Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

November 19 2014 - 6:02AM

Edgar (US Regulatory)

Filed pursuant to Rule 424(b)(3)

Registration No. 333-173312

PROSPECTUS SUPPLEMENT NO. 3

TO PROSPECTUS DATED MAY 9,

2012

ImmunoCellular Therapeutics, Ltd.

6,799,178 Shares

Common Stock

This prospectus

supplement supplements the prospectus, dated May 9, 2012, relating to the disposition from time to time of up to 6,799,178 shares of our outstanding common stock, which includes 3,212,422 shares of our common stock issuable upon the exercise of

warrants, which are held by the selling stockholders named therein. This prospectus supplement should be read in conjunction with the prospectus, and is qualified by reference to the prospectus, except to the extent that the information presented

herein supersedes the information contained in the prospectus. This prospectus supplement is not complete without, and may not be delivered or utilized except in connection with, the prospectus, including any amendments or supplements thereto.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 3 of the prospectus as well as

the section entitled “Risk Factors” included in our most recent annual report on Form 10-K and in our most recent quarterly reports on Form 10-Q, as well as any amendments thereto, as filed with the Securities and Exchange Commission.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES

OR DETERMINED IF THIS PROSPECTUS SUPPLEMENT OR THE PROSPECTUS TO WHICH IT RELATES IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus supplement is November 18, 2014.

The information in the table beginning on page 20 of the prospectus appearing under the caption

“Selling Securityholders” is amended as a result of (1) adjustment of the Exercise Price from $1.87 to $1.85 and increase in the Warrant Shares effective June 30, 2014; (2) transfer of a warrant to purchase 294,247 shares

(prior to subsequent adjustment) from Straus Healthcare Partners, L.P. to OTA LLC; and (3) adjustment of the Exercise Price from $1.85 to $1.84 and increase in the Warrant Shares effective September 30, 2014. The list of selling

securityholders is revised to read in its entirety as follows:

SELLING SECURITYHOLDERS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Beneficial Ownership Before Offering |

