UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities and Exchange Act of 1934

Date of Report (Date of earliest reported): November 14, 2014

MANHATTAN SCIENTIFICS, INC.

(Exact name of registrant as specified in charter)

|

Delaware

|

|

000-28411

|

|

85-0460639

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

The Chrysler Building

405 Lexington Avenue, 26th Floor

New York, New York, 10174

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including area code: (212) 541-2405

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement

Item 3.02 Unregistered Sales of Equity Securities

On November 14, 2014, Manhattan Scientifics, Inc. (the “Company”) entered into a securities purchase agreement with an accredited investor (the “November 2014 Accredited Investor”) pursuant to which the November 2014 Accredited Investor purchased 18,000,000 shares of the Company’s common stock at $0.11 per share (the “November 2014 Shares”) and warrants to acquire 4,500,000 shares of common stock (the " November 2014 Warrants" and together with the November 2014 Shares, the " November 2014 Securities") for an aggregate purchase price of $1,980,000 (the " November 2014 Funds"). The Warrants are exercisable for five (5) years at an exercise price of $0.1265 per share. The Funds were received by the Company on November 17, 2014.

A registered broker-dealer that assisted in the above transaction received a cash fee in the amount of five percent (5%) of the November 2014 Funds.

The November 2014 Securities were offered and sold in a private placement transaction made in reliance upon exemptions from registration pursuant to Section 4(2) under the Securities Act of 1933 (the “Securities Act”). The November 2014 Accredited Investor is an accredited investor as defined in Rule 501 of Regulation D promulgated under the Securities Act.

The foregoing information is a summary of each of the agreements involved in the transactions described above, is not complete, and is qualified in its entirety by reference to the full text of those agreements, each of which is attached an exhibit to this Current Report on Form 8-K. Readers should review those agreements for a complete understanding of the terms and conditions associated with this transaction.

Item 9.01 Financial Statements and Exhibits

|

Exhibit No.

|

|

Description of Exhibit

|

| |

|

|

|

4.1

|

|

Form of Securities Purchase Agreement entered by and between Manhattan Scientifics, Inc. and the November 2014 Accredited Investor

|

|

|

|

|

|

4.2

|

|

Form of Warrant

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

MANHATTAN SCIENTIFICS, INC. |

|

| |

|

|

|

| Date: November 18, 2014 |

By: |

/s/ Emmanuel Tsoupanarias |

|

| |

Name: |

Emmanuel Tsoupanarias |

|

|

Title: |

Chief Executive Officer |

|

|

New York, New York

|

|

|

|

4

EXHIBIT 4.1

THE SECURITIES OFFERED HEREBY SHOULD BE CONSIDERED TO BE AT THE HIGH END OF THE RISK SPECTRUM AND SHOULD NOT BE PURCHASED BY ANYONE WHO CANNOT AFFORD THE LOSS OF THEIR ENTIRE INVESTMENT.

SECURITIES PURCHASE AGREEMENT

This Securities Purchase Agreement (this “Agreement”) is dated as of November 14, 2014, among Manhattan Scientifics, Inc. a Delaware corporation (the “Company”), and the purchaser identified on the signature pages hereto (the “Purchaser”); and

WHEREAS, subject to the terms and conditions set forth in this Agreement and pursuant to Section 4(2) of the Securities Act of 1933, and/or Rule 506 promulgated thereunder, the Company desires to issue and sell to the Purchaser, and the Purchaser desires to purchase from the Company the number of shares subscribed for on page 6 hereafter, of shares of Common Stock (the “Shares”) and warrant to purchase shares of common stock (the "Warrants") on the Closing Date, as defined below.

NOW, THEREFORE, IN CONSIDERATION of the mutual covenants contained in this Agreement, and for other good and valuable consideration the receipt and adequacy of which are hereby acknowledged, the Company and each Purchaser agree as follows:

ARTICLE 1

SALE AND PURCHASE OF THE SHARES AND WARRANTS

1.1 Sale of the Shares and Warrants. Within one (1) day of the execution of this Agreement (the "Closing Date"), the Purchaser shall purchase from the Company and the Company shall issue and sell to each Purchaser, the number of Shares equal to such Purchaser’s amounts set forth below such Purchaser’s signature block on the signature page hereto (the “Subscription Amount”) divided by the per share purchase price (the “Per Share Purchase Price”), which shall be $0.11, subject to adjustment for reverse and forward stock splits, stock dividends, stock combinations and other similar transactions of the Company’s common stock that occur after the date of this Agreement. For each four (4) Shares purchased, Purchaser will receive warrants (the “Warrants”) to purchase one (1) share of common stock for a period of five (5) years at an exercise price of $0.1265 per share, a form of which is attached hereto as Exhibit A. The Shares and the Warrants hereinafter sometimes collectively referred to as the Securities.

