

Shared dispositive power

-0- |

| (11) |

|

Aggregate amount beneficially owned by each reporting person

340,954,683 (1) |

| (12) |

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions)

¨ |

| (13) |

|

Percent of class represented by amount

in Row (11) 87.5%(1)(2) |

| (14) |

|

Type of reporting person (see

instructions) OO |

| (1) |

Includes common stock issuable upon the conversion of 33,893 shares of Series I Convertible Preferred Stock at a ratio of approximately 1,053 shares of common stock for each share of Series I Convertible

Preferred Stock, 36,157 shares of Series J Convertible Preferred Stock at a ratio of approximately 1,053 shares of common stock for each share of Series J Convertible Preferred Stock, 36,157 warrants at a ratio of approximately 2,650

shares of common stock for each warrant, a warrant to purchase 5,000,000 shares of common stock held by Pegasus Capital Partners IV, L.P. and a warrant to purchase 5,000,000 shares of common stock held by Pegasus Capital Partners V, L.P.

|

| (2) |

Based on 209,946,697 shares of common stock outstanding as of November 7, 2014, as disclosed in the Issuer’s Quarterly Report on Form 10-Q filed with the SEC on November 14, 2014. |

CUSIP No. 53224G103

|

|

|

|

|

|

|

| (1) |

|

Names of

reporting persons CRAIG COGUT |

| (2) |

|

Check the appropriate box if a member

of a group (see instructions)

(a) ¨ (b) ¨ |

| (3) |

|

SEC use only

|

| (4) |

|

Source of funds (see instructions)

OO |

| (5) |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| (6) |

|

Citizenship or place of

organization United States |

| Number of

shares beneficially

owned by each

reporting person

with |

|

(7) |

|

Sole voting power

342,128,625 (1) |

| |

(8) |

|

Shared voting power

-0- |

| |

(9) |

|

Sole dispositive power

342,128,625 (1) |

| |

(10) |

|

Shared dispositive power

-0- |

| (11) |

|

Aggregate amount beneficially owned by each reporting person

342,128,625 (1) |

| (12) |

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions)

¨ |

| (13) |

|

Percent of class represented by amount

in Row (11) 87.8% (1)(2) |

| (14) |

|

Type of reporting person (see

instructions) IN |

| (1) |

Includes 570,959 shares of restricted stock issued to Pegasus Capital Advisors IV, L.P. related to director compensation in 2014 that are fully votable, but vest on January 1, 2015. Also includes common stock

issuable upon the conversion of 33,893 shares of Series I Convertible Preferred Stock at a ratio of approximately 1,053 shares of common stock for each share of Series I Convertible Preferred Stock, 36,157 shares of Series J Convertible Preferred

Stock at a ratio of approximately 1,053 shares of common stock for each share of Series J Convertible Preferred Stock, 36,157 warrants at a ratio of approximately 2,650 shares of common stock for each warrant, a warrant to purchase 5,000,000 shares

of common stock held by Pegasus Capital Partners IV, L.P. and a warrant to purchase 5,000,000 shares of common stock held by Pegasus Capital Partners V, L.P. |

| (2) |

Based on 209,946,697 shares of common stock outstanding as of November 7, 2014, as disclosed in the Issuer’s Quarterly Report on Form 10-Q filed with the SEC on November 14, 2014. |

Amendment No. 38 to Schedule 13D

This Amendment No. 38 amends and supplements the Schedule 13D (the “Schedule 13D”) filed on behalf of

LED Holdings, LLC (“LED Holdings”), Pegasus Capital Advisors, L.P. (“PCA”), Pegasus Capital Advisors GP, L.L.C. (“PCA GP”), PP IV (AIV) LED, LLC

(“PPAIV”), PP IV LED, LLC (“PPLED”), Pegasus Partners IV, L.P. (“PPIV”), LSGC Holdings LLC (“LSGC Holdings”), LSGC Holdings II LLC (“LSGC