|

|

Beneficial

Ownership After

Offering (1) |

|

|

|

|

|

|

|

| |

|

Number of

Shares |

|

|

Percent |

|

|

Number

of Shares

Being

Offered |

|

|

Number

of

Shares |

|

|

Percent |

|

| 390 Partners, LP, 390 Partners Management Co., Inc., General Partner |

|

|

51,982 |

(2) |

|

|

* |

|

|

|

51,982 |

(2) |

|

|

0 |

|

|

|

0 |

|

| ALB Private Investments LLC |

|

|

522,281 |

(3) |

|

|

* |

|

|

|

222,281 |

(3) |

|

|

300,000 |

|

|

|

* |

|

| Asset Management Company Venture Fund L.P. |

|

|

259,906 |

(4) |

|

|

* |

|

|

|

259,906 |

(4) |

|

|

0 |

|

|

|

0 |

|

| Auctus Private Equity Fund, LLC |

|

|

46,731 |

(5) |

|

|

* |

|

|

|

46,731 |

(5) |

|

|

0 |

|

|

|

0 |

|

| Josiah & Valer Austin Family Rev Tr dtd 2/20/04 |

|

|

104,742 |

(6) |

|

|

* |

|

|

|

104,742 |

(6) |

|

|

0 |

|

|

|

0 |

|

| Brio Capital Master Fund Ltd. |

|

|

78,892 |

(7) |

|

|

* |

|

|

|

78,892 |

(7) |

|

|

0 |

|

|

|

0 |

|

| David E. Burstein |

|

|

34,190 |

(8) |

|

|

* |

|

|

|

31,190 |

(8) |

|

|

3,000 |

|

|

|

* |

|

| Capital Ventures International |

|

|

642,713 |

(9) |

|

|

1.02 |

% |

|

|

552,713 |

(9) |

|

|

90,000 |

|

|

|

* |

|

| Cummings Bay Healthcare Master Fund, LP |

|

|

98,616 |

(10) |

|

|

* |

|

|

|

98,616 |

(10) |

|

|

0 |

|

|

|

0 |

|

| DAFNA Lifescience LTD |

|

|

61,223 |

(11) |

|

|

* |

|

|

|

24,823 |

(11) |

|

|

36,400 |

|

|

|

* |

|

| DAFNA Lifescience Market Neutral LTD |

|

|

53,811 |

(12) |

|

|

* |

|

|

|

22,011 |

(12) |

|

|

31,800 |

|

|

|

* |

|

| DAFNA Lifescience Select LT |

|

|

97,283 |

(13) |

|

|

* |

|

|

|

51,847 |

(13) |

|

|

45,436 |

|

|

|

* |

|

| Dare To Be Great, LLC |

|

|

389,857 |

(14) |

|

|

* |

|

|

|

389,857 |

(14) |

|

|

0 |

|

|

|

0 |

|

| Phyllis M. Esposito |

|

|

667,281 |

(15) |

|

|

1.06 |

% |

|

|

322,281 |

(15) |

|

|

345,000 |

|

|

|

* |

|

| Iguana Healthcare Master Fund, LTD |

|

|

618,137 |

(16) |

|

|

* |

|

|

|

443,137 |

(16) |

|

|

175,000 |

|

|

|

* |

|

| Klaus Kretschmer |

|

|

103,963 |

(17) |

|

|

* |

|

|

|

103,963 |

(17) |

|

|

0 |

|

|

|

0 |

|

| Anthony Low-Beer |

|

|

1,225,181 |

(18) |

|

|

1.95 |

% |

|

|

322,281 |

(18) |

|

|

902,900 |

|

|

|

1.44 |

% |

| Brendan S. MacMillan |

|

|

51,982 |

(19) |

|

|

* |

|

|

|

51,982 |

(19) |

|

|

0 |

|

|

|

0 |

|

| Kevin McCormack |

|

|

46,114 |

(20) |

|

|

* |

|

|

|

16,114 |

(20) |

|

|

30,000 |

|

|

|

* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ryan McCormack |

|

|

46,114 |

(21) |

|

|

* |

|

|

|

16,114 |

(21) |

|

|

30,000 |

|

|

|

* |

|

| OTA LLC |

|

|

591,688 |

(22) |

|

|

* |

|

|

|

591,688 |

(22) |

|

|

0 |

|

|

|

0 |

|

| JP Morgan Chase Bank as Custodian for Norman Schleifer Roth IRA |

|

|

61,887 |

(23) |

|

|

* |

|

|

|

51,887 |

(23) |

|

|

10,000 |

|

|

|

* |

|

| Norman Schleifer |

|

|

213,743 |

(24) |

|

|

* |

|

|

|

51,243 |

(24) |

|

|

162,500 |

|

|

|

* |

|

| Seamark Fund, LP |

|

|

559,906 |

(25) |

|

|

* |

|

|

|

259,906 |

(25) |

|

|

300,000 |

|

|

|

* |

|

| Starlight Investment Holdings Limited |

|

|

103,963 |

(26) |

|

|

* |

|

|

|

103,963 |

(26) |

|

|

0 |

|

|

|

0 |

|

| Stourbridge Investments LLC |

|

|

51,982 |

(27) |

|

|

* |

|

|

|

51,982 |

(27) |

|

|

0 |

|

|

|

0 |

|

| Stephen Taubenfeld |

|

|

28,200 |

(28) |

|

|

* |

|

|

|

28,200 |

(28) |

|

|

0 |

|

|

|

0 |

|

| The Thunen Family Trust dated 10/4/05 |

|

|

511,141 |

(29) |

|

|

* |

|

|

|

161,141 |

(29) |

|

|

350,000 |

|

|

|

* |

|

| Weisbrod Family Office, LLC |

|

|

427,852 |

(30) |

|

|

* |

|

|

|

427,852 |

(30) |

|

|

0 |

|

|

|

0 |

|

| Jonathan Blum |

|

|

24,898 |

(31) |

|

|

* |

|

|

|

24,898 |

(31) |

|

|

0 |

|

|

|

0 |

|

| Cranshire Capital Master Fund, Ltd. |

|

|

42,453 |

(32) |

|

|

* |

|

|

|

42,453 |

(32) |

|

|

0 |

|

|

|

0 |

|

| Scarsdale Equities LLC |

|

|

18,196 |

(33) |

|

|

* |

|

|

|

18,196 |

(33) |

|

|

0 |

|

|

|

0 |

|

| (1) |

Assumes the selling securityholder sells all of the shares of common stock included in this prospectus. |

| (2) |

Represents 32,258 shares of our common stock and 19,724 shares of our common stock issuable upon the exercise of warrants. Louis G. Lange III has voting and investment control over these securities. |

| (3) |

Represents 400,000 shares of our common stock and 122,281 shares of our common stock issuable upon the exercise of warrants, which includes 100,000 shares of our common stock and 122,281 shares of our common stock

issuable upon the exercise of warrants included in this prospectus. Francis A. Mlynarczyk, Jr., Manager of ALB Private Investments LLC, has voting and investment power over the securities. |

| (4) |

Represents 161,290 shares of our common stock and 98,616 shares of our common stock issuable upon the exercise of warrants. David G. Fleshman has voting and investment power over these securities. |

| (5) |

Represents 29,000 shares of our common stock and 17,731 shares of our common stock issuable upon the exercise of warrants. Al Sollami has voting and investment power over the securities. |

| (6) |

Represents 65,000 shares of our common stock and 39,742 shares of our common stock issuable upon the exercise of warrants. |

| (7) |

Represents 78,892 shares of our common stock issuable upon the exercise of warrants. Shaye Hirsch is Director of Brio Capital Master Fund Ltd. and has voting and investment power over these securities.

