Inside This Year’s M&A Boom and the IQ Merger Arbitrage ETF (MNA)

November 25 2014 - 9:00AM

ETFDB

Since the start of 2014, Wall Street has witnessed one of the

most active mergers and acquisition booms in some time. With only a

little more than a month to go, so far this year’s global

merger tally already tops $3 trillion, with U.S. M&A activity

accounting for $1.5 trillion. According to Dealogic, the current

dollar volume of announced deals in the world is higher than in any

full year since 2007 [see also ETF Issuer Solutions Welcomes

Industry Newcomers].

In light of this M&A boom, we’ll take a look at the recent

mega-deals, as well highlight how one particular fund has

tried to capitalize on this boom.

The Highest M&A Activity Since 2007

Global M&A volume totals $3.23 trillion year-to-date, which

is 27% higher than 2013′s volume and the highest YTD volume since

2007, which logged in a volume of $4.08 trillion. Below is a graph

of yearly M&A volumes from Dealogic:

While the majority of the deal volume has targeted the

healthcare sector, there have also been some other mega-deals in

other industries. Some of the largest deals of 2014 include:

- Comcast (CMCSA) Acquires Time Warner Cable (TWC) for $69.8

billion

- Actavis (ACT) Acquires Allergan (AGN) for $66 billion

- AT&T (T) Acquires DirectTV (DTV) for $67.1

billion

- Medtronic (MDT) Acquires Covidien (COV) for $46.8

billion

- Halliburton (HAL) Acquires Baker Hughes (BHI) for $34.6

billion

- Actavis (ACT) Acquires Forest Laboratories (FRX) for $25.3

billion

- Facebook (FB) Acquires WhatsApp for $19.4 billion

It should be noted that not all of these deals have been

approved by regulatory authorities yet.

A Look at the IQ Merger Arbitrage ETF

At its core, Merger Arbitrage ETFs aim to profit from the spread that occurs when an

acquisition is announced and the final purchase price is set.

The IndexIQ Merger Arbitrage ETF (MNA) is one of only a

handful of ETFs that utilizes this popular strategy [see also A

Closer Look at Merger Arbitrage

ETPs].

MNA tracks the IQ Merger Arbitrage Index,

which seeks to achieve capital appreciation by

investing in global companies for which there has been a public

announcement of a takeover by an acquirer. This differentiated

approach is based on a passive strategy of owning certain announced

takeover targets with the goal of generating returns that are

representative of global merger arbitrage activity. The Index also

includes short exposure to global equities as a partial equity

market hedge.

Below, take a look at MNA’s performance year-to-date, relative

to the S&P 500 ETF (SPY):

During the first few months of the year,

where equities entered a steep correction, MNA managed to

outperform the broader market. Once bullish momentum returned, SPY

charged higher, while MNA continued its steady upward trend. MNA

has also managed to outperform its competitors in the merger

arbitrage ETF category.

The Bottom Line

M&A activity has certainly picked up

its pace this year, which for the most part is a positive sign for

the economy. The IndexIQ Merger

Arbitrage ETF (MNA) has also benefited from this uptick in

mega-deals, logging in steady returns throughout the

year.

Follow me on

Twitter @DPylypczak

Disclosure: No positions at time of

writing.

Click here to read the original article on ETFdb.com.

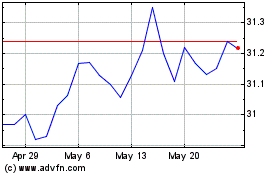

IQ Merger Arbitrage ETF (AMEX:MNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

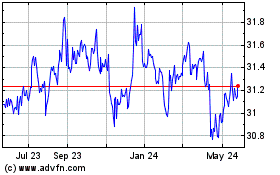

IQ Merger Arbitrage ETF (AMEX:MNA)

Historical Stock Chart

From Apr 2023 to Apr 2024