UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November 24, 2014

(Exact name of Registrant as Specified in its Charter)

|

Delaware

|

1-34220

|

95-4431352

|

|

(State or other jurisdiction

|

(Commission File

|

(IRS Employer

|

|

of Incorporation)

|

Number)

|

Identification No.)

|

333 Three D Systems Circle

Rock Hill, South Carolina, 29730 |

| (Address of principal executive offices) |

Registrant’s telephone number, including area code: (803) 326-3900

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01. Regulation FD Disclosure.

On November 24, 2014, the registrant announced that 3D Systems, Inc., a California corporation and wholly owned subsidiary of the registrant, had entered into a definitive agreement and plan of merger to acquire all of the outstanding ordinary shares of Cimatron Ltd. ("Cimatron") for $8.97 per share in cash, subject to reduction by a pro-rata (per share) portion of the amount, if any, by which Cimatron's transaction expenses relating to the transaction exceed $2 million. Cimatron is a provider of integrated 3D CAD/CAM software products and solutions for manufacturing. The transaction is subject to customary closing conditions, including requisite regulatory approvals and the approval of Cimatron's shareholders.

A copy of the press release is furnished as Exhibit 99.1 to this report and is incorporated by reference herein. The information in this Item (and in such press release) shall not be deemed "filed" with the Securities and Exchange Commission for purposes of the Securities Exchange Act of 1934, as amended, nor incorporated by reference in any registration statement filed by the registrant under the Securities Act of 1933, as amended.

Item 8.01. Other Events.

On November 24, 2014, the registrant announced that 3D Systems, Inc., a California corporation and wholly owned subsidiary of the registrant, had entered into a definitive agreement and plan of merger to acquire all of the outstanding ordinary shares of Cimatron Ltd. ("Cimatron") for $8.97 per share in cash, subject to reduction by a pro-rata (per share) portion of the amount, if any, by which Cimatron's transaction expenses relating to the transaction exceed $2 million. Cimatron is a provider of integrated 3D CAD/CAM software products and solutions for manufacturing. The transaction is subject to customary closing conditions, including requisite regulatory approvals and the approval of Cimatron's shareholders.

Forward-Looking Statements

Certain statements made in this filing that are not statements of historical or current facts, including statements regarding the expected timetable for completing the proposed transaction, benefits and synergies of the proposed transaction, future opportunities for the combined company and products, future financial performance and any other statements regarding the registrant's future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts, are forward-looking statements within the meaning of the federal securities laws. Forward-looking statements often use words such as "anticipate", "target", "expect", "estimate", "intend", "plan", "goal", "believe", "hope", "aim", "continue", "will", "may", "would", "could" or "should" or other words of similar meaning or the negative thereof. These statements are subject to numerous risks and uncertainties, many of which are beyond the companies' control, which could cause actual results to differ materially from the results expressed or implied by the statements. These risks and uncertainties include, but are not limited to: failure to obtain the required votes of Cimatron's shareholders; the timing to consummate the proposed transaction; satisfaction of the conditions to closing of the proposed transaction may not be satisfied or that the closing of the proposed transaction otherwise does not occur; the risk that a regulatory approval that may be required for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated; the diversion of management time on transaction-related issues; the ultimate timing, outcome and results of integrating the operations of Cimatron; the effects of the business combination of the registrant and Cimatron, including the combined company's future financial condition, results of operations, strategy and plans; expected synergies and other benefits from the proposed transaction and the ability of the registrant to realize such synergies and other benefits; expectations regarding regulatory approval of the transaction; results of litigation, settlements, and investigations; the availability and alternative uses of the registrant's cash; actions by third parties, including governmental agencies; protection of intellectual property rights and against cyber attacks; compliance with environmental laws; changes in government regulations and regulatory requirements; risks of international operations, including risks relating to unsettled political conditions, war, the effects of terrorism, and foreign exchange rates and controls, international trade and regulatory controls. The factors described under the headings "Forward-Looking Statements," "Cautionary Statements and Risk Factors," and "Risk Factors" in the registrant's report on Form 10-K for the year ended December 31, 2013 and other U.S. Securities and Exchange Commission (the "SEC") filings of the registrant discuss some of the important risk factors identified that may affect these factors and the registrant's business, results of operations and financial condition. The registrant undertakes no obligation to revise or update publicly any forward-looking statements for any reason. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

Item 9.01. Financial Statements and Exhibits.

|

(d) Exhibits.

|

|

|

|

99.1

|

Press Release dated November 24, 2014 regarding acquisition of Cimatron Ltd.

|

|

|

The information contained in the press release attached as Exhibit 99.1 to this report shall not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. Furthermore, the information contained in the press release attached as Exhibit 99.1 to this report shall not be deemed to be incorporated by reference in the filings of the registrant under the Securities Act of 1933, as amended.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

3D SYSTEMS CORPORATION |

|

Date: November 24, 2014

|

|

|

| |

By: |

/s/ ANDREW M. JOHNSON |

| |

Name: |

Andrew M. Johnson

|

| |

Title: |

Executive Vice President, Chief Legal Officer and Secretary

|

| |

|

|

|

Exhibit No.

