UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________________

FORM 8-K

____________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 13, 2014

____________________________________________________________________

Applied Materials, Inc.

(Exact name of registrant as specified in its charter)

____________________________________________________________________

|

| | | | |

| | | | |

Delaware | | 000-06920 | | 94-1655526 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

3050 Bowers Avenue | | |

P.O. Box 58039 Santa Clara, CA | | 95052-8039 |

(Address of principal executive | | (Zip Code) |

offices) | | |

Registrant’s telephone number, including area code: (408) 727-5555

N/A

(Former name or former address, if changed since last report.)

____________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| | |

o | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

o | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

o | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

o | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On November 13, 2014, Applied Materials, Inc. (“Applied Materials”) announced its financial results for its fourth quarter ended October 26, 2014. A copy of Applied Materials’ press release is attached hereto as Exhibit 99.1.

The information contained herein and in the accompanying exhibit shall not be incorporated by reference into any filing of Applied Materials, whether made before or after the date hereof, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing. The information in this report, including the exhibit hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

| | |

| | |

Exhibit No. | | Description |

99.1 | | Press Release issued by Applied Materials, Inc. dated November 13, 2014. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | | |

|

Applied Materials, Inc. (Registrant) |

Date: November 13, 2014 | By: | /s/ Thomas F. Larkins |

| | Thomas F. Larkins |

| | Senior Vice President, General Counsel and Corporate Secretary |

EXHIBIT INDEX

|

| | |

| | |

Exhibit No. | | Description |

99.1 | | Press Release issued by Applied Materials, Inc. dated November 13, 2014. |

Exhibit 99.1

APPLIED MATERIALS ANNOUNCES FOURTH QUARTER AND FISCAL YEAR 2014 RESULTS

| |

• | Q4 net sales of $2.26 billion up 14% year over year (YOY) led by growth in semiconductor equipment and services |

| |

• | Q4 non-GAAP adjusted gross margin of 44.2% up 220 bps YOY; GAAP gross margin of 42.4% up 240 bps YOY |

| |

• | Q4 non-GAAP adjusted operating income of $442 million up 37% YOY; GAAP operating income of $412 million up 95% YOY |

| |

• | Q4 non-GAAP adjusted EPS of $0.27 up 42% YOY; GAAP EPS of $0.23 up 53% YOY |

SANTA CLARA, Calif., Nov. 13, 2014 — Applied Materials, Inc. (NASDAQ:AMAT), the global leader in precision materials engineering solutions for the semiconductor, display and solar industries, today reported results for its fourth quarter and fiscal year ended October 26, 2014.

In its fourth quarter, Applied generated orders of $2.26 billion, down 9 percent sequentially and up 8 percent year over year. Net sales were $2.26 billion, flat sequentially and up 14 percent year over year.

On a non-GAAP adjusted basis, the company reported gross margin of 44.2 percent, operating income of $442 million, and net income of $338 million or $0.27 per diluted share. The company recorded GAAP gross margin of 42.4 percent, operating income of $412 million, and net income of $290 million or $0.23 per diluted share.

Full Year Results

In FY2014, orders grew 14 percent to $9.65 billion, net sales increased 21 percent to $9.07 billion, non-GAAP adjusted gross margin increased 200 basis points to 44.1 percent, non-GAAP adjusted operating income increased 73 percent to $1.78 billion or 19.6 percent of net sales, and non-GAAP adjusted net income increased 83 percent to $1.31 billion or $1.07 per diluted share. The company recorded GAAP gross margin of 42.4 percent, operating income of $1.52 billion or 16.8 percent of net sales, and net income of $1.11 billion or $0.90 per diluted share.

“Our fourth quarter results round out a strong year for Applied Materials where we grew revenues in our semiconductor business by 25 percent and expanded our company operating margin by 6 points,” said Gary Dickerson, president and CEO. “We are making our largest gains in areas of the market that are growing the fastest, including etch and deposition, and we carry positive momentum into 2015.”

Quarterly Results Summary

|

| | | | | | | | | | |

| | | | | | | | Change |

GAAP Results | | Q4 FY2014 | | Q3 FY2014 | | Q4 FY2013 | | Q4 FY2014 vs. Q3 FY2014 | | Q4 FY2014

vs. Q4 FY2013 |

Net sales | | $2.26 billion | | $2.27 billion | | $1.99 billion | | —% | | 14% |

Gross margin | | $959 million | | $992 million | | $795 million | | (3)% | | 21% |

Operating income | | $412 million | | $391 million | | $211 million | | 5% | | 95% |

Net income | | $290 million | | $301 million | | $183 million | | (4)% | | 58% |

Diluted earnings per share (EPS) | | $0.23 | | $0.24 | | $0.15 | | (4)% | | 53% |

Non-GAAP Adjusted Results | | | | | | | | | | |

Non-GAAP adjusted gross margin | | $1.00 billion | | $1.03 billion | | $835 million | | (3)% | | 20% |

Non-GAAP adjusted operating income | | $442 million | | $477 million | | $323 million | | (7)% | | 37% |

Non-GAAP adjusted net income | | $338 million | | $349 million | | $228 million | | (3)% | | 48% |

Non-GAAP adjusted diluted EPS | | $0.27 | | $0.28 | | $0.19 | | (4)% | | 42% |

Applied Materials, Inc.

