UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM 8-K

CURRENT

REPORT Pursuant

to

Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 14, 2014

Astrotech Corporation

(Exact name of registrant as specified in its

charter)

|

|

|

|

|

| Washington |

|

001-34426 |

|

91-1273737 |

|

|

|

|

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

| |

|

|

| 401 Congress Ave. Suite 1650 Austin, Texas |

|

78701 |

|

|

|

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (512) 485-9530

(Former

name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

|

| o |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

|

| o |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

| o |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02. |

Results of Operations and Financial Condition. |

On November 14, 2014, Astrotech Corporation issued a press release

announcing its results of operations for its first quarter ended September 30, 2014. A copy of the press release is attached hereto

as Exhibit 99.1.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

|

99.1 |

|

Press release, dated November 14, 2014, issued by Astrotech Corporation. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Astrotech Corporation |

| |

|

| |

By: |

/s/ Thomas B. Pickens III |

| |

|

Name: |

Thomas B. Pickens III |

| |

|

Title: |

Chairman of the Board and Chief Executive Officer |

Date: November 14, 2014

EXHIBIT INDEX

| Exhibit No. | |

Description | |

Paper (P) or

Electronic (E) |

| | 99.1 | | |

Press release, dated November 14, 2014, issued by Astrotech Corporation. | |

E |

Exhibit 99.1

|

|

|

Astrotech Corporation

401 Congress, Suite 1650

Austin, Texas

512.485.9530

fax: 512.485.9531

www.astrotechcorp.com |

FOR IMMEDIATE RELEASE

ASTROTECH REPORTS FIRST QUARTER 2015 FINANCIAL

RESULTS

Quarterly Highlights

| · |

GAAP results: net income of $23.3 million (attributable to Astrotech

Corporation), or $1.16 per diluted share for the quarter ended September 30, 2014 |

| · |

The sale of Astrotech Space Operations (“ASO”) to Lockheed

Martin was completed on August 22, 2014 for an agreed upon purchase price of $61.0 million, less a working capital adjustment of

$1.7 million |

| · | Adjusted EBITDA of $23.1 million from continuing operations for

the quarter ended September 30, 2014, which includes a gain from the sale of our former ASO business |

| · | 1st Detect was awarded a pivotal competitive contract

for the Next Generation Chemical Detector (NGCD) program |

| · | 1st Detect was granted one U.S. patent and two International

patents during the quarter |

Austin, Texas, November 14, 2014 —

Astrotech Corporation (NASDAQ: ASTC), a premier developer of innovative chemical detection technologies for use in the research,

security, industrial, process flow and healthcare markets, today announced financial results for its first quarter ended September

30, 2014.

“I want to begin by saying that

the sale of Astrotech Space Operations to Lockheed Martin went extremely well, and I would like to commend both the Astrotech

and Lockheed M&A teams for concluding an absolutely flawless transaction. The executive staff at Astrotech internally sourced

the transaction and managed all of our own negotiations, the structure of the asset sale, tax considerations, contracts and the

post sale transition resulting in receiving an excellent price for our shareholders. With the conclusion of this transaction we

begin a new era to grow the company with well seasoned leadership and ample resources. At the base of our growth is the Company’s

investment in our 1st Detect subsidiary where we have made excellent progress with our mass spectrometer technology.

Our recently announced award from the military’s Next Generation Chemical Detector program represents a big win as our technology

was chosen over the best the world has to offer. We have also recently introduced the iONTRAC factory floor in-process monitor

at the Gulf Coast Conference, winning bronze in their New Product Showcase. The iONTRAC is designed to pursue the many opportunities

controlling processes and quality throughout numerous factory floor industrial applications,” said Thomas B. Pickens

III, Chairman and CEO of Astrotech Corporation. “Additionally, we are actively seeking acquisitions along with complementary

and new technology commercialization opportunities.”

First Quarter Results

The Company posted first quarter fiscal year

2015 net income of $23.3 million, or $1.16 per diluted share, which was primarily the result of a $25.6 million gain ($23.7

million after-tax) related to the sale of our former ASO business to Lockheed Martin, compared with a first quarter fiscal year

2014 net income of $1.3 million or $0.06 per diluted share.

