As filed with the Securities and Exchange Commission on November 19, 2014

Registration No. 333-

________________________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________________________________________

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

________________________________________________________________________________

LIFEVANTAGE CORPORATION

(Exact name of registrant as specified in charter)

________________________________________________________________________________

|

| | |

Colorado | | 90-0224471 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

| | |

9785 S. Monroe Street, Suite 300 |

Sandy, UT 84070 |

(Address of Principal Executive Offices) |

________________________________________________________________________________

LifeVantage Corporation 2010 Long-Term Incentive Plan

(Full title of the plan)

________________________________________________________________________________

Douglas C. Robinson

Chief Executive Officer

LifeVantage Corporation

9785 S. Monroe Street, Suite 300

Sandy, UT 84070

(801) 432-9000

(Name, address, and telephone number, including area code, of agent for service)

________________________________________________________________________________

Copies to:

Kirt W Shuldberg, Esq.

Sheppard, Mullin, Richter & Hampton LLP

12275 El Camino Real, Suite 200

San Diego, CA 92130

(858) 720-8900

________________________________________________________________________________

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer | ¨ | Accelerated filer | ý |

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

CALCULATION OF REGISTRATION FEE

|

| | | | |

Title of securities to be registered | Amount to be

registered (1)

| Proposed maximum offering price per

share (2)

| Proposed maximum aggregate offering price | Amount of registration fee |

Common Stock, $0.001 par value per share | 3,600,000 shares | $1.30 (2) | $4,680,000(2) | $543.82 |

| |

(1) | Pursuant to Rules 416 and 457 under the Securities Act of 1933, this registration statement shall also cover any additional shares of common stock that may become issuable under the LifeVantage Corporation 2010 Long-Term Incentive Plan (the “Plan”) by reason of any stock dividend, stock split, recapitalization or other similar transaction that results in an increase in the number of the outstanding shares of common stock of the registrant. |

| |

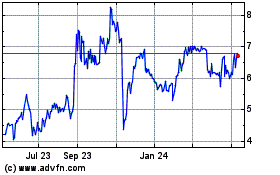

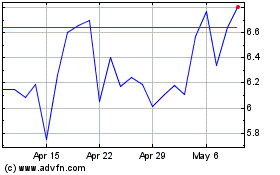

(2) | (i) Estimated pursuant to Rules 457(h) and 457(d) under the Securities Act of 1933 solely for the purpose of calculating the registration fee and is based on the average of the high and low prices of registrant’s common stock as reported on the NASDAQ Capital Market on November 13, 2014. |

(ii) Pursuant to General Instruction E to Form S-8, a filing fee is only being paid with respect to the registration of additional securities for the Plan. Registration statements on Form S-8 have been filed previously on June 23, 2011 (File No. 333-175104) and August 21, 2012 (File No. 333-183461) covering 3,500,000 and 3,400,000 shares of common stock, respectively, reserved for issuance pursuant to awards under the Plan.

The registration statement shall become effective upon filing in accordance with Rule 462(a) under the Securities Act of 1933.

EXPLANATORY NOTES

Incorporation by Reference. This registration statement is filed pursuant to General Instruction E to Form S-8. The contents of the registration statement on Form S-8 (File No. 333-175104) are incorporated herein by reference and made a part hereof.

Registration of Additional Shares of Common Stock Under the Plan. This registration statement is filed by the registrant to register an additional 3,600,000 shares of its common stock, par value $0.001 per share, which may be issuable under the LifeVantage Corporation 2010 Long-Term Incentive Plan pursuant to an amendment of such plan authorized by the shareholders of the registrant on November 19, 2014.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference

The contents of the registration statement on Form S-8 (File No. 333-175104) are incorporated herein by reference and made a part hereof. In addition, the following documents and information previously filed by the registrant with the Securities and Exchange Commission (“SEC”) are hereby incorporated by reference in this registration statement:

| |

(a) | the registrant’s annual report on Form 10-K for the fiscal year ended June 30, 2014, filed on September 10, 2014; |

| |

(b) | the registrant’s quarterly report on Form 10-Q for the fiscal quarter ended September 30, 2014 filed on November 6, 2014; |

| |

(c) | the registrant’s current reports on Form 8-K filed on each of August 27, 2014 and November 6, 2014; |

| |

(d) | all reports filed by the registrant pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 since the end of the fiscal year covered by the registrant’s latest annual report; and |

| |

(e) | the description of the registrant’s common stock contained in the registrant’s registration statement on Form SB-2 filed under the Securities Act of 1933 on December 17, 2007, including any amendment or report filed for the purpose of updating such description. |

In addition, all documents subsequently filed by the registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, after the date of this registration statement and prior to the filing of a post-effective amendment which indicates that all securities offered have been sold or which deregisters all securities then remaining unsold, will be incorporated by reference into this registration statement from the date of filing of such documents. In no event, however, will any information that the registrant discloses under Item 2.02 or Item 7.01 of any current report on Form 8-K that the registrant may from time to time furnish to the SEC be incorporated by reference into, or otherwise become a part of, this registration statement.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for the purposes of this registration statement to the extent that a statement contained herein or in any other subsequently filed document which also is or deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this registration statement.

Item 4. Exhibits.

|

| | | |

Exhibit No. | | Description |

4.1 |

| | Amended and Restated Articles of Incorporation of the Company and Statement of Correction to Amended and Restated Articles of Incorporation of the Company. |

4.2 |

| | Amended and Restated Bylaws of the Company (incorporated herein by reference to Exhibit 3.2 to the registrant’s Form 10-K filed on September 28, 2011). |

4.3 |

| | First Amendment to the Amended and Restated Bylaws of the Company (incorporated herein by reference to Exhibit 3.1 to the Form 8-K filed on May 31, 2012). |

4.4 |

| | LifeVantage Corporation 2010 Long-Term Incentive Plan, as amended. |

4.5 |

| | Forms of Incentive Stock Option and Nonqualifying Stock Option Agreements (incorporated herein by reference to Exhibit 10.33 to registrant’s Form 10-K filed September 28, 2011). |

4.6 |

| | Form of Restricted Stock Grant Agreement for the 2010 Long-Term Incentive Plan (incorporated herein by reference to Exhibit 4.6 of the registrant's registration statement on Form S-8 (File No. 333-183461) filed on August 21, 2012). |

4.7 |

| | Form of Stock Appreciation Right (SAR) Agreement for the 2010 Long-Term Incentive Plan (incorporated here by reference to Exhibit 4.7 to the registrant's registration statement on Form S-8 (File No. 333-183461) filed on August 21, 2012). |

4.8 |

| | Form of Stock Unit Agreement for the 2010 Long-Term Incentive Plan. |

5.1 |

| | Opinion of Sheppard, Mullin, Richter & Hampton LLP. |

23.1 |

| | Consent of EKS&H LLLP, an Independent Registered Public Accounting Firm. |

23.2 |

| | Consent of Sheppard, Mullin, Richter & Hampton LLP (included in Exhibit 5.1 to this registration statement). |

24.1 |

| | Power of Attorney (included as part of the signature page to this registration statement). |

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Sandy, State of Utah on November 19, 2014.

|

| | | |

| LIFEVANTAGE CORPORATION |

| | |

| By: | | /s/ Rob Cutler |

| | | Rob Cutler |

| | | General Counsel |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Douglas C. Robinson, David S. Colbert and Robert H. Cutler, and each or any one of them, his true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, for him and in his name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments, exhibits thereto and other documents in connection therewith) to this registration statement, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or any of them, or their or his substitutes or substitute, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities indicated on the dates indicated.

|

| | | | |

Signature | | Title | | Date |

/s/ Douglas C. Robinson | | President, Chief Executive Officer and Director (Principal Executive Officer) | | November 19, 2014 |