Page 2 of 12

Applied's non-GAAP adjusted results exclude the impact of the following, where applicable: certain items related to acquisitions or the announced business combination; restructuring charges and any associated adjustments; impairments of assets, goodwill, or investments; gain or loss on sale of strategic investments or facilities; and certain tax items. A reconciliation of the GAAP and non-GAAP adjusted results is provided in the financial tables included in this release. See also “Use of Non-GAAP Adjusted Financial Measures” section.

Fourth Quarter Reportable Segment Results and Comparisons to the Prior Quarter

Silicon Systems Group (SSG) orders were $1.33 billion, down 15 percent, with decreases in DRAM, flash and foundry partially offset by an increase in logic/other. Net sales decreased by 3 percent to $1.43 billion. Non-GAAP adjusted operating income decreased by 17 percent to $352 million or 24.5 percent of net sales. GAAP operating income decreased by 20 percent to $305 million or 21.3 percent of net sales. New order composition was: foundry 50 percent; DRAM 20 percent; logic/other 18 percent; and flash 12 percent.

Applied Global Services (AGS) orders of $747 million grew 35 percent, driven primarily by increases in semiconductor services and spares orders. Net sales of $592 million were up 4 percent. Operating income declined by 5 percent to $146 million on both a GAAP and non-GAAP adjusted basis, and represented 24.7 percent of net sales.

Display orders of $130 million were down 56 percent reflecting continued variability in industry order patterns. Net sales increased 60 percent to $190 million. Operating income doubled to $52 million on both a GAAP and non-GAAP adjusted basis, or 27.4 percent of net sales, including a benefit from the sale of previously reserved inventory that was equivalent to approximately one half point of company gross margin.

Energy and Environmental Solutions (EES) orders decreased to $44 million and net sales declined to $48 million. EES reported a non-GAAP adjusted operating loss of $1 million and a GAAP operating loss of $3 million.

Applied's backlog declined 2 percent sequentially to $2.92 billion and included negative adjustments of $42 million. Backlog composition by segment was: SSG 48 percent; AGS 27 percent; Display 20 percent; and EES 5 percent.

Full-Year Reportable Segment Results and Comparisons to the Prior Year

SSG orders increased by 11 percent to $6.13 billion, net sales increased by 25 percent to $5.98 billion, non-GAAP adjusted operating income increased by 49 percent to $1.57 billion or 26.2 percent of net sales, and GAAP operating income increased by 59 percent to $1.39 billion or 23.3 percent of net sales.

AGS orders increased by 16 percent to $2.43 billion, net sales increased by 9 percent to $2.20 billion, non-GAAP adjusted operating income increased by 30 percent to $576 million or 26.2 percent of net sales, and GAAP operating income increased by 31 percent to $573 million or 26.0 percent of net sales.

Display orders increased by 20 percent to $845 million, net sales increased by 14 percent to $615 million, non-GAAP adjusted operating income increased by 64 percent to $131 million or 21.3 percent of net sales, and GAAP operating income increased by 74 percent to $129 million or 21.0 percent of net sales.

EES orders increased by 43 percent to $238 million, net sales increased by 61 percent to $279 million. In FY2014, EES reported a non-GAAP adjusted operating income of $21 million or 7.5 percent of net sales, and GAAP operating income of $15 million or 5.4 percent of net sales. In FY2013, EES reported a non-GAAP adjusted operating loss of $115 million, and GAAP operating loss of $433 million.

Applied Materials, Inc.

Page 3 of 12

Business Outlook

For the first quarter of fiscal 2015, Applied expects net sales to be in the range of flat to up 5 percent from the previous quarter. Non-GAAP adjusted diluted EPS is expected to be in the range of $0.25 to $0.29, the mid-point of which would be flat with the previous quarter and up by 17 percent year over year.

This outlook excludes known charges related to completed acquisitions and integration costs of $0.03 per share. The outlook does not exclude other non-GAAP adjustments that may arise subsequent to this release.

Use of Non-GAAP Adjusted Financial Measures

Management uses non-GAAP adjusted results to evaluate the company’s operating and financial performance in light of business objectives and for planning purposes. These measures are not in accordance with GAAP and may differ from non-GAAP methods of accounting and reporting used by other companies. Applied believes these measures enhance investors’ ability to review the company’s business from the same perspective as the company’s management and facilitate comparisons of this period’s results with prior periods. The presentation of this additional information should not be considered a substitute for results prepared in accordance with GAAP.

Webcast Information

Applied Materials will discuss these results during an earnings call that begins at 1:30 p.m. Pacific Time today. A live webcast will be available at www.appliedmaterials.com. A replay will be available on the website beginning at 5:00 p.m. Pacific Time today.

Forward-Looking Statements

This press release contains forward-looking statements, including those regarding Applied’s performance, strategies, industry outlooks, and business outlook for the first quarter of fiscal 2015. These statements and their underlying assumptions are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements, including but not limited to: the level of demand for Applied’s products, which is subject to many factors, including uncertain global economic and industry conditions, end-demand for electronic products and semiconductors, and customers’ new technology and capacity requirements; the timing and nature of technology transitions; the concentrated nature of Applied’s customer base; Applied’s ability to (i) develop, deliver and support a broad range of products and expand its markets, (ii) achieve the objectives of operational and strategic initiatives, (iii) obtain and protect intellectual property rights in key technologies, (iv) attract, motivate and retain key employees, (v) successfully complete the announced business combination and realize expected benefits and synergies, and (vi) accurately forecast future results, which depends on multiple assumptions related to, without limitation, market conditions, customer requirements and business needs; and other risks described in Applied's SEC filings, including its most recent Forms 10-Q and 8-K. All forward-looking statements are based on management’s estimates, projections and assumptions as of the date hereof. The company undertakes no obligation to update any forward-looking statements.

