UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November 14, 2014

CONSOLIDATED COMMUNICATIONS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| |

|

|

|

|

|

Delaware

|

|

000-51446

|

|

02-0636095

|

|

(State of Incorporation)

|

|

(Commission File Number)

|

|

(IRS employer identification no.)

|

|

121 South 17th Street

|

|

|

|

Mattoon, Illinois

|

|

61938-3987

|

|

(Address of principal executive offices)

|

|

(Zip code)

|

Registrant’s telephone number, including area code: (217) 235-3311

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

On October 16, 2014, Consolidated Communications Holdings, Inc. (the “Company”) acquired Enventis Corporation, formerly Hickory Tech Corporation (“Enventis”) pursuant to a merger transaction.

As a result of that acquisition, under the Second Amended and Restated Credit Agreement, dated December 23, 2013, as amended, among the Company, as Parent Guarantor, Consolidated Communications, Inc. (“CCI”), as Borrower, the lenders referred to therein, Wells Fargo Bank, National Association, as administrative agent, and certain other parties thereto (the “Credit Agreement”), certain of the Enventis subsidiaries that the Company acquired through the merger transaction (the “Enventis Subsidiaries”) were required to guarantee certain obligations under the Credit Agreement and to pledge as collateral, and grant liens on and security interests in, all assets and property of such Enventis Subsidiaries as provided for in or contemplated by the Credit Agreement, whether now owned or existing or hereafter acquired or arising. The Enventis Subsidiaries have become parties to the Credit Agreement by executing a Joinder Agreement dated as of November 14, 2014. The Joinder Agreement is filed as Exhibit 4.1 hereto.

In addition, as a result of the Enventis Subsidiaries becoming guarantors under the Credit Agreement, each Enventis Subsidiary was also required to guarantee $200,000,000 aggregate principal amount of 6.50% Senior Notes due 2022 (the “2022 Notes”) of CCI issued pursuant to that certain indenture dated as of September 18, 2014, as supplemented by a First Supplemental Indenture dated as of October 16, 2014 (as supplemented, the “Indenture”), by and among CCI, the Guarantors named therein, and Wells Fargo Bank, National Association, as trustee (the “Trustee”). In addition, as a result of the Enventis Subsidiaries becoming guarantors under the 2022 Notes, each Enventis Subsidiary was required to become a party to a Registration Rights Agreement among CCI, Morgan Stanley & Co. LLC and the guarantors named therein, with respect to the 2022 Notes dated as of September 18, 2014, as amended by a Joinder dated as of October 16, 2014 (as amended, the “Registration Rights Agreement”). For a description of the Indenture and the Registration Rights Agreement, see the Current Reports on Form 8-K filed by the Company on September 24, 2014 and October 22, 2014, which are incorporated herein by reference.

On November 14, 2014, CCI, the Enventis Subsidiaries and the Trustee entered into a Second Supplemental Indenture, dated as of November 14, 2014, to the Indenture, pursuant to which the Enventis Subsidiaries guaranteed the 2022 Notes. The Enventis Subsidiaries have also become parties to the Registration Rights Agreement by executing a Joinder dated November 14, 2014. The Second Supplemental Indenture is filed as Exhibit 4.2 hereto and the Joinder is filed as Exhibit 4.3 hereto.

In addition, as a result of the Enventis Subsidiaries becoming guarantors under the Credit Agreement, each Enventis Subsidiary was also required to guarantee $300,000,000 aggregate principal amount of 10.875% Senior Notes due 2020 (the “2020 Notes”) of CCI issued pursuant to that certain Indenture dated as of May 30, 2012, as supplemented and amended (as supplemented and amended, the “2020 Notes Indenture”), by and among CCI, the Guarantors named therein, and Wells Fargo Bank, National Association, as trustee. On November 14, 2014, CCI, the Enventis Subsidiaries and the Trustee entered into a Fifth Supplemental Indenture, dated as of November 14, 2014, to the 2020 Indenture pursuant to which the Enventis Subsidiaries guaranteed the 2020 Notes. The Fifth Supplemental Indenture is filed as Exhibit 4.4 hereto.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

Exhibit No.

|

|

Description

|

| |

|

|

|

4.1*

|

|

Joinder Agreement, dated as of November 14, 2014, among Enventis Corporation, Cable Network, Inc., Crystal Communications, Inc., Enventis Telecom, Inc., Heartland Telecommunications Company of Iowa, Inc., Mankato Citizens Telephone Company, Mid-Communications, Inc., National Independent Billing, Inc., Ideaone Telecom, Inc., and Enterprise Integration Services, Inc. (collectively, the “Enventis Subsidiaries”), the Company, CCI, and Wells Fargo Bank, National Association, a national banking association, as Administrative Agent for the Lenders under the Credit Agreement

|

| |

|

|

|

4.2

|

|

Second Supplemental Indenture, dated as of November 14, 2014, among CCI, each of the Enventis Subsidiaries, and Wells Fargo Bank, National Association

|

| |

|

|

|

4.3

|

|

Joinder to Registration Rights Agreement, dated as of November 14, 2014, by each of the Enventis Subsidiaries

|

| |

|

|

|

4.4

|

|

Fifth Supplemental Indenture, dated as of November 14, 2014, among CCI, each of the Enventis Subsidiaries, and Wells Fargo Bank, National Association

|

* Annexes to the Joinder Agreement, which are listed in the exhibit, are omitted. The Company agrees to furnish supplementally a copy of any annex to the Securities and Exchange Commission upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: November 20, 2014

|

|

|

| |

Consolidated Communications Holdings, Inc.