Financial Position and Liquidity

Working capital was $44.1 million as of

September 30, 2014, which primarily consisted of $45.3 million in cash and cash equivalents, and a working capital holdback receivable

of $0.6 million related to the sale of our former ASO business. Additionally, the Company recorded a receivable of $6.1 million

for an indemnity holdback related to the sale. The Company believes it will fully realize the indemnity holdback in February 2016.

About Astrotech Corporation

Astrotech is a leader in identifying and commercializing

space technology for terrestrial use. 1st Detect Corporation is developing a breakthrough miniaturized mass spectrometer,

the MMS-1000™, while Astrogenetix, Inc. is a biotechnology company utilizing microgravity as a research platform for drug

discovery and development. Both are wholly owned subsidiaries of the parent.

This press release contains forward-looking

statements that are made pursuant to the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking

statements are subject to risks, trends, and uncertainties that could cause actual results to be materially different from the

forward-looking statement. These factors include, but are not limited to, our ability to successfully develop our remaining Spacetech

business unit, our ability to develop and integrate our miniaturized mass spectrometer, the MMS-1000™, product performance

and market acceptance of products and services, as well as other risk factors and business considerations. Any forward-looking

statements in this document should be evaluated in light of these important risk factors. Astrotech assumes no obligation to update

these forward-looking statements.

FOR MORE INFORMATION:

Eric Stober

Chief Financial Officer

Astrotech Corporation

512.485.9530

Tables follow

###

ASTROTECH CORPORATION AND SUBSIDIARIES

Condensed Consolidated Statements of Operations

(In thousands, except per share data)

|

|

Three Months

Ended September 30, |

|

|

|

2014 |

|

2013 |

|

|

(unaudited) |

| Revenue |

|

$ |

320 |

|

|

$ |

— |

|

| Cost of revenue |

|

|

277 |

|

|

|

— |

|

| Gross profit |

|

|

43 |

|

|

|

— |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

| Selling, general and administrative |

|

|

1,960 |

|

|

|

1,551 |

|

| Research and development |

|

|

692 |

|

|

|

805 |

|

| Total operating expenses |

|

|

2,652 |

|

|

|

2,356 |

|

| Loss from operations |

|

|

(2,609 |

) |

|

|

(2,356 |

) |

| Interest and other expense, net |

|

|

12 |

|

|

|

12 |

|

| Loss from continuing operations before income taxes |

|

|

(2,597 |

) |

|

|

(2,344 |

) |

| Income tax benefit |

|

|

1,325 |

|

|

|

1,173 |

|

| Loss from continuing operations |

|

|

(1,272 |

) |

|

|

(1,171 |

) |

| Discontinued operations |

|

|

|

|

|

|

|

|

| Income from operation of ASO business (including gain from sale of $25.6 million) |

|

|

26,933 |

|

|

|

3,352 |

|

| Income tax expense |

|

|

(2,378 |

) |

|

|

(1,173 |

) |

| Income from discontinued operations |

|

|

24,555 |

|

|

|

2,179 |

|

| Net income |

|

|

23,283 |

|

|

|

1,008 |

|

| Less: Net loss attributable to noncontrolling interest* |

|

|

— |

|

|

|

(245 |

) |

| Net income attributable to Astrotech Corporation |

|

$ |

23,283 |

|

|

$ |

1,253 |

|

| |

|

|

|

|

|

|

|

|

| Amounts attributable to Astrotech Corporation: |

|

|

|

|

|

|

|

|

| Income (loss) from continuing operations, net of tax |

|

$ |

(1,272 |

) |

|

$ |

(926 |

) |

| Income from discontinued operations, net of tax |

|

|

24,555 |

|

|

|

2,179 |

|

| Net income attributable to Astrotech Corporation |

|

$ |

23,283 |

|

|

$ |

1,253 |

|

| |

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

| Basic and diluted |

|

|

19,548 |

|

|

|

19,470 |

|

|

|

|

|

|

|

|

|

|

| Basic and diluted net income (loss) per common share: |

|

|

|

|

|

|

|

|

| Net income (loss) attributable to Astrotech Corporation from continuing operations |

