Filed Pursuant to Rule 424(b)(3)

Registration No. 333-199517

PROSPECTUS

GALENA BIOPHARMA, INC.

1,381,215 Shares of Common Stock

Offered by the Selling Stockholder

This prospectus relates to shares of our common stock issuable by us in partial payment of the first milestone payment under the license and supply agreement dated as of July 17, 2014 between us and MonoSol Rx, LLC, which we refer to herein as “MonoSol” or the “selling stockholder.” See “Selling Stockholder” on page 33 of this prospectus for more information about the selling stockholder.

We are not selling any shares of common stock under this prospectus, and will not receive any proceeds from the sale of the shares offered by the selling stockholder. We will pay all fees and expenses incurred in connection with the registration of the shares of common stock offered by this prospectus, including any brokerage or underwriting commissions or discounts incurred by the selling stockholder relating to the sale of the shares.

The selling stockholder or its donees, pledgees or other transferees may sell or otherwise transfer the shares of common stock offered by this prospectus from time to time in the public market or in privately negotiated transactions, either directly or through broker-dealers or underwriters, at fixed prices, at prevailing market prices at the time of sale, at prices relating to the prevailing market prices, at varying prices determined at the time of sale or at negotiated prices. See “Plan of Distribution” beginning on page 34 of this prospectus for more information about how the selling stockholder may sell or otherwise transfer the shares of common stock being offered by this prospectus.

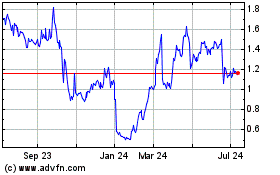

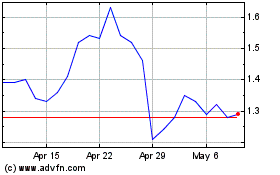

Our common stock is traded on The NASDAQ Capital Market under the symbol “GALE.” On November 19, 2014, the closing price of our common stock on The NASDAQ Capital Market was $1.81 per share.

Investing in our securities involves risks. See “Risk Factors” beginning on page 8 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is November 20, 2014

TABLE OF CONTENTS

|

| |

| |

| |

ABOUT THIS PROSPECTUS | i |

| |

PROSPECTUS SUMMARY | |

| |

NOTE REGARDING FORWARD-LOOKING STATEMENTS | |

| |

RISK FACTORS | |

| |

USE OF PROCEEDS | |

| |

SELLING STOCKHOLDER | |

| |

PLAN OF DISTRIBUTION | |

| |

DESCRIPTION OF COMMON STOCK | |

| |

LEGAL MATTERS | |

| |

EXPERTS | |

| |

WHERE YOU CAN FIND MORE INFORMATION | |

| |

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE | |

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed on behalf of the selling stockholder with the Securities and Exchange Commission, or the SEC, to permit the selling stockholder to sell the shares described in this prospectus in one or more transactions. The selling stockholder and the plan of distribution of the shares being offered by them are described in this prospectus under the headings “Selling Stockholder” and “Plan of Distribution,” respectively.

As permitted by the rules and regulations of the SEC, the registration statement filed by us includes additional information not contained in this prospectus. You may read the registration statement and the other reports we file with the SEC at the SEC’s web site or its offices described below under the heading “Where You Can Find More Information.”

Unless the context otherwise requires, references in this prospectus to “the company,” “we,” “us” and “our” refer to Galena Biopharma, Inc. and our subsidiaries, Apthera, Inc. and Mills Pharmaceuticals, LLC.

You should rely only on the information that is contained in this prospectus or that is incorporated by reference into this prospectus. We and the selling stockholder have not authorized anyone to provide you with information that is in addition to or different from that contained in, or incorporated by reference into, this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it.

The shares of common stock offered by this prospectus are not being offered in any jurisdiction where the offer or sale of such common stock is not permitted. You should not assume that the information contained in, or incorporated by reference into, this prospectus is accurate as of any date other than the date of this prospectus or, in the case of the documents incorporated by reference, the date of such documents, regardless of the date of delivery of this prospectus or any sale of the common stock offered by this prospectus. Our business, financial condition, liquidity, results of operations and prospects may have changed since those dates.

PROSPECTUS SUMMARY

This summary highlights selected information appearing elsewhere in this prospectus or incorporated by reference in this prospectus and does not contain all of the information that may be important to you or that you should consider before investing in our common stock. This prospectus includes or incorporates by reference information about the common stock being offered by the selling stockholder, as well as information regarding our business and industry and detailed financial data. Before making an investment decision, you should read this prospectus and the information incorporated by reference herein in their entirety, including “Risk Factors” beginning on page 8 of this prospectus.

About Galena

Galena Biopharma, Inc. (“we,” “us,” “our,” “Galena” or the “company”) is a biopharmaceutical company focused on developing and commercializing innovative, targeted treatments that address major unmet medical needs to advance cancer care.

Our strategy is to build value for patients and shareholders by:

| |

• | Completing the pivotal Phase 3 randomized, multicenter PRESENT (Prevention of Recurrence in Early-Stage, Node-Positive Breast Cancer with Low-to-Intermediate HER2 Expression with NeuVax Treatment) study of our lead product candidate, NeuVax™ (nelipepimut-S) in 700 patients under a U.S. Food and Drug Administration (FDA)-approved Special Protocol Assessment (SPA); |

| |

• | Supporting our investigators with completion of the Phase 2b randomized, multicenter, investigator-sponsored clinical trial in 300 HER2 1+ and 2+ breast cancer patients to study NeuVax in combination with Herceptin® (trastuzumab; Genentech/Roche); |

| |

• | Supporting our investigators with initiation and completion of the Phase 2 randomized, multicenter, investigator-sponsored trial to study NeuVax in combination with Herceptin in high-risk HER2 3+ breast cancer patients who have received neoadjuvant therapy; |

| |

• | Supporting our partner, Dr. Reddy’s Laboratories' initiation and completion of the Phase 2 gastric cancer trial with NeuVax in India; |

| |

• | Completing the Phase 2 clinical trial of GALE-301 (folate binding protein (FBP)) cancer immunotherapy in ovarian and endometrial cancer; |

| |

• | Completing a Phase 2 clinical trial with GALE-401 (anagrelide controlled release (CR)) in patients with myeloproliferative neoplasms, including essential thrombocythemia (ET); |

| |

• | Achieving revenue goals for Abstral® (fentanyl) sublingual tablets, for which we acquired the U.S. rights in March 2013 and launched in the fourth quarter of 2013; |

| |

• | Launching Zuplenz® (ondansetron) Oral Soluble Film in the U.S. during the first quarter of 2015; and |

| |

• | Pursuing strategic alliances and acquisitions of other therapeutic products to complement our existing product pipeline and commercialization capabilities. |

The chart below summarizes the current status of our commercial and development programs:

Developing Novel Cancer Immunotherapies

We are developing peptide vaccine (off-the-shelf) cancer immunotherapies, which address major patient populations of cancer survivors to prevent recurrence of their cancers. These therapies work by harnessing the patient’s own immune system to seek out and attack any residual cancer cells. Using peptide immunogens has many clinical advantages, including an excellent safety profile, as these drugs lack the toxicities typical of most cancer therapies. They also evoke long-lasting protection through immune system activation and convenient mode of delivery.