1.2 Instruments of Conveyance and Transfer.

| |

(a)

|

On the Closing Date, the Company shall deliver or cause to be delivered to the Purchaser this Agreement duly executed by the Company.

|

| |

|

|

| |

(b)

|

On the Closing Date, the Purchaser shall deliver or cause to be delivered to the Company the following:

|

| |

|

(i)

|

this Agreement duly executed by such Purchasers;

|

| |

|

|

|

| |

|

(ii)

|

a Warrant duly executed by the Company;

|

| |

|

|

|

| |

|

(iii)

|

a copy of the completed Accredited Investor Questionnaire, a copy of which is attached hereto as Exhibit B.

|

1.3 Consideration for the Shares. The Purchaser’s total purchase price for the Shares and the Warrants is the Subscription Amount.

ARTICLE 2

REPRESENTATIONS AND COVENANTS OF SELLER AND PURCHASER

2.1 The Company hereby represents and warrants that:

| |

(a)

|

The Securities issued hereunder have been duly authorized by the appropriate corporate action of the Company.

|

| |

|

|

| |

(b)

|

The Company shall transfer title, in and to the Securities to the Purchaser free and clear of all liens, security interests, pledges, encumbrances, charges, restrictions, demands and claims, of any kind and nature whatsoever, whether direct or indirect or contingent.

|

| |

|

|

| |

(c)

|

The certificate representing the Shares and the shares of common stock underlying the Warrants which will be issued to the Purchaser shall be subject to no liens, security interests, pledges, encumbrances, charges, restrictions, demands or claims in any other party whatsoever, except as set forth in the legend on the certificate, which legend shall provide as follows:

|

THE SHARES (OR OTHER SECURITIES) REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933. THE SHARES MAY NOT BE SOLD OR TRANSFERRED IN THE ABSENCE OF SUCH REGISTRATION OR AN OPINION OF COUNSEL THAT AN EXEMPTION FROM REGISTRATION UNDER SUCH ACT IS AVAILABLE.

| |

(d)

|

No Brokers. Except for the Letter Agreement entered between the Company and Govdesk, LLC ("Govdesk"), pursuant to which Govdesk shall receive from the Company a cash fee of five percent (5%) of any investment received from an investor introduced to the Company by Govdesk as well as common stock purchase warrants to acquire 3,000,000 shares of common stock for a period of five (5) years at an exercise price of $0.1265 per share, the Company has taken no action which would give rise to any claim by any person for brokerage commissions, transaction fees or similar payments relating to this Agreement or the transactions contemplated hereby. In addition, for services rendered to the Company by Govdesk, the Company will issue Govdesk or its assignees 2,000,000 shares of Common Stock.

|

| |

|

|

| |

(e)

|

Purchaser acknowledges and agrees that the Company makes no other representations or warranties with respect to the Shares or the Company.

|

2.2 Purchaser represents and warrants to the Company as follows:

| |

(a)

|

Purchaser has adequate means of providing for current needs and contingencies, has no need for liquidity in the investment, and is able to bear the economic risk of an investment in the Securities offered by the Company of the size contemplated. Purchaser represents that Purchaser is able to bear the economic risk of the investment and at the present time could afford a complete loss of such investment. Purchaser has had a full opportunity to inspect the books and records of the Company and to make any and all inquiries of the Company officers and directors regarding the Company and its business as Purchaser has deemed appropriate.

|

| |

(b)

|

Purchaser is an “Accredited Investor” as defined in Regulation D of the Securities Act and Purchaser, either alone or with Purchaser’s professional advisers who are unaffiliated with, have no equity interest in and are not compensated by the Company or any affiliate or selling agent of the Company, directly or indirectly, has sufficient knowledge and experience in financial and business matters that the Purchaser is capable of evaluating the merits and risks of an investment in the Securities offered by the Company and of making an informed investment decision with respect thereto and has the capacity to protect Purchaser’s own interests in connection with Purchaser’s proposed investment in the Securities.

|

| |

|

|

| |

(c)

|

Purchaser acknowledges that the Securities including the shares of common stock underlying the Warrants will initially be “restricted securities” (as such term is defined in Rule 144 (“Rule 144"), promulgated under the Securities Act of 1933, as amended (the “Securities Act”), that the Securities will include the restrictive legend set forth above, and, except as otherwise set forth in this Agreement, that the Securities cannot be sold unless registered with the United States Securities and Exchange Commission (“SEC”) and qualified by appropriate state securities regulators, or otherwise complies with an exemption from such registration and qualification (including, without limitation, compliance with Rule 144).

