|

|

UNITED STATES |

|

|

|

SECURITIES AND EXCHANGE COMMISSION |

|

|

|

Washington, D.C. 20549 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE 13D |

|

Under the Securities Exchange Act of 1934

(Amendment No. )*

Coherus BioSciences, Inc.

(Name of Issuer)

Common Stock, $0.0001 par value

(Title of Class of Securities)

(CUSIP Number)

David J. Sorkin, Esq.

c/o Kohlberg Kravis Roberts & Co. L.P.

9 West 57th Street, Suite 4200

New York, New York 10019

(212) 750-8300

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1I, 240.13d-1(f) or 240.13d-1(g), check the following box. o

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

CUSIP No. 19249H103 |

|

|

|

|

1. |

Names of Reporting Persons

KKR BIOSIMILAR L.P. |

|

|

|

|

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

|

|

|

(a) |

o |

|

|

|

(b) |

o |

|

|

|

|

3. |

SEC Use Only |

|

|

|

|

4. |

Source of Funds (See Instructions)

OO |

|

|

|

|

5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

|

|

|

|

6. |

Citizenship or Place of Organization

Delaware |

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

3,055,055 |

|

|

|

8. |

Shared Voting Power

0 |

|

|

|

9. |

Sole Dispositive Power

3,055,055 |

|

|

|

10. |

Shared Dispositive Power

0 |

|

|

|

|

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

3,055,055 |

|

|

|

|

12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

|

|

|

|

13. |

Percent of Class Represented by Amount in Row (11)

9.4% |

|

|

|

|

14. |

Type of Reporting Person (See Instructions)

PN |

|

|

|

|

|

|

2

|

CUSIP No. 19249H103 |

|

|

|

|

1. |

Names of Reporting Persons

KKR BIOSIMILAR GP LLC |

|

|

|

|

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

|

|

|

(a) |

o |

|

|

|

(b) |

o |

|

|

|

|

3. |

SEC Use Only |

|

|

|

|

4. |

Source of Funds (See Instructions)

OO |

|

|

|

|

5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

|

|

|

|

6. |

Citizenship or Place of Organization

Delaware |

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

3,055,055 |

|

|

|

8. |

Shared Voting Power

0 |

|

|

|

9. |

Sole Dispositive Power

3,055,055 |

|

|

|

10. |

Shared Dispositive Power

0 |

|

|

|

|

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

3,055,055 |

|

|

|

|

12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

|

|

|

|

13. |

Percent of Class Represented by Amount in Row (11)

9.4% |

|

|

|

|

14. |

Type of Reporting Person (See Instructions)

OO |

|

|

|

|

|

|

3

|

CUSIP No. 19249H103 |

|

|

|

|

1. |

Names of Reporting Persons

KKR FUND HOLDINGS L.P. |

|

|

|

|

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

|

|

|

(a) |

o |

|

|

|

(b) |

o |

|

|

|

|

3. |

SEC Use Only |

|

|

|

|

4. |

Source of Funds (See Instructions)

OO |

|

|

|

|

5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

|

|

|

|

6. |

Citizenship or Place of Organization

Cayman Islands |

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

3,055,055 |

|

|

|

8. |

Shared Voting Power

0 |

|

|

|

9. |

Sole Dispositive Power

3,055,055 |

|

|

|

10. |

Shared Dispositive Power

0 |

|

|

|

|

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

3,055,055 |

|

|

|

|

12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

|

|

|

|

13. |

Percent of Class Represented by Amount in Row (11)

9.4% |

|

|

|

|

14. |

Type of Reporting Person (See Instructions)

PN |

|

|

|

|

|

|

4

|

CUSIP No. 19249H103 |

|

|

|

|

1. |

Names of Reporting Persons

KKR FUND HOLDINGS GP LIMITED |

|

|

|

|

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

|

|

|

(a) |

o |

|

|

|

(b) |

o |

|

|

|

|

3. |

SEC Use Only |

|

|

|

|

4. |

Source of Funds (See Instructions)

