UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 18, 2014

AMARANTUS BIOSCIENCE HOLDINGS, INC.

(Exact name of registrant as specified in

its charter)

| Nevada |

333-148922 |

26-0690857 |

| (State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

IRS Employer

Identification No.) |

|

655 Montgomery Street

Suite 900

San Francisco, CA |

94111 |

| (Address of Principal Executive Offices) |

(Zip Code) |

(408) 737-2734

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| Item 8.01 |

Other Events

Amarantus Bioscience Holdings, Inc. (the

“Company”) intends to use the corporate presentation attached to this Current Report on Form 8-K as Exhibit 99.1 (the

“Slides”), in whole or in part, and possibly with modifications, in connection with its presentation to stockholders

and potential investors.. The Slides are attached as Exhibit 99.1 to this report on Form 8-K and are incorporated herein

by reference.

The information contained in the Slides

is summary information that is intended to be considered in the context of the Company’s Securities and Exchange Commission

(“SEC”) filings and other public announcements that the Company may make, by press release or otherwise, from time

to time. The Company undertakes no duty or obligation to publicly update or revise the information contained in this report, although

it may do so from time to time as its management believes is warranted. Any such updating may be made through the filing of other

reports or documents with the SEC, through press releases or through other public disclosure. |

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit

No. |

|

Description |

| |

|

|

| 99.1 |

|

Corporate presentation dated November 18, 2014 |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

| |

|

|

AMARANTUS BIOSCIENCE HOLDINGS, INC. |

| |

|

|

|

|

|

| |

|

|

|

|

|

| Date: November 18, 2014 |

|

By: |

/s/ Gerald E. Commissiong |

|

| |

|

|

|

Name: Gerald E. Commissiong |

|

| |

|

|

|

Title: Chief Executive Officer |

|

Exhibit 99.1

1 Diagnostic and therapeutic products in the areas of neurology, psychiatry, ophthalmology and regenerative medicine BUSINESS UPDATE AND ESS PRODUCT ACQUISITION OPTION November 18, 2014 1 OTCQB: AMBS

2 This presentation contains “ forward - looking statements ” within the meaning of the “ safe - harbor ” provisions of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from the results expressed or implied by such statements, including changes from anticipated levels of sales, future international, national or regional economic and competitive conditions, changes in relationships with customers, access to capital, difficulties in developing and marketing new products and services, marketing existing products and services, customer acceptance of existing and new products and services and other factors. Accordingly, although the Company believes that the expectations reflected in such forward - looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. The Company has no obligation to update the forward - looking information contained in this presentation. Forward - Looking Statements

Recent Operational Highlights Corporate x Strengthened Board of Directors with the appointments of seasoned biopharmaceutical industry executives Iain Ross and Donald Huffman. x Received approval for all matters voted upon at its annual shareholder’s meeting. Eltoprazine x Submitted a request for written feedback to the FDA regarding the proposed trial design for a Phase 2b clinical study in PD LID, expected to start in early 2015. The Company expects to receive written feedback in the coming weeks. LymPro x Initiated commercial development of LymPro at Icon Central Laboratories. x Completed Enrollment of 72 Patient LP - 002 Clinical Study for Alzheimer's Blood Diagnostic LymPro Test. x Reported 7 - year longitudinal data from LP - 001 patient record follow - up at the Alzheimer’s Association International Conference. 3

Recent Operational Highlights (Cont’d) LymPro x Reported positive data from 72 patients in the LP - 002 clinical performance study for diagnosing Alzheimer's disease showing the LymPro Test achieved highly statistically significant results in correctly distinguishing patients with moderate - to - severe AD from healthy controls. MANF x Completed the license of intellectual property from the University of Miami’s Bascom Palmer Eye Institute for the treatment of retinal disorders with MANF and/or CDNF (cerebral dopamine neurotrophic factor). x Submitted application to the US Food & Drug Administration (FDA) for Orphan Drug Designation of MANF in RP. x Presented positive MANF animal data in ocular conditions which concluded that MANF provided positive protective functional effects in animal models of central retinal vein occlusion (CRVO), as well as central retinal artery occlusion (CRAO) and Glaucoma. x Announced positive 15 - day non - GLP toxicology data for a single intravitreal administration of MANF in an ocular safety animal model, relevant to MANF's development in ocular diseases, including orphan indications such as RP. 4