Douglas C. Robinson | | |

| | |

/s/ David S. Colbert | | Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer) | | November 19, 2014 |

David S. Colbert | | |

| | |

/s/ Garry Mauro | | Chairman of the Board | | November 19, 2014 |

Garry Mauro | | |

| | |

/s/ Michael A. Beindorff | | Director | | November 19, 2014 |

Michael A. Beindorff | | |

| | |

/s/ Dave Manovich | | Director | | November 19, 2014 |

Dave Manovich | | |

| | |

/s/ George E. Metzger | | Director | | November 19, 2014 |

George E. Metzger | | |

| | |

/s/ Richard Okumoto | | Director | | November 19, 2014 |

Richard Okumoto | | |

INDEX TO EXHIBITS

|

| | | |

Exhibit No. | | Description |

4.1 |

| | Amended and Restated Articles of Incorporation of the Company and Statement of Correction to Amended and Restated Articles of Incorporation of the Company. |

4.2 |

| | Amended and Restated Bylaws of the Company (incorporated herein by reference to Exhibit 3.2 to the registrant’s Form 10-K filed on September 28, 2011). |

4.3 |

| | First Amendment to the Amended and Restated Bylaws of the Company (incorporated herein by reference to Exhibit 3.1 to the Form 8-K filed on May 31, 2012). |

4.4 |

| | LifeVantage Corporation 2010 Long-Term Incentive Plan, as amended. |

4.5 |

| | Forms of Incentive Stock Option and Nonqualifying Stock Option Agreements (incorporated herein by reference to Exhibit 10.33 to registrant’s Form 10-K filed September 28, 2011). |

4.6 |

| | Form of Restricted Stock Grant Agreement for the 2010 Long-Term Incentive Plan (incorporated herein by reference to Exhibit 4.6 of the registrant's registration statement on Form S-8 (File No. 333-183461) filed on August 21, 2012). |

4.7 |

| | Form of Stock Appreciation Right (SAR) Agreement for the 2010 Long-Term Incentive Plan (incorporated here by reference to Exhibit 4.7 to the registrant's registration statement on Form S-8 (File No. 333-183461) filed on August 21, 2012). |

4.8 |

| | Form of Stock Unit Agreement for the 2010 Long-Term Incentive Plan. |

5.1 |

| | Opinion of Sheppard, Mullin, Richter & Hampton LLP. |

23.1 |

| | Consent of EKS&H LLLP, an Independent Registered Public Accounting Firm. |

23.2 |

| | Consent of Sheppard, Mullin, Richter & Hampton LLP (included in Exhibit 5.1 to this registration statement). |

24.1 |

| | Power of Attorney (included as part of the signature page to this registration statement). |

Exhibit 4.1

AMENDED AND RESTATED

ARTICLES OF INCORPORATION

OF

LIFEVANTAGE CORPORATION

ARTICLE I

NAME OF CORPORATION

The name of this corporation (the “Corporation”) is Lifevantage Corporation.

ARTICLE II

PERIOD OF DURATION

The duration of the Corporation shall be perpetual.

ARTICLE III

PRINCIPAL OFFICE AND REGISTERED AGENT

The address of the Corporation’s principal office is: 6400 South Fiddler’s Green Circle, Suite 1970, Greenwood Village, Colorado 80111.

The registered agent of the Corporation is Gerald J. Houston at the Corporation’s principal office as set forth above.

ARTICLE IV

CORPORATE PURPOSE

The purpose of this Corporation is to engage in any lawful act or activity for which a corporation may be organized under the laws of Colorado.

ARTICLE V

AUTHORIZED CAPITAL STOCK

5.1. Number of Shares. The capital stock that the Corporation shall have authority to issue is three hundred million (300,000,000) shares, consisting of (a) two hundred-fifty million (250,000,000) shares of Common Stock and (b) fifty million (50,000,000) shares of Preferred Stock, par value of $.0001 per share.

5.2 Powers, Preferences and Rights of Capital Stock. The designations and the preferences, limitations and relative rights granted to or imposed upon the shares of each class of capital stock, except as the Board of Directors of the Corporation is herein authorized to determine by resolution, are as follows:

(a) Common Stock.

(i) Voting Rights. Except as expressly provided by law, or as provided by resolution of the Board of Directors pursuant to the authority granted under Section 5.2(b), all voting rights shall be vested in the holders of the Common Stock. Each holder of Common Stock shall be entitled to one vote for each share held on each matter to be voted on by the shareholders of the Corporation, except as otherwise provided in these Articles of Incorporation or by law.

(ii) Dividends. After the payment of any preferential dividends to the holders of shares of Preferred Stock, if any, and subject to any other applicable provisions of Section 5.2(b), dividends may be declared upon and paid to the holders of the Common Stock.

(iii) Rights Upon Liquidation. In the event of voluntary or involuntary liquidation or dissolution of the Corporation, after payment in full of all amounts required to be paid to the holders of the Preferred Stock, the holders of the Common Stock shall be entitled, to the extent not otherwise limited by the terms of any series of Preferred Stock then outstanding, to share ratably in all remaining assets of the Corporation.

(iv) Cumulative Voting. Cumulative voting shall not be used in the election of directors.

(v) Preemptive Rights. No shareholder of the Corporation shall have any preemptive rights to subscribe for, purchase or acquire any unissued shares of capital stock of the Corporation of any class, whether

now or hereafter authorized, or any obligations or other securities convertible into or exchangeable for any such shares.

(vi) Restrictions on Transfer. The Corporation shall have the right to restrict the transfer of any or all shares of capital stock at the time of issuance, or thereafter with the consent of the holder or holders of the shares to be restricted, the terms of said restriction to be clearly legended on the certificate or certificates representing such shares and set forth in the stock transfer records of the Corporation.

(vii) Quorum. At all meetings of the shareholders, a majority of the votes entitled to be cast on the matter by a voting group constitutes a quorum of that voting group for action on that matter.

(b) Preferred Stock. The Board of Directors is expressly authorized, at any time and from time to time, to provide for the issuance of shares of Preferred Stock in one or more series or classes, with such designation, preferences, limitations, and relative rights as shall be expressed in articles of amendment to these Articles of Incorporation, which shall be adopted by the Board of Directors and shall be effective without shareholder action, as provided in Section 7-106-102 of the Colorado Business Corporation Act (the “CBCA”).

5.3 Reclassification of Series A Common Stock. Immediately upon filing of these Articles of Incorporation with the Secretary of State of Colorado (the “Effective Time”), each share of the Corporation’s Series A Common Stock issued and outstanding immediately prior to the Effective Time (the “Series A Common Stock”) shall automatically, without further action on the part of the Corporation or any holder of Series A Common Stock, be reclassified into one share of Common Stock. The reclassification of the Series A Common Stock into Common Stock shall occur at the Effective Time regardless of when the certificates representing such Series A Common Stock are surrendered to the Corporation in exchange for certificates representing Common Stock. After the Effective Time, certificates representing the Series A Common Stock shall, until surrendered to the Corporation in exchange for Common Stock, represent the shares of Common Stock into which such Series A Common Stock shall have reclassified. Upon surrender by a holder of Series A Common Stock of a certificate or certificates for Common Stock, duly endorsed, to the Corporation for cancellation and reissuance, the Corporation shall, as soon as practicable thereafter, issue and deliver to such holder of a certificate representing Series A Common Stock, a certificate or certificates for the number of shares of Common Stock to which such holder shall be entitled as aforesaid.

ARTICLE VI

SHAREHOLDER ACTION BY WRITTEN CONSENT

Any action required or permitted by the CBCA to be taken at a shareholders’ meeting may be taken without a meeting if all of the shareholders entitled to vote thereon consent to such action in writing.