Holdings II”), PCA LSG Holdings, LLC (“PCA Holdings”) Pegasus Investors IV, L.P. (“PIIV”), Pegasus Investors IV GP, L.L.C. (“PIGP”), Pegasus Capital, LLC

(“PCLLC”), and Craig Cogut (“Mr. Cogut,” and together with LED Holdings, PPAIV, PPLED, PPIV, LSGC Holdings, LSGC Holdings II, PCA Holdings, PIIV, PIGP and PCLLC, the “Reporting

Persons”) with the Securities and Exchange Commission (the “SEC”), as the case may be, on October 15, 2007, as amended by Amendment No. 1 filed on April 11, 2008, Amendment No. 2 filed on

May 1, 2008, Amendment No. 3 filed on July 30, 2008, Amendment No. 4 filed on January 12, 2009, Amendment No. 5 filed on February 20, 2009, Amendment No. 6 filed on May 22, 2009, Amendment No. 7

filed on August 17, 2009, Amendment No. 8 filed on September 1, 2009, Amendment No. 9 filed on March 8, 2010, Amendment No. 10 filed on March 24, 2010, Amendment No. 11 filed on April 28, 2010, Amendment

No. 12 filed on May 14, 2010, Amendment No. 13 filed on July 2, 2010, Amendment No. 14 filed on July 16, 2010, Amendment No. 15 filed on November 5, 2010, Amendment No. 16 filed on December 28, 2010,

Amendment No. 17 filed on February 2, 2011, Amendment No. 18 filed on February 18, 2011, Amendment No. 19 filed on May 26, 2011, Amendment No. 20 filed on December 13, 2011, Amendment No. 21 filed on

December 23, 2011, Amendment No. 22 filed on January 30, 2012, Amendment No. 23 filed on April 4, 2012, Amendment No. 24 filed on April 24, 2012, Amendment No. 25 filed on May 31, 2012, Amendment

No. 26 filed on October 1, 2012, Amendment No. 27 filed on September 17, 2013, Amendment No. 28 filed on December 5, 2013, Amendment No. 29 filed on January 8, 2014, Amendment No. 30 filed on

January 15, 2014, Amendment No. 31 filed on February 12, 2014, Amendment No. 32 filed on February 21, 2014, Amendment No. 33 filed on April 7, 2014, Amendment No. 34 filed on June 23, 2014, Amendment

No. 35 filed on August 4, 2014, Amendment No. 36 filed on August 20, 2014, and Amendment No. 37 filed on September 5, 2014. Except as specifically provided herein, this Amendment No. 38 supplements, but does not

modify any of the disclosure previously reported in the Schedule 13D and the amendments referenced above. Each capitalized term used but not defined herein has the meaning ascribed to such term in the Schedule 13D, as amended.

| Item 1. |

Security and Issuer |

Item 1 of Schedule 13D is supplemented and superseded, as the case may be, as

follows:

As of the date hereof, the address of principal executive offices of Lighting Science Group Corporation (the “Issuer”)

is 1830 Penn Street, Melbourne, FL 32901.

| Item 2. |

Identity and Background |

Item 2(f) is hereby amended to replace Appendix A included in Amendment No. 34

to this Schedule 13D with Appendix A included in this Amendment No. 38 to Schedule 13D. Appendix A is incorporated by reference herein.

| Item 4. |

Purpose of Transaction |

Item 4 of Schedule 13D is supplemented and superseded, as the case may be,

as follows:

Amendments to Certificates of Designation

On November 14, 2014, in connection with an offering by the Issuer to a third party investor (the “Purchaser”) of (i) Series

J Convertible Preferred Stock of the Company, par value $0.001 per share (the “Series J Preferred Stock”) and (ii) a warrant to purchase 2,650 shares of common stock of the Company, par value $0.001 per share, at an

exercise price of $0.001 per share, the Issuer amended and restated the certificates of designation governing the Series I Convertible Preferred Stock (the “Series I Certificate”) and Series J Preferred Stock (the

“Series J Certificate” and together with the Series I Certificate, the “Certificates of Designation”).