About Applied Materials

Applied Materials, Inc. (Nasdaq:AMAT) is the global leader in precision materials engineering solutions for the semiconductor, flat panel display and solar photovoltaic industries. Our technologies help make innovations like smartphones, flat screen TVs and solar panels more affordable and accessible to consumers and businesses around the world. Learn more at www.appliedmaterials.com.

Contact:

Kevin Winston (editorial/media) 408.235.4498

Michael Sullivan (financial community) 408.986.7977

Applied Materials, Inc.

Page 4 of 12

APPLIED MATERIALS, INC.

UNAUDITED CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS

|

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

(In millions, except per share amounts) | | October 26,

2014 | | July 27,

2014 | | October 27,

2013 | | October 26,

2014 | | October 27,

2013 |

Net sales | | $ | 2,264 |

| | $ | 2,265 |

| | $ | 1,988 |

| | $ | 9,072 |

| | $ | 7,509 |

|

Cost of products sold | | 1,305 |

| | 1,273 |

| | 1,193 |

| | 5,229 |

| | 4,518 |

|

Gross margin | | 959 |

| | 992 |

| | 795 |

| | 3,843 |

| | 2,991 |

|

Operating expenses: | | | | | | | | | | |

Research, development and engineering | | 360 |

| | 357 |

| | 338 |

| | 1,428 |

| | 1,320 |

|

Marketing and selling | | 99 |

| | 108 |

| | 99 |

| | 423 |

| | 433 |

|

General and administrative | | 90 |

| | 136 |

| | 117 |

| | 467 |

| | 465 |

|

Impairment of goodwill and intangible assets | | — |

| | — |

| | — |

| | — |

| | 278 |

|

Restructuring charges and asset impairments | | (2 | ) | | — |

| | 30 |

| | 5 |

| | 63 |

|

Total operating expenses | | 547 |

| | 601 |

| | 584 |

| | 2,323 |

| | 2,559 |

|

Income from operations | | 412 |

| | 391 |

| | 211 |

| | 1,520 |

| | 432 |

|

Interest expense | | 23 |

| | 24 |

| | 24 |

| | 95 |

| | 95 |

|

Interest and other income, net | | 9 |

| | 3 |

| | 7 |

| | 23 |

| | 13 |

|

Income before income taxes | | 398 |

| | 370 |

| | 194 |

| | 1,448 |

| | 350 |

|

Provision for income taxes | | 108 |

| | 69 |

| | 11 |

| | 342 |

| | 94 |

|

Net income | | $ | 290 |

| | $ | 301 |

| | $ | 183 |

| | $ | 1,106 |

| | $ | 256 |

|

Earnings per share: | | | | | | | | | | |

Basic | | $ | 0.24 |

| | $ | 0.25 |

| | $ | 0.15 |

| | $ | 0.91 |

| | $ | 0.21 |

|

Diluted | | $ | 0.23 |

| | $ | 0.24 |

| | $ | 0.15 |

| | $ | 0.90 |

| | $ | 0.21 |

|

Weighted average number of shares: | | | | | | | | | | |

Basic | | 1,220 |

| | 1,218 |

| | 1,204 |

| | 1,215 |

| | 1,202 |

|

Diluted | | 1,236 |

| | 1,233 |

| | 1,222 |

| | 1,231 |

| | 1,219 |

|

Applied Materials, Inc.

Page 5 of 12

APPLIED MATERIALS, INC.

UNAUDITED CONSOLIDATED CONDENSED BALANCE SHEETS

|

| | | | | | | | | | | | |

(In millions) | | October 26,

2014 | | July 27,

2014 | | October 27,

2013 |

ASSETS | | | | | | |

Current assets: | | | | | | |

Cash and cash equivalents | | $ | 3,002 |

| | $ | 2,726 |

| | $ | 1,711 |

|

Short-term investments | | 160 |

| | 145 |

| | 180 |

|

Accounts receivable, net | | 1,670 |

| | 1,622 |

| | 1,633 |

|

Inventories | | 1,567 |

| | 1,547 |

| | 1,413 |

|

Other current assets | | 568 |

| | 600 |

| | 705 |

|

Total current assets | | 6,967 |

| | 6,640 |

| | 5,642 |

|

Long-term investments | | 935 |

| | 957 |

| | 1,005 |

|

Property, plant and equipment, net | | 861 |

| | 849 |

| | 850 |

|

Goodwill | | 3,304 |

| | 3,294 |

| | 3,294 |

|

Purchased technology and other intangible assets, net | | 951 |

| | 979 |

| | 1,103 |

|

Deferred income taxes and other assets | | 156 |

| | 132 |

| | 149 |

|

Total assets | | $ | 13,174 |

| | $ | 12,851 |

| | $ | 12,043 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | |

Current liabilities: | | | | | | |

Accounts payable and accrued expenses | | $ | 1,883 |

| | $ | 1,689 |

| | $ | 1,649 |

|

Customer deposits and deferred revenue | | 940 |

| | 1,066 |

| | 794 |

|

Total current liabilities | | 2,823 |

| | 2,755 |

| | 2,443 |

|

Long-term debt | | 1,947 |

| | 1,947 |

| | 1,946 |

|

Other liabilities | | 502 |

| | 465 |

| | 566 |

|

Total liabilities | | 5,272 |

| | 5,167 |

| | 4,955 |

|

Total stockholders’ equity | | 7,902 |

| | 7,684 |

| | 7,088 |

|

Total liabilities and stockholders’ equity | | $ | 13,174 |

| | $ | 12,851 |

| | $ | 12,043 |

|

Applied Materials, Inc.