NeuVax™ (nelipepimut-S)

NeuVax™ (nelipepimut-S), our lead cancer immunotherapy, is being developed for the prevention of cancer recurrence in HER2 expressing cancers. NeuVax is the immunodominant nonapeptide derived from the extracellular domain of the HER2 protein, a well-established target for therapeutic intervention in breast and gastric carcinomas. The NeuVax vaccine, nelipepimut-S peptide, is combined with the immune adjuvant, recombinant human granulocyte macrophage-colony stimulating factor (rhGM-CSF) for administration. Data has shown that an increased presence of circulating tumor cells (CTCs) predict Disease Free Survival (DFS) and Overall Survival (OS) — suggesting a dormancy of isolated micrometastases, which over time, lead to recurrence. After binding to the HLA A2/A3 molecules on antigen presenting cells, the nelipepimut-S sequence stimulates specific cytotoxic T lymphocyte (CTLs). These activated specific CTLs recognize, neutralize and destroy, through cell lysis, HER2 expressing cancer cells, including occult cancer cells and micrometastatic foci. The nelipepimut immune response can also generate CTLs to other immunogenic peptides through inter- and intra-antigenic epitope spreading.

NeuVax is a targeted cancer immunotherapy for approximately 30,000-40,000 of the 230,000 breast cancer patients annually diagnosed in the US who are at high risk of their breast cancer recurring, which we refer to as “disease recurrence,” after achieving "no evidence of disease" (NED) status (or becoming a “survivor”) with standard therapy (surgery, chemotherapy, radiation). These high-risk patients have a particular molecular signature and disease status: HER2 IHC 1+/2+ (oncoprotein associated with aggressive tumor growth), node positive (disease present in the axillary lymph nodes prior to surgery), and HLA A2/A3 (human leukocyte antigen from A2/A3 patients who have the same loci of genes who which represents 65% of population). Up to 25% of resectable node-positive breast cancer patients, having no radiographic evidence of disease following surgery and adjuvant chemo/radiation therapy, still relapse within three years following diagnosis. These cancer patients presumably still had isolated, undetected tumor cells also known as circulating tumor cells which, over time, led to a recurrence of cancer, either in the breast area (local recurrence) or at a remote location (metastatic disease).

We currently have four ongoing or planned trials with NeuVax:

| |

• | Phase 3 Ongoing: Based on our Phase 2 trial, which achieved its primary endpoint of DFS, the U.S. Food and Drug Administration (FDA) granted NeuVax a Special Protocol Assessment (SPA) for its Phase 3 PRESENT (Prevention of Recurrence in Early- Stage, Node-Positive Breast Cancer with Low to Intermediate HER2 Expression with NeuVax Treatment) study. The multinational, multicenter PRESENT trial is ongoing in North America, Western and Eastern Europe, and Israel. Additional information on the study can be found at www.neuvax.com. |

| |

• | Phase 2b Ongoing: A randomized, multicenter, investigator-sponsored, 300 patient Phase 2b clinical trial is enrolling node-positive and node-negative breast cancer patients to study NeuVax in combination with Herceptin (trastuzumab; Genentech/Roche). |

| |

• | Phase 2 Planned: In addition, in January 2014, we partnered NeuVax with Dr. Reddy’s in India for the commercialization of NeuVax in that region. Per the agreement, Dr. Reddy’s is responsible for running a Phase 2 gastric cancer trial of NeuVax in India that is expected to initiated in the first half of 2015. |

| |

• | Phase 2 Planned: An investigator-sponsored trial will study NeuVax in combination with Herceptin (trastuzumab; Genentech/Roche) in HER2 3+ breast cancer patients. The protocol for the multi-center, prospective, randomized, single-blinded Phase 2 trial is being finalized and is expected to enroll approximately 100 patients with a diagnosis of HER2 3+, beginning in the fourth quarter of 2014. Funding for this trial was awarded through the Congressionally Directed Medical Research Program (CDMRP), funded through the Department of Defense (DoD), via annual Congressional legislation known as the Defense Appropriations Act. The grant was a Breast Cancer Research Program (BCRP) Breakthrough Award. |

Breast Cancer: According to the National Cancer Institute, over 230,000 women in the U.S. are diagnosed with breast cancer annually. While improved diagnostics and targeted therapies have decreased breast cancer mortality in the United States, metastatic breast cancer remains incurable. Approximately 75% of breast cancer patients have tissue test positive for some increased amount of the HER2 receptor, which is associated with disease progression and decreased survival. Only approximately 20% to 30% of all breast cancer patients — those with HER2 IHC 3+ disease — have an approved treatment option available. This leaves the majority of breast cancer patients with low-to-intermediate HER2 IHC 1+/2+ ineligible for therapy and without an effective treatment option to prevent cancer recurrence.

Gastric Cancer: Gastric cancer (also known as stomach cancer) is a disease in which the cells forming the inner lining of the stomach become abnormal and start to divide uncontrollably, forming a cancerous tumor mass. Cancer can develop in any of the five sections of the stomach. Symptoms and outcomes of the disease will vary depending on the location of the cancer. Stomach cancer is one of the leading causes of cancer deaths in several areas of the world, most notably Japan and other Asian countries. Annually, almost one million people will be diagnosed worldwide with stomach cancer and over 800,000 will die from the disease. More than 95% of stomach cancers are caused by adenocarcinomas, malignant cancers that originate in glandular tissues. Overexpression of the HER2 receptor occurs in approximately 20% of gastric and gastro-esophageal junction adenocarcinomas, predominantly those of the intestinal type. Overall, only approximately 20% of patients with stomach cancer live at least five years following diagnosis and new adjuvant treatments are needed to prevent disease recurrence.

GALE-301 (folate binding protein (FBP))

Our second immunotherapy product candidate is GALE-301, or Folate Binding Protein (FBP). GALE-301 is derived from a protein that is over-expressed (20-80 fold) in more than 90% of ovarian and endometrial cancers. GALE-301 is highly immunogenic and can stimulate CTLs to recognize and destroy FBP-expressing cancer cells. The FBP vaccine consists of the FBP peptide(s) combined with recombinant human granulocyte macrophage-colony stimulating factor (rhGM-CSF). GALE-301 is currently in a Phase 2 trial in ovarian cancer.

Ovarian and Endometrial Cancer: Ovarian cancer occurs in more than 22,000 patients per year in the U.S. and is the most lethal gynecologic cancer. Despite the incidence of ovarian cancer being only approximately 20% of that of breast cancer, the number of patients who die from ovarian cancer is nearly 50% of that of breast cancer. Due to the lack of specific symptoms, the majority of ovarian cancer patients are diagnosed at later stages of the disease. These patients have their tumors routinely surgically debulked to minimal residual disease, and then are treated with platinum- and/or taxane-based chemotherapy. While most patients respond to this treatment regimen and become clinically free-of-disease, the majority of these patients will relapse, and once the disease recurs, the treatment options and successes drop dramatically. Endometrial cancer is the most common gynecologic cancer and occurs in more than 46,000 women with more than 8,000 deaths in the U.S. annually. There are two basic types of endometrial cancer: endometrioid and papillary serous. The latter has a much more aggressive clinical course and the majority of these patients will die of this form of the disease.

Building the Breadth, Depth and Pace of our Pipeline

Hematology - GALE-401 (anagrelide CR)

On January 13, 2014, we announced the acquisition of the worldwide rights to anagrelide controlled release (CR) formulation, which we renamed GALE-401, through our acquisition of Mills Pharmaceuticals, LLC. GALE-401 contains the active ingredient anagrelide, an FDA-approved product, which has been in use since the late 1990s for the treatment of essential thrombocythemia (ET). However, adverse events, such as nausea, diarrhea, abdominal pain, palpitations, tachycardia, and headache are associated with the currently available IR version of anagrelide, and, based on existing data, we believe it to be dose and plasma concentration dependent. Therefore, reducing the maximum concentration (Cmax) is hypothesized to reduce the side effects, but preserve efficacy. In Phase 1 clinical studies, GALE-401 has been shown to significantly reduce the Cmax of anagrelide following oral administration. Thus, GALE-401 may reduce the peak plasma exposure to lessen the adverse events while maintaining therapeutic levels for platelet inhibition.

