Mentor Capital Issues Q3 Financials with $1.5 M Revenue YTD

November 21 2014 - 11:31AM

Business Wire

$0.6 Million Cash, $5.5 Million in Assets with Non-Affiliate

Debt at $0.2 Million Reported at Q3 along with 2013 and 2012

Audits

Mentor Capital, Inc. (OTC Markets: MNTR) announced its third

quarter consolidated financial results in conjunction with its Form

10 filing which included 2013 and 2012 audited financial reports.

The complete financial filing can be viewed at the company’s web

site, at www.sec.gov and at the company’s Filings and Disclosure

page at the OTCMarkets.com website under the Mentor Capital ticker

(MNTR).

On an unaudited basis the company, as of September 30, 2014,

reports that it holds $553,467 in cash, which is an increase from

$40,184 held on December 31, 2013. As of September 30, 2014, the

company had $2,664,141 in current assets which is an increase from

$403,912 at 2013 year end. Consolidated total assets were

$5,538,768 on September 30, 2014 which is an increase from

$1,690,155 on December 31, 2013. Non-affiliate liabilities total

$151,980 on September 30, 2013 compared to $27,366 on December 31,

2013. Common equity is $3,997,543 on September 30, 2014 which is an

increase from the deficit of ($293,869) at December 31, 2013. The

2014 first nine month revenues were $1,546,128 compared to $24,000

for the first nine months of 2013. The company had a gross profit

of $483,773 at Sept 30, 2014 YTD which compares to a gross profit

of $24,000 at September 30, 2013 YTD. The net loss for the first

nine months of 2014 was ($11,268) which is an improvement from the

net loss of ($181,183) for the first nine months of 2013.

12,539,342 average diluted common shares were outstanding during

the first nine months of 2014 vs. 6,650,227 during the same period

of 2013.

Mentor Capital focuses new investments into the cannabis and

medical marijuana space. Reported financial results are

consolidated from several portfolio entities. Nevada Cannabis

Ventures, Inc. is funding the formation of the management company

for a hedge fund headquartered and somewhat focused in Nevada.

MicroCannabiz provides a definitive directory of 4,500 cannabis

entities, and other information related cannabis services. $1.5

Million was also paid through Bhang Corporation to Bhang owners,

who have kept the $1.5 Million. They have refused to issue any

Bhang shares to Mentor Capital, publicly repudiating the contract

they signed a few months earlier. Mentor Capital is pursuing

through the courts the return of the $1.5 Million which will be

redeployed into the cannabis space. Mentor Capital focuses on

investments in private medical marijuana companies but holds some

few public cannabis shares in its stock portfolio. GW

Pharmaceuticals is our largest holding there. Mentor Capital has

transitioned out of all of its public cancer stocks and has only

minority positions in Brighter Day Health and Shaw Capital (medical

devices) as residual private cancer investments pending socially

responsible exit opportunities. WCI is a final remaining

significant non-cannabis legacy investment.

About Mentor Capital: By acquisition or stock purchase,

Mentor Capital, Inc. seeks to invest in leading cannabis companies.

Additional important information for investors and founders seeking

expansion funding is presented at: www.MentorCapital.com

This press release is neither an offer to sell, nor a

solicitation of offers to purchase, securities.

Forward Looking Statements: This press release contains

forward-looking statements within the meaning of the federal

securities laws, including statements concerning financial

projections, financing activities, corporate combinations, product

development activities and sales and licensing activities. Such

forward-looking statements are not guarantees of future results or

performance, are sometimes identified by words of condition such as

“should,” “could,” “expects,” “may,” or “intends,” and are subject

to a number of risks and uncertainties, known and unknown, that

could cause actual results to differ materially from those intended

or anticipated. Such risks include, without limitation:

nonperformance of investments, partner and portfolio difficulties,

potential delays in marketing and sales activities, problems

securing the necessary financing to continue operations, problems

encountered in commercializing cannabis products, potential of

competitive products, services, and technologies, difficulties

experienced in product development, difficulties in recruiting

knowledgeable personnel and potential problems in protecting

intellectual property. Further information concerning these and

other risks is included in the Company’s Form 10 filing which,

along with other very important information about the Company, can

be found here: http://MentorCapital.com/disclosures/

The Company undertakes no obligation to update or revise such

forward-looking statements to reflect events or circumstances

occurring after the date of this press release.

Mentor Capital, Inc.Chet Billingsley, CEO(760) 788-4700

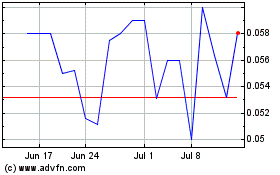

Mentor Capital (QB) (USOTC:MNTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

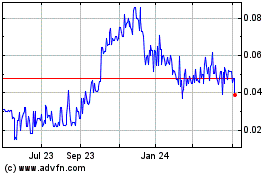

Mentor Capital (QB) (USOTC:MNTR)

Historical Stock Chart

From Apr 2023 to Apr 2024