Labor SMART, Inc. Provides Update on Its Balance Sheet and Capital Initiatives

November 18 2014 - 7:30AM

Access Wire

Management Goal is to

Minimize Equity Dilution

ATLANTA, GA / ACCESSWIRE / November 18, 2014 /

Labor SMART, Inc. (LTNC) (the "Company"), a leader in providing

on-demand blue collar staffing primarily in the southeastern United

States, is pleased to provide its shareholders with an update on

its balance sheet and capital initiatives.

"Over the past couple of years we have been able to grow our

business from $7 million revenue in 2012 to $16 million revenue in

2013 to $18 million revenue in the first nine months of 2014,"

stated Ryan Schadel, Labor SMART Chairman and Chief Executive

Officer. "In fact, we have doubled our branches to 30 locations in

the past year and reached positive EBITDA. None of this would have

been possible without the growth capital we raised along the way.

Venture or seed capital was not available to us, so we went the

route of convertible debentures. While they may not be ideal in

structure, at the time there were no traditional financing

opportunities available to us. Since we now have our business

generating $2 million revenue per month and EBITDA positive, it is

now a major focus of ours to minimize the equity dilution going

forward."

Mr. Schadel, continued, "We are taking a 3-pronged approach to

address the current capital structure. Due to the seasonality of

our business, we expect approximately $1.2 million of operating

cash flow over the next 4 months, which we will utilize to pay back

a portion of the notes. We will also allow for certain note holders

to convert into equity for a portion of the notes. Additionally, we

are actively pursuing additional outside cash infusions to

restructure a portion of the notes and for growth capital. Our

dependence on convertible debentures for financing has been greatly

reduced over the last 45 days as our business reached minimum

scale. We believe a combination of these three alternatives will

minimize the equity dilution and protect shareholder value without

sacrificing our long term growth strategy. As an organization

commited to transparency and communication to shareholders, we will

update our investors of major changes to our outstanding share

count via routine form 8K filings with the Securities and Exchange

Commision."

As of November 4, 2014, Labor SMART had a balance of

approximately $3.0 million of Convertible Notes Payable on its

balance sheet. The shares outstanding as of November 4, 2014 stood

at 55.5 million.

About Labor SMART, Inc.

Labor SMART, Inc. provides On-Demand temporary labor to a

variety of industries. The Company's clients range from small

businesses to Fortune 100 companies. Labor SMART was founded to

provide reliable, dependable and flexible resources for on-demand

personnel to small and large businesses in areas that include

construction, manufacturing, hospitality, event-staffing,

restoration, warehousing, retailing, disaster relief and cleanup,

demolition and landscaping. Labor SMART believes it can make a

positive contribution each and every day for the benefit of its

clients and temporary employees. The Company's mission is to be the

provider of choice to its growing portfolio of customers with a

service-focused approach that enables Labor SMART to be seen as a

resource and partner to its clients.

Safe Harbor Statement

This release contains statements that constitute forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. These statements appear in a number of places

in this release and include all statements that are not statements

of historical fact regarding the intent, belief or current

expectations of Labor SMART, Inc., its directors or its officers

with respect to, among other things: (i) financing plans; (ii)

trends affecting its financial condition or results of operations;

(iii) growth strategy and operating strategy. The words "may",

"would", "will", "expect", "estimate", "can", "believe",

"potential", and similar expressions and variations thereof are

intended to identify forward-looking statements. Investors are

cautioned that any such forward-looking statements are not

guarantees of future performance and involve risks and

uncertainties, many of which are beyond Labor SMART, Inc.'s ability

to control, and that actual results may differ materially from

those projected in the forward-looking statements as a result of

various factors. More information about the potential factors that

could affect the business and financial results is and will be

included in Labor SMART, Inc.'s filings with the U.S. Securities

and Exchange Commission.

Contacts:

Hayden IR

917-658-7878

hart@haydenir.com

SOURCE: Labor SMART, Inc.

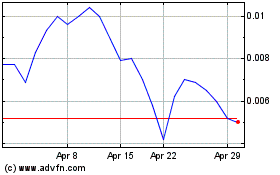

Labor Smart (PK) (USOTC:LTNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Labor Smart (PK) (USOTC:LTNC)

Historical Stock Chart

From Apr 2023 to Apr 2024