Multiple Phase 1 studies in approximately 90 healthy subjects have shown GALE-401 has a favorable pharmacokinetic profile (i.e. reduced Cmax) and appears to be well tolerated at the doses administered and to be capable of reducing platelet levels. Based on a regulatory meeting with the FDA, Galena believes a 505(b)(2) regulatory filing is an acceptable pathway for approval of GALE-401, with the reference drug Agrylin (anagrelide; Shire Pharmaceuticals). The Phase 1 program has provided the desired PK/PD (pharmacokinetic/pharmacodynamic) profile to enable the Phase 2 initiation in 2014. Based on discussions with the FDA, we believe that only a single Phase 3 trial would be adequate for approval.

Essential Thrombocythemia (ET): ET is an acquired disease of the bone marrow, characterized by highly elevated platelet counts, and is associated with vascular complications including increased risk of thrombosis and bleeding events such as heart attack and stroke. We believe ET has a prevalence in the U.S. of approximately 80,000-100,000 and an annual incidence rate of about 8,000 new diagnoses each year, with similar rates in Europe. Initially, many patients are asymptomatic so the disease goes undiagnosed, but with increased standard blood testing, the diagnoses are increasing as well. Currently, about 75% of diagnosed patients receive therapeutic treatment which highlights the importance of developing better tolerated drugs to this chronically treated, high risk orphan disease patient population.

Establishing and Expanding Commercial Capabilities

Abstral (fentanyl) Sublingual Tablets

Our first commercial product, Abstral (fentanyl) Sublingual Tablets, is an important treatment option for inadequately controlled breakthrough cancer pain (BTcP), which affects an estaimted 40-80% of all cancer patients. Abstral is approved by the U.S. Food and Drug Administration (FDA), as a sublingual (under the tongue) tablet for the management of breakthrough pain in patients with cancer, 18 years of age and older, who are already receiving, and who are tolerant to, opioid therapy for their persistent baseline cancer pain. The Abstral formulation delivers the analgesic power and increased bioavailability of micronized fentanyl in a convenient sublingual tablet which is designed to dissolve under the tongue in seconds, provide relief of breakthrough pain within minutes, and match the duration of the pain episode. Abstral is a transmucosal immediate release fentanyl (TIRF) product with product class oversight by the TIRF Risk Evaluation and Mitigation Strategy (REMS) access program. Galena manufactures and markets Abstral in the U.S. only, through its commercial organization.

Zuplenz (ondansetron) Oral Soluble Film

In July 2014 we expanded our commercial portfolio through the exclusive U.S. licensing from MonoSol of our second commercial product, Zuplenz® (ondansetron) Oral Soluble Film, which is approved by the FDA in adult patients for the prevention of highly and moderately emetogenic chemotherapy-induced nausea and vomiting (CINV), radiotherapy-induced nausea and vomiting (RINV), and post-operative nausea and vomiting (PONV) in adult patients. Zuplenz is also approved in pediatric patients for moderately emetogenic CINV. Nausea and vomiting are two of the most common side-effects experienced by post-surgery patients and patients receiving chemotherapy or radiation. It is estimated that up to 90% of chemotherapy and up to 80% of radiotherapy patients will experience CINV and RINV, respectively

Zuplenz utilizes MonoSol’s proprietary PharmFilm® technology, an oral soluble film that dissolves on the tongue in less than thirty seconds. This eliminates the burden of swallowing pills during periods of emesis and in cases of oral irritation, therefore increasing patient adherence and reducing emergency room visits and hospitalization due to a lack of patient compliance or the patient's inability to keep the medication down without vomiting. The active pharmaceutical ingredient in Zuplenz, ondansetron, belongs to a class of medications called serotonin 5-HT3 receptor antagonists and works by blocking the action of serotonin, a natural substance that may cause nausea and vomiting. MonoSol will exclusively manufacture Zuplenz for marketing by Galena in the United States through its expanded commercial organization.

Financial Condition

We had cash and cash equivalents of approximately $39.2 million as of June 30, 2014. We believe that our existing cash and cash equivalents, along with revenue from Abstral sales, should be sufficient to fund our operations until at least June 30, 2015. This projection is based on our current planned operations and revenue expectations and is subject to changes in our plans and uncertainties inherent in our business, and we may need to seek to replenish our existing cash and cash equivalents sooner than we project.

We expect to continue to incur operating losses as we commercialize Abstral and Zuplenz in the U.S. and continue to advance our product candidates through the drug development and regulatory process. We will need to generate significant revenues to achieve profitability and may never do so. In the absence of profits from the commercialization of Abstral and Zuplenz or our product candidates, our potential sources of operational funding are proceeds from the sale of equity and funded research and development payments and payments received under partnership and collaborative agreements.

There is no guarantee that we will generate sufficient revenue from our commercial operations to become profitable or that any debt, additional equity or other funding will be available to us on acceptable terms, or at all. If we fail to generate adequate revenue or obtain additional funding when needed, we would be forced to scale back, or terminate, our operations or to seek to merge with or to be acquired by another company.

Corporate Information

Our principal executive offices are located at 4640 SW Macadam Avenue, Suite 270, Portland, Oregon 97239, and our phone number is (855) 855-4253. Our website address is www.galenabiopharma.com. We do not incorporate the information on our website into this prospectus, and you should not consider such information part of this prospectus.

We were incorporated as Argonaut Pharmaceuticals, Inc. in Delaware on April 3, 2006 and changed our name to RXi Pharmaceuticals Corporation on November 28, 2006. On September 26, 2011, we changed our company name from RXi Pharmaceuticals Corporation to Galena Biopharma, Inc.

The Offering

|

| |

| |

Common stock offered by the selling stockholder | 1,381,215 shares of our common stock issuable in partial payment of the first milestone payment under the license and supply agreement dated as of July 17, 2014 between us and MonoSol Rx, LLC, which we refer to herin as “MonoSol" or the "selling stockholder." See “Plan of Distribution” for a description of the terms of the milestone payment. |

| |

Common stock to be outstanding after this offering | 122,838,333 shares, without giving effect to any other issuances of common stock subsequent to the date of this prospectus. |

| |

Use of proceeds | We will not receive any proceeds from the sale of our common stock by the selling stockholder. |

| |

Risk factors | Investing in our common stock involves a high degree of risk. See “Risk Factors” on page 8 of this prospectus. |

| |

NASDAQ Capital Market listing | Our common stock is listed on The NASDAQ Capital Market under the symbol “GALE.” |

The number of shares of common stock shown above to be outstanding after this offering is based on 121,457,118 shares outstanding as of September 30, 2014 and excludes as of that date the following:

| |

• | 8,994,116 shares of our common stock subject to outstanding options having a weighted-average exercise price of $3.34 per share; |

| |

• | 2,484,149 shares of our common stock reserved for issuance in connection with future awards under our 2007 stock incentive plan; |

| |

• | 641,859 shares of our common stock reserved for sale under our employee stock purchase plan; and |

| |

• | 8,539,565 shares of our common stock subject to outstanding warrants having a weighted-average exercise price of $2.25 per share. |

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the other documents we have filed with the SEC that are incorporated herein by reference contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties, as well as assumptions that, if they never materialize or prove incorrect, could cause our results to differ materially from those expressed or implied by such forward-looking statements. All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including any projections of financing needs, revenue, expenses, earnings or losses from operations, or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements concerning product research, development and commercialization plans and timelines; any statements regarding safety and efficacy of product candidates; any statements of expectation or belief; and any statements of assumptions underlying any of the foregoing. All forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by the cautionary statements and risk factors set forth under “Risk Factors” and elsewhere in this prospectus and set forth in our Form 10-K for the year ended December 31, 2013 and subsequent Quarterly Reports on Form 10‑Q filed with the SEC. See “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference” in this prospectus for information on how to access or obtain our reports filed with the SEC. In addition, forward-looking statements may contain the words “believe,” “anticipate,” “expect,” “estimate,” “intend,” “plan,” “project,” “will be,” “will continue,” “will result,” “seek,” “could,” “may,” “might,” or any variations of such words or other words with similar meanings.