|

| |

|

|

| |

(d)

|

The Purchaser has carefully read the Form 10-K Annual Report for the year ended December 31, 2013, the Form 10-Q Quarterly Report for the quarter ended June 30, 2014 and all other reports filed with the SEC (the “Reports”) as well as all other filings made by the Company with the SEC, and the related risk factors (the “Risk Factors”), which are contained in the Reports. The undersigned has been given the opportunity to ask questions of, and receive answers from, the Company concerning the terms and conditions of this offering, the Reports and the Risk Factors and to obtain such additional information, to the extent the Company possesses such information or can acquire it without unreasonable effort or expense, necessary to verify the accuracy of same as the undersigned reasonably desires in order to evaluate the investment. The Purchaser understands the Reports and the associated Risk Factors, and the undersigned has had the opportunity to discuss any questions regarding any of the disclosure in the Reports and the associated Risk Factors with his counsel or other advisor. Notwithstanding the foregoing, the only information upon which the undersigned has relied is that set forth in the Reports and the associated Risk Factors. The undersigned has received no representations or warranties from the Company, its employees, agents or attorneys, in making this investment decision other than as set forth in the Reports and the associated Risk Factors. The undersigned does not desire to receive any further information.

|

| |

|

|

| |

(e)

|

The Purchaser is aware that the purchase of the Securities is a speculative investment involving a high degree of risk, that there is no guarantee that the undersigned will realize any gain from this investment, and that the undersigned could lose the total amount of this investment. The undersigned acknowledges that the proceeds will be utilized for working capital.

|

| |

|

|

| |

(f)

|

The Purchaser understands that no federal or state agency has made any finding or determination regarding the fairness of the Securities for investment, or any recommendation or endorsement of the Securities.

|

| |

|

|

| |

(g)

|

The Purchaser represents that the Purchaser is not a broker, a broker dealer or an affiliate of a broker dealer.

|

| |

|

|

| |

(h)

|

During the period beginning on the Closing Date and continuing through May 15, 2017, the Purchaser agrees that any sales of the Shares or the shares of Common Stock underlying the Warrants into the market will not exceed 10% of the Company’s average volume for the preceding twenty (20) trading days on any given day. Notwithstanding the foregoing, the restrictions set forth in this Section 2.2(h) shall not apply to the sale by the Purchaser of the Shares or the shares of Common Stock or underlying Warrants in a privately negotiated transaction, including block trades that are cleared through a broker, provided that the purchaser(s) thereof agree to be bound in writing by the restrictions set forth herein.

|

ARTICLE 3

MISCELLANEOUS

3.1 Entire Agreement. This Agreement sets forth the entire agreement and understanding of the parties hereto with respect to the transactions contemplated hereby, and supersedes all prior agreements, arrangements and understandings related to the subject matter hereof. No understanding, promise, inducement, statement of intention, representation, warranty, covenant or condition, written or oral, express or implied, whether by statute or otherwise, has been made by any party hereto which is not embodied in this Agreement or the written statements, certificates, or other documents delivered pursuant hereto or in connection with the transactions contemplated hereby, and no party hereto shall be bound by or liable for any alleged understanding, promise, inducement, statement, representation, warranty, covenant or condition not so set forth.

3.2 Notices. Any notice, request, instruction, or other document required by the terms of this Agreement, or deemed by any of the parties hereto to be desirable, to be given to any other party hereto shall be in writing and shall be given by facsimile, personal delivery, overnight delivery, or mailed by registered or certified mail, postage prepaid, with return receipt requested. If notice is given by facsimile, personal delivery, or overnight delivery in accordance with the provisions of this Section, said notice shall be conclusively deemed given at the time of such delivery. If notice is given by mail in accordance with the provisions of this Section, such notice shall be conclusively deemed given seven days after deposit thereof in the United States mail.

3.3 Waiver and Amendment. Any term, provision, covenant, representation, warranty or condition of this Agreement may be waived, but only by a written instrument signed by the party entitled to the benefits thereof. The failure or delay of any party at any time or times to require performance of any provision hereof or to exercise its rights with respect to any provision hereof shall in no manner operate as a waiver of or affect such party's right at a later time to enforce the same. No waiver by any party of any condition, or of the breach of any term, provision, covenant, representation or warranty contained in this Agreement, in any one or more instances, shall be deemed to be or construed as a further or continuing waiver of any such condition or breach or waiver of any other condition or of the breach of any other term, provision, covenant, representation or warranty. No modification or amendment of this Agreement shall be valid and binding unless it be in writing and signed by all parties hereto.

3.4 Choice of Law. This Agreement and the rights of the parties hereunder shall be governed by and construed in accordance with the laws of the State of New York including all matters of construction, validity, performance, and enforcement and without giving effect to the principles of conflict of laws.