ARTICLE VII

BOARD OF DIRECTORS

All corporate powers of the Corporation shall be exercised by or under the authority of, and the business and affairs of the Corporation managed under the direction of, the Board of Directors of the Corporation. The authorized number of directors of the Corporation may be stated in or fixed in accordance with the bylaws of the Corporation.

ARTICLE VIII

AMENDMENT OF ARTICLES OF INCORPORATION

The Corporation expressly reserves the right to amend, alter, change or repeal any provision contained in, or to add any provisions to, its Articles of Incorporation from time to time, in any manner now or hereafter prescribed or permitted by the provisions of the statutes of the State of Colorado, and all rights and powers conferred upon directors and shareholders hereby are granted subject to this reservation.

ARTICLE IX

SHAREHOLDER VOTING

If a quorum exists at a meeting of shareholders of the Corporation, action on a matter other than the election of directors is approved if the votes cast within each voting group favoring the action exceed the votes cast

within such voting group opposing the action, unless the vote of a greater number is required by the CBCA or these Articles of Incorporation.

ARTICLE X

INDEMNIFICATION; LIMITATION ON LIABILITY

10.1 Indemnification. The Corporation shall indemnify, to the fullest extent permitted by applicable law in effect from time to time, any person, and the estate and personal representative of any such person, against all liability and expense (including attorneys’ fees) incurred by reason of the fact that he or she is or was a director or officer of the Corporation or, while serving as a director or officer of the Corporation, he or she is or was serving at the request of the Corporation as a director, officer, partner, trustee, employee, fiduciary, or agent of, or in any similar managerial or fiduciary position of, another entity corporation or other individual or entity or of an employee benefit plan. The Corporation shall also indemnify any person who is serving or has served the Corporation as director, officer, employee, fiduciary, or agent, and that person’s estate and personal representative, to the extent and in the manner provided in any bylaw, resolution of the shareholders or directors, contract, or otherwise, so long as such provision is legally permissible.

10.2 Director Liability. There shall be no personal liability of a director to the Corporation or to its shareholders for monetary damages for breach of fiduciary duty as a director, except that said personal liability shall not be eliminated to the Corporation or to the shareholders for monetary damages arising due to any breach of the director’s duty of loyalty to the Corporation or to the shareholders, acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, acts specified in Section 7-108-403 of the CBCA or any successor provision, or any transaction from which a director derived an improper personal benefit, or as otherwise limited by law. This Section 10.2 shall apply to any person who has ceased to be a director of the Corporation with respect to any breach of fiduciary duty which occurred when such person was serving as a director. This Section 10.2 shall not be construed to limit or modify in any way a director’s right to indemnification or other right whatsoever under these Articles of Incorporation, the Corporation’s bylaws, or the CBCA. If the CBCA is hereafter amended to authorize the further elimination of the liability of the Corporation’s directors, in addition to the limitation of personal liability provided herein, the directors’ liability shall be limited to the fullest extent permitted by the CBCA as so amended. Any repeal or modification of this Section 10.2 shall be prospective only and shall not adversely affect any limitation on the personal liability of any director existing at the time of such repeal or modification. The affirmative vote of at least two-thirds of shareholders’ total voting power shall be required to amend or repeal, or adopt any provision inconsistent with this Section 10.2.

ARTICLE XI

BUSINESS COMBINATIONS

11.1 Definitions. As used in this Article, the term:

(a) “Affiliate” means a person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, another person.

(b) “Associate,” when used to indicate a relationship with any person, means: (i) any corporation, partnership, unincorporated association or other entity of which such person is a director, officer or partner or is, directly or indirectly, the owner of 20% or more of any class of voting stock; (ii) any trust or other estate in which such person has at least a 20% beneficial interest or as to which such person serves as trustee or in a similar fiduciary capacity; and (iii) any relative or spouse of such person, or any relative of such spouse, who has the same residence as such person.

(c) “Business Combination” means:

(i) any merger, consolidation or plan of share exchange involving the Corporation or any direct or indirect majority-owned subsidiary of the Corporation with (A) an interested Shareholder (as hereinafter defined), or (B) with any other corporation, partnership, unincorporated association or other entity if the merger, consolidation or plan of share exchange is caused by the Interested Shareholder and as a result of such merger, consolidation or plan of share exchange Section 11.2 is not applicable to the surviving entity;

(ii) any sale, lease, exchange, mortgage, pledge, transfer or other disposition (in one transaction or a series of transactions), except proportionately with all other shareholders of the Corporation, to or with the

Interested Shareholder, whether as part of a dissolution or otherwise, of assets of the Corporation or of any direct or indirect majority-owned subsidiary of the Corporation which assets have an aggregate market value equal to 10% or more of either the aggregate market value of all the assets of the Corporation determined on a consolidated basis or the aggregate market value of all the outstanding stock of the Corporation;

(iii) any transaction which results in the issuance or transfer by the Corporation or by any direct or indirect majority-owned subsidiary of the Corporation of any stock of the Corporation or of such subsidiary to an Interested Shareholder, except: (A) pursuant to the exercise, exchange or conversion of securities exercisable for, exchangeable for or convertible into stock of the Corporation or any such subsidiary which securities were outstanding prior to the time that the Interested Shareholder became such (B) pursuant to a dividend or distribution paid or made, or the exercise, exchange or conversion of securities exercisable for, exchangeable for or convertible into stock of the Corporation or any such subsidiary which security is distributed, pro rata to all holders of a class or series of stock of the Corporation subsequent to the time the Interested Shareholder became such (C) pursuant to an exchange offer by the Corporation to purchase stock made on the same terms to all holders of said stock; or (D) any issuance or transfer of stock by the Corporation; provided however, that in no case under items (B)-(D) of this subparagraph shall there be an increase in the Interested Shareholder’s proportionate share of the stock of any class or series of the Corporation or of the voting stock of the Corporation;

(iv) any transaction involving the Corporation or any direct or indirect majority-owned subsidiary of the Corporation which has the effect, directly or indirectly, of increasing the proportionate share of the stock of any class or series, or securities convertible into the stock of any class or series, of the Corporation or of any such subsidiary which is owned by the Interested Shareholder, except as a result of immaterial changes due to fractional share adjustments or as a result of any purchase or redemption of any shares of stock not caused, directly or indirectly, by the Interested Shareholder; or

(v) any receipt by the Interested Shareholder of the benefit, directly or indirectly (except proportionately as a shareholder of the Corporation), of any loans, advances, guarantees, pledges or other financial benefits (other than those expressly permitted in subparagraphs (i)-(iv) of this paragraph) provided by or through the Corporation or any direct or indirect majority-owned subsidiary.

(d) “control,” including the terms “controlling,” “controlled by” and “under common control with,” means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a person, whether through the ownership of voting stock, by contract or otherwise. A person who is the owner of 20% or more of the outstanding voting stock of any corporation, partnership, unincorporated association or other entity shall be presumed to have control of such entity, in the absence of proof by a preponderance of the evidence to the contrary; notwithstanding the foregoing, a presumption of control shall not apply where such person holds voting stock, in good faith and not for the purpose of circumventing this section, as an agent, bank, broker, nominee, custodian or trustee for one or more owners who do not individually or as a group have control of such entity.