Given these uncertainties, you should not place undue reliance on these forward-looking statements. You should read this prospectus and the documents that we reference in this prospectus with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we do not undertake any obligation to update or revise any forward-looking statements contained in this prospectus and any supplements to this prospectus, whether as a result of new information, future events or otherwise.

RISK FACTORS

Investing in our common stock involves a high degree of risk. Before making an investment decision, you should carefully consider the risks relating to ownership of our common stock and to this offering described below, together with the information under “Risk Factors” in our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q and the other information incorporated by reference in this prospectus. Some of these factors relate principally to our business and the industry in which we operate. Other factors relate principally to your investment in our common stock. If any of these risks were to occur, our business, financial condition, results of operations, cash flows or prospects could be materially and adversely affected. In such case, you may lose all or part of your investment.

The risks and uncertainties described below and in our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10‑Q are not the only ones facing us. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also materially and adversely affect our business and operations.

Risks Related to Our Commercial Program

We initiated our first product launch less than a year ago, and cannot predict its success, or the success of our planned launch of Zuplenz, and we cannot predict if or when we will become profitable.

In October 2013, we initiated the product launch of Abstral sublingual tablets in the United States, and have realized net sales of Abstral since the launch. Despite our launch of Abstral in the United States, we have continued to incur losses and negative cash flow and expect to do so for the foreseeable future.

Our ability to generate sufficient revenues from our products and to transition to profitability and generate positive cash flow will depend on numerous factors described in the “Risk Factors” sections of our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, and we may never achieve profitability or positive cash flow. If we are unable to transition to profitability and generate positive cash flow over time, our business, results of operations and financial condition would be materially and adversely affected, which could result in our inability to continue operations.

Because of the numerous risks and uncertainties associated with our commercialization efforts, even if we do achieve significant revenues from our products, or become profitable, we may not be able to sustain or increase our revenues or maintain profitability on an ongoing basis.

We are dependent upon the commercial success of Abstral and Zuplenz to generate revenue.

Although we are in the process of testing and developing other drug candidates and may seek to acquire rights in other approved drugs, we anticipate that our ability to generate revenues and to become profitable in the foreseeable future will depend upon the commercial success of our only approved products, Abstral and Zuplenz. In addition to the other risks discussed in the “Risk Factors - Risks Related to Our Commercial Program” sections of our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, our ability to generate future revenues from the sale of our products will depend on a number of factors, including, but not limited to:

| |

• | achievement of market acceptance and coverage by third-party payors for Abstral and Zuplenz; |

| |

• | the effectiveness of our efforts in marketing and selling Abstral and rebranding, marketing and selling Zuplenz; |

| |

• | our ability to effectively work with physicians to ensure that patients are treated to effective doses of Abstral and Zuplenz; |

| |

• | our ability to comply with regulatory requirements; |

| |

• | our contract manufacturers’ ability to successfully manufacture commercial quantities of Abstral and Zuplenz at acceptable cost levels and in compliance with regulatory requirements; |

| |

• | our ability to maintain a cost-efficient commercial organization; and |

| |

• | our ability to successfully maintain intellectual property protection for Abstral and Zuplenz. |

In this regard, in August 2014, Express Scripts Inc. (“ESI”), a major pharmacy benefits manager, made public its formulary exclusion list, which included Abstral and several of the most significant competing products, including the leading branded product in the market. The exclusion means that, effective on January 1, 2015, ESI will no longer purchase these excluded products. Based on our preliminary assessment, we do not believe this formulary change will have a material, adverse effect on our Abstral customer base. It is possible, however, that other pharmacy benefits managers or third-party payors will follow ESI’s action with similar actions of their own and that the actual impact on our business will differ, perhaps significantly, from our preliminary assessment.

There is no assurance that Zuplenz will achieve market acceptance.

On July 17, 2014, we entered into a license and supply agreement with MonoSol under which we acquired the exclusive license to commercialize Zuplenz® Oral Soluble Film in the U.S. Zuplenz was approved in 2010 by the FDA in adult patients for the prevention of highly and moderately emetogenic chemotherapy-induced nausea and vomiting (CINV), radiotherapy-induced nausea and vomiting (RINV), and post-operative nausea and vomiting (PONV). Zuplenz also is approved in pediatric patients for moderately emetogenic CINV. In December 2012, Vestiq Pharmaceuticals, LLC, or “Vestiq,” began marketing and distributing Zuplenz under an exclusive license from MonoSol, and in May 2014, the parent company of Vestiq initiated liquidation proceedings under Chapter 7 of the U.S. Bankruptcy Code. We acquired our exclusive U.S. rights to Zuplenz from MonoSol as part of the Bankruptcy Court-approved plan of liquidation of Vestiq’s parent company. Under the terms of the license agreement, we assumed responsibility for the commercialization of Zuplenz and for all regulatory and reporting matters in the U.S. We also agreed in the license and supply agreement to use our best commercial efforts to begin commercializing Zuplenz in the U.S. on or before December 31, 2014 in accordance with a joint commercialization plan to be established by us and MonoSol. We also agreed that, until net sales of Zuplenz exceed a specified minimum amount or a competing product has been approved by the FDA and is entered the market for sale, we will maintain a specified minimum number of field sales force personnel on specified terms. There is no assurance that we will be successful in re-launching Zuplenz in the United States.

As with Abstral, the commercial success of Zuplenz will depend upon the acceptance of that product by physicians, patients, healthcare payors and the medical community. Coverage and reimbursement for that product by third-party payors is also necessary for commercial success. The degree of market acceptance of Zuplenz will depend on a number of factors, including:

| |

• | our ability to communicate acceptable evidence of safety and efficacy; |

| |

• | acceptance by physicians and patients of the product as a safe and effective treatment; |

| |

• | the relative convenience and ease of administration; |

| |

• | the prevalence and severity of adverse side effects; |

| |

• | limitations or warnings contained in Zuplenz’s FDA-approved labeling; |

| |

• | the clinical indications for which Zuplenz is approved; |

| |

• | availability and perceived advantages of alternative treatments; |

| |

• | the effectiveness of our current or future collaborators’ sales, marketing and distribution strategies; |

| |

• | pricing and cost effectiveness; |

| |

• | our ability to obtain and maintain sufficient third-party payor coverage and reimbursement; |

| |

• | the effectiveness of our patient assistance efforts; and |

| |

• | our ability to maintain compliance with regulatory requirements. |

Our efforts to educate the medical community and third-party payors on the benefits of Zuplenz and gain broad market acceptance may require significant resources, and we may never be successful.

We will be dependent upon MonoSol for the commercial supply of Zuplenz.

