UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): November 12, 2014

Wabash National Corporation

(Exact name of registrant

as specified in its charter)

| Delaware |

|

1-10883 |

|

52-1375208 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File No.) |

|

(IRS Employer Identification No.) |

| 1000 Sagamore Parkway South, Lafayette, Indiana 47905 |

| (Address of principal executive offices) (Zip Code) |

Registrant’s telephone number, including

area code:

(765) 771-5310

__________________

Not applicable

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

INFORMATION TO BE INCLUDED IN THE REPORT

Section 7 – Regulation FD

Item 7.01 Regulation FD Disclosure.

Wabash National Corporation

has prepared updated slides for use in connection with investor presentations. A copy of the slides is furnished as an exhibit

hereto and is incorporated herein by reference. This information shall not be deemed “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, and is not incorporated

by reference into any filing of Wabash National Corporation, whether made before or after the date of this report, regardless of

any general incorporation language in the filing.

Section 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

| 99.1 | Wabash National Corporation slide presentation. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

| |

WABASH NATIONAL CORPORATION |

| |

|

| |

|

|

| Date: November 12, 2014 |

By: |

/s/ Jeffery L. Taylor |

| |

|

Jeffery L. Taylor |

| |

|

Senior Vice President and Chief Financial Officer |

EXHIBIT INDEX

| Exhibit No. |

|

Description |

| |

|

|

| 99.1 |

|

Wabash National Corporation slide presentation |

WABASH NATIONAL CORPORATION Investor Update November 2014

2 This presentation contains certain forward - looking statements, as defined by the Private Securities Litigation Reform Act of 1995. All statements other than historical facts are forward - looking statements, including without limit, those regarding shipment outlook, Operating EBITDA, backlog, demand level expectations, profitability and earnings capacity, margin opportunities, and potential benefits of any recent acquisitions. Any forward - looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those implied by the forward - looking statements. Without limit, these risks and uncertainties include economic conditions, increased competition, dependence on new management, reliance on certain customers and corporate partnerships, shortages and costs of raw materials, manufacturing capacity and cost containment risks, dependence on industry trends, access to capital, acceptance of products, and government regulation. You should review and consider the various disclosures made by the Company in this presentation and in its reports to its stockholders and periodic reports on Forms 10 - K and 10 - Q. We cannot give assurance that the expectations reflected in our forward - looking statements will prove to be correct. Our actual results could differ materially from those anticipated in these forward - looking statements. All written and oral forward - looking statements attributable to us are expressly qualified in their entirety by the factors we disclose that could cause our actual results to differ materially from our expectations. S AFE H ARBOR S TATEMENT © 2014 Wabash National, L.P. All rights reserved. Wabash®, Wabash National®, DuraPlate ®, DuraPlate AeroSkirt ®, Walker, Brenner® and Beall® are marks owned by Wabash National, L.P. Transcraft ® and Benson® are marks owned by Transcraft Corporation.

3 S TRATEGIC S EGMENTS Wabash National Corporation Commercial Trailer Products 2013 Sales: $1.1B • Dry & Refrigerated Vans • Platform Trailers • Fleet Used Trailers Diversified Products 2013 Sales: $502M • Walker Group • Wabash Composites • Wabash Wood Products New Markets. New Innovation. New Growth. Retail 2013 Sales: $181M • 15 Retail Locations in U.S. • New & Used Trailer Sales • Parts & Service Segment Revenue is prior to the elimination of intersegment sales.