3.5 Jurisdiction. The parties submit to the jurisdiction of the Courts of the County of New York, State of New York or a Federal Court empanelled in the State of New York for the resolution of all legal disputes arising under the terms of this Agreement, including, but not limited to, enforcement of any arbitration award.

3.6 Counterparts. This Agreement may be executed in two or more counterparts, including, without limitation, by facsimile transmission, all of which counterparts shall be considered one and the same agreement and shall become effective when counterparts have been signed by each party and delivered to the other party. In the event any signature page is delivered by facsimile transmission, the party using such means of delivery shall cause additional original executed signature pages to be delivered to the other parties as soon as practicable thereafter.

3.7 Attorneys' Fees. Except as otherwise provided herein, if a dispute should arise between the parties including, but not limited to arbitration, the prevailing party shall be reimbursed by the non-prevailing party for all reasonable expenses incurred in resolving such dispute, including reasonable attorneys' fees exclusive of such amount of attorneys' fees as shall be a premium for result or for risk of loss under a contingency fee arrangement.

3.8 Taxes. Any income taxes required to be paid in connection with the payments due hereunder, shall be borne by the party required to make such payment. Any withholding taxes in the nature of a tax on income shall be deducted from payments due, and the party required to withhold such tax shall furnish to the party receiving such payment all documentation necessary to prove the proper amount to withhold of such taxes and to prove payment to the tax authority of such required withholding.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, the parties hereto have executed this Stock Purchase Agreement, as of the date first written hereinabove.

|

MANHATTAN SCIENTIFICS, INC.

|

|

Address for Notice:

|

|

|

|

|

|

|

By:

|

|

|

405 Lexington Avenue, 32nd Floor

|

|

Name:

|

Emmanuel Tsoupanarias

|

|

New York, New York, 10174

|

|

Title:

|

Chief Executive Officer

|

|

|

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK

SIGNATURE PAGES FOR PURCHASER FOLLOWS]

[PURCHASER SIGNATURE PAGES TO SECURITIES PURCHASE AGREEMENT]

IN WITNESS WHEREOF, the undersigned have caused this Securities Purchase Agreement to be duly executed by their respective authorized signatories as of the date first indicated above.

Total Subscription Amount: $1,980,000 ($0.11 per share)

Shares 18,000,000 (determined by dividing the above subscription amount by $0.11)

Warrants 4,500,000 (determined by multiplying the number of Shares by 4)

Tax Payer Identification Number (or Social Security or EIN number): _________________________

Name of Purchaser: ________________________________________________________________

Signature of Authorized Signatory of Purchaser: _________________________________________

Name of Authorized Signatory: __________________________________________________

Title of Authorized Signatory: ________________________________________

Email Address of Purchaser: _______________________________

Facsimile of Purchaser: __________________________________________________

Address for Notice of Purchaser:

Address for Delivery of Securities for Purchaser (if not same as above):

EXHIBIT B

ACCREDITED INVESTOR QUESTIONNAIRE

The Purchaser warrants and represents to the Company that it qualifies as an “accredited investor,” as such term is defined in Rule 501(a) of Regulation D under the Securities Act of 1933, as amended (the “Securities Act”), by virtue of the fact that the Purchaser meets the following criteria at the time of the sale of the Securities to the Purchaser (Purchaser must initial the applicable categories below):

I. ACCREDITED INVESTOR STATUS

A. Individual Investors: (Initial one or more of the following statements)

1. ____ I certify that I am an accredited investor because I have had individual income (exclusive of any income earned by my spouse) of more than $200,000 in each of the two most recent calendar years and I reasonably expect to have an individual income in excess of $200,000 for the current year.

2. ____ I certify that I am an accredited investor because I have had joint income with my spouse in excess of $300,000 in each of the two most recent calendar years and I reasonably expect to have joint income with my spouse in excess of $300,000 for the current year.

3. ____ I certify that I am an accredited investor because I have an individual net worth, or my spouse and I have a joint net worth, in excess of $1,000,000 which excludes the value of your primary residence.

4. ____ I certify that I am an accredited investor because I am a director, executive officer, or general partner of the issuer of the securities being offered or sold, or any director, executive officer, or general partner of a general partner of that issuer.