|

|

Exhibit Description

|

|

|

|

|

|

99.1

|

|

Press Release dated November 24, 2014 regarding acquisition of Cimatron Ltd.

|

|

|

|

|

EXHIBIT 99.1

3D Systems and Cimatron Enter Definitive Agreement for 3D Systems to Acquire Cimatron

Combination Strengthens Design and Manufacturing Technology and Product Portfolio, Extends Direct Sales and Channel Reach, Creates Value and Completes the Digital Thread for Enhanced Customer Experience

ROCK HILL, S.C. and GIVAT SHMUEL, Israel, Nov. 24, 2014 (GLOBE NEWSWIRE) -- 3D Systems Corporation (NYSE:DDD) and Cimatron Ltd. (Nasdaq:CIMT) today announced a definitive agreement under which 3DS will acquire all of the outstanding shares of Cimatron for $8.97 per share in cash, subject to certain adjustments for Cimatron transaction expenses, for a total of approximately $97 million, inclusive of its net cash.

The combination of Cimatron's products with 3DS' portfolio, strengthens 3DS' position in the fast-growing 3D design and manufacturing space. The transaction adds complementary products and technology and extends 3DS' direct and reseller sales coverage globally. 3DS management expects the acquisition of Cimatron to be immediately accretive to its cash generation and to its Non-GAAP earnings per share upon closing.

"We believe that the perfect strategic fit between our businesses, combined with expanded capabilities in product development, channel coverage and marketing, could present sizeable synergies that together offer significant long-term customer benefits and shareholder value," commented Avi Reichental, President and CEO of 3DS.

Cimatron is a leading provider of integrated 3D CAD/CAM software products and solutions for manufacturing. Cimatron's products are used by a growing number of companies worldwide for their 3D production molds, tools and dies in a wide variety of functional end-use manufacturing applications. With two major product lines, CimatronE and GibbsCAM®, Cimatron caters to all manufacturing sectors. CimatronE is an integrated CAD/CAM solution for toolmakers and manufacturers of discrete parts, which provides full associativity across the manufacturing process from quoting, through design and up to delivery. GibbsCAM, the CAM industry's recognized ease-of-use leader, offers simple to use, yet extremely powerful, solutions for programming multi-axis CNC machine tools.

"We are delighted to combine our leading 3D CAD/CAM software products with 3DS' expanding design and manufacturing digital thread," said Danny Haran, CEO of Cimatron. "We have always been focused on providing comprehensive, cost-effective solutions that streamline manufacturing cycles and shorten product delivery time, and as part of 3DS we can substantially accelerate our progress and extend our reach and impact."

"Our entire Board of Directors is proud of Cimatron and its management's long term success in building a great company with leading products that create sustained customer and shareholder value, and are grateful to have been part of guiding this journey," added Yossi Ben Shalom, Chairman of the Board of Cimatron.

The transaction is subject to customary closing conditions, including requisite regulatory approvals and the approval of Cimatron's shareholders. The Boards of Directors of both companies have unanimously approved the proposed transaction. The companies expect the transaction to close in the first quarter of 2015.

Advisors

Needham & Company is serving as financial advisor to 3DS. Hunton & Williams LLP and Gornitzky & Co. are serving as 3DS' legal counsel.

Prometheus Financial Advisory is serving as financial advisor to Cimatron. Meitar Liquornik Geva Leshem Tal is serving as Cimatron's legal counsel.

Forward-Looking Statements

Certain statements made in this press release that are not statements of historical or current facts, including statements regarding the expected timetable for completing the proposed transaction, benefits and synergies of the proposed transaction, future opportunities for the combined company and products, future financial performance and any other statements regarding 3DS' and Cimatron's future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts, are forward-looking statements within the meaning of the federal securities laws. Forward-looking statements often use words such as "anticipate", "target", "expect", "estimate", "intend", "plan", "goal", "believe", "hope", "aim", "continue", "will", "may", "would", "could" or "should" or other words of similar meaning or the negative thereof. These statements are subject to numerous risks and uncertainties, many of which are beyond the companies' control, which could cause actual results to differ materially from the results expressed or implied by the statements. These risks and uncertainties include, but are not limited to: failure to obtain the required votes of Cimatron's shareholders; the timing to consummate the proposed transaction; satisfaction of the conditions to closing of the proposed transaction may not be satisfied or that the closing of the proposed transaction otherwise does not occur; the risk that a regulatory approval that may be required for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated; the diversion of management time on transaction-related issues; the ultimate timing, outcome and results of integrating the operations of Cimatron; the effects of the business combination of 3DS and Cimatron, including the combined company's future financial condition, results of operations, strategy and plans; expected synergies and other benefits from the proposed transaction and the ability of 3DS to realize such synergies and other benefits; expectations regarding regulatory approval of the transaction; results of litigation, settlements, and investigations; the availability and alternative uses of 3DS' cash; actions by third parties, including governmental agencies; protection of intellectual property rights and against cyber attacks; compliance with environmental laws; changes in government regulations and regulatory requirements; risks of international operations, including risks relating to unsettled political conditions, war, the effects of terrorism, and foreign exchange rates and controls, international trade and regulatory controls. The factors described under the headings "Forward-Looking Statements," "Cautionary Statements and Risk Factors," and "Risk Factors" in 3DS' report on Form 10-K for the year ended December 31, 2013 and Cimatron's report on Form 20-F for the year ended December 31, 2013, and other U.S. Securities and Exchange Commission (the "SEC") filings of 3DS and Cimatron discuss some of the important risk factors identified that may affect these factors and 3DS' and Cimatron's respective business, results of operations and financial condition. 3DS and Cimatron undertake no obligation to revise or update publicly any forward-looking statements for any reason. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