4 2013 S EGMENT R EVENUE AND P RODUCT M IX New Markets. New Innovation. New Growth. 2013 Consolidated Revenue: $1.6B

5 W ALKER AND B EALL A CQUISITIONS A CCELERATE D IVERSIFICATION End - Markets Geographies Transportation Products Leader Engineered Products Leader 80% of Total Revenues 20% of Total Revenues Position Products Est. Share # 1 ALL liquid - transportation systems in North America 30% # 1 Stainless - steel liquid - transportation systems in North America 62% # 1 Stainless - steel liquid - tank trailers for the North American chemical market 61 % # 1 Stainless - steel liquid - tank trailers for the North American food market 74% # 1 Liquid - tank trailers for the worldwide aircraft refuelers market 35% Position Products Est. Share # 1 Isolators globally 30% # 1 Downflow booths globally 30% # 2 Stationary silos in the U.S. 35% Note: All information based on 2013 revenues Sources : TTMA, ACT, Polk, Trailer Body Builders 2013 Chemical, 33% Dairy, Food & Beverage, 31% Aviation, 12% Energy, 13% Pharmaceutical, 7% Defense, 1% Environmental, 2% Other, 1% US, 87% Europe, 7% Asia, 1% Mexico & Canada, 2% Latin America, 1% Other, 1%

6 2007 Higher Growth and Margin Profile, Less Cyclicality 2013 D IVERSIFICATION E FFORTS D RIVING R ESULTS Revenue Manufacturing Retail 14% 86% 28% Commercial Trailer Products Diversified Products Retail 62% 10% Operating Income Manufacturing Retail Diversified Products Commercial Trailer Products 55% 2% 43% Gross Margin 0% 5% 10% 15% 20% 25% 7.2% 22.9% 11.1% 13.2% CTP Retail Consol. DPG 0% 5% 10% 15% 20% 25% 8.7% 6.3% 8.3% Mfg Retail Consol. $1.1B $1.6B $92M $215M 100% $26M $103M Growth > 45% > 133% > 296%

7 L ONG - T ERM G ROWTH D RIVERS ▪ Pricing discipline ▪ Operational efficiency / lean manufacturing ▪ Supply chain optimization Margin Expansion ▪ New end markets and geographies ▪ Product innovations / portfolio expansion ▪ Aftermarket p arts and s ervice capabilities Organic Growth ▪ Proven ability to acquire and integrate ▪ Enhance business stability and reduce cyclicality ▪ Operational synergies ▪ Strategic but selective Mergers & Acquisitions New Markets. New Innovation. New Growth.

8 S EGMENT G ROWTH I NITIATIVES New Markets. New Innovation. New Growth. CTP DPG Retail ▪ TrustLock® Plus System ▪ MaxClearance ™ Door System ▪ EZ - Adjust™ Tensioning System ▪ ID/Aux Stop Light System ▪ Pneumatic Door Seals ▪ Tire and Coil Haul Trailers ▪ DuraPlate XD - 35® Model ▪ Total Cost of Ownership Value Proposition ▪ Weight Reduction and Corrosion Resistance Through Advanced Materials ▪ Indirect Channel Development ▪ International Market Development Innovation/Product Portfolio Growth Key Strategic Initiatives ▪ Lean Duplex Steel ▪ FRP Tank Trailers ▪ Mobile Clean Rooms ▪ DuraPlate® AeroSkirt® Portfolio ▪ Mobile Shelters/Portable Storage Units ▪ Freight Decking Systems ▪ Less - Than - Truckload TruckBox ▪ Beall® Dry Bulk and Petroleum Tanks in Midwest/East Coast ▪ Tank Operations in Lafayette, Indiana ▪ Semiconductor Market Opportunities ▪ New Aerodynamic Solutions ▪ Commercial Cargo Trailer Market ( towables ) ▪ Silo Manufacturing Expansion ▪ Mobile Service — Roadside ▪ Mobile Service — Customer Terminal ▪ Customer Site Service (asset lite) ▪ Product O ffering Expansion — Non - Wabash Equipment ▪ Tank Trailer Parts and Service Expansion ▪ Targeted N. American Expansion ▪ Local Market Competitiveness

9 T RANSPORTATION S ECTOR O UTLOOK Strong demand above replacement levels ▪ Truck Tonnage at or near record levels ▪ Truck Loadings continue to rise ▪ Trucking Conditions outlook remains strong Positive Freight Trend & Trucking Conditions Trucking Indicators