Page 6 of 12

APPLIED MATERIALS, INC.

UNAUDITED CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS

|

| | | | | | | | | | | | | | | | | | | |

(In millions) | Three Months Ended | | Twelve Months Ended |

October 26,

2014 | | July 27,

2014 | | October 27,

2013 | October 26,

2014 | | October 27,

2013 |

Cash flows from operating activities: | | | | | | | | | |

Net income | $ | 290 |

| | $ | 301 |

| | $ | 183 |

| | $ | 1,106 |

| | $ | 256 |

|

Adjustments required to reconcile net income to cash provided by operating activities: | | | | | | | | | |

Depreciation and amortization | 94 |

| | 93 |

| | 98 |

| | 375 |

| | 410 |

|

Impairment of goodwill and intangible assets | — |

| | — |

| | — |

| | — |

| | 278 |

|

Restructuring charges and asset impairments | (2 | ) | | — |

| | 30 |

| | 5 |

| | 63 |

|

Unrealized loss on derivative associated with announced business combination | 12 |

| | 10 |

| | 7 |

| | 21 |

| | 7 |

|

Share-based compensation | 45 |

| | 44 |

| | 41 |

| | 177 |

| | 162 |

|

Other | (1 | ) | | 48 |

| | 11 |

| | 36 |

| | (91 | ) |

Net change in operating assets and liabilities | (31 | ) | | 88 |

| | (351 | ) | | 80 |

| | (462 | ) |

Cash provided by operating activities | 407 |

| | 584 |

| | 19 |

| | 1,800 |

| | 623 |

|

Cash flows from investing activities: | | | | | | | | | |

Capital expenditures | (63 | ) | | (65 | ) | | (57 | ) | | (241 | ) | | (197 | ) |

Cash paid for acquisition, net of cash acquired | (12 | ) | | — |

| | — |

| | (12 | ) | | (1 | ) |

Proceeds from sale of facility | 25 |

| | — |

| | 7 |

| | 25 |

| | 7 |

|

Proceeds from sales and maturities of investments | 176 |

| | 181 |

| | 276 |

| | 878 |

| | 1,013 |

|

Purchases of investments | (179 | ) | | (308 | ) | | (169 | ) | | (811 | ) | | (607 | ) |

Cash provided by (used in) investing activities | (53 | ) | | (192 | ) | | 57 |

| | (161 | ) | | 215 |

|

Cash flows from financing activities: | | | | | | | | | |

Proceeds from common stock issuances and others, net | 44 |

| | 2 |

| | 57 |

| | 137 |

| | 182 |

|

Common stock repurchases | — |

| | — |

| | (47 | ) | | — |

| | (245 | ) |

Payments of dividends to stockholders | (122 | ) | | (121 | ) | | (120 | ) | | (485 | ) | | (456 | ) |

Cash used in financing activities | (78 | ) | | (119 | ) | | (110 | ) | | (348 | ) | | (519 | ) |

Increase (decrease) in cash and cash equivalents | 276 |

| | 273 |

| | (34 | ) | | 1,291 |

| | 319 |

|

Cash and cash equivalents — beginning of period | 2,726 |

| | 2,453 |

| | 1,745 |

| | 1,711 |

| | 1,392 |

|

Cash and cash equivalents — end of period | $ | 3,002 |

| | $ | 2,726 |

| | $ | 1,711 |

| | $ | 3,002 |

| | $ | 1,711 |

|

Supplemental cash flow information: | | | | | | | | | |

Cash payments for income taxes | $ | 87 |

| | $ | 49 |

| | $ | 12 |

| | $ | 195 |

| | $ | 196 |

|

Cash refunds from income taxes | $ | 78 |

| | $ | 21 |

| | $ | 35 |

| | $ | 111 |

| | $ | 102 |

|

Cash payments for interest | $ | 7 |

| | $ | 39 |

| | $ | 7 |

| | $ | 92 |

| | $ | 92 |

|

Applied Materials, Inc.

Page 7 of 12

APPLIED MATERIALS, INC.