OO |

|

|

|

|

5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

|

|

|

|

6. |

Citizenship or Place of Organization

Cayman Islands |

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

3,055,055 |

|

|

|

8. |

Shared Voting Power

0 |

|

|

|

9. |

Sole Dispositive Power

3,055,055 |

|

|

|

10. |

Shared Dispositive Power

0 |

|

|

|

|

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

3,055,055 |

|

|

|

|

12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

|

|

|

|

13. |

Percent of Class Represented by Amount in Row (11)

9.4% |

|

|

|

|

14. |

Type of Reporting Person (See Instructions)

CO |

|

|

|

|

|

|

5

|

CUSIP No. 19249H103 |

|

|

|

|

1. |

Names of Reporting Persons

KKR GROUP HOLDINGS L.P. |

|

|

|

|

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

|

|

|

(a) |

o |

|

|

|

(b) |

o |

|

|

|

|

3. |

SEC Use Only |

|

|

|

|

4. |

Source of Funds (See Instructions)

OO |

|

|

|

|

5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

|

|

|

|

6. |

Citizenship or Place of Organization

Cayman Islands |

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

3,055,055 |

|

|

|

8. |

Shared Voting Power

0 |

|

|

|

9. |

Sole Dispositive Power

3,055,055 |

|

|

|

10. |

Shared Dispositive Power

0 |

|

|

|

|

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

3,055,055 |

|

|

|

|

12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

|

|

|

|

13. |

Percent of Class Represented by Amount in Row (11)

9.4% |

|

|

|

|

14. |

Type of Reporting Person (See Instructions)

PN |

|

|

|

|

|

|

6

|

CUSIP No. 19249H103 |

|

|

|

|

1. |

Names of Reporting Persons

KKR GROUP LIMITED |

|

|

|

|

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

|

|

|

(a) |

o |

|

|

|

(b) |

o |

|

|

|

|

3. |

SEC Use Only |

|

|

|

|

4. |

Source of Funds (See Instructions)

OO |

|

|

|

|

5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

|

|

|

|

6. |

Citizenship or Place of Organization

Cayman Islands |

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

3,055,055 |

|

|

|

8. |

Shared Voting Power

0 |

|

|

|

9. |

Sole Dispositive Power

3,055,055 |

|

|

|

10. |

Shared Dispositive Power

0 |

|

|

|

|

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

3,055,055 |

|

|

|

|

12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

|

|

|

|

13. |

Percent of Class Represented by Amount in Row (11)

9.4% |

|

|

|

|

14. |

Type of Reporting Person (See Instructions)

CO |

|

|

|

|

|

|

7

|

CUSIP No. 19249H103 |

|

|

|

|

1. |

Names of Reporting Persons

KKR & CO. L.P. |

|

|

|

|

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

|

|

|

(a) |

o |

|

|

|

(b) |

o |

|

|

|

|

3. |

SEC Use Only |

|

|

|

|

4. |

Source of Funds (See Instructions)

OO |

|

|

|

|

5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

|

|

|

|

6. |

Citizenship or Place of Organization

Delaware |

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

3,055,055 |

|

|

|

8. |

Shared Voting Power

0 |

|

|

|

9. |

Sole Dispositive Power

3,055,055 |

|

|

|

10. |

Shared Dispositive Power

0 |

|

|

|

|

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

3,055,055 |

|

|

|

|

12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

|

|

|

|

13. |

Percent of Class Represented by Amount in Row (11)

9.4% |

|

|

|

|

14. |

Type of Reporting Person (See Instructions)

PN |

|

|

|

|

|

|

8

|

CUSIP No. 19249H103 |

|

|

|

|

1. |

Names of Reporting Persons

KKR MANAGEMENT LLC |

|

|

|

|

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

|

|

|

(a) |

o |

|

|

|

(b) |

o |

|

|

|

|

3. |

SEC Use Only |

|

|

|

|

4. |

Source of Funds (See Instructions)