|

| (8) |

Represents 22,355 shares of our common stock and 11,835 shares of our common stock issuable upon the exercise of warrants, which includes 19,355 shares of our common stock and 11,835 shares of our common stock issuable

upon the exercise of warrants included in this prospectus. |

| (9) |

Represents 633,849 shares of our common stock issuable upon the exercise of warrants, which includes 552,713 shares of our common stock issuable upon exercise of warrants included in this prospectus. Heights Capital

Management, Inc., the authorized agent of Capital Ventures International (“CVI”), has discretionary authority to vote and dispose of the shares held by CVI and may be deemed to be the beneficial owner of these shares. Martin Kobinger, in

his capacity as Investment Manager of Heights Capital Management, Inc., may also be deemed to have investment discretion and voting power over the shares held by CVI. Mr. Kobinger disclaims any such beneficial ownership of the shares.

|

| (10) |

Represents 98,616 shares of our common stock issuable upon the exercise of warrants. James Pondero, President of Cummings Bay Healthcare Master Fund, LP, has voting and investment power over these securities.

|

| (11) |

Represents 60,825 shares of our common stock issuable upon the exercise of warrants, which includes 24,823 shares of our common stock issuable upon exercise of warrants included in this prospectus. Nathan Fischel,

Managing Member of DAFNA Lifescience Ltd., has voting and investment power over these securities. |

| (12) |

Represents 53,458 shares of our common stock issuable upon the exercise of warrants, which includes 22,011 shares of our common stock issuable upon exercise of warrants included in this prospectus. Nathan Fischel,

Managing Member of DAFNA Lifescience Market Neutral Ltd., has voting and investment power over these securities. |

| (13) |

Represents 96,452 shares of our common stock issuable upon the exercise of warrants, which includes 51,847 shares of our common stock issuable upon exercise of warrants included in this prospectus. Nathan Fischel,

Managing Member of DAFNA Lifescience Select Ltd., has voting and investment power over these securities. |

| (14) |

Represents 241,935 shares of our common stock and 147,922 shares of our common stock issuable upon the exercise of warrants. Rainer Twiford, Managing Member of Dare to be Great, LLC, has voting and investment power over

these securities. |

| (15) |

Represents 540,000 shares of our common stock and 125,320 shares of our common stock issuable upon the exercise of warrants, which includes 200,000 shares of our common stock and 122,281 shares of our common stock

issuable upon the exercise of warrants included in this prospectus. Phylis Esposito has voting power and Phylis Esposito, Anthony Low-Beer and Scarsdale Equities LLC have investment power over the securities. Mr. Low-Beer and Scarsdale Equities

LLC disclaim beneficial ownership of the securities. |

| (16) |

Represents 400,000 shares of our common stock and 215,441 shares of our common stock issuable upon the exercise of warrants, which includes 275,000 shares of our common stock and 168,137 shares of our common stock

issuable upon the exercise of warrants included in this prospectus. Stuart Weisbrod has voting and investment power over these securities. |

| (17) |

Represents 64,516 shares of our common stock and 39,447 shares of our common stock issuable upon the exercise of warrants. |

| (18) |

Represents 1,102,900 shares of our common stock and 122,281 shares of our common stock issuable upon the exercise of warrants, which includes 200,000 shares of our common stock and 122,281 shares of our common stock

issuable upon exercise of warrants included in this prospectus. |

| (19) |

Represents 32,258 shares of our common stock and 19,724 shares of our common stock issuable upon the exercise of warrants. |

| (20) |

Represents 40,000 shares of our common stock and 6,114 shares of our common stock issuable upon the exercise of warrants, which includes 10,000 shares of our common stock and 6,114 shares of our common stock issuable

upon the exercise of warrants included in this prospectus. Kevin McCormack has voting power and Kevin McCormack, Anthony Low-Beer and Scarsdale Equities LLC have investment power over the securities. Mr. Low-Beer and Scarsdale Equities LLC

disclaim beneficial ownership of the securities. |

| (21) |

Represents 40,000 shares of our common stock and 6,114 shares of our common stock issuable upon the exercise of warrants, which includes 10,000 shares

of our common stock and 6,114 shares of our common stock issuable upon the exercise of warrants |

| |

included in this prospectus. Ryan McCormack has voting power and Ryan McCormack, Anthony Low-Beer and Scarsdale Equities LLC have investment power over the securities. Mr. Low-Beer and