|

| |

|

|

| |

By:

|

/s/ Steven L. Childers

|

| |

Name: Steven L. Childers

Title: Chief Financial Officer

|

| |

|

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

| |

|

|

|

4.1*

|

|

Joinder Agreement, dated as of November 14, 2014, among Enventis Corporation, Cable Network, Inc., Crystal Communications, Inc., Enventis Telecom, Inc., Heartland Telecommunications Company of Iowa, Inc., Mankato Citizens Telephone Company, Mid-Communications, Inc., National Independent Billing, Inc., Ideaone Telecom, Inc., and Enterprise Integration Services, Inc. (collectively, the “Enventis Subsidiaries”), the Company, CCI, and Wells Fargo Bank, National Association, a national banking association, as Administrative Agent for the Lenders under the Credit Agreement

|

| |

|

|

|

4.2

|

|

Second Supplemental Indenture, dated as of November 14, 2014, among CCI, each of the Enventis Subsidiaries, and Wells Fargo Bank, National Association

|

| |

|

|

|

4.3

|

|

Joinder to Registration Rights Agreement, dated as of November 14, 2014, by each of the Enventis Subsidiaries

|

| |

|

|

|

4.4

|

|

Fifth Supplemental Indenture, dated as of November 14, 2014, among CCI, each of the Enventis Subsidiaries, and Wells Fargo Bank, National Association

|

* Annexes to the Joinder Agreement, which are listed in the exhibit, are omitted. The Company agrees to furnish supplementally a copy of any annex to the Securities and Exchange Commission upon request.

Exhibit 4.1

JOINDER AGREEMENT

THIS JOINDER AGREEMENT, dated as of November 14, 2014 (the “Agreement”), to the Guaranty Agreement and the Collateral Agreement referred to below is entered into by and among CONSOLIDATED COMMUNICATIONS, INC., an Illinois corporation (the “Borrower”), CONSOLIDATED COMMUNICATIONS HOLDINGS, INC., a Delaware corporation (“Holdings”), ENVENTIS CORPORATION, a Minnesota corporation, CABLE NETWORK, INC., a Minnesota corporation, CRYSTAL COMMUNICATIONS, INC., a Minnesota Corporation, ENVENTIS TELECOM, INC., a Minnesota corporation, HEARTLAND TELECOMMUNICATIONS COMPANY OF IOWA, a Minnesota corporation, MANKATO CITIZENS TELEPHONE COMPANY, a Minnesota corporation, MID-COMMUNICATIONS, INC., a Minnesota corporation, NATIONAL INDEPENDENT BILLING, INC., a Minnesota corporation, IDEAONE TELECOM, INC., a Minnesota corporation, ENTERPRISE INTEGRATION SERVICES, INC., a Minnesota corporation (each a “New Subsidiary” and collectively, the “New Subsidiaries”), and WELLS FARGO BANK, NATIONAL ASSOCIATION, a national banking association, as Administrative Agent for the Lenders (the “Administrative Agent”) under the Credit Agreement referred to below.

Statement of Purpose

Reference is hereby made to that certain Second Amended and Restated Credit Agreement dated as of December 23, 2013 (as amended, restated, supplemented or otherwise modified, the “Credit Agreement”) among the Borrower, Holdings, the Lenders who are or may become party thereto (the “Lenders”) and the Administrative Agent. In connection with the Credit Agreement, Holdings, the Borrower and certain of their respective Subsidiaries have entered into the Collateral Agreement referred to therein and certain Subsidiaries of Holdings have entered into the Guaranty Agreement referred to therein.

On October 16, 2014, each New Subsidiary became a Domestic Subsidiary of the Borrower. Pursuant to Section 5.16 of the Credit Agreement, (a) each New Subsidiary will execute, among other documents, this Agreement in order (i) to become a Guarantor under the Guaranty Agreement and (ii) to become a Grantor and an Issuer, as applicable, under the Collateral Agreement and (b) the Borrower, as Grantor under the Collateral Agreement and owner of the Equity Interests of each New Subsidiary, will execute, among other documents, this Agreement, in order to confirm and reaffirm its pledge of one hundred percent (100%) of the Equity Interests of each New Subsidiary.

NOW THEREFORE, in consideration of the premises and other good and valuable consideration, the parties hereto hereby agree as follows:

Section 1. Guaranty Agreement Supplement.

(a) Each New Subsidiary hereby agrees that by execution of this Agreement it is a Guarantor under the Guaranty Agreement as if a signatory thereof on the Closing Date, and each New Subsidiary (i) shall comply with, and be subject to, and have the benefit of, all of the terms, conditions, covenants, agreements and obligations set forth in the Guaranty Agreement and (ii) hereby makes each representation and warranty set forth in the Guaranty Agreement.