Amended Series J Certificate

The Issuer amended and

restated the Series J Certificate (the “Amended Series J Certificate”) to, among other things:

(i) require the

Issuer to redeem the Series J Preferred Stock (a) on November 14, 2019, at the election of the holders of Series J Preferred Stock (the “Special Redemption”), (b) upon the occurrence of an uncured material

breach by the Issuer of any of the Certificates of Designation and (c) subject to certain limited exceptions, immediately prior to the redemption of any security which ranks junior to, or pari passu with, the Series J Preferred Stock;

(ii) if the Issuer does not have sufficient capital available to redeem the Series J Preferred

Stock upon the exercise of a Special Redemption, require the Issuer to issue a non-interest bearing note or notes (payable 180 days after issuance) in the principal amount of the liquidation amount of any shares of Series J Preferred Stock not

redeemed by the Issuer in connection with such Special Redemption, subject to certain limitations imposed by Delaware law governing distributions to stockholders;

(iii) in each case subject to certain exceptions, require the Issuer or any successor entity in connection with any merger, consolidation or

similar capital reorganization (each a “Reorganization”) to (a) assume the covenants and obligations set forth in the Amended Series J Certificate and (b) to the extent such assumption of covenants and obligations

is not required, adjust the consideration to be received upon conversion of the Series J Preferred Stock following a Reorganization to substantially preserve the economic benefit the Series J Preferred Stock would have been entitled to in a

qualified underwritten public offering (a “QPO”) by the Issuer’s successor;

(iv) subject to certain limited

exceptions, require the Issuer to take any action necessary or desirable to provide the holders of Series J Preferred Stock with the benefit of any term that is more favorable than the terms of the Amended Series J Certificate resulting from an

amendment to any term or any new term, set forth in the certificate of designation governing any of the Issuer’s securities ranking junior to, or pari passu with, the Series J Preferred Stock;

(v) prohibit the Issuer from issuing securities to related parties other than on arm’s-length terms; and

(vi) make certain other clarifying amendments.

The Amended Series J Certificate also requires the Issuer to obtain the consent of the Purchasers under most circumstances to (i) make certain amendments

to the terms and rights of the Series J Preferred Stock set forth in the Amended Series J Certificate, (ii) pay dividends or make certain distributions on any shares of the Issuer’s capital stock, (iii) engage in any recapitalization,

change of control transaction, or sale of a substantial portion of the Issuer’s assets or (iv) reclassify or exchange any outstanding securities of the Issuer for securities which rank senior to, or pari passu with, the Series J

Preferred Stock.

Amended Series I Certificate

The

Issuer also amended and restated the Series I Certificate (the “Amended Series I Certificate”) to, among other things:

(i) require the Issuer to redeem the shares of Series I Convertible Preferred Stock upon the occurrence of an event that requires the Issuer to

redeem the Series J Preferred Stock;

(ii) in each case subject to certain exceptions, require the Issuer or any successor entity in

connection with any Reorganization to (a) assume the covenants and obligations set forth in the Amended Series I Certificate, and (b) to the extent such assumption of covenants and obligations is not required, adjust the consideration to

be received upon conversion of the Series I Convertible Preferred Stock following a Reorganization to substantially preserve the economic benefit the Series I Convertible Preferred Stock would have been entitled to in a QPO by the Issuer’s

successors; and

(iii) subject to certain limited exceptions, require the Issuer to take any action necessary or desirable to provide the

holders of Series I Convertible Preferred Stock with the benefit of any term that is more favorable than the terms of the Amended Series I Certificate resulting from an amendment to any term or any new term, set forth in the certificate of

designation governing any of the Issuer’s securities which rank junior to, or pari passu with, the Series I Convertible Preferred Stock.