Scarsdale Equities LLC disclaim beneficial ownership of the securities. |

| (22) |

Represents 591,688 shares of our common stock issuable upon the exercise of warrants. |

| (23) |

Represents 42,200 shares of our common stock and 19,687 shares of our common stock issuable upon the exercise of warrants, which includes 32,200 shares of our common stock and 19,687 shares of our common stock issuable

upon the exercise of warrants included in this prospectus. |

| (24) |

Represents 144,300 shares of our common stock and 69,131 shares of our common stock issuable upon the exercise of warrants, which includes 31,800 shares of our common stock and 19,443 shares of our common stock issuable

upon the exercise of warrants included in this prospectus. |

| (25) |

Represents 361,290 shares of our common stock and 197,034 shares of our common stock issuable upon the exercise of warrants, which includes 161,290 shares of our common stock and 98,616 shares of our common stock

issuable upon the exercise of warrants included in this prospectus. David T. Harrington and John D. Fraser, Managing Partners of Seamark Fund LP, have voting and investment power over these securities. |

| (26) |

Represents 64,516 shares of our common stock and 39,447 shares of our common stock issuable upon the exercise of warrants. |

| (27) |

Represents 32,258 shares of our common stock and 19,724 shares of our common stock issuable upon the exercise of warrants. Steve Schnipper, Managing Member of Stourbridge Investments LLC, has voting and investment power

over these securities. |

| (28) |

Represents 17,500 shares of our common stock and 10,700 shares of our common stock issuable upon the exercise of warrants. |

| (29) |

Represents 450,000 shares of our common stock and 61,141 shares of our common stock issuable upon the exercise of warrants, which includes 100,000 shares of our common stock and 61,141 shares of our common stock

issuable upon the exercise of warrants included in this prospectus. Garret G. Thunen and Carol Thunen, Trustees, have voting power and Garret G. Thunen, Carol Thunen, Anthony Low-Beer and Scarsdale Equities LLC have investment power over the

securities. Mr. Low-Beer and Scarsdale Equities LLC disclaim beneficial ownership of the securities. |

| (30) |

Represents 275,000 shares of our common stock and 152,852 shares of our common stock issuable upon the exercise of warrants. Stuart Weisbrod, Chief Investment Officer for the Weisbrod Family Office, LLC, has voting and

investment power over these securities. |

| (31) |

Represents 24,898 shares of our common stock issuable upon the exercise of warrants that we issued in consideration for services rendered as a placement agent in our February 2011 private placement. The selling

securityholder identified has indicated that he is, or is an affiliate of, Dawson James Securities, Inc., a registered broker-dealer. |

| (32) |

Represents 42,453 shares of our common stock issuable upon the exercise of warrants. Downsview Capital, Inc. (“Downsview”) is the general partner of Cranshire Capital Master Fund, Ltd. (“Cranshire”)

and consequently has voting control and investment discretion over securities held by Cranshire. Mitchell P. Kopin, President of Downsview, has voting control over Downsview. As a result of the foregoing, each of Mr. Kopin and Downsview may be

deemed to have beneficial ownership (as determined under Section 13(d) of the Securities Exchange Act of 1934, as amended) of the shares of common stock beneficially owned by Cranshire. |

| (33) |

Represents 18,196 shares of our common stock issuable upon the exercise of warrants that we issued in consideration for services rendered as a placement agent in our February 2011 private placement. Francis A.

Mlynarczyk, Jr., Chief Executive Officer of Scarsdale Equities LLC has voting and investment power over these securities. |

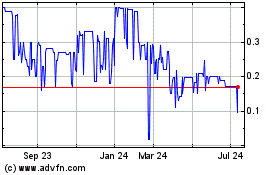

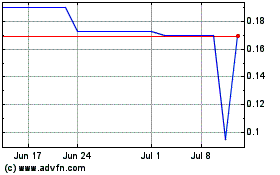

EOM Pharmaceutical (PK) (USOTC:IMUC)

Historical Stock Chart

From Mar 2024 to Apr 2024

EOM Pharmaceutical (PK) (USOTC:IMUC)

Historical Stock Chart

From Apr 2023 to Apr 2024