(b) The Borrower and each New Subsidiary hereby agree that each reference to a “Guarantor” or the “Guarantors” in the Credit Agreement, the Guaranty Agreement and the other Loan Documents shall include each New Subsidiary, and each reference to the “Guaranty Agreement” or “Guaranty” as used therein shall mean the Guaranty Agreement as supplemented hereby.

Section 2. Collateral Agreement Supplement.

(a) Joinder to the Collateral Agreement.

(i) The Borrower and each New Subsidiary hereby agree that by execution of this Agreement, each New Subsidiary is a party to the Collateral Agreement as if a signatory thereof as a Grantor and as an Issuer on the Closing Date, and each New Subsidiary shall (A) comply with, and be subject to, and have the benefit of, all of the terms, covenants, conditions, agreements and obligations set forth in the Collateral Agreement and (B) hereby makes each representation and warranty set forth in the Collateral Agreement (subject to the information set forth on the schedules delivered pursuant to clause (d) below). The Borrower and each New Subsidiary hereby agree that each reference to a “Grantor”, the “Grantors”, an “Issuer” or the “Issuers” in the Collateral Agreement and the other Loan Documents shall include each New Subsidiary.

(ii) In order to secure the prompt and complete payment and performance when due (whether at the stated maturity, by acceleration or otherwise) of the Obligations in accordance with the terms of the Credit Agreement and the other Loan Documents, (A) each New Subsidiary hereby grants, pledges and collaterally assigns to the Administrative Agent, for the ratable benefit of itself and the Lenders, a security interest in and to all of such New Subsidiary’s right, title and interest in and to all Collateral whether now or at any time hereafter acquired by such New Subsidiary or in which such New Subsidiary now has or at any time in the future may acquire any right, title or interest, and wherever located or deemed located (collectively, the “New Collateral”) and (B) the Borrower hereby confirms and reaffirms that the Collateral of the Borrower includes one hundred percent (100%) of the Equity Interests owned by the Borrower in each New Subsidiary (collectively, the “Additional Investment Property”).

(iii) The Borrower and each New Subsidiary hereby agree that “Collateral” as used in the Collateral Agreement and the Credit Agreement shall include all New Collateral and all Additional Investment Property pledged pursuant hereto, “Investment Property” and “Partnership/LLC Interests”, as applicable, as used therein shall include the Additional Investment Property pledged pursuant hereto and “Collateral Agreement” or “Agreement” as used therein shall mean the Collateral Agreement as supplemented hereby.

(b) Filing Information and Perfection. The Borrower and each New Subsidiary shall deliver to the Administrative Agent such certificates and other documents (including, without limitation, UCC-1 financing statements, unit certificates and unit powers, as applicable) and take such action as the Administrative Agent shall reasonably request in order to effectuate the terms hereof and the Collateral Agreement.

(c) Acknowledgement and Consent. Each New Subsidiary hereby acknowledges receipt of a copy of the Collateral Agreement, the Guaranty Agreement and the other Loan Documents to which it is a party and agrees for the benefit of the Administrative Agent and the Lenders to be bound thereby and to comply with the terms thereof insofar as such terms are applicable to it.

(d) Schedules to the Credit Agreement and the Collateral Agreement. Attached hereto as Annex A is all information required to be provided on Schedules 3.09 and 3.10(b) to the Credit Agreement and each of the Schedules to the Collateral Agreement, as applicable, setting forth all information required to be provided therein with respect to each New Subsidiary.

Section 3. Effectiveness. This Agreement shall become effective upon receipt by the Administrative Agent of an originally executed counterpart hereof by the Administrative Agent, the Borrower and each New Subsidiary.

Section 4. General Provisions.

(a) Limited Effect. Except as expressly provided herein, the Credit Agreement and each other Loan Document shall continue to be, and shall remain, in full force and effect. This Agreement shall not be deemed (i) to be a waiver of, or consent to, or a modification or amendment of, any other term or condition of the Credit Agreement or any other Loan Document or (ii) to prejudice any right or rights which the Administrative Agent or any Lender may now have or may have in the future under or in connection with the Credit Agreement or the other Loan Documents or any of the instruments or agreements referred to therein, as the same may be amended or modified from time to time. References in the Credit Agreement to “this Agreement” (and indirect references such as “hereunder”, “hereby”, “herein”, and “hereof”) and in any Loan Document to the “Credit Agreement” shall be deemed to be references to the Credit Agreement as modified hereby.

(b) Costs and Expenses. The Borrower and each other Loan Party, jointly and severally, shall pay or reimburse the Administrative Agent for all of its out-of-pocket costs and expenses incurred in connection with the preparation, negotiation and execution of this Agreement including, without limitation, the reasonable fees and disbursements of counsel.

(c) Counterparts. This Agreement may be executed in any number of counterparts and by different parties hereto in different counterparts, each of which when so executed shall be deemed to be an original and shall be binding upon all parties, their successors and assigns, and all of which when taken together shall constitute one and the same agreement.

(d) Definitions. The following capitalized terms used and not defined herein shall have the meanings given thereto in the Collateral Agreement: “Grantor”, “Investment Property”, “Issuer”, “Partnership/LLC Interest” and “Security Interest”. All other capitalized terms used and not defined herein shall have the meanings given thereto in the Credit Agreement or the applicable Loan Document referred to therein.