UNAUDITED SUPPLEMENTAL INFORMATION

Reportable Segment Results

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q4 FY2014 | | Q3 FY2014 | | Q4 FY2013 |

(In millions) | | New Orders | | Net Sales | | Operating Income (Loss) | | New Orders | | Net Sales | | Operating Income (Loss) | | New Orders | | Net Sales | | Operating Income (Loss) |

SSG | | $ | 1,334 |

| | $ | 1,434 |

| | $ | 305 |

| | $ | 1,565 |

| | $ | 1,476 |

| | $ | 381 |

| | $ | 1,390 |

| | $ | 1,243 |

| | $ | 213 |

|

AGS | | 747 |

| | 592 |

| | 146 |

| | 552 |

| | 567 |

| | 154 |

| | 548 |

| | 538 |

| | 115 |

|

Display | | 130 |

| | 190 |

| | 52 |

| | 296 |

| | 119 |

| | 25 |

| | 114 |

| | 163 |

| | 19 |

|

EES | | 44 |

| | 48 |

| | (3 | ) | | 66 |

| | 103 |

| | 24 |

| | 40 |

| | 44 |

| | (30 | ) |

Corporate | | — |

| | — |

| | (88 | ) | | — |

| | — |

| | (193 | ) | | — |

| | — |

| | (106 | ) |

Consolidated | | $ | 2,255 |

| | $ | 2,264 |

| | $ | 412 |

| | $ | 2,479 |

| | $ | 2,265 |

| | $ | 391 |

| | $ | 2,092 |

| | $ | 1,988 |

| | $ | 211 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | FY 2014 | | FY 2013 |

(In millions) | | New Orders | | Net Sales | | Operating Income (Loss) | | New Orders | | Net Sales | | Operating Income (Loss) |

SSG | | $ | 6,132 |

| | $ | 5,978 |

| | $ | 1,391 |

| | $ | 5,507 |

| | $ | 4,775 |

| | $ | 876 |

|

AGS | | 2,433 |

| | 2,200 |

| | 573 |

| | 2,090 |

| | 2,023 |

| | 436 |

|

Display | | 845 |

| | 615 |

| | 129 |

| | 703 |

| | 538 |

| | 74 |

|

EES* | | 238 |

| | 279 |

| | 15 |

| | 166 |

| | 173 |

| | (433 | ) |

Corporate | | — |

| | — |

| | (588 | ) | | — |

| | — |

| | (521 | ) |

Consolidated | | $ | 9,648 |

| | $ | 9,072 |

| | $ | 1,520 |

| | $ | 8,466 |

| | $ | 7,509 |

| | $ | 432 |

|

* Operating loss for FY2013 included $278 million in goodwill and intangible asset impairment charges.

Corporate Unallocated Expenses

|

| | | | | | | | | | | | | | | | | | | | |

(In millions) | | Q4 FY2014 | | Q3 FY2014 | | Q4 FY2013 | | FY 2014 | | FY 2013 |

Restructuring charges and asset impairments

| | $ | (2 | ) | | $ | — |

| | $ | 23 |

| | $ | 5 |

| | $ | 35 |

|

Share-based compensation | | 45 |

| | 44 |

| | 41 |

| | 177 |

| | 162 |

|

Gain on sale of facility | | (4 | ) | | — |

| | — |

| | (4 | ) | | (4 | ) |

Certain items associated with announced business combination | | 23 |

| | 23 |

| | 17 |

| | 73 |

| | 17 |

|

Loss (gain) on derivative associated with announced business combination, net | | (39 | ) | | 10 |

| | 7 |

| | (30 | ) | | 7 |

|

Other unallocated expenses | | 65 |

| | 116 |

| | 18 |

| | 367 |

| | 304 |

|

Total corporate | | $ | 88 |

| | $ | 193 |

| | $ | 106 |

| | $ | 588 |

| | $ | 521 |

|

Applied Materials, Inc.

Page 8 of 12

APPLIED MATERIALS, INC.

UNAUDITED SUPPLEMENTAL INFORMATION

Additional Information

|

| | | | | | | | | | | | | | | | | | |

| | Q4 FY2014 | | Q3 FY2014 | | Q4 FY2013 |

New Orders and Net Sales by Geography | | | | | | | | | | | | |

(In $ millions) | | New Orders | | Net Sales | | New Orders | | Net Sales | | New Orders | | Net Sales |