10 T RAILER S ECTOR O UTLOOK Strong demand above replacement levels Strong Demand Projected Throughout Forecast Period ▪ Strong demand above replacement levels forecast for next 5 years ▪ Fleet equipment dynamics and regulations key drivers of trailer demand ▪ ACT forecasts for 2016 – 2018 include anticipated federal regulations for 33' pups Trailer Forecasts ACT Shipments Forecast by Segment 2013 2014 F 2015 F 2016 F 2017 F 2018 F 2019 F Dry Van 134,586 157,100 173,000 170,000 150,000 157,800 153,800 Refrigerated 35,879 38,700 40,000 36,500 33,500 38,000 40,000 Platform 22,122 26,300 28,000 27,000 24,000 23,500 23,000 Liquid Tanks 8,301 8,700 8,300 7,200 6,700 6,700 6,800 Other 35,839 41,250 39,800 39,500 41,100 41,300 40,000 Total 236,727 272,050 289,100 280,200 255,300 267,300 263,600

11 T RAILER D EMAND D RIVERS Strong demand above replacement levels Fleet Age and Regulations Driving Trailer D emand Fleet Equipment Dynamics ▪ Average age of equipment remains near record high ▪ 3 + years of significant underbuy (2008 - 2010) ▪ Improved access to financing ▪ Hours of Service (HOS) ▪ Compliance, Safety, Accountability (CSA ) ▪ California Air Resources Board (CARB) ▪ Moving Ahead for Progress in the 21st Century Act (MAP - 21) Regulatory

12 T RAILER D EMAND D RIVERS Fleet Rates Increase with Tightening Capacity ▪ Active truck utilization has reached 99%, expected to stay elevated for several years due to regulatory impact ▪ Truckload rates increasing ▪ Fleet profitability near record levels Carrier Operating Environment

13 C OMMERCIAL T RAILER P RODUCTS I NTERMODAL G ROWTH : M INIMAL I MPACT TO T RUCK F REIGHT Trucking Boosts Share of Total Tonnage to 71% by 2025 Overall Freight Trends • Total tonnage projected to increase from 14B tons in 2013 to 16.3B tons in 2019 • Total freight revenue projected to increase from $840B in 2013 to $ 1,166B in 2019 Trucking Freight Trends • Truck mode share of total freight tonnage projected to rise from 69.1% in 2013 to 70.9% in 2019 • Estimated Freight Increase ’14 - ’19 ’20 - ’25 Truckload (TL) 3.5% 1.2% Less - than - truckload (LTL) 3.8% 2.5% Source: ATA

14 T RAILER O RDER - TO - S HIPMENT C YCLE Order - to - Shipment Cycle Trends Show Distinct Seasonality Q1 Q2 Q3 Q4 Net Orders Backlog Builds Shipments Reflects Order - to - Shipment Cycles: 2011 - 2013 Source: ACT

15 S EGMENT O UTLOOK : D IVERSIFIED P RODUCTS ▪ Projected growth in Truck Body market drives DuraPlate® panel sales growth ▪ CARB compliance requirements continue to drive DuraPlate ® AeroSkirt ® demand ▪ Housing Starts support potential moving and storage growth and need for portable storage containers

16 S EGMENT O UTLOOK : D IVERSIFIED P RODUCTS ▪ Growing milk production supports demand for dairy silos, mixers and food - grade tank trailers ▪ Pharmaceutical R&D is expected to increase through 2018 ▪ Lower cost access to natural gas driving energy demand Source: U.S. Energy Information Administration, “Annual Energy Outlook 2014” * SpecialtyTransportation.net

17 S EGMENT O UTLOOK : D IVERSIFIED P RODUCTS ▪ World air passenger traffic is projected to steadily increase over the next 20 years ▪ World air cargo traffic is projected to more than double over the next 20 years RTK: Revenue Ton K ilometers Source : Boeing, World Air Cargo Forecast 2012 - 2013