(e) GOVERNING LAW. THIS AGREEMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH THE LAW OF THE STATE OF NEW YORK.

(f) Electronic Transmission. A facsimile, telecopy or other reproduction of this Agreement may be executed by one or more parties hereto, and an executed copy of this Agreement may be delivered by one or more parties hereto by facsimile or similar instantaneous electronic transmission device pursuant to which the signature of or on behalf of such party can be seen, and such execution and delivery shall be considered valid, binding and effective for all purposes. At the request of any party hereto, all parties hereto agree to execute an original of this Agreement as well as any facsimile, telecopy or other reproduction hereof.

[Signature Pages Follow]

IN WITNESS WHEREOF the undersigned hereby causes this Agreement to be executed and delivered as of the date first above written.

| |

NEW SUBSIDIARIES:

|

| |

|

|

| |

ENVENTIS CORPORATION, as a Guarantor, Grantor and Issuer

|

| |

|

|

| |

By: |

/s/ Steven L. Childers

|

| |

Name: |

Steven L. Childers

|

| |

Title: |

Chief Financial Officer

|

| |

|

|

| |

CABLE NETWORK, INC., as a Guarantor, Grantor and Issuer

|

| |

|

|

| |

By: |

/s/ Steven L. Childers

|

| |

Name: |

Steven L. Childers

|

| |

Title: |

Chief Financial Officer

|

| |

|

|

| |

CRYSTAL COMMUNICATIONS, INC., as a Guarantor, Grantor and Issuer

|

| |

|

|

| |

By: |

/s/ Steven L. Childers

|

| |

Name: |

Steven L. Childers

|

| |

Title: |

Chief Financial Officer

|

| |

|

|

| |

ENVENTIS TELECOM, INC., as a Guarantor, Grantor and Issuer

|

| |

|

|

| |

By: |

/s/ Steven L. Childers

|

| |

Name: |

Steven L. Childers

|

| |

Title: |

Chief Financial Officer

|

| |

|

|

| |

HEARTLAND TELECOMMUNICATIONS COMPANY OF IOWA, as a Guarantor, Grantor and Issuer

|

| |

|

|

| |

By: |

/s/ Steven L. Childers

|

| |

Name: |

Steven L. Childers

|

| |

Title: |

Chief Financial Officer

|

| |

|

|

| |

MANKATO CITIZENS TELEPHONE COMPANY, as a Guarantor, Grantor and Issuer

|

| |

|

|

| |

By: |

/s/ Steven L. Childers

|

| |

Name: |

Steven L. Childers

|

| |

Title: |

Chief Financial Officer

|

Joinder Agreement

Enventis Corporation

Signature Page

| |

MID-COMMUNICATIONS, INC., as a Guarantor, Grantor and Issuer

|

| |

|

|

| |

By: |

/s/ Steven L. Childers

|

| |

Name: |

Steven L. Childers

|

| |

Title: |

Chief Financial Officer

|

| |

|

|

| |

NATIONAL INDEPENDENT BILLING, INC as a Guarantor, Grantor and Issuer

|

| |

|

|

| |

By: |

/s/ Steven L. Childers

|

| |

Name: |

Steven L. Childers

|

| |

Title: |

Chief Financial Officer

|

| |

|

|

| |

IDEAONE TELECOM, INC., as a Guarantor, Grantor and Issuer

|

| |

|

|

| |

By: |

/s/ Steven L. Childers

|

| |

Name: |

Steven L. Childers

|

| |

Title: |

Chief Financial Officer

|

| |

|

|

| |

ENTERPRISE INTEGRATION SERVICES, INC as a Guarantor, Grantor and Issuer

|

| |

|

|

| |

By: |

/s/ Steven L. Childers

|

| |

Name: |

Steven L. Childers

|

| |

Title: |

Chief Financial Officer

|

| |

|

|

| |

BORROWER:

|

| |

|

|

| |

CONSOLIDATED COMMUNICATIONS, INC., as Borrower and Grantor

|

| |

|

|

| |

By: |

/s/ Steven L. Childers

|

| |

Name: |

Steven L. Childers

|

| |

Title: |

Chief Financial Officer

|

| |

|

|

Joinder Agreement

Enventis Corporation

Signature Page

| |

ADMINISTRATIVE AGENT:

|

| |

|

|

| |

WELLS FARGO BANK, NATIONAL ASSOCIATION, as Administrative Agent

|

| |

|

|

| |

By: |

/s/ Kieran Mahon

|

| |

Name: |

Kieran Mahon

|

| |

Title: |

Vice President

|

Joinder Agreement

Enventis Corporation

Signature Page

ANNEX A

TO

JOINDER AGREEMENT

(see attached)

Exhibit 4.2

Second Supplemental Indenture (this “Supplemental Indenture”), dated as of November 14, 2014 among Enventis Corporation, a Minnesota corporation, Cable Network, Inc., a Minnesota corporation, Crystal Communications, Inc., a Minnesota corporation, Enventis Telecom, Inc., a Minnesota corporation, Heartland Telecommunications Company of Iowa, Inc., a Minnesota corporation, Mankato Citizens Telephone Company, a Minnesota corporation, Mid-Communications, Inc., a Minnesota corporation, National Independent Billing, Inc., a Minnesota corporation, Ideaone Telecom, Inc., a Minnesota corporation, Enterprise Integration Services, Inc., a Minnesota corporation (each, a “Guaranteeing Subsidiary”), each a subsidiary of Consolidated Communications, Inc., an Illinois corporation (or its permitted successor) (the “Company”), the Company, and Wells Fargo Bank, National Association, a national banking association (or its permitted successor), as trustee under the Indenture referred to below (the “Trustee”). Capitalized terms used herein without definition shall have the meanings ascribed to them in the Indenture.