OO |

|

|

|

|

5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

|

|

|

|

6. |

Citizenship or Place of Organization

Delaware |

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

3,055,055 |

|

|

|

8. |

Shared Voting Power

0 |

|

|

|

9. |

Sole Dispositive Power

3,055,055 |

|

|

|

10. |

Shared Dispositive Power

0 |

|

|

|

|

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

3,055,055 |

|

|

|

|

12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

|

|

|

|

13. |

Percent of Class Represented by Amount in Row (11)

9.4% |

|

|

|

|

14. |

Type of Reporting Person (See Instructions)

OO |

|

|

|

|

|

|

9

|

CUSIP No. 19249H103 |

|

|

|

|

1. |

Names of Reporting Persons

HENRY R. KRAVIS |

|

|

|

|

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

|

|

|

(a) |

o |

|

|

|

(b) |

o |

|

|

|

|

3. |

SEC Use Only |

|

|

|

|

4. |

Source of Funds (See Instructions)

OO |

|

|

|

|

5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

|

|

|

|

6. |

Citizenship or Place of Organization

United States |

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

0 |

|

|

|

8. |

Shared Voting Power

3,055,055 |

|

|

|

9. |

Sole Dispositive Power

0 |

|

|

|

10. |

Shared Dispositive Power

3,055,055 |

|

|

|

|

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

3,055,055 |

|

|

|

|

12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

|

|

|

|

13. |

Percent of Class Represented by Amount in Row (11)

9.4% |

|

|

|

|

14. |

Type of Reporting Person (See Instructions)

IN |

|

|

|

|

|

|

10

|

CUSIP No. 19249H103 |

|

|

|

|

1. |

Names of Reporting Persons

GEORGE R. ROBERTS |

|

|

|

|

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

|

|

|

(a) |

o |

|

|

|

(b) |

o |

|

|

|

|

3. |

SEC Use Only |

|

|

|

|

4. |

Source of Funds (See Instructions)

OO |

|

|

|

|

5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

|

|

|

|

6. |

Citizenship or Place of Organization

United States |

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

0 |

|

|

|

8. |

Shared Voting Power

3,055,055 |

|

|

|

9. |

Sole Dispositive Power

0 |

|

|

|

10. |

Shared Dispositive Power

3,055,055 |

|

|

|

|

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

3,055,055 |

|

|

|

|

12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

|

|

|

|

13. |

Percent of Class Represented by Amount in Row (11)

9.4% |

|

|

|

|

14. |

Type of Reporting Person (See Instructions)

IN |

|

|

|

|

|

|

11

Item 1. Security and Issuer.

This Schedule 13D relates to Common Stock, $0.0001 par value (the “Common Stock”) of Coherus BioSciences, Inc., a Delaware corporation (the “Issuer”). The principal executive offices of the Issuer are located at 201 Redwood Shores Parkway, Suite 200, Redwood City, California 94065.

Item 2. Identity and Background.

(a), (f) This statement on Schedule 13D is being filed pursuant to Rule 13d-1(a) under the Securities Exchange Act of 1934, as amended, by:

(i) KKR Biosimilar L.P., a Delaware limited partnership (“KKR Biosimilar”)

(ii) KKR Biosimilar GP LLC, a Delaware limited liability company (“KKR Biosimilar GP”)

(iii) KKR Fund Holdings L.P., a Cayman Islands exempted limited partnership (“KKR Fund Holdings”);

(iv) KKR Fund Holdings GP Limited, a Cayman Islands limited company (“KKR Fund Holdings GP”);

(v) KKR Group Holdings L.P., a Cayman Islands exempted limited partnership (“KKR Group Holdings”);

(vi) KKR Group Limited, a Cayman Islands limited company (“KKR Group”);

(vii) KKR & Co. L.P., a Delaware limited partnership (“KKR & Co.”);

(viii) KKR Management LLC, a Delaware limited liability company (“KKR Management”);

(ix) Henry R. Kravis, a United States citizen; and

(x) George R. Roberts, a United States citizen (the persons and entities listed in items (i) through (x) are collectively referred to herein as the “Reporting Persons”).