Under our license and supply agreement with MonoSol, MonoSol and its affiliates and designees have the exclusive right to supply all of our requirements for Zuplenz, subject to certain conditions. Our ability to commercialize Zuplenz will depend, in part, on the ability of MonoSol and any of its affiliates or designee to successfully manufacture Zuplenz at competitive costs, in accordance with regulatory requirements and in sufficient quantities for commercialization. To the extent they fail to do so and we experience a supply “interruption” or “outage,” we will be entitled under the license and supply agreement to arrange for alternative sources of supply, but there currently is no readily available alternative source of supply. In the event we were to have to arrange for alternate sources of supply of Zuplenz, we could experience delays or substantial additional costs in doing so, and our ability to successfully commercialize Zuplenz could be materially adversely affected.

We face intense competition, including from generic products, and if our competitors market or develop alternative treatments that are demonstrated to be safer or more effective than our products, our commercial opportunities will be reduced or eliminated.

The pharmaceutical industry is characterized by rapidly advancing technologies, intense competition and a strong emphasis on developing proprietary therapeutics. We face competition from a number of sources, some of which may target the same indications as our products, such as pharmaceutical companies, including generic drug companies, biotechnology companies, drug delivery companies and academic and research institutions, many of which have greater financial resources, marketing capabilities, including well-established sales forces, manufacturing capabilities, research and development capabilities, experience in obtaining regulatory approvals for product candidates and other resources than we have.

If Abstral does not achieve market acceptance or coverage by third-party payors, the revenues that we generate from that product will be limited.

The commercial success of Abstral will depend upon the acceptance of that product by physicians, patients, healthcare payors and the medical community. Coverage and reimbursement for that product by third-party payors is also necessary for commercial success. The degree of market acceptance of Abstral will depend on a number of factors, including:

| |

• | our ability to communicate acceptable evidence of safety and efficacy; |

| |

• | acceptance by physicians and patients of the product as a safe and effective treatment; |

| |

• | the relative convenience and ease of administration; |

| |

• | the prevalence and severity of adverse side effects; |

| |

• | limitations or warnings contained in Abstral’s FDA-approved labeling; |

| |

• | the clinical indications for which Abstral is approved; |

| |

• | availability and perceived advantages of alternative treatments; |

| |

• | any negative publicity related to Abstral or our competitors’ products; |

| |

• | the effectiveness of our or any current or future collaborators’ sales, marketing and distribution strategies; |

| |

• | pricing and cost effectiveness; |

| |

• | our ability to obtain sufficient third-party payor coverage and reimbursement; |

| |

• | the effectiveness of our patient assistance efforts; and |

| |

• | our ability to maintain compliance with regulatory requirements. |

For example, while we believe that our sublingual delivery method for Abstral will appeal to patients, some patients may believe that an under the tongue delivery method is ineffective or may otherwise react unfavorably to sublingual delivery. In accordance with the risk evaluation mitigation strategy (REMS) protocol for all transmucosal immediate-release fentanyl (TIRF) products, physicians are advised to begin patients at the lowest dose available for the applicable TIRF product, which for Abstral is 100 mcg. If patients do not experience pain relief at initial low-dose prescriptions of Abstral, it or its physicians may conclude that Abstral is ineffective in general and may discontinue use of Abstral before titrating to an effective dose. In addition, many third-party payors require usage and failure on cheaper generic versions of fentanyl prior to providing reimbursement for Abstral, which would limit Abstral’s use as a first-line treatment option.

Products used to treat and manage pain, especially in the case of controlled substances, are from time to time subject to negative publicity, including negative publicity relating to illegal use, overdoses, abuse, diversion, serious injury and death. These events have led to heightened regulatory scrutiny. Controlled substances are classified by the U.S. Drug Enforcement Administration (the “DEA”) as Schedule I through V substances, with Schedule I substances being prohibited for sale in the United States, Schedule II substances considered to present the highest risk of abuse and Schedule V substances being considered to present the lowest relative risk of abuse. Abstral contains fentanyl, an opioid, and is regulated as a Schedule II controlled substance. Despite the strict regulations on the marketing, distributing, prescribing and dispensing of such substances, illicit use and abuse of controlled substances is well-documented. Thus, the marketing of Abstral may generate public controversy that may adversely affect market acceptance of Abstral.

Our efforts to educate the medical community and third-party payors on the benefits of Abstral and gain broad market acceptance may require significant resources and may never be successful. If Abstral does not achieve an adequate level of acceptance by physicians, third-party payors and patients, we may not generate sufficient revenue from that product to become or remain profitable.

In addition, fentanyl treatments can be costly to third-party payors and patients. Accordingly, hospitals and physicians may resist prescribing Abstral, and third-party payors and patients may not purchase Abstral due to cost.

We are subject, directly or indirectly, to U.S. federal and state health care fraud and abuse and false claims laws and regulations. Prosecutions under such laws have increased in recent years and we may become subject to such litigation. If we are unable to, or have not fully complied with such laws, we could face substantial penalties.

Our Abstral operations are directly, or indirectly through our customers and health care professionals, subject to various U.S. federal and state fraud and abuse laws, including, without limitation, the federal Anti-Kickback Statute, federal False Claims Act, federal Sunshine Act, and federal Foreign Corrupt Practices Act. These laws may impact, among other things, our Abstral sales, and marketing and education programs.

The federal Anti-Kickback Statue prohibits persons from knowingly and willfully soliciting, offering, receiving, or providing renumeration, directly or indirectly, in exchange for or to induce either the referral of an individual, or the furnishing or arranging for a good or service, for which payment may be made under a federal health care program such as the Medicare and Medicaid programs. Several courts have interpreted the statute’s intent requirement to mean that if any one purpose of an arrangement involving

renumeration is to induce referrals of federal health care covered business, the statute has been violated. The Anti-Kickback Statue is broad, and despite a series of narrow safe harbors, prohibits many arrangements and practices that are lawful in businesses outside of the health care industry. Penalties for violations of the federal Anti-Kickback Statute include criminal penalties and civil and administrative sanctions such as fines, imprisonment and possible exclusion from Medicare, Medicaid and other federal health care programs. An alleged violation of the Anti-Kickback Statute may be used as a predicate offense to establish liability pursuant to other federal laws and regulations such as a the federal False Claims Act. Many states have also adopted laws similar to the federal Anti-Kickback Statute, some of which apply to the referral of patients for health care items or services reimbursed by any source, not only Medicare and Medicaid programs.

The federal False Claims Act prohibits persons from knowingly filing, or causing to be filed, a false claim to, or the knowing use of false statements to obtain payment from, the federal government. Suits filed under the False Claims Act, known as “qui tam” actions, can be brought by any individual on behalf of the government and such individuals, commonly known as “relators” or “whistleblowers,” may share in any amounts paid by the entity to the government in fines or settlement. The frequency of filing qui tam actions has increased significantly in recent years, causing greater numbers of health care companies to have to defend a False Claim Act action. The federal Patient Protection and Affordable Care Act includes provisions expanding the ability of certain relators to bring actions that would have been dismissed under prior law. When an entity is determined to have violated the federal False Claims Act, it may be required to pay up to three times the actual damages sustained by the government, plus civil penalties for each separate false claim. The Deficit Reduction Act of 2005 encouraged states to enact or modify its state false claims act to be at least as effective as the federal False Claims Act by granting states a portion of any federal Medicaid funds recovered through Medicaid-related actions. Most states have enacted state false claims laws, and many of those states included laws including qui tam provisions.