18 V ALUE P ROPOSITION New Markets. New Innovation. New Growth. Superior Product ▪ Leading producer of semi - trailers and liquid transportation systems for 14 of the past 20 years* ▪ Long history of innovation with nearly 100 patents ▪ Customer - focused solutions ▪ Products that revolutionize the trucking industry ▪ Designing for safety, efficiency and performance ▪ Lower total cost of ownership Operational Excellence ▪ Lean operations for more than 12 years ▪ Focus on continuous improvement ▪ Manufacturing optimization/velocity Customer Relationships ▪ Best - in - class quality and durability ▪ Proven reliability ▪ Dependable service and delivery ▪ Personal sales and service support ▪ Serve nearly half of the top 50 U.S. fleets Investment Thesis Strong Brands ▪ Blue Chip Customer Base Industry L eadership ▪ #1 in total trailer production ▪ #1 in dry van production ▪ #1 in liquid - transportation systems Growth & Diversification ▪ Less risk of cyclicality ▪ More balanced across segments ▪ Leveraging synergies between businesses ▪ Diverse and expanded customer profile ▪ Margins expanding Solid Long - Term F orecast ▪ Trailer demand cycle remains strong Financial Discipline ▪ Record revenue and operating EBITDA in 2013 ▪ Good stewards of capital ▪ Strong cash flow and liquidity ▪ Strong balance sheet * Source : Trailer Body Builders Magazine

19 L ONG - T ERM S TRATEGIC O BJECTIVES Expectations 2011 2012 2013 Long - term Revenue $1.2B $1.5B $1.6B > $ 2.0B Diversified Products Revenue (1) $107M $356M $502M > $600M Consolidated Gross Margins 5.6% 11.2% 13.2% > 13% CTP Gross Margins 3.6% 6.6% 7.2% > 10% Operating EBITDA Margins 3.3% 8.1% 9.2% > 10% Net Leverage 1.3x 3.1x 1.9x < 2.0x Notes: (1) Diversified Products segment revenues prior to eliminations Executing Against Our Strategic Plan x x

WABASH NATIONAL CORPORATION Financial Overview

21 $338 $640 $1,187 $1,462 $1,636 $1,794 $0 $400 $800 $1,200 $1,600 $2,000 12/09 12/10 12/11 12/12 12/13 9/14 ($ millions) F INANCIAL P ERFORMANCE Trailing Twelve Month (TTM) Revenue FY 2013 Revenue & Operating Income Set New Records ($ millions) Significantly improved financial results : ▪ TTM revenue up more than $1.4B since year end 2009 ▪ TTM Operating Income increases $178M since year end 2009 ▪ Gross Margin Levels exceed 13% in 2013 ▪ 2013 Financial Results – Record performance in Revenue, Gross Profit, Gross Margin %, and Operating Income TTM Operating Income and Gross Margin $(66) $(15) $20 $70 $103 $112 - 6.8% 4.4% 5.6% 11.2% 13.2% 12.4% -10.0% -5.0% 0.0% 5.0% 10.0% 15.0% $(90) $(40) $10 $60 $110 $160 12/09 12/10 12/11 12/12 12/13 9/14 Operating Income Gross Margin

22 F INANCIAL P ERFORMANCE TTM EBITDA at $159M and Net Leverage of 1.7x Net Leverage Ratio Improved top - line and margins lead to: ▪ FY EBITDA at best ever level in 2013 and on - track to set new record in 2014 ▪ Cash generation leading to lower net debt leverage and significantly improved liquidity ($43) $5 $39 $119 $150 $159 ($75) ($25) $25 $75 $125 $175 12/09 12/10 12/11 12/12 12/13 9/14 ($millions) (1) See Appendix for reconciliation of non - GAAP financial information TTM Operating EBITDA (1) Target Liquidity ( 2) $21 $60 $126 $224 $254 $220 $- $50 $100 $150 $200 $250 $300 12/09 12/10 12/11 12/12 12/13 9/14 ($ millions) 3.0 2.6 3.1 2.7 2.3 1.9 2.1 1.9 1.7 0 0.5 1 1.5 2 2.5 3 3.5 4 Q3 12 Q4 12 Q1 13 Q2 13 Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 Leverage (2) Defined as cash on hand plus available borrowing capacity on our revolving credit facility