The foregoing description of the Amended Series J Certificate and the Amended Series I Certificate, and the amendments effected thereby, does

not purport to be complete and is qualified in its entirety by reference to the Issuer’s Current Report on Form 8-K filed with the SEC on November 20, 2014, and the full texts of the Amended Series J Certificate and the Amended Series I

Certificate, attached thereto as Exhibits 4.3 and 4.2, respectively.

The Reporting Persons continuously assess the Issuer’s

business, financial condition, results of operations and prospects, general economic conditions, other developments and additional investment opportunities. Depending on such assessments, the Reporting Persons and/or their affiliates may acquire

additional securities of the Issuer, including but not limited to common stock, existing preferred securities or new securities of the Issuer or may determine to purchase, sell or otherwise dispose of all or some of the Issuer’s securities in

the open market, as applicable, in privately negotiated transactions, in transactions directly with the Issuer or otherwise. Such actions will depend upon a variety of factors, including, without limitation, current and anticipated future trading

prices, the financial condition, results of operations and prospects of the Issuer, alternative investment opportunities, general economic, financial market and industry conditions and other factors that the Reporting Persons and/or their affiliates

may deem material to its investment decision. Also, the Reporting Persons and/or their affiliates have had and will continue to have discussions with management regarding the operations of the Issuer and matters of mutual interest, which could

include the items in subparagraphs (a) through (j) of Item 4 of Schedule 13D.

Except as set forth herein and/or in previous amendments to this Schedule 13D, as the case may

be, the Reporting Persons do not have present plans or proposals at this time that relate to or would result in any of the transactions described in subparagraphs (a) through (j) of Item 4 of Schedule 13D.

| Item 5. |

Interest in Securities of the Issuer |

Item 5 of this Schedule 13D is hereby amended and restated in

its entirety as follows:

(a) (b) Items 7 through 11 and 13 of each of the cover pages of this amended Schedule 13D are incorporated herein by

reference. Such information is based upon 209,946,697 shares of common stock outstanding as of November 7, 2014, as disclosed in the Issuer’s Quarterly Report on Form 10-Q filed with the SEC on November 14, 2014.

(c) Except as set forth herein and/or in our previously filed amendments to Schedule 13D, as the case may be, there have been no other transactions in the

class of securities reported on that were effected within the past 60 days.

(d) The disclosure regarding the relationship between the Reporting Persons in

Item 2(f) of Amendment No. 28 to this Schedule 13D is incorporated by reference herein.

