| Prospectus Supplement No. 4 |

|

Filed Pursuant to

Rule 424(b)(3) |

| Dated November 24, 2014 |

|

Registration No. 333-195783 |

| (to Prospectus dated June 20, 2014) |

|

|

Ekso

Bionics Holdings, INC.

67,134,768 Shares

Common Stock

This prospectus supplement no. 4 (the “Supplement”)

supplements information contained in the prospectus dated June 20, 2014, as supplemented by the prospectus supplement no. 1 dated

August 10, 2014, prospectus supplement no. 2 dated November 7, 2014, prospectus supplement no. 3 dated November 20, 2014 (together,

the “Prospectus”), relating to the resale by selling stockholders of Ekso Bionics Holdings, Inc., a Nevada corporation,

of up to 67,134,768 shares of our common stock, par value $0.001 per share. Of the shares being offered, 53,960,268

are presently issued and outstanding and 13,174,500 are issuable upon exercise of common stock purchase warrants. The shares offered

by the Prospectus may be sold by the selling stockholders from time to time in the open market, through privately negotiated transactions

or a combination of these methods, at market prices prevailing at the time of sale or at negotiated prices.

This Supplement is being filed to update

and supplement the information in the Prospectus with the information contained in our Current Report on Form 8-K filed with the

Securities and Exchange Committee on November 24, 2014 (the “Form 8-K”). Accordingly, we have attached the Form 8-K

to this Prospectus Supplement.

This Supplement

is incorporated by reference into, and should be read in conjunction with, the Prospectus. This Supplement is not complete without,

and may not be delivered or utilized except in connection with, the Prospectus, including any amendments or supplements thereto.

Any statement contained in the Prospectus shall be deemed to be modified or superseded to the extent that information in this Prospectus

Supplement modifies or supersedes such statement. Any statement that is modified or superseded shall not be deemed to constitute

a part of the Prospectus except as modified or superseded by this Prospectus Supplement.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this Supplement is truthful

or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus Supplement is

November 24, 2014

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported): November 20, 2014

Ekso Bionics Holdings, Inc.

(Exact

Name of Registrant as specified in its charter)

| Nevada |

333-181229 |

99-0367049 |

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

1414 Harbour Way South, Suite 1201

Richmond, California 94804

(Address of principal executive offices,

including zip code)

(203) 723-3576

(Registrant’s telephone number, including

area code)

Not Applicable

(Registrant’s name or former address,

if change since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| o | Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

| 1.01 | Entry Into a Material Definitive Agreement |

Offer to Amend and Exercise Certain Warrants to Purchase

Common Stock

On November 20, 2014, Ekso Bionics

Holdings, Inc. (the “Company”) consummated its offer to amend and exercise (the “Offer to Amend and Exercise”)

certain outstanding warrants to purchase an aggregate of 30,300,000 shares of the Company’s common stock originally issued

to investors participating in the Company’s private placement financing with respect to which closings occurred on January

15, 2014, January 29, 2014 and February 6, 2014 (the “Original Warrants”).

The Offer to Amend and Exercise expired at 9:00 p.m. Pacific

time (midnight Eastern time) on November 20, 2014 (the “Expiration Date”). Pursuant to the Offer to Amend and Exercise,

an aggregate of 22,755,500 Original Warrants were tendered by their holders and were amended and exercised in connection therewith

for gross proceeds to the Company of approximately $22.8 million. Such tendered Original Warrants represent approximately 75% of

the Company’s outstanding Original Warrants as of November 20, 2014.