B. Partnerships, Corporations, Trusts or Other Entities: (Initial one of the following statements)

1. The undersigned hereby certifies that it is an accredited investor because it is:

a. ______ any corporation, partnership, or Massachusetts or similar business trust, not formed for the specific purpose of acquiring the securities offered, with total assets in excess of $5,000,000;

b. ______ a trust with total assets in excess of $5,000,000, not formed for the specific purpose of acquiring the securities offered, whose purchase is directed by a person who has such knowledge and experience in financial and business matters that he is capable of evaluating the merits and risks of an investment in the securities offered as described in Rule 506(b)(2)(ii) under the Securities Act;

c. ______ an employee benefit plan within the meaning of the Employee Retirement Income Security Act of 1974, whose investment decisions are made by a plan fiduciary, as defined in Section 3 (21) of such act, which is either a bank, savings and loan association, an insurance company or registered investment adviser;

d. ______ a self-directed employee benefit plan within the meaning of the Employee Retirement Income Security Act of 1974, with investment decisions made solely by persons that are accredited investors;

e. ______ an employee benefit plan within the meaning of the Employee Retirement Income Security Act of 1974 with total assets in excess of $5,000,000;

f. ______ any plan established and maintained by a state, its political subdivisions, or any agency or instrumentality of a state or its political subdivisions, for the benefit of its employees, with total assets in excess of $5,000,000;

g. ______ an organization described in Section 501(c)(3) of the Internal Revenue Code of 1986, as amended, not formed for the specific purpose of acquiring the securities offered, with total assets in excess of $5,000,000;

h. ______ a private business development company as defined in Section 202(a)(22) of the Investment Advisers Act of 1940;

i. ______ any bank as defined in Section 3(a)(2) of the Securities Act or any savings and loan association or other institution as defined in Section 3(a)(5)(A) of the Securities Act whether acting in its individual or fiduciary capacity;

j. ______ any broker or dealer registered pursuant to Section 15 of the Securities Exchange Act of 1934, as amended;

k. ______ any insurance company as defined in Section 2(a)(13) of the Securities Act;

l. ______ any investment company registered under the Investment Company Act of 1940 or a business development company as defined in Section 2(a)(48) of the Investment Company Act of 1940;

m. ______ any Small Business Investment Company licensed by the U.S. Small Business Administration under Section 301(c) or (d) of the Small Business Investment Act of 1958; or

2. ____ The undersigned hereby certifies that it is an accredited investor because it is an entity in which each of the equity owners qualifies as an accredited investor under items A(1), (2) or (3) or item B(1) above.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

Please indicate whether Purchaser is an INDIVIDUAL, or if purchased as JOINT TENANTS, as TENANTS IN COMMON, or as COMMUNITY PROPERTY:

Date: _______________, 2014

|

|

|

|

|

|

Purchaser(s)

|

|

Purchaser(s)

|

|

|

|

|

|

|

|

|

|

|

|

|

Print Name(s)

|

|

Print Name(s)

|

|

|

|

|

|

|

|

|

|

|

|

|

Print Title

|

|

Print Title

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature(s)

|

|

Signature(s)

|

|

_______________________________

_______________________________

Address

10

EXHIBIT 4.2

WARRANT

THE WARRANT EVIDENCED OR CONSTITUTED HEREBY, AND ALL SHARES OF COMMON STOCK DELIVERABLE UPON EXERCISE HEREUNDER, HAVE BEEN AND WILL BE ISSUED WITHOUT REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (“THE ACT”) AND MAY NOT BE SOLD, OFFERED FOR SALE, TRANSFERRED, PLEDGED OR HYPOTHECATED WITHOUT REGISTRATION UNDER THE ACT UNLESS EITHER (A) THE COMPANY HAS RECEIVED AN OPINION OF COUNSEL, IN FORM AND SUBSTANCE REASONABLY SATISFACTORY TO THE COMPANY, TO THE EFFECT THAT REGISTRATION IS NOT REQUIRED IN CONNECTION WITH SUCH DISPOSITION OR (B) THE SALE OF SUCH SECURITIES IS MADE PURSUANT TO SECURITIES AND EXCHANGE COMMISSION RULE 144.

|

Date: November 17, 2014

|

Warrant No. 2014 B-01

|

WARRANT TO PURCHASE COMMON STOCK

OF MANHATTAN SCIENTIFICS, INC.

THIS CERTIFIES THAT, for value received, Drake Private Investments, LLC (“Holder”), is entitled, subject to the terms and conditions of this Warrant, at any time or from time to time and after November 17, 2014 (the “Effective Date”), to purchase up to 4,500,000 shares of common stock, par value $0.001 per share (the “Warrant Shares”), from Manhattan Scientifics, Inc., a Delaware corporation (the “Company”), at an exercise price per share equal to $0.1265 (the “Purchase Price”). This Warrant shall expire at 5:00 p.m., New York, time on that date which is five (5) years from the date of this Warrant (the “Expiration Date”). Both the Warrant Shares and the Purchase Price are subject to adjustment and change as provided herein.

1. CERTAIN DEFINITIONS. As used in this Warrant the following terms shall have the following respective meanings:

“1933 Act” shall mean the Securities Act of 1933, as amended.

“1934 Act” shall mean the Securities Exchange Act of 1934, as amended.