The federal Patient Protection and Affordable Care Act include provisions known as the Physician Payments Sunshine Act, which requires manufacturers of drugs, biologics, devices and medical supplies covered under Medicare and Medicaid to record any transfers of value to physicians and teaching hospitals and to report this data beginning in 2013 to the Centers for Medicare and Medicaid Services for subsequent public disclosures. Manufacturers must also disclose investment interest held by physicians and its family members. Failure to submit the required information may result in civil monetary penalties of up to $1 million per year for knowing violations and may result in liability under other federal laws or regulations. Similar reporting requirements have also been enacted on the state level in the U.S., and an increasing number of countries worldwide either have adopted or are considering similar laws requiring transparency of interactions with health care professionals. In addition, some states such as Massachusetts and Vermont imposed an outright ban on certain gifts to physicians. These laws could affect our Abstral promotional activities by limiting the kinds of interactions we could have with hospitals, physicians or other potential purchasers or users of our system. Both the disclosure laws and gift bans also will impose administrative, cost and compliance burdens on us.

We are unable to predict whether we could become subject to actions under any of these laws, or the impact of such actions. If we are found to be in violation of any of the laws described above and other applicable state and federal fraud and abuse laws, we may be subject to penalties, including civil and criminal penalties, damages, fines, or an administrative action of suspension or exclusion from government health care reimbursement programs and the curtailment or restructuring of our commercial operations.

In addition, to the extent we commence commercial operations overseas, we will be subject to the Foreign Corrupt Practices Act and other countries’ anti-corruption/anti-bribery regimes, such as the U.K. Bribery Act. The Foreign Corrupt Practices Act prohibits improper payments or offers of payments to foreign governments and its officials for the purpose of obtaining or retaining business. Safeguards we implement to discourage improper payments or offers of payments by our employees, consultants, sales agents or distributors may be ineffective, and violations of the Foreign Corrupt Practices Act and similar laws may result in severe criminal or civil sanctions, or other liabilities or proceedings against us, any of which would likely harm our reputation, business, financial conditions and results of operations.

We have no internal manufacturing capabilities; we rely instead on third parties for the commercial supply of Abstral, and if we fail to maintain our supply and manufacturing relationships with these third parties or develop new relationships with other third parties, we may be unable to continue to commercialize Abstral.

We rely on third parties for the commercial supply of Abstral. Our ability to commercially supply Abstral will depend, in part, on our ability to successfully obtain fentanyl, the active pharmaceutical ingredient (“API”) for Abstral, and outsource most, if not all, of the aspects of its manufacture at competitive costs, in accordance with regulatory requirements and in sufficient quantities for commercialization. If we fail to maintain supply relationships with these third parties, we may be unable to continue to commercialize Abstral.

We will purchase the fentanyl API utilized in connection with Abstral from third parties. Our ability to obtain fentanyl API in sufficient quantities and quality, and on a timely basis, is critical to our commercialization of Abstral. There is no assurance that these suppliers will produce the materials in the quantities and quality and at the times it are needed, if at all.

The manufacture of pharmaceutical products generally requires significant expertise and capital investment, often including the development of advanced manufacturing techniques and process controls. Manufacturers of pharmaceutical products often encounter difficulties in production, particularly in scaling up and validating initial production. These problems can include difficulties with production costs and yields, quality control, including stability of the product, quality assurance testing, shortages of qualified personnel, as well as compliance with strictly enforced federal, state and foreign regulations. Additionally, our manufacturers may experience difficulties due to resource constraints, labor disputes, unstable political environments or natural disasters. If our manufacturers were to encounter any of these difficulties, or otherwise fail to comply with its contractual obligations for any reason, our ability to commercially supply Abstral could be jeopardized. Any delay or interruption in our ability to commercially supply Abstral will result in the loss of potential revenues and could adversely affect the market’s acceptance of that product.

Manufacturers and suppliers are subject to regulatory requirements including current Good Manufacturing Practices (“cGMPs”), which cover, among other things, manufacturing, testing, quality control and recordkeeping relating to Abstral, and are subject to ongoing inspections by the FDA, the Drug Enforcement Agency (DEA) and other regulatory agencies. If any of our third-party manufacturers cannot successfully manufacture product that conforms to our specifications and the applicable regulatory authorities’ strict regulatory requirements, it will not be able to secure or maintain regulatory approval for the manufacturing facilities. In addition, we have no control over the ability of third-party manufacturers to maintain adequate quality control, quality assurance and qualified personnel. If the FDA or any other applicable regulatory authorities do not approve these facilities for the manufacture of Abstral or if it withdraw any such approval in the future, we may need to find alternative manufacturing facilities, which would significantly impact our ability to commercially supply Abstral.

We face intense competition, including from generic products, and if our competitors market or develop alternative treatments that are demonstrated to be safer or more effective than Abstral, our commercial opportunities will be reduced or eliminated.

The pharmaceutical industry is characterized by rapidly advancing technologies, intense competition and a strong emphasis on developing proprietary therapeutics. We face competition from a number of sources, some of which may target the same indications as Abstral, such as pharmaceutical companies, including generic drug companies, biotechnology companies, drug delivery companies and academic and research institutions, many of which have greater financial resources, marketing capabilities, including well-established sales forces, manufacturing capabilities, research and development capabilities, experience in obtaining regulatory approvals for product candidates and other resources than we have.

Abstral competes against numerous branded and generic products already being marketed and potentially those which are or will be in development. Many of these competitive products are offered in the United States by large, well-capitalized companies. In the breakthrough cancer pain (“BTcP”) market, physicians often treat BTcP with a variety of short-acting opioid medications, including morphine, morphine and codeine derivatives and fentanyl. Some currently marketed products against which we directly compete include Teva Pharmaceutical Industries Ltd.’s Fentora and Actiq, Insys’s Subsys, Archimedes Pharma Ltd.’s Lazanda and BioDelivery Sciences International, Inc.’s Onsolis. Some generic fentanyl products against which Abstral competes are marketed by Mallinckrodt, Inc., Par Pharmaceutical Companies, Inc. and Actavis, Inc. In addition, we are aware of numerous companies developing other treatments and technologies for rapid delivery of opioids to treat BTcP, including transmucosal, transdermal, nasal spray, and inhaled sublingual delivery systems. If these treatments and technologies are successfully developed and approved, it could represent significant additional competition to Abstral. We will also face competition from third parties in obtaining allotments of fentanyl under applicable DEA annual quotas and in recruiting and retaining qualified personnel.

If we are unable to achieve and maintain adequate levels of coverage and reimbursement for Abstral, on reasonable pricing terms, its commercial success may be severely hindered.

Successful sales of Abstral depend on the availability of adequate coverage and reimbursement from third-party payors. Patients who are prescribed medicine for the treatment of its conditions generally rely on third-party payors to reimburse all or part of the costs associated with its prescription drugs. Adequate coverage and reimbursement from governmental healthcare programs, such as Medicare and Medicaid, and commercial payors is critical to new product acceptance. Coverage decisions may depend upon clinical and economic standards that disfavor new drug products when more established or lower cost therapeutic alternatives are already available or subsequently become available. The reimbursement payment rates for Abstral might not be adequate or may require co-payments that patients find unacceptably high. Patients are unlikely to use Abstral unless coverage is provided and reimbursement is adequate to cover a significant portion of the cost of Abstral.

In addition, the market for Abstral depends significantly on access to third-party payors’ drug formularies, or lists of medications for which third-party payors provide coverage and reimbursement. The industry competition to be included in such formularies often leads to downward pricing pressures on pharmaceutical companies. Also, third-party payors may refuse to include a particular branded drug in its formularies or otherwise restrict patient access to a branded drug when a less costly generic equivalent or other alternative is available. For example, many third-party payors require usage and failure on cheaper generic versions of rapid

acting fentanyl prior to providing reimbursement for Abstral and other branded TIRF products, which limits Abstral’s use as a first-line treatment option.