United States | | 596 |

| | 633 |

| | 680 |

| | 683 |

| | 261 |

| | 357 |

|

% of Total | | 26 | % | | 28 | % | | 27 | % | | 30 | % | | 12 | % | | 18 | % |

Europe | | 198 |

| | 178 |

| | 146 |

| | 160 |

| | 203 |

| | 242 |

|

% of Total | | 9 | % | | 8 | % | | 6 | % | | 7 | % | | 10 | % | | 12 | % |

Japan | | 287 |

| | 209 |

| | 378 |

| | 229 |

| | 117 |

| | 276 |

|

% of Total | | 13 | % | | 9 | % | | 15 | % | | 10 | % | | 6 | % | | 14 | % |

Korea | | 251 |

| | 187 |

| | 217 |

| | 226 |

| | 209 |

| | 231 |

|

% of Total | | 11 | % | | 8 | % | | 9 | % | | 10 | % | | 10 | % | | 12 | % |

Taiwan | | 599 |

| | 618 |

| | 497 |

| | 598 |

| | 721 |

| | 589 |

|

% of Total | | 27 | % | | 27 | % | | 20 | % | | 26 | % | | 34 | % | | 30 | % |

Southeast Asia | | 113 |

| | 136 |

| | 177 |

| | 81 |

| | 95 |

| | 89 |

|

% of Total | | 5 | % | | 6 | % | | 7 | % | | 4 | % | | 5 | % | | 4 | % |

China | | 211 |

| | 303 |

| | 384 |

| | 288 |

| | 486 |

| | 204 |

|

% of Total | | 9 | % | | 14 | % | | 16 | % | | 13 | % | | 23 | % | | 10 | % |

| | | | | | | | | | | | |

Employees (In thousands) | | | | | | | | | | | | |

Regular Full Time | | 14.0 | | | 13.8 | | | 13.7 | |

|

| | | | | | | | | | | | |

| | FY 2014 | | FY 2013 |

New Orders and Net Sales by Geography | | | | | | | | |

(In $ millions) | | New Orders | | Net Sales | | New Orders | | Net Sales |

United States | | 2,200 |

| | 1,966 |

| | 1,419 |

| | 1,473 |

|

% of Total | | 23 | % | | 22 | % | | 17 | % | | 20 | % |

Europe | | 662 |

| | 658 |

| | 735 |

| | 680 |

|

% of Total | | 7 | % | | 7 | % | | 8 | % | | 9 | % |

Japan | | 1,031 |

| | 817 |

| | 822 |

| | 685 |

|

% of Total | | 11 | % | | 9 | % | | 10 | % | | 9 | % |

Korea | | 1,086 |

| | 965 |

| | 915 |

| | 924 |

|

% of Total | | 11 | % | | 10 | % | | 11 | % | | 12 | % |

Taiwan | | 2,740 |

| | 2,702 |

| | 2,885 |

| | 2,640 |

|

% of Total | | 28 | % | | 30 | % | | 34 | % | | 35 | % |

Southeast Asia | | 412 |

| | 356 |

| | 351 |

| | 320 |

|

% of Total | | 4 | % | | 4 | % | | 4 | % | | 4 | % |

China | | 1,517 |

| | 1,608 |

| | 1,339 |

| | 787 |

|

% of Total | | 16 | % | | 18 | % | | 16 | % | | 11 | % |

Applied Materials, Inc.

Page 9 of 12

APPLIED MATERIALS, INC.

UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP ADJUSTED RESULTS

|

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

(In millions, except percentages) | | October 26,

2014 | | July 27,

2014 | | October 27,

2013 | | October 26,

2014 | | October 27,

2013 |

Non-GAAP Adjusted Gross Margin | | | | | | | | | | |

Reported gross margin - GAAP basis | | $ | 959 |

| | $ | 992 |

| | $ | 795 |

| | $ | 3,843 |

| | $ | 2,991 |

|

Certain items associated with acquisitions1 | | 42 |

| | 38 |

| | 40 |

| | 158 |

| | 166 |

|

Acquisition integration costs | | — |

| | — |

| | — |

| | 1 |

| | 3 |

|

Non-GAAP adjusted gross margin | | $ | 1,001 |

| | $ | 1,030 |

| | $ | 835 |

| | $ | 4,002 |

| | $ | 3,160 |

|

Non-GAAP adjusted gross margin percent (% of net sales) | | 44.2 | % | | 45.5 | % | | 42.0 | % | | 44.1 | % | | 42.1 | % |

Non-GAAP Adjusted Operating Income | | | | | | | | | | |

Reported operating income - GAAP basis | | $ | 412 |

| | $ | 391 |

| | $ | 211 |

| | $ | 1,520 |

| | $ | 432 |

|

Certain items associated with acquisitions1 | | 48 |

| | 44 |

| | 47 |

| | 183 |

| | 201 |

|

Acquisition integration costs | | 4 |

| | 9 |

| | 11 |

| | 34 |

| | 38 |

|

Loss (gain) on derivative associated with announced business combination, net | | (39 | ) | | 10 |

| | 7 |

| | (30 | ) | | 7 |

|

Certain items associated with announced business combination2 | | 23 |

| | 23 |

| | 17 |

| | 73 |

| | 17 |

|

Impairment of goodwill and intangible assets | | — |

| | — |

| | — |

| | — |

| | 278 |

|

Restructuring charges and asset impairments3, 4, 5 | | (2 | ) | | — |

| | 30 |

| | 5 |

| | 63 |

|

Gain on sale of facility | | (4 | ) | | — |

| | — |

| | (4 | ) | | (4 | ) |

Non-GAAP adjusted operating income | | $ | 442 |

| | $ | 477 |

| | $ | 323 |

| | $ | 1,781 |

| | $ | 1,032 |

|

Non-GAAP adjusted operating margin percent (% of net sales) | | 19.5 | % | | 21.1 | % | | 16.2 | % | | 19.6 | % | | 13.7 | % |

Non-GAAP Adjusted Net Income | | | | | | | | | | |

Reported net income - GAAP basis | | $ | 290 |

| | $ | 301 |

| | $ | 183 |

| | $ | 1,106 |

| | $ | 256 |

|

Certain items associated with acquisitions1 | | 48 |

| | 44 |

| | 47 |

| | 183 |

| | 201 |

|

Acquisition integration costs | | 4 |

| | 9 |

| | 11 |

| | 34 |

| | 38 |

|

Loss (gain) on derivative associated with announced business combination, net | | (39 | ) | | 10 |

| | 7 |

| | (30 | ) | | 7 |

|

Certain items associated with announced business combination2 | | 23 |

| | 23 |

| | 17 |

| | 73 |

| | 17 |

|

Impairment of goodwill and intangible assets | | — |

| | — |

| | — |

| | — |

| | 278 |

|

Restructuring charges and asset impairments3, 4, 5 | | (2 | ) | | — |

| | 30 |

| | 5 |

| | 63 |

|

Gain on sale of facility | | (4 | ) | | — |

| | — |

| | (4 | ) | | (4 | ) |

Impairment (gain on sale) of strategic investments, net | | (5 | ) | | (1 | ) | | (3 | ) | | (9 | ) | | 1 |