Recent Operational Highlights (Cont’d) Financial Updates x Research and development costs for the three months ended September 30, 2014 increased $1,610,000 to $1,899,000 from $289,000 for the three months ended September 30, 2013 and reflects an extensive amount of pre - clinical and clinical work. x General and administrative expenses for the three months ended September 30, 2014 increased $1,680,000 to $2,070,000 from $390,000 for the three months ended September 30, 2013 primarily due an increase in employee compensation related expenses, increases in legal patent and audit related expenses, and increased business development expenses. x Interest expense decreased $471,000, to $46,000 from $517,000 for the three months ended September 30, 2013 primarily due to debt conversion to equity. x Change in fair value of warrants and derivatives liabilities decreased $1,727,000, to $117,000 from $1,844,000 primarily due to warrant exercises. x Net loss for the three months ended September 30, 2014 was $4,399,000 as compared to a net loss of $3,040,000 for the three months ended September 30, 2013 . x The Company completed a $3M raise on November 10, 2014 to extend cash runway x The Company continues to have access to over $17 million in additional funding available from an equity financing facility with Lincoln Park Capital. 5

AMBS Core Competence in Uncovering Groundbreaking Opportunities Screening expertise in identifying assets with challenges and transforming into significant product opportunities for portfolio expansion 6 LymPro Test® Eltoprazine MANF ESS

Process for Identifying Candidates x Core scientific competence among key scientists in our sphere of influence (KOLs) x Compelling & sound /validated science that address key unmet clinical need x Extensive due diligence to ascertain ‘drugability’ of the opportunity x Little to no ‘effective’ competition in the therapeutic area of interest x Special situation where asset value was once high, and now significantly reduced due to non - asset related circumstances x LymPro: Significant financial difficulties, Flow Cytometry stability failed during financial crisis of 2008 x Eltoprazine: Strategic decision to focus on CRO Business, PoC not quite sufficient for Pharma deal x Relationship establishment with key team members that will assist in moving the opportunity forward once inside Amarantus x Strategic fit to change the value proposition (upside value) for Amarantus while mitigating overall enterprise risk (different asset class) x Clear exit strategy within 2 - 3 years (incubator business model) x Heavily discounted purchase price compared to comparable products/companies x Diagnostics division is first example of pending exit opportunity for Amarantus 7

Portfolio Expansion into Regenerative Medicine 8 Amarantus Diagnostics (LymPro/ NuroPro ) Therapeutics (Eltoprazine/MANF) Discovery ( PhenoGuard ) Regen Med* (ESS) * = Upon Completion of the acquisition from Lonza Corporate infrastructure in place to absorb assets. For ESS - W, 1 - 2 key hires + CROs needed

ESS Pending Acquisition Summary • Entered into an exclusive option agreement with Lonza Walkersville, to acquire Cutanogen Corporation (a subsidiary of Lonza) • Intent is to develop Engineered Skin Substitute – Walkserville (ESS - W) as a autologous skin replacement product for the treatment of Stage 3 and Stage 4 intractable severe burns – Research efforts for Permaderm/ESS provides strong anecdotal clinical data that warrants further investigation in corporate setting • Engage Lonza via a long - term MSA to produce ESS - W for human clinical trials and commercial distribution • Cash payments due to Lonza based on achievement of certain milestones and royalty payments on sales performance • Cash payments due to Regenecin to unencumber ESS - W • Transaction on track to be completed 1Q 2015 9 Represents paradigm - shifting approach to treat human diseases and repair tissue damage

Extensive Due Diligence Conducted • AMBS team conducted 18 - months of due diligence • Engaged RDM (Rare Disease Management) for in - depth review and recommendations • Extensive review of all documents delivered by Lonza • Permaderm/ESS Product Profile, timeline, product history and comprehensive FDA audit history • Epidemiology, US and global burn statistics, cost of care information for burn patients and detailed statistics and information on severe wound care marketplace (US and Ex - US) • Regulatory Pathway for ESS - W US, EU and China clinical development pathway research • Market competitors analysis - US and global • Data on competition and regulatory pathway case study history • Comprehensive insight on US FDA CBER , CRDH and HUD/HDE Exemption process for Amarantus and implications • KOL Interviews - American Burn Association President Dr. David Ahrenholtz, Director of the U.S. Army Institute of Surgical Research Burn Center Dr. Booker King, Director of The Office of Orphan Product Development (OOPD) Dr. Henry Startzman • KOL Interview - China CFDA Advisor and Burn Physician • Comprehensive database with over 50 research documents and resources on Permaderm/ESS • GMP Process that distinguishes ESS - W from Permaderm/ESS 10