W I T N E S S E T H

WHEREAS, the Company and the other Guarantors party thereto have heretofore executed and delivered an Indenture, dated as of September 18, 2014 (as amended, supplemented or otherwise modified from time to time, the “Indenture”), providing for the issuance by the Company of its 6.50% Senior Notes due 2022 (the “Notes”);

WHEREAS, the Indenture provides that under certain circumstances a Guaranteeing Subsidiary shall execute and deliver to the Trustee a supplemental indenture pursuant to which such Guaranteeing Subsidiary shall, subject to Article 10 of the Indenture, unconditionally guarantee the Notes on the terms and conditions set forth therein (the “Note Guarantee”); and

WHEREAS, pursuant to Section 9.01 of the Indenture, the Trustee is authorized to execute and deliver this Supplemental Indenture.

NOW THEREFORE, in consideration of the foregoing and for other good and valuable consideration, the receipt and adequacy of which is hereby acknowledged, the Company, the Guaranteeing Subsidiaries and the Trustee mutually covenant and agree as follows for the benefit of each other and for the equal and ratable benefit of the Holders as follows:

ARTICLE 1

DEFINITIONS

Section 1.1 Defined Terms. As used in this Supplemental Indenture, terms defined in the Indenture or in the preamble or recitals hereto are used herein as therein defined. The words “herein,” “hereof” and “hereby” and other words of similar import used in this Supplemental Indenture refer to this Supplemental Indenture as a whole and not to any particular section hereof.

ARTICLE 2

AGREEMENT TO GUARANTEE

Section 2.1 Agreement to be Bound. Each Guaranteeing Subsidiary hereby becomes a party to the Indenture as a Guarantor and as such will have all of the rights and be subject to all of the obligations and agreements of a Guarantor under the Indenture.

Section 2.2 Guarantee. Each Guaranteeing Subsidiary agrees, on a joint and several basis with all the existing Guarantors, to fully, unconditionally and irrevocably Guarantee to each Holder of the Notes and the Trustee the Guaranteed Obligations pursuant to Article 10 of the Indenture on a senior basis.

ARTICLE 3

MISCELLANEOUS

Section 3.1 Execution and Delivery. Each Guaranteeing Subsidiary agrees that the Note Guarantee shall remain in full force and effect notwithstanding any failure to endorse on each Note a notation of the Note Guarantee.

Section 3.2 Benefits Acknowledged. Each Guaranteeing Subsidiary’s Note Guarantee is subject to the terms and conditions set forth in the Indenture. Each Guaranteeing Subsidiary acknowledges that it will receive direct and indirect benefits from the financing arrangements contemplated by the Indenture and this Supplemental Indenture and that the guarantee and waivers made by it pursuant to its Note Guarantee and this Supplemental Indenture are knowingly made in contemplation of such benefits.

Section 3.3 Ratification of Indenture; Supplemental Indentures Part of Indenture. Except as expressly amended hereby, the Indenture is in all respects ratified and confirmed and all the terms, conditions and provisions thereof shall remain in full force and effect. This Supplemental Indenture shall form a part of the Indenture for all purposes, and every Holder of Notes heretofore or hereafter authenticated and delivered shall be bound hereby.

Section 3.4 Severability. In case any provision in this Supplemental Indenture shall be invalid, illegal or unenforceable, the validity, legality and enforceability of the remaining provisions shall not in any way be affected or impaired thereby and such provision shall be ineffective only to the extent of such invalidity, illegality or unenforceability.

Section 3.5 Guaranteeing Subsidiary May Consolidate, Etc., on Certain Terms. No Guaranteeing Subsidiary may sell or otherwise dispose of all or substantially all of its assets to, or consolidate with or merge with or into, any Person other than as set forth in Section 10.04 of the Indenture.

Section 3.6 Release. Each Guaranteeing Subsidiary’s Note Guarantee shall be released as set forth in Section 10.05 of the Indenture.

Section 3.7 No Recourse Against Others. Pursuant to Section 12.07 of the Indenture, no director, officer, employee, incorporator or stockholder of any Guaranteeing Subsidiary shall have any liability for any obligations of the Guaranteeing Subsidiaries under the Notes, the Indenture, this Supplemental Indenture, the Note Guarantees or for any claim based on, in respect of, or by reason of, such obligations or their creation. This waiver and release are part of the consideration for the Note Guarantee.

Section 3.8 Governing Law. THE LAWS OF THE STATE OF NEW YORK SHALL GOVERN AND BE USED TO CONSTRUE THIS SUPPLEMENTAL INDENTURE.