Third-party payors, whether governmental or commercial, are developing increasingly sophisticated methods of controlling healthcare costs. In addition, in the United States, no uniform policy of coverage and reimbursement for drug products exists among third-party payors. Therefore, coverage and reimbursement for drug products can differ significantly from payor to payor. As a result, the coverage determination process is often a time-consuming and costly process that will require us to provide scientific and clinical support for the use of Abstral to each payor separately, with no assurance that coverage and adequate reimbursement will be obtained.

Further, we believe that future coverage and reimbursement will likely be subject to increased restrictions in the United States. Third-party coverage and reimbursement for Abstral may cease to be available or adequate in the United States, which could have a material adverse effect on our business, results of operations, financial condition and prospects.

We anticipate that the majority of our sales of Abstral will be to wholesale pharmaceutical distributors who, in turn, will sell the products to pharmacies, hospitals and other customers. The loss by us of any of these wholesale pharmaceutical distributors’ accounts or a material reduction in its purchases could have a material adverse effect on our business, results of operations, financial condition and prospects.

In addition, these wholesale customers comprise a significant part of the distribution network for pharmaceutical products in the United States. This distribution network has undergone, and may continue to undergo, significant consolidation marked by mergers and acquisitions. As a result, a small number of large wholesale distributors control a significant share of the market. Consolidation of drug wholesalers has increased, and may continue to increase, competitive and pricing pressures on pharmaceutical products. We cannot assure you that we can manage these pricing pressures or that wholesaler purchases will not fluctuate unexpectedly from period to period.

Our sales of Abstral can be greatly affected by the inventory levels our wholesalers carry. We will monitor wholesaler inventory of Abstral using a combination of methods. However, our estimates of wholesaler inventories may differ significantly from actual inventory levels. Significant differences between actual and estimated inventory levels may result in excessive production (requiring us to hold substantial quantities of unsold inventory), inadequate supplies of products in distribution channels, insufficient product available at the retail level, and unexpected increases or decreases in orders from our wholesalers. These changes may cause our revenues to fluctuate significantly from quarter to quarter, and in some cases may cause our operating results for a particular quarter to be below our expectations or the expectations of securities analysts or investors. In addition, at times, wholesaler purchases may exceed customer demand, resulting in reduced wholesaler purchases in later quarters, which may result in substantial fluctuations in our results of operations from period to period. If our financial results are below expectations for a particular period, the market price of our common stock may drop significantly.

We rely on third parties to perform many necessary services for Abstral, including services related to distribution, invoicing, storage and transportation.

We have retained third-party service providers to perform a variety of functions related to the sale and distribution of Abstral, key aspects of which will be out of our direct control. For example, we rely on third parties to provide logistics, warehousing and inventory management, distribution, contract administration and chargeback processing, accounts receivable management, patient assistance program management, and call center management and, as a result, most of our Abstral inventory may be stored at warehouses maintained by the service providers. If these third-party service providers fail to comply with applicable laws and regulations, fail to meet expected deadlines, or otherwise do not carry out its contractual duties to us, or encounter physical damage or natural disaster at its facilities, our ability to deliver Abstral to meet commercial demand would be significantly impaired. In addition, we expect to utilize third parties to perform various other services for us relating to sample accountability and regulatory monitoring, including adverse event reporting, safety database management and other product maintenance services. If the quality or accuracy of the data maintained by these service providers is insufficient, our ability to continue to market Abstral could be jeopardized or we could be subject to regulatory sanctions. We do not currently have the internal capacity to perform these important commercial functions, and we may not be able to maintain commercial arrangements for these services on reasonable terms.

We may need to increase the size and complexity of our organization in the future, and we may experience difficulties in managing our growth and executing our growth strategy.

Our management and personnel, systems and facilities currently in place may not be adequate to support our business plan and future growth. The effective management of our commercial program requires that we:

| |

• | continue to improve our operational, financial, management and regulatory compliance controls and reporting systems and procedures; |

| |

• | attract and retain sufficient numbers of talented employees; |

| |

• | manage our commercialization activities in a cost-effective manner; and |

| |

• | carry out our contractual obligations to contractors and other third parties. |

In addition, historically, we have utilized and continue to utilize the services of part-time outside consultants to perform a number of tasks for us, including tasks related to accounting and finance, compliance programs, clinical trial management, regulatory affairs, formulation development and other drug development functions. Our growth strategy related to Abstral may also entail expanding our use of consultants to implement these and other tasks going forward. Because we rely on consultants for certain functions of our business, we will need to be able to effectively manage these consultants to ensure that they successfully carry out this contractual obligations and meet expected deadlines. There can be no assurance that we will be able to manage our existing consultants or find other competent outside consultants, as needed, on economically reasonable terms, or at all. If we are not able to effectively expand our organization by either hiring new employees and expanding our use of consultants, or both, we may be unable to successfully implement the tasks necessary to effectively execute on our Abstral-related development and commercialization activities and, accordingly, may not achieve our goals.

We face potential product liability exposure relating to Abstral and, if successful claims are brought against us, we may incur substantial liability if our insurance coverage for those claims is inadequate.

The commercial sale of Abstral or other products we succeed in commercializing exposes us to possible product liability claims. This risk exists even if a product is approved for commercial sale by the FDA and manufactured in facilities licensed and regulated by the FDA, such as the case with Abstral. Abstral is designed to affect important bodily functions and processes. Any side effects, manufacturing defects, misuse or abuse associated with Abstral could result in injury to a patient or even death. For example, because Abstral is designed to be self-administered by patients, it is possible that a patient could fail to follow instructions and as a result apply a dose in a manner that results in injury. In addition, Abstral is an opioid pain reliever that contains fentanyl, which is regulated as a “controlled substance” under the Controlled Substances Act of 1970 (the “CSA”) and could result in harm to patients relating to its potential for abuse. In addition, a liability claim may be brought against us even if Abstral merely appears to have caused an injury. Product liability claims may be brought against us by consumers, health care providers, pharmaceutical companies or others selling or otherwise coming into contact with Abstral. If we cannot successfully defend ourselves against product liability claims we will incur substantial liabilities. In addition, regardless of merit or eventual outcome, product liability claims may result in:

| |

• | decreased demand for Abstral; |

| |

• | impairment of our business reputation; |

| |

• | product recall or withdrawal from the market; |

| |

• | costs of related litigation; |

| |

• | distraction of management’s attention from our primary business; |

| |

• | substantial monetary awards to patients or other claimants; or |

We have obtained product liability insurance coverage for commercial product sales with a $5 million per occurrence and a $5 million annual aggregate coverage limit. We also carry excess product liability insurance coverage for commercial product sales with an additional $5 million per occurrence and an additional $5 million annual aggregate coverage limit. Our insurance coverage may not be sufficient to cover all of our product liability related expenses or losses and may not cover us for any expenses or losses we may suffer. Moreover, insurance coverage is becoming increasingly expensive and, in the future, we may not be able to maintain insurance coverage at a reasonable cost, in sufficient amounts or upon adequate terms to protect us against losses due to product liability. If we determine that it is prudent to increase our product liability coverage based on sales of Abstral, we may be unable to obtain this increased product liability insurance on commercially reasonable terms or at all. Large judgments have been awarded in class action or individual lawsuits based on drugs that had unanticipated side effects, including side effects that are less severe than those of Abstral. A successful product liability claim or series of claims brought against us could cause our stock price to decline and, if judgments exceed our insurance coverage, could decrease our cash and have a material adverse effect our business, results of operations, financial condition and prospects.