About 3D Systems

3DS is pioneering 3D printing for everyone. 3DS provides the most advanced and comprehensive 3D design-to-manufacturing solutions including 3D printers, print materials and cloud sourced custom parts. Its powerful digital thread empowers professionals and consumers everywhere to bring their ideas to life in material choices including plastics, metals, ceramics and edibles. 3DS' leading healthcare solutions include end-to-end simulation, training and integrated 3D planning and printing for personalized surgery and patient specific medical and dental devices. Its democratized 3D design and inspection products embody the latest perceptual, capture and touch technology. Its products and services replace and complement traditional methods with improved results and reduced time to outcomes. These solutions are used to rapidly design, create, communicate, plan, guide, prototype or produce functional parts, devices and assemblies, empowering customers to manufacture the future.

Leadership Through Innovation and Technology

-

3DS invented 3D printing with its Stereolithography (SLA) printer and was the first to commercialize it in 1989.

-

3DS invented Selective Laser Sintering (SLS) printing and was the first to commercialize it in 1992.

-

3DS invented the ColorJet Printing (CJP) class of 3D printers and was the first to commercialize 3D powder-based systems in 1994.

-

3DS invented MultiJet Printing (MJP) printers and was the first to commercialize it in 1996.

-

3DS Medical Modeling pioneered virtual surgical planning (VSP) and its services are world-leading, helping many thousands of patients on an annual basis.

Today its comprehensive range of 3D printers is the industry's benchmark for production-grade manufacturing in aerospace, automotive, patient specific medical device and a variety of consumer, electronic and fashion accessories.

More information on 3DS is available at www.3dsystems.com.

About Cimatron

Cimatron is a leading provider of 3D CAD/CAM software for the manufacturing industry. With two major product lines, GibbsCAM and CimatronE, Cimatron caters to all manufacturing sectors, offering specialized solutions for mold and die makers, as well as solutions for multi-Axis production milling and turning.

Ranked among the top CAD/CAM suppliers in every global region, Cimatron has subsidiaries in Asia, North America and Europe, and works with certified independent service providers in over 40 countries worldwide. Cimatron service providers offer responsive and effective sales and technical support, helping businesses use Cimatron software to maximize their potential.

Cimatron's full range of products and solutions use the most advanced technology available to speed up productivity and shorten delivery times. Designed and developed by manufacturers and toolmakers with a wealth of experience on the shop floor, both of Cimatron's product lines are easy to learn and intuitive for the manufacturing professionals who use them.

More information is available at www.cimatron.com.

Additional Information

In connection with the proposed transaction, Cimatron intends to mail a proxy statement to its shareholders and furnish a copy of the proxy statement with the SEC on Form 6-K. Shareholders of Cimatron are urged to read the proxy statement and the other relevant material when they become available because they will contain important information about Cimatron, 3DS, the proposed transaction and related matters. Shareholders are urged to read carefully the proxy statement and other relevant materials when they become available before making any voting or investment decision with respect to the proposed transaction. The proxy statement (when available) may be obtained for free at the SEC website at www.sec.gov.

This press release is neither a solicitation of proxy, an offer to purchase nor a solicitation of an offer to sell shares of Cimatron. Cimatron, its executive officers and directors may be deemed to be participants in the solicitation of proxies from shareholders of Cimatron in connection with the proposed transaction. Information about those executive officers and directors of Cimatron and their ownership of Cimatron shares is set forth in Cimatron's proxy statement for its special meeting of shareholders scheduled for 6-Jan-2015, which will be furnished to the SEC on Form 6-K. Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed transaction will be included in the proxy statement that Cimatron intends to furnish to the SEC on Form 6-K.

CONTACT: Investor Contact:

Stacey Witten

Email: Stacey.Witten@3dsystems.com

Media Contact:

Alyssa Hoyt

Email: Press@3dsystems.com

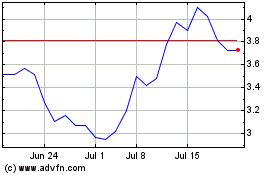

3D Systems (NYSE:DDD)

Historical Stock Chart

From Mar 2024 to Apr 2024

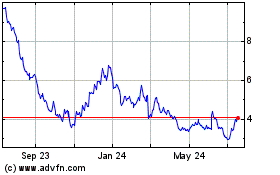

3D Systems (NYSE:DDD)

Historical Stock Chart

From Apr 2023 to Apr 2024