In the "Geospace Technologies Corporation and Subsidiaries

Consolidated Statements of Operations" table, the gross profit line

for the year ended September 30, 2013 should read: 139,761 (instead

of 39,761).

The corrected release reads:

GEOSPACE TECHNOLOGIES REPORTS FISCAL YEAR

2014 RESULTS

Geospace Technologies (NASDAQ: GEOS) today announced net income

of $36.9 million, or $2.81 per diluted share, on revenues of $236.9

million for its fiscal year ended September 30, 2014. This compares

with a net income of $69.6 million, or $5.38 per diluted share, on

revenues of $300.6 million for the prior year.

For the fourth quarter ended September 30, 2014, the company

recorded revenues of $26.3 million and a net loss of $1.8 million,

or $0.14 per diluted share. For the comparable period last year,

the company recorded revenues of $68.3 million and net income of

$13.7 million, or $1.05 per diluted share.

Walter R. (“Rick”) Wheeler, Geospace Technologies’ President and

CEO said, “Fiscal year 2014 has seen significant extremes in our

quarterly financial results. In our first fiscal quarter, revenues

and net income reached the highest levels in our company’s history,

while in our fourth quarter these numbers approached record lows.

This is hard evidence of the lumpiness that, as we continually

point out, our business experiences. But through it all, we are

pleased to have increased shareholder equity by 13.9% at the end of

fiscal year 2014. In our fourth quarter, revenues and net income

were down by $42.0 million or 62%, and $15.5 million or 113%,

respectively, from last year’s fourth quarter. The reduction in

revenue was a direct consequence of the completion of the Statoil

order back in April, whereby we recognized $38.1 million of

revenues in last year’s fourth quarter. In addition, the current

year fourth quarter reflected lower product demand across all of

our seismic and non-seismic product segments compared to last

year’s fourth quarter.”

“Fourth quarter revenues for our traditional and wireless

seismic products were down by $2.3 million or 21%, and $0.5 million

or 5%, respectively from last year. Demand for product sales has

fallen in direct association with reduced capital spending by our

customers due to diminished seismic exploration activities across

most sectors of the industry. To the extent that oil and gas

companies continue to reduce exploration spending to find new

energy, we expect the demand for these products to remain soft. We

anticipate that during this time, we will continue to see our

overall traditional and wireless product revenues decrease, and we

anticipate some shifting of revenues from sales to rentals. Despite

market softness, we believe our wireless products represent the

best and most cost efficient alternatives for seismic industry

contractors in lieu of legacy cabled equipment, which enhances our

position in future sales and rental opportunities. We sold 86,000

channels of our GSX land wireless products during fiscal year 2014

and we had 134,000 channels in our worldwide rental fleet.”

“Despite the softness experienced by the seismic industry, the

ocean-bottom seismic market remains active. We are seeing growing

customer interest, quote inquiries, and rental contracts for use of

our cableless OBX ocean bottom systems. We recently announced an

agreement with a major international seismic contractor to rent

4,000 stations of our cableless OBX ocean bottom nodal system for

180 days. We expect to deliver this OBX system to the customer in

our second quarter of fiscal year 2015. In a related matter that we

have previously reported on, Seafloor Geophysical Solutions

continues to move forward in their effort to secure capital

funding, although slowly. We understand that SGS received a small

amount of working capital funding from a potential investor which

has extended the timing of their efforts to secure the long-term

financing needed to proceed with their business plans, which

currently includes the purchase of our deep-water OBX system. We

cautiously interpret this as a positive indicator in their pursuit

toward a successful outcome and we understand that this funding

helps SGS operate through the end of calendar year 2014, although

we must point out that we have no specific knowledge about when or

if a successful completion might occur.”

“Fourth quarter revenues from our reservoir products declined by

$38.7 million or 91% from last year. As mentioned above, almost the

entire decrease in revenues for the fourth quarter resulted from

the completion of the manufacturing portion of Statoil’s permanent

reservoir monitoring (PRM) system back in April 2014. We are very

satisfied and proud of the work which our employees achieved during

this contract, finishing the project in record time and with

quality workmanship. We are confident that Statoil is pleased with

system’s data quality and the work we performed, and we expect a

positive on-going relationship between our companies. While we

currently have no PRM contracts in hand at this time, we remain

optimistic that our PRM products will contribute significantly to

our results of operations in the future. We are aware of a number

of operators around the world who are considering PRM systems for

their fields and we believe we are the world leader in the design

and construction of such systems.”