Section 3.9 Waiver of Jury Trial. EACH GUARANTEEING SUBSIDIARY HEREBY IRREVOCABLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY LEGAL PROCEEDING ARISING OUT OF OR RELATING TO THIS SUPPLEMENTAL INDENTURE, THE INDENTURE, THE NOTES, THE NOTE GUARANTEES OR THE TRANSACTIONS CONTEMPLATED HEREBY.

Section 3.10 Counterparts. The parties may sign any number of copies of this Supplemental Indenture (including by electronic transmission). Each signed copy shall be an original, but all of them together represent the same agreement. The exchange of copies of this Supplemental Indenture and of signature pages by facsimile or PDF transmission shall constitute effective execution and delivery of this Supplemental Indenture as to the parties hereto and may be used in lieu of the original Supplemental Indenture for all purposes. Signatures of the parties hereto transmitted by facsimile or PDF shall be deemed to be their original signatures for all purposes.

Section 3.11 Effect of Headings. The Section headings herein are for convenience only and shall not affect the construction hereof.

Section 3.12 Trustee. The Trustee shall not be responsible in any manner whatsoever for or in respect of the validity or sufficiency of this Supplemental Indenture or for or in respect of the recitals contained herein, all of which recitals are made solely by the Guaranteeing Subsidiaries and the Company. In entering into this Supplemental Indenture, the Trustee shall be entitled to the benefit of every provision of the Indenture relating to the conduct or affeting the liability of or affording protection to the Trustee, including its right to be compensated, reimbursed and indemnified, whether or not elsewhere herein so provided.

[SIGNATURE PAGES FOLLOWS]

IN WITNESS WHEREOF, the parties hereto have caused this Supplemental Indenture to be duly executed and attested, all as of the date first above written.

| |

ENVENTIS CORPORATION

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

| |

CABLE NETWORK, INC.

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

| |

CRYSTAL COMMUNICATIONS, INC.

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

| |

ENVENTIS TELECOM, INC.

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

| |

HEARTLAND TELECOMMUNICATIONS COMPANY OF IOWA, INC.

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

[Signature Page to Second Supplemental Indenture]

| |

MANKATO CITIZENS TELEPHONE COMPANY

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

| |

MID-COMMUNICATIONS, INC.

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

| |

NATIONAL INDEPENDENT BILLING, INC.

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

| |

IDEAONE TELECOM, INC.

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

| |

ENTERPRISE INTEGRATION SERVICES, INC.

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

| |

CONSOLIDATED COMMUNICATIONS, INC.

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

[Signature Page to Second Supplemental Indenture]

| |

WELLS FARGO BANK, NATIONAL ASSOCIATION, as Trustee

|

| |

|

| |

By:

|

/s/ Julius Zamora

|

| |

|

Name:

|

Julius Zamora

|

| |

|

Title:

|

Vice President

|

[Signature Page to Second Supplemental Indenture]

Exhibit 4.3

$200,000,000

CONSOLIDATED COMMUNICATIONS, INC.

6.50% SENIOR NOTES DUE 2022

JOINDER TO REGISTRATION RIGHTS AGREEMENT

November 14, 2014

Morgan Stanley & Co. LLC

As Representative of the several Initial Purchasers

|

c/o

|

Morgan Stanley & Co. LLC

1585 Broadway

New York, New York 10036

|

Ladies and Gentlemen:

Reference is made to the Registration Rights Agreement dated as of September 18, 2014, as supplemented by a Joinder Agreement dated October 16, 2014 (the “Registration Rights Agreement”), among Consolidated Communications, Inc. (as successor to Consolidated Communications Finance II Co.), the Guarantors named therein and Morgan Stanley & Co. LLC. Capitalized terms used in this Joinder Agreement without definition have the respective meanings given to them in the Registration Rights Agreement.

The undersigned Guarantors hereby agree, on a joint and several basis, to accede to the terms of the Registration Rights Agreement and to undertake and perform all of the obligations of the “Guarantors” set forth therein as though the undersigned Guarantors had entered into the Registration Rights Agreement on the Closing Date and been named as “Guarantors” therein. The undersigned Guarantors agree that such obligations include, without limitation, (a) all of the obligations of the Guarantors to perform and comply with all of the agreements thereof contained in the Registration Rights Agreement, including the obligation to pay Additional Interest, and (b) the Guarantors’ indemnification and other obligations contained in Section 6 of the Registration Rights Agreement. Each of the undersigned Guarantors acknowledges and agrees that all references to the Guarantors in the Registration Rights Agreement shall include the undersigned Guarantors and that the undersigned Guarantors shall be bound by all provisions of the Registration Rights Agreement containing such references.

THIS JOINDER AGREEMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK.

This Joinder Agreement may be executed in any number of counterparts and by the parties hereto in separate counterparts, each of which when so executed shall be deemed to be an original and all of which taken together shall constitute one and the same agreement. Delivery of an executed counterpart of a signature page by facsimile, e-mail or other electronic means shall be effective as delivery of a manually executed counterpart.

[Signature Pages Follow]

IN WITNESS WHEREOF, the parties hereto have executed this Joinder Agreement as of the date first written above.

| |

ENVENTIS CORPORATION

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

|

|

| |

CABLE NETWORK, INC.