Our business involves the use of hazardous materials and we and our third-party manufacturers and suppliers must comply with environmental laws and regulations, which can be expensive and restrict how we do business.

Our third-party manufacturers’ and suppliers’ activities involve the controlled storage, use and disposal of hazardous materials, including the components of Abstral. We and our manufacturers and suppliers are subject to laws and regulations governing the use, manufacture, storage, handling and disposal of these hazardous materials. In some cases, these hazardous materials and various wastes resulting from its use will be stored at our and our manufacturers’ facilities pending use and disposal. We cannot completely eliminate the risk of contamination, which could cause an interruption of our Abstral commercialization efforts, injury to our employees and others, environmental damage resulting in costly clean-up and liabilities under applicable laws and regulations

governing the use, storage, handling and disposal of these materials and specified waste products. Although we expect that the safety procedures utilized by our third-party manufacturers for handling and disposing of these materials will generally comply with the standards prescribed by these laws and regulations, we cannot guarantee that this will be the case or eliminate the risk of accidental contamination or injury from these materials. In such an event, we may be held liable for any resulting damages and such liability could exceed our resources. We do not currently carry biological or hazardous waste insurance coverage and our property and casualty and general liability insurance policies specifically exclude coverage for damages and fines arising from biological or hazardous waste exposure or contamination.

Abstral is subject to ongoing and continued regulatory review, which may result in significant expense and adversely affect our commercialization of Abstral.

Even after U.S. regulatory approval for a product such as Abstral, the FDA may still impose significant restrictions on the approved indicated uses for which the product may be marketed or on the conditions of approval. For example, a product’s approval may contain requirements for potentially costly post-approval studies and surveillance, including Phase 4 clinical trials, to monitor the safety and efficacy of the product. We will also be subject to ongoing FDA obligations and continued regulatory review with respect to the manufacturing, processing, labeling, packaging, distribution, adverse event reporting, storage, advertising, promotion and recordkeeping for Abstral. These requirements include submissions of safety and other post-marketing information and reports, registration, as well as continued compliance with cGMPs, good clinical practices and good laboratory practices.

In the case of Abstral, we and our contract manufacturers are also subject to ongoing DEA regulatory obligations, including, among other things, annual registration renewal, security, recordkeeping, theft and loss reporting, periodic inspection and annual quota allotments for the raw material for commercial production of Abstral. In addition, manufacturers of drug products and its facilities are subject to continual review and periodic inspections by the FDA and other regulatory authorities for compliance with cGMP regulations. If we or a regulatory agency discovers previously unknown problems with a product, such as adverse events of unanticipated severity or frequency, or problems with the facility where, or processes by which, the product is manufactured, a regulatory agency may impose restrictions on that product, the manufacturer or us, including requiring product recall, notice to physicians, withdrawal of the product from the market or suspension of manufacturing.

If we, Abstral or the manufacturing facilities for Abstral fail to comply with applicable regulatory requirements, a regulatory agency may:

| |

• | impose restrictions on the marketing or manufacturing of Abstral, suspend or withdraw product approvals or revoke necessary licenses; |

| |

• | issue warning letters, show cause notices or untitled letters describing alleged violations, which may be publicly available; |

| |

• | commence criminal investigations and prosecutions; |

| |

• | impose injunctions, suspensions or revocations of necessary approvals or other licenses; |

| |

• | impose fines or other civil or criminal penalties; |

| |

• | deny or reduce quota allotments for the raw material for commercial production of Astral; |

| |

• | suspend or impose restrictions on operations, including costly new manufacturing requirements; or |

| |

• | seize Abstral or require us to initiate a product recall. |

In addition, our product labeling, advertising and promotion are subject to regulatory requirements and continuing regulatory review. The FDA strictly regulates the promotional claims that may be made about prescription drug products. In particular, a drug product may not be promoted for uses that are not approved by the FDA as reflected in the product’s approved labeling, although the FDA does not regulate the prescribing practices of physicians. The FDA and other agencies actively enforce the laws and regulations prohibiting the promotion of off-label uses, and a company that is found to have improperly promoted off-label uses may be subject to significant liability, including substantial monetary penalties and criminal prosecution.

The FDA’s regulations, policies or guidance may change and new or additional statutes or government regulations may be enacted that could further restrict or regulate post-approval activities relating to Abstral. We cannot predict the likelihood, nature or extent of adverse government regulation that may arise from future legislation or administrative action. If we are not able to achieve and maintain regulatory compliance, we may not be permitted to market Abstral, which would adversely affect our ability to generate revenue and achieve or maintain profitability.

Abstral may cause undesirable side effects or have other unexpected properties that could result in post-approval regulatory action.

If we or others identify undesirable side effects, or other previously unknown problems, caused by Abstral or other products with the same or related active ingredients, a number of potentially significant negative consequences could result, including:

| |

• | regulatory authorities may withdraw its approval of Abstral; |

| |

• | regulatory authorities may require us to recall Abstral; |

| |

• | regulatory authorities may require the addition of warnings in the product label or narrowing of the indication in the product label; |

| |

• | we may be required to create a Medication Guide outlining the risks of such side effects for distribution to patients; |

| |

• | we may be required to change the way Abstral is administered or modify Abstral in some other way; |

| |

• | the FDA may require us to conduct additional clinical trials or costly post-marketing testing and surveillance to monitor the safety or efficacy of the product; |

| |

• | we could be sued and held liable for harm caused to patients; and |

| |

• | our business and results of operations and our reputation may suffer. |

Any of the above events resulting from undesirable side effects or other previously unknown problems could prevent us from achieving or maintaining market acceptance of Abstral and could substantially increase the costs of commercializing Abstral.

We are subject to numerous complex regulations and failure to comply with these regulations, or the cost of compliance with these regulations, may harm our business.

The research, testing, development, manufacturing, quality control, approval, labeling, packaging, storage, recordkeeping, promotion, advertising, marketing, distribution, possession and use of Abstral are subject to regulation by numerous governmental authorities in the United States. The FDA regulates drugs under the Federal Food, Drug and Cosmetic Act (the “FDCA”) and implementing regulations. Noncompliance with any applicable regulatory requirements can result in refusal to approve products for marketing, warning letters, product recalls or seizure of products, total or partial suspension of production, prohibitions or limitations on the commercial sale of products or refusal to allow the entering into of federal and state supply contracts, fines, civil penalties and/or criminal prosecution. Additionally, the FDA and comparable governmental authorities have the authority to withdraw product approvals that have been previously granted. Moreover, the regulatory requirements relating to Abstral may change from time to time, and it is impossible to predict what the impact of any such changes may be.

Abstral is a controlled substance as defined in the CSA, which establishes, among other things, certain registration, production quotas, security, recordkeeping, reporting, import, export and other requirements administered by the DEA. The DEA regulates controlled substances as Schedule I, II, III, IV or V substances. Schedule I substances by definition have high potential for abuse, no currently accepted medical use in the United States and lack accepted safety for use under medical supervision, and may not be marketed or sold in the United States. Except for research and industrial purposes, a pharmaceutical product may be listed as Schedule II, III, IV or V, with Schedule II substances considered to present the highest risk of abuse and Schedule V substances the lowest relative risk of abuse among such substances. Fentanyl is listed by the DEA as a Schedule II substance under the CSA.

The manufacture, shipment, storage, sale and use, among other things, of controlled substances that are pharmaceutical products are subject to a high degree of regulation. For example, generally all Schedule II substance prescriptions, such as prescriptions for fentanyl, must be written and signed by a physician, physically presented to a pharmacist and may not be refilled without a new prescription.