KKR Biosimilar GP is the general partner of KKR Biosimilar. KKR Fund Holdings is the sole member of KKR Biosimilar GP. KKR Fund Holdings GP is a general partner of KKR Fund Holdings. KKR Group Holdings is the sole shareholder of KKR Fund Holdings GP and a general partner of KKR Fund Holdings. KKR Group is the general partner of KKR Group Holdings. KKR & Co. is the sole shareholder of KKR Group. KKR Management is the general partner of KKR & Co. Messrs. Kravis and Roberts are executive officers and the designated members of KKR Management.

Each of Todd A. Fisher and William J. Janetschek and David J. Sorkin is a director of KKR Fund Holdings GP and KKR Group and an executive officer of KKR Management. Each of Messrs. Fisher, Janetschek and Sorkin is a United States citizen.

The Reporting Persons have entered into a joint filing agreement, dated as of November 17, 2014, a copy of which is attached hereto as Exhibit A.

(b) The address of the principal business office of KKR Biosimilar, KKR Biosimilar GP, KKR Fund Holdings, KKR Fund Holdings GP, KKR Group Holdings, KKR Group, KKR & Co., KKR Management and Messrs. Kravis, Fisher, Janetschek and Sorkin is:

c/o Kohlberg Kravis Roberts & Co. L.P.

9 West 57th Street, Suite 4200

New York, NY 10019

The address of the principal business office of Mr. Roberts is:

c/o Kohlberg Kravis Roberts & Co. L.P.

2800 Sand Hill Road, Suite 200

Menlo Park, CA 94025

(c) Each of KKR Biosimilar and KKR Biosimilar GP is formed for the purpose of investing in the Issuer.

Each of KKR Fund Holdings, KKR Fund Holdings GP, KKR Group Holdings, KKR Group, KKR & Co. and KKR Management is principally engaged as a holding company for the subsidiaries engaged in the investment management business.

The present principal occupation or employment of each of Messrs. Kravis, Roberts, Fisher, Janetschek and Sorkin is as an executive of Kohlberg Kravis Roberts & Co. L.P. and/or one or more of its affiliates.

(d) During the last five years, none of the Reporting Persons or, to the best knowledge of the Reporting Persons, any of the other persons named in this Item 2, has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) During the last five years, none of the Reporting Persons or, to the best knowledge of the Reporting Persons, any of the other persons named in this Item 2, has been party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding were or are subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

12

Item 3. Source and Amount of Funds or Other Consideration.

On November 12, 2014, immediately prior to the consummation of the Issuer’s initial public offering, KKR Biosimilar received 2,499,499 shares of Common Stock upon the automatic conversion of 2,499,499 shares of the Issuer’s Series C convertible preferred stock, which KKR Biosimilar had purchased from the Issuer in May 2014 for an aggregate purchase price of $24,999,996. On November 12, 2014, KKR Biosimilar purchased an additional 555,556 shares of Common Stock for $13.50 per share, in the Issuer’s initial public offering, for a total purchase price of $7,500,006.

The purchase of the securities was funded from general funds available to the Reporting Persons and the applicable subsidiaries and affiliates thereof, including capital contributions from investors.

Item 4. Purpose of Transaction.

The information set forth in Items 3 and 6 of this Schedule 13D is hereby incorporated by reference in this Item 4.

The Reporting Persons acquired the securities reported herein for investment purposes and intend to review their investments in the Issuer on a continuing basis. Depending on various factors, including but not limited to the Issuer’s financial position and strategic direction, price levels of the Common Stock, conditions in the securities markets, and general economic and industry conditions, the Reporting Persons may in the future take actions with respect to their investment in the Issuer as they deem appropriate, including changing their current intentions, with respect to any or all matters required to be disclosed in this Schedule 13D. Without limiting the foregoing, the Reporting Persons may, from time to time, acquire or cause affiliates to acquire additional shares of Common Stock or other securities of the Issuer, dispose, or cause affiliates to dispose, of some or all of the Common Stock or other securities of the Issuer or continue to hold, or cause affiliates to hold, Common Stock or other securities of the Issuer (or any combination or derivative thereof).