ESS - W Overview 11

ESS - W Product Profile • Tissue - engineered skin substitute prepared from autologous (patient’s own) skin cells having both epidermal and dermal layers. • Absorbable collagen and glycosaminoglycan (C - GAG) matrix populated with autologous epidermal keratinocytes and dermal fibroblasts. • Cells and C - GAG matrix are cultured in vitro to promote cell growth, differentiation and maturation, and then packaged in a nutrient medium. • Prepared as individual units of 10 inches x 1 - inches cultured skin graft. Each unit is within a sterile culture medium. 12

Permaderm/ESS Challenges • Non - compliance issues in earlier clinical studies. • Questionable credibility of data generated till date and unlikely that FDA will allow use clinical data • Clinical Hold by FDA • Regulatory pathway needs to be agreed • New clinical development to be conducted • Limited and variable number of severe burn cases across US and EU • Detailed commercial planning to be undertaken 13 Challenges halt clinical advancement and make product appear undesirable

Permaderm /ESS Challenges Represent Exciting Acquisition Opportunity for AMBS • Non - compliance issues in earlier clinical studies. • Questionable credibility of data generated till date and unlikely that FDA will allow use clinical data • Clinical Hold by FDA • Regulatory pathway needs to be agreed • New clinical development to be conducted • Limited and variable number of severe burn cases across US and EU • Detailed commercial planning to be undertaken 14 Permaderm/ ESS Challenges Solution yield upon due diligence x Orphan Drug Designation Granted 2012 x New IND – Clinical hold lifted in May 2014 x New protocol design to suit DoD needs x Lonza invested $8 - 10M in optimization to make ESS - W a GMP - compliant product suitable for mass distribution x Phase 1/2a study with new ESS - W product to commence 2Q 15 x Strong KOL support and involvement x Massive KOL response during due diligence

Strong KOL Support 15 Nicole S. Gibran, M.D., F.A.C.S. , a Professor of Surgery and Director of the University of Washington Medicine Regional Burn Center at Harborview Medical Center in Seattle, Washington, and a principle investigator for the upcoming Phase 2 ESS clinical study “Severe burns represent some of the most horrific injuries a human can endure. In spite of major advances in burn care over the past 25 years, we as a burn community have reached a limit in our ability to heal the burns of patients with major burns with currently available products. ESS offers hope to care providers, who treat severely wounded individuals, that a reliable skin substitute will be available for the horrible situation when wound coverage is not possible. I have long wanted to see ESS developed so that we can offer this life - saving technology to our patients and am delighted that Amarantus is committed to move this forward.“

ESS - W Highlights • Initial Patient Population : 500 - 2000 patients per year – Cost of treatment per patient : $ 1 . 6 M – Cost of treatment with complications : $ 10 M+ • Market opportunity in US : $ 500 M+ • Studies partially funded by US Gov’t grant : AFIRM • Strong KOL support and involvement from leading burn experts • Granted Orphan Drug Designation • Active IND • Phase 1 / 2 a clinical trial expected to commence in 2 Q 2015 • Time to commercialization : ~ 4 years • Secondary applications below 50 % surface burn area & others 16

Burn Overview • Burns are a global public health problem, accounting for an estimated 265,000 deaths annually • In many high - income countries, burn death rates have been decreasing, and the rate of child deaths from burns is currently over 7 times higher in low - and middle - income countries than in high - income countries • Non - fatal burns are a leading cause of morbidity, including prolonged hospitalization, disfigurement and disability, often with resulting stigma and rejection • Burns are among the leading causes of disability - adjusted life - years (DALYs) lost in low - and middle - income countries • In 2004, nearly 11 million people worldwide were burned severely enough to require medical attention 17

USA Burn Market Statistics • Data from the National Center for Injury Prevention and Control in the US shows that each year 1 . 2 million people present with burn injuries • Moderate to severe burn injuries requiring hospitalization account for approximately 100 , 000 of these cases • TOTAL NUMBER OF SEVERE ( 50 % +) BURN PATIENTS IN US : 500 - 2000 • Severe burns leave their victims with disabilities that cost more than $ 80 . 2 billion a year in lost productivity (wages and skills) alone • Tissue engineering and cell therapy represents a market that is expected to grow from $ 6 . 9 billion in 2009 to almost $ 32 billion by 2018 in the U . S . alone* • The rapid growth has been attributed primarily to demonstrable clinical benefits, a clearly defined regulatory path, and a readiness by clinicians to adopt products for use 18

Cost of Care - USA Burn Patients • For severe burn patients without complications, the cost of care tops $ 1 . 6 million • With complications, severe burn treatment cost is over $ 10 million to treat successfully • Overall, costs escalate for major burn cases because of repeated admissions for reconstruction and rehabilitation therapy • In the United States, current annual estimates show that more than US $ 18 billion is spent on specialized care of patients with severe burn injuries 19