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

|

|

| |

CRYSTAL COMMUNICATIONS, INC.

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

|

|

| |

ENVENTIS TELECOM, INC.

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

|

|

| |

HEARTLAND TELECOMMUNICATIONS COMPANY OF IOWA, INC.

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

|

|

| |

MANKATO CITIZENS TELEPHONE COMPANY

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

[Signature Page to Joinder to Registration Rights Agreement]

| |

MID-COMMUNICATIONS, INC.

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

|

|

| |

NATIONAL INDEPENDENT BILLING, INC.

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

|

|

| |

IDEAONE TELECOM, INC.

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

|

|

| |

ENTERPRISE INTEGRATION SERVICES, INC.

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

[Signature Page to Joinder to Registration Rights Agreement]

Exhibit 4.4

Fifth Supplemental Indenture (this “Supplemental Indenture”), dated as of November 14, 2014 among Enventis Corporation, a Minnesota corporation, Cable Network, Inc., a Minnesota corporation, Crystal Communications, Inc., a Minnesota corporation, Enventis Telecom, Inc., a Minnesota corporation, Heartland Telecommunications Company of Iowa, Inc., a Minnesota corporation, Mankato Citizens Telephone Company, a Minnesota corporation, Mid-Communications, Inc., a Minnesota corporation, National Independent Billing, Inc., a Minnesota corporation, Ideaone Telecom, Inc., a Minnesota corporation, Enterprise Integration Services, Inc., a Minnesota corporation (each, a “Guaranteeing Subsidiary”), each a subsidiary of Consolidated Communications, Inc., an Illinois corporation (or its permitted successor) (the “Company”), the Company, and Wells Fargo Bank, National Association, a national banking association (or its permitted successor), as trustee under the Indenture referred to below (the “Trustee”). Capitalized terms used herein without definition shall have the meanings ascribed to them in the Indenture.

W I T N E S S E T H

WHEREAS, the Company and the other Guarantors party thereto have heretofore executed and delivered an Indenture, dated as of May 30, 2012 (as amended, supplemented or otherwise modified from time to time, the “Indenture”), providing for the issuance by the Company of its 10.875% Senior Notes due 2020 (the “Notes”);

WHEREAS, the Indenture provides that under certain circumstances a Guaranteeing Subsidiary shall execute and deliver to the Trustee a supplemental indenture pursuant to which such Guaranteeing Subsidiary shall, subject to Article 10 of the Indenture, unconditionally guarantee the Notes on the terms and conditions set forth therein (the “Note Guarantee”); and

WHEREAS, pursuant to Section 9.01 of the Indenture, the Trustee is authorized to execute and deliver this Supplemental Indenture.

NOW THEREFORE, in consideration of the foregoing and for other good and valuable consideration, the receipt and adequacy of which is hereby acknowledged, the Company, the Guaranteeing Subsidiaries and the Trustee mutually covenant and agree as follows for the benefit of each other and for the equal and ratable benefit of the Holders as follows:

ARTICLE 1

DEFINITIONS

Section 1.1 Defined Terms. As used in this Supplemental Indenture, terms defined in the Indenture or in the preamble or recitals hereto are used herein as therein defined. The words “herein,” “hereof” and “hereby” and other words of similar import used in this Supplemental Indenture refer to this Supplemental Indenture as a whole and not to any particular section hereof.

ARTICLE 2

AGREEMENT TO GUARANTEE

Section 2.1 Agreement to be Bound. Each Guaranteeing Subsidiary hereby becomes a party to the Indenture as a Guarantor and as such will have all of the rights and be subject to all of the obligations and agreements of a Guarantor under the Indenture.

Section 2.2 Guarantee. Each Guaranteeing Subsidiary agrees, on a joint and several basis with all the existing Guarantors, to fully, unconditionally and irrevocably Guarantee to each Holder of the Notes and the Trustee the Guaranteed Obligations pursuant to Article 10 of the Indenture on a senior basis.

ARTICLE 3

MISCELLANEOUS

Section 3.1 Execution and Delivery. Each Guaranteeing Subsidiary agrees that the Note Guarantee shall remain in full force and effect notwithstanding any failure to endorse on each Note a notation of the Note Guarantee.

Section 3.2 Benefits Acknowledged. Each Guaranteeing Subsidiary’s Note Guarantee is subject to the terms and conditions set forth in the Indenture. Each Guaranteeing Subsidiary acknowledges that it will receive direct and indirect benefits from the financing arrangements contemplated by the Indenture and this Supplemental Indenture and that the guarantee and waivers made by it pursuant to its Note Guarantee and this Supplemental Indenture are knowingly made in contemplation of such benefits.

Section 3.3 Ratification of Indenture; Supplemental Indentures Part of Indenture. Except as expressly amended hereby, the Indenture is in all respects ratified and confirmed and all the terms, conditions and provisions thereof shall remain in full force and effect. This Supplemental Indenture shall form a part of the Indenture for all purposes, and every Holder of Notes heretofore or hereafter authenticated and delivered shall be bound hereby.

Section 3.4 Severability. In case any provision in this Supplemental Indenture shall be invalid, illegal or unenforceable, the validity, legality and enforceability of the remaining provisions shall not in any way be affected or impaired thereby and such provision shall be ineffective only to the extent of such invalidity, illegality or unenforceability.