(e) “Interested Shareholder” means any person (other than the Corporation and any direct or indirect majority-owned subsidiary of the Corporation) that (i) is the owner of 15% or more of the outstanding voting stock of the Corporation, or (ii) is an Affiliate or Associate of the Corporation and was the owner of 15% or more of the outstanding voting stock of the Corporation at any time within the 3-year period immediately prior to the date on which it is sought to be determined whether such person is an Interested Shareholder, and the Affiliates and Associates of such person; provided, however, that the term “Interested Shareholder” shall not include any person whose ownership of shares in excess of the 15% limitation set forth herein is the result of action taken solely by the Corporation; provided that such person shall be an Interested Shareholder if thereafter such person acquires additional shares of voting stock of the Corporation, except as a result of further corporate action not caused, directly or indirectly, by such person. For the purpose of determining whether a person is an Interested Shareholder, the voting stock of the Corporation deemed to be outstanding shall include stock deemed to be owned by the person through application of Section 11.1(i) but shall not include any other unissued stock of the Corporation which may be issuable pursuant to any agreement, arrangement or understanding, or upon exercise of conversion rights, warrants or options, or otherwise.

(f) “person” means any individual, corporation, partnership, unincorporated association or other entity.

(g) “stock” means, with respect to any corporation, capital stock and, with respect to any other entity, any equity interest.

(h) “voting stock” means, with respect to any corporation, stock of any class or series entitled to vote generally in the election of directors and, with respect to any entity that is not a corporation, any equity interest entitled to vote generally in the election of the governing body of such entity. Every reference to a percentage of voting stock shall refer to such percentage of the votes of such voting stock.

(i) “owner,” including, the terms “own” and “owned,” when used with respect to any stock, means a person that individually or with or through any of its Affiliates or Associates:

(i) beneficially owns such stock, directly or indirectly; or

(ii) has (A) the right to acquire such stock (whether such right is exercisable immediately or only after the passage of time) pursuant to any agreement, arrangement or understanding, or upon the exercise of conversion rights, exchange rights, warrants or options, or otherwise; provided, however, that a person shall not be deemed the owner of stock tendered pursuant to a tender or exchange offer made by such person or any of such person’s Affiliates or Associates until such tendered stock is accepted for purchase or exchange; or (B) the right to vote such stock pursuant to any agreement, arrangement or understanding; provided, however, that a person shall not be deemed the owner of any stock because of such person’s right to vote such stock if the agreement, arrangement or understanding to vote such stock arises solely from a revocable proxy or consent given in response to a proxy or consent solicitation made to 10 or more persons; or

(iii) has any agreement, arrangement or understanding for the purpose of acquiring, holding, voting (except voting pursuant to a revocable proxy or consent as described in item (B) of subparagraph (ii) of this paragraph), or disposing of such stock with any other person that beneficially owns, or whose Affiliates or Associates beneficially own, directly or indirectly, such stock.

11.2 Restriction on Certain Business Combinations. Notwithstanding any other provisions contained in these Articles of Incorporation, the Corporation shall not engage in any Business Combination with any Interested Shareholder for a period of three (3) years following the time that such shareholder became an Interested Shareholder, unless:

(a) Prior to such time the Board of Directors of the Corporation approved either the Business Combination or the transaction which resulted in the shareholder becoming an Interested Shareholder;

(b) Upon consummation of the transaction which resulted in the shareholder becoming an Interested Shareholder, the Interested Shareholder owned at least 85% of the voting stock of the Corporation outstanding at the time the transaction commenced, excluding for purposes of determining the voting stock outstanding (but not the outstanding voting stock owned by the interested stockholder) those shares owned (i) by persons who are directors and also officers and (ii) employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or

(c) At or subsequent to such time the Business Combination is approved by the Board of Directors and authorized at an annual or special meeting, of shareholders, and not by written consent, by the affirmative vote of at least 66 2/3% of the outstanding voting stock which is not owned by the Interested Shareholder.

11.3 Exemptions. The restrictions contained in this Article XI shall not apply if:

(a) The Corporation, by action of the shareholders, adopts an amendment to these Articles of Incorporation expressly repealing this Article XI; provided that, in addition to any other vote required by law, such amendment to the Articles of Incorporation must be approved by the affirmative vote of a majority of the shares entitled to vote. An amendment adopted pursuant to this Section 11.3(a) shall not be effective until 12 months after the adoption of such amendment and shall not apply to any Business Combination between the Corporation and any person who became an Interested Shareholder of the Corporation on or prior to the date of such adoption;

(b) A shareholder becomes an Interested Shareholder inadvertently and (i) as soon as practicable divests itself of ownership of sufficient shares so that the shareholder ceases to be an Interested Shareholder; and (ii) would not, at any time within the 3-year period immediately prior to a Business Combination between the Corporation and such shareholder, have been an Interested Shareholder but for the inadvertent acquisition of ownership; or

(c) The Business Combination is proposed prior to the consummation or abandonment of and subsequent to the earlier of the public announcement or the notice required under this Article XI of a proposed transaction which (i) constitutes one of the transactions described in the second sentence of this Section 11.3(c); (ii) is with or by a person who either was not an Interested Shareholder during the previous 3 years or who became an Interested Shareholder with the approval of the Corporation’s Board of Directors; and (iii) is approved or not opposed by a majority of the members of the Board of Directors then in office (but not less than 1) who were directors prior to any person becoming an Interested Shareholder during the previous 3 years or were recommended for election or elected to succeed such directors by a majority of such directors. The proposed transactions referred to in the preceding sentence are limited to (x) a merger, consolidation or plan of share exchange involving the Corporation (except for a merger in respect of which, pursuant to Section 7-111-104 of the CBCA or any successor provision thereto, no vote of the shareholders of the Corporation is required); (y) a sale, lease, exchange, mortgage, pledge, transfer or other disposition (in one transaction or a series of transactions), whether as part of a dissolution or otherwise, of assets of the Corporation or of any direct or indirect majority-owned subsidiary of the Corporation (other than to any direct or indirect wholly-owned subsidiary or to the Corporation) having an aggregate market value equal to 50% or more of either that aggregate market value of all of the assets of the Corporation determined on a consolidated basis or the aggregate market value of all the outstanding stock of the Corporation; or (z) a proposed tender or exchange offer for 50% or more of the outstanding voting stock of the Corporation. The Corporation shall give not less than 20 days’ notice to all Interested Shareholders prior to the consummation of any of the transactions described in clause (x) or (y) of the second sentence of this Section 11.3(c).

11.4 Shareholder Vote Requirement. No provision of these Articles of Incorporation or the Corporation’s bylaws shall require, for any vote of shareholders required by this section, a greater vote of shareholders than that specified in this section.

STATEMENT OF CORRECTION

TO

AMENDED AND RESTATED

ARTICLES OF INCORPORATION

OF

LIFEVANTAGE CORPORATION

LIFEVANTAGE CORPORATION, a corporation organized and existing under and by virtue of the Colorado Business Corporation Act (the “Corporation”), hereby certifies as follows:

FIRST: The name of the Corporation is Lifevantage Corporation.

SECOND: The original Articles of Incorporation of the Corporation were filed with the Colorado Secretary of State on June 10, 1988 under the name Andraplex Corporation. Articles of Amendment to the Articles of Incorporation were filed with the Colorado Secretary of State on January 29, 1992 and September 30, 2004. The Amended and Restated Articles of Incorporation of the Corporation were filed with the Colorado Secretary of State on November 22, 2006.

THIRD: The Amended and Restated Articles of Incorporation of the Corporation filed with the Colorado Secretary of State on November 22, 2006 (the “Restated Articles”) require correction as permitted by Section 7-90-305 of the Colorado Business Corporation Act and part 3 of Article 90 of Title 7 of the Colorado Revised Statutes.

FOURTH: The inaccuracy of the Restated Articles is found in Section 5.1 of Article V of the Restated Articles. The par value of the Corporation’s Common Stock was omitted from the Restated Articles and the par value of the Corporation’s Preferred Stock was incorrectly stated in the Restated Articles.

FIFTH: Section 5.1 of Article V of the Corporation’s Restated Articles shall be amended and restated to read in its entirety as follows:

5.1 Number of Shares. The capital stock that the Corporation shall have authority to issue is three hundred million (300,000,000) shares, consisting of (a) two hundred-fifty million (250,000,000) shares of Common Stock, par value of $.001 per share, and (b) fifty million (50,000,000) shares of Preferred Stock, par value of $.001 per share.