“Common Stock” shall mean the Common Stock of the Company and any other securities at any time receivable or issuable upon exercise of this Warrant.

“Person” means an individual, a corporation, a limited liability company, an association, a partnership, an estate, a trust or any other entity or organization, other than the Company or any of its affiliates.

“SEC” shall mean the Securities and Exchange Commission.

2. EXERCISE OF WARRANT

2.1 Payment. Subject to compliance with the terms and conditions of this Warrant and applicable securities laws, this Warrant may be exercised, in whole or in part at any time or from time to time, on or before the Expiration Date by the delivery (including, without limitation, delivery by facsimile) of the form of Notice of Exercise attached hereto as Exhibit 1 (the “Notice of Exercise”), duly executed by the Holder, at the address of the Company as set forth herein, and as soon as practicable after such date,

(a) surrendering this Warrant at the address of the Company, and

(b) providing payment, by check or by wire transfer, of an amount equal to the product obtained by multiplying the number of shares of Common Stock being purchased upon such exercise by the then effective Purchase Price (the “Exercise Amount”).

2.2 Common Stock Certificates; Fractional Shares. As soon as practicable on or after the date of an exercise of this Warrant, the Company shall deliver to the person or persons entitled to receive the same a certificate or certificates for the number of whole shares of Common Stock issuable upon such exercise. No fractional shares or scrip representing fractional shares of Common Stock shall be issued upon an exercise of this Warrant.

2.3 Partial Exercise: Effective Date of Exercise. In case of any partial exercise of this Warrant, the Holder and the Company shall cancel this Warrant upon surrender hereof and shall execute and deliver a new Warrant of like tenor and date for the balance of the shares of Common Stock purchasable hereunder. This Warrant shall be deemed to have been exercised on the close of business on the date of delivery of the Notice of Exercise as provided above. The Company acknowledges that the person entitled to receive the shares of Common Stock issuable upon exercise of this Warrant shall be treated for all purposes as the holder of record of such shares as of the close of business on the date the Holder is deemed to have exercised this Warrant.

3. TAXES. The Holder shall pay all taxes and other governmental charges that may be imposed in respect of the delivery of shares upon exercise of this Warrant.

4. ADJUSTMENT OF PURCHASE PRICE AND NUMBER OF COMMON STOCK. The number of shares of Common Stock deliverable upon exercise of this Warrant (or any shares of stock or other securities or property receivable upon exercise of this Warrant) and the Purchase Price are subject to adjustment upon occurrence of the following events:

4.1 Adjustment for Stock Splits, Stock Subdivisions or Combinations of Shares of Common Stock. The Purchase Price of this Warrant shall be proportionally decreased and the number of shares of Common Stock deliverable upon exercise of this Warrant (or any shares of stock or other securities at the time deliverable upon exercise of this Warrant) shall be proportionally increased to reflect any stock split or subdivision of the Company’s Common Stock. The Purchase Price of this Warrant shall be proportionally increased and the number of shares of Common Stock deliverable upon exercise of this Warrant (or any shares of stock or other securities at the time deliverable upon exercise of this Warrant) shall be proportionally decreased to reflect any combination of the Company’s Common Stock.

4.2 Reclassification. If the Company, by reclassification of securities or otherwise, shall change any of the securities as to which purchase rights under this Warrant exist into the same or a different number of securities of any other class or classes, this Warrant shall thereafter represent the right to acquire such number and kind of securities as would have been issuable as the result of such change with respect to the securities that were subject to the purchase rights under this Warrant immediately prior to such reclassification or other change and the Purchase Price therefore shall be appropriately adjusted, all subject to further adjustment as provided in this Section 4.

4.3 Adjustment for Capital Reorganization. Merger or Consolidation. In case of any capital reorganization of the capital stock of the Company (other than a combination, reclassification, exchange or subdivision of shares otherwise provided for herein), or any merger or consolidation of the Company with or into another entity, or the sale of all or substantially all the assets of the Company then, and in each such case, as a part of such reorganization, merger, consolidation, sale or transfer, lawful provision shall be made so that the Holder of this Warrant shall thereafter be entitled to receive upon exercise of this Warrant, during the period specified herein and upon payment of the Purchase Price then in effect, the number of shares of stock or other securities or property of the successor corporation resulting from such reorganization, merger, consolidation, sale or transfer that a holder of the shares deliverable upon exercise of this Warrant would have been entitled to receive in such reorganization, consolidation, merger, sale or transfer if this Warrant had been exercised immediately before such reorganization, merger, consolidation, sale or transfer, all subject to further adjustment as provided in this Section 4. The foregoing provisions of this Section 4.3 shall similarly apply to successive reorganizations, consolidations, mergers, sales and transfers and to the stock or securities of any other corporation that are at the time receivable upon the exercise of this Warrant. If the per-share consideration payable to the Holder hereof for shares in connection with any such transaction is in a form other than cash or marketable securities, then the value of such consideration shall be determined in good faith by the Company’s Board of Directors. In all events, appropriate adjustment (as determined in good faith by the Company’s Board of Directors) shall be made in the application of the provisions of this Warrant with respect to the rights and interests of the Holder after the transaction, to the end that the provisions of this Warrant shall be applicable after that event, as near as reasonably may be, in relation to any shares or other property deliverable after that event upon exercise of this Warrant.