WABASH NATIONAL CORPORATION Appendix

24 Best - in - Class , Technologically Innovative Products Financial Performance ▪ 2013 New Trailer Shipments: 43,800 ▪ Comprehensive portfolio: dry vans, refrigerated vans, platform trailers ▪ Leading brands and long - standing customer relationships ▪ Industry leader in van and platform trailer manufacturing ▪ Mature practitioner of lean manufacturing methodology ▪ Long history of innovative solutions for customers S EGMENT P ROFILE : C OMMERCIAL T RAILER P RODUCTS Segment Revenue and OI are prior to the elimination of intersegment sales. Key Brands & Models -20 0 20 40 60 80 100 0 200 400 600 800 1000 1200 2010 2011 2012 2013 Operating Income (M$) Revenue (M$) Revenue Op. Income

25 Broadest Tank Trailer Portfolio in the Industry Financial Performance Key Brands ▪ Walker Group, Wabash Composites and Wabash Wood Products ▪ Diverse portfolio of products serving a variety of customers and attractive end markets ▪ Leading brands and long - standing relationships with blue - chip customer base ▪ Higher growth and higher margin businesses ▪ Stable , strong cash flow profile S EGMENT P ROFILE : D IVERSIFIED P RODUCTS Segment Revenue and OI are prior to the elimination of intersegment sales. 0 20 40 60 80 100 0 100 200 300 400 500 600 2010 2011 2012 2013 Operating Income (M$) Revenue (M$) Revenue Op. Income

26 Company - Owned Retail Locations Strategic Footprint Providing National Support Financial Performance ▪ Dealership model, selling new and used trailers, aftermarket parts, and maintenance and repair services ▪ Integrated with OEM to deliver best practices and innovation in the aftermarket ▪ Expansion into new markets with mobile service and 3rd party maintenance ▪ Low CapEx and synergistic expansion in higher - margin tank parts and service S EGMENT P ROFILE : R ETAIL Tank Services Segment Revenue and OI are prior to the elimination of intersegment sales. -2 -1 0 1 2 3 4 5 6 7 0 50 100 150 200 2010 2011 2012 2013 Operating Income (M$) Revenue (M$) Revenue Op. Income