(e) N/A

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

Date: November 25, 2014

|

|

|

| LED HOLDINGS, LLC |

|

|

| By: |

|

/s/ Daniel Stencel |

| Name: |

|

Daniel Stencel |

| Title: |

|

Manager |

|

| PP IV (AIV) LED, LLC |

|

|

| By: |

|

Pegasus Partners IV (AIV), L.P., |

|

|

its sole member |

|

|

| By: |

|

Pegasus Investors IV, L.P., |

|

|

its general partner |

|

|

| By: |

|

Pegasus Investors IV GP, L.L.C., |

|

|

its general partner |

|

|

| By: |

|

/s/ Daniel Stencel |

| Name: |

|

Daniel Stencel |

| Title: |

|

Chief Financial Officer and Treasurer |

|

| PP IV LED, LLC |

|

|

| By: |

|

Pegasus Partners IV, L.P., |

|

|

its sole member |

|

|

| By: |

|

Pegasus Investors IV, L.P., |

|

|

its general partner |

|

|

| By: |

|

Pegasus Investors IV GP, L.L.C., |

|

|

its general partner |

|

|

| By: |

|

/s/ Daniel Stencel |

| Name: |

|

Daniel Stencel |

| Title: |

|

Chief Financial Officer and Treasurer |

|

|

|

| PEGASUS PARTNERS IV, L.P. |

|

|

| By: |

|

Pegasus Investors IV, L.P. |

|

|

its general partner |

|

|

| By: |

|

Pegasus Investors IV GP, L.L.C., |

|

|

its general partner |

|

|

| By: |

|

/s/ Daniel Stencel |

| Name: |

|

Daniel Stencel |

| Title: |

|

Chief Financial Officer and Treasurer |

|

| LSGC HOLDINGS LLC |

|

|

| By: |

|

Pegasus Partners IV, L.P., |

|

|

its managing member |

|

|

| By: |

|

Pegasus Investors IV, L.P., |

|

|

its general partner |

|

|

| By: |

|

Pegasus Investors IV GP, L.L.C., |

|

|

its general partner |

|

|

| By: |

|

/s/ Daniel Stencel |

| Name: |

|

Daniel Stencel |

| Title: |

|

Chief Financial Officer and Treasurer |

|

| LSGC HOLDINGS II LLC |

|

|

| By: |

|

Pegasus Partners IV, L.P., |

|

|

its sole member |

|

|

| By: |

|

Pegasus Investors IV, L.P., |

|

|

its general partner |

|

|

|

| By: |

|

Pegasus Investors IV GP, L.L.C., |

|

|

its general partner |

|

|

| By: |

|

/s/ Daniel Stencel |

| Name: |

|

Daniel Stencel |

| Title: |

|

Chief Financial Officer and Treasurer |

|

| PCA LSG HOLDINGS, LLC |

|

|

| By: |

|

Pegasus Capital, LLC, |

|

|

its managing member |

|

|

| By: |

|

/s/ Craig Cogut |

| Name: |

|

Craig Cogut |

| Title: |

|

President & Managing Member |

|

| PEGASUS INVESTORS IV, L.P. |

|

|

| By: |

|

Pegasus Investors IV GP, L.L.C., |

|

|

its general partner |

|

|

| By: |

|

/s/ Daniel Stencel |

| Name: |

|

Daniel Stencel |

| Title: |

|

Chief Financial Officer and Treasurer |

|

| PEGASUS INVESTORS IV GP, L.L.C. |

|

|

| By: |

|

/s/ Daniel Stencel |

| Name: |

|

Daniel Stencel |

| Title: |

|

Chief Financial Officer and Treasurer |

|

| PEGASUS CAPITAL, LLC |

|

|

| By: |

|

/s/ Craig Cogut |

| Name: |

|

Craig Cogut |

| Title: |

|

President & Managing Member |

|

| /s/ Craig Cogut |

| CRAIG COGUT |

|

|

|

|

|

| Appendix A

BOARD OF MANAGERS OF LED HOLDINGS, LLC |

| Name |

|

Position |

|

Address |

| Richard Davis |

|

Manager |

|

c/o Pegasus Capital Advisors,

99 River Road, Cos Cob, CT 06807 |

| Daniel Stencel |

|

Manager |

|

c/o Pegasus Capital Advisors,

99 River Road, Cos Cob, CT 06807 |

|

| EXECUTIVE OFFICERS OF PP IV (AIV) LED, LLC

|

| Name |

|

Position |

|

Address |

| Richard Davis |

|

President |

|

c/o Pegasus Capital Advisors,

99 River Road, Cos Cob, CT 06807 |

| Daniel Stencel |

|

Vice President and Treasurer |

|

c/o Pegasus Capital Advisors,

99 River Road, Cos Cob, CT 06807 |

|

| EXECUTIVE OFFICERS OF PP IV LED, LLC

|

| Name |

|

Position |

|

Address |

| Richard Davis |

|

President |

|

c/o Pegasus Capital Advisors,

99 River Road, Cos Cob, CT 06807 |

| Daniel Stencel |

|

Vice President and Treasurer |

|

c/o Pegasus Capital Advisors,

99 River Road, Cos Cob, CT 06807 |

|

| GENERAL PARTNER OF PEGASUS PARTNERS IV, L.P.