5. LOSS OR MUTILATION. Upon receipt of evidence reasonably satisfactory the Company of the ownership of and the loss, theft, destruction or mutilation of this Warrant, and of indemnity reasonably satisfactory to the Company (provided no bond shall be required to be posted), and (in the case of mutilation) upon surrender and cancellation of this Warrant, the Company will cause to be executed and delivered in lieu thereof a new Warrant of like tenor as the lost, stolen, destroyed or mutilated Warrant.

6. REPRESENTATION. Subject to the Company increasing its authorized shares of common stock, the Company hereby covenants that all shares issuable upon exercise of this Warrant, when delivered upon such exercise, shall be free and clear of all liens, security interests, charges and other encumbrances or restrictions on sale and free and clear of all preemptive rights, except encumbrances or restrictions arising under federal or state securities laws. Further, the Company hereby covenants to reserve such number of authorized but unissued shares of Common Stock for issuance upon exercise of this Warrant. Additionally, the Company covenants that all shares which may be issued upon the exercise of the purchase rights represented by this Warrant will, upon exercise of the purchase rights represented by this Warrant and payment for such shares in accordance herewith, be duly authorized, validly issued, fully paid and nonassessable. Except and to the extent as waived or consented to by the Holder, the Company shall not by any action, including, without limitation, amending its certificate of incorporation or through any reorganization, transfer of assets, consolidation, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms of this Warrant, but will at all times in good faith assist in the carrying out of all such terms and in the taking of all such actions as may be necessary or appropriate to protect the rights of Holder as set forth in this Warrant against impairment.

7. RESTRICTIONS ON TRANSFER. The Holder, by acceptance hereof, agrees that, absent an effective registration statement filed with the SEC under the 1933 Act, covering the disposition or sale of this Warrant or the Common Stock issued or issuable upon exercise hereof or the Common Stock issuable upon conversion thereof, as the case may be, and registration or qualification under applicable state securities laws, such Holder will not sell, transfer, pledge, or hypothecate any or all such Warrants or Common Stock, as the case may be, unless either (i) the Company has received an opinion of counsel, in form and substance reasonably satisfactory to the Company, to the effect that such registration is not required in connection with such disposition or (ii) the sale of such securities is made pursuant to SEC Rule 144.

8. COMPLIANCE WITH SECURITIES LAWS. By acceptance of this Warrant, the Holder hereby represents, warrants and covenants that he/she/it is an “accredited investor” as that term is defined under Rule 501 of Regulation D, that any shares of stock purchased upon exercise of this Warrant or acquired upon conversion thereof shall be acquired for investment only and not with a view to, or for sale in connection with, any distribution thereof, that the Holder has had such opportunity as such Holder has deemed adequate to obtain from representatives of the Company such information as is necessary to permit the Holder to evaluate the merits and risks of its investment in the Company; that the Holder is able to bear the economic risk of holding such shares as may be acquired pursuant to the exercise of this Warrant for an indefinite period; that the Holder understands that the shares of stock acquired pursuant to the exercise of this Warrant or acquired upon conversion thereof will not be registered under the 1933 Act (unless otherwise required pursuant to exercise by the Holder of the registration rights, if any, granted to the Holder) and will be “restricted securities” within the meaning of Rule 144 under the 1933 Act and that the exemption from registration under Rule 144 will not be available for at least six months from the date of exercise of this Warrant, and even then will not be available unless a public market then exists for the stock, adequate information concerning the Company is then available to the public, and other terms and conditions of Rule 144 are complied with; and that all stock certificates representing shares of stock issued to the Holder upon exercise of this Warrant or upon conversion of such shares may have affixed thereto a legend substantially in the following form:

THE SECURITIES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), OR UNDER THE SECURITIES LAWS OF ANY STATE. THESE SECURITIES ARE SUBJECT TO RESTRICTIONS ON TRANSFERABILITY AND RESALE AND MAY NOT BE TRANSFERRED OR RESOLD EXCEPT AS PERMITTED UNDER THE ACT AND ANY APPLICABLE STATE SECURITIES LAWS, PURSUANT TO REGISTRATION OR EXEMPTION THEREFROM. INVESTORS SHOULD BE AWARE THAT THEY MAY BE REQUIRED TO BEAR THE FINANCIAL RISKS OF THIS INVESTMENT FOR AN INDEFINITE PERIOD OF TIME. THE ISSUER OF THESE SECURITIES MAY REQUIRE AN OPINION OF COUNSEL IN FORM AND SUBSTANCE SATISFACTORY TO THE ISSUER TO THE EFFECT THAT ANY PROPOSED TRANSFER OR RESALE IS IN COMPLIANCE WITH THE ACT AND ANY APPLICABLE STATE SECURITIES LAWS.