27 K EY C USTOMERS Large & Diverse Customer Profile Wabash Composites Commercial Trailer Products Walker Group

28 C ONSOLIDATED I NCOME S TATEMENT New Markets. New Innovation. New Growth. ($ in thousands, except per share amounts) 2009 2010 2011 2012 2013 YTD Q3 2014 Net sales 337,840$ 640,372$ 1,187,244$ 1,461,854$ 1,635,686$ 1,335,838$ Cost of sales 360,750 612,289 1,120,524 1,298,031 1,420,563 1,165,925 Gross profit (22,910)$ 28,083$ 66,720$ 163,823$ 215,123$ 169,913$ % of sales -6.8% 4.4% 5.6% 11.2% 13.2% 12.7% General and administrative expenses 29,033 29,876 30,994 44,751 58,666 44,890 % of sales 8.6% 4.7% 2.6% 3.1% 3.6% 3.4% Selling expenses 11,176 10,669 12,981 23,589 30,597 20,361 % of sales 3.3% 1.7% 1.1% 1.6% 1.9% 1.5% Amortization of intangibles 2,955 2,955 2,955 10,590 21,786 16,413 % of sales 0.9% 0.5% 0.2% 0.7% 1.3% 1.2% Acquisition expenses - - - 14,409 883 - % of sales 0.0% 0.0% 0.0% 1.0% 0.1% 0.0% - - - - - - (Loss) Income from operations (66,074)$ (15,417)$ 19,790$ 70,484$ 103,191$ 88,249$ % of sales -19.6% -2.4% 1.7% 4.8% 6.3% 6.6% Other income (expense) Increase in fair value of warrant (33,447) (121,587) - - - - Interest expense (4,379) (4,140) (4,136) (21,724) (26,308) (16,904) Other, net (866) (667) (441) (97) 740 (1,626) (Loss) Income before income taxes (104,766)$ (141,811)$ 15,213$ 48,663$ 77,623$ 69,719$ Income tax (benefit) expense (3,001) (51) 171 (56,968) 31,094 27,877 Net (loss) income (101,765)$ (141,760)$ 15,042$ 105,631$ 46,529$ 41,842$ Preferred stock dividends and early extinguishment 3,320$ 25,454$ -$ -$ -$ -$ Net (loss) income applicable to common stockholders (105,085)$ (167,214)$ 15,042$ 105,631$ 46,529$ 41,842$ Diluted net (loss) income per share (3.48)$ (3.36)$ 0.22$ 1.53$ 0.67$ 0.58$

29 C ONSOLIDATED B ALANCE S HEET New Markets. New Innovation. New Growth. ($ in thousands) 2009 2010 2011 2012 2013 9/30/2014 ASSETS Current assets Cash and cash equivalents 1,108$ 21,200$ 19,976$ 81,449$ 113,262$ 79,551$ Accounts receivable 17,081 37,853 52,219 96,590 120,358 151,621 Inventories 51,801 110,850 189,533 189,487 184,173 259,794 Deferred income taxes - - - 33,194 21,576 17,162 Prepaid expenses and other 6,877 2,155 2,317 8,239 9,632 6,911 Total current assets 76,867$ 172,058$ 264,045$ 408,959$ 449,001$ 515,039$ Property, plant and equipment 108,802 98,834 96,591 132,146 142,082 137,170 Deferred income taxes - - - 17,454 1,401 27 Goodwill - - - 146,444 149,967 149,503 Intangible assets 25,952 22,863 19,821 171,990 159,181 142,718 Other assets 12,156 9,079 7,593 12,057 10,613 12,852 Total assets 223,777$ 302,834$ 388,050$ 889,050$ 912,245$ 957,309$ LIABILITIES & STOCKHOLDERS' EQUITY Current liabilities Current portion of long-term debt -$ -$ -$ 3,381$ 3,245$ 490$ Current portion of capital lease obligations 337 590 4,007 1,140 1,609 1,500 Accounts payable 30,201 71,145 107,985 87,299 112,151 137,842 Other accrued liabilities 34,583 38,896 59,024 104,873 99,358 98,902 Warrant 46,673 - - - - - Total current liabilities 111,794$ 110,631$ 171,016$ 196,693$ 216,363$ 238,734$ Long-term debt 28,437 55,000 65,000 416,849 358,890 323,689 Capital lease obligations 4,469 3,964 814 3,781 6,851 6,127 Other noncurrent liabilities 3,258 4,214 4,874 1,935 6,528 17,608 Deferrred income taxes - - - 1,065 1,234 886 Preferred stock 22,334 - - - - - Stockholders' equity 53,485 129,025 146,346 268,727 322,379 370,265 Total Liabilities and stockholders' equity 223,777$ 302,834$ 388,050$ 889,050$ 912,245$ 957,309$