SIXTH: The foregoing correction to the Amended and Restated Articles of Incorporation of the Corporation has been executed, acknowledged and filed in accordance with the provisions of Section 7‑90-305 of the Colorado Business Corporation Act and part 3 of Article 90 of Title 7 of the Colorado Revised Statutes.

[Signature Page Follows]

IN WITNESS WHEREOF, the Corporation has caused this Statement of Correction to be signed by its Chief Executive Officer this 17th day of May, 2007.

LIFEVANTAGE CORPORATION

By: /s/ James J. Krejci

Name: James J. Krejci

Title: Chief Executive Officer

Exhibit 4.4

LIFEVANTAGE CORPORATION

2010 LONG-TERM INCENTIVE PLAN

(Effective as of September 27, 2010 and as amended on August 21, 2014 to increase the number of authorized shares set forth in Section 5(a) from 6,900,000 to 10,500,000)

The Board adopted the Lifevantage Corporation 2010 Long-Term Incentive Plan on the Adoption Date and the Plan was subsequently amended on January 10, 2012 and the Plan was in each such instance timely approved by Company shareholders. On August 21, 2014, the Board amended the Plan (as set forth herein) to increase the maximum aggregate number of Shares that may be issued under the Plan (and pursuant to the exercise of Incentive Stock Options) from 6,900,000 to 10,500,000 Shares (“2014 Amendment”). The 2014 Amendment is conditioned upon and subject to obtaining Company shareholder approval in accordance with Section 15(a).

The purposes of the Plan are to (i) attract and retain the services of persons eligible to participate in the Plan; (ii) motivate Selected Employees, by means of appropriate equity and performance based incentives, to achieve long-term performance goals; (iii) provide equity and performance based incentive compensation opportunities that are competitive with those of other similar companies; and (iv) further align Participants' interests with those of the Company's other shareholders and thereby promote the financial interests of the Company and its affiliates and enhancement of shareholder return.

The Plan seeks to achieve this purpose by providing for Awards in the form of Options (which may constitute Incentive Stock Options or Nonstatutory Stock Options), Stock Appreciation Rights, Restricted Stock Grants, Stock Units and/or Cash Awards.

Capitalized terms shall have the meaning provided in Section 2 unless otherwise provided in this Plan or any related Stock Option Agreement, SAR Agreement, Restricted Stock Grant Agreement or Stock Unit Agreement.

(a)"Adoption Date" means September 27, 2010.

(b)"Affiliate" means any entity other than a Subsidiary, if the Company and/or one or more Subsidiaries own not less than 50% of such entity. For purposes of determining an individual's "Service," this definition shall include any entity other than a Subsidiary, if the Company, a Parent and/or one or more Subsidiaries own not less than 50% of such entity.

(c)"Award" means any award, under this Plan, to a Selected Employee of an Option, SAR, Restricted Stock Grant, Stock Unit or to a Covered Employment of any Cash Award.

(d)"Board" means the Board of Directors of the Company, as constituted from time to time.

(e)"Cash Award" means an award of a bonus opportunity, under this Plan, to a Covered Employee that is (i) payable only in cash, (ii) not an Option, SAR, Restricted Stock Grant or Stock Unit, (iii) paid based on achievement of Performance Goal(s) and (iv) intended to qualify as performance-based compensation under Code Section 162(m).

(f)"Cashless Exercise" means, to the extent that a Stock Option Agreement so provides and as permitted by applicable law and in accordance with any procedures established by the Committee, an arrangement whereby payment of some or all of the aggregate Exercise Price may be made all or in part by delivery of an irrevocable direction to a securities broker to sell Shares and to deliver all or part of the sale proceeds to the Company. Cashless Exercise may also be utilized to satisfy an Option's tax withholding obligations as provided in Section 14(b).

(g)"Cause" means, except as may otherwise be provided in a Participant employment agreement or applicable Award agreement (and in such case the employment agreement or Award agreement shall govern as to the definition of Cause), (i) dishonesty or fraud, (ii) serious willful misconduct, (iii) unauthorized use or disclosure of confidential information or trade secrets, (iv) conviction or confession of a felony, or (v) any other act or omission by a Participant that, in the opinion of the Company, could reasonably be expected to adversely affect the Company's or a Subsidiary's or an Affiliate's business, financial condition, prospects and/or reputation. In each of the foregoing subclauses (i) through (v), whether or not a "Cause" event has occurred will be determined by the Company's chief human resources officer or other person performing that function or, in the case of Participants who are Directors or Officers or Section 16 Persons, the Board, each of whose determination shall be final, conclusive and binding. A Participant's Service shall be deemed to have terminated for Cause if, after the Participant's Service has terminated, facts and circumstances are discovered that would have justified a termination for Cause, including, without limitation, violation of material Company policies or breach of confidentiality or other restrictive covenants that may apply to the Participant.

(h)"Change in Control" except as may otherwise be provided in a Participant employment agreement or applicable Award agreement (and in such case the employment agreement or Award agreement shall govern as to the definition of Change in Control), means the occurrence of any one or more of the following: (i) any merger, consolidation or business combination in which the shareholders of the Company immediately prior to the merger, consolidation or business combination do not own at least a majority of the outstanding equity interests of the surviving parent entity, (ii) the sale of all or substantially all of the Company's assets, (iii) the acquisition of beneficial ownership or control of (including, without limitation, power to vote) a majority of the outstanding Shares by any person or entity (including a "group" as defined by or under Section 13(d)(3) of the Exchange Act), (iv) the dissolution or liquidation of the Company, (v) a contested election of directors, as a result of which or in connection with which the persons who were directors of the Company before such election or their nominees cease to constitute a majority of the Board, or (vi) any other event specified by the Board or the Committee.

A transaction shall not constitute a Change in Control if its sole purpose is to change the state of the Company's incorporation or to create a holding company that will be owned in substantially the same proportions by the persons who held the Company's securities immediately before such transactions.

(i)"Code" means the Internal Revenue Code of 1986, as amended, and the regulations and interpretations promulgated thereunder.

(j)"Committee" means a committee described in Section 3.

(k)"Common Stock" means the Company's common stock, $0.001 par value per Share, and any other securities into which such shares are changed, for which such shares are exchanged or which may be issued in respect thereof.

(l)"Company" means Lifevantage Corporation, a Colorado corporation.

(m)"Consultant" means an individual (or entity) which performs bona fide services to the Company, a Parent, a Subsidiary or an Affiliate, other than as an Employee or Director or Non-Employee Director.

(n)"Covered Employees" means those individuals whose compensation is subject to the deduction limitations of Code Section 162(m).

(o)"Director" means a member of the Board who is also an Employee.

(p)"Disability" means, except as may otherwise be provided in a Participant employment agreement or applicable Award agreement (and in such case the employment agreement or Award agreement shall govern as to the definition of Disability), that the Participant is classified as disabled under a long-term disability policy of the Company or, if no such policy applies, the Participant is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or which has lasted or can be expected to last for a continuous period of not less than 12 months.

(q)"Employee" means any individual who is a common-law employee of the Company, or of a Parent, or of a Subsidiary or of an Affiliate.

(r)"Equity Award" means any Award other than a Cash Award.

(s)"Exchange Act" means the Securities Exchange Act of 1934, as amended.

(t)"Exercise Price" means, in the case of an Option, the amount for which a Share may be purchased upon exercise of such Option, as specified in the applicable Stock Option Agreement. "Exercise Price," in the case of a SAR, means an amount, as specified in the applicable SAR Agreement, which is subtracted from the Fair Market Value in determining the amount payable to a Participant upon exercise of such SAR.

