UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported): November 20, 2014

Ekso Bionics Holdings, Inc.

(Exact

Name of Registrant as specified in its charter)

| Nevada |

333-181229 |

99-0367049 |

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

1414 Harbour Way South, Suite 1201

Richmond, California 94804

(Address of principal executive offices,

including zip code)

(203) 723-3576

(Registrant’s telephone number, including

area code)

Not Applicable

(Registrant’s name or former address,

if change since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| o | Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

| 1.01 | Entry Into a Material Definitive Agreement |

Offer to Amend and Exercise Certain Warrants to Purchase

Common Stock

On November 20, 2014, Ekso Bionics

Holdings, Inc. (the “Company”) consummated its offer to amend and exercise (the “Offer to Amend and Exercise”)

certain outstanding warrants to purchase an aggregate of 30,300,000 shares of the Company’s common stock originally issued

to investors participating in the Company’s private placement financing with respect to which closings occurred on January

15, 2014, January 29, 2014 and February 6, 2014 (the “Original Warrants”).

The Offer to Amend and Exercise expired at 9:00 p.m. Pacific

time (midnight Eastern time) on November 20, 2014 (the “Expiration Date”). Pursuant to the Offer to Amend and Exercise,

an aggregate of 22,755,500 Original Warrants were tendered by their holders and were amended and exercised in connection therewith

for gross proceeds to the Company of approximately $22.8 million. Such tendered Original Warrants represent approximately 75% of

the Company’s outstanding Original Warrants as of November 20, 2014.

The Original Warrants of holders who

elected to participate in the Offer to Amend and Exercise were amended to reduce the exercise price from $2.00 to $1.00 per share

of common stock, to restrict the ability of the holder of shares issuable upon exercise of the amended warrants to sell, make any

short sale of, loan, grant any option for the purchase of, or otherwise dispose of any of such shares without the prior written

consent of the Company for a period of 50 days after the Expiration Date (the “Lock-Up Period”), and to provide

that a holder, acting alone or with others, agrees not to effect any purchases or sales of any securities of the Company in any

“short sales” as defined in Rule 200 promulgated under Regulation SHO under the Securities Exchange Act of 1934, as

amended (the “Exchange Act”), or any type of direct and indirect stock pledges, forward sale contracts, options, puts,

calls, short sales, swaps, “put equivalent positions” (as defined in Rule 16a-1(h) under the Exchange Act) or similar

arrangements, or sales or other transactions through non-U.S. broker dealers or foreign regulated brokers through the expiration

of the Lock-Up Period.

Following the amendment and exercise of the 22,755,500 Original

Warrants pursuant to the terms of the Offer to Amend and Exercise, the Company had 101,501,056 shares of common stock issued and

outstanding, excluding outstanding options and warrants to purchase 10,829,484 and 13,795,863 shares of the Company’s common

stock, respectively.

The Company issued the Original Warrants in private placement

transactions in reliance on the exemption from registration provided by Rule 506 of Regulation D under the Securities Act of 1933,

as amended (the “Securities Act”). In connection with such transactions, the holders of the Original Warrants represented

that they were “accredited investors.” Similarly, the issuance of the shares of the Company’s common stock upon

the amendment and exercise of the 22,755,500 Original Warrants was exempt from registration under the Securities Act pursuant to

Rule 506 of Regulation D. In connection with the Offer to Amend and Exercise, all holders of tendered Original Warrants represented

that they were “accredited investors.”

Amendment of Certain Warrants to Purchase Common Stock

Effective on or prior to November 20, 2014, Company and

the holders of at least a majority of each of the following classes of warrants have approved an amendment to remove the

price-based anti-dilution provisions in their respective classes of warrants: (a) the Original Warrants; (b) outstanding

warrants to purchase 2,600,000 shares of the Company’s common stock at an exercise price of $1.00 per share, issued on

January 15, 2014 to investors participating in the Ekso Bionics, Inc. bridge financing completed in November 2013 and to

a prior lender of Ekso Bionics, Inc. (the “Bridge Warrants”) and (c) outstanding warrants to purchase

3,030,000 shares of the Company’s common stock at an exercise price of $1.00 per share, issued to the placement

agent and its sub-agents in the Company’s private placement financing with respect to which closings occurred on

January 15, 2014, January 29, 2014 and February 6, 2014 and the Ekso Bionics, Inc. bridge financing completed in November

2013 (the “Agent Warrants”, and together with the Original Warrants and the Bridge Warrants, the “2014

Warrants”). As a result, all priced-based anti-dilution provisions contained in the 2014 Warrants have been removed and

are of no further force or effect as of November 20, 2014.

Item 3.02 Unregistered Sale of Equity Securities

The information contained in Item 1.01 of this Current Report

on Form 8-K is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure

On November 24, 2014, the Company issued

a press release with respect to the Offer to Amend and Exercise. The press release is attached to this Current Report on Form 8-K

as Exhibit 99.1 and is incorporated herein by reference.