In addition, without limitation, the Reporting Persons may engage in discussions with management, the board of directors, stockholders of the Issuer and other relevant parties or take other actions concerning any extraordinary corporate transaction (including but not limited to a merger, reorganization or liquidation) or the business, operations, assets, strategy, future plans, prospects, corporate structure, board composition, management, capitalization, dividend policy, charter, bylaws, corporate documents, agreements, de-listing or de-registration of the Issuer.

Mr. Satvat serves as a member of the board of directors of the Issuer as of the date of this filing.

Except as set forth above, or as would occur upon completion of any of the matters discussed herein, the Reporting Persons and, to the best knowledge of the Reporting Persons, each of the other individuals named in Item 2 above, have no present plans, proposals or intentions which would result in or relate to any of the transactions described in subparagraphs (a) through (j) of Item 4 of Schedule 13D. Although the foregoing reflects activities presently contemplated by the Reporting Persons and each other person named in Item 2 with respect to the Issuer, the foregoing is subject to change at any time.

Item 5. Interest in Securities of the Issuer.

(a) and (b) The Reporting Persons beneficially own an aggregate of 3,055,055 shares of Common Stock which represents, in the aggregate, approximately 9.4% of the outstanding shares of Common Stock based on 32,559,351 shares of Common Stock outstanding following the conversion of all of the Issuer’s outstanding preferred stock and the completion of the Issuer’s initial public offering on November 12, 2014, as reported in the Issuer’s prospectus dated November 6, 2014, filed with the Securities and Exchange Commission on November 6, 2014, and the partial exercise of the underwriters’ option to purchase additional shares in the initial public offering, as reported in the Issuer’s Current Report on Form 8-K filed with the Securities and Exchange Commission on November 13, 2014.

Each of KKR Biosimilar GP (as the general partner of KKR Biosimilar), KKR Fund Holdings (as the sole member of KKR Biosimilar GP) and KKR Fund Holdings GP (as a general partner of KKR Fund Holdings), KKR Group Holdings (as the sole shareholder of KKR Fund Holdings GP and a general partner of KKR Fund Holdings), KKR Group (as the general partner of KKR Group Holdings), KKR & Co. (as the sole shareholder of KKR Group), KKR Management (as the general partner of KKR & Co.), and Messrs. Henry R. Kravis and George R. Roberts (as the designated members of KKR Management), may be deemed to be the beneficial owner of the securities beneficially owned by KKR Biosimilar, and each disclaims beneficial ownership of the securities. None of Messrs. Fisher, Janetschek and Sorkin beneficially owns any shares of Common Stock.

(c) Other than as described in Item 3 above, the Reporting Persons, and to the best knowledge of the Reporting Persons, the other persons named in Item 2, have had no transactions in the Issuer’s Common Stock in the past 60 days.

(d) Other than the Reporting Persons, no one other than the Reporting Persons, or the partners, members, affiliates or shareholders of

13

the Reporting Persons, has the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of the Reporting Persons’ securities.

(e) Not applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

Lock Up Agreement

In connection with the initial public offering of the Issuer, KKR Biosimilar entered into a lock-up agreement and agreed with the underwriters, subject to certain exceptions, not to dispose of or hedge any shares of Common Stock or securities convertible into or exchangeable for shares of Common Stock during the period from the date of the lock-up agreement continuing through the date 180 days after November 6, 2014, except with the prior written consent of J.P. Morgan Securities LLC and Credit Suisse Securities (USA) LLC.

The foregoing description of the lock-up agreement is qualified in its entirety by reference to the form of the lock-up agreement, which is filed as Exhibit B to this Schedule 13D and incorporated by reference herein.