“Sales of our non-seismic products decreased $0.5 million or 8%

from last year’s fourth quarter primarily resulting from a decline

in offshore cable shipments. During the Statoil contract, we were

unable to accept certain orders for offshore cable products due to

a lack of ample manufacturing capacity. We are aggressively

pursuing new orders and new customers for our offshore cable

products.”

“The architectural plans for the construction of a new building

at our Pinemont facilities are now in the hands of local officials

for approval and permitting. It is estimated that the conclusion of

this process should occur sometime before mid-December. This

further pushes back any significant effort towards the construction

of the new facilities to the second quarter of fiscal year 2015, at

the earliest. However, our remodeling of a smaller building on the

property was fully completed on schedule, and we successfully moved

all operations from a previously rented satellite facility into

this building. Present circumstances indicate that much of the

seismic exploration industry is in the midst of curtailed

activities that are typical of the cyclical lows the industry has

seen before. However, we maintain that future opportunities for us

to provide permanent reservoir monitoring systems and other

innovative products to the industry are primary drivers in a

long-term strategy that calls for us to enhance and expand our

facilities and capacity.”

While we are clearly in a period of pressure on our operations,

our balance sheet is very strong and we believe we are in a good

position to work through the correction in oil and gas exploration

and production activities.

Conference Call

Information

Geospace Technologies will host a conference call to review its

fiscal year 2014 full year financial results on November 21, 2014,

at 10:00 a.m. Eastern Time (9:00 a.m. Central). Participants can

access the call at (866) 952-1906 (US) or (785) 424-1825

(International). Please reference the conference ID: GEOSQ414 prior

to the start of the conference call. A replay will be available for

approximately 60 days and may be accessed through the Investor tab

of our website at www.geospace.com.

About Geospace

Technologies

Geospace Technologies Corporation designs and manufactures

instruments and equipment used by the oil and gas industry to

acquire seismic data in order to locate, characterize and monitor

hydrocarbon producing reservoirs. The company also designs and

manufactures non-seismic products, including industrial products,

offshore cables, thermal printing equipment and film.

Forward Looking

Statements

This press release includes “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. All statements other than statements of historical fact

included herein including statements regarding potential future

products and markets, our potential future revenues, future

financial position, business strategy, future expectations and

estimates and other plans and objectives for future operations, are

forward-looking statements. We believe our forward-looking

statements are reasonable. However, they are based on certain

assumptions about our industry and our business that may in the

future prove to be inaccurate. Important factors that could cause

actual results to differ materially from our expectations include

the level of seismic exploration worldwide, which is influenced

primarily by prevailing prices for oil and gas, the extent to which

our new products are accepted in the market, the availability of

competitive products that may be more technologically advanced or

otherwise preferable to our products, tensions in the Middle East

and other factors disclosed under the heading “Risk Factors” and

elsewhere in our most recent Annual Report on Form 10-K and

Quarterly Report on Form 10-Q, which are on file with the

Securities and Exchange Commission. Further, all written and verbal

forward-looking statements attributable to us or persons acting on

our behalf are expressly qualified in their entirety by such

factors. We assume no obligation to revise or update any

forward-looking statement, whether written or oral, that we may

make from time to time, whether as a result of new information,

future developments or otherwise.

GEOSPACE TECHNOLOGIES CORPORATION AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except share and per

share amounts)

Three Months Ended Year Ended

September 30, 2014

September 30, 2013

September 30, 2014

September 30, 2013

(unaudited) (unaudited) (unaudited) Revenues: Products $ 19,414 $

65,714 $ 209,581 $ 287,233 Rental equipment

6,871 2,574

27,331 13,374 Total

revenues 26,285 68,288 236,912 300,607 Cost of sales: Products

14,956 36,518 125,497 152,659 Rental equipment

5,240 1,990

14,956 8,187 Total

cost of sales

20,196

38,508 140,453

160,846 Gross profit 6,089 29,780

96,459

139,761

Operating expenses: Selling, general and administrative

5,799 6,511 25,291 23,383 Research and development 3,397 4,234

16,536 14,694 Bad debt expense (recovery)

175

(97 )

833 457 Total

operating expenses

9,371

10,648 42,660

38,534 Income (loss) from operations

(3,282 )