30 2009 2010 2011 2012 2013 YTD Q3 2014 Cash flows from operating activities Net (loss) income (101,765)$ (141,760)$ 15,042$ 105,631$ 46,529$ 41,842$ Adjustments to reconcile net (loss) income to net cash (used in) provided by operating activities Depreciation 16,630 13,900 12,636 14,975 16,550 12,730 Amortization of intangibles 2,955 2,955 2,955 10,590 21,786 16,413 Net (gain) loss on the sale of assets (55) 431 (9) 203 140 - Loss on debt extinguishment 303 - 668 - 1,889 1,042 Deferred income taxes - - - (55,292) 30,089 14,571 Increase in fair value of warrant 33,447 121,587 - - - - Stock-based compensation 3,382 3,489 3,398 5,149 7,480 5,509 Accretion of debt discount - - - 2,972 4,643 3,624 Changes in operating assets and liabilities Accounts receivable 20,845 (20,772) (14,366) 1,180 (23,691) (31,263) Inventories 41,095 (59,062) (78,683) 41,696 6,260 (79,534) Prepaid expenses and other (1,570) 3,024 (162) 736 (3,893) 2,721 Accounts payable and accrued liabilities (22,666) 45,251 56,968 (48,777) 18,082 25,094 Other, net 420 650 386 (3,046) 2,805 1,961 Net cash (used in) provided by operating activities (6,979)$ (30,307)$ (1,167)$ 76,017$ 128,669$ 14,710$ Cash flows from investing activities Capital expenditures (981) (1,782) (7,264) (14,916) (18,352) (9,017) Acquisition, net of cash acquired - - - (364,012) (15,985) - Proceeds from the sale of property, plant and equipment 300 1,813 17 607 305 - Other - - - (2,500) 2,500 4,228 Net cash (used in) provided by investing activities (681)$ 31$ (7,247)$ (380,821)$ (31,532)$ (4,789)$ Cash flows from financing activities Proceeds from issuance of common stock, net of expenses - 71,948 (155) - - - Proceeds from exercise of stock options - 504 538 354 600 1,789 Borrowings under revolving credit facilities 276,853 712,491 848,705 206,015 1,166 565 Payments under revolving credit facilities (328,424) (685,928) (838,705) (271,015) (1,166) (565) Principal payments under capital lease obligations (334) (352) (671) (1,629) (1,700) (1,492) Principal payments under term loan credit facility - - - (2,250) (62,827) (42,078) Principal payments under industrial revenue bond - - - - (381) (354) Stock repurchase (35) (384) (533) (564) (35) (1,497) Proceeds from issuance of convertible senior notes - - - 145,500 - - Proceeds from issuance of term loan credit facility, net - - - 292,500 - - Proceeds from issuance of preferred stock and warrant 35,000 - - - - - Payments under redemption of preferred stock - (47,791) - - - - (1,420) - (1,989) (5,134) (981) - - - - 2,500 - - (2,638) (120) - - - - Net cash (used in) provided by financing activities (20,998)$ 50,368$ 7,190$ 366,277$ (65,324)$ (43,632)$ Net (decrease) increase in cash and cash equivalents (28,658)$ 20,092$ (1,224)$ 61,473$ 31,813$ (33,711)$ Cash and cash equivalents at beginning of period 29,766 1,108 21,200 19,976 81,449 113,262 Cash and cash equivalents at end of period 1,108$ 21,200$ 19,976$ 81,449$ 113,262$ 79,551$ Preferred stock issuance costs paid Debt amendment and issuance costs paid Proceeds from issuance of industrial revenue bond C ONSOLIDATED C ASH F LOWS New Markets. New Innovation. New Growth. ($ in thousands)

31 R ECONCILIATION OF N ON - GAAP M EASURES New Markets. New Innovation. New Growth. ($ in millions) Note: This table reconciles annual net income (loss) for the periods presented to the non - GAAP measure of Operating EBITDA. Differences may exist in the calculation of Operating EBITDA due to rounding. 2009 2010 2011 2012 2013 YTD Q3 2014 Net (loss) income (101.8)$ (141.8)$ 15.0$ 105.6$ 46.5$ 41.8$ Income tax (benefit) expense (3.0) (0.1) 0.2 (57.1) 31.1 27.9 Increase in fair value of warrant 33.4 121.6 - - - - Interest expense 4.4 4.1 4.1 21.7 26.3 16.9 Depreciation and amortization 19.6 16.9 15.6 25.6 38.3 29.2 Stock-based compensation 3.4 3.5 3.4 5.2 7.5 5.5 Acquisition expenses - - - 17.3 0.9 - Other non-operating expense (income) 0.9 0.7 0.5 0.2 (0.7) 1.6 Operating EBITDA (43.1)$ 4.9$ 38.8$ 118.5$ 149.9$ 122.9$ % of sales -12.8% 0.8% 3.3% 8.1% 9.2% 9.0%