|

$ |

(0.09 |

) |

|

$ |

(0.05 |

) |

| Net income from discontinued operations |

|

|

1.25 |

|

|

|

0.11 |

|

| Net income attributable to Astrotech Corporation |

|

$ |

1.16 |

|

|

$ |

0.06 |

|

| |

|

|

|

|

|

|

|

|

|

| * | Noncontrolling interest resulted from grants of restricted stock in 1st Detect and Astrogenetix to certain employees,

officers and directors. Please refer to the September 30, 2014 10-Q filed with the Securities and Exchange Commission for

further detail. |

ASTROTECH CORPORATION AND SUBSIDIARIES

Condensed Consolidated Balance Sheets

(In thousands)

| | |

September 30, | |

June 30, |

| | |

2014 | |

2014 |

| | |

(unaudited) |

| Assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 45,271 | | |

$ | 3,831 | |

| Accounts receivable, net of allowance | |

| 327 | | |

| 59 | |

| Prepaid expenses and other current assets | |

| 1,132 | | |

| 389 | |

| Discontinued operations – current assets | |

| — | | |

| 1,405 | |

| Total current assets | |

| 46,730 | | |

| 5,684 | |

| Property and equipment, net | |

| 1,168 | | |

| 1,211 | |

| Indemnity receivable | |

| 6,100 | | |

| — | |

| Discontinued operations – net of current assets | |

| — | | |

| 33,887 | |

| Total assets | |

$ | 53,998 | | |

$ | 40,782 | |

| | |

| | | |

| | |

| Liabilities and stockholders’ equity | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 217 | | |

$ | 996 | |

| Accrued liabilities and other | |

| 1,326 | | |

| 1,753 | |

| Income tax payable | |

| 1,053 | | |

| — | |

| Discontinued operations – current liabilities | |

| — | | |

| 7,344 | |

| Total current liabilities | |

| 2,596 | | |

| 10,093 | |

| Other liabilities | |

| 148 | | |

| 152 | |

| Discontinued operations – net of current liabilities | |

| — | | |

| 237 | |

| Total liabilities | |

| 2,744 | | |

| 10,482 | |

| Total stockholders’ equity | |

| 51,254 | | |

| 30,300 | |

| Total liabilities and stockholders’ equity | |

$ | 53,998 | | |

$ | 40,782 | |

| | |

| | | |

| | |

ASTROTECH CORPORATION AND SUBSIDIARIES

Unaudited Reconciliation of Non-GAAP Measures

Earnings Before Interest, Taxes, Depreciation

and Amortization

(In thousands)

| | |

Three Months

Ended September 30, |

| | |

2014 | |

2013 |

| | |

(unaudited) |

| Adjusted EBITDA from continuing operations including gain from the sale of ASO business | |

$ | 23,122 | | |

$ | (2,261 | ) |

| Gain from sale of ASO business | |

| 25,630 | | |

| — | |

| EBITDA from continuing operations | |

$ | (2,508 | ) | |

$ | (2,261 | ) |

| Depreciation & amortization | |

| 89 | | |

| 83 | |

| Interest expense | |

| — | | |

| — | |

| Income tax benefit | |

| (1,325 | ) | |

| (1,173 | ) |

| Loss from continuing operations | |

$ | (1,272 | ) | |

$ | (1,171 | ) |

EBITDA (earnings before interest, taxes, depreciation and amortization)

is a non-U.S. GAAP financial measure. We included information concerning EBITDA because we use such information when evaluating

operating earnings (loss) to better evaluate the underlying performance of the Company. EBITDA does not represent, and should

not be considered an alternative to, net income (loss), operating earnings (loss), or cash flow from operations as those terms

are defined by U.S. GAAP and does not necessarily indicate whether cash flows will be sufficient to fund cash needs. While EBITDA

is frequently used as measures of operations and the ability to meet debt service requirements by other companies, our use of this

financial measure is not necessarily comparable to such other similarly titled captions of other companies.

###

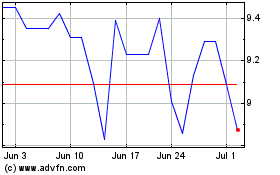

Astrotech (NASDAQ:ASTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Astrotech (NASDAQ:ASTC)

Historical Stock Chart

From Apr 2023 to Apr 2024