(u)"Fair Market Value" means the market price of a Share, determined by the Committee as follows:

(i)If the Shares were traded on a stock exchange (such as the New York Stock Exchange, NYSE Amex, the NASDAQ Global Market or NASDAQ Capital Market) at the time of determination, then the Fair Market Value shall be equal to the regular session closing price for such stock as reported by such exchange (or the exchange or market with the greatest volume of trading in the Shares) on the date of determination, or if there were no sales on such date, on the last date preceding such date on which a closing price was reported;

(ii)If the Shares were traded on the OTC Bulletin Board at the time of determination, then the Fair Market Value shall be equal to the last-sale price reported by the OTC Bulletin Board for such date, or if there were no sales on such date, on the last date preceding such date on which a sale was reported; and

(iii)If neither of the foregoing provisions is applicable, then the Fair Market Value shall be determined by the Committee in good faith using a reasonable application of a reasonable valuation method as the Committee deems appropriate.

Whenever possible, the determination of Fair Market Value by the Committee shall be based on the prices reported by the applicable exchange or the OTC Bulletin Board, as applicable, or a nationally recognized publisher of stock prices or quotations (including an electronic on-line publication). Such determination shall be conclusive and binding on all persons.

(v)"Fiscal Year" means the Company's fiscal year.

(w)"Incentive Stock Option" or "ISO" means an incentive stock option described in Code Section 422.

(x)"Net Exercise" means, to the extent that a Stock Option Agreement so provides and as permitted by applicable law, an arrangement pursuant to which the number of Shares issued to the Optionee in connection with the Optionee's exercise of the Option will be reduced by the Company's retention of a portion of such Shares. Upon such a net exercise of an Option, the Optionee will receive a net number of Shares that is equal to (i) the number of Shares as to which the Option is being exercised minus (ii) the quotient (rounded down to the nearest whole number) of the aggregate Exercise Price of the Shares being exercised divided by the Fair Market Value of a Share on the Option exercise date. The number of Shares covered by clause (ii) will be retained by the Company and not delivered to the Optionee. No fractional Shares will be created as a result of a Net Exercise and the Optionee must contemporaneously pay for any portion of the aggregate Exercise Price that is not covered by the Shares retained by the Company under clause (ii). The number of Shares delivered to the Optionee may be further reduced if Net Exercise is utilized under Section 14(b) to satisfy applicable tax withholding obligations.

(y)"Non-Employee Director" means a member of the Board who is not an Employee.

(z)"Nonstatutory Stock Option" or "NSO" means a stock option that is not an ISO.

(aa)"Officer" means an individual who is an officer of the Company within the meaning of Rule 16a-1(f) of the Exchange Act.

(ab)"Option" means an ISO or NSO granted under the Plan entitling the Optionee to purchase a specified number of Shares, at such times and applying a specified Exercise Price, as provided in the applicable Stock Option Agreement.

(ac)"Optionee" means an individual, estate or other entity that holds an Option.

(ad)"Parent" means any corporation (other than the Company) in an unbroken chain of corporations ending with the Company, if each of the corporations other than the Company owns stock possessing 50% or more of the total combined voting power of all classes of stock in one of the other corporations in such chain. A corporation that attains the status of a Parent on a date after the Adoption Date shall be considered a Parent commencing as of such date.

(ae)"Participant" means an individual or estate or other entity that holds an Award.

(af)"Performance Goals" means one or more objective performance targets established for a Participant which may be described in terms of Company-wide objectives and/or objectives that are related to the performance of the individual Participant or a Parent, Subsidiary, Affiliate, division, department or function within the Company or entity in which the Participant is employed, and such targets may be applied either individually, alternatively or in any combination, and measured either annually or cumulatively over a period of years, on an absolute basis or relative to a pre-established target, to previous years' results or to a designated comparison group, in each case as specified by the Committee. Any Performance Goals that are included in an Award in order to make such Award qualify as performance-based compensation under Code Section 162(m) shall be limited to one or more of the following target objectives: (i) operating income; (ii) earnings before interest, taxes, depreciation and amortization, or EBITDA; (iii) earnings; (iv) cash flow; (v) market share; (vi) sales or revenue; (vii) expenses; (viii) cost of goods sold; (ix) profit/loss or profit margin; (x) working capital; (xi) return on equity or assets or investment; (xii) earnings per share; (xiii) economic value added, or EVA; (xiv) stock price including without limitation total shareholder return; (xv) price/earnings ratio; (xvi) debt or debt-to-equity; (xvii) accounts receivable; (xviii) writeoffs; (xix) cash; (xx) assets; (xxi) liquidity; (xxii) operations; (xxiii) research or related milestones; (xxiv) business development; (xxv) intellectual property (e.g., patents); (xxvi) product development; (xxvii) regulatory activity; (xxviii) information technology; (xxix) financings; (xxx) product quality control; (xxxi) management; (xxxii) human resources; (xxxiii) corporate governance; (xxxiv) compliance program; (xxxv) legal matters; (xxxvi) internal controls; (xxxvii) policies and procedures; (xxxviii) accounting and reporting; (xxxix) strategic alliances, licensing and partnering; (xl) site, plant or building development; (xli) corporate transactions including without limitation mergers, acquisitions, divestitures and/or joint ventures; (xlii) customer satisfaction; (xliii) capital expenditures and/or (xliv) Company advancement milestones. Awards issued to individuals who are not Covered Employees (or which are not intended to qualify as performance-based compensation under Code Section 162(m)) may take into account other (or no) factors.

(ag)"Performance Period" means any period of time as determined by the Committee, in its sole discretion. The Committee may establish different Performance Periods for different Participants, and the Committee may establish concurrent or overlapping Performance Periods.

(ah)"Plan" means this Lifevantage Corporation 2010 Long-Term Incentive Plan as it may be amended from time to time.

(ai)"Prior Equity Compensation Plans" means the Company's 2007 Long-Term Incentive Plan (as assumed from Lifeline Therapeutics, Inc., a Colorado corporation) and its predecessor plans and any other Company equity compensation plans.

(aj)"Re-Price" means that the Company has lowered or reduced the Exercise Price of outstanding Options and/or outstanding SARs for any Participant(s) in a manner described by SEC Regulation S-K Item 402(d)(2)(viii) (or as described in any successor provision(s) or definition(s)).

(ak)"Restricted Stock Grant" means Shares awarded under the Plan as provided in Section 9.

(al)"Restricted Stock Grant Agreement" means the agreement described in Section 9 evidencing each Award of a Restricted Stock Grant.

(am)"SAR Agreement" means the agreement described in Section 8 evidencing each Award of a Stock Appreciation Right.

(an)"SEC" means the Securities and Exchange Commission.

(ao)"Section 16 Persons" means those officers, directors or other persons who are subject to Section 16 of the Exchange Act.

(ap)"Securities Act" means the Securities Act of 1933, as amended.

(aq)"Selected Employee" means an Employee, Consultant, Director, or Non-Employee Director who has been selected by the Committee to receive an Award under the Plan.

(ar)"Separation From Service" means a Participant's separation from service with the Company within the meaning provided to such term under Code Section 409A.