32 R ECONCILIATION OF N ON - GAAP M EASURES ($ in millions) Note: This table reconciles the trailing twelve month net income (loss) for the periods presented above to the non - GAAP measure of Operating EBITDA. Differences may exist in the calculation of Operating EBITDA due to rounding. New Markets. New Innovation. New Growth. Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Net (loss) income (101.8)$ (212.5)$ (200.2)$ (135.7)$ (141.8)$ 0.6$ 9.5$ 12.5$ 15.0$ 17.0$ 15.6$ 32.9$ 105.6$ 106.2$ 118.4$ 116.2$ 46.5$ 48.1$ 50.2$ 52.3$ Income tax (benefit) expense (3.0) (3.0) (3.0) (2.9) (0.1) (0.2) (0.2) (0.1) 0.2 (0.3) 0.8 1.9 (57.1) (52.9) (44.6) (35.1) 31.1 33.7 35.2 35.0 Increase (Decrease) in fair value of warrant 33.4 160.3 158.4 101.1 121.6 (5.2) (3.3) - - - - - - - - - - - - - Interest expense 4.4 4.3 4.0 3.9 4.1 4.0 4.1 4.2 4.1 3.9 8.2 14.9 21.7 28.5 29.7 28.2 26.3 24.5 23.6 22.7 Depreciation and amortization 19.6 19.2 18.7 18.0 16.9 16.3 15.9 15.7 15.6 15.4 18.6 21.7 25.6 31.6 34.0 36.4 38.3 38.1 38.4 38.8 Stock-based compensation 3.4 3.3 3.0 2.9 3.5 3.4 3.2 2.9 3.4 4.0 4.1 5.2 5.2 5.7 6.9 7.0 7.5 7.2 7.2 7.5 Acquisition expenses - - - - - - - - - 1.7 15.0 17.0 17.3 16.2 3.1 1.1 0.9 0.3 - - Other non-operating expense (income) 0.9 0.8 1.7 0.5 0.7 0.8 0.7 0.7 0.5 0.6 - (0.2) 0.2 (2.0) (1.7) (0.9) (0.7) 1.5 2.2 2.2 Operating EBITDA (43.1)$ (27.6)$ (17.4)$ (12.2)$ 4.9$ 19.7$ 29.9$ 35.9$ 38.8$ 42.3$ 62.3$ 93.4$ 118.5$ 133.3$ 145.8$ 152.9$ 149.9$ 153.4$ 156.8$ 158.5$ % of sales -12.8% -8.2% -4.3% -2.5% 0.8% 2.5% 3.2% 3.3% 3.3% 3.4% 4.7% 6.7% 8.1% 8.8% 9.4% 9.6% 9.2% 9.2% 9.0% 8.8% Trailing Twelve Months Operating EBITDA For Quarter Ending 20142009 2010 2011 2012 2013

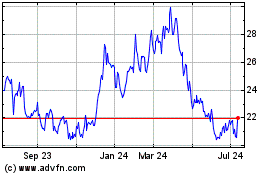

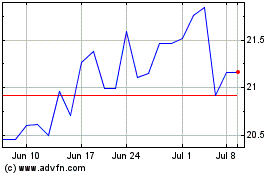

Wabash National (NYSE:WNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Wabash National (NYSE:WNC)

Historical Stock Chart

From Apr 2023 to Apr 2024