|

Reinstatement of federal R&D tax credit | | — |

| | — |

| | — |

| | — |

| | (13 | ) |

Resolution of prior years’ income tax filings and other tax items | | 16 |

| | (19 | ) | | (10 | ) | | (6 | ) | | (24 | ) |

Income tax effect of non-GAAP adjustments | | 7 |

| | (18 | ) | | (54 | ) | | (38 | ) | | (102 | ) |

Non-GAAP adjusted net income | | $ | 338 |

| | $ | 349 |

| | $ | 228 |

| | $ | 1,314 |

| | $ | 718 |

|

|

| |

1 | These items are incremental charges attributable to completed acquisitions, consisting of amortization of purchased intangible assets. |

| |

2 | These items are incremental charges related to the announced business combination agreement with Tokyo Electron Limited, consisting of acquisition-related and integration planning costs. |

| |

3 | Results for the three months ended October 26, 2014 included a $2 million favorable adjustment of restructuring reserve and results for the twelve months ended October 26, 2014 included $5 million of employee-related costs related to the restructuring program announced on October 3, 2012. |

| |

4 | Results for the three months ended October 27, 2013 included $27 million of employee-related costs related to the restructuring program announced on October 3, 2012, and restructuring and asset impairment charges of $7 million related to the restructuring program announced on May 10, 2012, partially offset by a favorable adjustment of $4 million in restructuring charges related to other restructuring plans. |

| |

5 | Results for the twelve months ended October 27, 2013 included $39 million of employee-related costs, net, related to the restructuring program announced on October 3, 2012, and restructuring and asset impairment charges of $26 million related to the restructuring program announced on May 10, 2012, partially offset by a favorable adjustment of $2 million related to other restructuring plans. |

Applied Materials, Inc.

Page 10 of 12

APPLIED MATERIALS, INC.

UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP ADJUSTED RESULTS

|

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

(In millions except per share amounts) | | October 26,

2014 | | July 27,

2014 | | October 27,

2013 | | October 26,

2014 | | October 27,

2013 |

Non-GAAP Adjusted Earnings Per Diluted Share | | | | | | | | | | |

Reported earnings per diluted share - GAAP basis | | $ | 0.23 |

| | $ | 0.24 |

| | $ | 0.15 |

| | $ | 0.90 |

| | $ | 0.21 |

|

Certain items associated with acquisitions | | 0.04 |

| | 0.03 |

| | 0.03 |

| | 0.13 |

| | 0.14 |

|

Acquisition integration costs | | — |

| | 0.01 |

| | — |

| | 0.02 |

| | 0.02 |

|

Certain items associated with announced business combination | | 0.01 |

| | 0.02 |

| | 0.01 |

| | 0.05 |

| | 0.01 |

|

Gain on derivative associated with announced business combination, net | | (0.02 | ) | | — |

| | — |

| | (0.02 | ) | | — |

|

Impairment of goodwill and intangible assets | | — |

| | — |

| | — |

| | — |

| | 0.21 |

|

Restructuring charges and asset impairments | | — |

| | — |

| | 0.01 |

| | — |

| | 0.03 |

|

Reinstatement of federal R&D tax credit and resolution of prior years’ income tax filings and other tax items | | 0.01 |

| | (0.02 | ) | | (0.01 | ) | | (0.01 | ) | | (0.03 | ) |

Non-GAAP adjusted earnings per diluted share | | $ | 0.27 |

| | $ | 0.28 |

| | $ | 0.19 |

| | $ | 1.07 |

| | $ | 0.59 |

|

Weighted average number of diluted shares | | 1,236 |

| | 1,233 |

| | 1,222 |

| | 1,231 |

| | 1,219 |

|

Applied Materials, Inc.

Page 11 of 12

APPLIED MATERIALS, INC.

UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP ADJUSTED RESULTS

|

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

(In millions, except percentages) | | October 26,

2014 | | July 27,

2014 | | October 27,

2013 | | October 26,

2014 | | October 27,

2013 |

SSG Non-GAAP Adjusted Operating Income | | | | | | | | | | |

Reported operating income - GAAP basis | | $ | 305 |

| | $ | 381 |

| | $ | 213 |

| | $ | 1,391 |

| | $ | 876 |

|

Certain items associated with acquisitions1 | | 46 |

| | 42 |

| | 44 |

| | 172 |

| | 175 |

|

Acquisition integration costs | | 1 |

| | — |

| | 1 |

| | 2 |

| | (2 | ) |

Restructuring charges and asset impairments3 | | — |

| | — |

| | — |

| | — |

| | 1 |

|

Non-GAAP adjusted operating income | | $ | 352 |

| | $ | 423 |

| | $ | 258 |

| | $ | 1,565 |

| | $ | 1,050 |

|

Non-GAAP adjusted operating margin percent (% of net sales) | | 24.5 | % | | 28.7 | % | | 20.8 | % | | 26.2 | % | | 22.0 | % |