Cost of Care - USA Burn Patients • Disfigurement, scarring, or contracture, occurring in 66 percent of cases, add $ 28 , 000 - 35 , 000 to treatment costs • Psychological complications, occurring in 57 percent of cases, add $ 16 , 000 - 75 , 000 to treatment costs • Fragile skin or skin breakdown, occurring in 55 percent of cases, add $ 38 , 000 - 107 , 000 to treatment costs • Infections, including pneumonia, sepsis, and other organ failure from infection problems, occurring in 35 percent of cases, add $ 58 , 000 - 120 , 000 to treatment costs • Delayed wound healing or skin graft failure, occurring in 32 percent of cases, add $ 37 , 000 - 110 , 000 to treatment costs 20

Competitive Product Analysis • Skin substitutes are extensively used in burn wound management • An ideal product should offer quick replacement of both the lost epidermis and dermis layers of skin with permanent wound coverage • Other important factors in selection of a product are: cost effectiveness, durability with long term stability, long shelf life, resist infection, flexibility etc. • A number of both natural as well as synthetic skin substitutes are available in market • Porcine or cadaver grafts have potential for immune system rejection • No single product offers complete coverage and two or more products are used in combination to achieve desired outcome in burn wound management • Tissue engineered skin substitutes have made significant progress in last few years 21 ESS - W has the potential to address shortcomings in severe burn care market and provide live - saving solutions for patients

ESS - W Opportunity Summary • Differentiated product fulfilling significant unmet needs and near - term commercial opportunity • Potential for meaningful revenue generation in the near - term • Providing life - saving solutions to patients and strong potential to play a key role in market • All historical issues addressed with new product in the eyes of FDA and moving forward from position of strength • Identified clear path to registration • Working closely with world’s leading KOLs to design and implement clinical programs • Engaging Lonza, a preeminent manufacturing organization, for highest quality results • Leveraging internal and external development expertise to ensure operational excellence 22

Near - Term Next Steps • Finalize transaction with Lonza and Regenecin • Prepare to commence Phase 1/2a study • Conduct formal pricing and reimbursement study 23

ESS - W is Perfectly Aligned with AMBS Strategy • AMBS has robust pipeline with high value product candidates from discovery to commercial - ready • Regenerative medicine space is “HOT” and attractive to Big Pharma – entry by acquisition • ESS provides yet another opportunity to unlock significant value in the near and long term – Immediate value creation by unencumbering asset from litigation – Long - term value creation from clinical successes 24

Robust Pipeline from Discovery to Commercial has Potential to Unlock Significant Value in Near Term 25 Asset Pre - Clinical Phase 1 Phase 2 Phase 3 Commercial LymPro Test®: Alzheimer’s (CLIA) Potential spinoff in 2015 Eltoprazine: Parkinson’s / Adult ADHD Potential partnership in 2016 ESS - W*: Intractable Severe Burns Potential spinoff / partner 2017 MANF: Retinitis Pigmentosa Pre - Clinical Potential PoC in orphan ocular in 2018 * = upon exercise of exclusive option to acquire ESS - W from Lonza

AMBS Near - Term Milestones Eltoprazine • IND Submission/approval • Initiation of Eltoprazine Phase 2b clinical study in PD LID anticipated for early Q1/2015 • Initiation of the Phase 2b adult ADHD clinical trial with Eltoprazine anticipated for later in 2015 LymPro • Completion of enrollment in expanded LP - 002 clinical study to assess LymPro's predictive value in diagnosing early - stage Alzheimer's disease patients expected by year end • Launch of LymPro diagnostic for Alzheimer's disease anticipated before the end of 2014 26

AMBS Near - Term Milestones (Cont’d) MANF • Response on Orphan Drug Designation Application for MANF in RP expected from FDA • Functional data in RP in animals • File RP ODD application in Europe • CRVO ODD at FDA ESS - W • Completion of transaction to acquire asset • Initiation of Phase 1/2a study in Q2 2015 Corporate • Preparation for uplisting • Preparation for potential spin - out of diagnostics division (potential stock dividend to shareholders) 27

Q&A 28

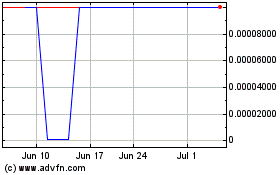

Amarantus Bioscience (CE) (USOTC:AMBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

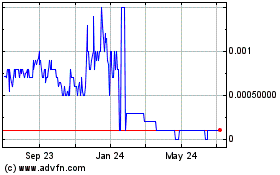

Amarantus Bioscience (CE) (USOTC:AMBS)

Historical Stock Chart

From Apr 2023 to Apr 2024