Investor Rights Agreement

Under Third Amended and Restated Investor Rights Agreement, following the closing of the initial public offering of the Issuer, KKR Biosimilar has the right to require the Issuer to register its shares under the Securities Act of 1933, as amended, so that those shares may be publicly resold, or to include their shares in any registration statement the Issuer files, in each case as described below.

Demand Registration Rights

Based on the number of shares outstanding as of June 30, 2014, after the consummation of the Issuer’s initial public offering, the holders of approximately 21.3 million shares of the Issuer’s Common Stock (including KKR Biosimilar) or their transferees, will be entitled to certain demand registration rights. Beginning 180 days following November 6, 2014, the holders of at least 50% of these shares can, on not more than four occasions, request that the Issuer register all or a portion of their shares which they had received upon conversion of the convertible preferred stock held prior to the Issuer’s initial public offering. Such request for registration must cover a number of shares with an anticipated aggregate offering price, net of underwriting discounts and commissions, of at least $5.0 million. Additionally, the Issuer will not be required to effect a demand registration during the period beginning 60 days prior to the filing and 180 days following the effectiveness of an Issuer-initiated registration statement relating to a public offering of its securities, provided that the Issuer has complied with certain notice requirements to the holders of these shares.

Form S-3 Registration Rights

Such holders will also be entitled to certain Form S-3 registration rights whereby they can make a written request that the Issuer register shares which they had received upon conversion of the convertible preferred stock held prior to the Issuer’s initial public offering on Form S-3 if the Issuer is eligible to file a registration statement on Form S-3 and if the aggregate price to the public of the shares offered is at least $1.0 million. These stockholders may make an unlimited number of requests for registration on Form S-3, but in no event will the Issuer be required to file more than two registrations on Form S-3 in any 12-month period. However, the Issuer will not be required to effect a registration on Form S-3 during the period beginning 60 days prior to the filing and 180 days following the effectiveness of an Issuer-initiated registration statement relating to a public offering of its securities, provided that the Issuer has complied with certain notice requirements to the holders of these shares.

Piggyback Registration Rights

In the event that the Issuer determines to register any of its securities under the Securities Act of 1933, as amended, (subject to certain exceptions), either for its own account or for the account of other security holders, the holders of approximately 21.3 million shares of Common Stock (including KKR Biosimilar) or their transferees, will be entitled to certain “piggyback” registration rights allowing the holders to include their shares which they had received upon conversion of the convertible preferred stock held prior to the Issuer’s initial public offering in such registration, subject to certain marketing and other limitations. As a result, whenever the Issuer proposes to file a registration statement under the Securities Act of 1933, as amended, other than with respect to a registration related to employee benefit plans, the offer and sale of debt securities or corporate reorganizations or certain other transactions, the holders of these shares are entitled to notice of the registration and have the right, subject to limitations that the underwriters may impose on the number of shares included in the registration, to include such shares in the registration.

Expenses of Registration

The Issuer will pay the registration expenses of the holders of the shares registered pursuant to the demand, piggyback and Form S-3 registration rights described above.

14

Expiration of Registration Rights

The demand, piggyback and Form S-3 registration rights described above will expire, with respect to any particular stockholder, upon the earlier of five years after the consummation of the initial public offering or when that stockholder can sell all of its shares under Rule 144 of the Securities Act of 1933, as amended.

The foregoing description of the Third Amended and Restated Investor Rights Agreement is qualified in its entirety by reference to the Third Amended and Restated Investor Rights Agreement, which is filed as Exhibit C to this Schedule 13D and incorporated by reference herein.

Item 7. Material to be Filed as Exhibits.

A. Joint Filing Agreement, dated as of November 17, 2014, by and among the Reporting Persons.

B. Form of Lock-Up Agreement (incorporated herein by reference to Exhibit A to the Form of Underwriting Agreement filed as Exhibit 1.1 to the Issuer’s Form S-1 (File No. 333-198936) filed on October 24, 2014).