(as)"Service" means service as an Employee, Director, Non-Employee Director or Consultant. Service will be deemed terminated as soon as the entity to which Service is being provided is no longer either (i) the Company, (ii) a Parent, (iii) a Subsidiary or (iv) an Affiliate. A Participant's Service does not terminate if he or she is a common-law employee and goes on a bona fide leave of absence that was approved by the Company in writing and the terms of the leave provide for continued service crediting, or when continued service crediting is required by applicable law. However, for purposes of determining whether an Option is entitled to continuing ISO status, a common-law employee's Service will be treated as terminating ninety (90) days after such Employee went on leave, unless such Employee's right to return to active work is guaranteed by law or by a contract. Service terminates in any event when the approved leave ends, unless such Employee immediately returns to active work. The Committee determines which leaves count toward Service, and when Service commences and terminates for all purposes under the Plan. For avoidance of doubt, a Participant's Service shall not be deemed terminated if the Committee determines that (i) a transition of employment to service with a partnership, joint venture or corporation not meeting the requirements of a Subsidiary in which the Company or a Subsidiary is a party is not considered a termination of Service, (ii) the Participant transfers between service as an Employee and service as a Consultant or other personal service provider (or vice versa), or (iii) the Participant transfers between service as an Employee and that of a Non-Employee Director (or vice versa). The Committee may determine whether any company transaction, such as a sale or spin-off of a division or subsidiary that employs a Participant, shall be deemed to result in termination of Service for purposes of any affected Awards, and the Committee's decision shall be final and binding.

(at)"Share" means one share of Common Stock.

(au)"Specified Employee" means a Participant who is considered a "specified employee" within the meaning provided to such term under Code Section 409A.

(av)"Stock Appreciation Right" or "SAR" means a stock appreciation right awarded under the Plan which provides the holder with a right to potentially receive, in cash and/or Shares, value with respect to a specific number of Shares, as provided in Section 8.

(aw)"Stock Option Agreement" means the agreement described in Section 6 evidencing each Award of an Option.

(ax)"Stock Unit" means a bookkeeping entry representing the equivalent of one Share, as awarded under the Plan and as provided in Section 10.

(ay)"Stock Unit Agreement" means the agreement described in Section 10 evidencing each Award of Stock Units.

(az)"Subsidiary" means any corporation (other than the Company) in an unbroken chain of corporations beginning with the Company, if each of the corporations other than the last corporation in the

unbroken chain owns stock possessing 50% or more of the total combined voting power of all classes of stock in one of the other corporations in such chain. A corporation that attains the status of a Subsidiary on a date after the Adoption Date shall be considered a Subsidiary commencing as of such date.

(ba)"Termination Date" means the date on which a Participant's Service terminates as determined by the Committee.

(bb)"10-Percent Shareholder" means an individual who owns more than 10% of the total combined voting power of all classes of outstanding stock of the Company, its Parent or any of its Subsidiaries. In determining stock ownership, the attribution rules of Section 424(d) of the Code shall be applied.

| |

SECTION 3. | ADMINISTRATION. |

(a)Committee Composition. A Committee appointed by the Board shall administer the Plan. Unless the Board provides otherwise, the Board's Compensation Committee (or a comparable committee of the Board) shall be the Committee. The Board may also at any time terminate the functions of the Committee and reassume all powers and authority previously delegated to the Committee.

To the extent required, the Committee shall have membership composition which enables (i) Awards to Section 16 Persons to qualify as exempt from liability under Section 16(b) of the Exchange Act and (ii) Awards to Covered Employees to be able to qualify as performance-based compensation as provided under Code Section 162(m) (to the extent such Awards are intended to qualify as performance-based compensation).

The Board may also appoint one or more separate committees of the Board, each composed of directors of the Company who need not qualify under Rule 16b-3 of the Exchange Act or Code Section 162(m), that may administer the Plan with respect to Selected Employees who are not Section 16 Persons or Covered Employees, respectively, may grant Awards under the Plan to such Selected Employees and may determine all terms of such Awards. To the extent permitted by applicable law, the Board may also appoint a committee, composed of one or more Officers, that may authorize Awards to Employees (who are not Section 16 Persons or Covered Employees) within parameters specified by the Board and consistent with any limitations imposed by applicable law.

Notwithstanding the foregoing, the Board shall constitute the Committee and shall administer the Plan with respect to all Awards granted to Non-Employee Directors.

(b)Authority of the Committee. Subject to the provisions of the Plan, the Committee shall have full authority and discretion to take any actions it deems necessary or advisable for the administration of the Plan. Such actions shall include without limitation:

(i)determining Selected Employees who are to receive Awards under the Plan;

(ii)determining the type, number, vesting requirements, Performance Goals (if any) and their degree of satisfaction, and other features and conditions of such Awards and amending such Awards;

(iii)correcting any defect, supplying any omission, or reconciling or clarifying any inconsistency in the Plan or any Award agreement;

(iv)accelerating the vesting, or extending the post-termination exercise term, or waiving restrictions, of Awards at any time and under such terms and conditions as it deems appropriate;

(v)interpreting the Plan and any Award agreements;

(vi)making all other decisions relating to the operation of the Plan; and

(vii)adopting such plans or subplans as may be deemed necessary or appropriate to provide for the participation by non-U.S. employees of the Company and its Subsidiaries and Affiliates, which plans and/or subplans shall be attached hereto as appendices.

The Committee may adopt such rules or guidelines, as it deems appropriate to implement the Plan. The Committee's determinations under the Plan shall be final, conclusive and binding on all persons. The Committee's decisions and determinations need not be uniform and may be made selectively among Participants in the Committee's sole discretion. The Committee's decisions and determinations will be afforded the maximum deference provided by applicable law.

(c)Indemnification. To the maximum extent permitted by applicable law, each member of the Committee, or of the Board, or any persons (including without limitation Employees and Officers) who are delegated by the Board or Committee to perform administrative functions in connection with the Plan, shall be indemnified and held harmless by the Company against and from (i) any loss, cost, liability, or expense that may be imposed upon or reasonably incurred by him or her in connection with or resulting from any claim, action, suit, or proceeding to which he or she may be a party or in which he or she may be involved by reason of any action taken or failure to act under the Plan or any Award Agreement, and (ii) from any and all amounts paid by him or her in settlement thereof, with the Company's approval, or paid by him or her in satisfaction of any judgment in any such claim, action, suit, or proceeding against him or her, provided he or she shall give the Company an opportunity, at its own expense, to handle and defend the same before he or she undertakes to handle and defend it on his or her own behalf. The foregoing right of indemnification shall not be exclusive of any other rights of indemnification to which such persons may be entitled under the Company's Articles of Incorporation or Bylaws, by contract, as a matter of law, or otherwise, or under any power that the Company may have to indemnify them or hold them harmless.

(a)General Eligibility. Only Employees, Consultants, Directors and Non-Employee Directors shall be eligible for designation as Selected Employees by the Committee.

(b)Incentive Stock Options. Only Selected Employees who are common-law employees of the Company, a Parent or a Subsidiary shall be eligible for the grant of ISOs. In addition, a Selected Employee who is a 10-Percent Shareholder shall not be eligible for the grant of an ISO unless the requirements set forth in Section 422(c)(5) of the Code are satisfied. If and to the extent that any Shares are issued under a portion of any Option that exceeds the $100,000 limitation of Section 422 of the Code, such Shares shall not be treated as issued under an ISO notwithstanding any designation otherwise. Certain decisions, amendments, interpretations and actions by the Committee and certain actions by a Participant may cause an Option to cease to qualify as an ISO pursuant to the Code and by accepting an Option the Participant agrees in advance to such disqualifying action.

(c)Buyout of Awards. Subject to approval of Company shareholders, the Committee may at any time (i) offer to buy out for a payment in cash or cash equivalents (including without limitation Shares valued at Fair Market Value that may or may not be issued from this Plan) an Award previously granted or (ii) authorize a Participant to elect to cash out an Award previously granted, in either case at such time and based upon such terms and conditions as the Committee shall establish.

(d)Restrictions on Shares. Any Shares issued pursuant to an Award shall be subject to such Company policies, rights of repurchase, rights of first refusal and other transfer restrictions as the Committee may determine. Such restrictions shall apply in addition to any restrictions that may apply to holders of Shares generally and shall also comply to the extent necessary with applicable law. In no event shall the Company be required to issue fractional Shares under this Plan.