9. NO RIGHTS OR LIABILITIES AS STOCKHOLDERS. This Warrant shall not entitle the Holder to any voting rights or other rights as a shareholder of the Company. In the absence of affirmative action by such Holder to purchase Common Stock by exercise of this Warrant, no provisions of this Warrant, and no enumeration herein of the rights or privileges of the Holder hereof shall cause such Holder hereof to be a shareholder of the Company for any purpose.

10. NOTICES. All notices and other communications required or permitted hereunder shall be in writing and shall be mailed by registered or certified mail, postage prepaid, return receipt requested, or by telecopier, or by email or otherwise delivered by hand or by messenger, addressed or telecopied to the person to whom such notice or communication is being given at its address set forth on the related signature page. In order to be effective, a copy of any notice or communication sent by telecopier or email must be sent by registered or certified mail, postage prepaid, return receipt requested, or delivered personally to the person to whom such notice or communication is being at its address set forth after its signature hereto. If notice is provided by mail, notice shall be deemed to be given three (3) business days after proper deposit with the United States mail, one (1) business day after proper deposit with a nationally recognized overnight courier, or immediately upon personally delivery thereof, to person to whom such notice or communication is being at such address. If notice is provided by telecopier, notice shall be deemed to be given upon confirmation by the telecopier machine of the receipt of such notice at the telecopier number provided below. If notice is provided by email, notice shall be deemed to be given upon confirmation by the sender’s email program of the receipt of such notice at the email address provided after the signature of the person to whom such notice or communication is being delivered. The addresses set forth on the signature page hereto may be changed by written notice complying with the terms of this Section 10.

11. LAW GOVERNING. This Warrant shall be construed and enforced in accordance with, and governed by, the laws of the State of New York.

12. SEVERABILITY. If any term, provision, covenant or restriction of this Warrant is held by a court of competent jurisdiction to be invalid, void or unenforceable, the remainder of the terms, provisions, covenants and restrictions of this Warrant shall remain in full force and effect and shall in no way be affected, impaired or invalidated.

13. COUNTERPARTS. For the convenience of the parties, any number of counterparts of this Warrant may be executed by the parties hereto and each such executed counterpart shall be, and shall be deemed to be, an original instrument.

IN WITNESS WHEREOF, the parties hereto have executed this Warrant as of date first written above.

MANHATTAN SCIENTIFICS, INC.

|

By:

|

|

|

|

Name:

|

Emmanuel Tsoupanarias

|

|

|

Title:

|

Chief Executive Officer

|

|

405 Lexington Avenue, 26th Floor

New York, NY 10174

Fax: (614) 455-6714

EXHIBIT 1

NOTICE OF EXERCISE

(To be executed upon exercise of Warrant)

|

_________________

|

WARRANT NO. ___

|

The undersigned hereby irrevocably elects to exercise the right of purchase represented by the within Warrant Certificate for, and to purchase thereunder, securities of Manhattan Scientifics, Inc., as provided for therein, and:

Tenders herewith payment of the exercise price in full in the form of cash or a certified or official bank check in same-day funds in the amount of $____________ for _________ such securities.

Please issue a certificate or certificates for such securities in the name of, and pay any cash for any fractional share to (please print name, address and social security number):

Name: ___________________

Address: ___________________

Signature: ___________________

Note: The above signature should correspond exactly with the name on the first page of this Warrant Certificate.

If said number of shares shall not be all the shares purchasable under the within Warrant Certificate, a new Warrant Certificate is to be issued in the name of said undersigned for the balance remaining of the shares purchasable thereunder rounded up to the next higher whole number of shares.

6

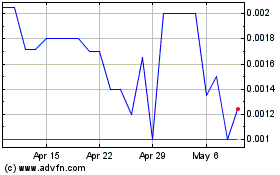

Manhattan Scientifics (PK) (USOTC:MHTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

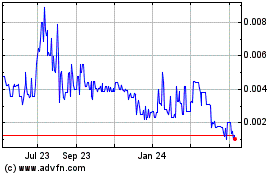

Manhattan Scientifics (PK) (USOTC:MHTX)

Historical Stock Chart

From Apr 2023 to Apr 2024