C. Third Amended and Restated Investor Rights Agreement, dated as of May 9, 2014, among Coherus BioSciences, Inc. and the stockholders listed therein (incorporated herein by reference to Exhibit 4.3 to the Issuer’s Form S-1 (File No. 333-198936) filed on September 25, 2014).

15

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: November 17, 2014

|

|

|

KKR BIOSIMILAR L.P. |

|

|

|

|

|

|

By: |

KKR BIOSIMILAR GP LLC, its general partner |

|

|

|

|

|

|

By: |

/s/ Terence Gallagher |

|

|

|

Name: |

Terence Gallagher |

|

|

|

Title: |

Attorney-in-fact for William J. Janetschek, |

|

|

|

|

Chief Financial Officer |

|

|

|

KKR BIOSIMILAR GP LLC |

|

|

|

|

|

|

By: |

/s/ Terence Gallagher |

|

|

|

Name: |

Terence Gallagher |

|

|

|

Title: |

Attorney-in-fact for William J. Janetschek, |

|

|

|

|

Chief Financial Officer |

|

|

|

KKR FUND HOLDINGS L.P. |

|

|

|

|

|

|

By: |

KKR Group Holdings L.P., a general partner |

|

|

|

|

|

|

By: |

KKR Group Limited, its general partner |

|

|

|

|

|

|

By: |

/s/ Terence Gallagher |

|

|

|

Name: |

Terence Gallagher |

|

|

|

Title: |

Attorney-in-fact for William J. Janetschek, Director |

|

|

|

KKR FUND HOLDINGS GP LIMITED |

|

|

|

|

|

|

By: |

/s/ Terence Gallagher |

|

|

|

Name: |

Terence Gallagher |

|

|

|

Title: |

Attorney-in-fact for William J. Janetschek, Director |

|

|

|

KKR GROUP HOLDINGS L.P. |

|

|

|

|

|

|

By: |

KKR Group Limited, its general partner |

|

|

|

|

|

|

By: |

/s/ Terence Gallagher |

|

|

|

Name: |

Terence Gallagher |

|

|

|

Title: |

Attorney-in-fact for William J. Janetschek, Director |

|

|

|

KKR GROUP LIMITED |

|

|

|

|

|

|

By: |

/s/ Terence Gallagher |

16

|

|

|

Name: |

Terence Gallagher |

|

|

|

Title: |

Attorney-in-fact for William J. Janetschek, Director |

|

|

|

KKR & CO. L.P. |

|

|

|

|

|

|

By: |

KKR Management LLC, its general partner |

|

|

|

|

|

|

By: |

/s/ Terence Gallagher |

|

|

|

Name: |

Terence Gallagher |

|

|

|

Title: |

Attorney-in-fact for William J. Janetschek, Chief Financial Officer |

|

|

|

KKR MANAGEMENT LLC |

|

|

|

|

|

|

By: |

/s/ Terence Gallagher |

|

|

|

Name: |

Terence Gallagher |

|

|

|

Title: |

Attorney-in-fact for William J. Janetschek, Chief Financial Officer |

|

|

|

HENRY R. KRAVIS |

|

|

|

|

|

|

By: |

/s/ Terence Gallagher |

|

|

|

Name: |

Terence Gallagher |

|

|

|

Title: |

Attorney-in-fact |

|

|

|

GEORGE R. ROBERTS |

|

|

|

|

|

|

By: |

/s/ Terence Gallagher |

|

|

|

Name: |

Terence Gallagher |

|

|

|

Title: |

Attorney-in-fact |

17

Exhibit A

JOINT FILING AGREEMENT

This will confirm the agreement by and among the undersigned that the Schedule 13D filed with the Securities and Exchange Commission on or about the date hereof with respect to the beneficial ownership by the undersigned of the shares of common stock, $0.0001 par value of Coherus BioSciences, Inc., is being filed, and all amendments thereto will be filed, on behalf of each of the persons and entities named below that is named as a reporting person in such filing in accordance with Rule 13d-1(k) under the Securities Exchange Act of 1934, as amended. This Agreement may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