(e)Beneficiaries. A Participant may designate one or more beneficiaries with respect to an Award by timely filing the prescribed form with the Company. A beneficiary designation may be changed by filing the prescribed form with the Company at any time before the Participant's death. If no beneficiary was designated or if no designated beneficiary survives the Participant, then after a Participant's death any vested Award(s) shall be transferred or distributed to the Participant's estate.

(f)Performance Goals. The Committee may, in its discretion, include Performance Goals or other performance objectives in any Award. If Performance Goals are included in Awards to Covered Employees in order to enable such Awards to qualify as performance-based compensation under Code Section 162(m), then such

Awards will be subject to the achievement of such Performance Goals that will be established and administered pursuant to the requirements of Code Section 162(m) and as described in this Section 4(f). If an Award is intended to qualify as performance-based compensation under Code Section 162(m) and to the extent required by Code Section 162(m), the Committee shall certify in writing the degree to which the Performance Goals have been satisfied before any Shares underlying an Award or any Award payments are released to a Covered Employee with respect to a Performance Period. Without limitation, the approved minutes of a Committee meeting shall constitute such written certification. With respect to Awards that are intended to qualify as performance-based compensation under Code Section 162(m), the Committee may adjust the evaluation of performance under a Performance Goal (to the extent permitted by Code Section 162(m)) to remove the effects of certain events including without limitation the following:

(i)asset write-downs or discontinued operations,

(ii)litigation or claim judgments or settlements,

(iii)material changes in or provisions under tax law, accounting principles or other such laws or provisions affecting reported results,

(iv)reorganizations or restructuring programs or divestitures or acquisitions, and/or

(v)extraordinary non-recurring items as described in applicable accounting principles and/or items of gain, loss or expense determined to be extraordinary or unusual in nature or infrequent in occurrence.

Notwithstanding satisfaction of any completion of any Performance Goal, to the extent specified at the time of grant of an Award, the number of Shares, Options, SARs, Stock Units or other benefits granted, issued, retainable and/or vested under an Award on account of satisfaction of such Performance Goals may be reduced by the Committee on the basis of such further considerations as the Committee in its sole discretion shall determine. Awards with Performance Goals or performance objectives (if any) that are granted to Selected Employees who are not Covered Employees or any Awards to Covered Employees which are not intended to qualify as performance-based compensation under Code Section 162(m) need not comply with the requirements of Code Section 162(m).

(g)No Rights as a Shareholder. A Participant, or a transferee of a Participant, shall have no rights as a shareholder (including without limitation voting rights or dividend or distribution rights) with respect to any Common Stock covered by an Award until such person becomes entitled to receive such Common Stock, has satisfied any applicable withholding or tax obligations relating to the Award and the Common Stock has been issued to the Participant. No adjustment shall be made for cash or stock dividends or other rights for which the record date is prior to the date when such Common Stock is issued, except as expressly provided in Section 11.

(h)Termination of Service. Unless the applicable Award agreement or employment agreement provides otherwise (and in such case, the Award or employment agreement shall govern as to the consequences of a termination of Service for such Awards), the following rules shall govern the vesting, exercisability and term of outstanding Awards held by a Participant in the event of termination of such Participant's Service (in all cases subject to the term of the Option or SAR as applicable):

(i)if the Service of a Participant is terminated for Cause, then all of Participant's Options, SARs, unvested portions of Stock Units and unvested portions of Restricted Stock Grants shall terminate and be forfeited immediately without consideration as of the Termination Date (except for repayment of any amounts the Participant had previously paid to the Company to acquire Shares underlying the forfeited Awards);

(ii)if the Service of Participant is terminated for any reason other than for Cause and other due to Participant's death or Disability), then the vested portion of Participant's then-outstanding Options/SARs may be exercised by such Participant or his or her personal representative within three months after the Termination Date and all unvested portions of Participant's outstanding Awards shall be forfeited without

consideration as of the Termination Date (except for repayment of any amounts the Participant had previously paid to the Company to acquire Shares underlying the forfeited Awards); or

(iii)if the Service of a Participant is terminated due to Participant's death or Disability, the vested portion of Participant's then outstanding Options/SARs may be exercised within twelve months after the Termination Date and all unvested portions of any outstanding Awards shall be forfeited without consideration as of the Termination Date (except for repayment of any amounts the Participant had previously paid to the Company to acquire Shares underlying the forfeited Awards).

(i)Code Section 409A. Notwithstanding anything in the Plan to the contrary, the Plan and Awards granted hereunder are intended to comply with the requirements of Code Section 409A and shall be interpreted in a manner consistent with such intention. In the event that any provision of the Plan or an Award Agreement is determined by the Committee to not comply with the applicable requirements of Code Section 409A and the Treasury Regulations and other guidance issued thereunder, the Committee shall have the authority to take such actions and to make such changes to the Plan or an Award Agreement as the Committee deems necessary to comply with such requirements, provided that no such action shall adversely affect any outstanding Award without the consent of the affected Participant. Each payment to a Participant made pursuant to this Plan shall be considered a separate payment and not one of a series of payments for purposes of Code Section 409A. Notwithstanding the foregoing or anything elsewhere in the Plan or an Award Agreement to the contrary, if upon a Participant's Separation From Service he/she is then a Specified Employee, then solely to the extent necessary to comply with Code Section 409A and avoid the imposition of taxes under Code Section 409A, the Company shall defer payment of "nonqualified deferred compensation" subject to Code Section 409A payable as a result of and within six (6) months following such Separation From Service under this Plan until the earlier of (i) the first business day of the seventh month following the Participant's Separation From Service, or (ii) ten (10) days after the Company receives written confirmation of the Participant's death. Any such delayed payments shall be made without interest. In no event whatsoever shall the Company be liable for any additional tax, interest or penalties that may be imposed on a Participant by Code Section 409A or for any damages for failing to comply with Code Section 409A.

(j)Suspension or Termination of Awards. If at any time (including after a notice of exercise has been delivered) the Committee (or the Board), reasonably believes that a Participant has committed an act of Cause (which includes a failure to act), the Committee (or Board) may suspend the Participant's right to exercise any Option or SAR (or payment of a Cash Award or vesting of Restricted Stock Grants or Stock Units) pending a determination of whether there was in fact an act of Cause. If the Committee (or the Board) determines a Participant has committed an act of Cause, neither the Participant nor his or her estate shall be entitled to exercise any outstanding Option or SAR whatsoever and all of Participant's outstanding Awards shall then terminate without consideration. Any determination by the Committee (or the Board) with respect to the foregoing shall be final, conclusive and binding on all interested parties.

(k)Electronic Communications. Subject to compliance with applicable law and/or regulations, an Award agreement or other documentation or notices relating to the Plan and/or Awards may be communicated to Participants by electronic media.

(l)Unfunded Plan. Insofar as it provides for Awards, the Plan shall be unfunded. Although bookkeeping accounts may be established with respect to Participants who are granted Awards under this Plan, any such accounts will be used merely as a bookkeeping convenience. The Company shall not be required to segregate any assets which may at any time be represented by Awards, nor shall this Plan be construed as providing for such segregation, nor shall the Company or the Committee be deemed to be a trustee of stock or cash to be awarded under the Plan.

(m)Liability of Company. The Company (or members of the Board or Committee) shall not be liable to a Participant or other persons as to: (a) the non-issuance or sale of Shares as to which the Company has been unable to obtain from any regulatory body having jurisdiction the authority deemed by the Company's counsel to be necessary to the lawful issuance and sale of any Shares hereunder; and (b) any unexpected or adverse tax consequence or any tax consequence expected, but not realized, by any Participant or other person due to the grant, receipt, exercise or settlement of any Award granted hereunder.