|

| Name |

|

Position |

|

Address |

| Pegasus Investors IV, L.P. |

|

General Partner |

|

c/o Pegasus Capital Advisors,

99 River Road, Cos Cob, CT 06807 |

|

| MANAGING MEMBER OF LSGC HOLDINGS LLC

|

| Name |

|

Position |

|

Address |

| Pegasus Partners IV, L.P. |

|

Managing Member |

|

c/o Pegasus Capital Advisors,

99 River Road, Cos Cob, CT 06807 |

| MANAGING MEMBER OF LSGC HOLDINGS II LLC

|

| Name |

|

Position |

|

Address |

| Pegasus Partners IV, L.P. |

|

Managing Member |

|

c/o Pegasus Capital Advisors,

99 River Road, Cos Cob, CT 06807 |

|

|

|

|

|

| GENERAL PARTNER OF PEGASUS INVESTORS IV, L.P.

|

| Name |

|

Position |

|

Address |

| Pegasus Investors IV GP, L.L.C. |

|

General Partner |

|

c/o Pegasus Capital Advisors,

99 River Road, Cos Cob, CT 06807 |

|

| MANAGING MEMBER AND EXECUTIVE OFFICERS OF PEGASUS INVESTORS IV GP, L.L.C.

|

| Name |

|

Position |

|

Address |

| Pegasus Capital, LLC |

|

Managing Member |

|

c/o Pegasus Capital Advisors,

99 River Road, Cos Cob, CT 06807 |

| Craig Cogut |

|

President and Chairman |

|

c/o Pegasus Capital Advisors,

99 River Road, Cos Cob, CT 06807 |

| Eric Gribetz |

|

Vice President |

|

c/o Pegasus Capital Advisors,

99 River Road, Cos Cob, CT 06807 |

| Alec Machiels |

|

Vice President |

|

c/o Pegasus Capital Advisors,

99 River Road, Cos Cob, CT 06807 |

| Richard Davis |

|

Chief Operating Officer |

|

c/o Pegasus Capital Advisors,

99 River Road, Cos Cob, CT 06807 |

| Andrew Cooper |

|

Vice President |

|

c/o Pegasus Capital Advisors,

99 River Road, Cos Cob, CT 06807 |

| Daniel Stencel |

|

Chief Financial Officer and Treasurer |

|

c/o Pegasus Capital Advisors,

99 River Road, Cos Cob, CT 06807 |

| Anne Frank-Shapiro |

|

Chief Compliance Officer and Chief Administrative Officer |

|

c/o Pegasus Capital Advisors,

99 River Road, Cos Cob, CT 06807 |

|

| MANAGING MEMBER AND EXECUTIVE OFFICER OF PEGASUS CAPITAL LLC

|

| Name |

|

Position |

|

Address |

| Craig Cogut |

|

President and Managing Member |

|

c/o Pegasus Capital Advisors,

99 River Road, Cos Cob, CT 06807 |

|

| MANAGING MEMBER AND EXECUTIVE OFFICERS OF PCA LSG Holdings, LLC

|

| Name |

|

Position |

|

Address |

| Pegasus Capital, LLC |

|

Managing Member |

|

c/o Pegasus Capital Advisors,

99 River Road, Cos Cob, CT 06807 |

| Craig Cogut |

|

President |

|

c/o Pegasus Capital Advisors,

99 River Road, Cos Cob, CT 06807 |

| Daniel Stencel |

|

Chief Financial Officer and Treasurer |

|

c/o Pegasus Capital Advisors,

99 River Road, Cos Cob, CT 06807 |

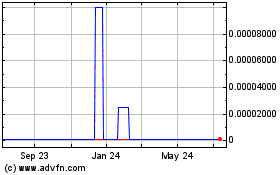

Lighting Science (CE) (USOTC:LSCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

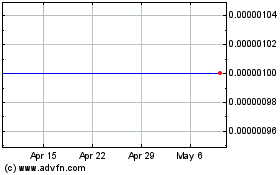

Lighting Science (CE) (USOTC:LSCG)

Historical Stock Chart

From Apr 2023 to Apr 2024