The Original Warrants of holders who

elected to participate in the Offer to Amend and Exercise were amended to reduce the exercise price from $2.00 to $1.00 per share

of common stock, to restrict the ability of the holder of shares issuable upon exercise of the amended warrants to sell, make any

short sale of, loan, grant any option for the purchase of, or otherwise dispose of any of such shares without the prior written

consent of the Company for a period of 50 days after the Expiration Date (the “Lock-Up Period”), and to provide

that a holder, acting alone or with others, agrees not to effect any purchases or sales of any securities of the Company in any

“short sales” as defined in Rule 200 promulgated under Regulation SHO under the Securities Exchange Act of 1934, as

amended (the “Exchange Act”), or any type of direct and indirect stock pledges, forward sale contracts, options, puts,

calls, short sales, swaps, “put equivalent positions” (as defined in Rule 16a-1(h) under the Exchange Act) or similar

arrangements, or sales or other transactions through non-U.S. broker dealers or foreign regulated brokers through the expiration

of the Lock-Up Period.

Following the amendment and exercise of the 22,755,500 Original

Warrants pursuant to the terms of the Offer to Amend and Exercise, the Company had 101,501,056 shares of common stock issued and

outstanding, excluding outstanding options and warrants to purchase 10,829,484 and 13,795,863 shares of the Company’s common

stock, respectively.

The Company issued the Original Warrants in private placement

transactions in reliance on the exemption from registration provided by Rule 506 of Regulation D under the Securities Act of 1933,

as amended (the “Securities Act”). In connection with such transactions, the holders of the Original Warrants represented

that they were “accredited investors.” Similarly, the issuance of the shares of the Company’s common stock upon

the amendment and exercise of the 22,755,500 Original Warrants was exempt from registration under the Securities Act pursuant to

Rule 506 of Regulation D. In connection with the Offer to Amend and Exercise, all holders of tendered Original Warrants represented

that they were “accredited investors.”

Amendment of Certain Warrants to Purchase Common Stock

Effective on or prior to November 20, 2014, Company and

the holders of at least a majority of each of the following classes of warrants have approved an amendment to remove the

price-based anti-dilution provisions in their respective classes of warrants: (a) the Original Warrants; (b) outstanding

warrants to purchase 2,600,000 shares of the Company’s common stock at an exercise price of $1.00 per share, issued on

January 15, 2014 to investors participating in the Ekso Bionics, Inc. bridge financing completed in November 2013 and to

a prior lender of Ekso Bionics, Inc. (the “Bridge Warrants”) and (c) outstanding warrants to purchase

3,030,000 shares of the Company’s common stock at an exercise price of $1.00 per share, issued to the placement

agent and its sub-agents in the Company’s private placement financing with respect to which closings occurred on

January 15, 2014, January 29, 2014 and February 6, 2014 and the Ekso Bionics, Inc. bridge financing completed in November

2013 (the “Agent Warrants”, and together with the Original Warrants and the Bridge Warrants, the “2014

Warrants”). As a result, all priced-based anti-dilution provisions contained in the 2014 Warrants have been removed and

are of no further force or effect as of November 20, 2014.

Item 3.02 Unregistered Sale of Equity Securities

The information contained in Item 1.01 of this Current Report

on Form 8-K is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure

On November 24, 2014, the Company issued

a press release with respect to the Offer to Amend and Exercise. The press release is attached to this Current Report on Form 8-K

as Exhibit 99.1 and is incorporated herein by reference.

The information contained in this Item

7.01 of this Current Report on Form 8-K, including the information contained in Exhibit 99.1, is being furnished and shall not

be deemed “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended, or incorporated

by reference into any filing of the Company, whether made before or after the date hereof, regardless of any general incorporation

language in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| |

|

|

| 99.1 |

|

Press Release dated November 24, 2014 |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the

undersigned thereunto duly authorized.

| |

EKSO BIONICS HOLDINGS, INC. |

| |

|

| |

|

|

| |

By: |

/s/ Nathan Harding |

| |

Name: |

Nathan Harding |

| |

Title: |

Chief Executive Officer |

Dated: November 24, 2014

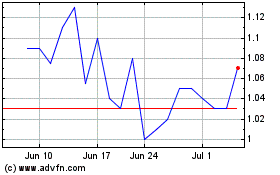

Ekso Bionics (NASDAQ:EKSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ekso Bionics (NASDAQ:EKSO)

Historical Stock Chart

From Apr 2023 to Apr 2024