AGS Non-GAAP Adjusted Operating Income | | | | | | | | | | |

Reported operating income - GAAP basis | | $ | 146 |

| | $ | 154 |

| | $ | 115 |

| | $ | 573 |

| | $ | 436 |

|

Certain items associated with acquisitions1 | | — |

| | — |

| | 1 |

| | 3 |

| | 5 |

|

Restructuring charges and asset impairments3 | | — |

| | — |

| | — |

| | — |

| | 2 |

|

Non-GAAP adjusted operating income | | $ | 146 |

| | $ | 154 |

| | $ | 116 |

| | $ | 576 |

| | $ | 443 |

|

Non-GAAP adjusted operating margin percent (% of net sales) | | 24.7 | % | | 27.2 | % | | 21.6 | % | | 26.2 | % | | 21.9 | % |

Display Non-GAAP Adjusted Operating Income | | | | | | | | | | |

Reported operating income - GAAP basis | | $ | 52 |

| | $ | 25 |

| | $ | 19 |

| | $ | 129 |

| | $ | 74 |

|

Certain items associated with acquisitions1 | | — |

| | 1 |

| | 1 |

| | 2 |

| | 6 |

|

Non-GAAP adjusted operating income | | $ | 52 |

| | $ | 26 |

| | $ | 20 |

| | $ | 131 |

| | $ | 80 |

|

Non-GAAP adjusted operating margin percent (% of net sales) | | 27.4 | % | | 21.8 | % | | 12.3 | % | | 21.3 | % | | 14.9 | % |

EES Non-GAAP Adjusted Operating Income (Loss) | | | | | | | | | | |

Reported operating income (loss) - GAAP basis | | $ | (3 | ) | | $ | 24 |

| | $ | (30 | ) | | $ | 15 |

| | $ | (433 | ) |

Certain items associated with acquisitions1 | | 2 |

| | 1 |

| | 1 |

| | 6 |

| | 15 |

|

Restructuring charges and asset impairments2, 3 | | — |

| | — |

| | 7 |

| | — |

| | 25 |

|

Impairment of goodwill and intangible assets | | — |

| | — |

| | — |

| | — |

| | 278 |

|

Non-GAAP adjusted operating income (loss) | | $ | (1 | ) | | $ | 25 |

| | $ | (22 | ) | | $ | 21 |

| | $ | (115 | ) |

Non-GAAP adjusted operating margin percent (% of net sales) | | (2.1 | )% | | 24.3 | % | | (50.0 | )% | | 7.5 | % | | (66.5 | )% |

|

| |

1 | These items are incremental charges attributable to completed acquisitions, consisting of amortization of purchased intangible assets. |

| |

2 | Results for the three months ended October 27, 2013 included restructuring and asset impairment charges of $7 million related to the restructuring program announced on May 10, 2012. |

| |

3 | Results for the twelve months ended October 27, 2013 included restructuring and asset impairment charges of $26 million related to the restructuring program announced on May 10, 2012 and severance charges of $2 million related to the integration of Varian. |

Applied Materials, Inc.

Page 12 of 12

APPLIED MATERIALS, INC.

UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP ADJUSTED OPERATING EXPENSES

|

| | | | | | | |

| Three Months Ended |

(In millions) | October 26, 2014 | | July 27, 2014 |

| | | |

Operating expenses - GAAP basis | $ | 547 |

| | $ | 601 |

|

Gain (loss) on derivative associated with announced business combination, net | 39 |

| | (10 | ) |

Restructuring charges and asset impairments | 2 |

| | — |

|

Certain items associated with acquisitions | (6 | ) | | (6 | ) |

Acquisition integration costs | (4 | ) | | (9 | ) |

Certain items associated with announced business combination

| (23 | ) | | (23 | ) |

Gain on sale of facility | 4 |

| | — |

|

Non-GAAP adjusted operating expenses | $ | 559 |

| | $ | 553 |

|

UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP ADJUSTED EFFECTIVE INCOME TAX RATE

|

| | | |

| Three Months Ended |

(In millions, except percentages) | October 26, 2014 |

| |

Provision for income taxes - GAAP basis (a) | $ | 108 |

|

Resolutions of prior years’ income tax filings and other tax items | (16 | ) |

Income tax effect of non-GAAP adjustments | (7 | ) |

Non-GAAP adjusted provision for income taxes (b) | $ | 85 |

|

| |

Income before income taxes - GAAP basis (c) | $ | 398 |

|

Certain items associated with acquisitions | 48 |

|

Restructuring charges and asset impairments | (2 | ) |

Acquisition integration costs | 4 |

|

Gain on derivative associated with announced business combination | (39 | ) |

Certain items associated with announced business combination | 23 |

|

Gain on sale of strategic investments, net | (5 | ) |

Gain on sale of facility | (4 | ) |

Non-GAAP adjusted income before income taxes (d) | $ | 423 |

|

| |

Effective income tax rate - GAAP basis (a/c) | 27.1 | % |

| |

Non-GAAP adjusted effective income tax rate (b/d) | 20.1 | % |

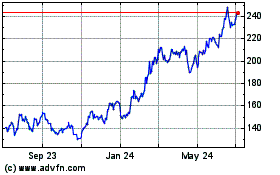

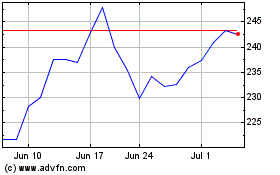

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Apr 2023 to Apr 2024