19,132 53,799

101,227 Other income (expense): Interest

expense (93 ) (68 ) (471 ) (260 ) Interest income 55 185 123 880

Foreign exchange gains (losses) 50 195 182 (708 ) Other, net

(2 ) (38

) (90 )

(46 ) Total other income (expense), net

10 274

(256 ) (134

) Income before income taxes (3,272 ) 19,406

53,543 101,093 Income tax expense (benefit)

(1,439 ) 5,722

16,632 31,536

Net income (loss)

$ (1,833

) $ 13,684

$ 36,911 $

69,557 Basic earnings (loss) per

share

$ (0.14 )

$ 1.06 $

2.82 $ 5.40

Diluted earnings (loss) per share

$

(0.14 ) $ 1.05

$ 2.81 $

5.38 Weighted average shares outstanding

- Basic 12,954,373 12,924,043

12,950,958 12,886,372 Weighted average shares

outstanding - Diluted 12,954,373 12,977,436

12,997,009 12,938,661

GEOSPACE TECHNOLOGIES CORPORATION AND

SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands)

September 30, 2014 September 30,

2013 ASSETS (unaudited) Current

assets: Cash and cash equivalents $ 33,357 $ 2,726 Short-term

investments 19,861 -- Trade accounts receivable, net of allowance

of $1,125 and $376 24,602 49,756 Notes receivable, net 3,786 5,290

Inventories, net 145,890 149,548 Costs and estimated earnings in

excess of billings -- 12,400 Deferred income tax assets 7,244 7,056

Prepaid expenses and other current assets

9,268

6,327 Total current assets

244,008 233,103 Rental equipment, net 53,873 36,908

Property, plant and equipment, net 49,205 48,480 Goodwill 1,843

1,843 Non-current deferred income tax assets 75 594 Non-current

notes receivable 28 Prepaid income taxes 5,848 6,201 Other assets

106 96

Total assets

$ 354,986

$ 327,225 LIABILITIES

AND STOCKHOLDERS’ EQUITY Current liabilities: Accounts

payable trade $ 4,964 $ 16,737 Accrued expenses and other current

liabilities 14,590 16,638 Deferred revenue 3,752 1,093 Deferred

income tax liabilities 23 12 Income taxes payable

22 159 Total

current liabilities 23,351 34,639 Long-term debt --- 931

Non-current deferred income tax liabilities

2,377 2,597

Total liabilities

25,728

38,167 Commitments and contingencies

Stockholders’ equity: Preferred stock, 1,000 shares

authorized, no shares issued and outstanding -- -- Common stock,

$.01 par value, 20,000,000 shares authorized, 13,147,416 and

12,942,066 shares issued and outstanding. 131 129 Additional

paid-in capital 70,704 65,985 Retained earnings 260,919 224,008

Accumulated other comprehensive loss

(2,496

) (1,064 )

Total stockholders’ equity

329,258

289,058 Total liabilities and

stockholders’ equity

$ 354,986

$ 327,225

GEOSPACE TECHNOLOGIES CORPORATION AND

SUBSIDIARIES

SUMMARY OF SEGMENT REVENUES

(in thousands)

(unaudited)

Three Months Ended Year Ended

September 30, 2014

September 30, 2013

September 30, 2014

September 30, 2013

Seismic segment: Traditional exploration products $ 8,729 $ 11,054

$ 52,001 $ 49,781 Wireless exploration products 8,303 8,771 78,636

87,316 Reservoir products

3,607

42,272 84,309

138,103 20,639 62,097 214,946 275,200

Non-Seismic segment 5,504 5,984 21,420 24,578 Corporate

142 207 546

829 Total revenues

$

26,285 $ 68,288

$ 236,912 $

300,607

Geospace TechnologiesWalter R. Wheeler, 713.986.4444President

and CEO

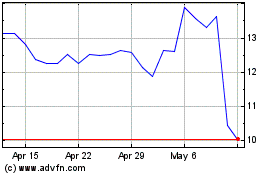

Geospace Technologies (NASDAQ:GEOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

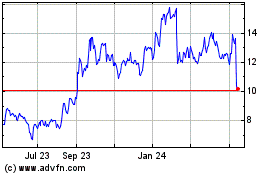

Geospace Technologies (NASDAQ:GEOS)

Historical Stock Chart

From Apr 2023 to Apr 2024