Dated: November 17, 2014

|

|

|

KKR BIOSIMILAR L.P. |

|

|

|

|

|

|

By: |

KKR BIOSIMILAR GP LLC, its general partner |

|

|

|

|

|

|

By: |

/s/ Terence Gallagher |

|

|

|

Name: |

Terence Gallagher |

|

|

|

Title: |

Attorney-in-fact for William J. Janetschek, |

|

|

|

|

Chief Financial Officer |

|

|

|

KKR BIOSIMILAR GP LLC |

|

|

|

|

|

|

By: |

/s/ Terence Gallagher |

|

|

|

Name: |

Terence Gallagher |

|

|

|

Title: |

Attorney-in-fact for William J. Janetschek, |

|

|

|

|

Chief Financial Officer |

|

|

|

KKR FUND HOLDINGS L.P. |

|

|

|

|

|

|

By: |

KKR Group Holdings L.P., a general partner |

|

|

|

|

|

|

By: |

KKR Group Limited, its general partner |

|

|

|

|

|

|

By: |

/s/ Terence Gallagher |

|

|

|

Name: |

Terence Gallagher |

|

|

|

Title: |

Attorney-in-fact for William J. Janetschek, Director |

|

|

|

KKR FUND HOLDINGS GP LIMITED |

|

|

|

|

|

|

By: |

/s/ Terence Gallagher |

|

|

|

Name: |

Terence Gallagher |

|

|

|

Title: |

Attorney-in-fact for William J. Janetschek, Director |

|

|

|

KKR GROUP HOLDINGS L.P. |

|

|

|

|

|

|

By: |

KKR Group Limited, its general partner |

|

|

|

|

|

|

By: |

/s/ Terence Gallagher |

|

|

|

Name: |

Terence Gallagher |

|

|

|

Title: |

Attorney-in-fact for William J. Janetschek, Director |

18

|

|

|

KKR GROUP LIMITED |

|

|

|

|

|

|

By: |

/s/ Terence Gallagher |

|

|

|

Name: |

Terence Gallagher |

|

|

|

Title: |

Attorney-in-fact for William J. Janetschek, Director |

|

|

|

KKR & CO. L.P. |

|

|

|

|

|

|

By: |

KKR Management LLC, its general partner |

|

|

|

|

|

|

By: |

/s/ Terence Gallagher |

|

|

|

Name: |

Terence Gallagher |

|

|

|

Title: |

Attorney-in-fact for William J. Janetschek, Chief Financial Officer |

|

|

|

KKR MANAGEMENT LLC |

|

|

|

|

|

|

By: |

/s/ Terence Gallagher |

|

|

|

Name: |

Terence Gallagher |

|

|

|

Title: |

Attorney-in-fact for William J. Janetschek, Chief Financial Officer |

|

|

|

HENRY R. KRAVIS |

|

|

|

|

|

|

By: |

/s/ Terence Gallagher |

|

|

|

Name: |

Terence Gallagher |

|

|

|

Title: |

Attorney-in-fact |

|

|

|

GEORGE R. ROBERTS |

|

|

|

|

|

|

By: |

/s/ Terence Gallagher |

|

|

|

Name: |

Terence Gallagher |

|

|

|

Title: |

Attorney-in-fact |

19

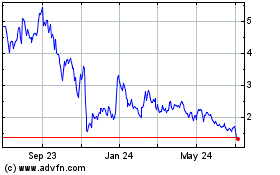

Coherus BioSciences (NASDAQ:CHRS)

Historical Stock Chart

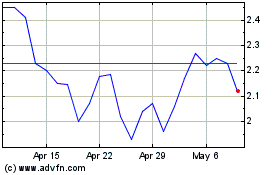

From Mar 2024 to Apr 2024

Coherus BioSciences (NASDAQ:CHRS)

Historical Stock Chart

From Apr 2023 to Apr 2024