The information contained in this Item

7.01 of this Current Report on Form 8-K, including the information contained in Exhibit 99.1, is being furnished and shall not

be deemed “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended, or incorporated

by reference into any filing of the Company, whether made before or after the date hereof, regardless of any general incorporation

language in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| |

|

|

| 99.1 |

|

Press Release dated November 24, 2014 |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the

undersigned thereunto duly authorized.

| |

EKSO BIONICS HOLDINGS, INC. |

| |

|

| |

|

|

| |

By: |

/s/ Nathan Harding |

| |

Name: |

Nathan Harding |

| |

Title: |

Chief Executive Officer |

Dated: November 24, 2014

Exhibit 99.1

FOR IMMEDIATE RELEASE

Ekso Bionics Completes Offer to Amend and Exercise its Warrants

Brings Total Raised in 2014 to over $53 million.

RICHMOND, Calif., November 24, 2014 – Ekso Bionics Holdings,

Inc. (OTCQB: EKSO), a robotic exoskeleton company, today announced that warrant holders have elected to exercise 22.8 million of

their $2.00 warrants at a reduced exercise price of $1.00 per share, providing $22.8 million in gross proceeds to Ekso Bionics.

Additionally, Ekso Bionics has received approval of a majority of the Company’s warrant holders to remove the price-based

anti-dilution provisions from the outstanding warrants, simplifying the Company’s path to a future up-listing onto a primary

exchange.

"I am excited about the exceptional support that our stakeholders

continue to show. Our Ekso GT™ robotic exoskeleton is well received by our customers – to date, almost 15 million steps

have been taken in leading clinics around the world. There is active interest in our able-bodied applications, demonstrated by

the recent agreement with Google’s Boston Dynamics. Now, a big thanks to our shareholders for providing the means for us

to continue investing in our growth plans" stated Nathan Harding, chief executive officer and co-founder. "2015

looks to be an exciting year for us as we work towards making exoskeletons the standard of care in rehabilitation and introducing

our next generation of exoskeleton products for new applications.”

The Company intends to use the proceeds to expand its sales

and marketing efforts, to build on initial positive clinical evidence, to bolster the healthcare economics case for exoskeleton

rehabilitation and to support their reimbursement strategy for an expansion into the personal mobility markets. In conjunction

with these efforts, Ekso Bionics intends to pursue the commercialization of able-bodied exoskeletons, including leveraging its

extensive exoskeleton IP portfolio to secure commercial partnership(s).

Katalyst Securities and EDI Financial acted as the co-exclusive

warrant agents for this successful warrant solicitation.

About Ekso Bionics

Since 2005, Ekso Bionics has been pioneering the field of robotic

exoskeletons, or wearable robots, to augment human strength, endurance and mobility. The company’s first commercially available

product, called the Ekso device, has helped thousands of people with paralysis take millions of steps not otherwise possible. By

designing and creating some of the most forward-thinking and innovative solutions for people looking to augment human capabilities,

Ekso Bionics is helping people rethink current physical limitations and achieve the remarkable.

Ekso Bionics is headquartered in Richmond, CA and is listed

on the OTC QB under the symbol EKSO. To learn more about Ekso Bionics please visit us at www.eksobionics.com

Facebook: www.facebook.com/eksobionics

Twitter: @eksobionics

YouTube: http://www.youtube.com/user/EksoBionics/

Forward-Looking Statements

Any statements contained in this press release that do not describe

historical facts may constitute forward-looking statements. Forward-looking statements may include, without limitation, statements

regarding (i) the plans and objectives of management for future operations, including plans or objectives relating to the design,

development and commercialization of human exoskeletons, (ii) a projection of financial results, financial condition, capital expenditures,

capital structure or other financial items, (iii) the Company's future financial performance and (iv) the assumptions underlying

or relating to any statement described in points (i), (ii) or (iii) above. Such forward-looking statements are not meant

to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon

the Company's current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number

of risks and uncertainties and other influences, many of which the Company has no control over. Actual results and the timing

of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of

these risks and uncertainties. Factors that may influence or contribute to the inaccuracy of the forward-looking statements

or cause actual results to differ materially from expected or desired results may include, without limitation, the Company's inability

to obtain adequate financing to fund the Company's operations and necessary to develop or enhance our technology, the significant

length of time and resources associated with the development of the Company's products, the Company's failure to achieve broad

market acceptance of the Company's products, the failure of our sales and marketing organization or partners to market our products

effectively, adverse results in future clinical studies of the Company's medical device products, the failure to obtain or maintain

patent protection for the Company's technology, failure to obtain or maintain regulatory approval to market the Company's medical

devices, lack of product diversification, existing or increased competition, and the Company's failure to implement the Company's

business plans or strategies. These and other factors are identified and described in more detail in the Company's filings with

the SEC. To learn more about

Ekso Bionics please visit us at www.eksobionics.com

###

Media Contact:

Heidi Darling, Director of Marketing Communications

Phone: 415.302.4777

hdarling@eksobionics.com

Investor Contact:

Lauren Glaser, Vice President

Phone: 646.378.2972

lglaser@troutgroup.com

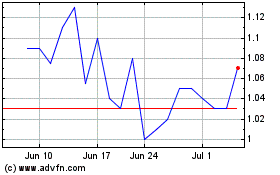

Ekso Bionics (NASDAQ:EKSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ekso Bionics (NASDAQ:EKSO)

Historical Stock Chart

From Apr 2023 to Apr 2024