Section 3.5 Guaranteeing Subsidiary May Consolidate, Etc., on Certain Terms. No Guaranteeing Subsidiary may sell or otherwise dispose of all or substantially all of its assets to, or consolidate with or merge with or into, any Person other than as set forth in Section 10.04 of the Indenture.

Section 3.6 Release. Each Guaranteeing Subsidiary’s Note Guarantee shall be released as set forth in Section 10.05 of the Indenture.

Section 3.7 No Recourse Against Others. Pursuant to Section 12.07 of the Indenture, no director, officer, employee, incorporator or stockholder of any Guaranteeing Subsidiary shall have any liability for any obligations of the Guaranteeing Subsidiaries under the Notes, the Indenture, this Supplemental Indenture, the Note Guarantees or for any claim based on, in respect of, or by reason of, such obligations or their creation. This waiver and release are part of the consideration for the Note Guarantee.

Section 3.8 Governing Law. THE LAWS OF THE STATE OF NEW YORK SHALL GOVERN AND BE USED TO CONSTRUE THIS SUPPLEMENTAL INDENTURE.

Section 3.9 Waiver of Jury Trial. EACH GUARANTEEING SUBSIDIARY HEREBY IRREVOCABLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY LEGAL PROCEEDING ARISING OUT OF OR RELATING TO THIS SUPPLEMENTAL INDENTURE, THE INDENTURE, THE NOTES, THE NOTE GUARANTEES OR THE TRANSACTIONS CONTEMPLATED HEREBY.

Section 3.10 Counterparts. The parties may sign any number of copies of this Supplemental Indenture (including by electronic transmission). Each signed copy shall be an original, but all of them together represent the same agreement. The exchange of copies of this Supplemental Indenture and of signature pages by facsimile or PDF transmission shall constitute effective execution and delivery of this Supplemental Indenture as to the parties hereto and may be used in lieu of the original Supplemental Indenture for all purposes. Signatures of the parties hereto transmitted by facsimile or PDF shall be deemed to be their original signatures for all purposes.

Section 3.11 Effect of Headings. The Section headings herein are for convenience only and shall not affect the construction hereof.

Section 3.12 Trustee. The Trustee shall not be responsible in any manner whatsoever for or in respect of the validity or sufficiency of this Supplemental Indenture or for or in respect of the recitals contained herein, all of which recitals are made solely by the Guaranteeing Subsidiaries and the Company. In entering into this Supplemental Indenture, the Trustee shall be entitled to the benefit of every provision of the Indenture relating to the conduct or affecting the liability of or affording protection to the Trustee, including its right to be compensated, reimbursed and indemnified, whether or not elsewhere herein so provided. The Company hereby confirms to the Trustee that this Supplemental Indenture has not resulted in a material modification of the Notes for Foreign Accounting Tax Compliance Act (“FATCA”) purposes. The Company shall give the Trustee prompt written notice of any material modification of the Notes deemed to occur for FATCA purposes. The Trustee shall assume that no material modification for FATCA purposes has occurred regarding the Notes, unless the Trustee receives written notice of such modification from the Company.

[SIGNATURE PAGES FOLLOWS]

IN WITNESS WHEREOF, the parties hereto have caused this Supplemental Indenture to be duly executed and attested, all as of the date first above written.

| |

ENVENTIS CORPORATION

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

|

|

| |

CABLE NETWORK, INC.

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

|

|

| |

CRYSTAL COMMUNICATIONS, INC.

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

|

|

| |

ENVENTIS TELECOM, INC.

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

|

|

| |

HEARTLAND TELECOMMUNICATIONS COMPANY OF IOWA, INC.

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

[Signature Page to Fifth Supplemental Indenture]

| |

MANKATO CITIZENS TELEPHONE COMPANY

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

|

|

| |

MID-COMMUNICATIONS, INC.

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

|

|

| |

NATIONAL INDEPENDENT BILLING, INC.

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

|

|

| |

IDEAONE TELECOM, INC.

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

|

|

| |

ENTERPRISE INTEGRATION SERVICES, INC.

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

|

|

| |

CONSOLIDATED COMMUNICATIONS, INC.

|

| |

|

| |

By:

|

/s/ Steven L. Childers

|

| |

|

Name:

|

Steven L. Childers

|

| |

|

Title:

|

Chief Financial Officer

|

[Signature Page to Fifth Supplemental Indenture]

| |

WELLS FARGO BANK, NATIONAL ASSOCIATION, as Trustee

|

| |

|

| |

By:

|

/s/ Julius Zamora

|

| |

|

Name:

|

Julius Zamora

|

| |

|

Title:

|

Vice President

|

[Signature Page to Fifth Supplemental Indenture]

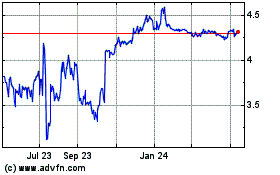

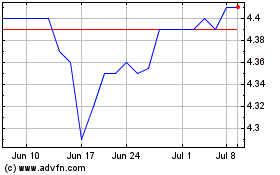

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Apr 2023 to Apr 2024